Nitheesh NH

US Apparel and Beauty Spending Tracker: March 2022

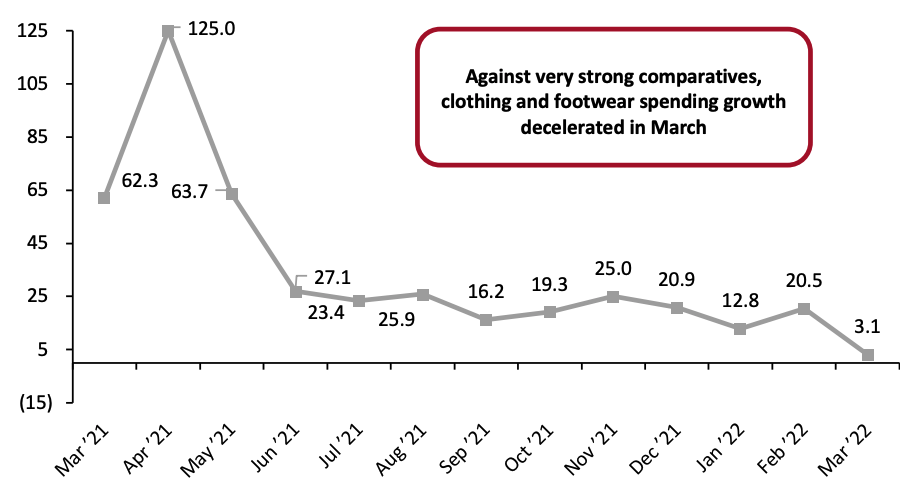

The Coresight Research US Apparel and Beauty Spending Tracker provides a monthly update on the trajectory of consumer spending on beauty, clothing and footwear. The data presented in this report refer to consumer spending through any channel and so differ from retail sales data, which include product category sales by type of retailer. The year-over-year changes that are the focus of this report are inferred from US Bureau of Economic Analysis (BEA) data. Clothing and Footwear Spending Update Against very strong comparatives, the growth in consumer spending on clothing and footwear decelerated in March 2022. Shoppers upped their spending by 3.1% year over year, lower than February’s revised 20.5% growth. Although it is a deceleration from February, March 2022’s growth reflects a substantial recovery in category spending—considering high-double-digit growth seen in March 2021. On a month-over-month basis, consumer spending on clothing and footwear increased by 0.4%.Figure 1. US Consumer Spending on Clothing and Footwear (YoY % Change) [caption id="attachment_146435" align="aligncenter" width="700"]

Expenditure data are seasonally adjusted

Expenditure data are seasonally adjustedSource: BEA/Coresight Research[/caption] Clothing and Footwear Spending by Subcategory We track four subcategories of clothing and footwear: footwear, children’s and infants’ clothing, men’s and boys’ clothing, and women’s and girls’ clothing. Against demanding comparatives (59.7% growth in the same month last year), spending on clothing overall saw a year-over-year increase of 4.8% in March, lower than the revised 20.8% growth in February. Figure 2 shows spending on clothing by category type. Category sales growth followed the same growth pattern as clothing overall, with a peak in April 2021, followed by strong growth from May 2021 to February 2022.

Figure 2. US Consumer Spending on Clothing by Category (YoY % Change) [wpdatatable id=1933]

Source: BEA/Coresight Research

Year-over-year growth in spending on footwear turned negative in March at (2.4) %, versus 20.5% growth in February.Figure 3. US Consumer Spending on Footwear (YoY % Change) [wpdatatable id=1934]

Source: BEA/Coresight Research

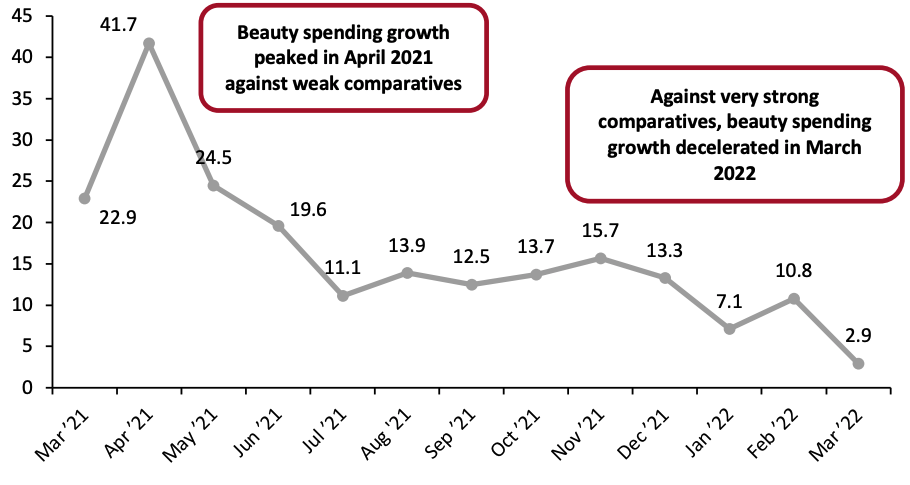

Beauty Spending Update Our tracker follows the US BEA definition of the beauty category, including bath products, cosmetics, nail products and tools and perfumes. Against very strong comparatives, consumer spending on beauty increased by 2.9% year over year in March, lower than the 10.8% growth seen in February. Spending on beauty recovered quickly amid the pandemic and has seen positive year-over-year growth since July 2020.Figure 4. US Consumer Spending on Selected Beauty Categories (YoY % Change) [caption id="attachment_146438" align="aligncenter" width="700"]

The beauty category is defined as bath products, cosmetics, nail products and tools and perfumes

The beauty category is defined as bath products, cosmetics, nail products and tools and perfumesSource: BEA/Coresight Research[/caption]