Nitheesh NH

What’s the Story?

We provide an overview of major distribution channels and retailers in the US clothing and footwear market (including accessories and jewelry), which we abbreviate as “apparel” in this report. We analyze the performance of the following key sales channels in the US apparel market:- Department stores: Large retailers that sell a variety of products in department divisions spanning clothing and footwear as well as cosmetics, electronics, homeware and toys, among others.

- Mass merchandisers: Retailers that provide a one-stop shop for many product categories—often with a focus on grocery—but spanning clothing and footwear and home products, among others.

- Online-only retailers: Retailers that sell clothing and footwear products online and have no physical apparel stores.

- Specialty retailers: Retailers that sell women’s clothing, men’s clothing, children’s and infants’ clothing, as well as clothing accessories, costumes and footwear from fixed point-of-sale locations.

- Warehouse clubs: General merchandise retailers offering a limited merchandise assortment sold in bulk and at low prices.

Why It Matters

The pandemic has been driving major changes in the US apparel market from the rapid growth of e-commerce and shift in business models to the accelerated decline of department stores. These changes are altering the way that apparel brands and retailers sell products to consumers. We discuss major sales channels to help brands and retailers identify profitable sales channels and gain share in an ever-changing retail environment.US Apparel and Footwear Distribution: Coresight Research Analysis

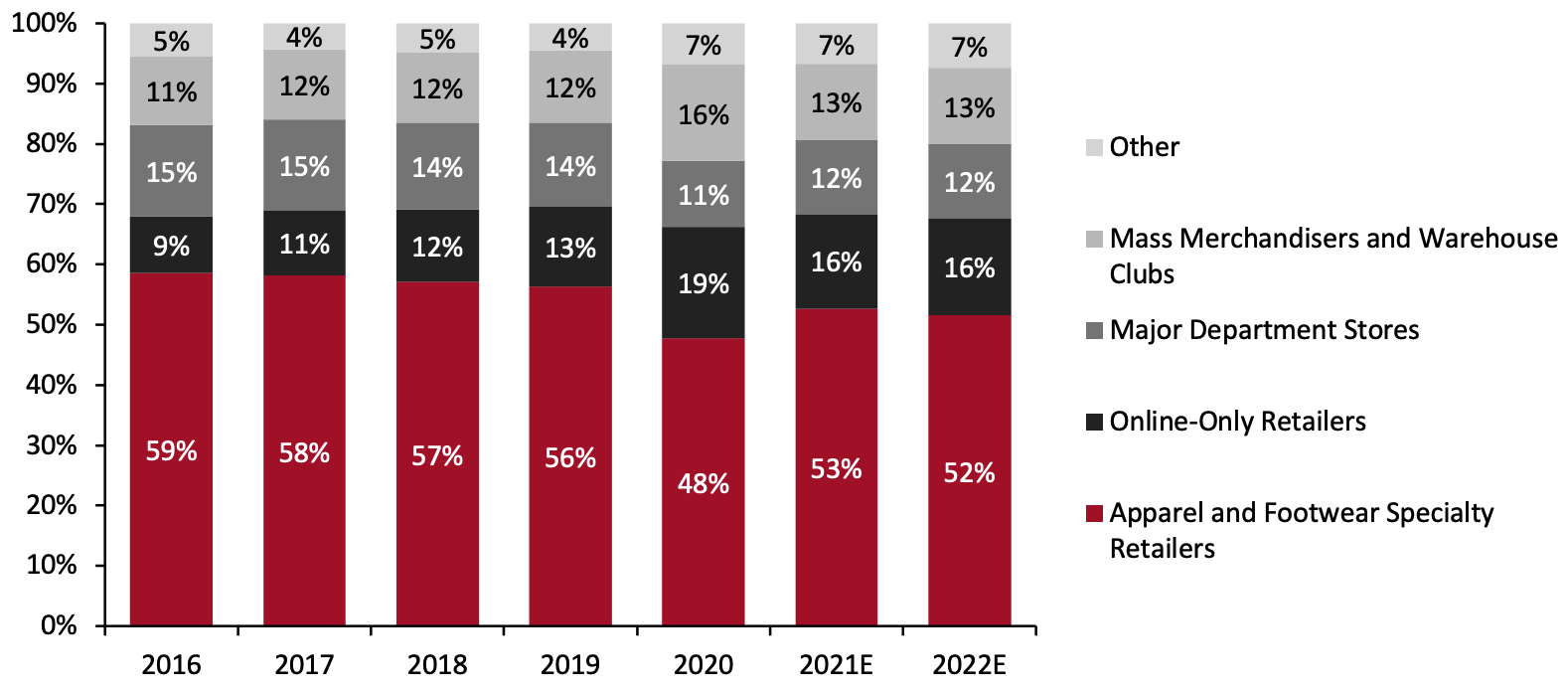

Market Overview The total apparel and footwear market (including jewelry and watches), measured by consumer spending, totaled $430 billion in 2020, including sales taxes, according to our analysis of data from the Bureau of Economic Analysis (BEA). We break out our estimates for clothing, footwear and accessories distribution by channel in Figure 1, based on multiple inputs.- Apparel specialty retailers have been losing share for the past five years, dropping from 59% in 2016 to 48% in 2020, we estimate. However, the sector still dominates US apparel, footwear and accessories sales and has seen a strong recovery in 2021.

- Online-only retailers are the second biggest channel, we estimate. Amazon sold approximately $39 billion of clothing, footwear and accessories in 2020, we estimate, and that would give it approximately half of online-only apparel sales (we show Amazon’s position in US apparel retail in Figure 2). We expect this sector to be losing some share amid general pure-play softness in 2021.

- Mass merchandisers and warehouse clubs captured a greater share in 2020 as rivals such as apparel stores and department stores were forced to close. Walmart and Target management have recently called out apparel as a strong category (for the third quarter), although we estimate that even with this strong performance these sectors will in aggregate be ceding some share to rival channels in 2021.

- Department stores have seen a consistent decline in apparel market share, exacerbated by forced store closures in 2020. In 2021, the major retailers, in aggregate, are regaining some of that lost share—yet we estimate that the sector is underpacing the recovery in clothing and footwear overall. Structural challenges include increased competition from online-only rivals, brands selling direct and the decline of “middleground” retail as shoppers peel away to value players and premium brands.

Figure 1. Estimated Distribution of US Clothing, Footwear and Jewelry Spending, by Channel [caption id="attachment_136663" align="aligncenter" width="700"]

Note: 1. Warehouse clubs comprise BJ’s Wholesale Club, Costco and Sam’s Club; mass merchandisers comprise Target and Walmart; department stores reflect the major chains—Dillard's, Kohl’s, JCPenney, Macy’s and Nordstrom; the “Other” category includes supermarkets, discount stores not counted elsewhere and nonstore retail that is not online-only. 2. We benchmark to BEA-recorded spending on clothing, footwear and jewelry—the latter because a number of companies include jewelry in their reported apparel sales and because the Census Bureau includes jewelry stores in the apparel specialists sector. Our calculations adjust for BEA spending data including sales tax. 3. We have sought to adjust for noncategory sales where these are substantial although differences in category reporting definitions between retailers may lead to an overstatement of some sector shares.

Note: 1. Warehouse clubs comprise BJ’s Wholesale Club, Costco and Sam’s Club; mass merchandisers comprise Target and Walmart; department stores reflect the major chains—Dillard's, Kohl’s, JCPenney, Macy’s and Nordstrom; the “Other” category includes supermarkets, discount stores not counted elsewhere and nonstore retail that is not online-only. 2. We benchmark to BEA-recorded spending on clothing, footwear and jewelry—the latter because a number of companies include jewelry in their reported apparel sales and because the Census Bureau includes jewelry stores in the apparel specialists sector. Our calculations adjust for BEA spending data including sales tax. 3. We have sought to adjust for noncategory sales where these are substantial although differences in category reporting definitions between retailers may lead to an overstatement of some sector shares. Totals may not sum to 100% due to rounding.

Source: US Census Bureau/Bureau of Economic Analysis/company reports/Coresight Research[/caption] Figure 2 shows the top 10 retailers of apparel in the US, based on company reporting and Coresight Research estimates. Where based on what companies report, some retailers include nonapparel categories in the total. The list underscores the strength of mass merchandisers and warehouse clubs (the latter represented by Costco). However, according to our estimates, Amazon is the largest seller in apparel, including sales by third-party sellers.

Figure 2. US 10 Largest Retailers of Clothing, Footwear and Accessories: Sales and Share of Total Category Sales, 2020 [wpdatatable id=1460]

Data are for fiscal years closest to calendar 2020—for most retailers, that ended January 2021, but Costco has an August year-end and Amazon has a December year-end. Share of spending on clothing, footwear and jewelry. Source: Company reports/Coresight Research

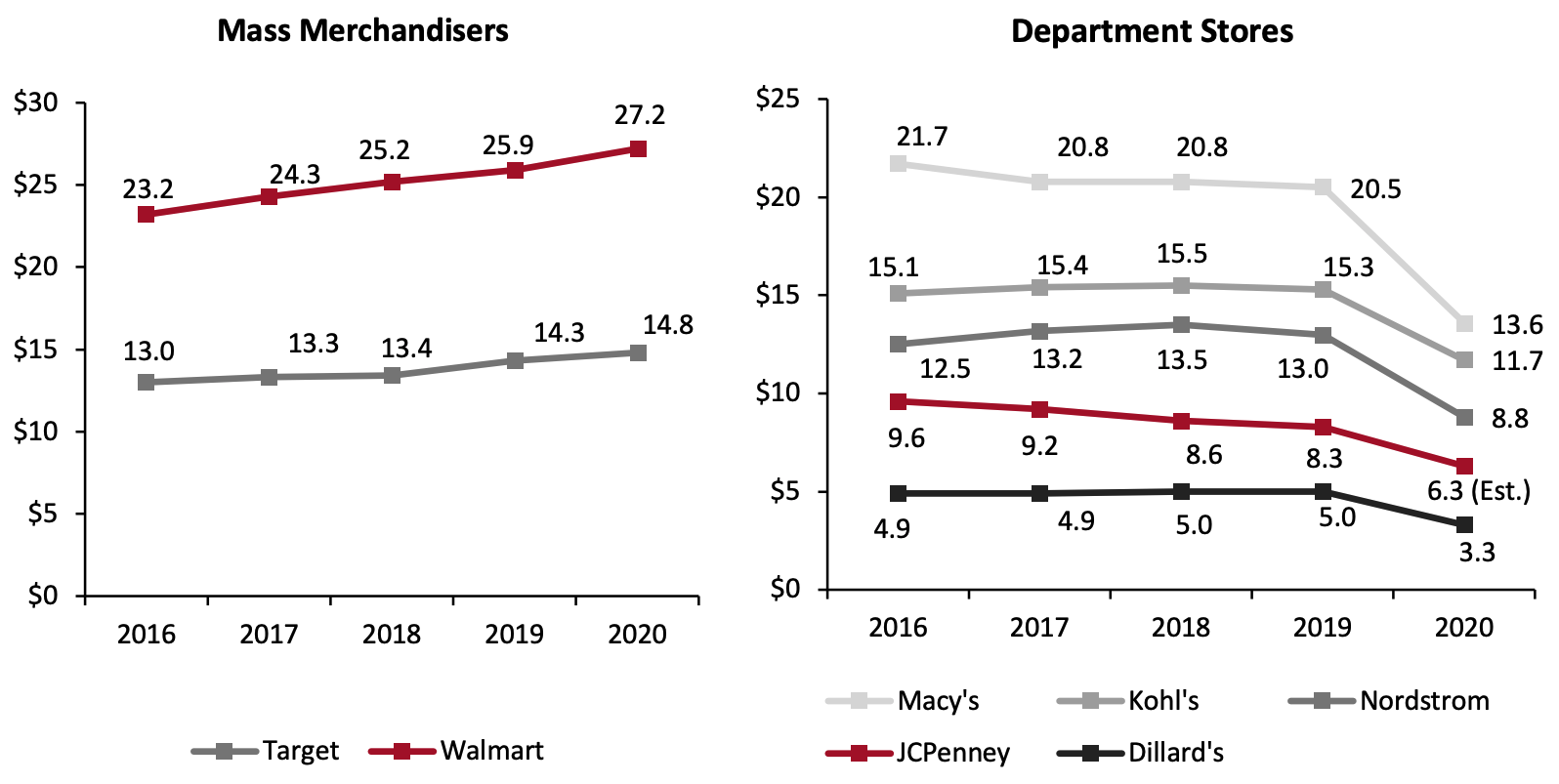

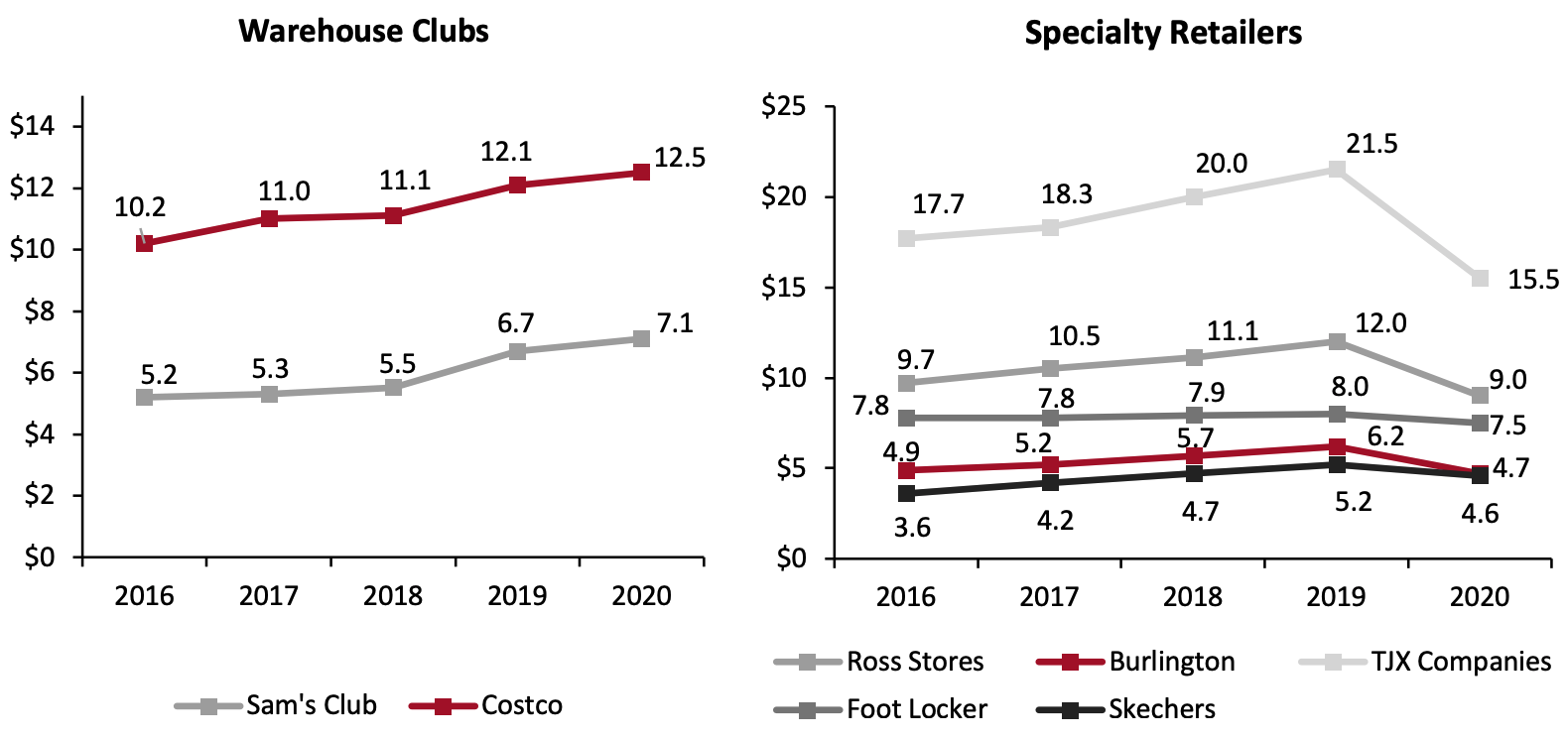

Figure 3 displays apparel sales by selected brands and retailers within mass merchandisers, department stores, warehouse clubs and specialty retailers, giving a more detailed picture of how these apparel sales channels perform in the market. The charts show the outperformance of mass merchandisers and warehouse clubs in 2020. We represent the data as reported, wherever possible. All apparel sales are US-based and include jewelry. Walmart’s apparel sales are under the Walmart banner only, excluding Sam’s Club. Macy’s apparel sales include cosmetics and fragrances. Data for JCPenney and Walmart are estimated. Sam’s Club’s apparel sales include home items. Costco’s charted sales include all softlines and small appliances. Data are for the companies’ fiscal years.Figure 3. Selected Major Apparel and Footwear Retailers: Sales of Clothing, Footwear and Accessories (USD Bil.)

[caption id="attachment_136665" align="aligncenter" width="700"]

[caption id="attachment_136665" align="aligncenter" width="700"] All apparel sales are US-based and include jewelry. Walmart’s apparel sales are under the Walmart banner only, excluding Sam’s Club. Macy’s apparel sales include cosmetics and fragrances. Data for JCPenney, TJX and Walmart are estimated. Sam’s Club’s apparel sales include home items. Costco’s apparel sales are for all softlines including small appliances.

All apparel sales are US-based and include jewelry. Walmart’s apparel sales are under the Walmart banner only, excluding Sam’s Club. Macy’s apparel sales include cosmetics and fragrances. Data for JCPenney, TJX and Walmart are estimated. Sam’s Club’s apparel sales include home items. Costco’s apparel sales are for all softlines including small appliances.Source: Company reports/Coresight Research[/caption] Sales Channel Insights 1. Department Stores: Recapturing Market Share Via Younger Consumers Structurally challenged department stores have lost apparel shares consistently from 2016 to 2020. As implied by the data in Figure 1, this is not simply about losing share to e-commerce rivals; lower-price competitors such as mass merchandisers and warehouse clubs have retained or grown share by attracting price-conscious shoppers. Macy’s recorded negative CAGRs from 2016 to 2020, indicating the decline of its apparel and footwear businesses. Though Kohl’s and Nordstrom had positive CAGRs between 2016 and 2018, their apparel and footwear sales saw declines in 2019 and 2020. However, upscale department store Dillard’s has seen greater growth momentum in apparel than typical department stores. Excluding the influence of the pandemic, Dillard’s reported a 0.6% CAGR in apparel and footwear sales from 2016 to 2019. To recapture apparel market share, we are seeing department stores transitioning to attract younger consumers. We have identified three ways that department stores are executing this shift in their target demographic. Bring in Digitally Native Apparel Brands Born online, digitally native brands typically sell directly to consumers, initially via their own websites, with many then expanding into multi-brand retailers or developing a brick-and-mortar presence. We see opportunities for digitally apparel native brands to work with department stores for mutual benefit. Digitally native brands can leverage department stores’ existing customer bases, long-standing reputations and strong physical footprints to grow their own business. For department stores, carrying digitally native apparel brands will help them to better resonate with millennials and Gen Z consumers. For instance, Nordstrom has adopted this strategy with the opening of 21 Indochino shop-in-shop locations across the US in July 2021. Consumers can also access Indochino’s online store through Nordstrom’s website. [caption id="attachment_136666" align="aligncenter" width="580"]

Digitally native brand Indochino’s shop-in-shop in Nordstrom

Digitally native brand Indochino’s shop-in-shop in NordstromSource: Nordstrom/Indochino[/caption] Update Brand Portfolios We are seeing department stores update their brand portfolios to shift toward attracting younger consumers.

- Kohl’s launched a new private-label brand FLX in March 2021, which is focused on sustainability, performance, comfort and style, according to the company. The addition of the brand illustrates Kohl’s continued commitment to growing its active business and evolving its brand portfolio to meet the preferences of today’s young consumers.

- Nordstrom announced in July 2021 that it has acquired a minority stake in four apparel brands (Topshop, Topman, Miss Selfridge and activewear label HIIT, aiming to target consumers in their twenties. The brands are all owned by UK online fashion house ASOS.

Macy’s new contemporary site within Macy’s.com

Macy’s new contemporary site within Macy’s.comSource: Macy’s[/caption] 2. Online-only Retailers: Faster Deliveries, Optimized Websites and Better Product Assortments Online-only apparel retailers’ mature service offerings for e-commerce provide a convenient alternative to in-store shopping and may bolster consumers’ shift to buying more online, as well as better serving existing demand. To meet consumer demand for convenience in the shopping journey, online-only apparel brands and retailers such as Amazon, eBay and Wish have increased their investments in e-commerce capabilities—such as enhancing shipping speed, upgrading websites and increasing product assortment online. Among online-only apparel retailers, e-commerce giant Amazon.com retains its leadership position. Some 51% of US consumers reported that they had purchased clothing or footwear on Amazon.com in the past 12 months, making it the most-shopped retailer, according to Coresight Research’s Amazon Apparel Survey launched in March 2021. Apparel brands, clothing and apparel specialists, and department stores continue to fall behind Amazon.com, further highlighting the importance of a strong e-commerce presence for these retailers, even as the pandemic subsides. Fast, free delivery (65.7%) was the number-one reason reported by consumers for shopping clothing and footwear on Amazon.com., followed by the easy search/browsing functions of Amazon’s website (51.1%) and good availability of products on the site (41.8%). We believe apparel retailers and brands that want to grow their e-commerce businesses would benefit from offering faster deliveries, easy-to-navigate websites and better product assortment.

Figure 4. All Respondents: Retailers at Which They Have Shopped for Clothing or Footwear in the Past 12 Months (% of Respondents) [wpdatatable id=1461]

Base: 1,818 US respondents aged 18+ who had purchased clothing or footwear in the past 12 months Source: Coresight Research

3. Mass Merchandisers: Market Leaders Target and Walmart Step Up Their Apparel Focus Target and Walmart have channeled focus into expanding their market shares in the US apparel and footwear sector in recent years. On Walmart’s third-quarter 2021 earnings call, management pointed to “strong sales trends” being led by apparel, among other categories. Walmart had earlier stated on its February 2021 earnings call that the company is seeing a lot of upside in apparel and is going to invest more in the sector. On Target’s third-quarter 2021 earnings call, management reported a low-double-digit comp in apparel. Like Walmart, Target believes that its apparel business has potential for further expansion. The two companies are adopting varying growth strategies, which we discuss below. Target Target is focusing on private-label launches, collaborations and capabilities improvements. Owned and exclusive brands accounted for around one-third of Target’s sales in the year ended January 2021—a gradual achievement since the company started building its private-label offering in 2015. Figure 5 presents a timeline of Target’s apparel private-label launches.Figure 5. Timeline of Target’s Apparel Private-Label Launches [wpdatatable id=1462]

Source: Company reports/Coresight Research

Target has also leaned into brand collaborations to drive traffic and boost its reputation in apparel. In May 2020, Target launched an apparel series that brought together designer brands Cushnie, Lisa Marie Fernandez and LoveShackFancy. Items in the collection are priced between $40–$60 and reflect Target’s commitment to size inclusivity, ranging from XXS–3X. Furthermore, in April 2021, Target introduced a designer dress collection in collaboration with Vogue fashion fund winner Christopher John Rogers. In addition, to improve its apparel business operations, Target partnered with Shipt in 2021 to expand its apparel assortments available for same-day delivery. Target is also adjusting its promotional and clearance markdown rates to right-size its apparel inventory. Walmart Walmart is growing its apparel business through acquisitions, private-label launches, collaborations and capabilities improvements, although it has also divested a number of brands in recent years. As of June 2021, Walmart has added more than 1,000 apparel brands to its online assortment through marketplace sellers, as well as launching many exclusive brands. It has also partnered with children’s clothing subscription provider Kidbox and online consignment and thrift store platform ThredUP to expand its footprint in apparel subscription and rental business models. Walmart has also focused on adding capabilities to its apparel business to grow sales. From the apparel technology perspective, Walmart acquired virtual fitting room technology company Zeekit in May 2021. Figure 6 presents a timeline of Walmart’s recent moves to step up its apparel game.Figure 6. Walmart: Timeline of Recent Developments To Scale Its Apparel Business [caption id="attachment_136669" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

4. Specialty Retailers: Off-Price and Luxury Set for Strong Recovery

As a sales channel, specialty retailers are primarily losing share to e-commerce as they pivot their business models to cater to increased online demand.

However, off-price selling channels in specialty retail have seen strong growth momentum in the past five years. In apparel and footwear sales (including accessories) Ross Stores reported a 7.3% CAGR from 2016 to 2019 with Burlington reporting an 8.2% CAGR, and TJX companies a 5.3% CAGR for the same period. Although sales declined at these companies in 2020 amid the pandemic they have seen strong recovery from the third quarter of 2020.

Within specialty retail, luxury apparel was also heavily impacted by the pandemic in 2020 and by domestic and international travel limitations in early 2021. We expect to see strong demand in late 2021 and recovery in luxury apparel sales from 2022 onward.

Source: Company reports/Coresight Research[/caption]

4. Specialty Retailers: Off-Price and Luxury Set for Strong Recovery

As a sales channel, specialty retailers are primarily losing share to e-commerce as they pivot their business models to cater to increased online demand.

However, off-price selling channels in specialty retail have seen strong growth momentum in the past five years. In apparel and footwear sales (including accessories) Ross Stores reported a 7.3% CAGR from 2016 to 2019 with Burlington reporting an 8.2% CAGR, and TJX companies a 5.3% CAGR for the same period. Although sales declined at these companies in 2020 amid the pandemic they have seen strong recovery from the third quarter of 2020.

Within specialty retail, luxury apparel was also heavily impacted by the pandemic in 2020 and by domestic and international travel limitations in early 2021. We expect to see strong demand in late 2021 and recovery in luxury apparel sales from 2022 onward.

- Click here to read about the 10 key trends we have identified in the global luxury sector.

Figure 7. Warehouse Clubs: Curated Brands and Price Points, as of July 2021 [wpdatatable id=1463]

Source: Company websites

What We Think

Implications for Apparel Brands/Retailers- Apparel specialty retailers and department stores have been losing share in the market for the past five years while the market share of online-only retailers has been rising. With the landscape of apparel selling channels altering, it is important for apparel retailers and brands to identify profitable selling channels and adjust their business strategies accordingly.

- Upscale and off-price selling channels saw more organic growth in the past five years than middle-positioned channels. We expect to see continued strong demand in off-price apparel and recovery of the luxury market in 2022. Apparel brands and retailers should adjust their product assortments and update their pricing strategies to reflect demand.

- Department stores are transitioning to attract younger consumers to recapture apparel market share. Department stores are adding digitally native apparel brands that resonate with younger consumers, launching private-label brands and upgrading their operational infrastructure to reach their new target demographic.

- We believe that apparel retailers and brands that want to grow their e-commerce businesses would benefit from offering faster deliveries, easy-to-navigate websites and better product assortment.