albert Chan

Introduction

What’s the Story?

We examine the US athleisure market—including sports apparel and footwear that can be worn for sports or casualwear purposes—and identify key drivers and trends in the market. We define athleisure as a category of sportswear that can be worn for casual purposes. In theory, any sportswear item (excluding professional sports items) can be characterized as athleisure wear. We examine what brands and retailers are doing to better serve the market.

Why It Matters

Athleisure has enjoyed great popularity over the last few years, driven by growing enthusiasm for fitness activities and increasing demand for comfortable casual wear, including in the workplace. Driven, in part, by the coronavirus pandemic, we expect athleisure to continue to show promising growth opportunities, reflecting the casualization of the workforce and more stay-at-home fitness activities.

As consumers increasingly adopt athleisure for daily wear, existing apparel brands are innovating their product offerings. More and more companies are entering the athleisure category, with traditional apparel and footwear brands also extending their product offerings into athleisure, attracted by the category’s strong growth opportunities.

The US Athleisure Market: Coresight Research Analysis

Market Size

The core sportswear market, excluding sportswear for outdoor activities such as hiking, sailing and skiing, can be used as a proxy for the athleisure market: Consumers can use any sportswear for crossover or leisure purposes.

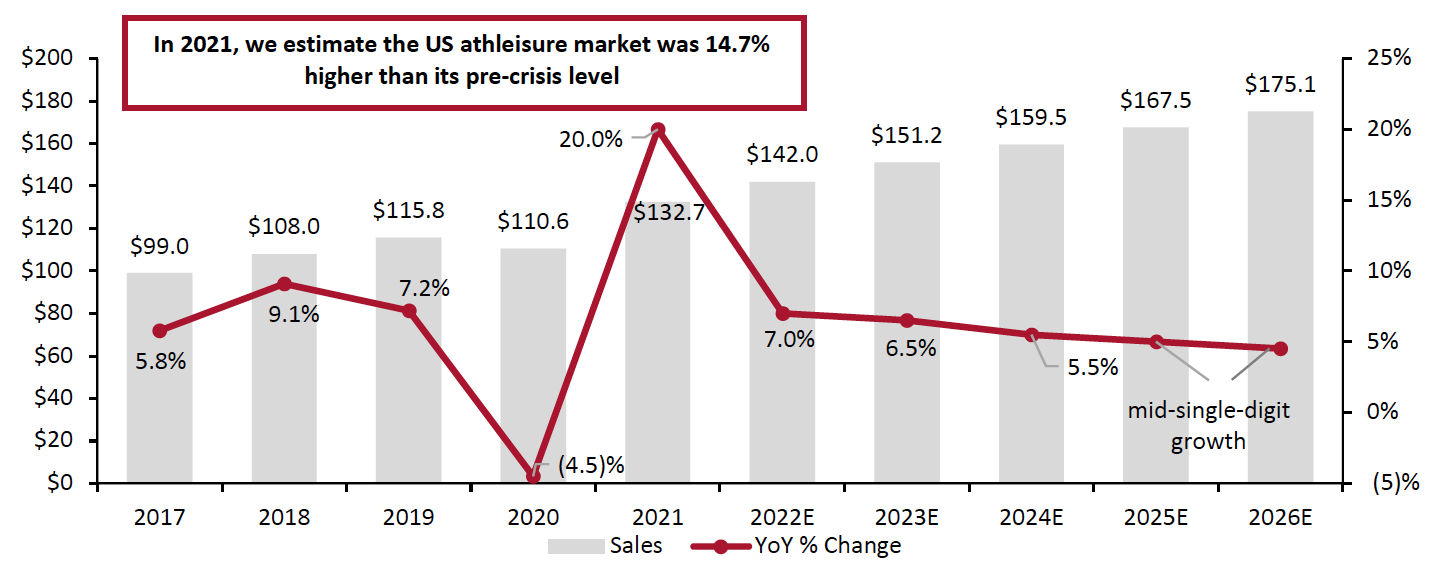

We see the continued growth momentum of the athleisure category. We expect the market (represented by sports clothing and footwear) to grow 7% in 2022, reaching $142.0 billion, and to grow at a CAGR of 8.0% between 2020 and 2026. We discuss the drivers behind this growth below.

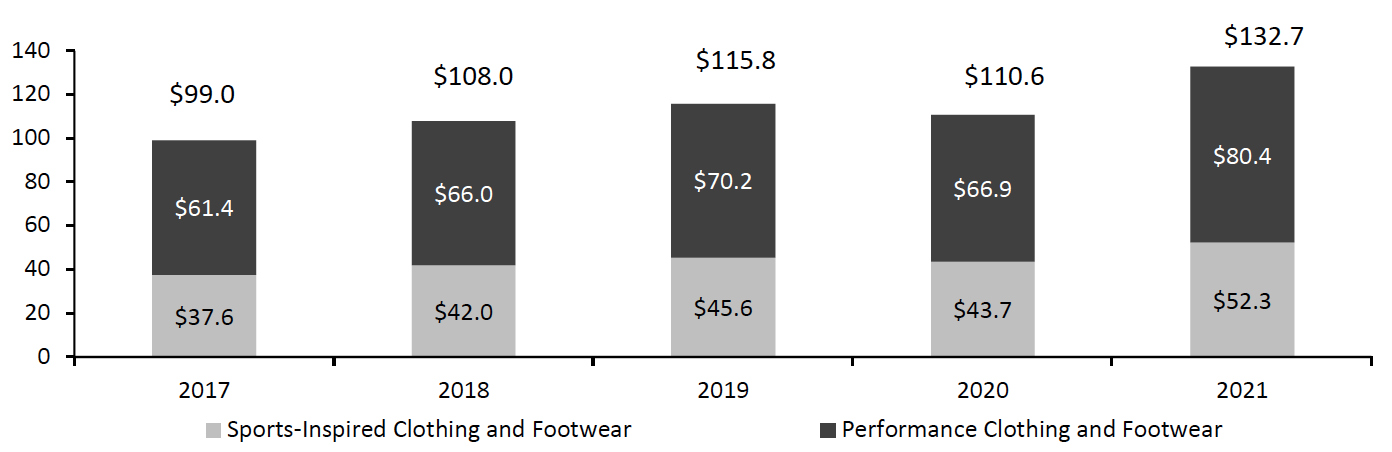

We estimate that the market recovered with 20.0% growth in 2021. US athleisure sales totaled $132.7 billion in 2021, according to Euromonitor International and Coresight Research, with sports-inspired clothing and footwear contributing $52.3 billion and performance clothing comprising $80.4 billion. The share of sports-inspired clothing and footwear versus the total market has been stable between 38% and 39% in the past five years, while the share of performance apparel has been stable between 61% and 62%.

US athleisure sales totaled $110.6 billion in 2020, according to Euromonitor International and Coresight Research. The $110.6 billion sales in 2020 was a pandemic-driven year-over-year decline of 4.5%. Although the athleisure sales declined in 2020, the category showed its resilience in an overall negative environment when the total apparel and footwear market declined by 9%.

Figure 1. US Sports Clothing and Footwear Sales (Left Axis, USD Bil.) and YoY Growth (Right Axis, %) [caption id="attachment_140070" align="aligncenter" width="700"]

Market is the total of sports-inspired clothing and footwear, and performance clothing and footwear

Market is the total of sports-inspired clothing and footwear, and performance clothing and footwearSource: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Figure 2. US Athleisure Sales by Categories (USD Bil.) [caption id="attachment_140071" align="aligncenter" width="700"]

Performance clothing and footwear is characterized by new fibers and fabrics as well as innovative process technologies. Sports-inspired clothing and footwear includes non-performance items by major sports brands as well as sports-inspired products offered by general apparel brands.

Performance clothing and footwear is characterized by new fibers and fabrics as well as innovative process technologies. Sports-inspired clothing and footwear includes non-performance items by major sports brands as well as sports-inspired products offered by general apparel brands.Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Market Factors

We identify three drivers of growth in the US athleisure market.

A Sustained Shift Toward Casualization Over the Next Three Years

More casual consumer lifestyles, including in workplaces (pre-pandemic and in the future) and at home, is transforming the apparel and footwear market. The trend has likely been accelerated by Covid-19, as consumers have become increasingly accustomed to wearing what they like while working from home. Their expectations for greater comfort in apparel are growing.

We anticipate a sustained shift toward casualization over the next three years, with consumers opting to wear casual clothes while working more at home and workplaces increasingly relaxing dress codes. This will help grow the athleisure market.

Heightened Consumer Focus on Health and Wellness

The Covid-19 pandemic has heightened consumer focus on health and wellness, which is a key driver of demand for athleisure products. An increasing number of health-minded individuals are participating in at-home fitness classes or in activities in outdoor public spaces. Consumers are also showcasing their healthy lifestyles on social media, posting photos of themselves dressed in activewear, participating in healthy activities and preparing healthy meals.

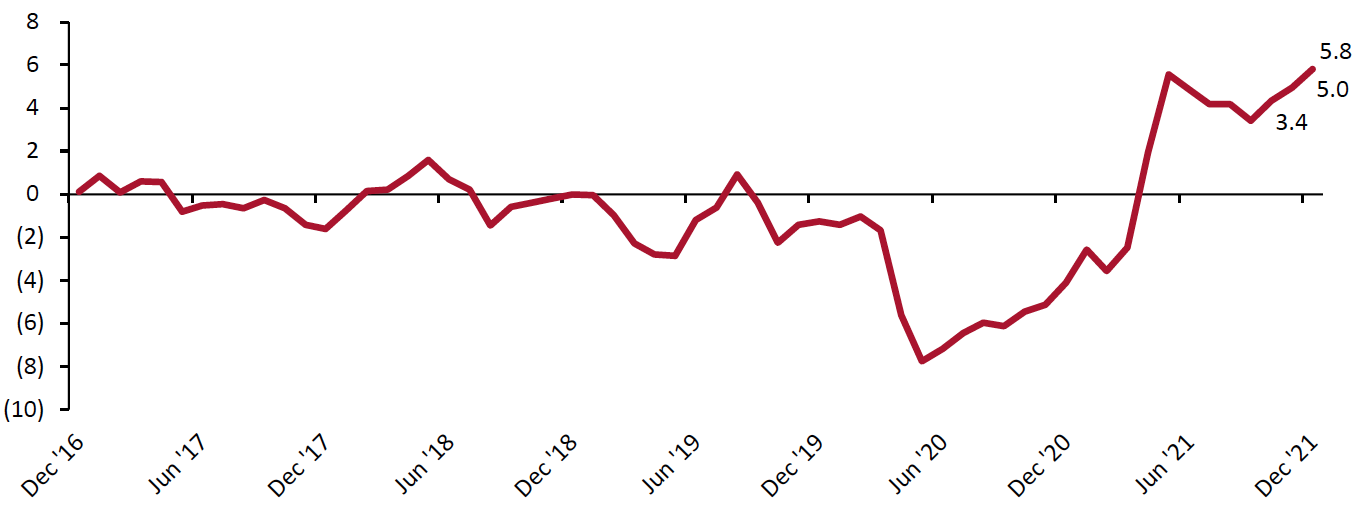

Inflation

We see inflation as a meaningful driver of the US athleisure market in 2022. US consumer prices in the apparel and footwear category rose 5.8% in December 2021 compared to the same month in 2020, the highest increase in category prices since 1991, according to the Bureau of Labor Statistics.

Figure 3. YoY Changes of Consumer Price Index in Apparel and Footwear for All Urban Consumers (%, Seasonally Adjusted) [caption id="attachment_140109" align="aligncenter" width="700"]

Source: US Bureau of Labor Statistics[/caption]

Source: US Bureau of Labor Statistics[/caption]

Athleisure and Sportswear/Casual Wear Boundaries Continue To Blur

Athleisure has changed consumer expectations regarding the comfort and fit of their clothing. Both traditional and new brands and retailers are launching apparel categories such as jeggings, jogger pants and yoga pants that can be worn for both casual occasions and workouts. We expect the boundaries between sportswear and casual wear to continue to blur in the next three years.

Figure 4. Trending Categories Within Athleisure [wpdatatable id=1633] Source: Coresight Research

Competitive Landscape

The US athleisure market encompasses a range of retailers and brands, from traditional sportswear companies NIKE, Adidas and Under Armour, to general retailers such as Amazon and Target, to rising digitally native brands such as Carbon38 and Outdoor Voices and athleisure celebrity brands such as Ivy Park.

Luxury brands are also embracing athleisure. We believe opportunities exist for new brands with unique selling points, such as an active social media presence or tech innovations in this fast-growing space.

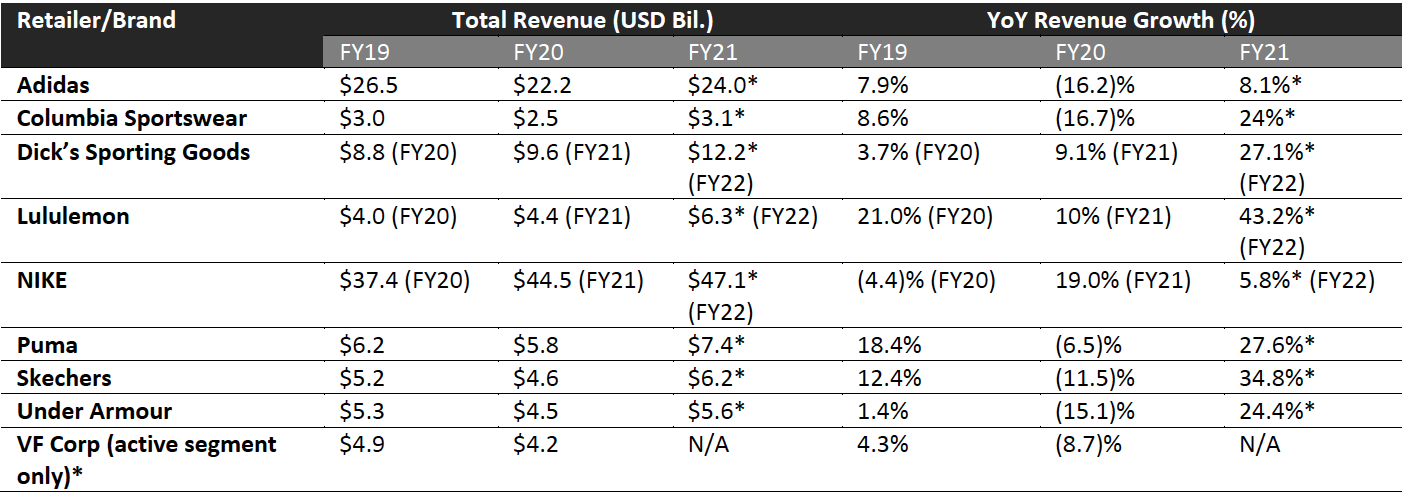

In Figure 5, we present the revenue growth of selected athleisure players. Note that the absolute dollar sales may include some double-counting between brands and retailers that sell those brands.

Figure 5. Selected List of Key Athleisure Industry Players’ Growth Trends

[caption id="attachment_140085" align="aligncenter" width="700"] N/A=Not available

N/A=Not available* Revenues with an asterisk are forecasts collected from S&P Capital IQ; Revenues are converted into US dollars using constant currency rates of December 31, 2020; We include the activewear segment of VF Corp only so the revenue forecasts of FY21 are not available.

Source: Company reports/S&P Capital IQ[/caption] Figure 6 presents major players in the US athleisure market.

Figure 6. Selected Brands/Retailers in the US Athleisure Market [wpdatatable id=1634] Source: Coresight Research In figure 7, we highlight some of the launches in the athleisure market in 2021.

Figure 7. Selected Brand and Retailer Launches in the Athleisure Space in 2021 [wpdatatable id=1635] Source: Company reports/Coresight Research

The Power of Traditional Sportswear Companies in the Athleisure Market

The US athleisure market in general is still brand-prominent and we expect brands to become more important in consumers’ athleisure purchasing decisions.

The top 10 traditional brands in the athleisure market captured around 32% of the total market in 2020. Moving forward from 2020, in the next three to five years, we expect the top 10 brands to continue dominating the market as well as pick up more shares from smaller brands.

Figure 8. Top 10 Traditional Sportswear Brands by US Revenue, 2020 (USD Bil.)

[wpdatatable id=1636] We estimated Skechers’ US revenue by adding up domestic wholesale sales and direct-to-consumer (DTC) sales. This includes DTC sales facing international markets. Source: Company reports/Coresight ResearchOpportunities for General Retailers

We are seeing general retailers introduce new lines and extend existing lines to capitalize on the growing demand for athleisurewear. Athleisure private labels are performing well in the market, based on guidance published by key retailers, as shown in Figure 9.

Although the US athleisure market in general is still brand-prominent, we believe private labels will slightly increase their share in the next three to five years. We recommend that general retailers carry more established, third-party athleisure brands to grow sales.

Figure 9. Selected General Retailers in the US Athleisure Market [wpdatatable id=1637] Source: Company reports

Luxury Brands Embrace Athleisure

Athleisure is engaging young luxury shoppers, with brands such as Balenciaga, Dior and Louis Vuitton designing branded hoodies, sweatshirts and sneakers to target millennial consumers that value the perceived high social status of luxury brands. Millennials have been driving the “wellness as a luxury” trend for several years now, participating in premium workout and fitness classes, using wearables to track fitness statistics and wearing athleisure fashion as a signifier of their lifestyle.

We are increasingly seeing fashion designers team up with sports brands to create co-branded clothing for sports or gym-to-the-office styles. We expect this trend to continue for the next three to five years. Below, we highlight selected athleisure launches by luxury brands in 2021.

- Balenciaga

In June 2021, Balenciaga collaborated with Kith (a young luxury fashion brand) to launch running shoes.

[caption id="attachment_140074" align="aligncenter" width="350"] Source: Balenciaga[/caption]

Source: Balenciaga[/caption]

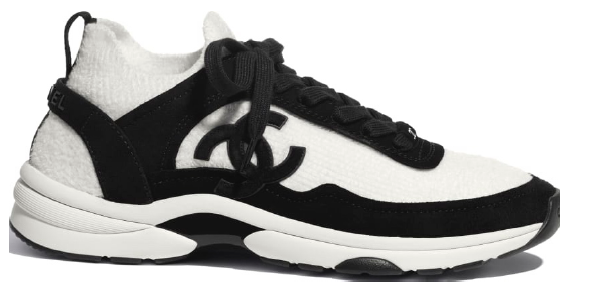

- Chanel

Source: Chanel[/caption]

Source: Chanel[/caption]

- Dior

Source: Dior[/caption]

Source: Dior[/caption]

- Fendi

Source: Fendi[/caption]

Source: Fendi[/caption]

- Louis Vuitton

Source: Louis Vuitton[/caption]

Source: Louis Vuitton[/caption]

The Rise of Digitally Native Athleisure Brands

Digitally native vertical brands (DNVBs) are seeing success within the US apparel and footwear market, as the pandemic accelerates the shift to e-commerce. We estimate that total e-commerce sales by DNVBs in the US apparel and footwear market grew 20.0% to $8.4 billion in 2021.

In the DNVB apparel and footwear market, several digitally native athleisure brands are seeing fast growth. For example, sustainable active apparel and footwear brand Allbirds made $219 million in revenue in 2020, up from $194 million in 2019. The brand went public in November 2021 and was valued at over $4 billion. The company expects its 2021 revenues to be between $270 million to $272 million, representing growth in the range of 23% to 24% versus 2020 and 39% to 40% versus 2019.

Vuori Clothing, an activewear brand, landed $400 million in investment and received a $4 billion valuation from SoftBank in October 2021. The brand is planning to open 100 US stores in the next five years.

In Figure 10, we present a range of key digitally native players in the US athleisure market.

Figure 10. Selected Digitally Native Vertical Brands in the US Athleisure Market [wpdatatable id=1638] Source: Company reports/ZoomInfoDigitally native athleisure retailer Carbon38 is operating successfully in the athleisure market. Carbon38 has seen success in its function-led apparel offerings. The company focuses on launching smaller, female-founded brands that align with its philosophy of empowering women. It offers a range of athleisure products such as its Sculpt Jacket, a hooded zip-front top layer made from lightweight and stretchy fabric. The company reached revenue of $50 million in 2020.

Popular Athleisure Celebrity Brands

Athleisure celebrity brands capture less than 5% of the athleisure market, we estimate, but are an important part of the space. We provide an introduction to key celebrity brands in the athleisure market:

- EleVen is a lifestyle brand founded by tennis professional Venus Williams, providing fashion-forward tennis and everyday looks for on and off the court. The brand features functional and fashionable workout gear. In August 2021, EleVen partnered with activewear retailer Carbon38 on a limited-edition capsule collection, comprising sports bras, leggings, crop tops, tanks, a romper, and a tennis dress and skirt. The collaboration offered a mix of both athletic performance wear for intense workouts as well as comfy, everyday athleisure pieces.

A long sleeve cropped polo top, made with lightweight microterry fabric

A long sleeve cropped polo top, made with lightweight microterry fabricSource: EleVen[/caption]

- Fabletics is an active lifestyle brand founded by American actress Kate Hudson. The brand did not release any new athleisure collections in 2021 but launched several new athleisure items, such as leggings made with lightweight materials.

Opal seamless half-zip sleeve top and leggings launched by Fabletics in 2021

Opal seamless half-zip sleeve top and leggings launched by Fabletics in 2021Source: Fabletics[/caption]

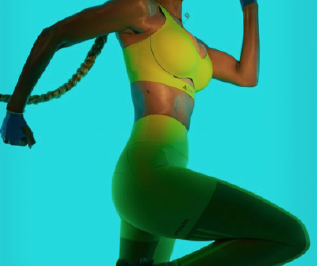

- IvyPark is an activewear brand co-founded by singer Beyoncé and Topshop. In October 2021, Ivy Park partnered with Adidas and Peloton to launch an athleisure collection with 29 pieces.

IvyPark athleisure bras and leggings for workouts or casual occasions

IvyPark athleisure bras and leggings for workouts or casual occasionsSource: IvyPark[/caption]

- Mission Statement is a line of “luxury athleisure” designed by actress Hilary Swank specifically to be functional, fashionable and practical. In 2021, the brand did not launch a specific athleisure collection, but continued to add athleisure items to its website.

Stride run tights that offer comfort

Stride run tights that offer comfortSource: Mission Statement[/caption]

What We Think

The growth momentum of the US athleisure market is likely to continue in 2022 and 2023, driven by the casualization trend and consumers’ heightened focus on health and wellness. We expect the US athleisure market to expand at a CAGR of 8.0% between 2020 and 2026. This offers opportunities for apparel retailers and brands to enter and grow in the market. We calculate that the US athleisure market experienced a post-crisis bounce in 2021, with an estimated growth of 20%.

Implications for Apparel Brands/Retailers

- Athleisure has changed consumer expectations regarding the comfort and fit of their apparel. Traditional brands and retailers should look to leverage athleisure features or risk losing consumers to athleisure brands. We expect the boundaries between athleisure, sportswear and casual wear will continue to blur.

- Versus clothing and footwear in total, sportswear tends to be more strongly brand led: Consumers seek out the most desirable sports and athleisure brands, driving names such as NIKE and Adidas to global market leadership in clothing and footwear. As sportswear/athleisure continues to account for a larger share of the total clothing and footwear market, that brand prominence implies a consolidation of overall apparel market share around major sports brands. In turn, that suggests less-desirable, or tertiary, non-sports brands will be forced to fight over a diminishing residual share of the total US clothing and footwear market.

- In this context, we expect retailers and brands to continue to offer more athleisure items over the next five years.

- Digitally native athleisure brands are growing fast. In this competitive landscape, we believe opportunities exist for new brands to leverage unique selling points, such as an active social media presence or technology innovations.

Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved