Nitheesh NH

Introduction

The coronavirus outbreak hit all discretionary retail sectors. Although some could bounce back quickly, the future performance of many sectors remains uncertain. One of the worst-affected sectors so far is apparel. In this report, we discuss how its recovery could play out, with several factors affecting consumer purchasing power and buying conviction. This report analyzes the apparel sector’s prospects over the three-to-nine-month period after the lockdown ends. We discuss four possible apparel-recovery scenarios and characterize the two stages of apparel downturn and recovery. Our insights are based on Coresight Research proprietary survey data, key metrics and guidance and management commentary from apparel players.Coronavirus Hits the Apparel Industry Hard

The coronavirus outbreak played havoc with the US apparel industry in the first quarter. The market capitalization of the US textiles, apparel and luxury goods sector plunged by 45% from January to March, according to financial services corporation Fidelity Investments. However, with store reopenings having begun in May, market capitalization has seen some improvement—it was down 10% year to date as of June 8, 2020. The apparel industry relies heavily on intercontinental supply chains, consumer spending and regular collection changes. The Covid-19 outbreak has choked both supply and demand: The supply chain is distorted, with retailers canceling brand orders and brands canceling factory orders. Key production centers such as Bangladesh, Indonesia and Malaysia are all feeling the impacts of the pandemic. This crisis has rendered previously planned strategies for 2020 redundant. Retailers are heavily discounting their spring and summer collections to clear inventory. Owing to cashflow crunches and uncertainty over future demand and supply, apparel brands and retailers are operating conservatively.High Projected Unemployment and Slow Economic Growth Could Prolong Apparel Recovery

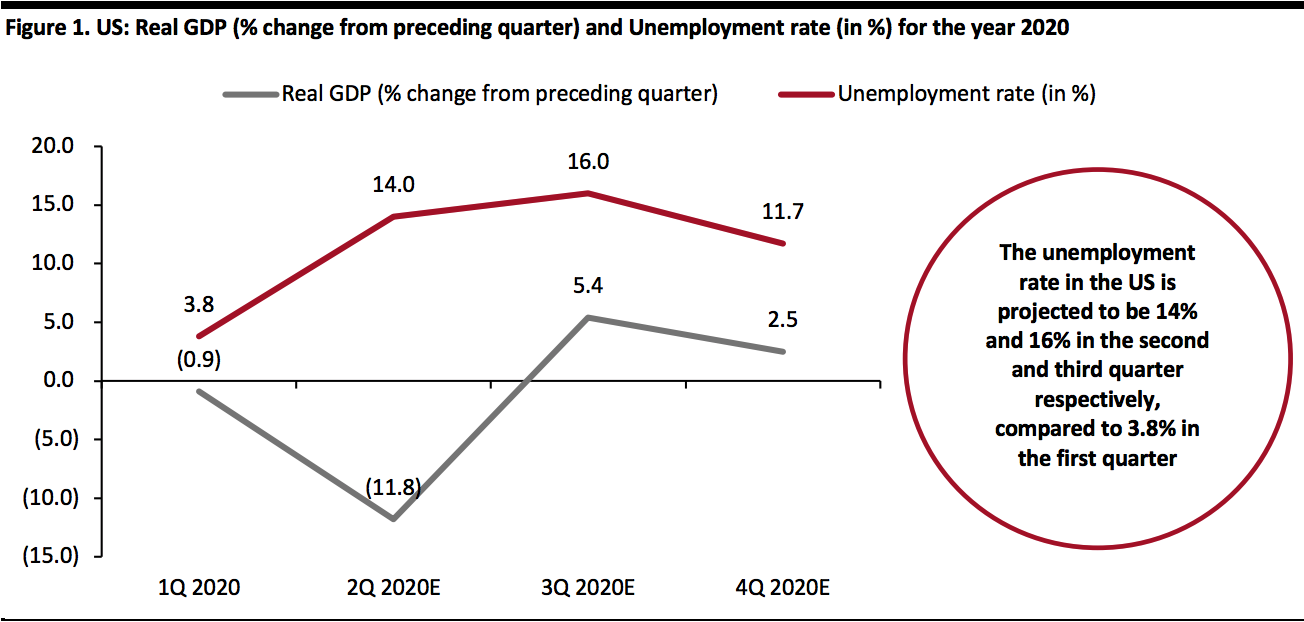

Coronavirus-induced shutdowns and furloughs made a considerable dent in consumers’ income and spending ability—and were particularly devastating for employees in retail, travel and hospitality. Consumer spending contributes around 70% of US GDP. The unemployment rate in the US is projected to be 14% and 16% in the second and third quarter respectively, compared to 3.8% in the first quarter, according to a report released by the US CBO. Although the unemployment rate is forecasted to improve after the third quarter, it is expected to stay above 10% throughout 2020. This means that many furloughed employees may return to work this year. The CBO forecasts the decline in GDP to deepen in the second quarter, followed by a slow recovery in the third and fourth quarter. [caption id="attachment_111482" align="aligncenter" width="700"] Source: US Congressional Budget Office[/caption]

Source: US Congressional Budget Office[/caption]

Apparel Retail Recovery Scenarios

We define recovery as the majority of apparel stores being reopened (those of surviving retailers), with measures in place to help ensure full access to products for consumers and employees. In Figure 1, we have laid down four recovery scenarios: V-shaped, U-shaped, W-shaped and tick/swoosh. Figure 2. Apparel Retail Recovery Scenarios [wpdatatable id=249]Source: Coresight Research

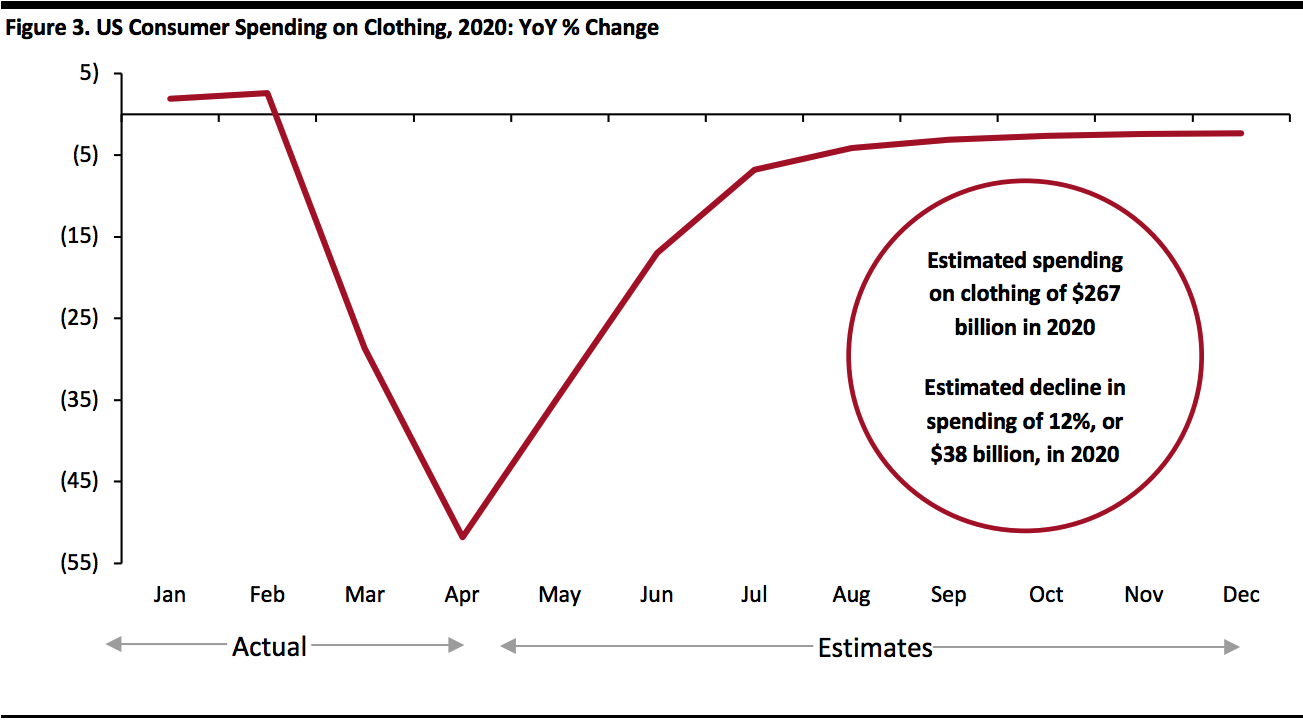

Characterizing the Downturn and Recovery Cycle of the US Apparel Industry

We characterize the downturn and recovery for apparel retail in two stages—shutdown and reopening and recovery. As lockdowns began to ease and stores reopened from May, we expect that April will have been the trough in consumption. Significantly, some apparel retailers are witnessing higher-than-anticipated sales productivity in their reopened stores as a proportion of their performance this time last year. Our estimates suggest a broadly V-shaped recovery, with the majority of the decline recouped in the few months following April, but with apparel spending still down meaningfully year over year at the end of that “V.” Subsequently, we estimate a more gradual improvement as spending on apparel remains below 2019 levels through the remainder of 2020. We believe that, with the right strategies, apparel retailers can revive demand and engineer a broadly V-shaped recovery.- For 2020 overall, we estimate consumer spending on clothing to fall 12%, or $38 billion, to approximately $267 billion (including sales taxes). This reflects spending through all channels, including lockdown-resilient, higher-growth e-commerce.

- Apparel speciality retailers, which were already underperforming versus spending, will underpace this total: For 2020, we estimate that clothing, footwear and accessories retailers will see a 21.5% decline in sales, taking sector sales to approximately $210 billion (excluding sales taxes), driven by the deep declines through lockdowns.

Source: US Bureau of Economic Analysis/Coresight Research[/caption]

Source: US Bureau of Economic Analysis/Coresight Research[/caption]

The Phases of Apparel Retail Recovery

The coronavirus outbreak is poised to disrupt the apparel retail cycle this year. However, over the next couple of months, we expect consumers’ propensity to spend on discretionary items to increase and their perceptions of risk to change. Below, we have listed a detailed phase-based recovery approach to the next nine months. Phase 1: The Next Three Months The next three months are crucial for apparel retailers to survive the crisis and navigate their businesses toward gradual recovery. The Reopening of Store Networks Apparel businesses around the country are reopening as local and state governments ease lockdown and travel restrictions. However, brands and retailers are initially operating well below capacity. For example, as of May 19, over 40% of Urban Outfitters stores were open: 252 in North America and 27 in Europe. Stores in North America were down about 50% in sales and about 65% in traffic. The retailer reported that it expected to open about 100 more stores by the first week of June. Similarly, Gap Inc. reopened nearly 800 stores across its portfolio of brands in May, while AEO reopened around 600 of its 1,000 stores in May. In the next three months, we believe customer traffic and sales will improve in brick-and-mortar stores due to the release of pent-up consumer demand. However, some apparel retailers may never reopen their stores, owing to bankruptcies and store-portfolio rationalization on the back of the crisis. For example, J.Crew is one of the major US apparel retailers to file for bankruptcy protection and has furloughed 11,000 of its 13,000 employees. The retailer had been struggling before the outbreak, but things got worse during the crisis as it failed to cope with its nearly $2 billion debt burden. In the bankruptcy filing, the retailer said that it might close stores permanently unless it could secure accommodations from landlords; J.Crew is looking for streamlined lease rejections. Figure 4. Selected US Apparel Brands and Retailers: Sales Productivity of Reopened Stores Versus Last Year [wpdatatable id=250]Source: Company reports/Coresight Research

Inventory Management Going forward, managing inventories will be a cumbersome task for retailers. To clear inventory, apparel retailers have been running deep discounts online since April, when stores were closed across the US. In April 2020, apparel prices for US urban consumers dropped 5.7% year over year, the largest decline since 1950, according to the US Bureau of Labor Statistics. The price decline trend continued in May, even as some brick-and-mortar stores reopened. For example, Burlington Stores offered 50% discounts throughout the entire store (some exclusions apply) in May. In contrast, to avoid price slashing or selling at steep discounts via alternative channels such as off-price retailers, some retailers may adopt the “pack and hold” approach. For example, Gap Inc. plans to hold its spring/summer 2020 ranges for 2021. The retailer is also likely to place far fewer orders for spring/summer 2021 merchandise. On the positive side, it might not only protect the potential margin but also make working capital available for the first half of fiscal year 2021. However, on the negative side, the pack-and-hold model increases storage costs, ties up capital in temporarily unsellable spring/summer inventory and includes the risk of styles and designs becoming outdated. However, this risk is lower for retailers with less seasonal assortments. For instance, in its earnings conference call in late March, Lululemon Athletica said that its assortment is less seasonal in nature as many of its core styles are relevant year-round and can be held and continued to be sold for a much longer period of time; the retailer is thus less dependent on clearing inventory. Some apparel brands and brand owners such as Hanesbrands, Levi’s and PVH Corp. are planning to leverage e-commerce for the forthcoming back-to-school (BTS) shopping season and more directly align inventory and production to meet demand. We believe Amazon could be a good inventory clearance channel for apparel brands. In recent years, the e-commerce giant has increased its presence in the US clothing and footwear market. According to a February 2020 Coresight Research survey, 70.5% of apparel shoppers had bought apparel on Amazon in the past 12 months—up 10 percentage points from 2019 and up almost 25 percentage points from 2018. Amazon is reportedly hosting a “summer sale” on June 22, 2020, which is designed to provide a boost for sellers feeling the impacts of the coronavirus pandemic. This follows the delay of the company’s annual Prime Day event (usually held in July) to fall. We expect the apparel retailers to review their full-year inventory and make inventory-management decisions based on trends, seasonality and confidence in style. Limited-run and exclusive collections will likely be the only items that retailers can sell at, or near, full price. Acceleration of Automation The coronavirus pandemic may speed up automation in the apparel retail industry. In early 2020, Gap Inc. entered into a deal with US-based robotics and AI firm Kindred to more than triple the number of item-picking robots it uses to 106 by fall this year. Each robot could handle work typically performed by four people. Gap Inc. has been speeding up its rollout of warehouse robots for assembling online orders so that it can limit human contact during the crisis. The retailer targets to finish the rollout to four of its five US facilities by July, months ahead of schedule. Amazon has an edge in the domain of automation, with its more than 100 warehouses and thousands of robots. Rise of Virtual Fitting Rooms We might see more retailers invest in virtual fitting solutions, such as digital mirrors that utilize augemented reality (AR), to enable customers to visualize how a product would look without having to physically try it on. Retailers have been leveraging AR tools during the Covid-19 pandemic to stay connected with their customers. Plans for the BTS, Fall and Holiday Seasons Most apparel retailers are reviewing and reworking their marketing calendar to look for opportunities to drive traffic to brick-and-mortar stores. Apparel companies are looking to the BTS season in July to boost sales, launching key campaigns to drive foot and online traffic. In its first-quarter earnings conference call on June 3, AEO said that it will set new BTS merchandise in July and enter the fall season strong. The retailer is also focusing on providing clean and fresh assortments for the holiday season. COO Michael R. Rempell empahasized that, due to lower costs of commodity, energy and cotton, AEO can add higher mark-ups to its retail prices as it moves into the back-to-school and holiday seasons. This is positive for the retailer, enabling it to preserve margin. Similarly, in its first-quarter earnings conference call on April 30, Hanesbrands said that it is expecting a good BTS season. The retailer’s reopened stores, which represent half of its sales, are actively planning for the BTS season. Beginning with the spring and summer inventories, retailers could determine which products could be delayed for late summer and fall or even pushed to 2021. Some products might also be sold in flash sales during the holiday period, depending on the availability of storage space. Accounting for the first-half carryover, retailers would adjust required quantities of new stock for the fall and holiday seasons. Phase 2: Six Months from Now Most components of Phase 1 will carry into Phase 2. However, we could see improvement in consumer demand six months from now. Many forward-looking retailers may adopt strategies that would have a medium- to long-term impact on their operations, such as the adoption of new retail models and moving a higher proportion of store business to the e-commerce channel. Holiday Season Although we believe that consumer holiday demand for apparel will be slightly below that of 2019, the peak holiday season is when apparel retailers could still bring in hordes of extra shoppers through promotions, discounts and special events. To start driving holiday traffic, retailers may have to incur promotion-related expenses ahead of time—i.e., as early as the beginning of October. Most retailers place orders for holiday collections by early summer (June/July), but this may be delayed due to uncertainty around the crisis and financial concerns. As spring and summer merchandise are currently on sale, most of the fall merchandise may arrive to stores late—in October or November—due to lag times in production. There is a therefore high possiblity that the receipt of holiday season merchandise will be delayed. Some retailers with a less seasonal assortment have flexibility to adapt to this situation. For example, with regard to its winter 2020 collection, Lululemon reported that it has flexibility in pushing out or lowering its orders. New Retail Models Will Gain Momentum To ensure financial sustainability, many apparel retailers will look for new ways of selling, such as launching virtual stores, livestreaming sessions, loyalty programs and social commerce. Retailers’ attitudes and approaches to building customer loyalty during the crisis will play a major role in their long-term growth. Apparel retailers that remain strong and resilient during Phase 2 could stand ready to gain market share from bankrupt rivals, including by leveraging targeted communications aimed at winning those rivals’ customers. Increasing Proportion of Store Business To Move Online We believe that the heightened online shopping trend is likely to to continue even after the broad reopening of stores, and an increasing proportion of sales may move from the brick-and-mortar format to online platforms in the next six months. Coresight Research’s June 3 survey of US consumers found that 70.5% of respondents expect to shop more online than they used to. About 34% of respondents said they are buying more apparel online this week. Stores will play a key role in supporting greater online sales by developing resources to pick, pack and ship online sales. Impact of a Covid-19 Second Wave The expected timeline for recovery in the US apparel market hinges on the broader containment of the coronavirus. There is a possibility that its spread may peak again in the October-November period, according to various medical experts, including Dr. Anthony Fauci, who is spearheading the White House Coronavirus Task Force. The resurgence of a pandemic could force apparel stores to close again in certain areas, if not nationally, potentially causing another wave of bankruptcies. In the case that the coronavirus reappears in the winter, the recovery scenario would be W-shaped (as described in Figure 2). However, if the coronavirus is tamed within the next six months, the best-case scenario could see high sales in the apparel sector. Phase 3: Nine Months from Now Nine months from now, we could see apparel businesses pick up the pace of operations, as recovery from the crisis continues. This will also be when some of the the packed-away inventory is released, such as Gap Inc.’s spring/summer 2020 collection. Furthermore, many retailers may adopt strategies that would have a long-term impact on their operations, such as expanding their digital presence, building a resilient supply chain, reducing their exposure to lower-tier malls and modifying lease conditions. Building a Resilient Supply Chain As retailers plan for 2021, this is also an opportunity to put all of the major supply chain issues on the table: labor, slow-moving product categories, shortages, the role of automation, standards, etc. Apparel brands and retailers may look to diversify and broaden their supply chains to become more resilient post coronavirus: Multi-sourcing from global or local suppliers or alternate sites of single suppliers will minimise the risks associated with localized disruptions. For example, AEO—which sources nearly 20% of its goods and products from China—has been dealing with disruption since the crisis started earlier this year. The company had already been looking to migrate sourcing to other countries, but the pandemic is likely to have accelerated this process. Some apparel manufacturing could also move closer to the US so that retailers can gain better control of their supply chains. However, this requires supply chain managers to develop systems to comprehensively track their networks. Onboarding new vendors in the recovery phase could be more practical for the apparel industry where products are simple and are not heavily regulated. Some retailers would start building buffer stock, particularly for complex parts that require collaboration with multiple suppliers. Beyond Lower-Tier Malls Apparel retailers have been reducing their exposure to lower-tier malls for a while, but the impact of Covid-19 is likely to have highlighted this as a necessary move for retailers. Although we have seen a declining trend in the expected avoidance of shopping centers/malls since the week of May 20, Coresight Research’s June 10 survey of US consumers found that a still-high proportion of respondents (43.3%) expect to avoid malls after lockdowns end. To encourage the return of shoppers, leading mall owners are reopening shopping centers and launching retail revitalization programs. In early May, Simon Property Group, which operates around 200 malls and outlet centers in the US, announced that it would have reopened nearly 50% of its shopping centers within a week. Mall owner Brookfield plans to spend $5 billion to assist medium-sized retailers in getting back on their feet—those funding enterprises that have been operating for at least two years and were fetching normalized revenues of at least $250 million pre-coronavirus. Modifications in Lease Conditions We expect that there will considerable changes in lease conditions in malls and off-mall locations as retailers look to renegotiate terms in the wake of the retail shutdowns. For example, Urban Outfitters reported that about 50% of its stores’ leases are expiring within the next four years, so it is renegotiating with landlords and is seeing very favorable terms. The strength of retail properties will not only be determined based on the length of the lease but also on the attractiveness of the location and other tenants. Traditionally, anchor stores have helped to drive traffic to shopping centers, making malls a more appealing location for smaller in-line stores. Co-tenancy clauses permit rent reductions or the ability to terminate the lease early if anchor stores stop operating/leave and/or the overall occupancy of the mall falls below a pre-determined level. So, with large apparel chains potentially permanently closing locations in malls following the Covid-19 criss, co-tenancy provisions would be triggered, allowing even more tenants to pay lower rent or terminate their leases. Many apparel retailers are going to reconsider their store portfolios: Wherever they see gestation periods are high or they do not have the right rental model, they will either close stores or shrink square footage. There is also the possibility that retailers may move to turnover rents where the landlord takes a proportion of the turnover from each store. However, this will require transparency from all sides as it reflects the marketing and performance of a particular location, along with individual store performance. Expanding a Digital Presence We have seen improvements in e-commerce sales in many discretionary retail sectors since the end of March due to physical store closures. E-commerce revenues (for all retail) in the first quarter of fiscal year 2020 grew 20%, compared to 12% growth in the same quarter last year, according to the Salesforce Q1 Shopping Index, powered by Commerce Cloud; this comprises 16% web-traffic growth and 4% shopper-spend growth (average amount spent per shopper per visit). Digital revenues grew by 31% year over year for active apparel like athleisure and sportswear. We could see the broader adoption of e-commerce among previously underpenetrated consumer segments (such as baby boomers and Generation Zers) and categories (such as lingerie). In addition to their own websites, retailers may also collaborate with e-retailers or with wholesale partners that have stronger e-commerce businesses to drive online sales. By the end of 2020, we expect more apparel retailers to accelerate investments in enhancing their digital presence and shift media spending to the online channel. Digital marketing will play a fundamental role in not only maintaining customer engagement and boosting online sales but also enticing customers to visit stores. More Collaboration and Distribution Strategies The apparel retail ecosystem is marked by co-dependence, with all players having vested interests in long-term survival over short-term gains. Going forward, there will likely be more collaborations and distribution partnerships formed to offer products via more channels and in different spaces. Specialty retailers could collaborate with innovators, disruptors and other retailers. Some will look for opportunities to consolidate or acquire brands, assets or capabilities at attractive prices that would allow them to better serve their core customers. The Coresight Research Retail Playbook offers a guide for nonfood brands and retailers (including apparel) in Western markets, to help them navigate the coronavirus crisis. The playbook is based around the themes of reacting in the short term and adapting in the medium-to-long term.What US Apparel Brands and Retailers Are Reporting on the Coronavirus Impact and Outlook

The coronavirus pandemic has caught apparel companies unprepared, and the resulting societal and economic shutdowns present unprecedented challenges. Below, we summarize key commentary from major US apparel retailers and brand owners on the impact of the coronavirus crisis on recent performance, as well as their future outlook. Figure 5. Apparel Brands and Retailers Key Commentary and Outlook [wpdatatable id=251]Source: Company reports/Coresight Research

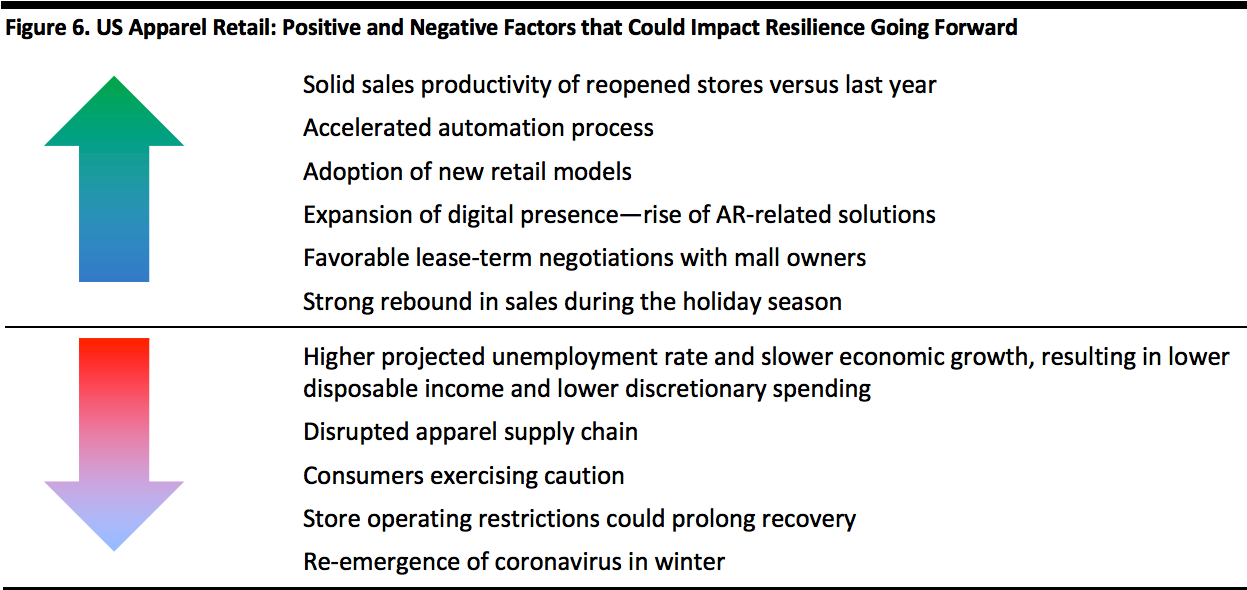

Factors Impacting the Apparel Sector’s Resilience

As we have seen the crisis unfold, the issues of resilience or lack thereof have come to the fore in apparel retail. Below, we list some of the key factors that could impact the resilience of the sector going forward. [caption id="attachment_111489" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]