DIpil Das

We surveyed US consumers on August 5, 2020, about their attitudes toward BTS as well as their expected shopping and spending behaviors; this was an update to our survey from four weeks earlier, on July 8, 2020. In this report, we look at the changes between July and August.

Respondents could select multiple options

Respondents could select multiple options

Base: US Internet users aged 18+ who expect to buy BTS products this year

Source: Coresight Research [/caption] Respondents could select multiple options

Respondents could select multiple options

Base: US Internet users aged 18+ who expect to buy BTS products this year

Source: Coresight Research [/caption] Respondents could select multiple options

Respondents could select multiple options

Base: US Internet users aged 18+ who expect to buy BTS products this year

Source: Coresight Research [/caption]

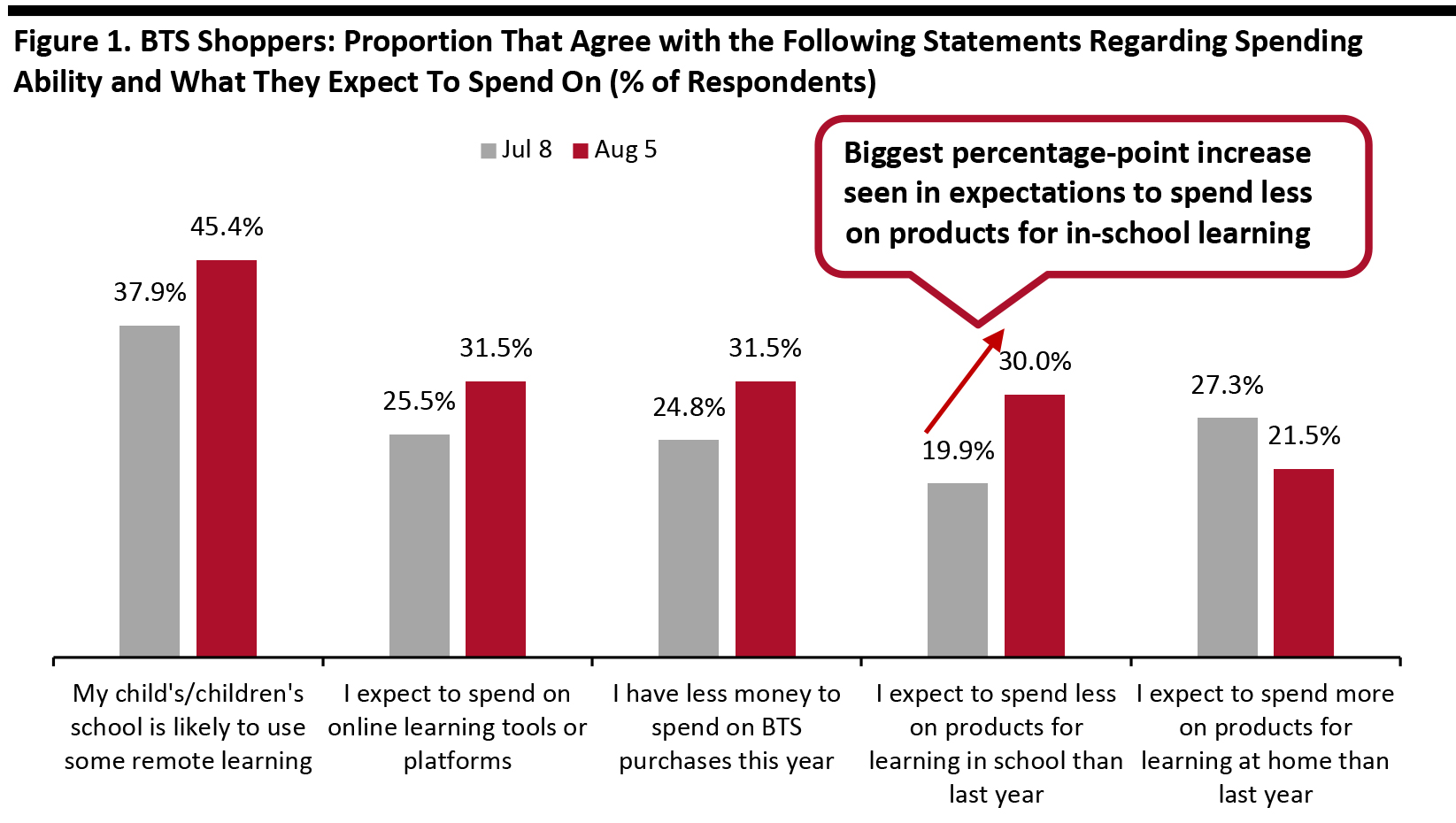

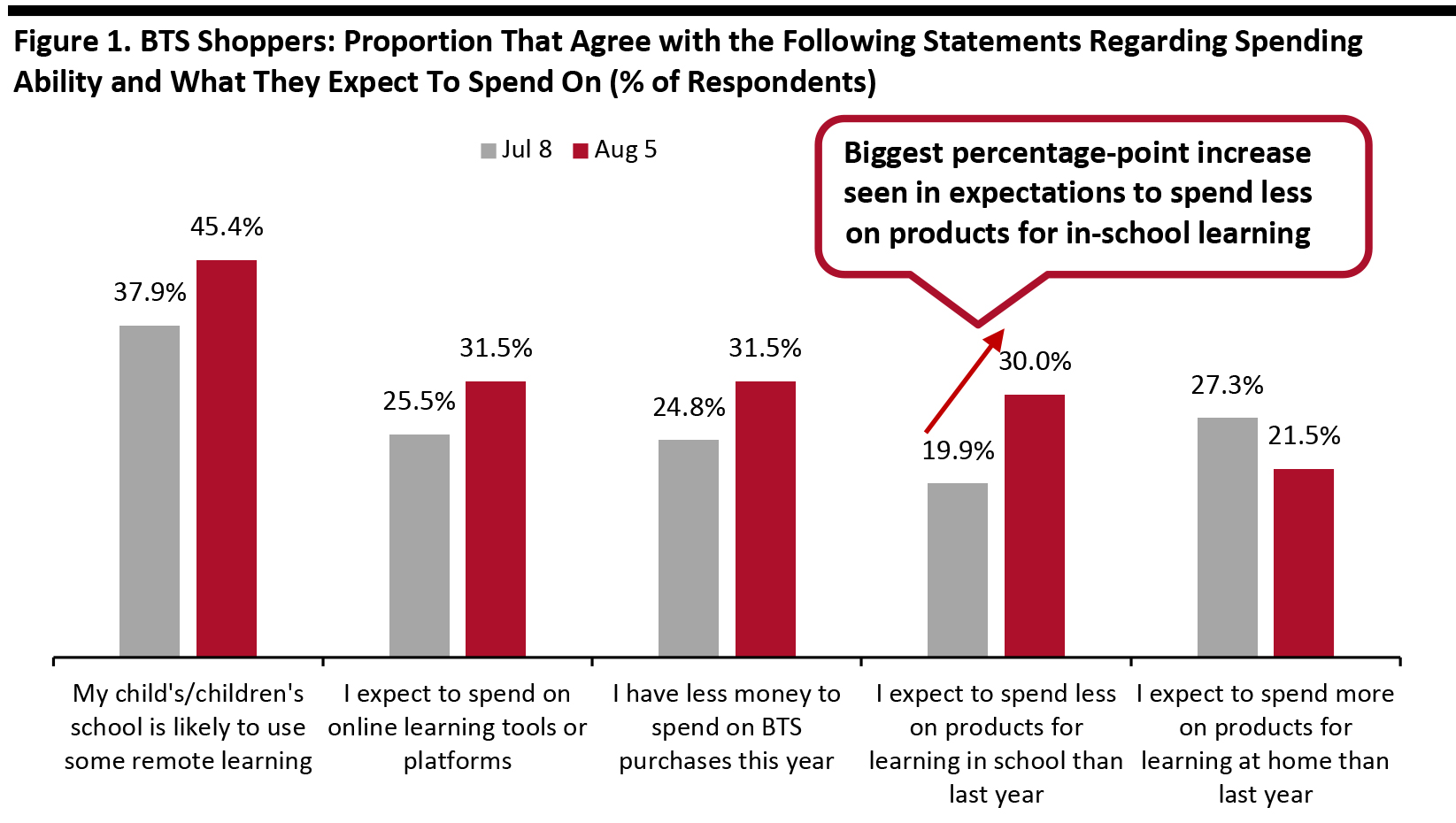

1. BTS Shoppers’ Spending Ability and What They Expect To Spend On

BTS shoppers are changing how they expect to spend:- Online Learning Gains: Some 31.5% of respondents said that they expect to spend on online learning tools or platforms, up from 25.5% in July.

- In-School Loses: More shoppers now expect to spend less on products for in-school learning: 30.0% in August versus 19.9% in July. This supports our expectations of a meaningful, 7.5–9.5% year-over-year decline in total BTS retail spending.

- At-Home Slows: The proportion of respondents that expect to spend more on products for learning at home than they did last year fell to 21.5% from 27.3%, possibly a function of the increase in shoppers having less to spend than they did last year.

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+ who expect to buy BTS products this year

Source: Coresight Research [/caption]

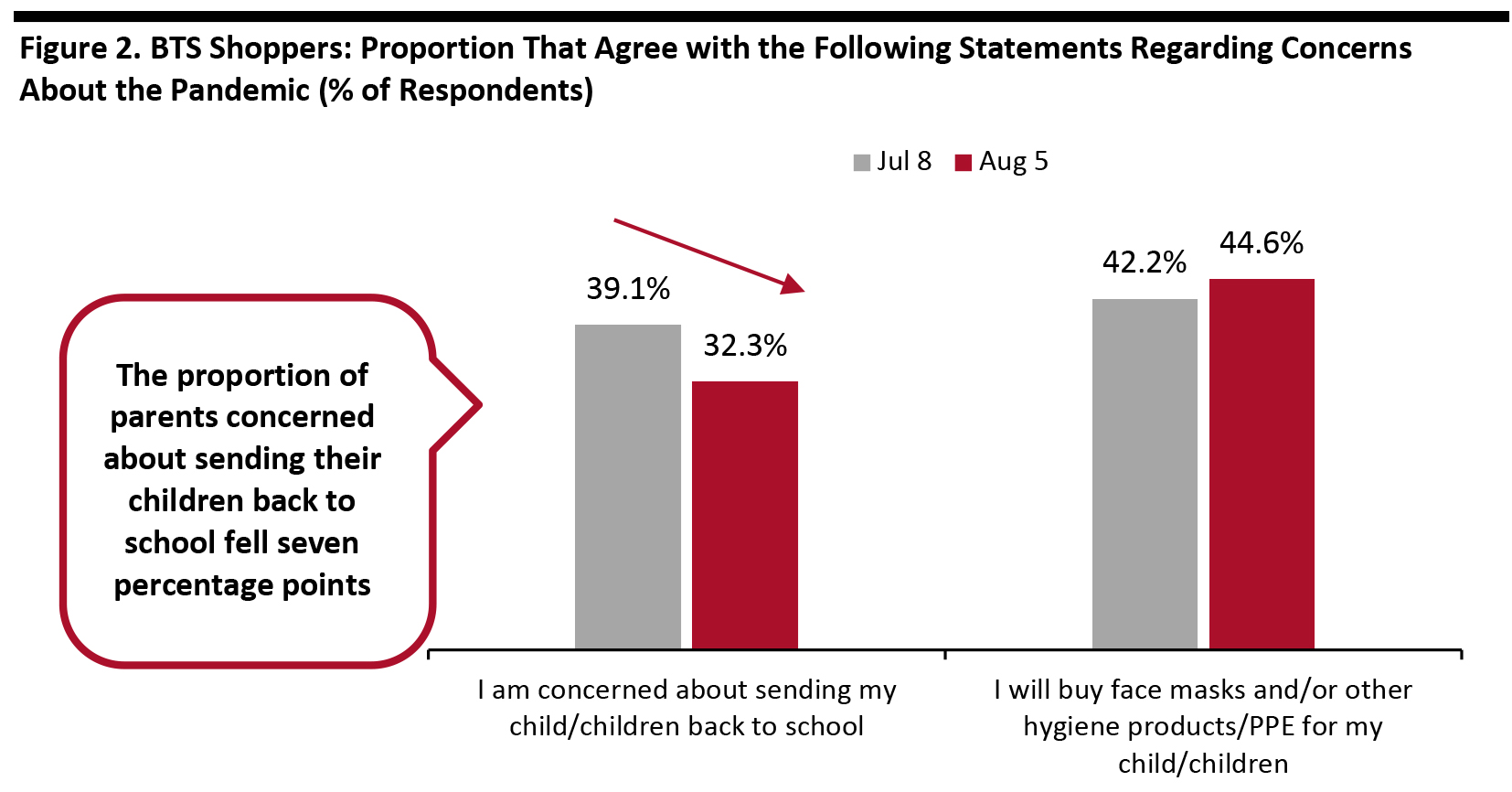

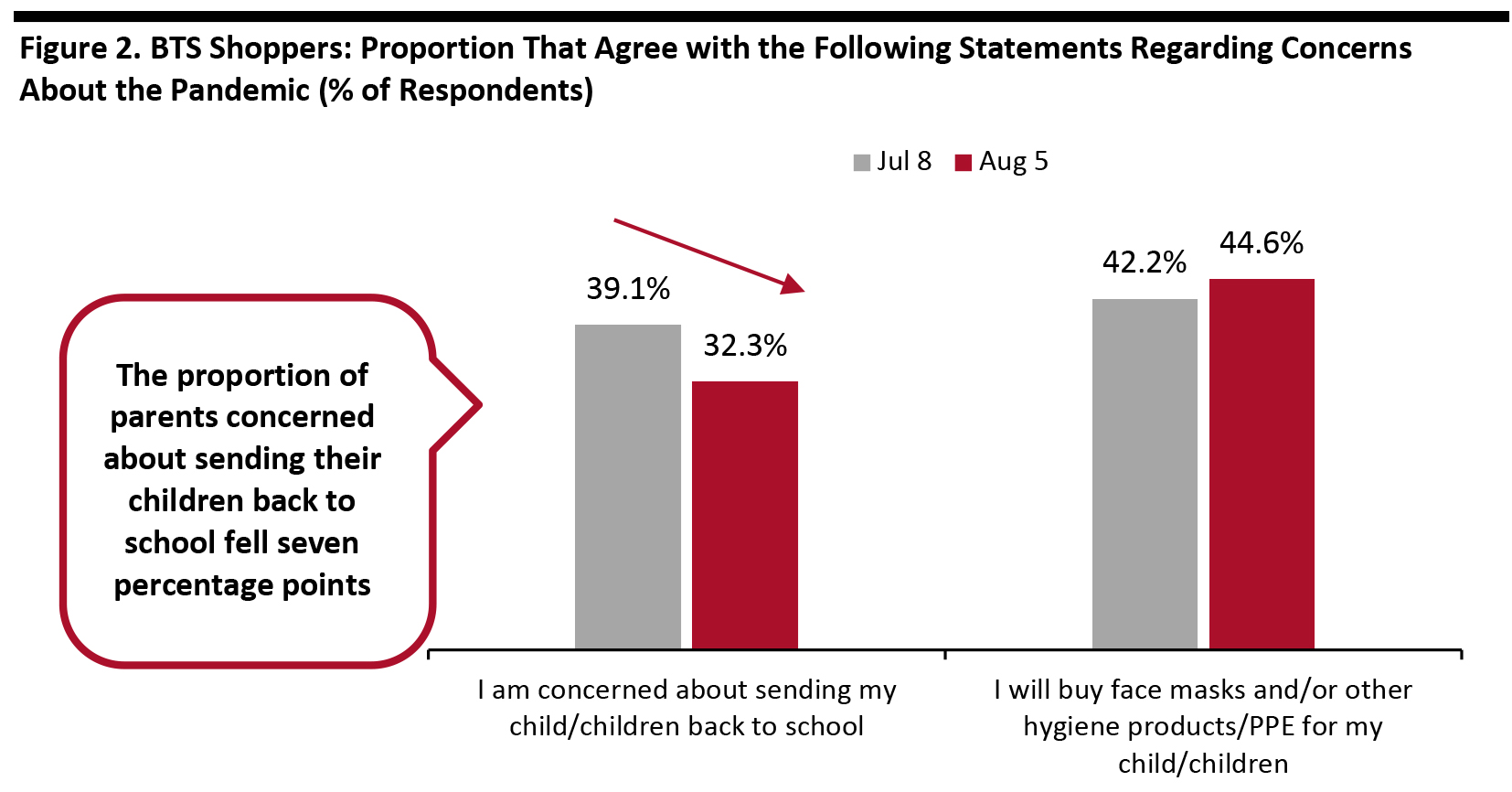

2. BTS Shoppers’ Concerns About the Pandemic

BTS shoppers concerns about the pandemic seem to be mixed. When we asked these consumers about their expected behaviors and attitudes, we found the following:- A little under half of BTS shoppers said that they will buy face masks, other hygiene products or personal protective equipment (PPE), indicating that many parents are preparing for in-school learning.

- Fewer parents are worried about sending their children to school than: 32.3% said they are concerned about this, compared to 39.1% in July. As we are now closer to the first day of term, more schools have likely published their reopening models than was the case at the time of our last survey—perhaps confirming remote learning (aligning with our findings discussed above) or detailing in-school safety protocols, thus helping to allay parents’ concerns about sending their children back to school.

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+ who expect to buy BTS products this year

Source: Coresight Research [/caption]

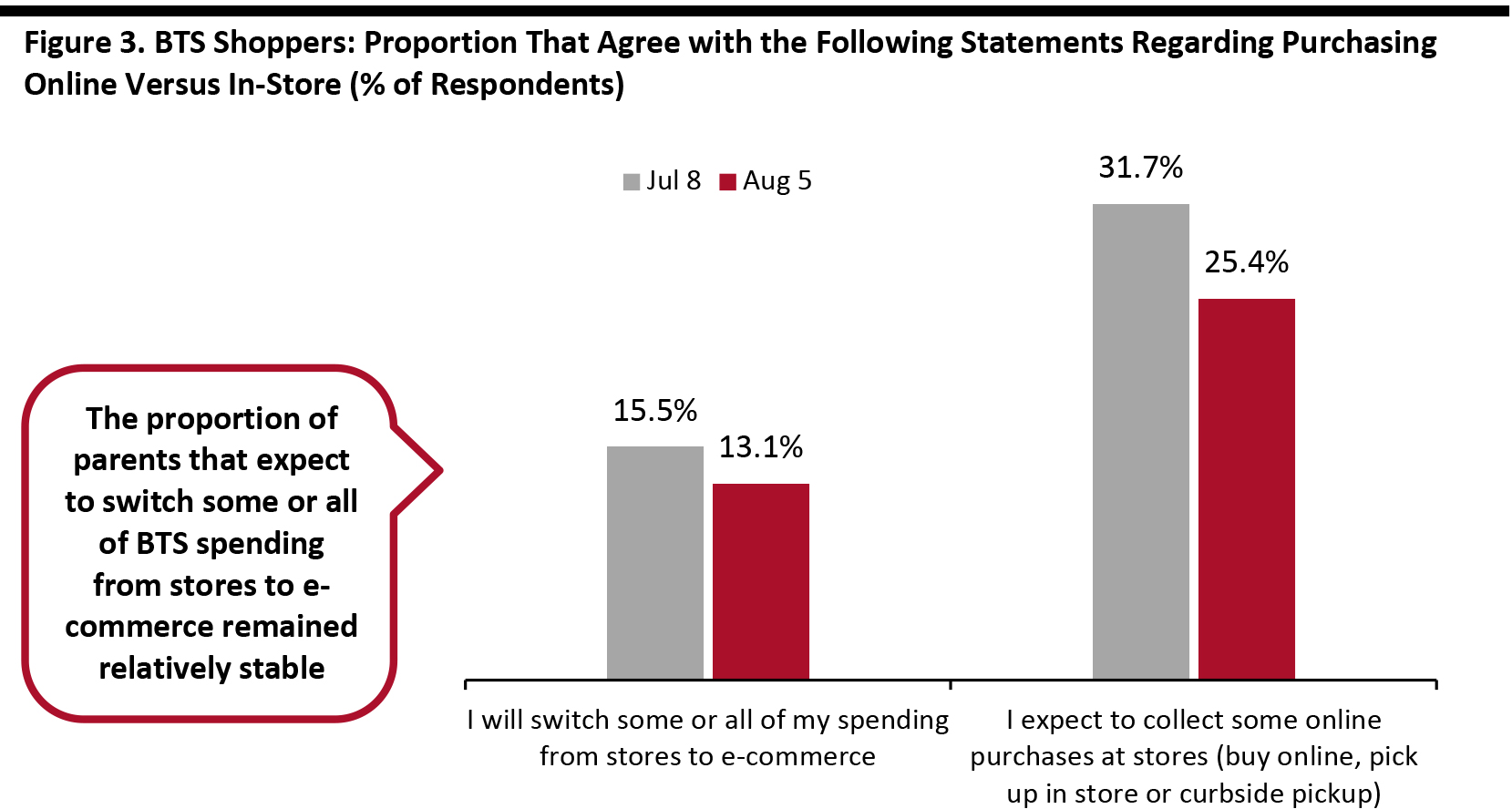

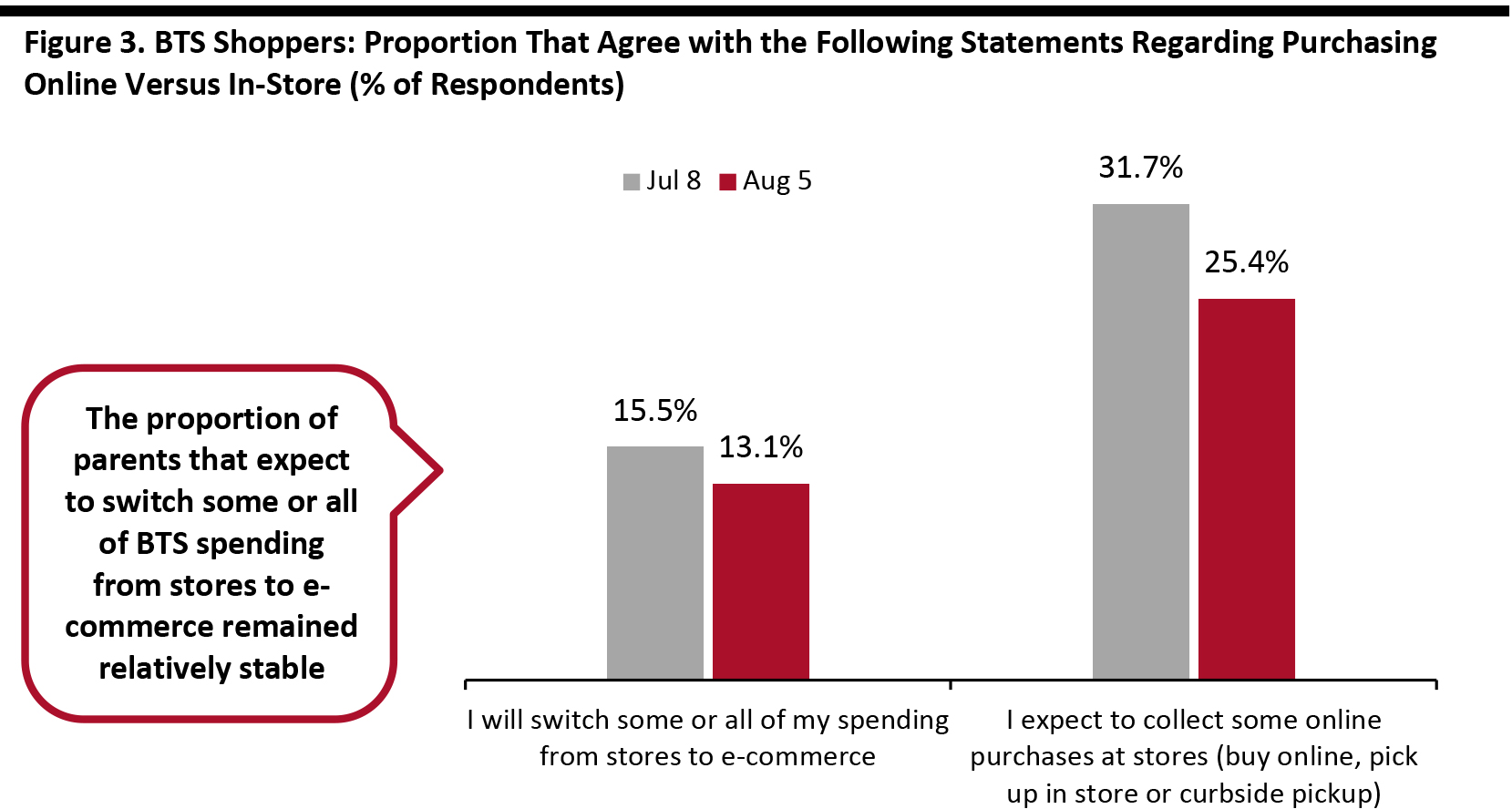

3. BTS Shoppers’ Attitudes About In-Store Versus Online Shopping

BTS shoppers’ attitudes to how they will shop seem to be mixed.- Only 13.1% plan to switch some or all of their BTS shopping from stores to e-commerce this year; the change from 15.5% a month ago is not statistically significant.

- One-quarter of respondents expect to use contact-light collection options, including BOPIS (buy online, pick up in store) or curbside-pickup services for online purchases, compared to one-third in July.

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+ who expect to buy BTS products this year

Source: Coresight Research [/caption]