DIpil Das

The Coresight Research US Apparel and Beauty Spending Tracker provides a monthly update on the trajectory of consumer spending on beauty, clothing and footwear. The data presented in this report refer to consumer spending through any channels and so differ from retail sales data, which include product category sales by type of retailer. The data are sourced from the US Bureau of Economic Analysis (BEA).

Clothing and Footwear Spending Update

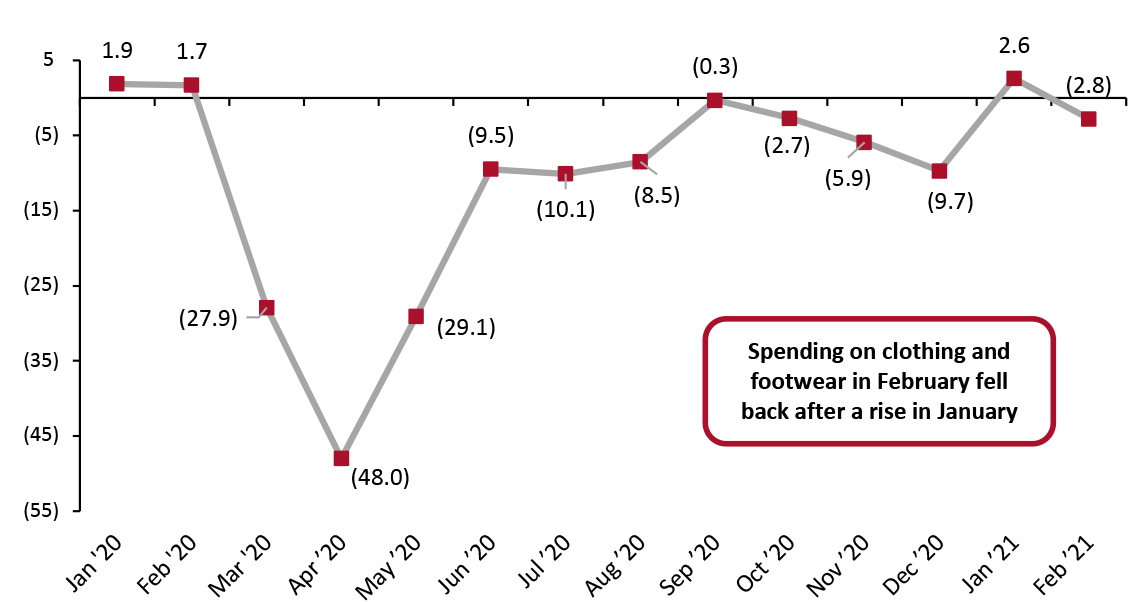

Consumer spending on clothing and footwear fell back in February 2021 with a year-over-year decline of 2.8%, compared to a rise of 2.6% in January 2021. The decline may reflect the sharp decrease in the distribution of economic stimulus payments in February 2021 as most of the second-round checks were distributed in January.

March and April 2021 annualize the deep declines of 2020. Against the weak comparatives charted below, we estimate clothing and footwear spending to have increased by 31.8% year over year in March and we estimate an 82.8% jump in April. These estimates are based on our central assumption that spending in these months will be 5.0% below the comparable months in precrisis 2019. The two-year percentage-change was (7.1)% in November 2020, (5.2)% in December 2020, 4.6% in January 2021 and (1.2)% in February 2021—so we believe our core (5.0)% two-year growth assumption is conservative.

We see the potential window for year-over-year change in clothing and footwear spending in March 2021 as ranging from up 29.0% (based on a more pessimistic model of March 2021 spend being 7.0% below 2019 levels) to up 38.7% (based on March 2021 spend being level with that in March 2019). On the same basis, we see the potential range for increases in April spending being between 78.9% year over year and 92.4% year over year.

Our weekly US consumer survey tracks purchasing behaviors each week. After a post-holiday lull, in the most recent weeks, our survey has recorded a gradual increase in the proportion of respondents buying clothing or footwear, whether in-store or online—see our US Consumer Tracker Databank.

Figure 1. US Consumer Spending on Clothing and Footwear (YoY % Change) [caption id="attachment_125623" align="aligncenter" width="725"] Note: Expenditure data are seasonally adjusted at annual rates

Note: Expenditure data are seasonally adjusted at annual rates

Source: BEA/Coresight Research [/caption] Clothing and Footwear Spending by Subcategory We track subcategories of clothing and footwear, including children’s and infants' clothing, footwear, men's and boys' clothing, and women's and girls' clothing. Spending on clothing saw a year-over-year decline of 3.0% in February 2021, with a 3.7% decline in women's and girls' clothing spending and a 2.5% decline in men's and boys' clothing specifically. Children’s and infants' clothing continued to outperform, driven by the need for renewal in children's clothing: In February, the category saw positive year-over-year growth of 0.6%. Figure 2 shows spending on clothing by category type. Category sales growth followed the same growth pattern as clothing overall, with sequential declines in growth from October to December 2020, followed by a revival in January 2021 and a fallback in February 2021.

Figure 2. US Consumer Spending on Clothing, by Category (YoY% Change) [wpdatatable id=859 table_view=regular]

Source: BEA/Coresight Research Spending on footwear declined by 3.1% year over year in February 2021, versus a 6.2% decline in January 2021.

Figure 3. US Consumer Spending on Footwear (YoY % Change) [wpdatatable id=860 table_view=regular]

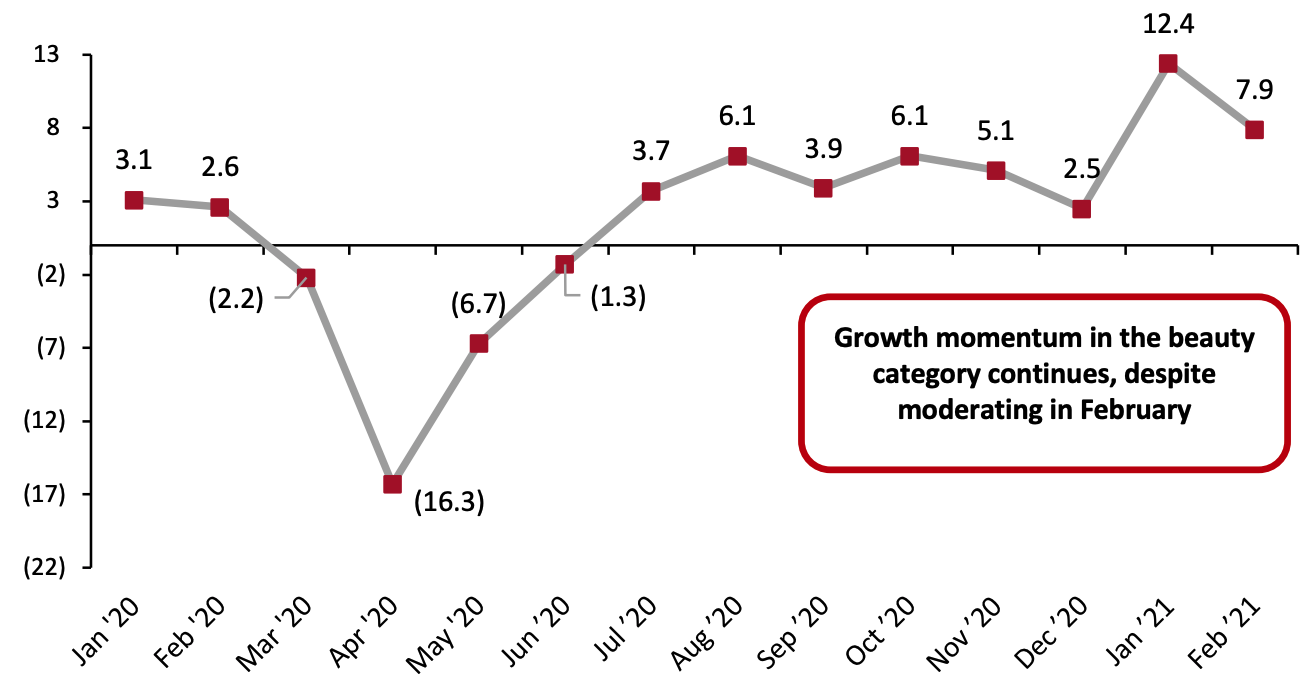

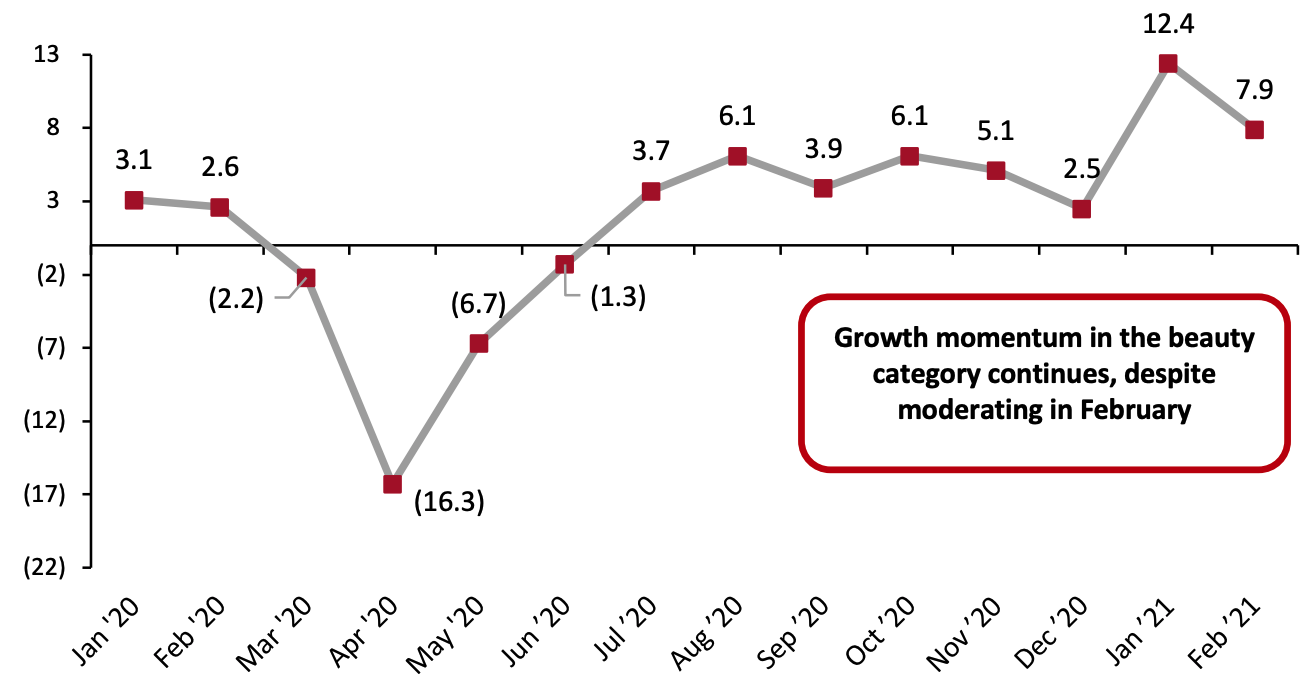

Source: BEA/Coresight Research Beauty Spending Update For our tracker, we include bath products, cosmetics, nail preparations and implements, and perfumes within the beauty category, following the US BEA definition. Growth in consumer spending on beauty moderated to 7.9% year over year in February 2021, compared to a surge of 12.4% in January 2021. Spending on beauty has recovered quickly from June 2020 onward and has seen positive year-over-year growth since July 2020. Although the growth rate moderated in February 2021, the growth momentum in the beauty category continues. On a two-year basis, category spending growth averaged 11.0% across the November 2020–February 2021 period and stood at 10.8% in February 2021. Should that 11.0% average continue, we would see a 13.5% year-over-year increase in beauty spending in March and a 32.6% year-over-year jump in April.

Figure 4. US Consumer Spending on Selected Beauty Categories (YoY % Change) [caption id="attachment_125650" align="aligncenter" width="720"] Beauty is defined as bath products, cosmetics, nail preparations and implements, and perfume.

Beauty is defined as bath products, cosmetics, nail preparations and implements, and perfume.

Source: BEA/Coresight Research [/caption]

Figure 1. US Consumer Spending on Clothing and Footwear (YoY % Change) [caption id="attachment_125623" align="aligncenter" width="725"]

Source: BEA/Coresight Research [/caption] Clothing and Footwear Spending by Subcategory We track subcategories of clothing and footwear, including children’s and infants' clothing, footwear, men's and boys' clothing, and women's and girls' clothing. Spending on clothing saw a year-over-year decline of 3.0% in February 2021, with a 3.7% decline in women's and girls' clothing spending and a 2.5% decline in men's and boys' clothing specifically. Children’s and infants' clothing continued to outperform, driven by the need for renewal in children's clothing: In February, the category saw positive year-over-year growth of 0.6%. Figure 2 shows spending on clothing by category type. Category sales growth followed the same growth pattern as clothing overall, with sequential declines in growth from October to December 2020, followed by a revival in January 2021 and a fallback in February 2021.

Figure 2. US Consumer Spending on Clothing, by Category (YoY% Change) [wpdatatable id=859 table_view=regular]

Source: BEA/Coresight Research Spending on footwear declined by 3.1% year over year in February 2021, versus a 6.2% decline in January 2021.

Figure 3. US Consumer Spending on Footwear (YoY % Change) [wpdatatable id=860 table_view=regular]

Source: BEA/Coresight Research Beauty Spending Update For our tracker, we include bath products, cosmetics, nail preparations and implements, and perfumes within the beauty category, following the US BEA definition. Growth in consumer spending on beauty moderated to 7.9% year over year in February 2021, compared to a surge of 12.4% in January 2021. Spending on beauty has recovered quickly from June 2020 onward and has seen positive year-over-year growth since July 2020. Although the growth rate moderated in February 2021, the growth momentum in the beauty category continues. On a two-year basis, category spending growth averaged 11.0% across the November 2020–February 2021 period and stood at 10.8% in February 2021. Should that 11.0% average continue, we would see a 13.5% year-over-year increase in beauty spending in March and a 32.6% year-over-year jump in April.

Figure 4. US Consumer Spending on Selected Beauty Categories (YoY % Change) [caption id="attachment_125650" align="aligncenter" width="720"]

Beauty is defined as bath products, cosmetics, nail preparations and implements, and perfume.

Beauty is defined as bath products, cosmetics, nail preparations and implements, and perfume. Source: BEA/Coresight Research [/caption]