albert Chan

Introduction

What’s the Story?

Brands including NIKE and Under Armour, which announced reductions to their wholesale partners in 2021, are reembracing wholesale partners strategically in 2022, but in different ways. While many brands claimed to pivot more toward the DTC (direct-to-consumer) channel, we still view wholesale to third-party retailers as an important channel in apparel and footwear retailing.

We compare the wholesale and DTC sales channels, examining sales growth across the two channels for 13 US apparel and footwear brands (the companies covered in Coresight 100 list, our focus list of key brands and retailers). We also present a playbook for brands to improve their wholesale and DTC strategies, including alternative wholesale approaches.

Our coverage of wholesale distribution comprises third-party retailers that brands rely on to sell their products. DTC refers to brands bypassing third-party retailers and marketplaces to sell products via their own operations—either their own e-commerce websites or physical stores.

Why It Matters

Selling directly to consumers used to be a strategy attributed to new brands that would otherwise be overshadowed by larger market rivals or vertically integrated monobrand retailers (such as Zara) which sell through their own stores. However, it is becoming an increasingly important channel for both new and existing brands, whether big or small, given the advantages of faster speed to market, better customer insights and increased control over data, brand image and pricing.

Within this shift, many brands are rethinking wholesale efficiency and are seeking a harmonious solution for wholesale and DTC channels.

US Apparel and Footwear Brands Adopt Hybrid Wholesale-DTC Models: Coresight Research Analysis

We believe that DTC will allow brands to have better control of inventory and allocation and a better understanding of customers, but the model involves more supply chain pressures and higher marketing costs. Wholesale allows brands to have access to a large customer base but lowers profit margins due to additional fees, and brings challenges in retaining brand identity.

Brands Are Pivoting Towards DTC, but Wholesale Is Not Dead

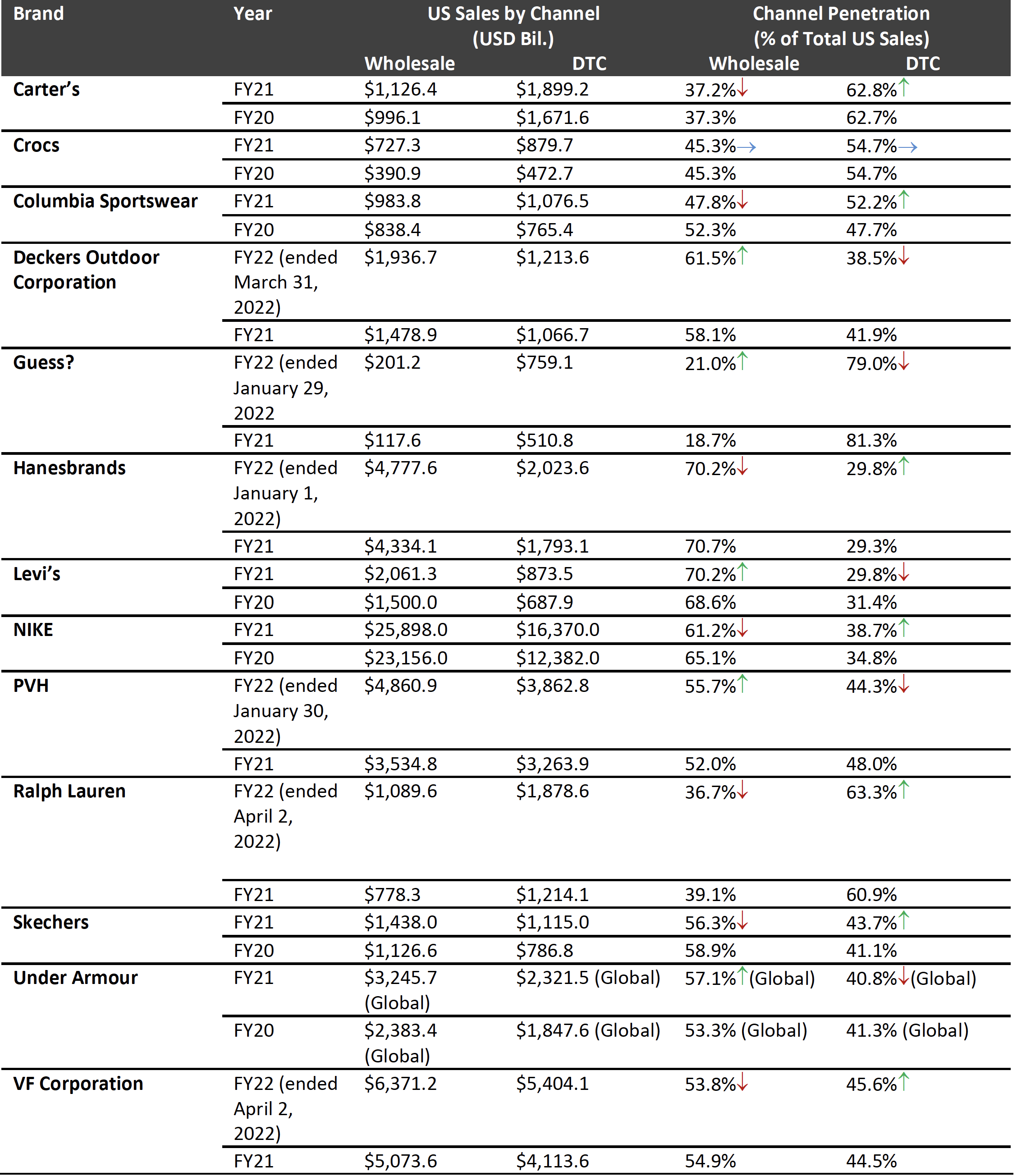

Among the 13 companies covered in Figure 1, seven explicitly mentioned on earnings calls or in press releases that DTC will be their next focus. While this shows that many apparel and footwear companies are pivoting toward DTC, we view wholesale as an important distribution channel in the next three years.

NIKE and Under Armour, which both announced reductions to their wholesale partners in 2021, are re-embracing wholesale partners strategically:

- NIKE and partner retailer Dick’s Sporting Goods linked their loyalty programs in November 2021. Customers can connect their Dick’s Scorecard and NIKE Membership accounts through the Dick’s mobile app. The loyalty integration will allow the two companies to each reach more customers and provide them with access to exclusive products, experiences and offers. NIKE mentioned on its earnings call on June 27, 2022, that it saw success in the connected loyalty programs with Dick’s Sporting Goods and expects to see wholesale growth in fiscal 2023. NIKE disclosed that it has shared inventory with Dick’s Sporting Goods, so if customers are in Dick’s stores and want NIKE items that are out of stock in their size, NIKE can fulfill the order. NIKE expects its direct business to represent approximately 60% of its business over the long term, indicating the company’s intention to rely on a hybrid wholesale-DTC model.

- Under Armour completed its reduction of wholesale exposure to the off-price channel by February 2022 and is seeing organic growth in its wholesale channel, the company reported on its earnings call on May 6, 2022. Under Armour is investing in shop-in-shop locations around the world to improve sales and drive customer engagement through wholesale channels.

2021 was a big year for both wholesale and DTC. Among the 13 companies we tracked, we found the following:

- Seven companies increased their exposure to DTC businesses in their most recent fiscal years.

- Five companies (including Levi’s and Deckers Outdoor Corporation, which are both pivoting toward DTC) posted higher shares of wholesale businesses.

- Crocs reported an unchanged share of wholesale and DTC sales in fiscal 2021.

Apparel brands typically wholesale their products to department stores, specialty retailers, outlets and marketplaces. Overall, we believe that strong wholesale growth among selected apparel and footwear companies in 2021 was mainly driven by brands’ strategic wholesale business adjustments (for example, Deckers’ wholesale business expansion with specialty and outdoor retailers, and Levi’s wholesaling premium jeans with Target) and partly driven by consumers’ preferences to visit one-stop shopping destinations to consolidate trips and so better avoid potential Covid-19 infection.

Figure 1. Selected US-Based Apparel and Footwear Companies: US Wholesale and DTC Sales [caption id="attachment_153671" align="aligncenter" width="700"]

Note: Crocs’ sales include sales in the US, Canada and Puerto Rico; Guess?’s sales include sales in the US, Canada, Central and South America; Hanesbrands’ wholesale sales are brick-and-mortar wholesale only (the company’s DTC sales include e-commerce of third-party retailers and marketplaces); the wholesale and DTC sales of NIKE, Under Armour and VF Corporation do not sum to 100 because of other business segments (such as license and corporate)

Note: Crocs’ sales include sales in the US, Canada and Puerto Rico; Guess?’s sales include sales in the US, Canada, Central and South America; Hanesbrands’ wholesale sales are brick-and-mortar wholesale only (the company’s DTC sales include e-commerce of third-party retailers and marketplaces); the wholesale and DTC sales of NIKE, Under Armour and VF Corporation do not sum to 100 because of other business segments (such as license and corporate)Source: Company reports[/caption]

Brands Are Expanding Wholesale Partnerships

While brands including NIKE and Under Armour adjusted their wholesale strategies and exited from selected wholesale doors, Adidas and Reebok are expanding their wholesale partnerships to capture the available opportunities. Since NIKE has moved away from selected partner retailers, we expect competitor brands to gain more shelf space and pick up wholesale sales.

- On May 5, 2022, Adidas announced an expanded partnership with Foot Locker with the aim of generating more than $2 billion in retail sales by 2025. Adidas will provide Foot Locker with a dedicated team to deliver an elevated consumer experience both in stores and online to help create demand and elevate the marketplace, according to the Adidas press release. NIKE moved away from Foot Locker in a shift to DTC on February 25, 2022.

- On May 3, 2022, Reebok announced that it would make more of its products available at Macy’s. Macy’s will carry a deeper assortment of Reebok apparel both online and in stores, and Reebok will develop exclusive products for the department store. NIKE stopped selling apparel directly to Macy’s on March 26, 2021.

Alternative Practices Are Emerging

Traditionally, major brands have worked with retailers through wholesale models, selling their products at negotiated prices, which the retailer then marks up to sell the product to consumers. Some retailers also offer the concession model, in which brands occupy space within the host store in return for paying a lease or a percentage of sales to the host store. Now, we are seeing alternative practices rising. Below, we analyze their impacts on apparel brands.

E-Concession

With the continual growth of online apparel business driven by the structural shift to online shopping, we see the rise of e-concession, an online evolution of concessions. Brands in marketplaces, for example, use the e-concession model to sell products while retaining more control over prices, product data, marketing, web designs and associate hiring. In addition, brands can achieve higher profit margins as they can retain 65% to 90% of a sale generated, as opposed to a traditional wholesale model where the brand typically gains 40% to 50% of the product’s retail price.

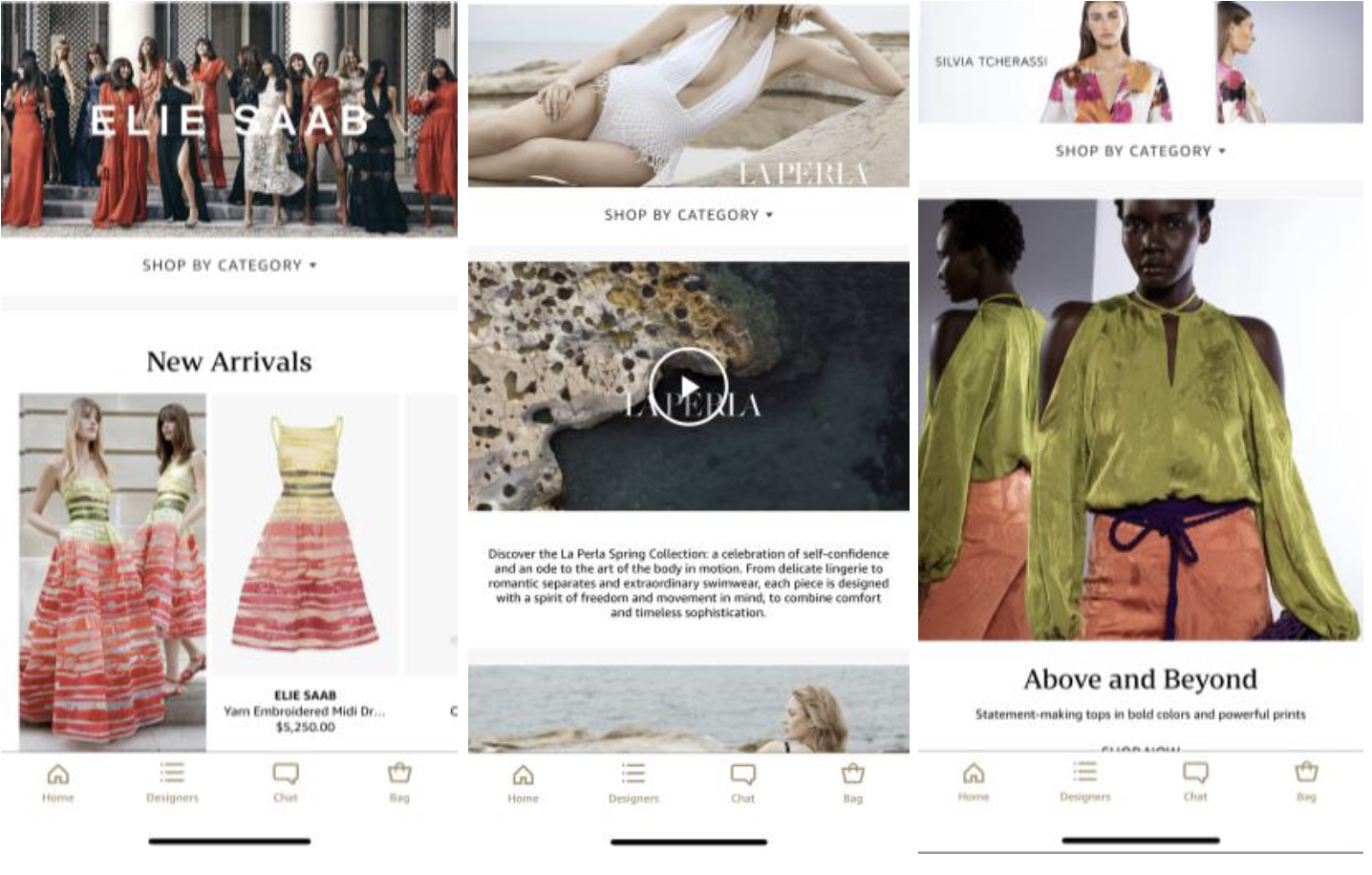

Department stores and marketplaces such as Nordstrom, Saks Fifth Avenue, Mytheresa (Germany-based but with an online store in the US) and Net-a-Porter (London-based but with an online store in the US) are adding e-concession to their business models. Apparel brands such as Elie Saab, La Perla, Soirée Season, and Silvia Tcherassi are working with Amazon’s Luxury Stores marketplace (launched by Amazon in 2020) under e-concession models.

[caption id="attachment_153672" align="aligncenter" width="550"] From left to right: Elie Saab, La Perla and Silvia Tcherassi store homepages

From left to right: Elie Saab, La Perla and Silvia Tcherassi store homepagesSource: Elie Saab/La Perla/Silvia Tcherassi[/caption]

Revenue Sharing

Revenue sharing is a model (applied offline typically) wherein retailers take a certain amount of revenue generated by the brands occupying space in the retailer’s store rather than charging a specific rent from the brands. Through this model, brands can reduce rental costs and minimize risks if the retailers fail to attract customers.

Department stores such as Nordstrom are testing and applying this model.

- Nordstrom expects “partner-owned” and “shared-ownership” models to account for 30% of its sales in the future, according to the company’s Investor Day in February 2021.

Dropshipping

In the dropshipping model, where retailers sell products without keeping them in stock, brands can increase profit margins (compared to products bought and stored by retailers) and have the ability to test new products.

We see dropshipping as a good model for luxury brands as they typically generate higher inventory management and shipping costs.

- Prada started to offer dropshipping options for sales on Net-a-Porter in February 2021.

- Loewe is using the model with Nordstrom. Nordstrom stated that it has had great success with dropshipping: during its anniversary sale in 2020, over 25% of sales on Nordstrom.com were fulfilled via dropshipping.

The shop-in-shop model allows brands to sell goods in retailers’ stores in a space dedicated to the brand. We are seeing more brands leverage this model to increase exposure to customers.

- The newly founded shapewear brand Yitty by Lizzo (launched in April 2022), opened shop-in-shop locations in selected Fabletics stores on June 27, 2022.

- Under Armour disclosed on its earnings call in May 2022 that it is investing in shop-in-shop locations around the world.

A Playbook on Wholesale from a Brand’s Perspective: Three Key Strategies

1. Choose Retailers That Align with Brand Positioning

It is important that apparel brands work with retailers that align with the brand’s positioning.

- Levi’s is increasing its distribution in specialty retailers such as Urban Outfitters because it attracts younger consumers. Levi’s is also doubling its premium business with Nordstrom and Bloomingdale’s, increasing full-priced items, according to the company’s earnings call on January 26, 2022.

Levi’s pop-up store in Nordstrom’s New York City flagship in September 2021, which showcases full-priced iconic denim products designed by Collina Strada, Melody Ehsani and Thompson Street Studio

Levi’s pop-up store in Nordstrom’s New York City flagship in September 2021, which showcases full-priced iconic denim products designed by Collina Strada, Melody Ehsani and Thompson Street StudioSource: Nordstrom/Levi’s[/caption]

2. Choose Retailers That Have Strong Digital Capabilities

It is important that apparel brands work with retailers that have strong digital capabilities.

- PVH Corp. reported on April 13, 2022, that a little over one-third of its full-price wholesale business comes from its partners’ e-commerce businesses, and the company is planning to work more with digitally adept retailers (moving toward a 50% online wholesale business). The company stated that its partnerships with ASOS, Kohl’s and Macy’s are doing well as these are digitally adept retailers.

3. Work with Retailers That Offer One-Stop Shopping

Apparel brands such as Carter’s, Calvin Klein and Levi’s saw good product demand through retailers such as Amazon, Target and Walmart during the pandemic, because these retailers provide one-stop shopping for both essential and discretionary products. We are seeing companies working more with these retailers.

- Carter’s plans to roll out its eco-friendly Little Planet brand to more stores and online at Amazon, Buy Baby, Kohl’s and Target in 2022, the company reported on its earnings call in April 2022.

- Levi’s saw overwhelming success of the Levi’s brand at Target, the company stated on its earnings call on April 6, 2022. The company is planning to expand the partnership, rolling out the Levi’s brand to an additional 300 Target stores in spring (to a total of 800 Target stores). The company reported that it is picking up incremental new consumers to the Levi’s brand at Target and feels optimistic about the expansion plan.

A Playbook on DTC: Three Key Strategies

1. Host Livestreaming Events

We are seeing apparel brands using livestreaming to communicate with customers more directly. Livestreaming provides a new, digital channel for brands to connect with consumers and influence purchasing decisions. Shoppable videos can enrich the shopping experience by facilitating direct communication between brands and their communities, enabling them to respond to consumer queries in real time, provide exclusive discounts and offer detailed product information.

Brands such as Guess?, NIKE and Vera Bradley have already turned to livestreaming e-commerce, hosting events to engage with consumers.

- In March 2022, Diane von Furstenberg (DVF) held a livestreamed event on Alibaba’s Tmall platform in honor of International Women’s Day. More than 18,000 viewers from China joined the event for an exclusive look at DVF’s latest fashion trends.

Diane von Furstenberg and her granddaughter Talita von Furstenberg feature in a DVF livestream event

Diane von Furstenberg and her granddaughter Talita von Furstenberg feature in a DVF livestream eventSource: Alibaba/DVF[/caption]

2. Leverage Social Media or Gaming Platforms To Drive Customer Engagement

Social media networks and gaming platforms such as Instagram, Roblox and TikTok are not merely platforms for sharing and connecting, but also platforms for discovery. Apparel brands are leveraging these platforms to promote products and engage with target consumers.

- NIKE has been an important example in driving customer engagement through its DTC channel. The company is driving customer engagement in new ways, such as by partnering with video game Fortnite to provide custom skins and a digital scavenger hunt. To celebrate the Super Bowl, NIKE collaborated with EA Sports, a video-game developer, offering rewards to Nike Run Club members who ran five miles. Members had to link accounts between NIKE and EA to join the challenge, representing the brand’s first incidence of account linking with its gaming partners. The number of new members NIKE acquired through the initiative surpassed its expectations, the company stated on its earnings call on March 21, 2022.

3. Optimize DTC Website Functions

Brands looking for better DTC sales should ensure that their digital capabilities rival those of their strongest retail competitors with websites that offer smooth search functions, clear layouts and engaging content.

- Under Armour’s investment into e-commerce platform smoothness, the function of offering personalized suggestions and better customer relationship management are examples of ways to improve website engagement.

What We Think

In the last few years, selected apparel and footwear brands announced plans to bypass traditional, multibrand distribution channels to sell directly to consumers. However, building an efficient DTC model will be time intensive and brands will likely be cautious in giving up existing customer bases developed through multi-sales channels. Moreover, the growing power of third-party marketplaces and retail giants such as Amazon, Target and Walmart still offer significant partnership opportunities for brands.

We expect brands to continue to rely on a hybrid wholesale-DTC model for the next three years but to still see an increase in DTC revenue as this channel becomes the strategic focus.

Implications for Apparel and Footwear Brands

- We are seeing the rise of alternative wholesale models: e-concession, revenue-sharing, dropshipping, and shop-in-shop. We recommend brands choose models that suit their needs. For example, luxury brands that typically generate higher inventory management and shipping costs can choose to use the dropshipping model to send products directly to customers once an order is placed.

- We believe brands that hope to improve their wholesale businesses can benefit from the following strategies: 1) choosing retailers that align with the brand’s positioning, 2) choosing retailers that have strong digital capabilities, and 3) working with retailers that offer one-stop shopping.

- We believe brands that hope to improve their DTC businesses can benefit from the following strategies: 1) hosting livestreaming events; 2) leveraging social media or gaming platforms to drive customer engagement; and 3) optimizing DTC website functions.

Implications for Retailers

- Specialty retailers, department stores and marketplaces should offer alternative models to attract brands to partner with them for their wholesale business.

Implications for Technology Vendors

- Innovators have strong opportunities to partner with apparel and footwear brands to drive their push into direct-to-consumer business expansion. Innovators can support brands in driving customer engagement, improving marketing efficiency, and understanding customers.