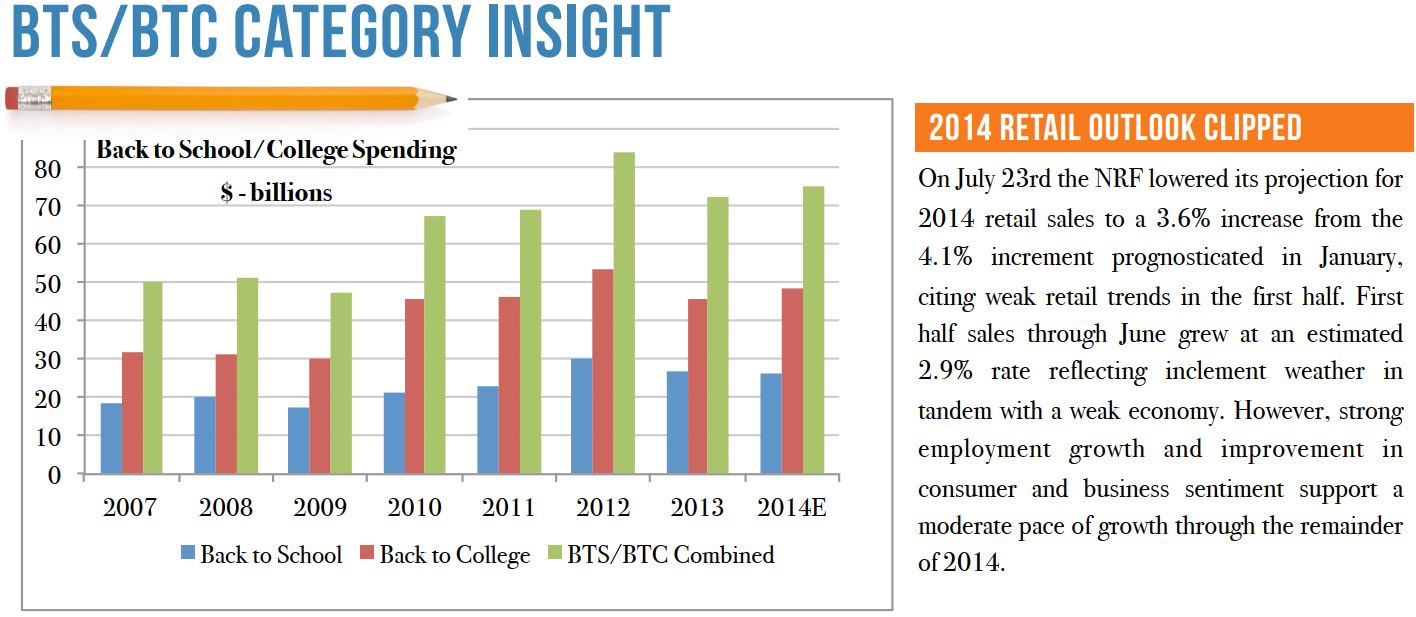

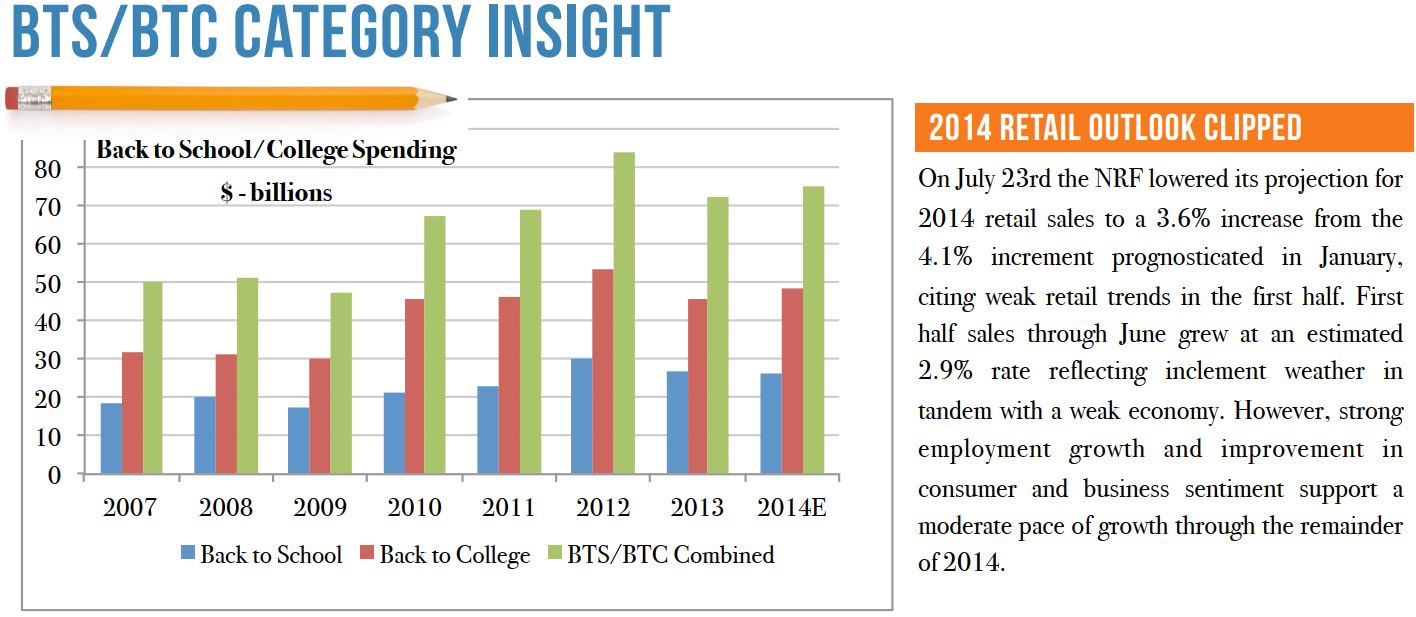

The National Retail Federation (NRF) released its annual Back to School/Back to College (BTS/BTC) outlook on July 17 and projected a combined total spending of $74.9 billion, up 3.3% from the projected season’s spend in 2013.

According to

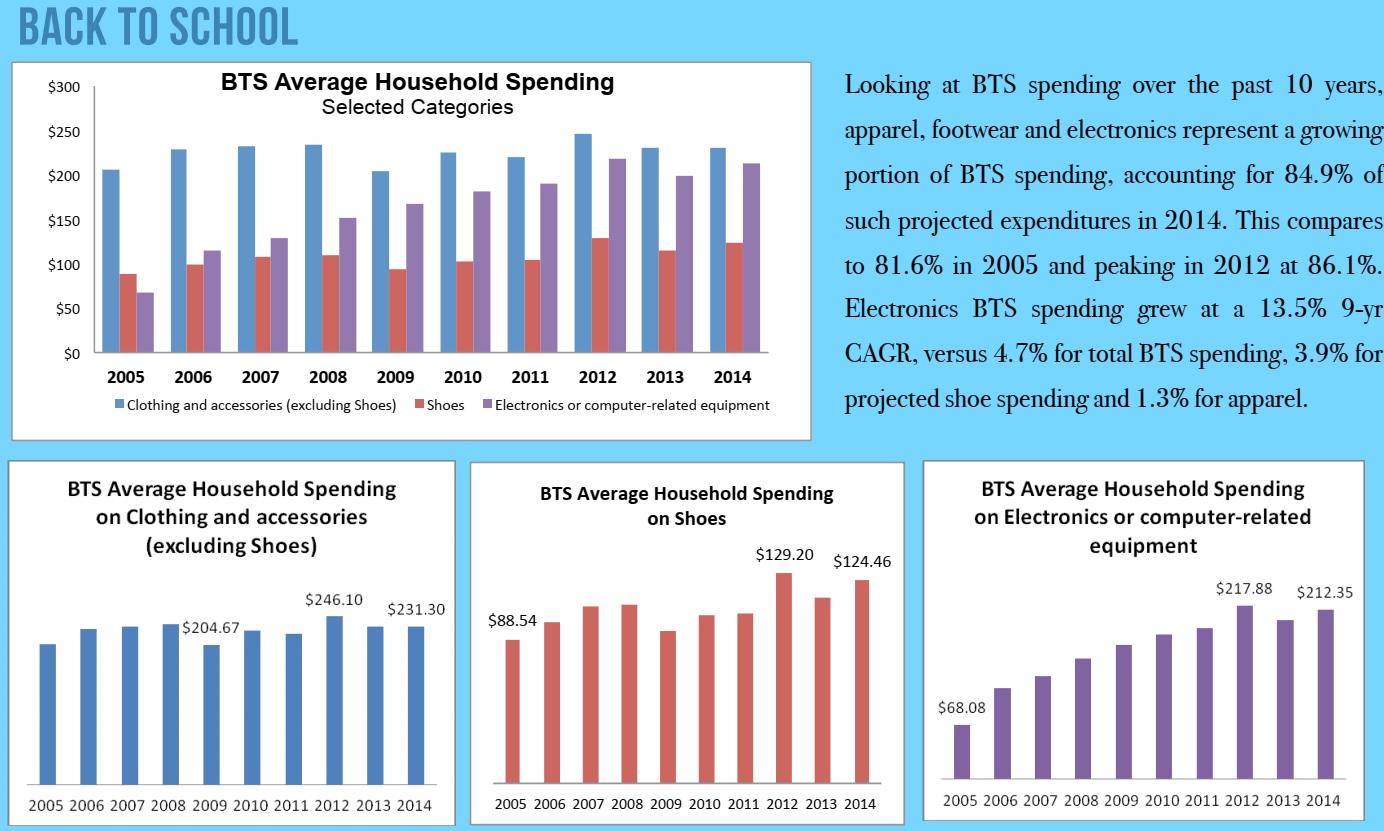

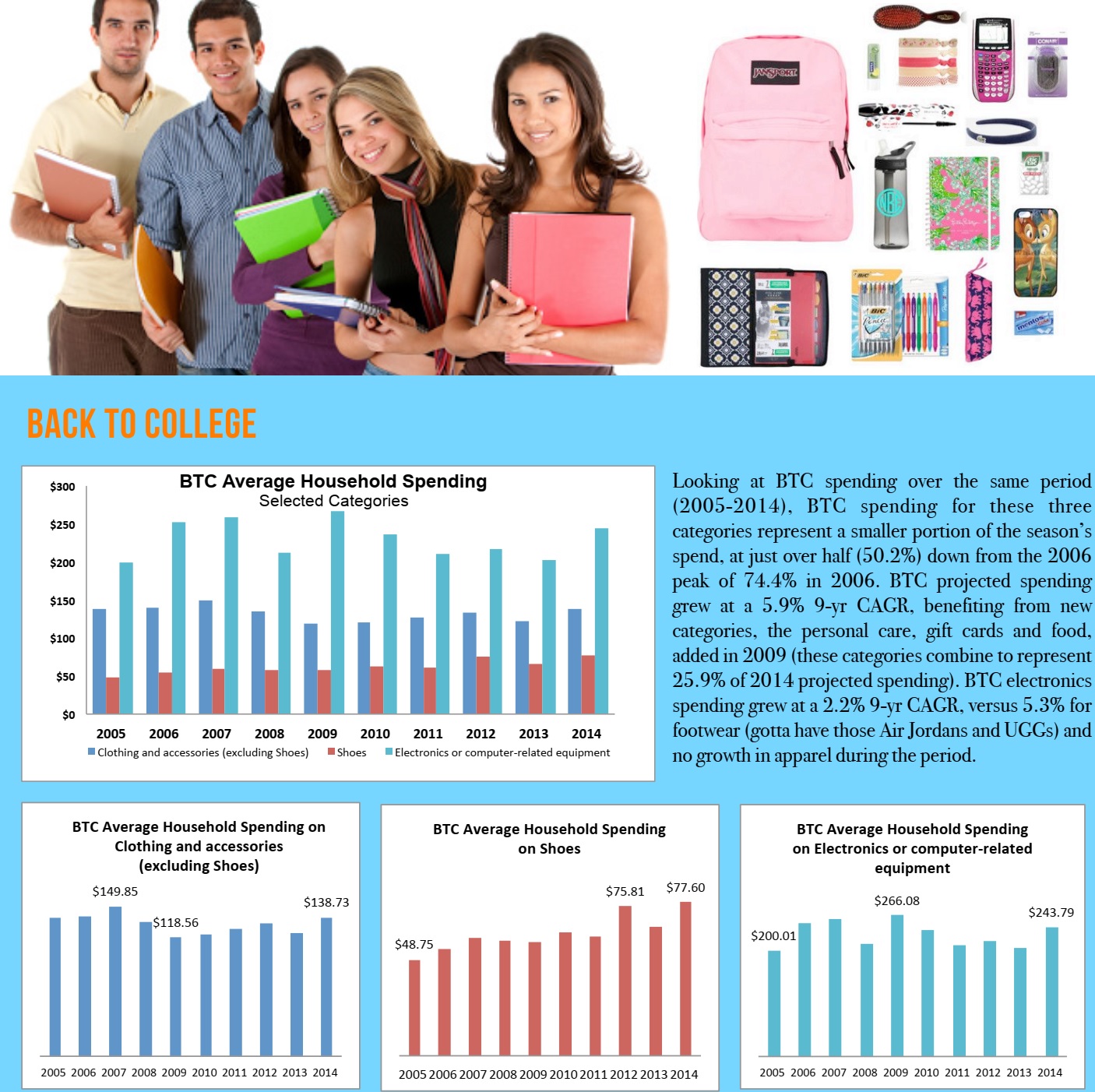

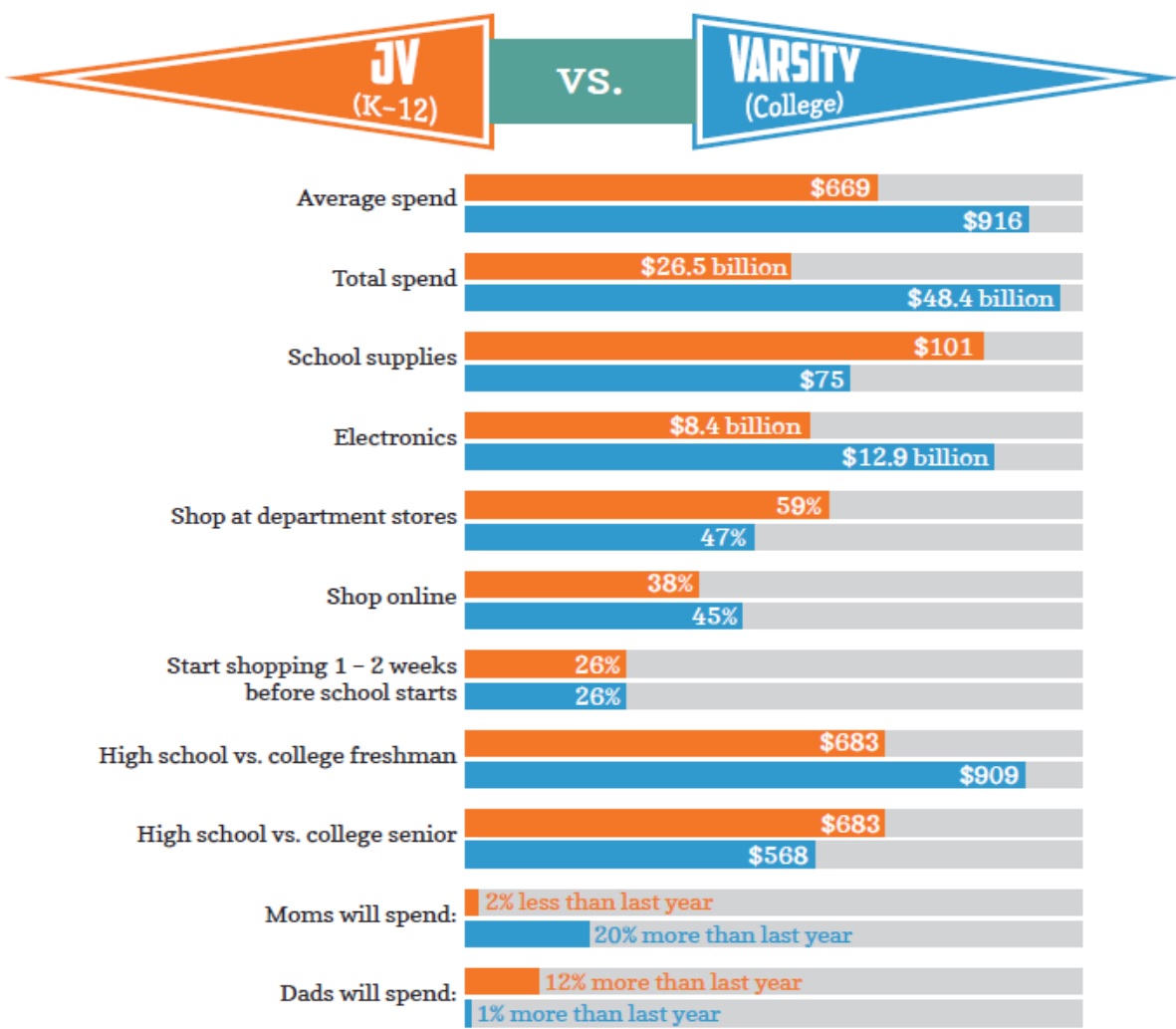

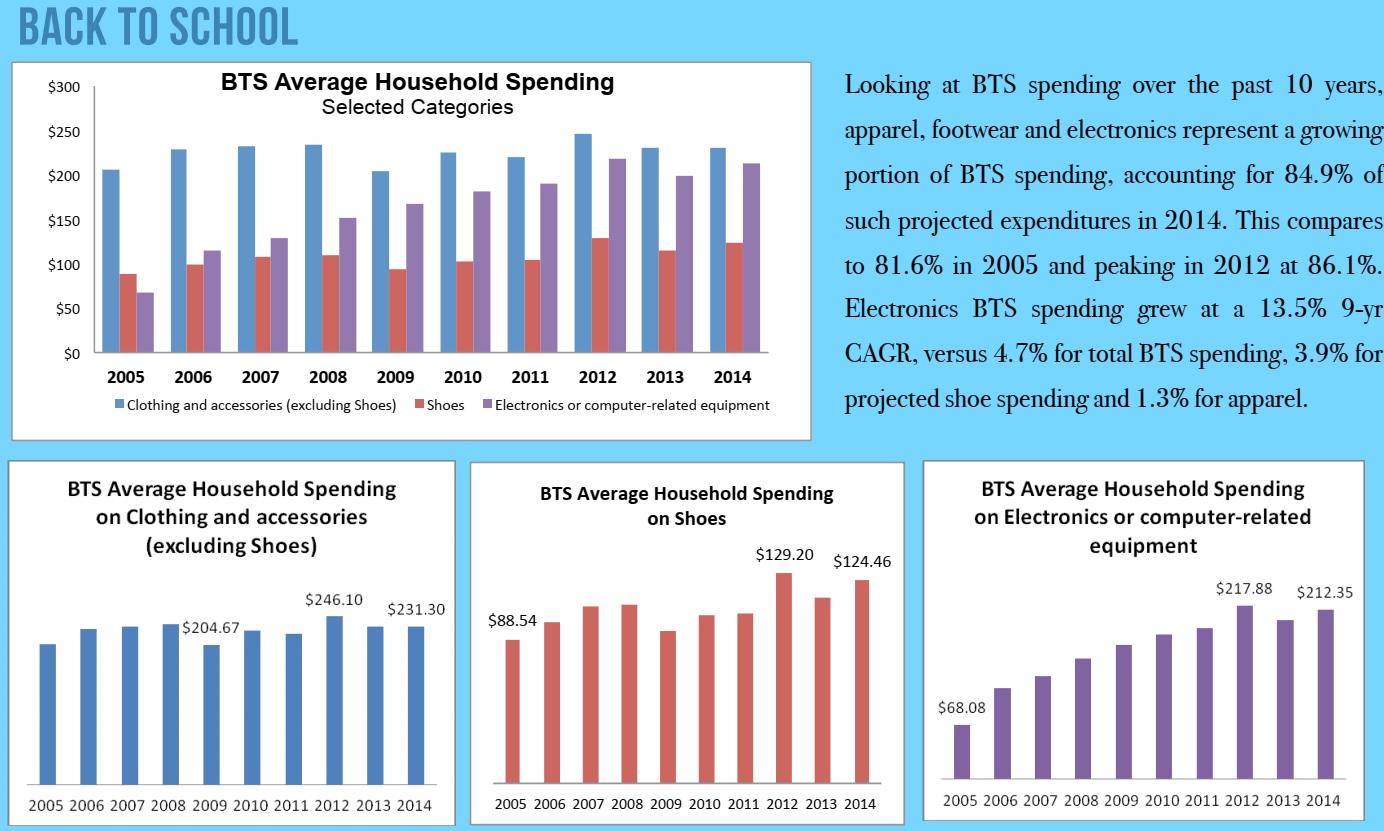

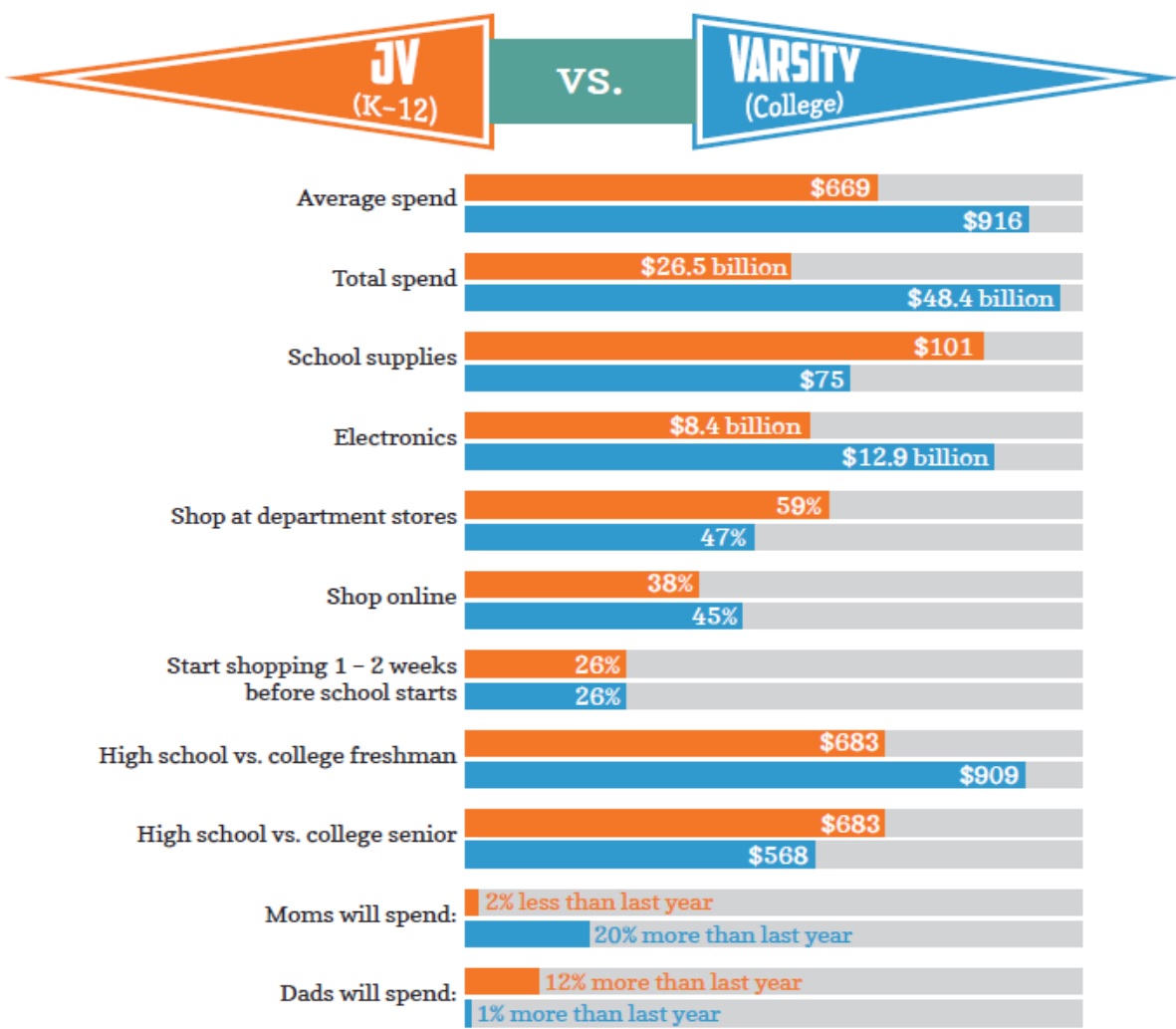

NRF’s 2014 BTS Survey conducted by Prosper Insights & Analytics, the average family with children in grades K-12 will spend $669 on apparel, shoes, supplies and electronics, up 5% from $635 last year, totaling $26.5 billion. Its BTC Survey found the average college student and their family will spend $916 on dorm furniture, school supplies, electronics and more, up 10% from $837 last year for a $48.4 billion total. Spending on electronics (including PCs, cell phones, calculators, digital cameras and mp3 players) and apparel garner the greatest wallet share with the K-12 demographic spending an average $231 on apparel and $212 on electronics, while for the older college age students, spending on apparel is expected to average $139 and $244 for electronics.

The

International Council of Shopping Centers (ICSC) is looking for an average $672 BTS spending. $347 on electronics and $325 on non-electronic categories including apparel, footwear, backpacks and supplies with a significant YOY lift in households intending to purchase dorm-type furniture (from 17% to 27%).

eMarketer is projecting a 16% increase in e- commerce BTS sales (which they define as digital sales excluding travel and event services occurring in July and August), to $50.2 billion, with core BTS categories (apparel, accessories, books & media, consumer electronics, office equipment and supplies, toys and hobby) growing at a 16.5% pace to $27.4 billion. With the season’s above average growth rate, eMarketer projects the season’s spending to account for 16.5% of 2014 e-commerce spending and during Q3, e-commerce sales of core BTS categories will account for a hefty 38.5% of total e-commerce (excluding travel and event tickets).

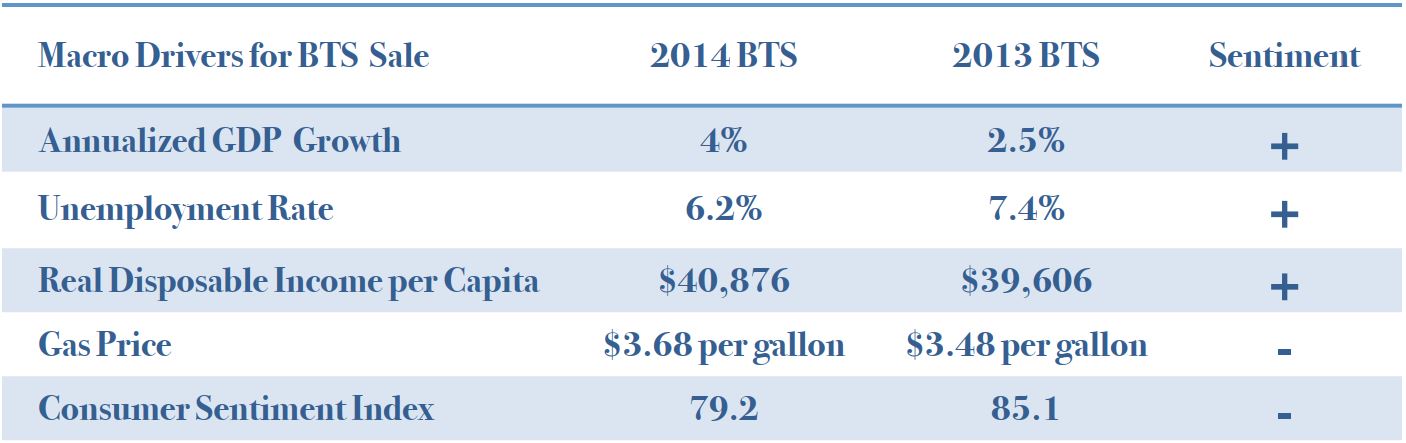

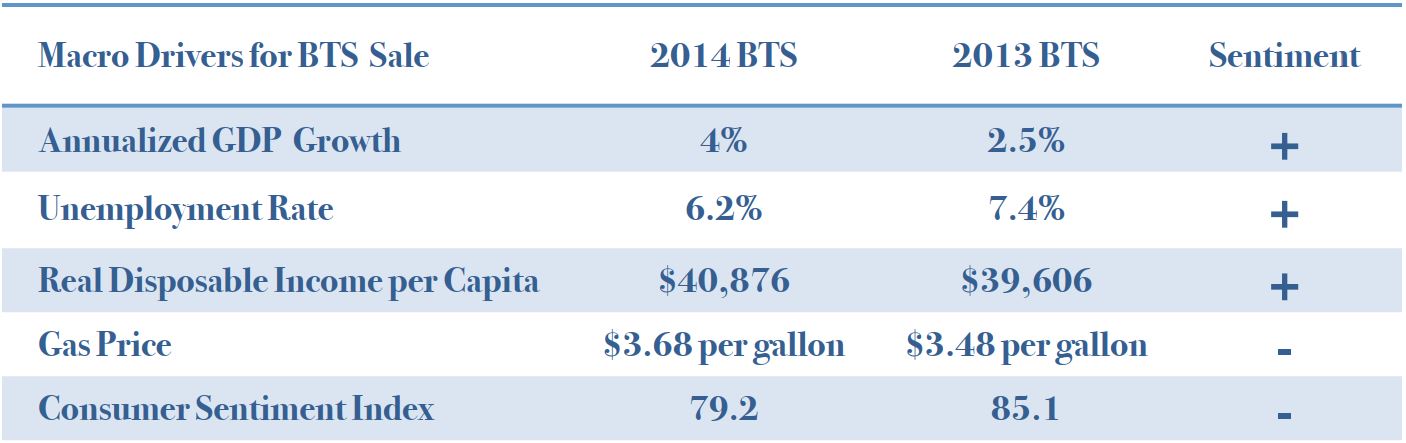

From GDP growth, teen unemployment to the cost of gas at the pump, macro factors impact consumer sentiment and consumer spending. The University of Michigan preliminary reading on U.S. consumer sentiment (released August 15) was weaker than expected, coming in at 79.2 versus the Bloomberg consensus estimate of 82.3 reflecting a pessimistic outlook. This could portend of a potentially disinterested consumer for holiday spending. Meanwhile, consumers’ assessment of the current situation improved modestly, so BTS/BTC spending is not likely to suffer. Additionally, BTS demand is somewhat isolated given the needs based aspect to the season’s shopping list. Another plus this year is the estimated 526,000 additional primary, secondary and post-secondary students enrolled in 2014, a 0.7% increase to a 76.7 million, and the highest enrollment since 2007.

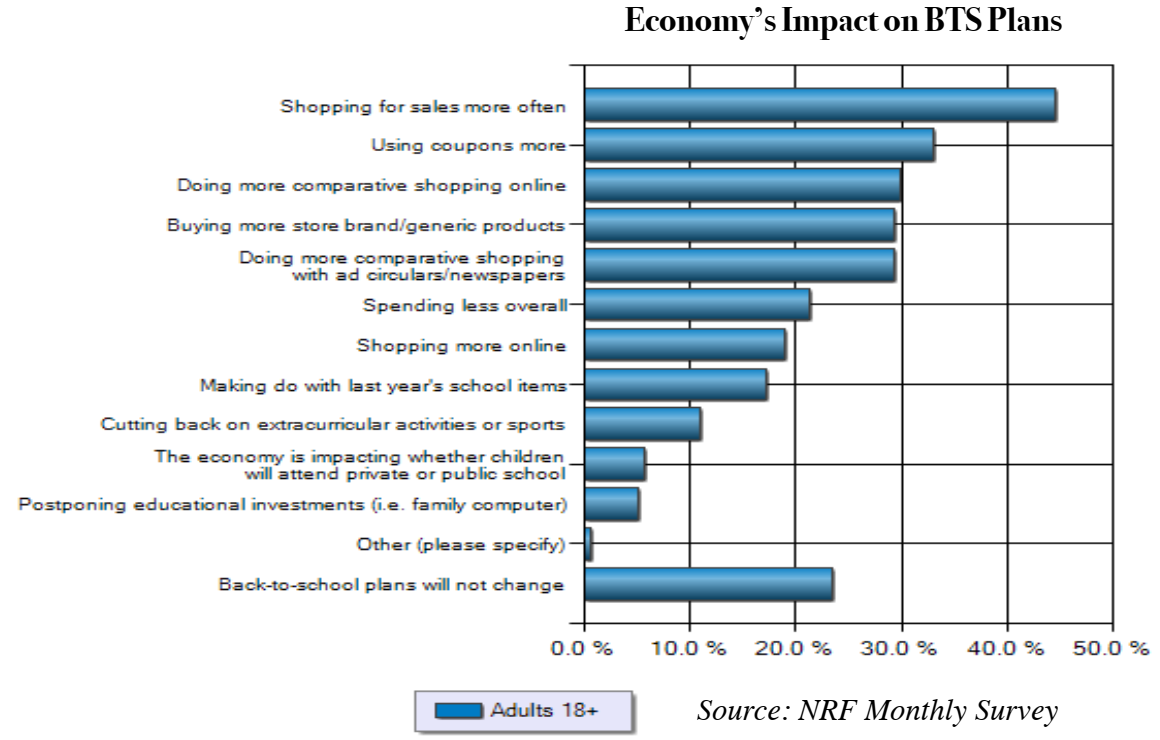

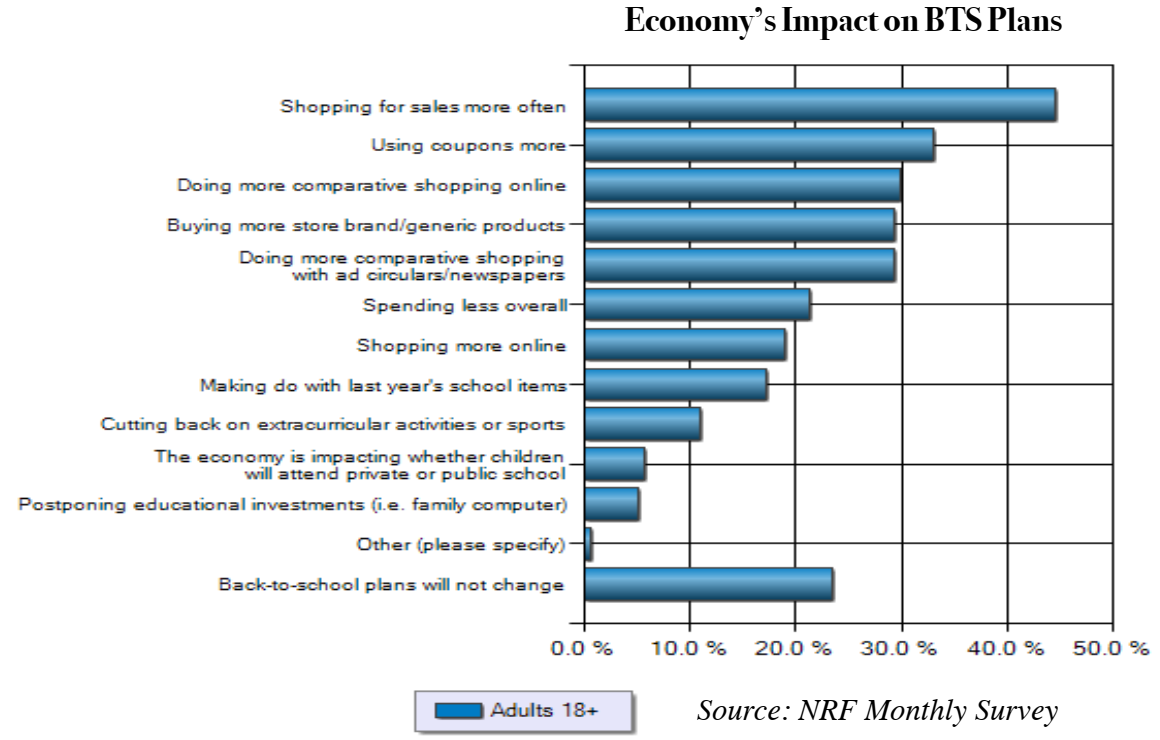

Since 2009 the NRF has asked school shoppers how the U.S. economy will impact their spending plans. This year eight in ten Americans shopping for the season’s merchandise are affected. The survey concludes that more families plan to buy store brand/generic items for school, will make do with last year’s items, and plan to shop online more often to save money. The latter metric rose from 18.5% to 19.6% of BTS shoppers and from 19% to 21% for BTC shoppers, (one third of BTC shoppers plan to do comparative shopping online.)

Mobile devices are a handy aid for BTS/BTC shopping, with 37% of BTS shoppers who own a smartphone using it for research and 22% expect to make a purchase. Among BTC shoppers, 34% plan to use their smartphone for research and 22%, to purchase. Both BTS and BTC shoppers use their mobile devices to locate brick and mortar stores and to locate and compare products and prices.

According to a white paper

UPS Pulse of the Online Shopper (June 2014), which surveyed 5,849 online shoppers, consumer preference remains desktop or laptop for researching (61%) and purchasing (41%) with a tablet being the preferred method of research for 11% and preferred by 7% for purchase, followed by smart phones with 10% and 4%, respectively. Improvements in mobile-centric experiences will drive a shift to increased mobile purchases, potentially seen this coming holiday season.

More than half the consumers queried opted to pick up their purchase in the store, and 40% of those shoppers made additional purchases on those ‘pick up’ trips. This behavior is pivotal to omnichannel success and mobile can be vital in this cross-channel shopping behavior with product recommendations and handy coupons inside mobile wallets. Presently, the biggest hurdle for mobile is the imagery and product details aren’t adequate for shoppers to complete the t r ansaction. Shoppers want more information! So off to the store or a tablet, and yet even after the store visit, many opt to complete the purchase online. In the store, the most frequent use of smart phones is for price comparisons (36%). Despite the growing propensity to use technology and mobile, about 90% of retail transactions in the U.S. occur in a physical store environment.

Department and discount stores are the retailers of choice for both student groups, with more than half of the respondents planning to shop these formats according to the NRF. The ICSC sees 80% of BTS shoppers heading to discounters in 2014 (down from 90% in 2013) affording the channel 23.7% of the season’s total spend, versus 28.6% last year. Specialty stores will see seasonal traffic as well with 54% of BTS shoppers planning a visit to clothing stores and 28% intending to visit an electronics store.

Michael Shay, CEO of the NRF stated, “Slow improvements in the economy may have contributed to the growth in confidence among back-to-school shoppers, and while we are encouraged by the overall tone of the results and expect to see continued improvement in consumer spending through the year, we know Americans are still grappling with their purchase decisions every day.”

The NRF looked at the many influences affecting shoppers, and according to its survey 35% of parents say more than half of their BTS spending is influenced by their children. At the high school level, students drive 100% of BTS in 12% of households. Prosper Insights Consumer Insights Director Pam Goodfellow commented, “Students will make sure to keep one eye on social media and the other on retailers’ websites as they seek out what’s new and exciting in their hunt for fresh, fashionable and relevant back-to-school gear.” This is a heads up to mobile marketers as they plan their holiday strategies.

Lazy, narcissistic and easily bored, the Millennial generation is a unique group of people that retailers are trying to engage as the consumers of tomorrow. There are currently 80 million Millennials, Generation Y or GenY in the U.S. alone, born during the 1982-2000 span. By 2020, they will represent a total of $1.4 trillion or 30% of retail sales in the U.S.

This young generation is often self-expressive, less financially independent and prefer an urban living environment. Millennials are the most connected generation, nearly universal according to eMarketer, which estimates 97% penetration among 12-17 year olds and 93.5% for their 18-24 year old siblings (aggregate penetration is at 77.7% in the U.S.). Because of their distinctive characteristics, they tend to exhibit different shopping patterns from the rest of the general population.

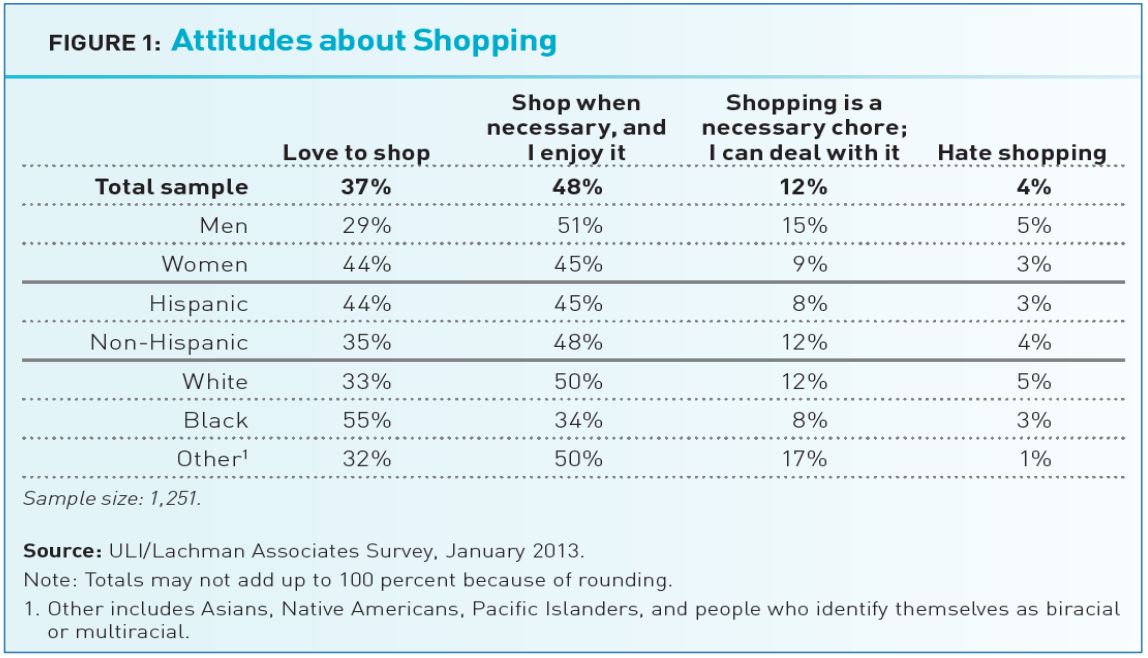

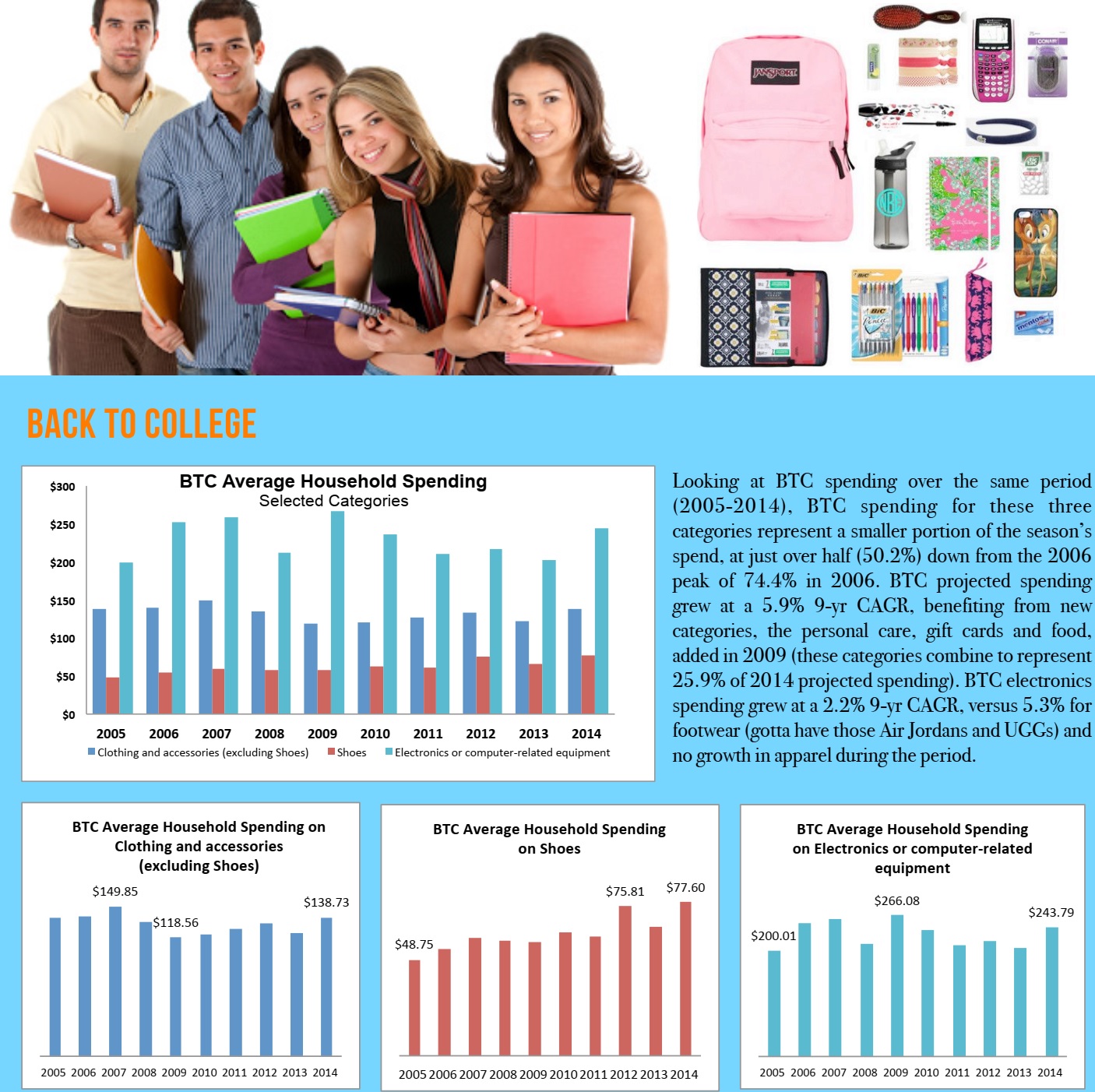

Millennials love shopping

Rest assured that Millennials love shopping: 85% of this generation enjoys shopping and nearly two thirds visit shopping malls monthly. However, they show little brand loyalty and are constantly attracted to new things. Retailers need to increase their efforts to more frequently change store displays and to renovate stores to attract this flighty demographic.

With their income restrained, Millennials tend to shop for cheaper options at discount stores and browse online for coupons. In the NRF BTS/BTC survey, discount stores rank the number one destination for BTS and Millennial consumers will frequently shop for sales regardless of channels.

Source: Urban Land Institute

In addition to their preference for discount stores, they are looking for a seamless shopping experience with 24/7 access. While it is true that Millennials often shop online, this generation also enjoys shopping at brick and mortar stores, with the option to ‘touch and feel it.’

Millennials represent the high school and college segment (age 15-22) in BTS/BTC. They are expected to have a significant influence on purchasing choices this year as noted above and plan to spend $913 million (in the aggregate) of their own savings to buy BTS/BTC items. Millennials plan to spend $247 more than their younger counterparts, significantly favoring electronics.

Source: 2014 survey conducted by Prosper Insights & Analytics

1. Tech-friendly Backpacks:

Tablets and computers are among the most popular BTS products for 2014. Backpacks equipped with compartments and padding for laptops/tablets are of the most interest.

2. Wearable Tech:

Fitness Tracking Accessories:

Millennials are heavy tech users and there is no exception when it comes to keeping fit. They are more likely to track their own health data and use technology as a complement to their fitness routine.

Hottest for Kids:

Hottest for Kids:

Since 1 in 10 parents reports that 100% of purchases are influenced by children, product developers created a slew of attractive wearable tech accessories that are particularly appealing to kids, such as colorful touch-screen watches with educational games for ages 4+.

3. Sneaker Rebirth

Marking the new school year with new shoes has been the tradition for generations of BTS shoppers. For 2014, brands big or small have reinvented the appearance of their sneakers without altering the forever-popular structure of their footwear. Prints and embellishment carry the overall best-sellers.

4. Pretty in Pastel

The array of pastel colors from Spring 2014 are still going strong into Fall.

5. Prints, Prints, Everywhere

Floral, geometric, kitchy prints, animal prints you name it!

6. The Must-Have Maxi Skirt

Maxi skirts are versatile. It continues to be the must-have item for back-to-school season. The favorite summer maxi skirt is perfect for fall with a pair of new boots.

7. Wild Wild West

The word “WILD” says it! The cowgirl boots and suede with fringe stand out in the crowd right up against the 90s grunge.

8. Back to the ’90s

The 90s grunge style is the Millennials’ retro. It represents the rebellious spirit embodied by every teen.

9. Plaid Is Forever!

What is Fall without plaid! Plaid has been the connecting piece between fall and holidays. It works perfectly with 90s grunge as well as the Western look in 2014.

10. Grey Denim for Boys and Girls

Colored denim has been sought-after through the year. Grey denim becomes the most popular for both boys and girls for this back-to-school season.

While early bird shoppers are at it in July, most shoppers wait until the end of summer and benefit from its heightened promotional activity. According to the NRF survey, one quarter will wait to take advantage of retailers’ late summer deals and shop one to two weeks before school begins while 23% plan to begin shopping at least two months before school starts and 45% will shop three to four weeks before school starts. Less than 10% plan to begin their shopping after the start of the school year. According to ICSC, while August captures the lion share of BTS shopping at 59.1%, the month lost 6.6 percentage points of total BTS spending versus 2013; July captured an additional 4.5 percentage points with 22.1% of 2014 BTS shopping ( vs. 17. 6% in 2013) and September, 2 percentage points to 18.8%.

The National Retail Federation (NRF) released its annual Back to School/Back to College (BTS/BTC) outlook on July 17 and projected a combined total spending of $74.9 billion, up 3.3% from the projected season’s spend in 2013.

According to NRF’s 2014 BTS Survey conducted by Prosper Insights & Analytics, the average family with children in grades K-12 will spend $669 on apparel, shoes, supplies and electronics, up 5% from $635 last year, totaling $26.5 billion. Its BTC Survey found the average college student and their family will spend $916 on dorm furniture, school supplies, electronics and more, up 10% from $837 last year for a $48.4 billion total. Spending on electronics (including PCs, cell phones, calculators, digital cameras and mp3 players) and apparel garner the greatest wallet share with the K-12 demographic spending an average $231 on apparel and $212 on electronics, while for the older college age students, spending on apparel is expected to average $139 and $244 for electronics.

The National Retail Federation (NRF) released its annual Back to School/Back to College (BTS/BTC) outlook on July 17 and projected a combined total spending of $74.9 billion, up 3.3% from the projected season’s spend in 2013.

According to NRF’s 2014 BTS Survey conducted by Prosper Insights & Analytics, the average family with children in grades K-12 will spend $669 on apparel, shoes, supplies and electronics, up 5% from $635 last year, totaling $26.5 billion. Its BTC Survey found the average college student and their family will spend $916 on dorm furniture, school supplies, electronics and more, up 10% from $837 last year for a $48.4 billion total. Spending on electronics (including PCs, cell phones, calculators, digital cameras and mp3 players) and apparel garner the greatest wallet share with the K-12 demographic spending an average $231 on apparel and $212 on electronics, while for the older college age students, spending on apparel is expected to average $139 and $244 for electronics.

The International Council of Shopping Centers (ICSC) is looking for an average $672 BTS spending. $347 on electronics and $325 on non-electronic categories including apparel, footwear, backpacks and supplies with a significant YOY lift in households intending to purchase dorm-type furniture (from 17% to 27%).

eMarketer is projecting a 16% increase in e- commerce BTS sales (which they define as digital sales excluding travel and event services occurring in July and August), to $50.2 billion, with core BTS categories (apparel, accessories, books & media, consumer electronics, office equipment and supplies, toys and hobby) growing at a 16.5% pace to $27.4 billion. With the season’s above average growth rate, eMarketer projects the season’s spending to account for 16.5% of 2014 e-commerce spending and during Q3, e-commerce sales of core BTS categories will account for a hefty 38.5% of total e-commerce (excluding travel and event tickets).

The International Council of Shopping Centers (ICSC) is looking for an average $672 BTS spending. $347 on electronics and $325 on non-electronic categories including apparel, footwear, backpacks and supplies with a significant YOY lift in households intending to purchase dorm-type furniture (from 17% to 27%).

eMarketer is projecting a 16% increase in e- commerce BTS sales (which they define as digital sales excluding travel and event services occurring in July and August), to $50.2 billion, with core BTS categories (apparel, accessories, books & media, consumer electronics, office equipment and supplies, toys and hobby) growing at a 16.5% pace to $27.4 billion. With the season’s above average growth rate, eMarketer projects the season’s spending to account for 16.5% of 2014 e-commerce spending and during Q3, e-commerce sales of core BTS categories will account for a hefty 38.5% of total e-commerce (excluding travel and event tickets).

From GDP growth, teen unemployment to the cost of gas at the pump, macro factors impact consumer sentiment and consumer spending. The University of Michigan preliminary reading on U.S. consumer sentiment (released August 15) was weaker than expected, coming in at 79.2 versus the Bloomberg consensus estimate of 82.3 reflecting a pessimistic outlook. This could portend of a potentially disinterested consumer for holiday spending. Meanwhile, consumers’ assessment of the current situation improved modestly, so BTS/BTC spending is not likely to suffer. Additionally, BTS demand is somewhat isolated given the needs based aspect to the season’s shopping list. Another plus this year is the estimated 526,000 additional primary, secondary and post-secondary students enrolled in 2014, a 0.7% increase to a 76.7 million, and the highest enrollment since 2007.

From GDP growth, teen unemployment to the cost of gas at the pump, macro factors impact consumer sentiment and consumer spending. The University of Michigan preliminary reading on U.S. consumer sentiment (released August 15) was weaker than expected, coming in at 79.2 versus the Bloomberg consensus estimate of 82.3 reflecting a pessimistic outlook. This could portend of a potentially disinterested consumer for holiday spending. Meanwhile, consumers’ assessment of the current situation improved modestly, so BTS/BTC spending is not likely to suffer. Additionally, BTS demand is somewhat isolated given the needs based aspect to the season’s shopping list. Another plus this year is the estimated 526,000 additional primary, secondary and post-secondary students enrolled in 2014, a 0.7% increase to a 76.7 million, and the highest enrollment since 2007.

Since 2009 the NRF has asked school shoppers how the U.S. economy will impact their spending plans. This year eight in ten Americans shopping for the season’s merchandise are affected. The survey concludes that more families plan to buy store brand/generic items for school, will make do with last year’s items, and plan to shop online more often to save money. The latter metric rose from 18.5% to 19.6% of BTS shoppers and from 19% to 21% for BTC shoppers, (one third of BTC shoppers plan to do comparative shopping online.)

Since 2009 the NRF has asked school shoppers how the U.S. economy will impact their spending plans. This year eight in ten Americans shopping for the season’s merchandise are affected. The survey concludes that more families plan to buy store brand/generic items for school, will make do with last year’s items, and plan to shop online more often to save money. The latter metric rose from 18.5% to 19.6% of BTS shoppers and from 19% to 21% for BTC shoppers, (one third of BTC shoppers plan to do comparative shopping online.)

Mobile devices are a handy aid for BTS/BTC shopping, with 37% of BTS shoppers who own a smartphone using it for research and 22% expect to make a purchase. Among BTC shoppers, 34% plan to use their smartphone for research and 22%, to purchase. Both BTS and BTC shoppers use their mobile devices to locate brick and mortar stores and to locate and compare products and prices.

According to a white paper UPS Pulse of the Online Shopper (June 2014), which surveyed 5,849 online shoppers, consumer preference remains desktop or laptop for researching (61%) and purchasing (41%) with a tablet being the preferred method of research for 11% and preferred by 7% for purchase, followed by smart phones with 10% and 4%, respectively. Improvements in mobile-centric experiences will drive a shift to increased mobile purchases, potentially seen this coming holiday season.

More than half the consumers queried opted to pick up their purchase in the store, and 40% of those shoppers made additional purchases on those ‘pick up’ trips. This behavior is pivotal to omnichannel success and mobile can be vital in this cross-channel shopping behavior with product recommendations and handy coupons inside mobile wallets. Presently, the biggest hurdle for mobile is the imagery and product details aren’t adequate for shoppers to complete the t r ansaction. Shoppers want more information! So off to the store or a tablet, and yet even after the store visit, many opt to complete the purchase online. In the store, the most frequent use of smart phones is for price comparisons (36%). Despite the growing propensity to use technology and mobile, about 90% of retail transactions in the U.S. occur in a physical store environment.

Mobile devices are a handy aid for BTS/BTC shopping, with 37% of BTS shoppers who own a smartphone using it for research and 22% expect to make a purchase. Among BTC shoppers, 34% plan to use their smartphone for research and 22%, to purchase. Both BTS and BTC shoppers use their mobile devices to locate brick and mortar stores and to locate and compare products and prices.

According to a white paper UPS Pulse of the Online Shopper (June 2014), which surveyed 5,849 online shoppers, consumer preference remains desktop or laptop for researching (61%) and purchasing (41%) with a tablet being the preferred method of research for 11% and preferred by 7% for purchase, followed by smart phones with 10% and 4%, respectively. Improvements in mobile-centric experiences will drive a shift to increased mobile purchases, potentially seen this coming holiday season.

More than half the consumers queried opted to pick up their purchase in the store, and 40% of those shoppers made additional purchases on those ‘pick up’ trips. This behavior is pivotal to omnichannel success and mobile can be vital in this cross-channel shopping behavior with product recommendations and handy coupons inside mobile wallets. Presently, the biggest hurdle for mobile is the imagery and product details aren’t adequate for shoppers to complete the t r ansaction. Shoppers want more information! So off to the store or a tablet, and yet even after the store visit, many opt to complete the purchase online. In the store, the most frequent use of smart phones is for price comparisons (36%). Despite the growing propensity to use technology and mobile, about 90% of retail transactions in the U.S. occur in a physical store environment.

Department and discount stores are the retailers of choice for both student groups, with more than half of the respondents planning to shop these formats according to the NRF. The ICSC sees 80% of BTS shoppers heading to discounters in 2014 (down from 90% in 2013) affording the channel 23.7% of the season’s total spend, versus 28.6% last year. Specialty stores will see seasonal traffic as well with 54% of BTS shoppers planning a visit to clothing stores and 28% intending to visit an electronics store.

Michael Shay, CEO of the NRF stated, “Slow improvements in the economy may have contributed to the growth in confidence among back-to-school shoppers, and while we are encouraged by the overall tone of the results and expect to see continued improvement in consumer spending through the year, we know Americans are still grappling with their purchase decisions every day.”

The NRF looked at the many influences affecting shoppers, and according to its survey 35% of parents say more than half of their BTS spending is influenced by their children. At the high school level, students drive 100% of BTS in 12% of households. Prosper Insights Consumer Insights Director Pam Goodfellow commented, “Students will make sure to keep one eye on social media and the other on retailers’ websites as they seek out what’s new and exciting in their hunt for fresh, fashionable and relevant back-to-school gear.” This is a heads up to mobile marketers as they plan their holiday strategies.

Department and discount stores are the retailers of choice for both student groups, with more than half of the respondents planning to shop these formats according to the NRF. The ICSC sees 80% of BTS shoppers heading to discounters in 2014 (down from 90% in 2013) affording the channel 23.7% of the season’s total spend, versus 28.6% last year. Specialty stores will see seasonal traffic as well with 54% of BTS shoppers planning a visit to clothing stores and 28% intending to visit an electronics store.

Michael Shay, CEO of the NRF stated, “Slow improvements in the economy may have contributed to the growth in confidence among back-to-school shoppers, and while we are encouraged by the overall tone of the results and expect to see continued improvement in consumer spending through the year, we know Americans are still grappling with their purchase decisions every day.”

The NRF looked at the many influences affecting shoppers, and according to its survey 35% of parents say more than half of their BTS spending is influenced by their children. At the high school level, students drive 100% of BTS in 12% of households. Prosper Insights Consumer Insights Director Pam Goodfellow commented, “Students will make sure to keep one eye on social media and the other on retailers’ websites as they seek out what’s new and exciting in their hunt for fresh, fashionable and relevant back-to-school gear.” This is a heads up to mobile marketers as they plan their holiday strategies.

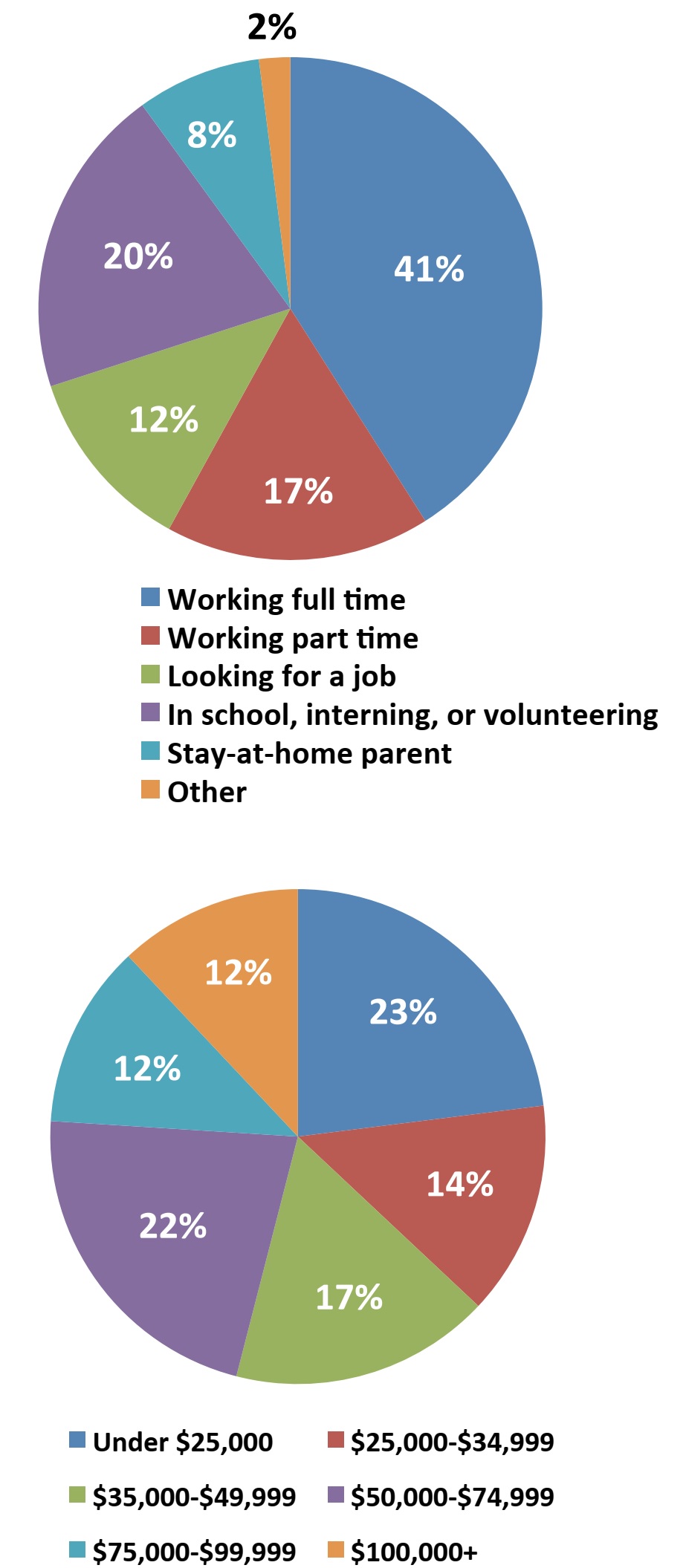

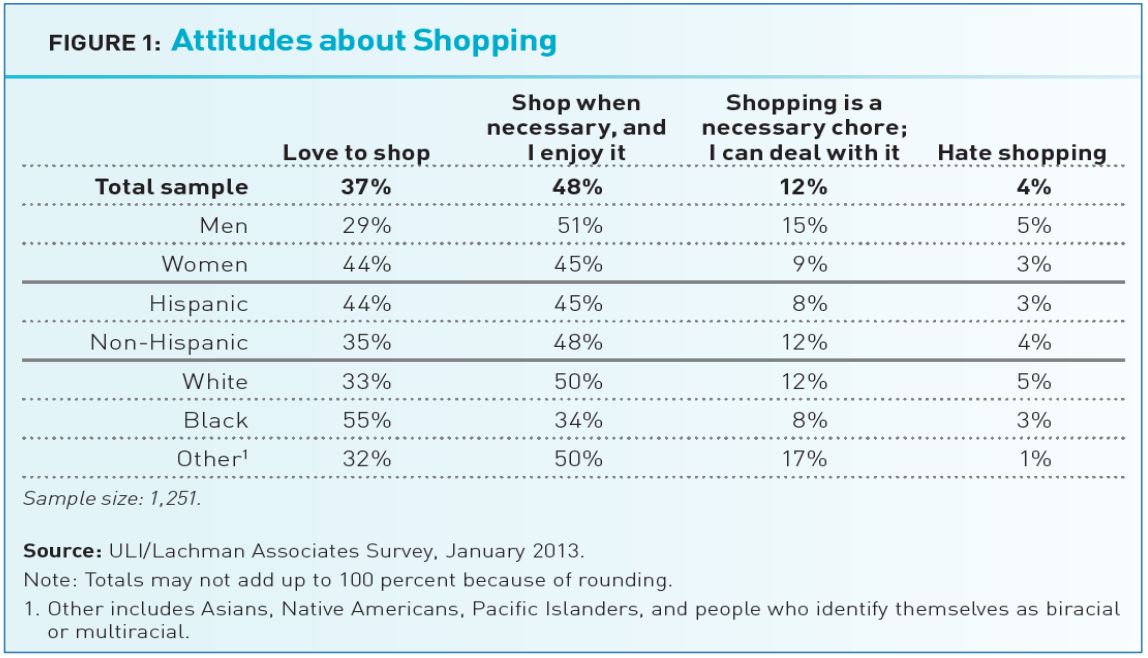

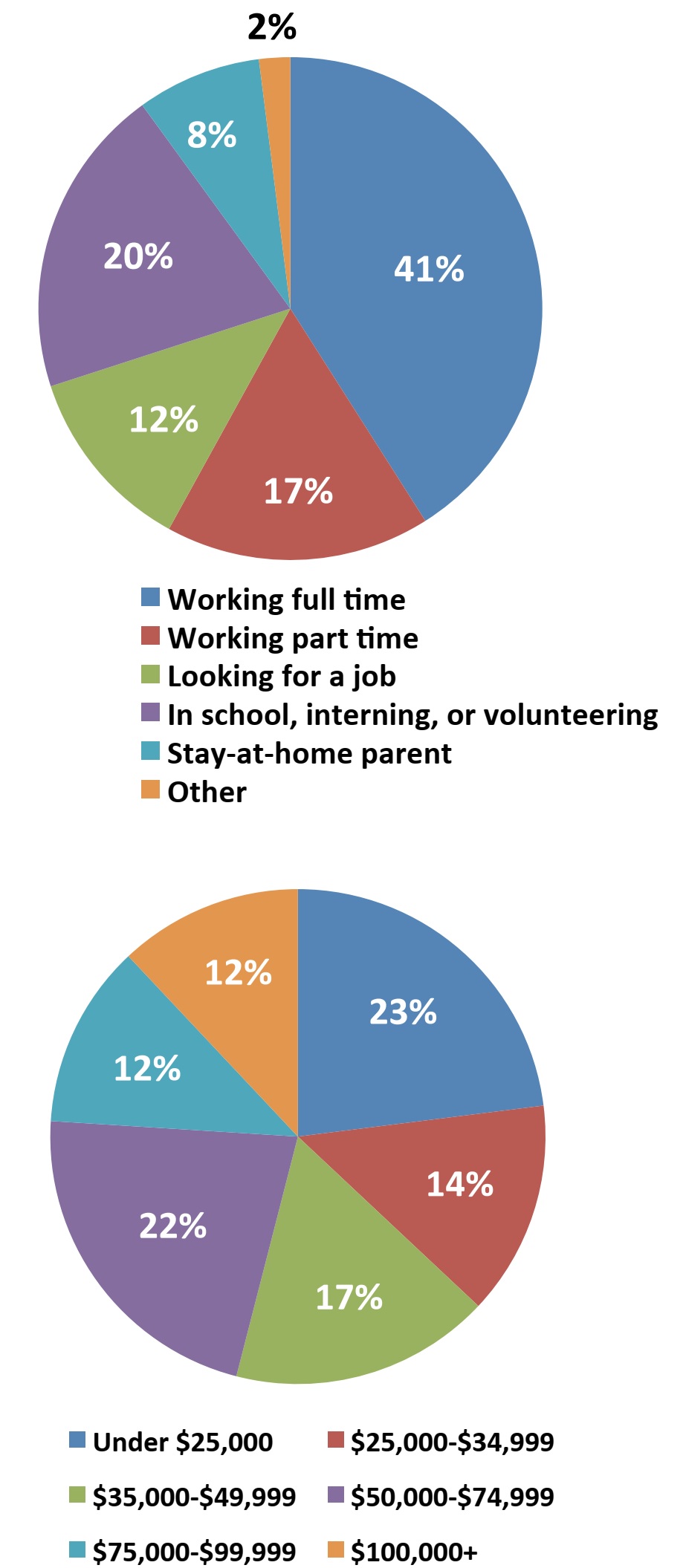

Lazy, narcissistic and easily bored, the Millennial generation is a unique group of people that retailers are trying to engage as the consumers of tomorrow. There are currently 80 million Millennials, Generation Y or GenY in the U.S. alone, born during the 1982-2000 span. By 2020, they will represent a total of $1.4 trillion or 30% of retail sales in the U.S.

This young generation is often self-expressive, less financially independent and prefer an urban living environment. Millennials are the most connected generation, nearly universal according to eMarketer, which estimates 97% penetration among 12-17 year olds and 93.5% for their 18-24 year old siblings (aggregate penetration is at 77.7% in the U.S.). Because of their distinctive characteristics, they tend to exhibit different shopping patterns from the rest of the general population.

Lazy, narcissistic and easily bored, the Millennial generation is a unique group of people that retailers are trying to engage as the consumers of tomorrow. There are currently 80 million Millennials, Generation Y or GenY in the U.S. alone, born during the 1982-2000 span. By 2020, they will represent a total of $1.4 trillion or 30% of retail sales in the U.S.

This young generation is often self-expressive, less financially independent and prefer an urban living environment. Millennials are the most connected generation, nearly universal according to eMarketer, which estimates 97% penetration among 12-17 year olds and 93.5% for their 18-24 year old siblings (aggregate penetration is at 77.7% in the U.S.). Because of their distinctive characteristics, they tend to exhibit different shopping patterns from the rest of the general population.

With their income restrained, Millennials tend to shop for cheaper options at discount stores and browse online for coupons. In the NRF BTS/BTC survey, discount stores rank the number one destination for BTS and Millennial consumers will frequently shop for sales regardless of channels.

With their income restrained, Millennials tend to shop for cheaper options at discount stores and browse online for coupons. In the NRF BTS/BTC survey, discount stores rank the number one destination for BTS and Millennial consumers will frequently shop for sales regardless of channels.

In addition to their preference for discount stores, they are looking for a seamless shopping experience with 24/7 access. While it is true that Millennials often shop online, this generation also enjoys shopping at brick and mortar stores, with the option to ‘touch and feel it.’

In addition to their preference for discount stores, they are looking for a seamless shopping experience with 24/7 access. While it is true that Millennials often shop online, this generation also enjoys shopping at brick and mortar stores, with the option to ‘touch and feel it.’

Millennials represent the high school and college segment (age 15-22) in BTS/BTC. They are expected to have a significant influence on purchasing choices this year as noted above and plan to spend $913 million (in the aggregate) of their own savings to buy BTS/BTC items. Millennials plan to spend $247 more than their younger counterparts, significantly favoring electronics.

Millennials represent the high school and college segment (age 15-22) in BTS/BTC. They are expected to have a significant influence on purchasing choices this year as noted above and plan to spend $913 million (in the aggregate) of their own savings to buy BTS/BTC items. Millennials plan to spend $247 more than their younger counterparts, significantly favoring electronics.

Hottest for Kids:

Since 1 in 10 parents reports that 100% of purchases are influenced by children, product developers created a slew of attractive wearable tech accessories that are particularly appealing to kids, such as colorful touch-screen watches with educational games for ages 4+.

Hottest for Kids:

Since 1 in 10 parents reports that 100% of purchases are influenced by children, product developers created a slew of attractive wearable tech accessories that are particularly appealing to kids, such as colorful touch-screen watches with educational games for ages 4+.

While early bird shoppers are at it in July, most shoppers wait until the end of summer and benefit from its heightened promotional activity. According to the NRF survey, one quarter will wait to take advantage of retailers’ late summer deals and shop one to two weeks before school begins while 23% plan to begin shopping at least two months before school starts and 45% will shop three to four weeks before school starts. Less than 10% plan to begin their shopping after the start of the school year. According to ICSC, while August captures the lion share of BTS shopping at 59.1%, the month lost 6.6 percentage points of total BTS spending versus 2013; July captured an additional 4.5 percentage points with 22.1% of 2014 BTS shopping ( vs. 17. 6% in 2013) and September, 2 percentage points to 18.8%.

While early bird shoppers are at it in July, most shoppers wait until the end of summer and benefit from its heightened promotional activity. According to the NRF survey, one quarter will wait to take advantage of retailers’ late summer deals and shop one to two weeks before school begins while 23% plan to begin shopping at least two months before school starts and 45% will shop three to four weeks before school starts. Less than 10% plan to begin their shopping after the start of the school year. According to ICSC, while August captures the lion share of BTS shopping at 59.1%, the month lost 6.6 percentage points of total BTS spending versus 2013; July captured an additional 4.5 percentage points with 22.1% of 2014 BTS shopping ( vs. 17. 6% in 2013) and September, 2 percentage points to 18.8%.