Nitheesh NH

The Covid-19 pandemic has altered consumer behavior and shopping seasons alike, and the present back-to-class season is no exception. We present three insights into digital trends this season, covering consumer expectations for online BTS retail spending.

Furthermore, as the threat of the virus still looms large, schools are rolling out their reopening plans, a significant proportion of which include remote learning for at least the initial weeks after reopening. We discuss the impact of digital learning on retail.

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Respondents could select multiple options

Respondents could select multiple options

Base: 1,240 moms who plan to buy BTS supplies online and 1,405 moms who are at least moderately likely to buy BTS attire

Source: Field Agent[/caption] Base: 739 US School Districts

Base: 739 US School Districts

Source: School Districts’ Reopening Plans: A Snapshot (2020, July 15). Education Week. Retrieved August 23, 2020 from https://www.edweek.org/ew/section/multimedia/school-districts-reopening-plans-a-snapshot.html[/caption] BTS Shoppers’ Spending Expectations for Online Learning A number of parents are already preparing to shop for digital learning, according to our August survey of BTS shoppers, which was this was an update to our survey from four weeks earlier, on July 8, 2020. Respondents could select multiple options

Respondents could select multiple options

Base: US Internet users aged 18+ who expect to buy BTS products this year

Source: Coresight Research[/caption]

Digital Trends

1. E-Commerce To Capture Greater Share of a Declining Market

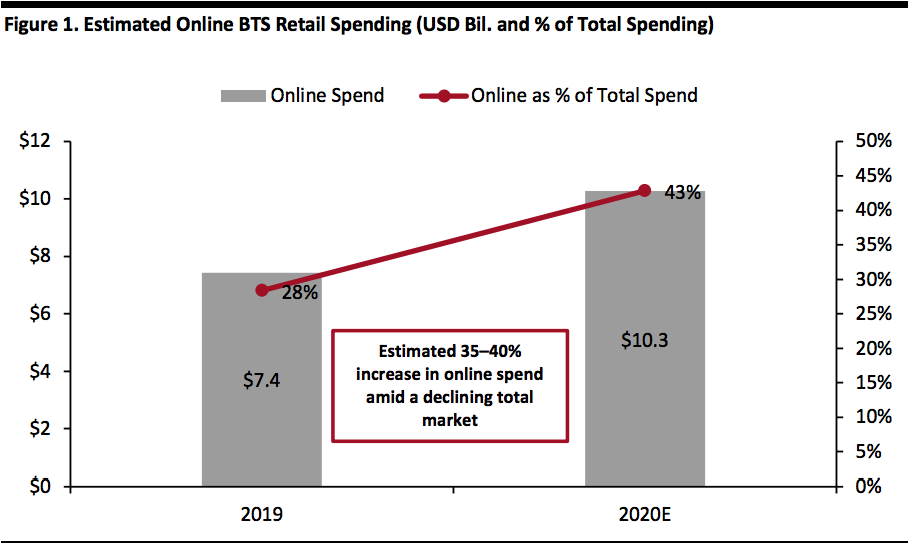

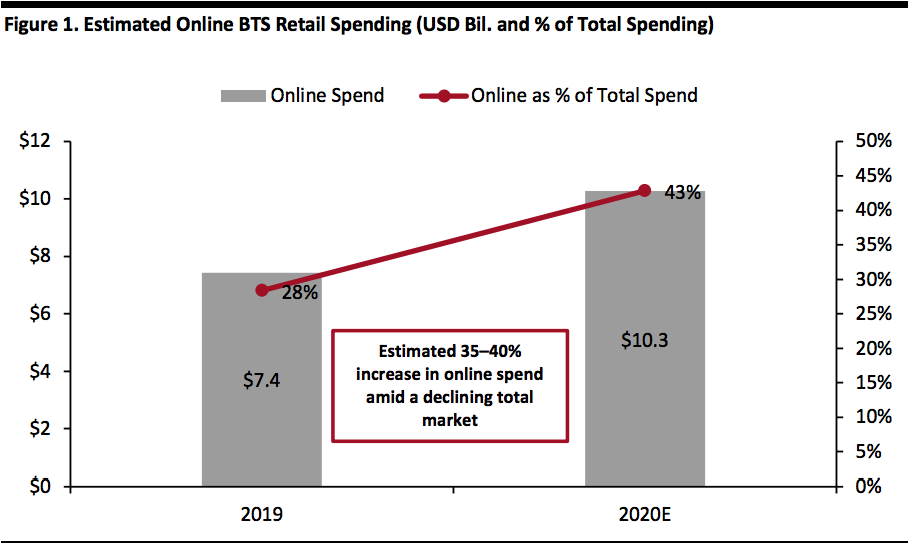

In 2020, we expect e-commerce to take a greater share of the market than ever before.- We expect online BTS retail spending to total around $10 billion this year, equivalent to approximately 43% of our $24 billion estimate for total BTS spend; that is up from around 28% last year.

- We estimate that online BTS spending will rise by 35–40% year over year in dollar terms—and this is in a total BTS market that we expect to decline by around 8.5%.

- We expect to see the strongest year-over-year e-commerce growth in school supplies (such as stationery) and electronics, while expected meaningful declines in total apparel spend will soften e-commerce growth for clothing and footwear. We estimate that electronics will see the highest e-commerce penetration rate, with around half of all spending occurring online, compared to around 40% in apparel and footwear.

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

2. Parents’ Shopping Expectations Are Mixed

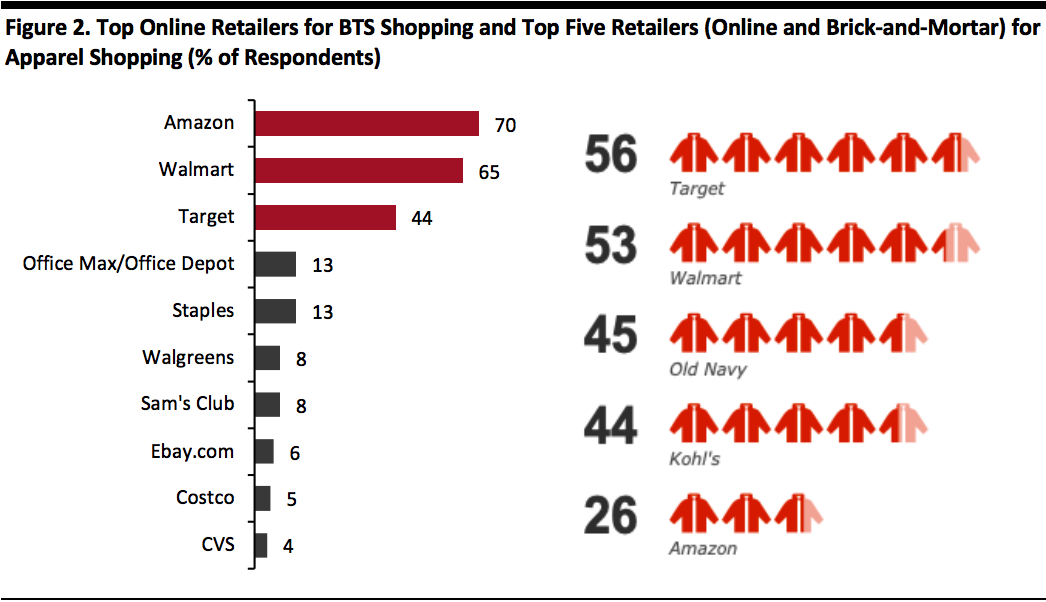

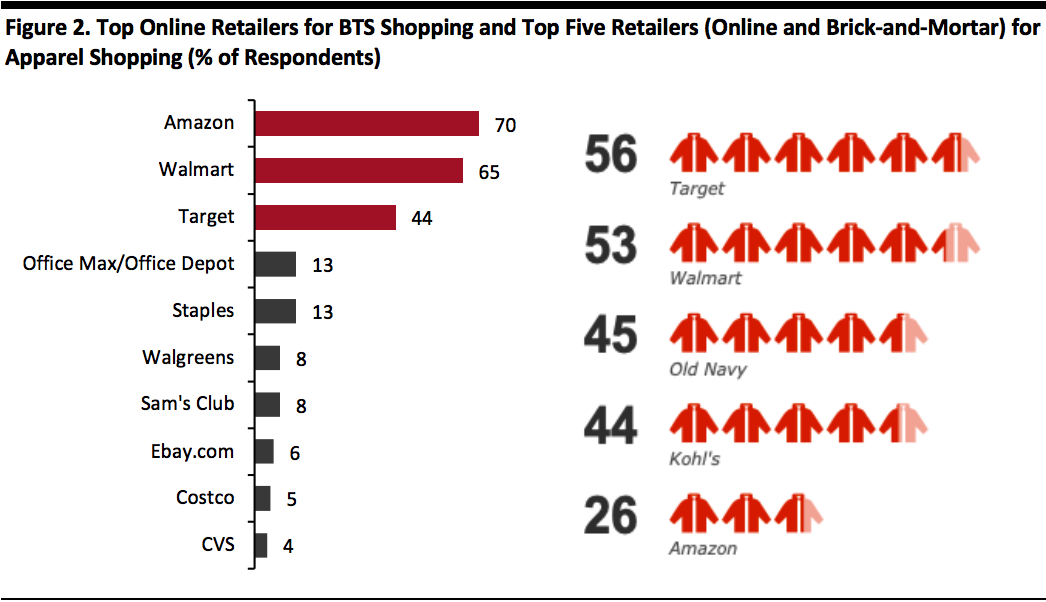

How Parents Expect To Shop for BTS We surveyed US consumers on August 5, 2020, about their attitudes toward BTS as well as their expected shopping and spending behaviors. We found that attitudes to how consumers will shop this season are mixed.- A relatively modest 13% said they plan to switch some or all of their BTS shopping from stores to e-commerce this year. BTS traditionally has a high e-commerce penetration rate—one that exceeds the averages for both total retail sales and total nonfood retail sales in any year—so shopper participation is already high. Moreover, 68% of US consumers are buying more online (of any categories) than they used to, according to our weekly survey on August 19. Separately, the National Retail Federation found that 55% of BTS shoppers expect to buy online this year, compared to 49% last year.

- About 25% of respondents in our August survey expect to use contact-light collection options, including pickup-in-store or curbside-pickup services for online BTS purchases.

Respondents could select multiple options

Respondents could select multiple optionsBase: 1,240 moms who plan to buy BTS supplies online and 1,405 moms who are at least moderately likely to buy BTS attire

Source: Field Agent[/caption]

3. What Some Retailers Are Doing To Promote Digital Shopping

From highlighting key categories to pickup and delivery options, retailers are making efforts to attract online shoppers:- Kohl’s is accommodating various reopening models into its BTS marketing campaign, by stating, “Heading back or logging in, the new year starts here.” The retailer is offering a promo code on its site for $10 savings per basket. Under its BTS favorites section on the homepage, Kohl’s top three categories are At-home learning, Active and Basics.

- Old Navy, a Gap Inc. banner, is offering contactless curbside pickup or in-store pickup for free in select stores for online BTS orders.

- Target has placed a “ready to learn” link for BTS essentials at the top of its home page, with the line “Choose order pickup or Drive Up for easy ordering.” The top categories emphasized by Target are kids’ tees and tanks, starting at $5, and “At-home Learning” essentials.

- Walmart is drawing attention to ordering online and using store pickup for “go-tos starting at $0.25.” It has listed out furniture, electronics and storage items for college, such as laptops starting at $230 and study furniture starting at $50. Highlights within its “school-ready essentials” include face coverings and kids’ fashion, starting at $10, with links to local-school supply lists.

Digital Learning Leads the Way

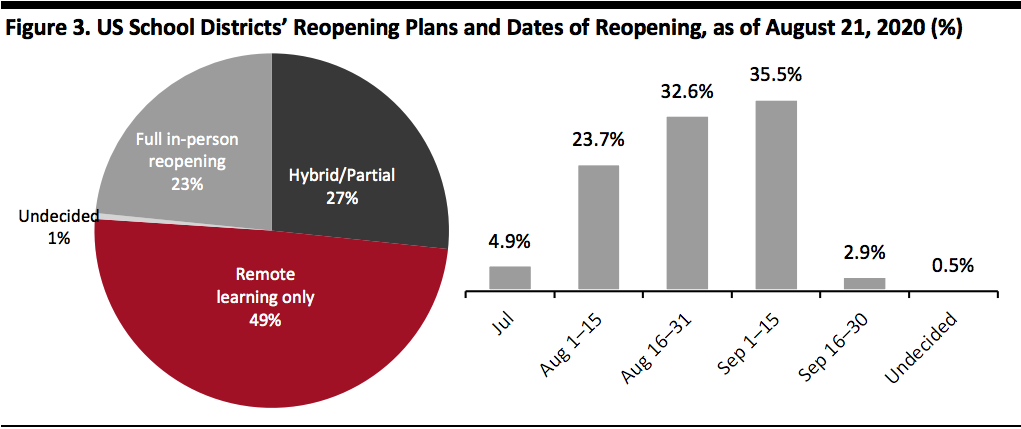

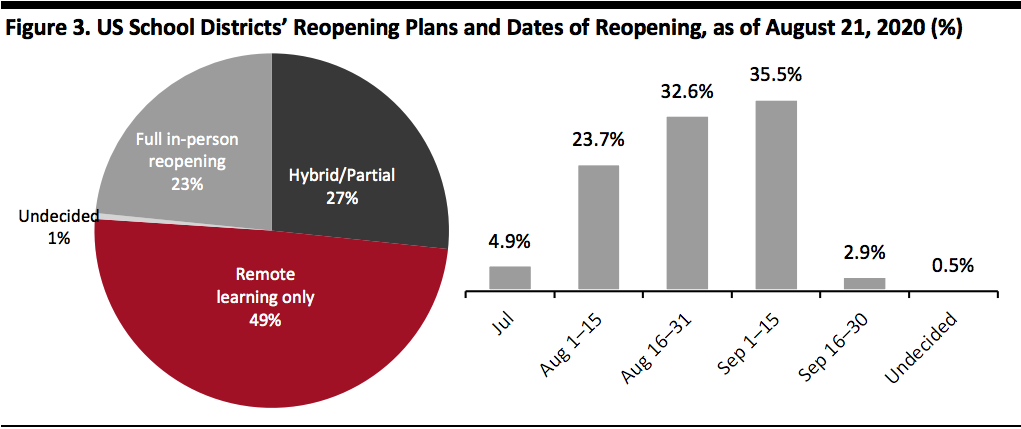

The digital theme this year encompasses schools’ reopening and learning methodologies, which in turn determine the BTS shopping basket size and spend. Based on data compiled by education news site EdWeek.org from 739 school districts, nearly 50% of school districts in the US plan to provide only remote learning when they reopen. Some 27% have decided to partially reopen schools and take a hybrid approach that includes some remote learning. Over 38% of schools are reopening on or after September 1, 2020. A small number of schools are yet undecided on their reopening dates and plans. [caption id="attachment_115360" align="aligncenter" width="700"] Base: 739 US School Districts

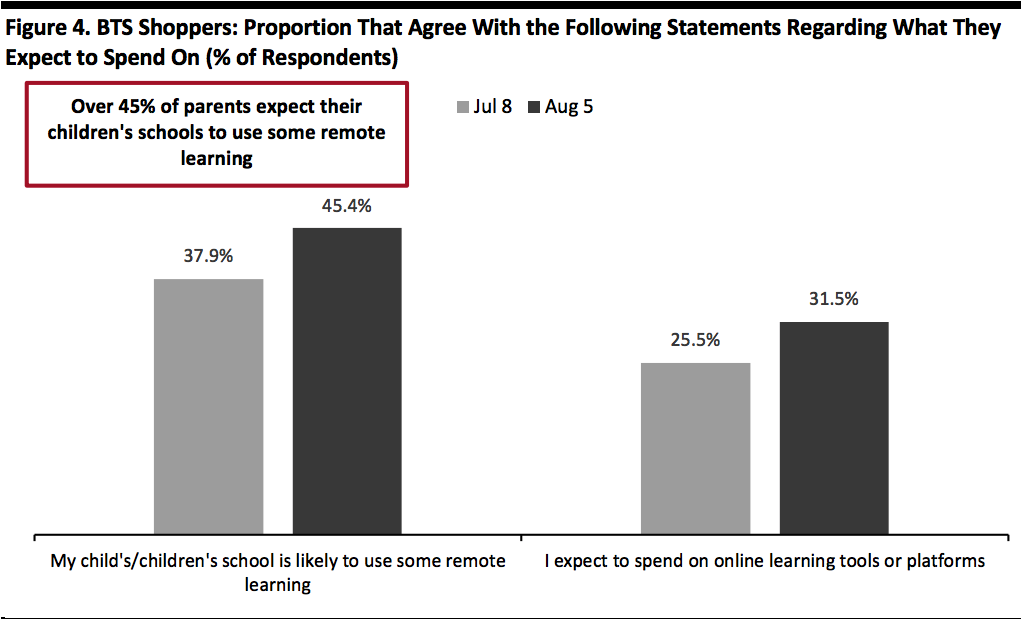

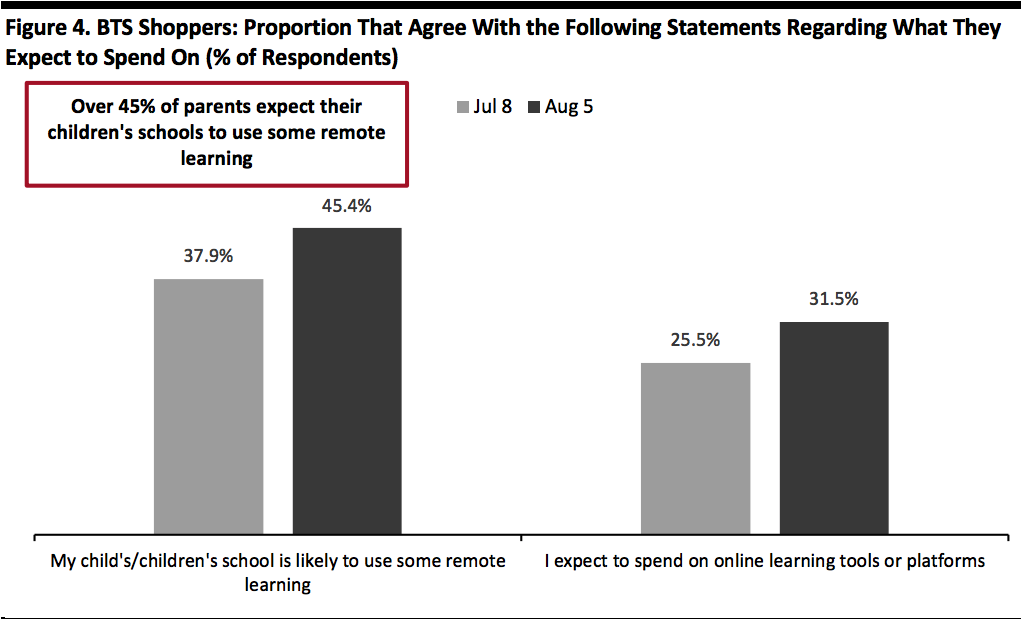

Base: 739 US School DistrictsSource: School Districts’ Reopening Plans: A Snapshot (2020, July 15). Education Week. Retrieved August 23, 2020 from https://www.edweek.org/ew/section/multimedia/school-districts-reopening-plans-a-snapshot.html[/caption] BTS Shoppers’ Spending Expectations for Online Learning A number of parents are already preparing to shop for digital learning, according to our August survey of BTS shoppers, which was this was an update to our survey from four weeks earlier, on July 8, 2020.

- Greater expectations for remote learning: About 45% of parents said they expect their child or children’s school to use some remote learning, up from 37.9% in the July survey and tying in with the data from actual reopening plans collected by EdWeek.

- Online learning: Some 31.5% of respondents said that they expect to spend on online learning tools or platforms, up from 25.5% in July.

Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+ who expect to buy BTS products this year

Source: Coresight Research[/caption]

Commentary from Retailers

These findings align with our expectations for a redefined back-to-class basket impacted by school-reopening scenarios—with remote learning resulting in gains for home-office furniture and electronics but softening demand for apparel and accessories. Below, we note commentary from some retailers on the BTS season, as of their latest reported quarter:- Kohl’s observed “a softer start to the BTS season.” The company said that it has planned for this eventuality and has stocked its apparel category with basics, including activewear and denim, which can be sold year-round.

- Ross Stores said it has planned for the BTS season “conservatively.” Management made a general comment about seeing a greater focus from its consumers on home versus apparel; within apparel, the retailer is seeing a greater shift toward casual wear.

- Target said that it will feature its BTS assortment for a longer period this year to give parents a chance to delay shopping until they have more certainty on their children’s school-reopening plans.

- The TJX Companies expects a slower BTS season and has factored this into its expectations for open-only comp sales to decline by 10–20% in the current quarter.

- Walmart has seen a slow start to the BTS season. The company noted that laptops, tablets and home-office furniture are performing well, while backpack and apparel sales are soft.