albert Chan

The coronavirus crisis is a highly fluid situation and makes it challenging for schools and colleges to decide reopening models in advance. Institutions have three models to choose from, each of which presents different implications for retail:

- In-person learning, which will have students attend class within the school or college buildings.

- Remote learning, which will see students attend classes remotely, off-campus.

- Blended learning, which is a mix of in-person and remote classes.

The coronavirus has dictated a “new normal” in terms of the way people live, shop and socialize. State governments have mandated several health and safety measures, including ensuring students are wearing masks, checking their temperature regularly, implementing social distancing in classes and hallways, reduced sports activities, eating lunch in classrooms and so on.

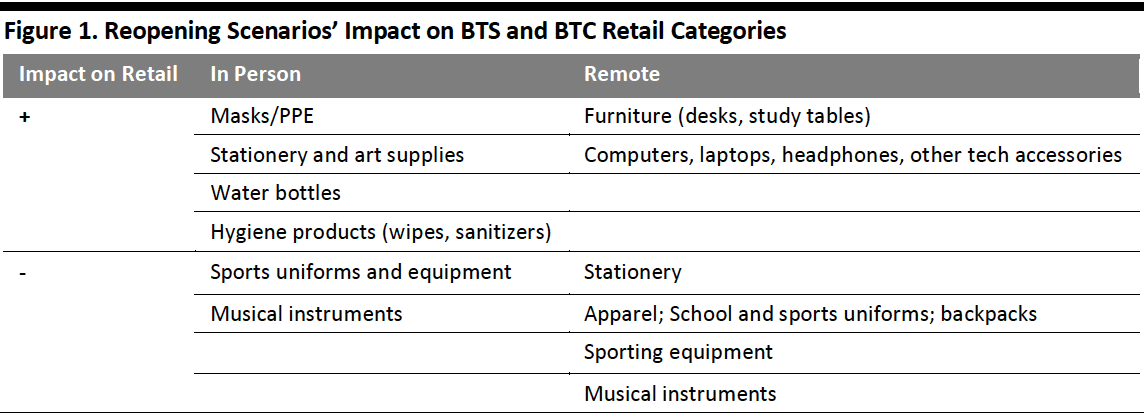

In addition to these state-mandated safety measures, the varied reopening models will heavily influence the new back-to-class basket:

- In-person learning will necessitate strict social distancing on campus, avoidance of common areas or activities involving groups, a reduction or cancellation of sports and extracurricular activities and non-sharing of supplies such as stationery and lab equipment. This implies that parents and students are likely to buy fewer items for extracurricular activities, such as sports kit or sporting equipment and musical instruments. Some items are likely to see a positive retail impact for in-person learning, such as masks and PPE, stationery and art supplies (as these cannot be shared), water bottles (as drinking water fountains cannot be used) and hygiene products such as wipes and sanitizers.

- Remote learning, on the other hand, may see parents and students buying more in categories such as study furniture (desks and chairs) and electronic equipment (computers or tablets, headphones and mice), but less apparel, footwear, uniforms, backpacks, lunch bags sports equipment and musical instruments. In BTC, dorm-room furnishings purchases may be impacted negatively, as college students will attend classes from home.

The pandemic may also determine how apparel buying could be altered. Parents may look to trade down on more expensive fabrics and brands and instead buy durable, washable options if they fear contamination of children’s clothes, backpacks and accessories and so want to wash them at hot temperatures. Students may not be allowed to stay in school or on campus after classes or to linger in hallways during school hours, removing opportunities to showcase their clothing and purchases and thus helping to shift focus from aspirational brands to practicality.

The market for sports clothing could be hit as schools and colleges may cut down on sports activities in order to reduce contact. The Ivy League colleges have already canceled sports events for the fall this year.

[caption id="attachment_113827" align="aligncenter" width="700"] Source: Coresight Research[/caption]

2. Challenges That Retailers Face in Determining Demand

Source: Coresight Research[/caption]

2. Challenges That Retailers Face in Determining Demand

The coronavirus pandemic has brought about a situation of immense uncertainty, and businesses, governments and consumers alike need to be able to adapt to the changing environment. As the reopening models will affect the types of products that BTC and BTS shoppers purchase for this academic year, retailers will be affected by the models that are implemented, as well as consumer uncertainty around these new school and college operations. Once schools reopen, the ways in which operate through the rest of the school year will be contingent on the spread, or containment, of the virus. Retailers need to be responsive to changes and make efforts to analyze and understand consumer demand in order to effectively optimize their inventory.

There will also be variance between states in consumer demand for certain products according to the reopening models that are used, so retailers will be need to be sensitive to local demand—rather than having the same inventory and sales expectations across their store fleets.

As this is a back-to-class season like no other, retailers should look to have inventory levels that are narrowly focused on practicality, rather than broad assortments that tend to focus on breadth of choice. This will better equip them to meet the difference in reopening scenarios and to pivot quickly and serve changing demand, including by reallocating specific categories to higher-demand regions as consumer behavior localizes.

Other factors that retailers will also need to consider are the possibility of a resurgence in Covid-19 cases as businesses and institutions continue to reopen and states taking action to prevent that by pausing or reversing openings. It is as yet uncertain as to when and if a “second wave” of the pandemic will take place.

3. BTC Transformation and Its ImplicationsSome colleges, including Harvard, informed their students several weeks ago that they will be implementing a blended reopening system—comprising in-person and remote learning—while others have only recently announced that they will be holding all classes online, such as such as the New School in New York and Occidental College in Los Angeles, California. However, many colleges are yet to announce the approach that they will take to reopening, leaving students uncertain of how to proceed with BTC shopping. Furthermore, students are still waiting to see the materials that their colleges require, with only 40% of students having received such lists by the end of July, according to the National Retail Federation. Amid such uncertainty, and the risk of a potential second wave of the coronavirus, we expect that retailers will have to prepare for BTC shopping to be delayed this year.

The current situation has also to some students changing their plans for college: Citing reasons such as “proximity to home” and “cost of attendance,” around 20% of incoming first-year college students have changed their first-choice school, as per a March 2020 survey held by education consulting firm Art & Science Group. This could result in significant changes for areas that are heavily supported by the influx of new college students—and presents further challenges for retailers in forecasting localized demand.

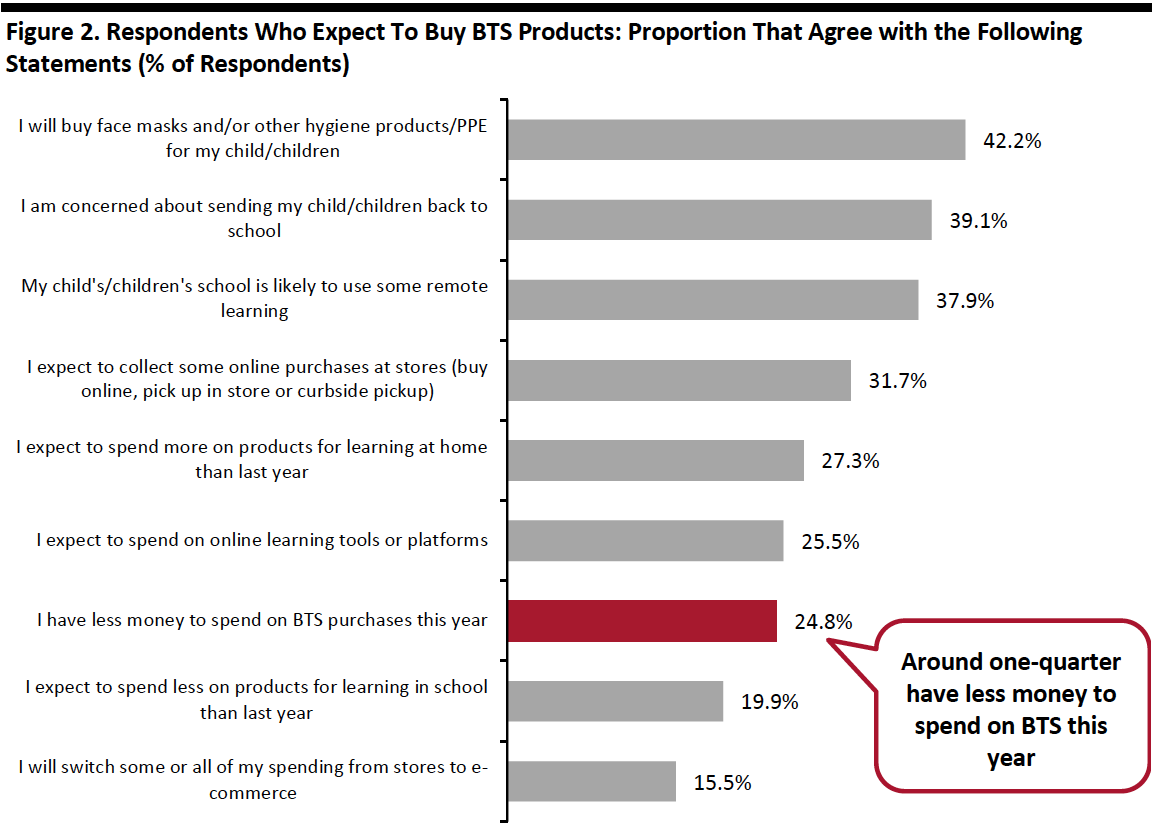

In addition to influencing when students and their families will purchase BTC products, another impact of Covid-19 is on how much these consumers will spend. Based on findings from a Coresight Research survey of US consumers conducted on July 8, 2020 survey, one-quarter of respondents that expect to buy BTS products this year indicated that they have less money to spend on such shopping. We think that this applies to parents who expect to spend on BTC too, with products including higher-value purchases such as furniture and furnishings for dorm rooms.

- Read our previous report for further discussion of the expected shopping behaviors of our survey respondents.

Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+ who expect to buy BTS products this year

Source: Coresight Research[/caption]

College tuition is the single largest expense for college students, and it historically rises at a rate of 3% each year, according data from nonprofit organization College Board. With so many voices calling for tuition reductions and colleges struggling with their own finances, the solution thus far has been a tuition freeze, which has been implemented by many colleges across the US.

However, the unemployment rate in the US in June was 11.1%—an improvement on May’s 13.3% but far higher than the 3.7% from the year-ago period—suggesting that many consumers will be feeling the impact of job losses and reductions in income. To cushion the blow, the federal government rolled out an economic stimulus package in March, which included one-time payments of $1,200 to individual taxpayers, $2,400 to married couples and $500 for each child under 17. Although this could bolster BTC spending, some 60% of consumers have already spent or plan to spend this money on food, and around 45% plan to spend it on utilities and household supplies, according to data from the US Census Bureau. It is therefore likely that families with students in college will simply be less able to spend on BTC categories in the current environment than may otherwise have been the case, at least for the foreseeable future.

Students’ personal spending habits are also bound to change as a consequence of remote learning and social distancing. More online classes and less socializing means less commuting, which means less eating out at college or nearby cafes and fewer visits to the pubs or other businesses in the vicinity of students’ colleges, including laundromats, book stores and stationery shops.

Additionally, many schools have announced they will cancel, or at the very least push back, fall sports. This includes the Ivy League, members of the New England Small College Athletic Conference, the Centennial Conference and others. As sporting event present opportunities for consumer spending, retailers of sporting goods and merchandise are likely to take a hit in the fall, and business in close proximity to sporting grounds that would typically benefit from such events will also be impacted.

What We Think

The uncertainty around reopening models presents numerous possibilities for this year’s back-to-class shopping basket.

- In-person classes may take place only if institutions adhere to various safety protocols, such as distanced desks, ensuring students wear masks and canceling activities and sports where social distancing cannot be followed. This could mean that parents buy more masks and hygiene products and less sports clothing or footwear.

- Remote learning will necessitate parents to buy supplies, electronics and equipment to facilitate learning from home, and cut back on apparel and footwear purchases.

- Parents and students will need to buy school supplies to support in-school and at-home learning if their institutions take a blended approach to reopening.

As we approach back-to-class season, retailers and brand should prepare for variability in demand within and across states. Retailers and brands should monitor the markets they serve closely to understand the kind of reopening models being followed—and redistribute categories to markets according to localized consumer demand. By being flexible, retailers and brands can optimize their inventory and improve their ability to serve their markets—with the potential that this season could help to make up for some lost sales during the year.