DIpil Das

Introduction

The coronavirus crisis has hit most discretionary retail sectors. However, while several have recovered, apparel remains one of the worst affected. In this report, we discuss how the US apparel market is performing amid the pandemic. We analyze the apparel sector’s prospects as it embarks on the three- to six-month period from October 2020 (the start of the holiday shopping season). We discuss our expectations for the sector’s recovery and insights into its performance, based on Coresight Research’s proprietary survey data as well as key metrics, guidance and management commentary from major apparel players.Apparel Sector Outlook: What the Rest of 2020 and Early 2021 Will Look Like

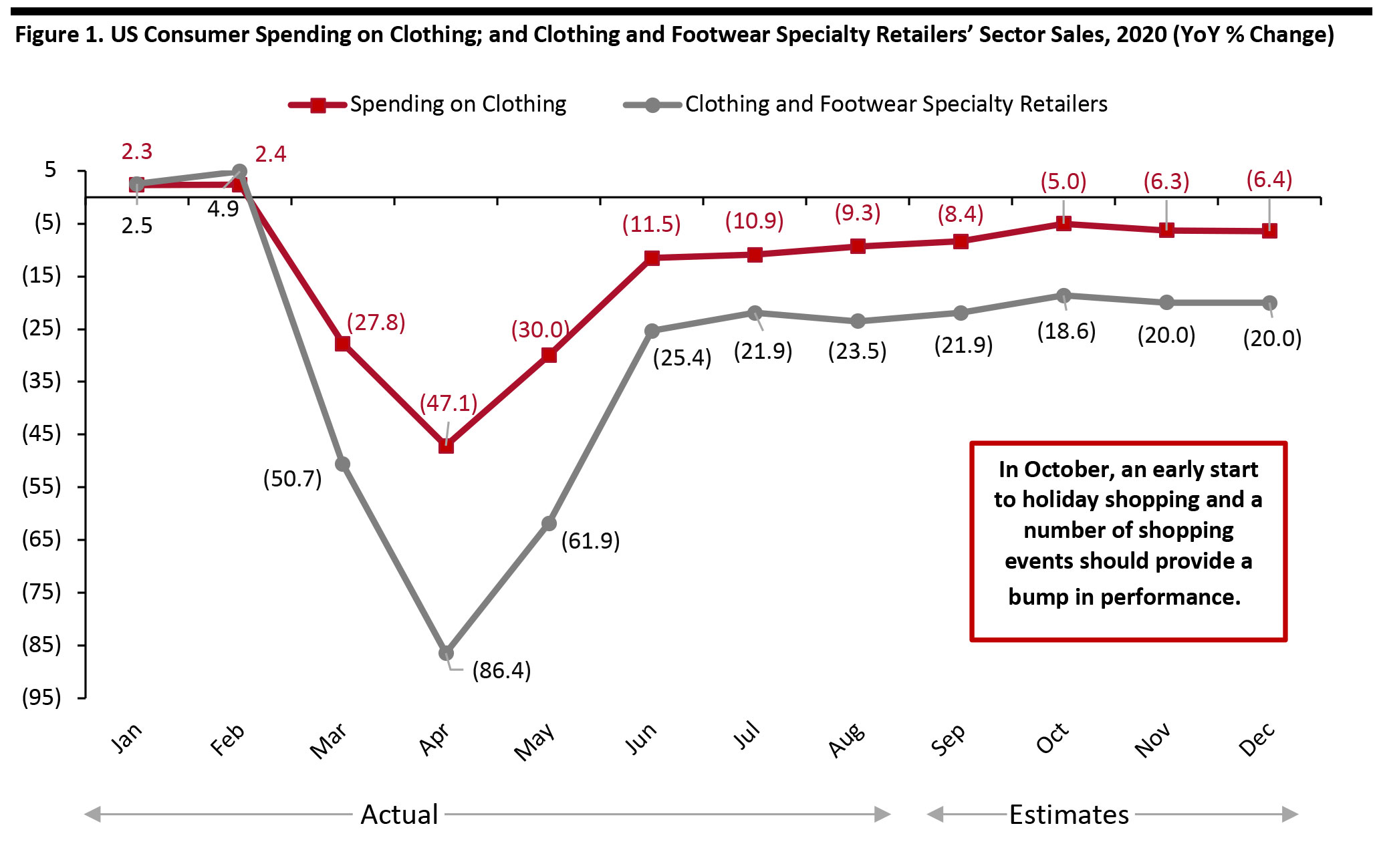

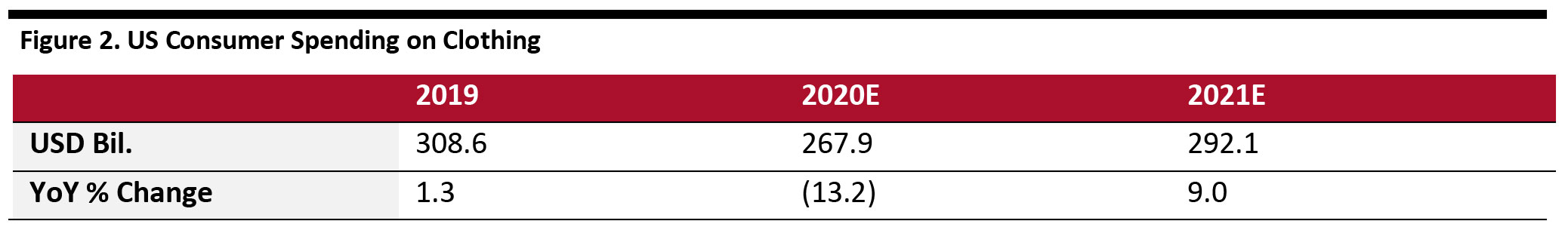

Our Estimates for 2020- Consumer spending on clothing will fall by 13.2% to around $268 billion (including sales taxes). This reflects spending through all channels, including lockdown-resilient, higher-growth e-commerce.

- Clothing and footwear speciality retailers, which were already underperforming versus spending, will underpace this total. For 2020, we estimate that sales in the clothing, footwear and accessories retail sector will drop by 29.3% to approximately $189 billion (excluding sales taxes), driven by the deep declines through lockdowns and a sluggish recovery.

- In October, we expect an early start to holiday shopping, with a number of shopping events providing a bump to performance. Amazon’s Prime Day on October 13–14, rival events from retailers such as Walmart and Target, and the new 10.10 Shopping Festival should help ease year-over-year declines in October.

- Many consumers plan to start their holiday shopping earlier this year, according to Coresight Research surveys, and we expect the pull-forward of holiday demand to ease the declines in October but at the expense of November and December.

- We anticipate holiday gifting demand to be less negative than underlying demand for clothing. Recent spending has been depressed by reduced demand for clothing for work or social events, but such immediate needs are less important for those buying apparel as gifts for others. However, clothing specialty retailers—like other store-based retailers—will face physical constraints on store capacity (i.e., number of shoppers in stores) in the holiday peak. During the busiest time of the year, managing fixed store capacity implies a more substantial year-over-year decline in in-store shopper numbers than at less busy times of the year.

Source: US Bureau of Economic Analysis/US Census Bureau/Coresight Research[/caption]

Outlook for 2021

Against very undemanding comparatives, and assuming a return to more normal ways of living and working, we estimate an approximate 9% increase in total clothing spending in 2021.

However, even with this jump, total clothing spending would be 5.4% below the level of 2019.

Drivers of demand in 2021 will include the following:

Source: US Bureau of Economic Analysis/US Census Bureau/Coresight Research[/caption]

Outlook for 2021

Against very undemanding comparatives, and assuming a return to more normal ways of living and working, we estimate an approximate 9% increase in total clothing spending in 2021.

However, even with this jump, total clothing spending would be 5.4% below the level of 2019.

Drivers of demand in 2021 will include the following:

- An expected incremental return to more normal ways of living will spur demand for apparel for workplaces and social events. Should there be a rapid return to near-pre-crisis normality, such as due to a vaccine, there could be upside potential to our 2021 estimate.

- Renewal—Consumers spending much more time at home, especially during lockdown, effectively deferred renewal in some clothing categories. For example, many consumers will have cut their spending on categories such as businesswear to close to zero in 2020 and will need to renew their wardrobes in 2021. This could be amplified by consumer fatigue with casual and comfort and a “revenge spending”-style return to more aspirational clothing.

- Childrenswear—Clothing for children is driven less by the demands of heading to a workplace (although they attend school) or looking good for a social event and much more by renewal, given that they outgrow clothing.

Source: US Bureau of Economic Analysis/Coresight Research[/caption]

What Retailers Have Said About the Holiday Season

Most apparel brands and retailers are positive for the holiday shopping season but some believe it will be highly promotional. A number of retailers have expressed expectations that holiday demand will start earlier this year.

In Urban Outfitter’s second-quarter fiscal-2020 earnings conference call in August 2020, CEO Richard Hayne said, “We are planning for an extended holiday shopping period—with sales beginning earlier, reaching a plateau sooner but missing the peaks characteristic of prior years as consumers seek to avoid crowds. We believe holiday sales could be positive but still heavily promotional.” Similarly, The TJX Companies said that it is monitoring consumer spending behavior closely for the holidays and is prepared to quickly adjust inventory levels from warehouses to the stores for an early or late holiday season according to spending cues.

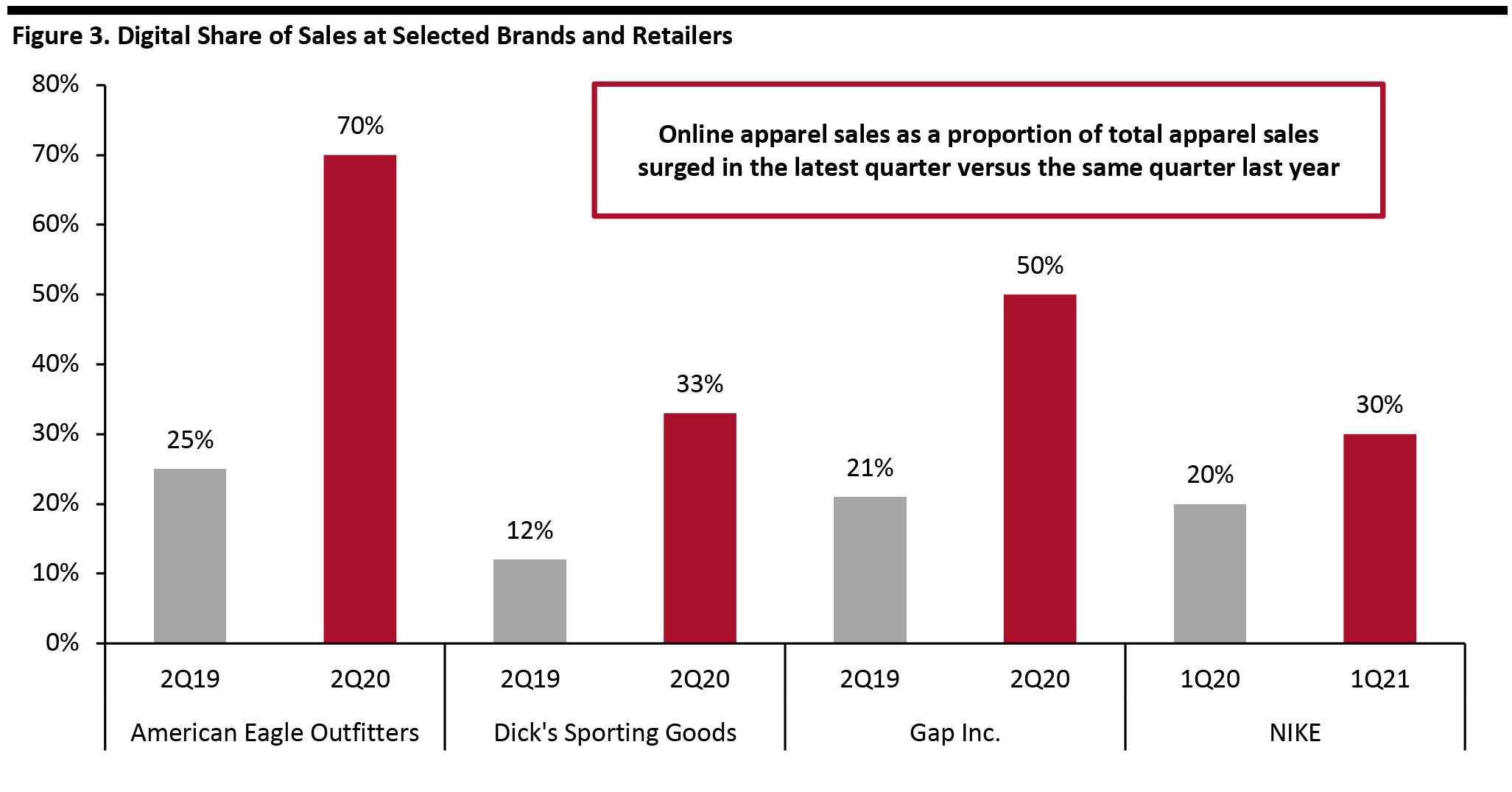

Expansion of Digital Presence

Apparel retailers continued to accelerate investments to enhance their digital presence, as well as shift media spending to the online channel. Going forward, we could witness the broader adoption of e-commerce among some of the underpenetrated apparel categories, such as lingerie and innerwear; and some of the underpenetrated consumer segments, such as baby boomers and Generation Zers.

Many apparel companies reported solid growth in online sales in their latest quarterly earnings:

Source: US Bureau of Economic Analysis/Coresight Research[/caption]

What Retailers Have Said About the Holiday Season

Most apparel brands and retailers are positive for the holiday shopping season but some believe it will be highly promotional. A number of retailers have expressed expectations that holiday demand will start earlier this year.

In Urban Outfitter’s second-quarter fiscal-2020 earnings conference call in August 2020, CEO Richard Hayne said, “We are planning for an extended holiday shopping period—with sales beginning earlier, reaching a plateau sooner but missing the peaks characteristic of prior years as consumers seek to avoid crowds. We believe holiday sales could be positive but still heavily promotional.” Similarly, The TJX Companies said that it is monitoring consumer spending behavior closely for the holidays and is prepared to quickly adjust inventory levels from warehouses to the stores for an early or late holiday season according to spending cues.

Expansion of Digital Presence

Apparel retailers continued to accelerate investments to enhance their digital presence, as well as shift media spending to the online channel. Going forward, we could witness the broader adoption of e-commerce among some of the underpenetrated apparel categories, such as lingerie and innerwear; and some of the underpenetrated consumer segments, such as baby boomers and Generation Zers.

Many apparel companies reported solid growth in online sales in their latest quarterly earnings:

- American Eagle Outfitter’s sales from e-commerce increased by more than 48% in the second quarter of fiscal 2020, which ended on August 1, 2020, the fastest growth in a decade. During the quarter, total customer acquisition rose by 22%, with more than doubling in the digital channel.

- Dick’s Sporting Goods’ online sales surged 194% in the second quarter of fiscal 2020, which ended on August 1, 2020.

- Gap Inc.’s online sales grew 95% year over year in the second quarter of fiscal 2020, which ended on August 1, 2020. The company added 3.5 million new online customers. At the end of the second quarter, it had activated curbside pickup and BOPIS (buy online, pick up in store) across more than 1,500 Athleta, Old Navy and Banana Republic stores.

- NIKE’s digital sales grew 83% in the first quarter of fiscal 2021, which ended on August 31, 2020. Even as stores reopened, the online business drove about $900 million of incremental revenue versus the prior year and acceleration versus the prior quarter.

- Urban Outfitters posted double-digit digital comps across its all brands, driven by a 76% year-over-year growth in new digital customers.

American Eagle Outfitters’, Dick’s Sporting Goods' and Gap Inc.’s second quarter of fiscal 2020 ended on August 1, 2020; NIKE’s first quarter of fiscal 2021 ended on August 31, 2020

American Eagle Outfitters’, Dick’s Sporting Goods' and Gap Inc.’s second quarter of fiscal 2020 ended on August 1, 2020; NIKE’s first quarter of fiscal 2021 ended on August 31, 2020 Source: Company reports/Coresight Research [/caption] Inventory Management For the holiday season, apparel retailers should make sure that they can scale with customer demand—such as by expanding ship-from-store capabilities. For example, American Eagle Outfitters has added logistics partners to ensure sufficient delivery capacity during the holiday season. With an efficient inventory management system, retailers can identify and move in-store stock with low demand to other store locations where demand is high. Similarly, data-driven insights can also support efficient inventory planning and in-store innovation—which have proved key for retailers amid the Covid-19 crisis. Building a Resilient Supply Chain Some apparel brands and retailers could look to diversify and broaden their supply chains to become more resilient post crisis. So far in 2020, we have seen more US apparel retailers diversifying their sourcing options—mostly reducing their exposure to China and increasing their exposure to other countries. As a result, China’s market share of US apparel imports has reduced to 21.7% in 2020 (January to July) versus 29.7% in 2019, according to the US Office of Textile and Apparel. On the other hand, other countries/regions have gained market share this year: ASEAN (34.3% market share of US apparel imports in year-to-date 2020 versus 27.4% in 2019), Vietnam (20.5% versus 16.2% in 2019), Bangladesh (8.6% versus 7.1% in 2019) and Cambodia (4.5% versus 3.2% in 2019). Furthermore, on September 14, the US imposed restrictions on some textile imports from Xinjiang in China, citing concerns about illegal and inhumane forced labor in the region. The restrictions include a ban on some entities from the region involved in manufacturing apparel and producing and processing cotton. Xinjiang accounts for about 80–85% of China’s cotton output, so this ban might create some short-term disruptions in the apparel supply chain going forward. Adoption of New Selling Models To ensure financial sustainability and facilitate consumer engagement, many apparel retailers could adopt new ways of selling, such as launching livestreaming sessions, opening virtual stores and leveraging social commerce. In May 2020, fashion brand Tommy Hilfiger, owned by PVH Corp., organized its first livestreaming event in North America and Europe to share its style inspirations for the Spring 2020 Tommy Hilfiger, Tommy Jeans and Tommy Sport collections. Furthermore, in September 2020, Tommy Hilfiger hosted a shoppable livestreaming event featuring six-time Formula One world champion Lewis Hamilton, showcasing sustainable pieces from the Fall 2020 Tommy Hilfiger, Tommy x Lewis, Hilfiger Collection and Tommy Jeans collections. These livestreaming events are being built on the next generation’s growing desire for interactive digital shopping experiences and will continue to gain popularity going forward. Beyond the Lower-Tier Malls Although apparel retailers have been reducing their exposure to the lower-tier malls for a long time, the pandemic has quickened this trend. For example, American Eagle Outfitters said that it will close 40–50 mall locations by the end of 2020, based on mall profile, lease tenure, customer engagement levels and proximity to other stores. Modification of Lease Conditions We expect that there would be considerable change in the way in which apparel retailers pay their rents in malls and at off-mall locations. Many retailers will be unwilling to sign new, or renew existing, ERV (estimated rental value)-based long-term leases, instead favoring flexible alternatives.

- American Eagle Outfitters said that it has 250 leases expiring in 2020. and a similar number are set to expire in 2021. The retailer said that its flexible lease portfolio allows it to quickly exit locations that are no longer favorable.

- Urban Outfitters reported that about 50% of its store leases are expiring within the next four years, so it is renegotiating with landlords and is seeing very favorable terms.

Key Trends and Insights

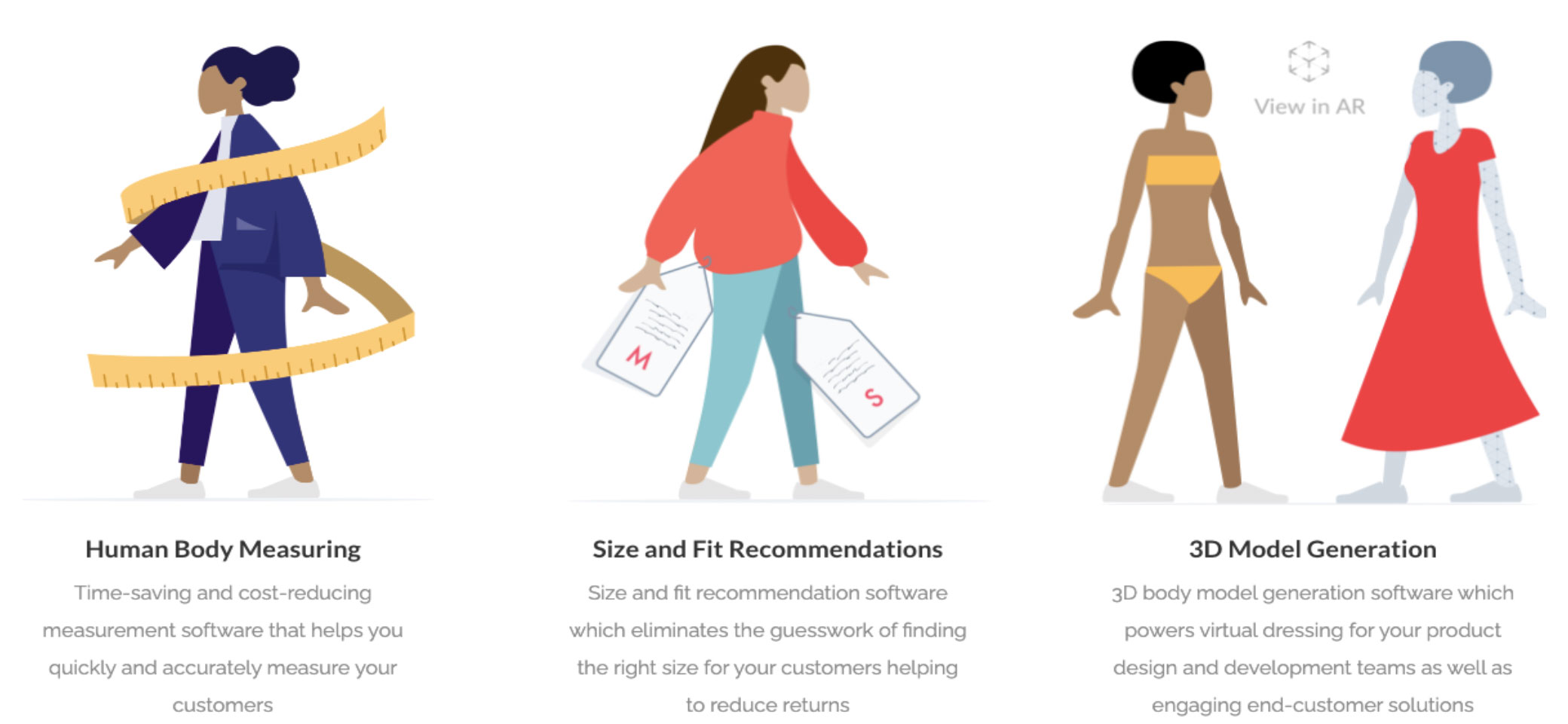

Apparel Retailers Are Leveraging Technology Innovators amid the Crisis The dramatic surge in online orders has prompted many brands and retailers to adopt apparel technology faster. Many apparel technology innovators are emerging as a significant enabler to drive brands’ and retailers’ push into e-commerce expansion. In August 2020, bankrupt apparel company Tailored Brands partnered with 3DLOOK to provide body measurement technology for two retail businesses of Tailored Brands: Men’s Wearhouse and Jos. A. Bank Clothiers. 3DLOOK, which leverages computer-vision algorithms to provide virtual body measurements from photos taken with any smartphone, aims to provide the technology to more than 1,000 locations of Tailored Brands by fall 2020. With this partnership, Tailored Brands aims to deliver deeper levels of personalization and retarget customers with products that would better fit their body shapes. Earlier in May, body data and sizing technology company Bold Metrics collaborated with virtual try-on company Forma to provide retailers with photorealistic try-on technology, coupled with size recommendations for shoppers to understand the fitting of apparel, whether buying online or in-store. [caption id="attachment_117502" align="aligncenter" width="700"] 3DLOOK’s body data platform

3DLOOK’s body data platform Source: 3DLOOK [/caption] Automation Is Gaining Momentum The coronavirus pandemic is speeding up automation in the apparel retail industry. In early 2020, Gap Inc. entered into a deal with US-based robotics and artificial intelligence (AI) firm Kindred to more than triple the number of item-picking robots for assembling online orders so that the retailer can limit human contact during the crisis. As of June 8, Gap Inc. had added 73 “Sort” piece-picking robots in its US distribution centers, increasing the total to 106. According to the retailer, each robot can handle work typically performed by four people, and the Sort robots completed more than 13 million unique picks of Gap merchandise between January and April 2020, with an average sorting speed of 335 units per hour, maintaining uptime at 99.8%. Similarly, NIKE is scaling robotics and automation in its logistics operations, with deployment across North America, Japan and EMEA. NIKE has reported that automation has accelerated digital throughput and cut order cycle times by up to 50%. Amazon has an edge in the domain of automation, with its more than 100 warehouses and thousands of robots. [caption id="attachment_117503" align="aligncenter" width="700"]

Kindred’s AI-powered Sort robots at Gap Inc.’s automated distribution center in Groveport, Ohio

Kindred’s AI-powered Sort robots at Gap Inc.’s automated distribution center in Groveport, Ohio Source: Gap Inc. [/caption] Athletic Wear and Activewear Are Trending, but Demand for Workwear Remains Weak Amid the pandemic and lockdowns, demand for athletic wear and activewear has remained strong, while structured apparel, geared for office and events, has understandably been much weaker. We believe that many apparel retailers will look to carve out their positions within the $16 billion women’s active apparel market in the US. American Eagle Outfitters launched “Offline,” its new activewear brand, in July 2020. The brand is currently available in Aerie’s digital channel and the company plans to open a few pilot stores in the coming months, starting with a store in Nashville in fall. The retailer also plans to feature “Offline” in Aerie’s 335 stores.

What US Apparel Brands and Retailers Are Reporting on the Coronavirus Impact and Outlook

The coronavirus pandemic has caught apparel companies unprepared, and the resulting societal and economic shutdowns have presented unprecedented challenges. The current crisis demands that apparel brands and retailers accelerate their progress on sustainable initiatives to be more competitive in the post-pandemic environment. Below, we summarize recent, key commentary from major US apparel retailers and brand owners on the impact of Covid-19 on recent performance, as well as their future outlook.Figure 4. Apparel Brands and Retailers: Key Commentary and Future Outlook

| Commentary | Outlook | |

| American Eagle Outfitters | In the second quarter (2Q), total revenues decreased by 15% versus a 38% decline in 1Q. Online sales rose by 48%: By brand, Aerie’s online sales surged 113%, while American Eagle (AE) saw its digital sales grow 21%. The company is focusing on Aerie as a priority. Management said that Aerie is on pace to reach $1 billion in revenue, and the company reported white space in core areas such as intimates, swim and lounge, representing a combined $40 billion addressable market. | The company expects to see continued sequential improvement in sales from the first half of the year. In 2020, the company plans to open 25 new Aerie locations and close 40–50 AE locations. |

| Burlington Stores | Total sales declined by 39% in 2Q, while sales in reopened stores decreased by 14%. CEO Michael Sullivan said, “Following the reopening of our stores, we experienced an exceptionally strong sales trend, driven by pent-up demand and by our own great clearance values. This strong sales trend continued into the second half of June, but then fell off dramatically as we struggled to replenish the depleted inventory levels in our stores. For inventory flow, we prioritized the stores that we opened in May. That was just over half the chain. These stores are now at approximately the inventory level that we want. Their sales levels are trending down approximately 20% but are on an improving trajectory.” Management reported that staffing shortages in distribution centers also contributed challenges. These issues are subsiding but have not completely gone away—and are a risk not only to Burlington but across the retail industry, as retailers start to ramp up for holiday. The company said that this could lead to an increase in supply chain costs across the industry this year. During the quarter, Burlington opened three new stores, bringing its total store count to 739 stores. | The company said that it is moving prudently on the major elements of its Burlington 2.0 off-price strategy, which is focused on long-term success beyond the pandemic and includes store expansion. In the third quarter, the company expects to open 37 new stores, with seven expected closures or relocations. In fiscal 2020, Burlington expects to open 62 new stores and close or relocate 26 stores. This would translate to 36 net new stores in the full year. |

| Dick’s Sporting Goods | Comps grew by 20.7% in 2Q, driven by a 17.9% increase in average ticket and 2.8% growth in transactions. The company saw growth across each of its three primary categories: apparel, footwear and hardlines. By the end of June, the company had reopened 100% of its stores to the public. CEO Edward Stack said, “The favorable shifts in consumer demand that drove our strong comps during Q2 have continued into Q3, partially offset by softness in the key BTS [back-to-school] categories. With the significant part of BTS already behind us, through the first three weeks of Q3, our consolidated comp sales have increased by 11%, with continued margin rate expansion.” The company’s private-label brands, such as CALIA and DSG, remained a key source of its strength and differentiation, outperforming the company’s average comparable sales growth by about 500 basis points in the second quarter. | Management said that the company is extremely pleased with its 3Q sales trend and remains enthusiastic about future prospects. |

| Lululemon Athletica | Total sales increased by 2% in 2Q, exceeding the company’s expectations of a high-single-digit decline. The company’s e-commerce comps grew 157% in the quarter. As of September 8, about 97% of the company’s stores are open globally. On average, the reopened stores are performing at 75% of last year’s volume. The company saw a sequential improvement in the men’s business, relative to the first quarter, although it lagged behind second-quarter growth in the women’s business. Lululemon continued to grow in international markets. In China, the company’s comparable sales grew more than 30% in the second quarter, coupled with e-commerce growth of over 130%. In Europe, the company saw 160% growth in online sales. During the quarter, the company opened 17 new stores: eight in North America, four in Mainland China, three in other markets across Asia and two in Europe. | In 3Q, the company expects total revenues to grow in the mid- to high-single-digit range. For 4Q, it expects revenue growth in the high-single-digit to low-double-digit range. In the second half, the company expects reopened store sales productivity to remain at the current 75% level and digital sales growth to remain above its pre-Covid growth of 30–40% but moderate as compared to 2Q. For the full year 2020, the company expects MIRROR (an at-home fitness innovator acquired by Lululemon in July 2020) to generate revenues of over $150 million, up from the initial revenue expectation of more than $100 million. CEO Calvin McDonald said, “We remain committed to our Power of Three growth plan, including the doubling of men’s, doubling of e-commerce and quadrupling of international by 2023.” |

| NIKE | Total revenues declined by 1% year over year in the first quarter of fiscal 2021. With existing physical stores reopening, NIKE is also opening new stores to deepen the connection with consumers, such as the House of Innovation concept store in Paris and the new NIKE Factory Store in the Watts neighborhood of Los Angeles. During the quarter, NIKE launched Nike M, its first maternity collection. It also introduced a new Nike Yoga collection that is gender-inclusive and features performance-fabric innovation. | For the full year, NIKE expects revenue to be up high-single digits to low-double digits. In the second half of 2020, the company is seeing sequential improvement in full-price sales but expects a continuation of higher markdown activity in the owned stores to sustain conversion rates on lower traffic. |

| PVH Corp. | In 2Q, total sales declined by 33% as the company’s owned stores and wholesale partner stores were closed for nearly one month during the quarter, and its stores operated at significantly lower occupancy levels and reduced working hours. By brand, Tommy Hilfiger sales declined by 28%, while Calvin Klein revenues decreased by 32%. Digital sales grew 50%, including a 90% surge in the company’s owned commerce sites. PVH believes that digital sales will contribute nearly 20% of its total sales in the next couple of years. CEO Emanuel Chirico said, “International tourist traffic to the United States, which typically represents about 30–40% of our revenues, is down over 90% so far this year—and we do not expect it to come back during the second half of 2020. While back-to-school was never a big business for PVH, it was a traffic driver for outlet centers and department stores that we are not experiencing at the same level this time this year.” | CFO Michael Shaffer said, “We currently expect revenue in the second half to be down 25% versus last year. We expect that our second-half gross margin will be relatively flat compared to the first half as we project heavy promotional activity across the industry in order to clear inventory, particularly in the United States.” Chirico said, “We are prepared to begin the holiday sales season early, as a number of our retail partners… are all beginning the holiday selling at an earlier time.” This includes PVH partner Amazon kickstarting its holiday season with the postponed Prime Day, which will now be held in October instead of its usual timing in the summer. |

| Gap Inc. | Total comps were up 13% in 2Q, primarily led by 95% growth in online sales. By brand, Athleta and Old Navy continue to outperform. As of August 1, 2020, Gap reopened about 90% of its stores, with inventory down about 4%. The company said that its inventory levels are more closely aligned with customer demand. In September, the company extended its loyalty program, deepening its customer relationship and inviting more loyalists to stick to its brands. | In the fall, the company is adding two new online payment options: Afterpay and PayPal. Gap expects the BTS season to extend over a longer period. |

| L Brands | Comps grew 33% at reopened stores, driven by non-apparel banner Bath & Body Works (BBW), whose comps surged 87%. Soap and hand sanitizer historically account for 14–15% of BBW business, which increased to 25% of sales in 1Q and increased even higher in 2Q. While BBW traffic was down in malls, this was offset by higher traffic in off-mall locations, higher conversion rates in the 30% range and a larger spend per customer. Victoria’s Secret comps were down 10% during the period that stores were open. Management reported that the 250 planned store closures at Victoria’s Secret are largely complete: The company expects to recapture 30–40% of sales from closed stores, with approximately 5% going to its digital business and the remainder to nearby stores. L Brands took steps to create standalone companies for Victoria’s Secret and BBW by reducing its home-office headcount by 15% and hiring advisors. Management will await holiday results to determine business valuation. Going forward, the company plans to be more conservative on its inventory levels and keep an eye on consumer demand. The company did not report any weakness for BTS merchandise sales. | For the holiday season, it expects store capacity to be at approximately 30% of normal levels due to social distancing. The company is adding a mobile point-of-sale checkout that allows customers and associates to spread out (since not all cash registers can be used under social-distancing guidelines). Management noted that at BBW, 50–60% of its customers are expected to purchase a gift during the holidays (30–40% during the non-holiday time), and the company will continue to have a variety of gifting options available for consumers. Management said that online fulfillment has been experiencing “holiday-like” volumes since the start of the pandemic, and L Brands has ramped up fulfillment-center capacity and is further increasing capacity for the second half of the year in preparation for increased volumes. |

| Ross Stores | Comps were down 12% for reopened stores. On average, stores were open for about 75% of the quarter, although operating on shorter hours compared to the prior year. By the end of May, all distribution centers had been reopened. Management reported that sales during the quarter were significantly impacted by Covid-19, particularly in Arizona, California, Florida and Texas, which represent about 50% of its store base. CEO Barbara Rentler said, “During the initial reopenings, overall sales were ahead of our conservative plans as we benefited from pent-up demand and aggressive markdowns to clear aged inventory. In the weeks thereafter, trends were negatively impacted from depleted store-inventory levels, while we were ramping up our buying and distribution capabilities.” Management said that the consumer is increasingly shopping for home and casual apparel categories, including activewear and athletic wear, and the company will continue to focus on these areas. “The consumer during the quarter was very much more focused on home as opposed to apparel,” CFO Travis Marquette said. Rentler noted that home becomes a more significant category in the holiday quarter. | Management said that it expects to add about 39 locations this fall for a total of 66 new stores for the full year. The company did not announce its holiday plans and hours, as it is still working through its plans. |

| The TJX Companies | Comps for open-only stores were down 3%. Throughout the quarter, the company saw strength in several categories, particularly HomeGoods, which delivered a double-digit open-only comp growth. Some of the non-trending, weaker categories were apparel, traditional casual and career-related apparel. CEO Ernie Herrman said, “Following the wave of strong initial demand, traffic and sales moderated as we moved through the second quarter and into the third quarter. As we reopened, we weren’t able to optimize the inventory flow back to our stores like we would in a normal environment.” | For 3Q, TJX expects overall open-only comp store sales to decrease by 10–20%, in line with the sales trends that the company has been seeing since the middle of July. Management commented that the company is monitoring consumer spending behavior closely for holidays and is prepared to quickly adjust inventory levels from warehouses to the stores for an early or late holiday season according to spending cues. |

| Urban Outfitters | Total comparable sales decreased by 13%. By brand, comps increased by 11% at Free People and decreased by 8% at Urban Outfitters and decreased by 25% at Anthropologie. Total new digital customers across all brands jumped by 76% year over year. The company’s athletic line FP Movement saw its customer base grow by 175%. This fall, the company plans to open the first FP Movement standalone location in Los Angeles. Management said that the home category produced very strong regular-price comps throughout the second quarter. The company’s Anthropologie brand was impacted by the pandemic, as it is known for offering more structured apparel geared for work and events. As the quarter progressed, the brand’s apparel team was able to adjust to more casual and less structured looks, resulting in a lesser need for markdowns and driving notable improvement in sales. The company announced that it is building another large omnichannel distribution facility in Kansas that will support its growing digital business in North America. | For 3Q, the company projects total sales growth to be mid-single-digit negative, with the Retail and Wholesale segments showing improvement from 2Q. For the holiday season, CEO Richard Hayne said, “We are planning for an extended holiday shopping period, with sales beginning earlier, reaching a plateau sooner but missing the peaks characteristic of prior years as consumers seek to avoid crowds. We believe holiday sales could be positive but still heavily promotional.” The company has taken several measures to ensure the capability to scale with customer demand during the holiday period. These include adding staff and installing equipment in existing fulfillment centers to boost efficiency and using a new distribution facility to ship faster on items and adding staff to the stores to allow for more pack-and-ship processing. |

| VF Corporation | Total revenues declined by 48% year over year, led by store closures and lower consumer demand due to the coronavirus outbreak and related restrictions. Global digital business increased by more than 80%, led by 115% growth in the Americas region and nearly 90% growth across its four big brands. Gross margin decreased by 340 basis points to 52.9%, primarily driven by elevated promotional activity to clear excess inventory. During the quarter, all of the company’s retail stores reopened in the APAC region. In the US, BOPIS and ship-from-store capabilities have been fully launched in the vast majority of stores. Its business in Mainland China is strong and has been recovering sharply since February, with a growth of 9% in the quarter. The company is applying many of its consumer-centric strategy learnings from China to other markets across the globe. VF continued to explore the divestiture of its Occupational Workwear business. | For the fiscal year 2021, the company expects more than 40% growth in its digital business and expects its digital penetration to be over 25% of total revenues. |

Apparel Companies Bankruptcies and Store Closures

Several apparel retailers were dealing with declining sales long before the coronavirus pandemic; however, the crisis has exacerbated an already challenging environment. Since March 2020, 11 major apparel companies have filed for bankruptcy in the US—already exceeding the full-year tally of apparel companies’ bankruptcies in 2019. Even post-lockdown reopenings did not provide much support to the most troubled names: Store rents and employees’ salaries became due, while sales remained stagnant due to low traffic levels and depressed spending in some categories. We believe that the coronavirus pandemic will prompt further apparel bankruptcy filings in late 2020; the longer the coronavirus crisis goes on, the greater the chance that more retailers will falter. [caption id="attachment_117504" align="aligncenter" width="700"] The revenue figure depicted for Centric Brands is for the nine-month period ended Sep 30, 2019. *True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017.

The revenue figure depicted for Centric Brands is for the nine-month period ended Sep 30, 2019. *True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. **J. Crew Group includes J.Crew and Madewell banners.

***Ascena Retail Group includes Justice, Catherines, Ann Taylor, LOFT, Lane Bryant and Lou & Grey banners.

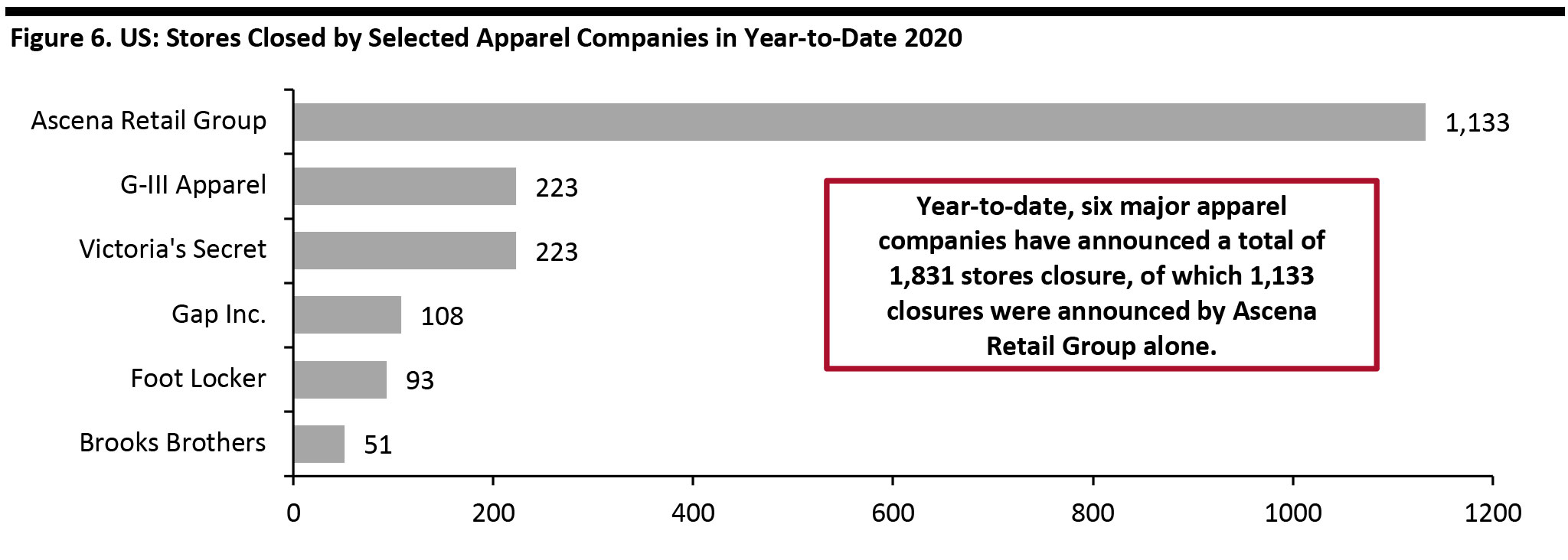

Source: Company reports [/caption] Year-to-date, six major apparel companies have announced a total of 1,831 store closures, of which 1,133 closures were announced by bankrupt Ascena Retail Group alone. G-III Apparel and Victoria’s Secret announced 223 store closures each. [caption id="attachment_117505" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

How Are DTC Apparel Companies Positioned in a Post-Crisis Environment?

The growth of e-commerce in the apparel industry in the last few months has been beneficial for direct-to-consumer (DTC) brands and retailers. Several DTC apparel brands witnessed strong growth in their monthly traffic in the second quarter of fiscal 2020, according to a July 2020 report by web analytics service provider SimilarWeb, whose shortlist of the 25 fastest-growing DTC brands includes the following:- Kid’s apparel company Cubcoats saw traffic growth of 337% quarter over quarter, with monthly visits at 57,000.

- Footwear company Hari Mari witnessed traffic growth of 337%, with monthly visits at 42,000.

- Women’s apparel company Draper James saw traffic growth of 194%, with monthly visits at 342,000.

- Fast-fashion company For Days reported traffic growth of 173%, with monthly visits at 43,000.

- Men’s apparel company Birddogs Shorts saw a traffic increase of 106%, with monthly traffic at 134,000.

- Bra company CUUP witnessed its traffic rising by 96%, with monthly traffic at 200,000.

- Footwear brand Atoms saw traffic growth of 89%, with monthly traffic at 142,000.

- Fashion and lifestyle brand Rowing Blazers saw traffic growth of 39% quarter over quarter, with monthly visits at 40,000.

- Men’s apparel subscription-based service company Trendy Butler witnessed a traffic increase of 36%, with monthly visits at 56,000.

- Athletic wear retailer Stadium Goods’ traffic increased by 35%, with monthly visits at 2.1 million.

- CUUP saw traffic growth of 35%, with average monthly visits at 102,000.

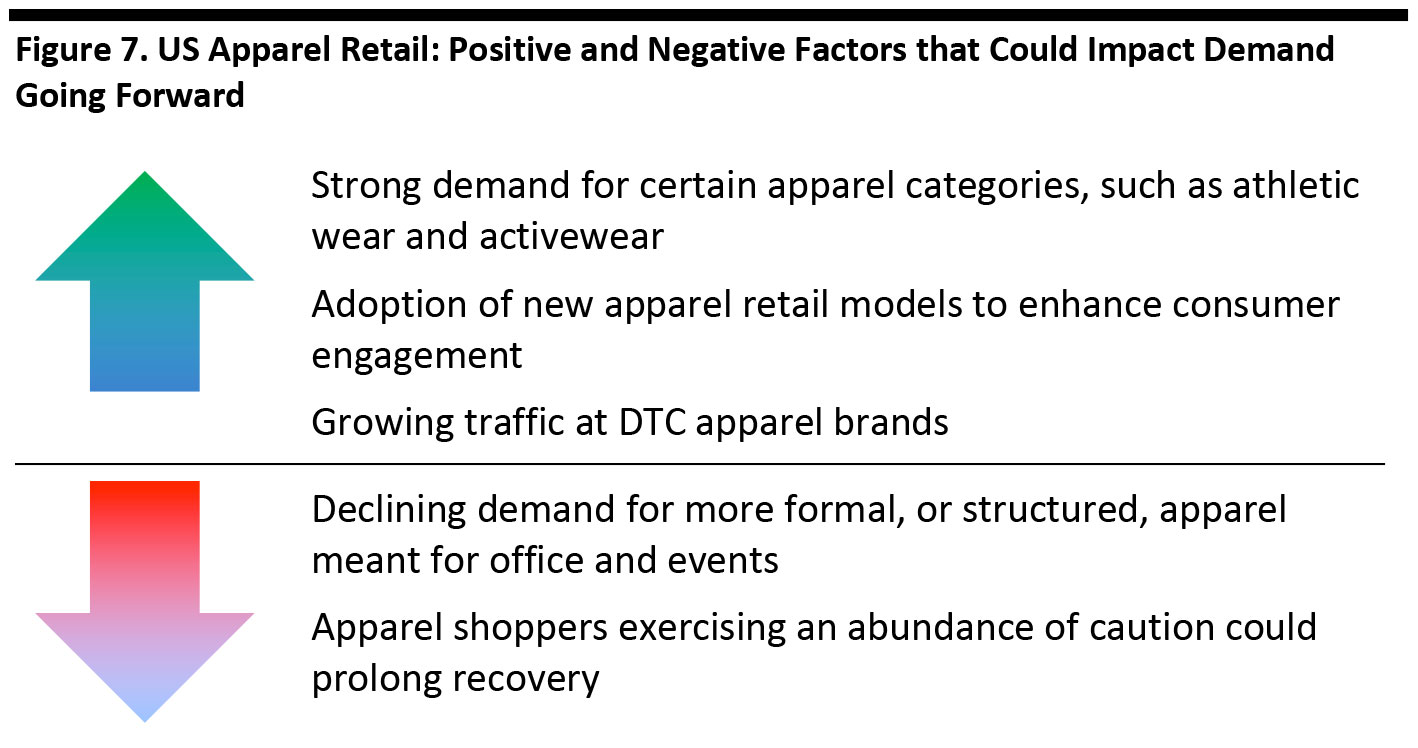

Factors Impacting the Apparel Sector’s Resilience

As we see the impacts of the crisis and gradual rebound within the apparel retail space, issues of resilience—or lack thereof—have come to the fore. Below, we list some of the key factors that could impact the resilience of the apparel sector going forward. [caption id="attachment_117506" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]