albert Chan

What’s the Story?

With strong growth expectations for 2021, we explore the US apparel subscription e-commerce market, focusing on two major apparel subscription models: curated monthly subscription boxes and rental subscription.

We exclude pure rental apparel e-commerce companies (without subscriptions). We discuss our market outlook for 2021, the competitive landscape and primary models in US apparel subscription e-commerce, and trends we are watching in the market. We also present three key strategies for apparel subscription e-commerce companies to improve profitability.

Why It Matters

With the retention of pandemic-driven online shopping habits in 2021, we expect to see significant expansion of the US apparel subscription e-commerce market in 2021. Brands and retailers should stay informed of market opportunities and trends to leverage apparel subscription demand.

The US Apparel Subscription E-Commerce Market: In Detail

Market Outlook

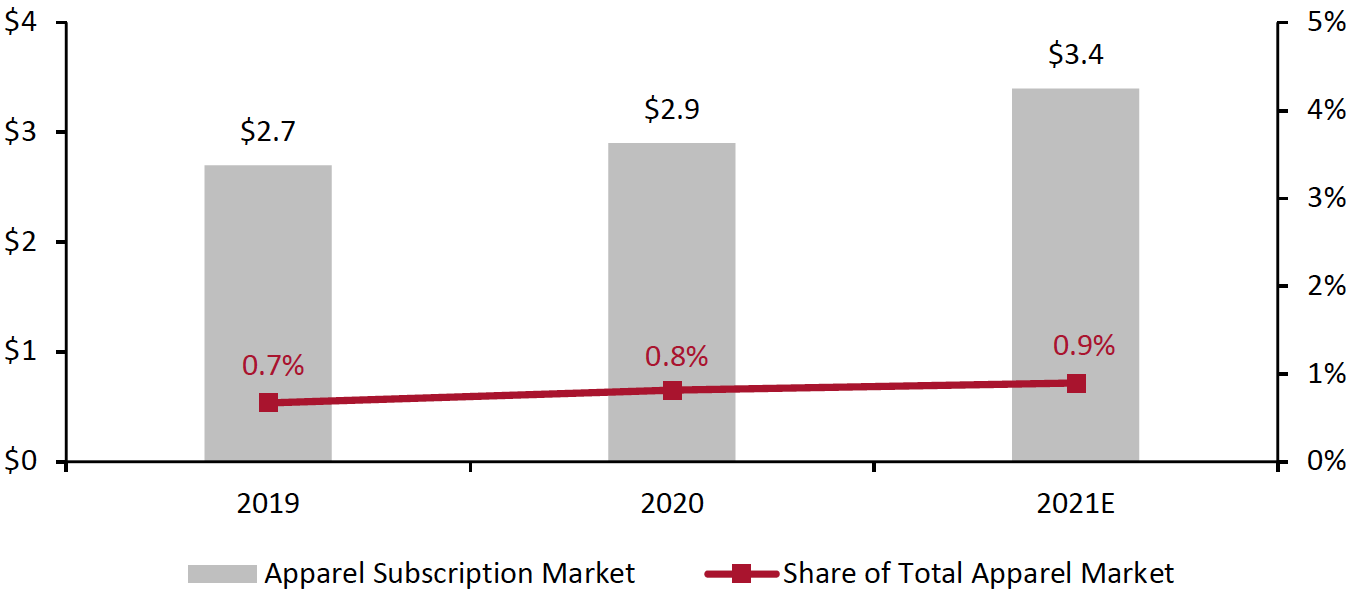

We expect the US apparel subscription e-commerce market to grow 17.2% in 2021, with its share of the total apparel market slightly increasing. This builds on 7.4% year-over-year growth in 2020, we estimate, with the US apparel subscription e-commerce market reaching $3.4 billion and capturing approximately 1.0% of the US apparel market. Coresight Research believes that growth is being driven by the formation of online shopping as a sustainable consumer habit, as well as increasing preferences for highly personalized experiences among shoppers. We are also seeing strong recovery of the US apparel market, which will also benefit the apparel subscription market.

The US apparel subscription e-commerce market captured 25.1% of the total US subscription e-commerce market in 2020, we estimate. This represents a decrease of 5.2 percentage points from 30.3% in 2019—largely due to the unprecedented growth of grocery subscriptions amid the pandemic—which diluted the share of apparel subscription. We expect the apparel subscription market to regain share in 2021.

Figure 1. US Apparel Subscription E-Commerce Market (Left Axis; USD Bil.) and Share of Total Apparel Market (Right Axis; %)

[caption id="attachment_131925" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

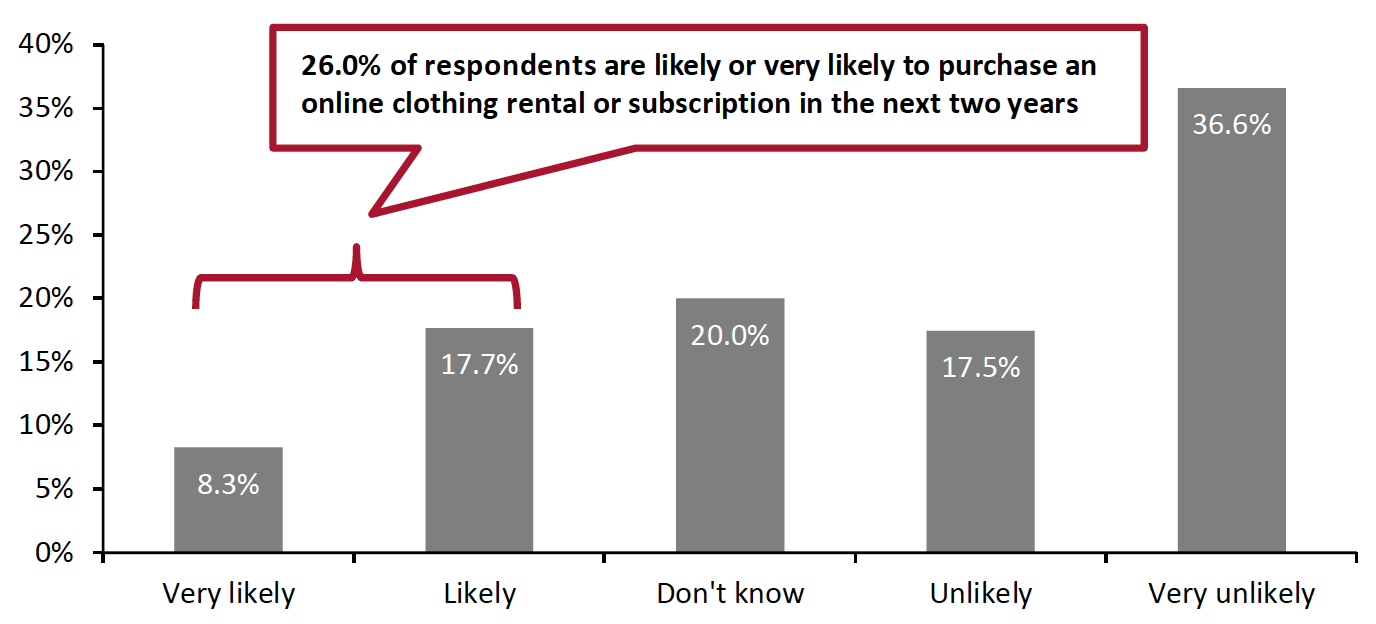

Consumer Insights: Market Opportunity

Coresight Research’s June 21, 2021, survey of US consumers indicated that 23.4% have used online subscription or rental subscription services for clothing. In addition, 26.0% of respondents stated that they are likely or very likely to subscribe to purchase an online clothing rental or subscription service in the next two years, as shown in Figure 2, highlighting opportunities in the apparel subscription market.

Figure 2. US Consumers: Likelihood of Using Online Subscription or Rental Subscription Services for Clothing in the Next Two Years (%)

[caption id="attachment_131948" align="aligncenter" width="700"] Base: 424 US Internet users aged 18+

Base: 424 US Internet users aged 18+Source: Coresight Research[/caption]

Competitive Landscape

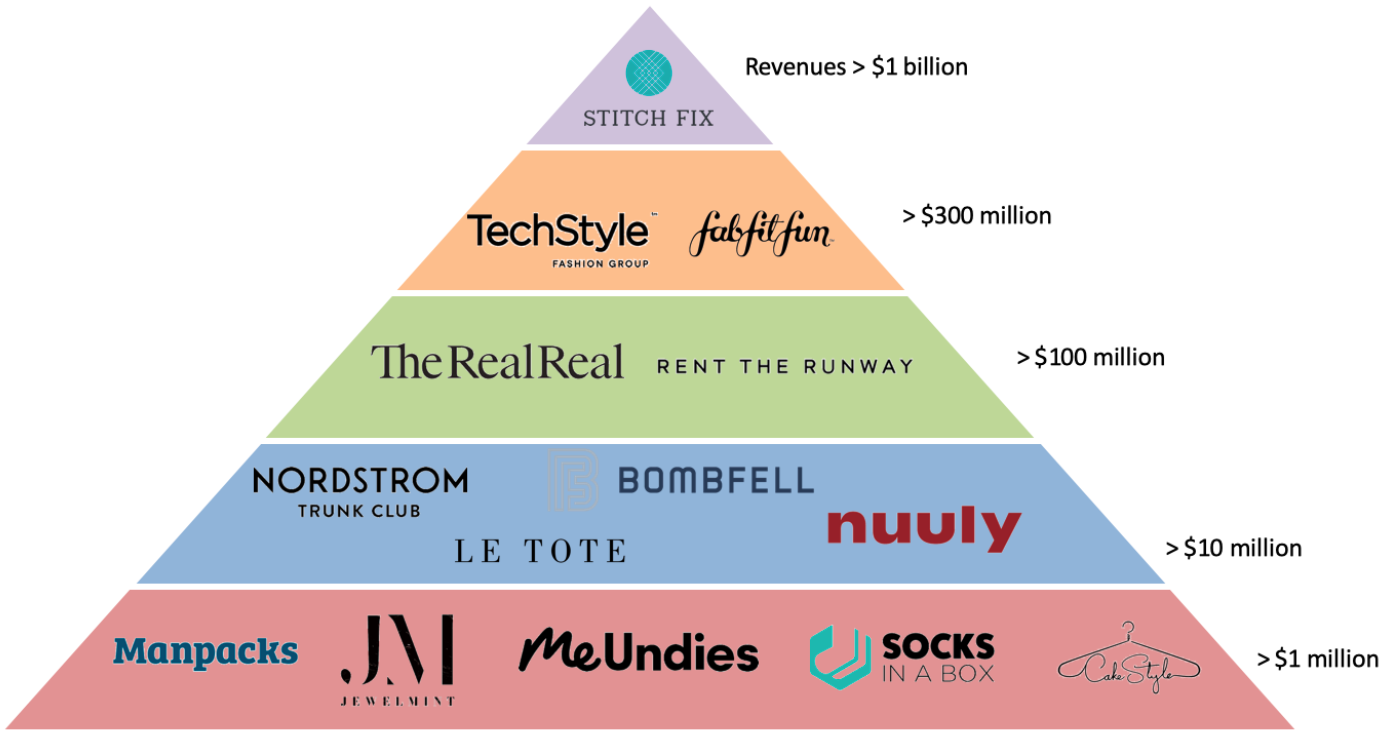

The top 10 apparel subscription e-commerce companies by revenue reached $2.3 billion in 2020, accounting for an estimated 79.3% of the total market. Figure 3 presents the competitive landscape, based on companies’ reported revenues or third-party revenue estimates in 2020.

Figure 3. Selected US Apparel Subscription E-Commerce Players: Competitive Landscape by 2020 Revenue [caption id="attachment_131927" align="aligncenter" width="700"]

All revenues are US-based only. Our competitive landscape does not include companies that report revenue but do not provide a breakdown for subscription revenues, such as Gap. For companies that do not publicly disclose revenues, we use third-party estimations. Companies that have revenues of less than $1 million are not included.

All revenues are US-based only. Our competitive landscape does not include companies that report revenue but do not provide a breakdown for subscription revenues, such as Gap. For companies that do not publicly disclose revenues, we use third-party estimations. Companies that have revenues of less than $1 million are not included.Source: Owler/Zoominfo/Incfact/company reports[/caption]

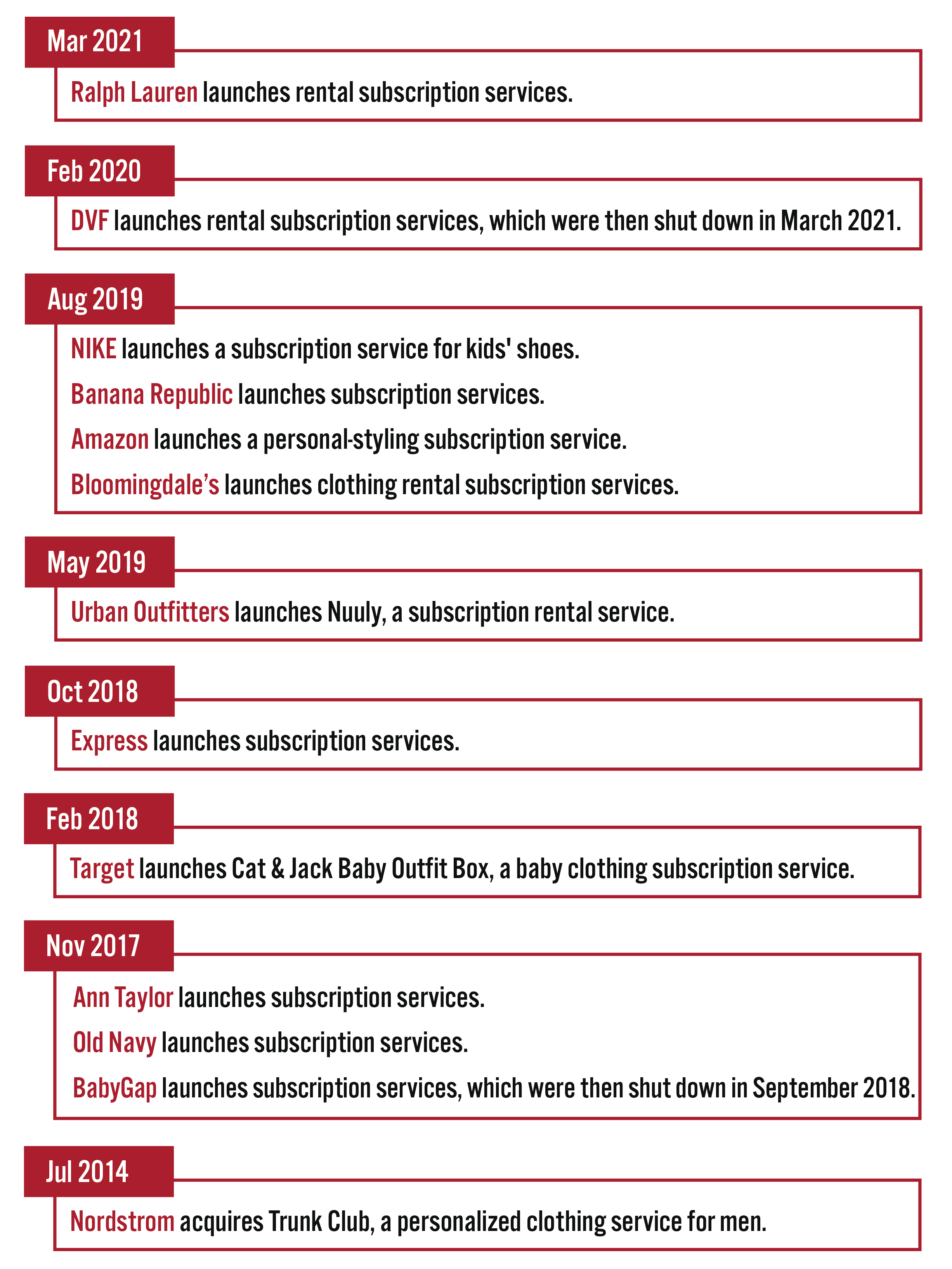

As well as dedicated apparel subscription e-commerce companies, we are seeing traditional retail players introducing subscription services within their offerings. Figure 4 details key developments among major retailers branching into the rental subscription space.

Figure 4. A Timeline of Apparel Retailers and Brands’ Subscription Service Launches [caption id="attachment_131951" align="aligncenter" width="550"]

Source: Company reports[/caption]

Source: Company reports[/caption]

Apparel Subscription Models

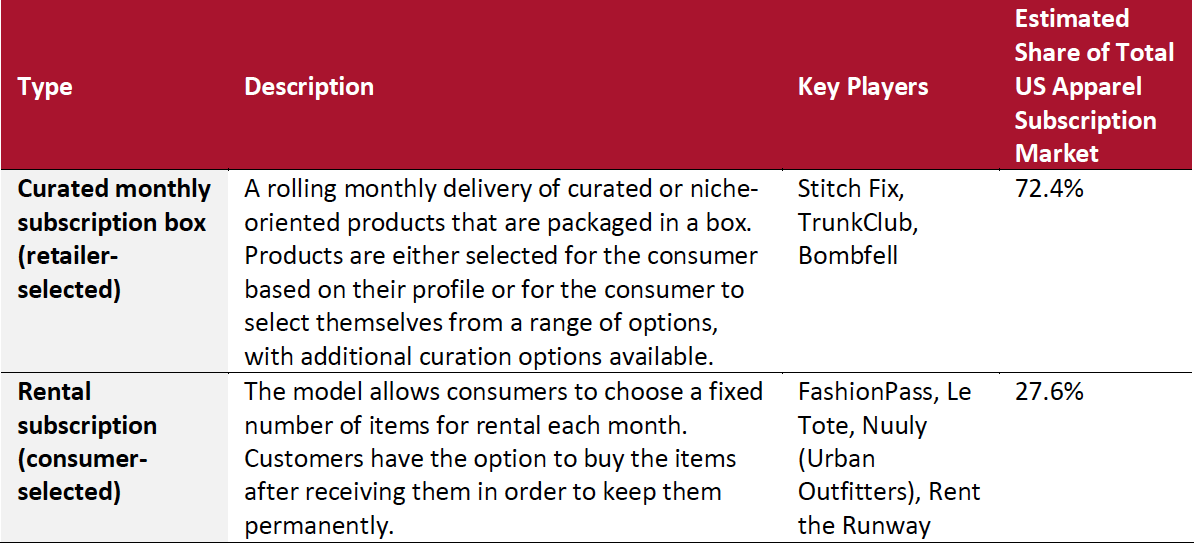

We present two subscription models that we identify as representing the majority of apparel subscription businesses today, including the estimated share of each model versus the total apparel subscription model.

Based on our estimates, the curated monthly subscription box model currently dominates the market.

Figure 5. Three Subscription Models That Represent the Majority of US Apparel Subscription Businesses [caption id="attachment_131929" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

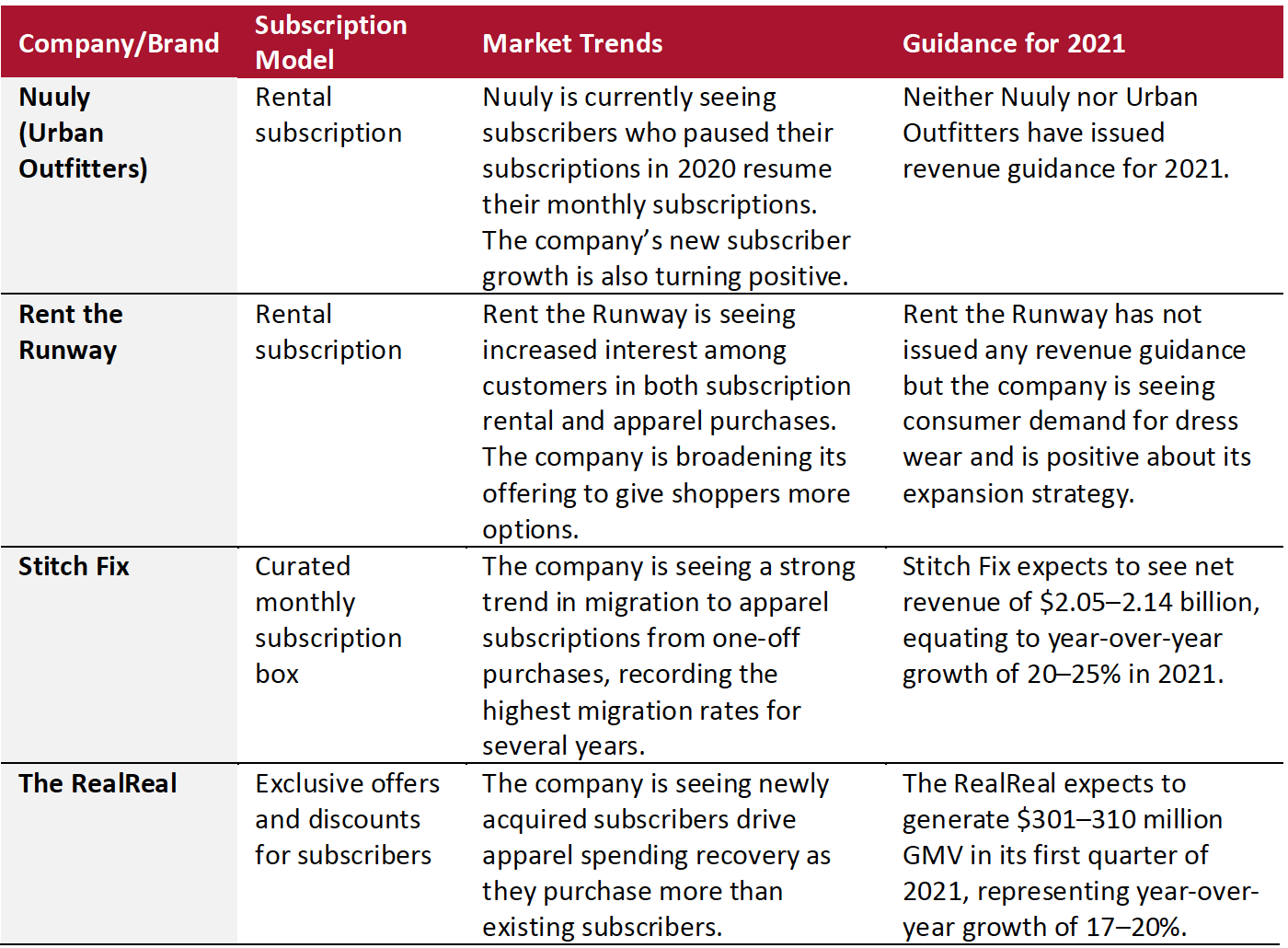

Market Guidance from Key Players

In Figure 6, we chart guidance for 2021 from key players in the US apparel subscription market, highlighting market trends identified by each company.

Figure 6. Key Industry Player’s Guidance for 2021 [caption id="attachment_131952" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Key Trends: Apparel Subscription Companies

Apparel subscription companies are evolving their offerings and expanding the range of purchase features they offer to deliver a more holistic shopping solution. We discuss two key trends we are seeing in the US apparel subscription space.

Direct Buy

Apparel subscription e-commerce companies are looking to avoid consumers gravitating back to conventional retail, attracted by its typically greater flexibility, by complementing their recurring services with “buy now” options.

For example, in late 2019, Stitch Fix announced plans to launch a “direct buy” option enabling the sale of individual items. The company believes that direct buy, available to non-subscription clients, will help the company to accelerate top line and client growth amid the pandemic, as stated by management on its December 2020 earnings call. Stitch Fix sees direct buy as a catalyst to attract new clients, convert prospective clients and reactivate lapsed subscribers. The company is currently testing the direct buy option with existing clients and plans to roll it out to first-time clients in its 2021 fourth quarter (around October 2021).

In the next three to five years, we expect more apparel subscription e-commerce companies to adopt an integrated model, combining both subscription-based and non-subscription services.

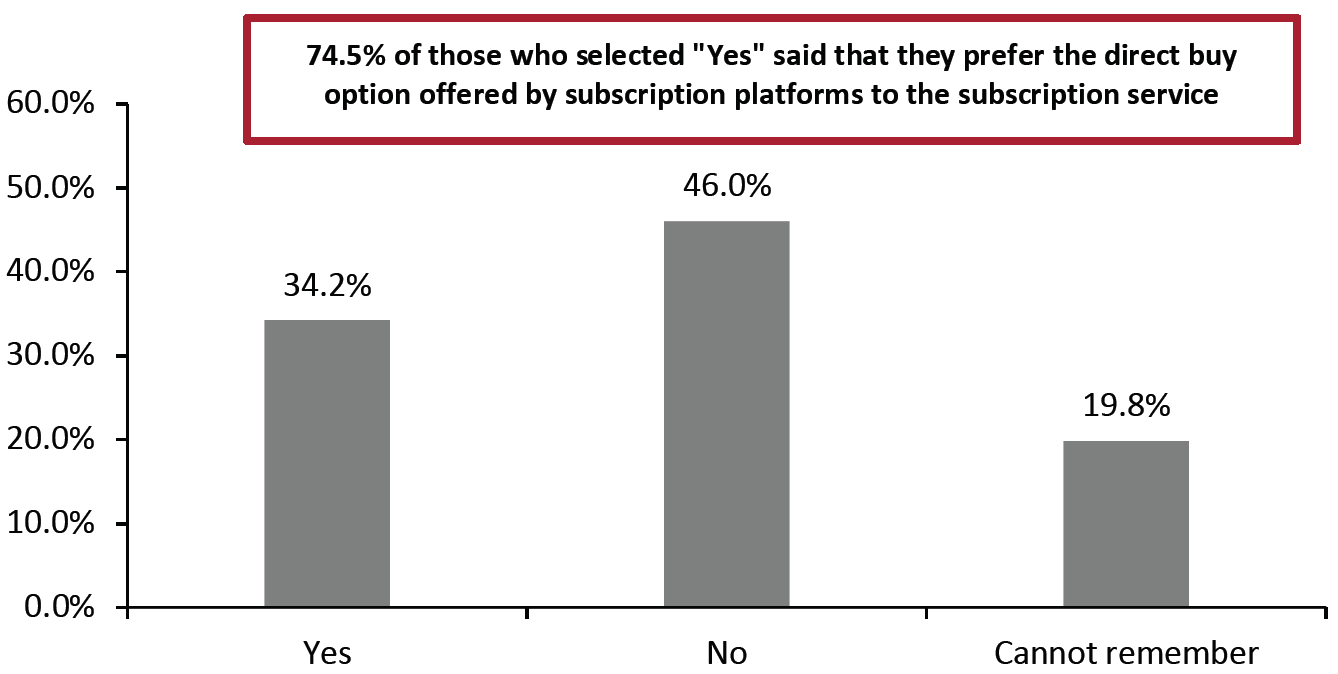

Coresight Research’s proprietary survey data from June 2021 also indicates consumer interest in direct buy: 34.2% of US consumers stated that they have purchased an item using a subscription platform’s direct buy feature—and among those who have, 74.5% said they prefer direct buy over subscription.

Figure 7. Whether US Consumers Have Purchased an Item Using a Subscription Platform’s Direct Buy Feature (%) [caption id="attachment_131955" align="aligncenter" width="700"]

Base: 424 US Internet users aged 18+

Base: 424 US Internet users aged 18+Source: Coresight Research[/caption]

Resale

We expect more apparel subscription companies to expand their business offerings in the resale space because of its large market opportunity. We estimate that the total US fashion resale market will reach $28 billion in 2021, compared to our estimate of $1.2 billion for the total US apparel rental market.

For instance, Rent the Runway offers rental subscriptions for secondhand designer clothes. In the context of the demand for “buy now” discussed above, Rent the Runway announced in June 2021 that it will soon expand its used designer clothing rental offering to include a “buy now” feature, combining demand for both resale and direct buy. Customers will not require a membership to purchase the items but members will be able to access exclusive discounts.

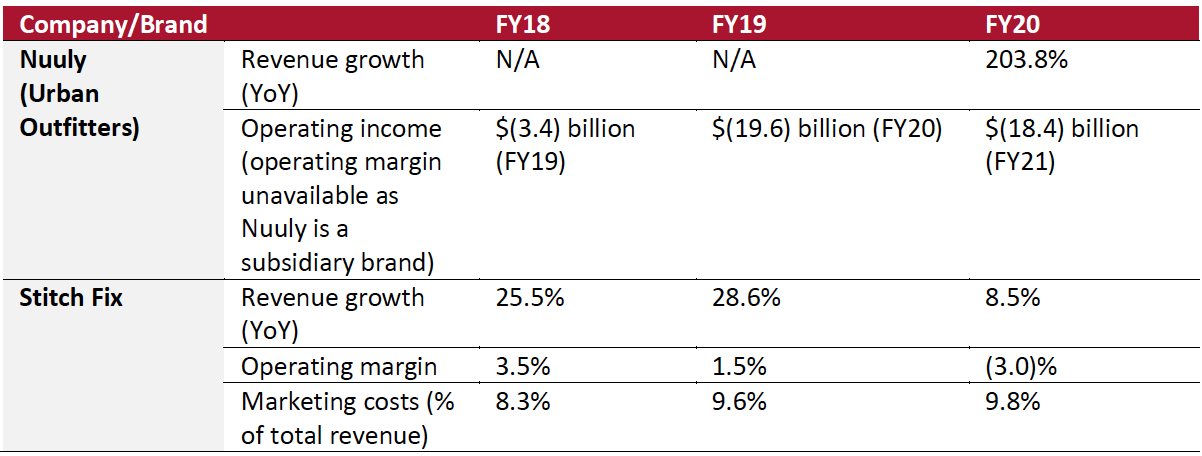

Profitability of Apparel Subscription Businesses

As the apparel subscription market is relatively new, profitability may be negatively impacted by high operating and marketing costs, unpredictable demand for merchandise and services, fierce competition, and a decrease in the growth rate of the overall apparel market.

As evidenced by the reported earnings shown in Figure 8, we believe that it will be another two to three years before existing apparel subscription companies achieve profitability. For instance, Stitch Fix has seen increasing marketing costs over the past three fiscal years, with its operating margin shrinking over the same period and becoming negative in fiscal 2020.

Figure 8. Operating Metrics of Selected Apparel Subscription E-Commerce Businesses

[caption id="attachment_131932" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

The profitability of apparel e-commerce subscription businesses largely depends on the ability to drive new client growth and control costs such as shipping, marketing and processing.

We present three key strategies for apparel subscription businesses to improve their profitability:

- Improve online experiences: Apparel subscription businesses must ensure customer loyalty, which can be improved by offering streamlined, unique and engaging customer experiences where each interaction is valuable. We expect to see a focus on differentiating online experiences to carve out success in the competitive apparel subscription market in 2021 and beyond.

- Expand product options: Offering subscribers a wider product range could improve customer retention and boost spending. Nuuly, Stitch Fix and Le Tote are all optimizing their product assortment and we expect this to be a key theme in the apparel subscription e-commerce market through the rest of 2021 and beyond. The RealReal is using its vendor program to strategize on product sourcing and has seen accelerating vendor GMV growth in 2020, according to the company.

- Optimize cost structures: As apparel subscription companies invest more in marketing, they must examine their cost structure and assess the benefits of their investment. Stitch Fix, for instance, aims to lower its merchandise and transportation spending to absorb increasing marketing costs. The company is also investing in artificial intelligence to automate styling and picking processes to reduce costs in the long term. The RealReal has invested in paid advertising on social media platforms such as Instagram and TikTok, as well as referral programs to boost consumer loyalty, while lowering shipping costs through negotiations with different partners.

What We Think

Implications for Brands/Retailers

- We see opportunities for apparel retailers and brands to enter the growing apparel subscription e-commerce market and test the market to uncover new revenue streams.

- Apparel subscription companies are evolving their offerings and expanding features to deliver a more holistic shopping solution. Direct buy and resale are two features that apparel subscription companies are adopting. We expect more apparel subscription e-commerce companies to adopt an integrated model, combining both subscription-based and non-subscription services.

- Strategies that apparel subscriptions businesses could adopt to improve profitability include developing their online experiences to boost loyalty, expanding their product options and optimizing their cost structures.