albert Chan

https://youtu.be/FnDd5tX1BxM

Introduction

Back-to-school shopping is a major retail event — and gives retailers an early indication of how demand is likely to look in the peak holiday period. As we outlined in the first report in this series, we expect to see a 2.0-2.5% year-over-year increase in our US back-to-school retail sales benchmark this year, a considerable slowdown from last year’s 4.4%.

Back-to-school shoppers’ buying habits continue to evolve as their familiarity with digital channels grows: Shoppers are researching, browsing and buying across channels in a multiplicty of shopping journeys that, at the drop of a hat, switch from website to mobile to in-store browsing, and culminating in collection at stores, home delivery or in-store purchases.

In the following sections, we assess major digital and omnichannel trends that can define the ways consumers shop in the 2019 back-to-school shopping season.

E-Commerce Continues to Build Share in Back-to-School Sales

For the back-to-school 2019 season, the online channel will continue to take a greater share of the market. We estimate about 28.3% of total back-to-school US consumer spend will be online this year, up from 26.1% in 2018.

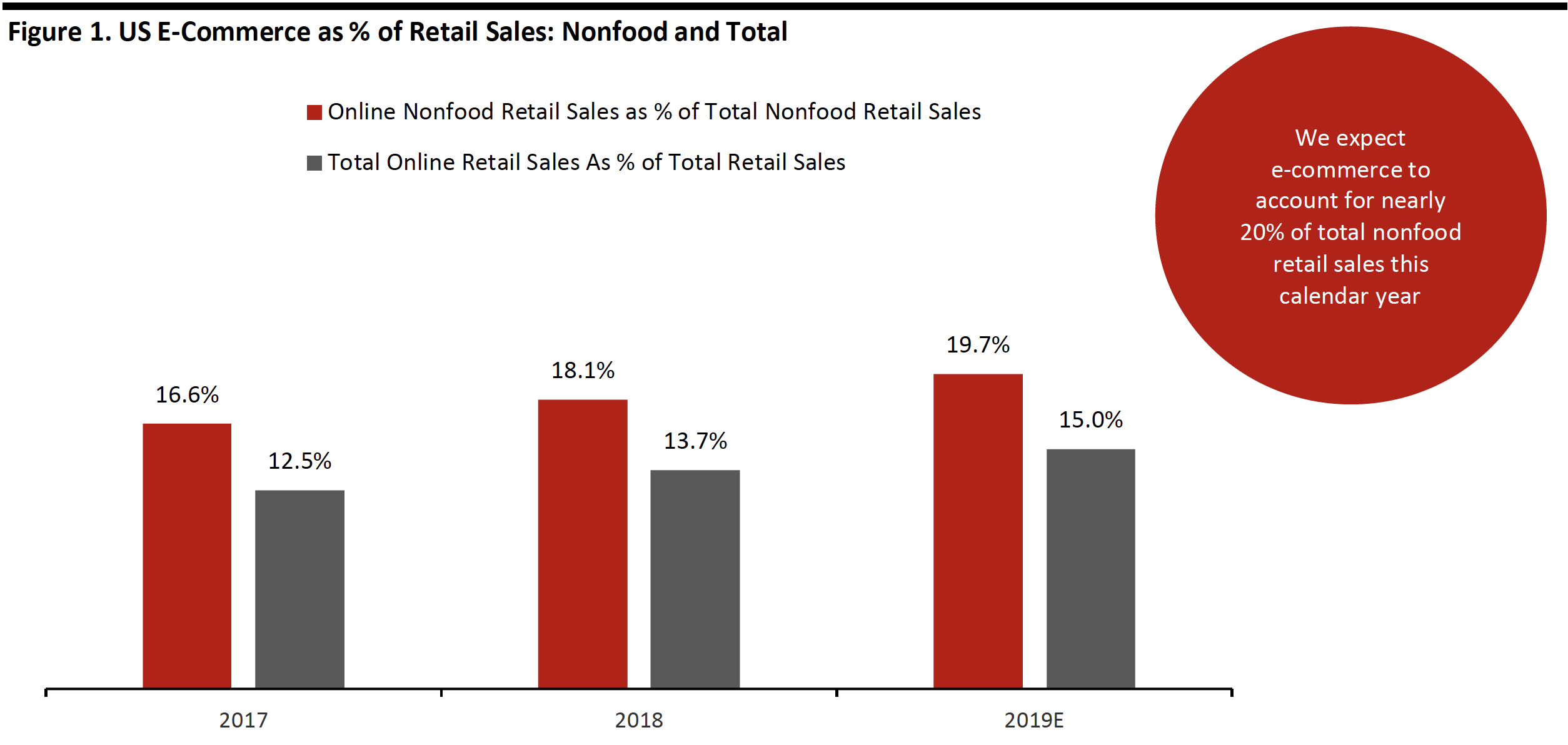

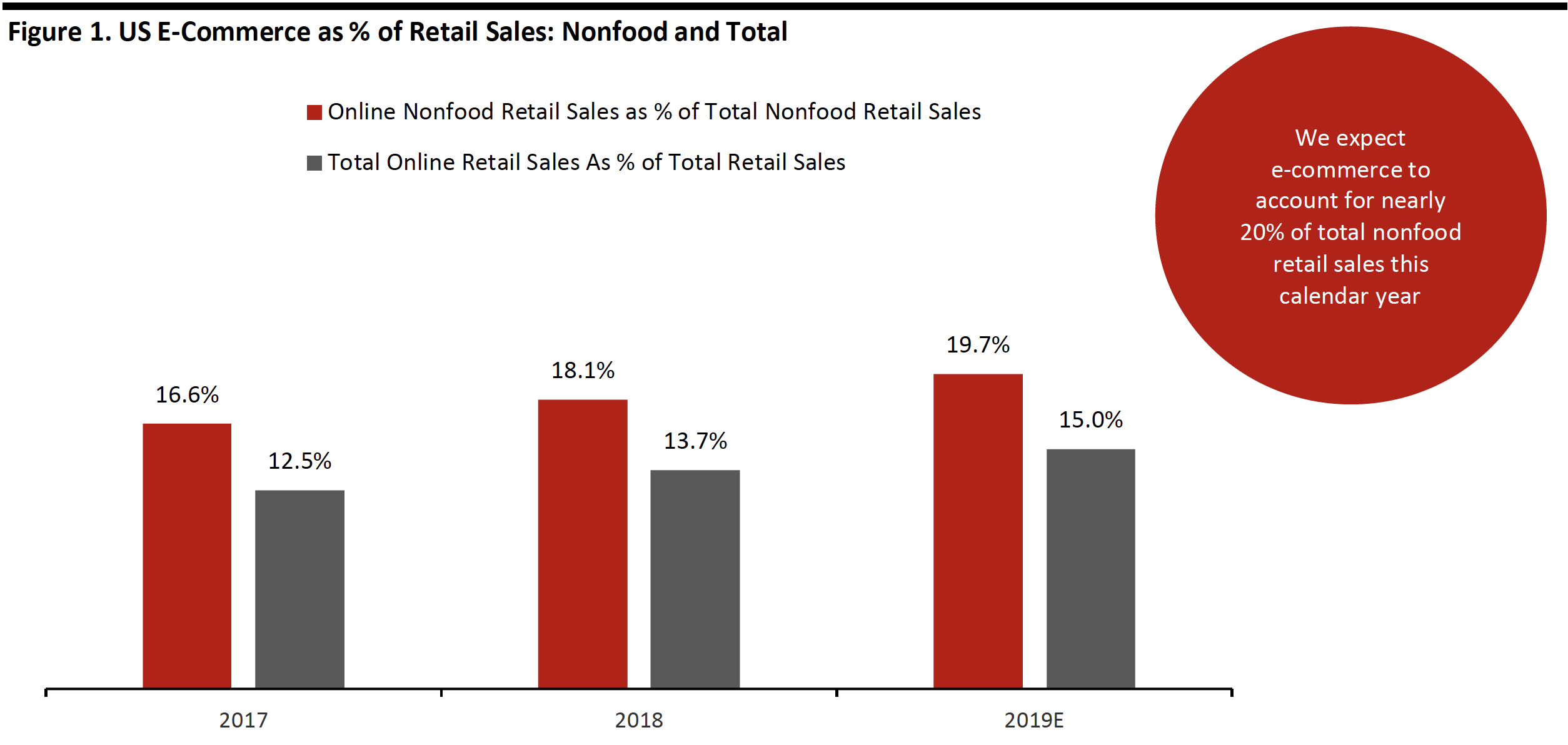

As we show in the chart below, we expect the e-commerce penetration rate across total US nonfood retail sales to be close to 20% this calendar year. We expect e-commerce to capture a greater share of back-to-school spending due simply to higher e-commerce penetration rates in the core back-to-school categories of apparel and consumer electronics.

[caption id="attachment_94328" align="aligncenter" width="700"] Source: US Census Bureau/US Bureau of Economic Analysis/Coresight Research[/caption]

Mobile Commerce Maintains Growth Momentum with Convenience-Craving Shoppers

Digital adoption represents more than just making purchases online: back-to-school shoppers are researching, browsing and buying across channels. According to a July survey by Prosper Insights & Analytics:

Source: US Census Bureau/US Bureau of Economic Analysis/Coresight Research[/caption]

Mobile Commerce Maintains Growth Momentum with Convenience-Craving Shoppers

Digital adoption represents more than just making purchases online: back-to-school shoppers are researching, browsing and buying across channels. According to a July survey by Prosper Insights & Analytics:

Base: US Internet users aged 18+ with school-age children and own a smartphone or tablet

Base: US Internet users aged 18+ with school-age children and own a smartphone or tablet

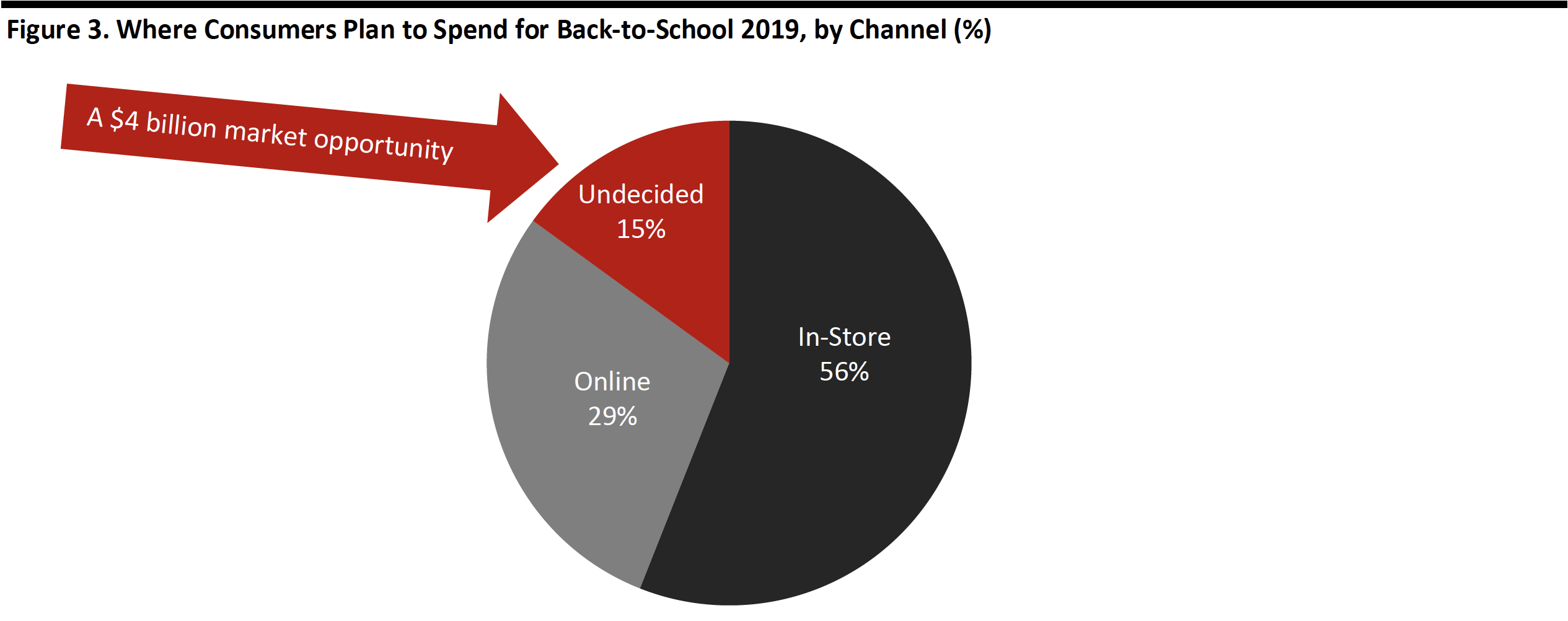

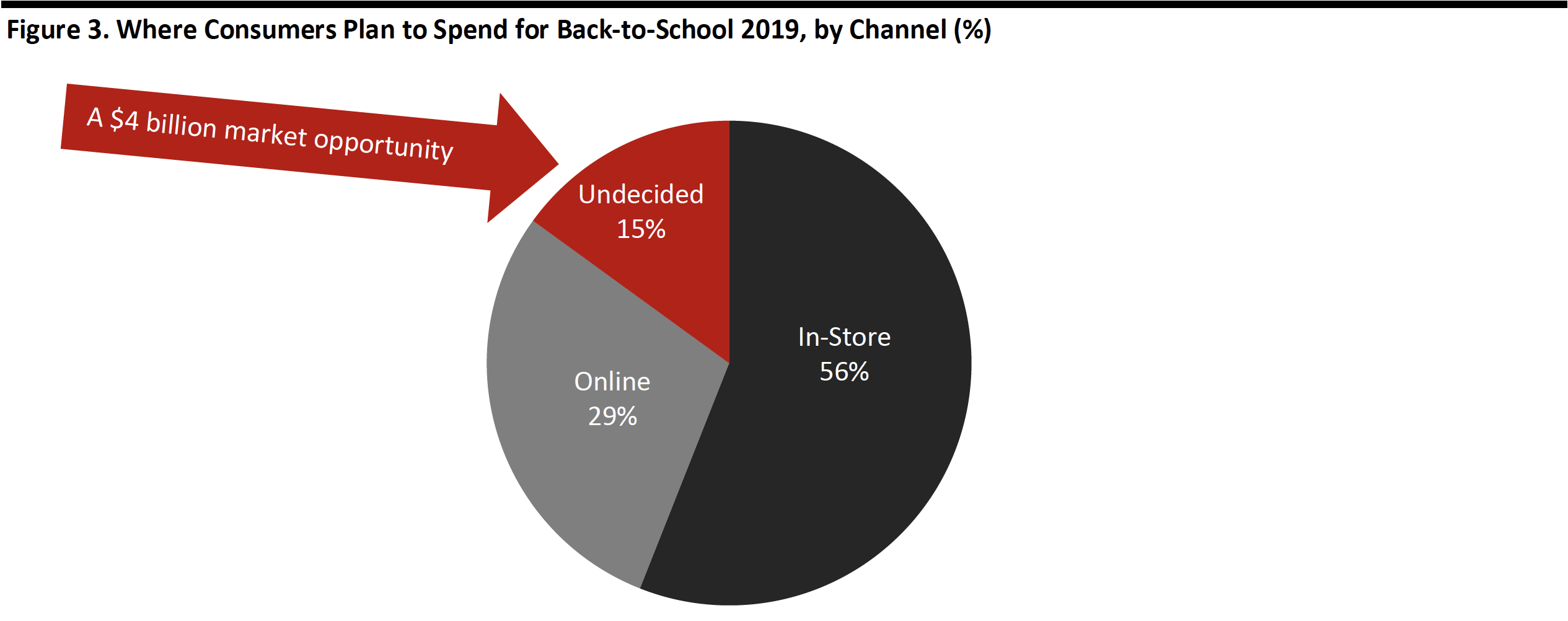

Source: Prosper Insights & Analytics[/caption] Omnichannel Retail Provides an Opportunity to Win Shoppers Omnichannel retailers enjoy an opportunity to win shoppers who have not yet made back-to-school shopping plans. According to a survey by Deloitte, shoppers plan to spend 56% (versus 57% in 2018) of their budget in-store, 29% online (versus 22% last year) and are undecided about the remaining 15% (versus 20% last year). That undecided portion remains up for grabs amounts to a $4.0 billion market opportunity. Omnichannel retailers must be ready to fight for those dollars. In 2018, omnichannel shoppers drove incremental value during back-to-school season, according to purchase information platform Cardlytics: Back-to-school shoppers who shopped both online and in-store spent 48% more than single-channel customers in 2018. We believe more retailers are boosting omnichannel efforts to capture both in-store and online sales this year. [caption id="attachment_94330" align="aligncenter" width="700"] Source: Deloitte[/caption]

US Retailer Digital and Omnichannel Retail Strategies

Below, we highlight a few examples of how retailers are implementing their digital and omnichannel strategies:

Walmart offers additional discounts for using its buy online, pick up in store service: Shoppers can pick up in store or have items brought to their car. Walmart also offers a speedy return process through its Mobile Express Returns. Shoppers can visit their nearby store, open the app at the Mobile Express Lane, scan a QR code and then hand over the items to a store associate, getting the refund amount instantly on the app.

Walgreens has replaced 50-60% of its PC-based in-store systems with tablets and handheld devices. With the new system in place, back-to-school shoppers can see a selection of products, place an order for home delivery or pick up at the store or see if it’s available at another store.

Macy’s has three buckets in its mobile-first strategy – My Wallet, My Stores and My Stylist. My Wallet allows shoppers to access products in their online wallets and pay through a stored credit card. With My Wallet, back-to-school shoppers can pick up products ordered online in store, which allows them to try on their apparel before purchasing. Shoppers scan the barcodes and pay on the app, stopping at a designated counter for a team member to confirm payment and remove sensors.

Macy’s My Stores provide store maps that can guide back-to-school shoppers to product location and offer in-store product recommendations via mobile device. Macy’s My Stylist is still in the pilot phase and allows shoppers to follow a stylist and collaborate with them via chat or style board.

Target has expanded its Drive Up offering to more cities, which lets shopppers have online orders delivered to the car – avoiding a trip into the store.

Kohl's rolled out an Amazon returns program at all its 1,150 stores nationwide on July 9, just in time for the back-to-school shopping season. Shoppers can return back-to-school supplies bought on Amazon at any of the Kohl's stores – free.

Office Depot added school list functionality to its app with thousands of school lists available. These school lists can be added to a virtual shopping cart with a single click. The retailer’s buy online pick up in store option provides same-day pickup for various back-to-school supplies. For select items, the company offers one-hour pick up.

Bed Bath & Beyond offers a school finder option, which gives restrictions so shoppers can figure out what is allowed in the school and what’s not.

Amazon launched a “Happy School Year” store for teachers, students and parents to find classroom supplies, laptops, school clothes and other electronic gadgets. Shoppers can also sign up for a subscription service to automatically replenish items such as paper, pens and others.

Amazon and Mass Merchandisers Remain the Most Popular Online Retailers

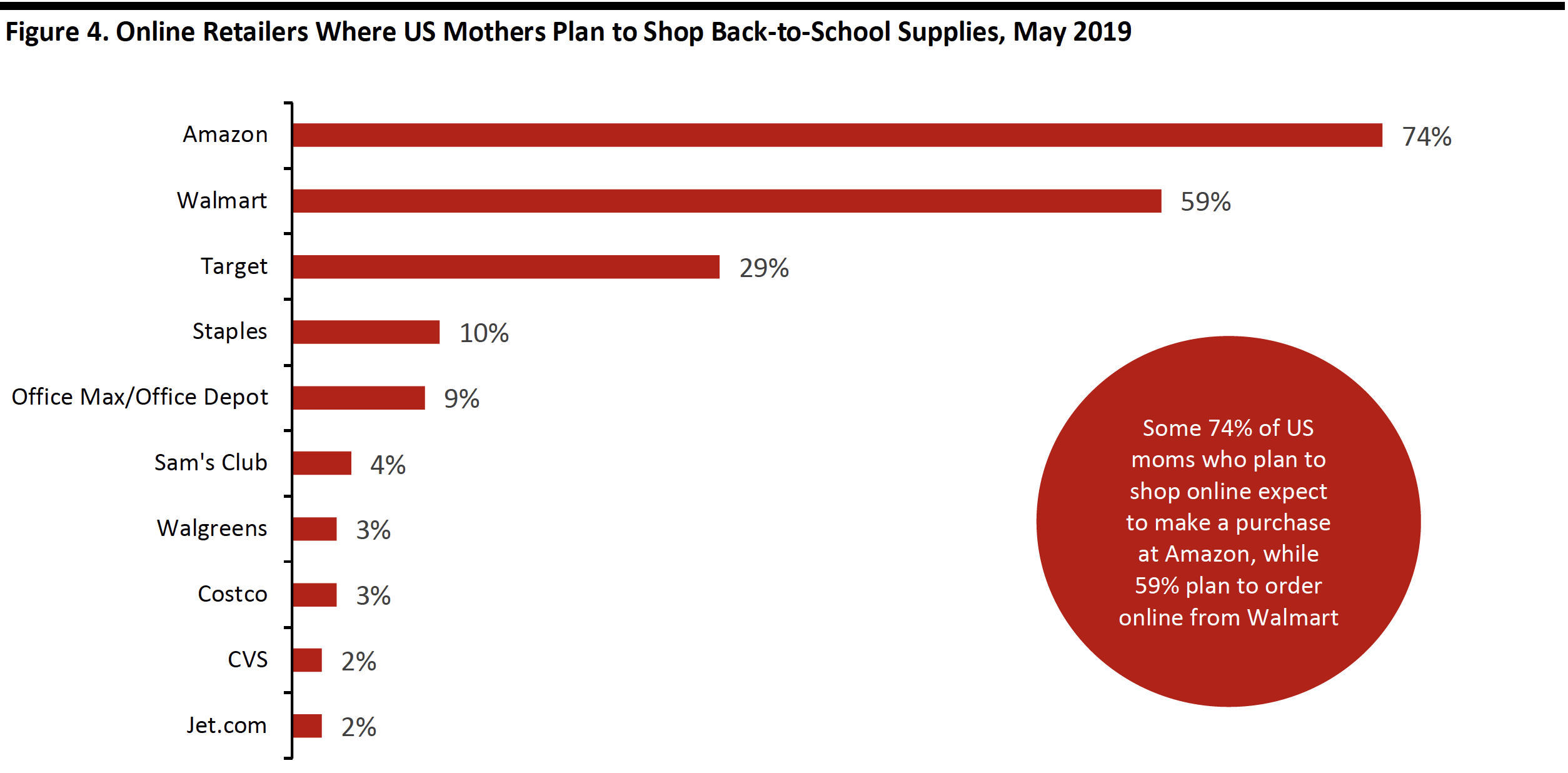

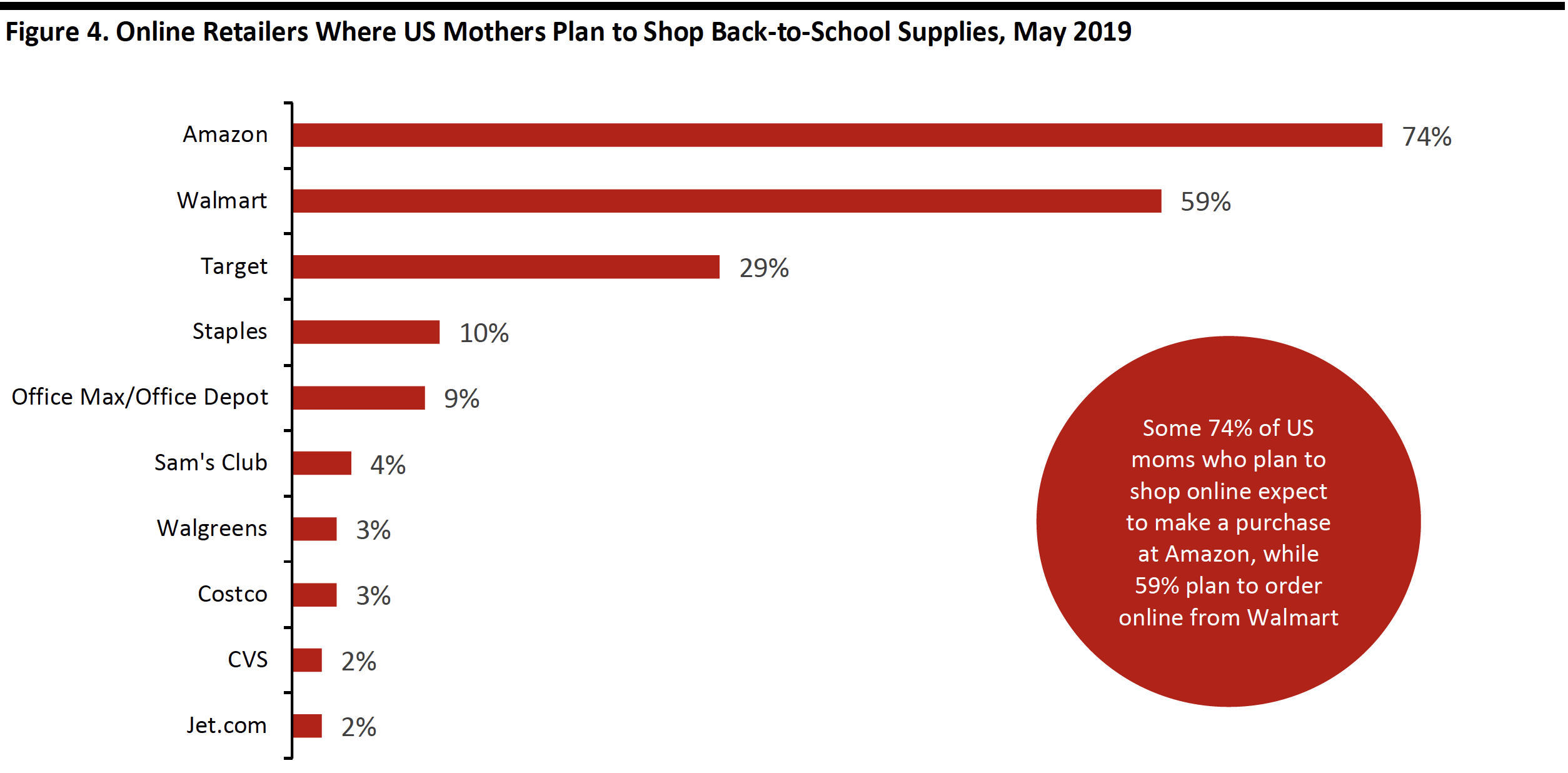

According to a May 2019 survey by auditing and research firm Field Agent, Amazon, Walmart and Target are the most popular online retailers among US mothers for purchasing back-to-school supplies.

The study found that 74% of US mothers who plan to buy online this back-to- school season will shop school supplies from Amazon. Some 59% of respondents will make online orders at Walmart, while 29% plan to shop online at Target.

[caption id="attachment_94331" align="aligncenter" width="700"]

Source: Deloitte[/caption]

US Retailer Digital and Omnichannel Retail Strategies

Below, we highlight a few examples of how retailers are implementing their digital and omnichannel strategies:

Walmart offers additional discounts for using its buy online, pick up in store service: Shoppers can pick up in store or have items brought to their car. Walmart also offers a speedy return process through its Mobile Express Returns. Shoppers can visit their nearby store, open the app at the Mobile Express Lane, scan a QR code and then hand over the items to a store associate, getting the refund amount instantly on the app.

Walgreens has replaced 50-60% of its PC-based in-store systems with tablets and handheld devices. With the new system in place, back-to-school shoppers can see a selection of products, place an order for home delivery or pick up at the store or see if it’s available at another store.

Macy’s has three buckets in its mobile-first strategy – My Wallet, My Stores and My Stylist. My Wallet allows shoppers to access products in their online wallets and pay through a stored credit card. With My Wallet, back-to-school shoppers can pick up products ordered online in store, which allows them to try on their apparel before purchasing. Shoppers scan the barcodes and pay on the app, stopping at a designated counter for a team member to confirm payment and remove sensors.

Macy’s My Stores provide store maps that can guide back-to-school shoppers to product location and offer in-store product recommendations via mobile device. Macy’s My Stylist is still in the pilot phase and allows shoppers to follow a stylist and collaborate with them via chat or style board.

Target has expanded its Drive Up offering to more cities, which lets shopppers have online orders delivered to the car – avoiding a trip into the store.

Kohl's rolled out an Amazon returns program at all its 1,150 stores nationwide on July 9, just in time for the back-to-school shopping season. Shoppers can return back-to-school supplies bought on Amazon at any of the Kohl's stores – free.

Office Depot added school list functionality to its app with thousands of school lists available. These school lists can be added to a virtual shopping cart with a single click. The retailer’s buy online pick up in store option provides same-day pickup for various back-to-school supplies. For select items, the company offers one-hour pick up.

Bed Bath & Beyond offers a school finder option, which gives restrictions so shoppers can figure out what is allowed in the school and what’s not.

Amazon launched a “Happy School Year” store for teachers, students and parents to find classroom supplies, laptops, school clothes and other electronic gadgets. Shoppers can also sign up for a subscription service to automatically replenish items such as paper, pens and others.

Amazon and Mass Merchandisers Remain the Most Popular Online Retailers

According to a May 2019 survey by auditing and research firm Field Agent, Amazon, Walmart and Target are the most popular online retailers among US mothers for purchasing back-to-school supplies.

The study found that 74% of US mothers who plan to buy online this back-to- school season will shop school supplies from Amazon. Some 59% of respondents will make online orders at Walmart, while 29% plan to shop online at Target.

[caption id="attachment_94331" align="aligncenter" width="700"] Base: 947 US mothers of K-12 children who plan to shop online for school supplies for the school year 2019-2020

Base: 947 US mothers of K-12 children who plan to shop online for school supplies for the school year 2019-2020

Source: Field Agent[/caption] Key Insights We estimate well over one-quarter of back-to-school spending will go online this year — about 28%, in fact. But consumers are shopping across channels and retailers are giving them more digital tools and options, including better-equipped mobile apps and more fulfillment choices. Like the holidays, back-to-school shopping is “shopping-list shopping” — it is largely functional and planned — so, we expect consumers to flock to those digital services that reduce friction and expedite the shopping process.

Source: US Census Bureau/US Bureau of Economic Analysis/Coresight Research[/caption]

Mobile Commerce Maintains Growth Momentum with Convenience-Craving Shoppers

Digital adoption represents more than just making purchases online: back-to-school shoppers are researching, browsing and buying across channels. According to a July survey by Prosper Insights & Analytics:

Source: US Census Bureau/US Bureau of Economic Analysis/Coresight Research[/caption]

Mobile Commerce Maintains Growth Momentum with Convenience-Craving Shoppers

Digital adoption represents more than just making purchases online: back-to-school shoppers are researching, browsing and buying across channels. According to a July survey by Prosper Insights & Analytics:

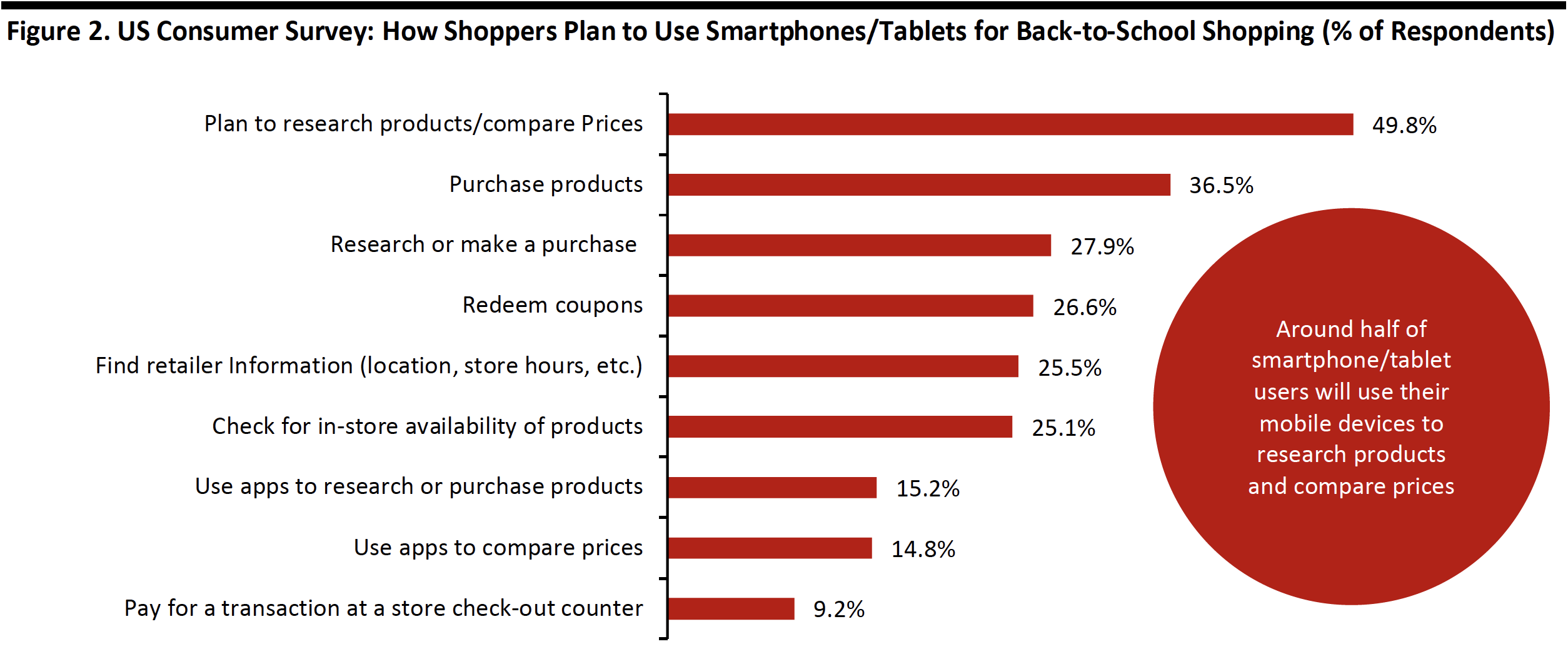

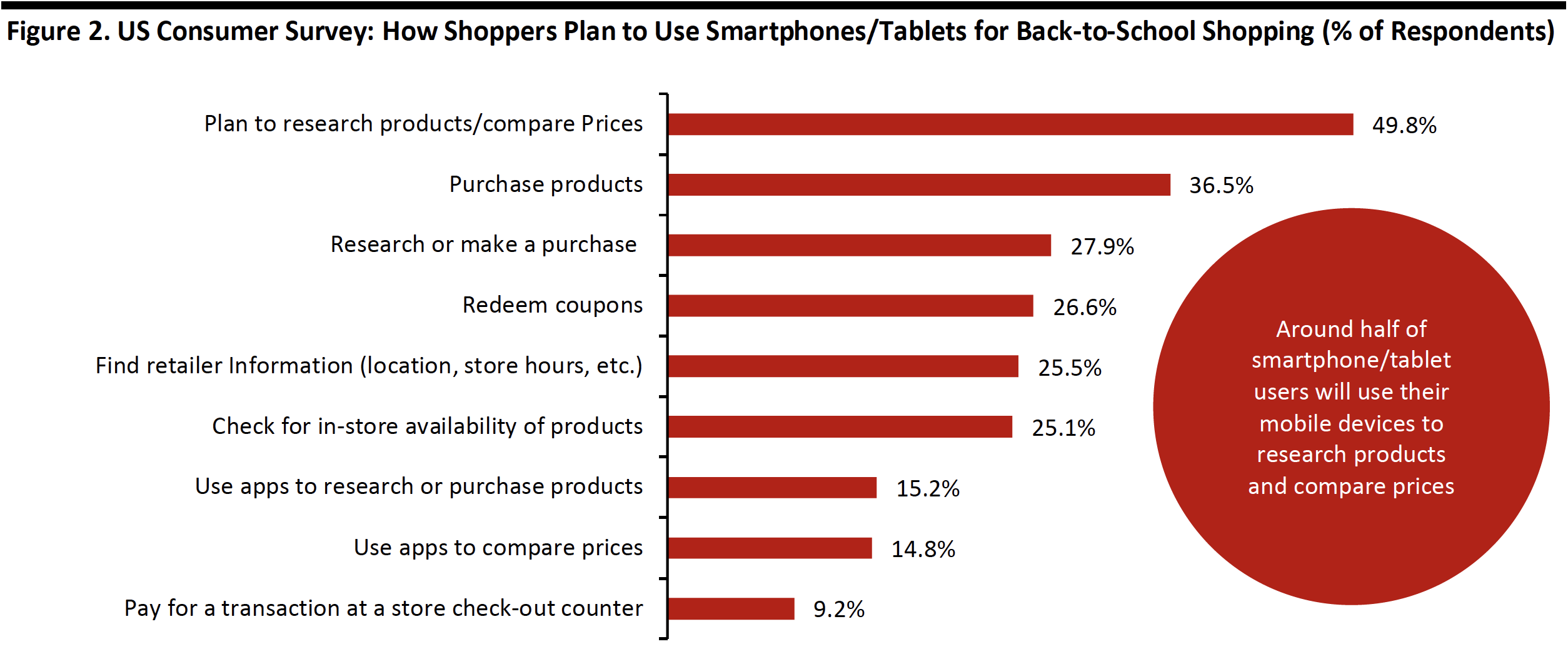

- Around half of smartphone/tablet users with school-age children will use their mobile devices to research products and compare prices.

- Nearly 37% of smartphone/tablet users with school-age children plan to make purchases from their mobile devices, while 27% plan to redeem coupons.

- Reflecting cross-channel shopping behaviors, one-quarter expect to check in-store product availability on their device.

Base: US Internet users aged 18+ with school-age children and own a smartphone or tablet

Base: US Internet users aged 18+ with school-age children and own a smartphone or tabletSource: Prosper Insights & Analytics[/caption] Omnichannel Retail Provides an Opportunity to Win Shoppers Omnichannel retailers enjoy an opportunity to win shoppers who have not yet made back-to-school shopping plans. According to a survey by Deloitte, shoppers plan to spend 56% (versus 57% in 2018) of their budget in-store, 29% online (versus 22% last year) and are undecided about the remaining 15% (versus 20% last year). That undecided portion remains up for grabs amounts to a $4.0 billion market opportunity. Omnichannel retailers must be ready to fight for those dollars. In 2018, omnichannel shoppers drove incremental value during back-to-school season, according to purchase information platform Cardlytics: Back-to-school shoppers who shopped both online and in-store spent 48% more than single-channel customers in 2018. We believe more retailers are boosting omnichannel efforts to capture both in-store and online sales this year. [caption id="attachment_94330" align="aligncenter" width="700"]

Source: Deloitte[/caption]

US Retailer Digital and Omnichannel Retail Strategies

Below, we highlight a few examples of how retailers are implementing their digital and omnichannel strategies:

Walmart offers additional discounts for using its buy online, pick up in store service: Shoppers can pick up in store or have items brought to their car. Walmart also offers a speedy return process through its Mobile Express Returns. Shoppers can visit their nearby store, open the app at the Mobile Express Lane, scan a QR code and then hand over the items to a store associate, getting the refund amount instantly on the app.

Walgreens has replaced 50-60% of its PC-based in-store systems with tablets and handheld devices. With the new system in place, back-to-school shoppers can see a selection of products, place an order for home delivery or pick up at the store or see if it’s available at another store.

Macy’s has three buckets in its mobile-first strategy – My Wallet, My Stores and My Stylist. My Wallet allows shoppers to access products in their online wallets and pay through a stored credit card. With My Wallet, back-to-school shoppers can pick up products ordered online in store, which allows them to try on their apparel before purchasing. Shoppers scan the barcodes and pay on the app, stopping at a designated counter for a team member to confirm payment and remove sensors.

Macy’s My Stores provide store maps that can guide back-to-school shoppers to product location and offer in-store product recommendations via mobile device. Macy’s My Stylist is still in the pilot phase and allows shoppers to follow a stylist and collaborate with them via chat or style board.

Target has expanded its Drive Up offering to more cities, which lets shopppers have online orders delivered to the car – avoiding a trip into the store.

Kohl's rolled out an Amazon returns program at all its 1,150 stores nationwide on July 9, just in time for the back-to-school shopping season. Shoppers can return back-to-school supplies bought on Amazon at any of the Kohl's stores – free.

Office Depot added school list functionality to its app with thousands of school lists available. These school lists can be added to a virtual shopping cart with a single click. The retailer’s buy online pick up in store option provides same-day pickup for various back-to-school supplies. For select items, the company offers one-hour pick up.

Bed Bath & Beyond offers a school finder option, which gives restrictions so shoppers can figure out what is allowed in the school and what’s not.

Amazon launched a “Happy School Year” store for teachers, students and parents to find classroom supplies, laptops, school clothes and other electronic gadgets. Shoppers can also sign up for a subscription service to automatically replenish items such as paper, pens and others.

Amazon and Mass Merchandisers Remain the Most Popular Online Retailers

According to a May 2019 survey by auditing and research firm Field Agent, Amazon, Walmart and Target are the most popular online retailers among US mothers for purchasing back-to-school supplies.

The study found that 74% of US mothers who plan to buy online this back-to- school season will shop school supplies from Amazon. Some 59% of respondents will make online orders at Walmart, while 29% plan to shop online at Target.

[caption id="attachment_94331" align="aligncenter" width="700"]

Source: Deloitte[/caption]

US Retailer Digital and Omnichannel Retail Strategies

Below, we highlight a few examples of how retailers are implementing their digital and omnichannel strategies:

Walmart offers additional discounts for using its buy online, pick up in store service: Shoppers can pick up in store or have items brought to their car. Walmart also offers a speedy return process through its Mobile Express Returns. Shoppers can visit their nearby store, open the app at the Mobile Express Lane, scan a QR code and then hand over the items to a store associate, getting the refund amount instantly on the app.

Walgreens has replaced 50-60% of its PC-based in-store systems with tablets and handheld devices. With the new system in place, back-to-school shoppers can see a selection of products, place an order for home delivery or pick up at the store or see if it’s available at another store.

Macy’s has three buckets in its mobile-first strategy – My Wallet, My Stores and My Stylist. My Wallet allows shoppers to access products in their online wallets and pay through a stored credit card. With My Wallet, back-to-school shoppers can pick up products ordered online in store, which allows them to try on their apparel before purchasing. Shoppers scan the barcodes and pay on the app, stopping at a designated counter for a team member to confirm payment and remove sensors.

Macy’s My Stores provide store maps that can guide back-to-school shoppers to product location and offer in-store product recommendations via mobile device. Macy’s My Stylist is still in the pilot phase and allows shoppers to follow a stylist and collaborate with them via chat or style board.

Target has expanded its Drive Up offering to more cities, which lets shopppers have online orders delivered to the car – avoiding a trip into the store.

Kohl's rolled out an Amazon returns program at all its 1,150 stores nationwide on July 9, just in time for the back-to-school shopping season. Shoppers can return back-to-school supplies bought on Amazon at any of the Kohl's stores – free.

Office Depot added school list functionality to its app with thousands of school lists available. These school lists can be added to a virtual shopping cart with a single click. The retailer’s buy online pick up in store option provides same-day pickup for various back-to-school supplies. For select items, the company offers one-hour pick up.

Bed Bath & Beyond offers a school finder option, which gives restrictions so shoppers can figure out what is allowed in the school and what’s not.

Amazon launched a “Happy School Year” store for teachers, students and parents to find classroom supplies, laptops, school clothes and other electronic gadgets. Shoppers can also sign up for a subscription service to automatically replenish items such as paper, pens and others.

Amazon and Mass Merchandisers Remain the Most Popular Online Retailers

According to a May 2019 survey by auditing and research firm Field Agent, Amazon, Walmart and Target are the most popular online retailers among US mothers for purchasing back-to-school supplies.

The study found that 74% of US mothers who plan to buy online this back-to- school season will shop school supplies from Amazon. Some 59% of respondents will make online orders at Walmart, while 29% plan to shop online at Target.

[caption id="attachment_94331" align="aligncenter" width="700"] Base: 947 US mothers of K-12 children who plan to shop online for school supplies for the school year 2019-2020

Base: 947 US mothers of K-12 children who plan to shop online for school supplies for the school year 2019-2020Source: Field Agent[/caption] Key Insights We estimate well over one-quarter of back-to-school spending will go online this year — about 28%, in fact. But consumers are shopping across channels and retailers are giving them more digital tools and options, including better-equipped mobile apps and more fulfillment choices. Like the holidays, back-to-school shopping is “shopping-list shopping” — it is largely functional and planned — so, we expect consumers to flock to those digital services that reduce friction and expedite the shopping process.