DIpil Das

Introduction

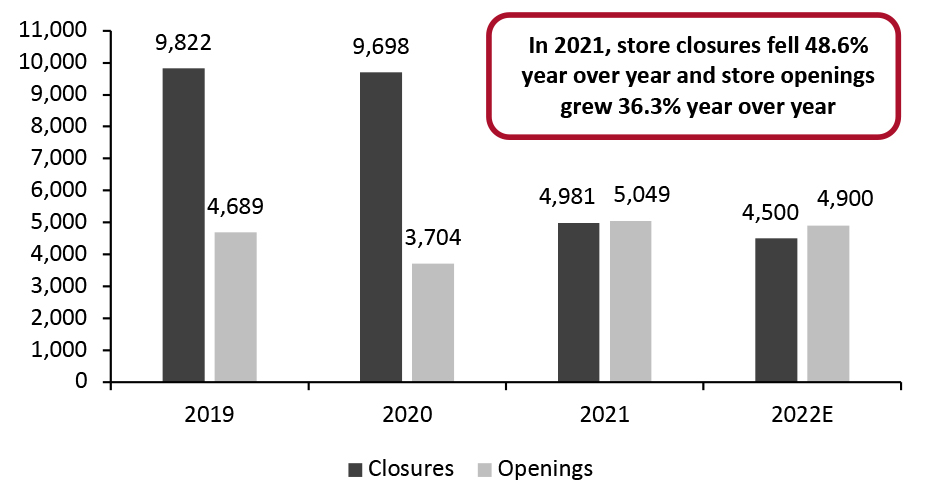

What’s the Story? In the US, a surge in retail sales and the return of shoppers to stores saw fewer closures and more openings in 2021 than 2020. In 2021, US closures and openings were relatively close in number and we expect to see a similar trend in 2022 as retailers try to put the pandemic behind them. In the UK, retailers also closed fewer stores and opened more stores in 2021 than 2020. Coresight Research’s Weekly US and UK Store Openings and Closures Tracker reports on store closures, openings and bankruptcies. Complementing our weekly report, the Coresight Research Retail Store Databank offers our premium subscribers access to openings and closures data from 2012 to 2022 year to date, filterable by sector and year. In this report, we review store closures for 2021 in the US and the UK and present our projections for US store closures and openings in 2022. Why It Matters After the adverse effect of the pandemic on store-based retail in 2020, store openings saw a 36.3% year over year increase and store closures saw a 48.6% decline in 2021. As the store-based retail sector bounces back from the pandemic, it is important to look back at trends in 2021 in order to understand how the sector will develop moving forward.Store Openings and Closures 2021 Review and 2022 Outlook: Coresight Research Analysis

1. 2021 US Store Closures and Openings Review Amid the retail buoyancy of 2021, US openings overtook closures for the first time since 2016. Closures: In the US, we saw 4,981 store closures by major retailers in 2021, equivalent to more than 55.4 million square feet (gross), according to Coresight Research estimates. 2020 saw 9,698 closures, spanning more than 149.2 million square feet (gross), primarily caused by a large number of department store closures. Openings: Major US retailers opened 5,049 stores in 2021, spanning an area of more than 70.3 million square feet (gross), according to Coresight Research estimates. By comparison, 2020 saw 3,684 store openings, spanning an area of approximately 49.8 million square feet (gross).Figure 1. US Store Openings and Closures [caption id="attachment_139754" align="aligncenter" width="700"]

Source: Company reports/Coresight Research [/caption]

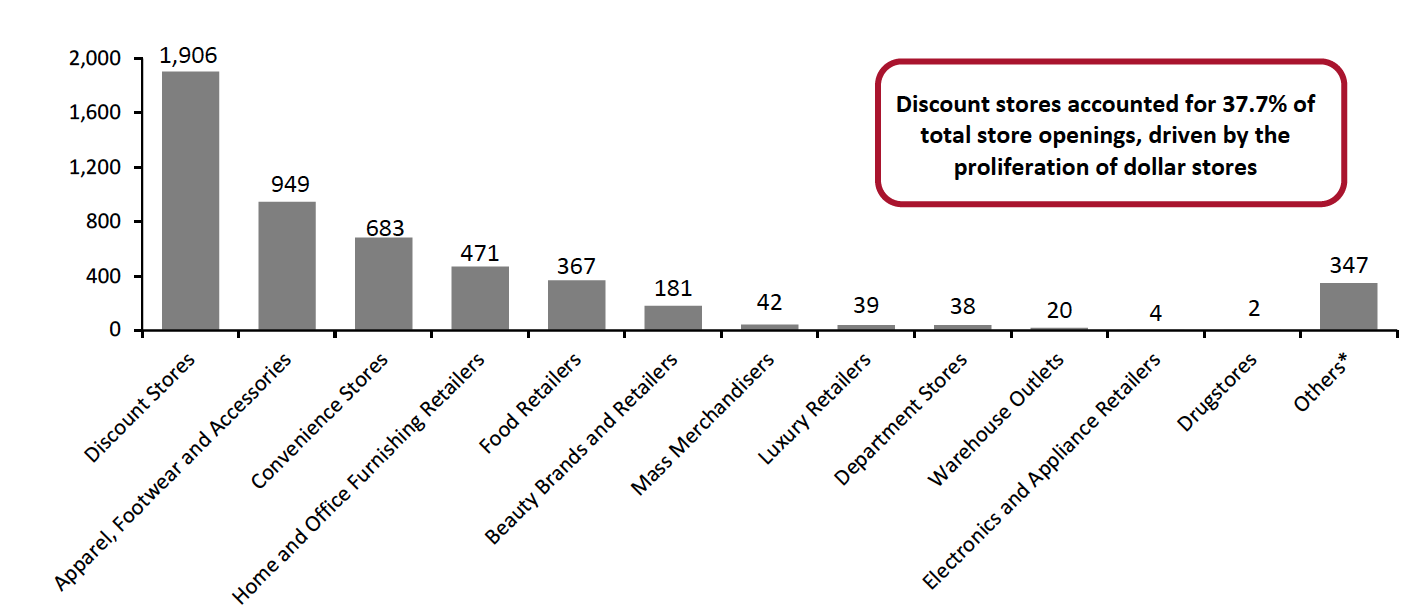

As in 2020, discount stores contributed the highest proportion of US openings by sector, accounting for 37.7% of total openings in 2021, down from 45.9% in 2020. In absolute terms, the number of discount stores opened in 2021 was 1,956, compared to 1,699 stores in 2020.

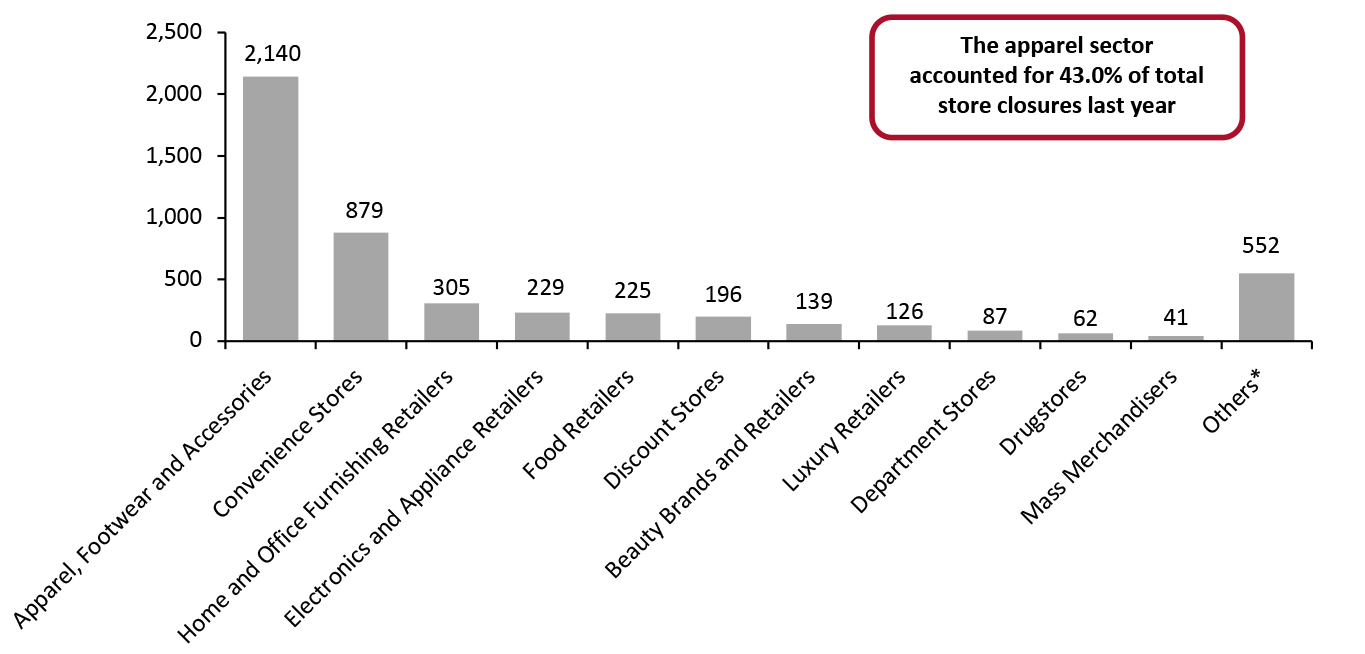

Apparel retailers saw the highest number of closures in 2021, as in 2020—the sector accounted for 43.0% of total closures in 2021 and 34.9% in 2020. In absolute terms, the number of apparel stores closed in 2021 was 2,140, versus 3,385 stores in 2020.

Source: Company reports/Coresight Research [/caption]

As in 2020, discount stores contributed the highest proportion of US openings by sector, accounting for 37.7% of total openings in 2021, down from 45.9% in 2020. In absolute terms, the number of discount stores opened in 2021 was 1,956, compared to 1,699 stores in 2020.

Apparel retailers saw the highest number of closures in 2021, as in 2020—the sector accounted for 43.0% of total closures in 2021 and 34.9% in 2020. In absolute terms, the number of apparel stores closed in 2021 was 2,140, versus 3,385 stores in 2020.

Figure 2. US Store Closure and Openings Overview [wpdatatable id=1620]

Source: Company reports/Coresight Research 2. US Store Closures: Apparel Stores Saw the Most Closures Analyzing the closures by sector, we can see that apparel (including clothing, footwear and accessories retailers) far outpaced other retail sectors over the course of 2021, with 2,142 closures in total (see Figure 1)—the next closest was convenience stores, which saw 879 closures.

Figure 3. US Store Closures by Sector, 2021 [caption id="attachment_139755" align="aligncenter" width="700"]

*Includes retailers such as pet supplies retailer Pet Valu, Video rental chain Family Video and jewelry retailer Signet Jewelers

*Includes retailers such as pet supplies retailer Pet Valu, Video rental chain Family Video and jewelry retailer Signet Jewelers Source: Company reports/Coresight Research [/caption] Apparel, Footwear and Accessories: Sector Breakdown Bankruptcies were a driving force behind a significant number of store closures in the apparel sector:

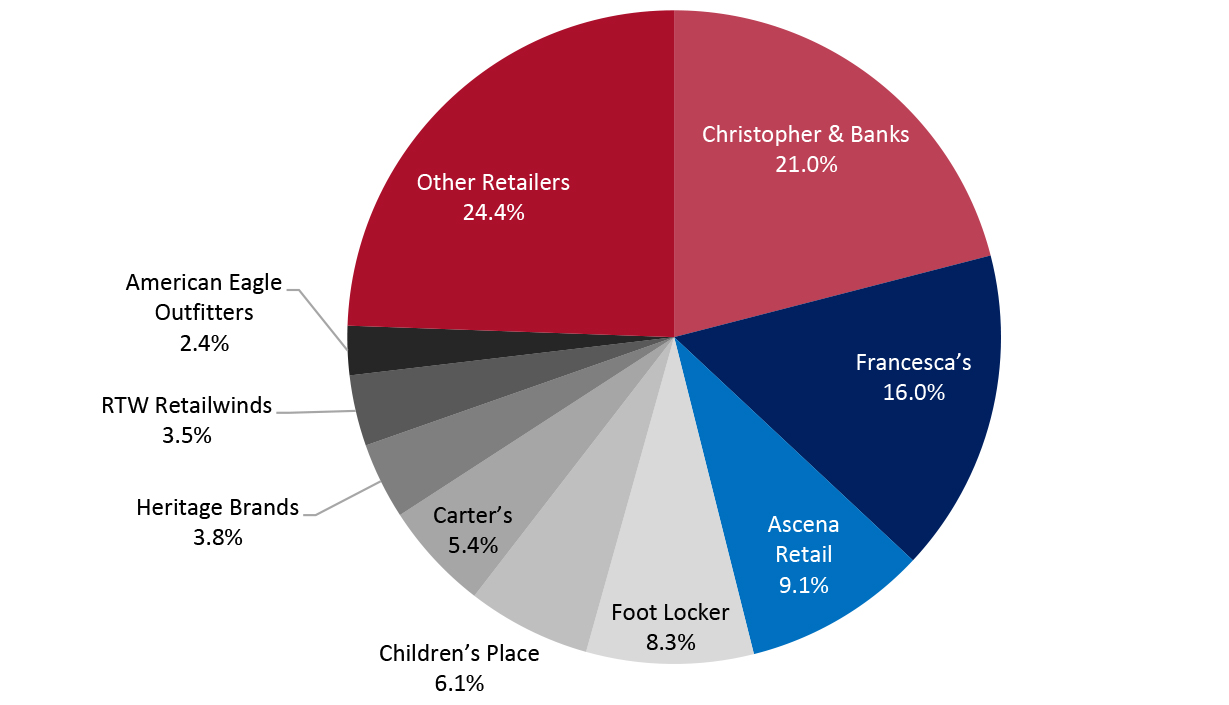

- Christopher & Banks shut 449 stores in 2021 and accounted for the highest number of store closures in the year across all sectors. The company filed for bankruptcy in January 2021.

- Francesca’s filed for bankruptcy in December 2020 and sold all its stores to private equity firm Tiger Capital in 2021, which shuttered 342 stores during the year.

- Ascena Retail Group filed for bankruptcy in July 2020 and sold its Justice brand’s intellectual property to brand management company Bluestar Alliance in November 2020, which closed all 195 stores in early 2021.

- Foot Locker, which closed 177 stores.

- Children’s Place, which shuttered 131 stores.

- Carter’s, which closed 115 stores.

- Heritage Brands, which closed 81 stores.

- RTW Retailwinds, which closed 75 stores.

- American Eagle Outfitters, which closed 52 stores.

Figure 4. Percentage Distribution of US Store Closures in the Apparel Sector, 2021 [caption id="attachment_139756" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Store Closures Across Other Sectors

Among convenience stores, two major chains closed over 250 stores each:

Source: Company reports/Coresight Research[/caption]

Store Closures Across Other Sectors

Among convenience stores, two major chains closed over 250 stores each:

- Alimentation Couche-Tard, which closed 318 stores in North America.

- 7-Eleven, which was forced to close 293 stores as part of court proceedings to acquire convenience store chain Speedway.

Figure 5. US Store Openings by Sector, 2021 [caption id="attachment_139768" align="aligncenter" width="700"]

*Includes retailers such as stationery retailers, jewelry retailers, gift retailers, toys retailer and offline retail stores of Amazon

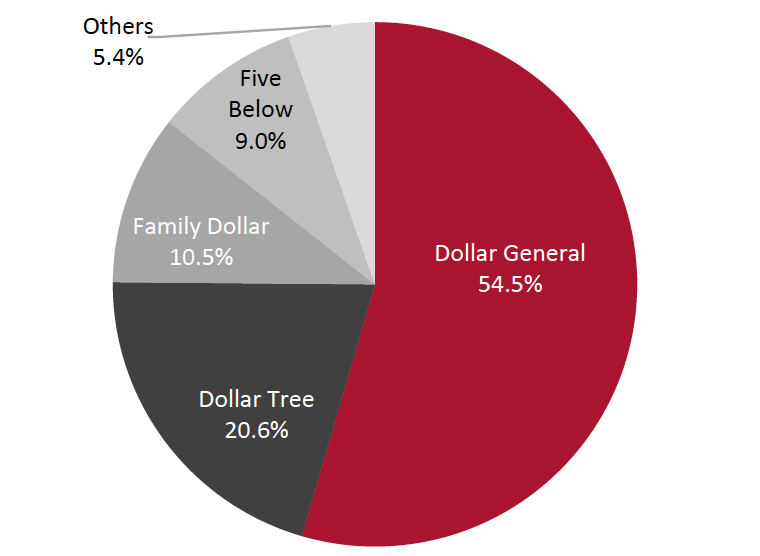

*Includes retailers such as stationery retailers, jewelry retailers, gift retailers, toys retailer and offline retail stores of AmazonSource: Company reports/Coresight Research[/caption] Discount Stores: Sector Breakdown Dollar stores had a significant impact on the total number of openings in the discount-store sector last year—and accounted for three of the top five retailers across all sectors, with Dollar General opening 1,039 stores,Dollar Tree opening 393 and Family Dollar opening 200. Together, these three retailers accounted for 85.6% of openings in the sector in 2021, signifying the prolific expansion of dollar stores in the US retail landscape. Among other discount retailers, Five Below opened an estimated 172 stores in 2021. As mentioned previously, we categorize grocery discounters separately under grocery retailers.

Figure 6. Percentage Distribution of US Store Openings in the Discount Store Sector, 2021 [caption id="attachment_139769" align="aligncenter" width="350"]

Source: Company reports/Coresight Research[/caption]

Store Openings Across Other Sectors

Among convenience stores, Murphy USA, Casey’s and Alimentation Couche-Tard were the frontrunners in store openings, opening an estimated 211, 160 and 155 stores, respectively.

In the apparel sector, Aerie, Windsor Fashion and TJX Companies opened the highest number of stores with 76, 75 and 74 estimated stores openings, respectively.

In the home and office retail sector, Ace Hardware opened the highest number of stores (145 estimated openings), while Tractor Supply Company opened 80.

In the grocery retail sector, German discount grocery chain Aldi opened 78 stores in 2021, while Lidl opened 38. Ahold Delhaize opened 75 stores.

4. 2021 UK Store Closures and Openings Review

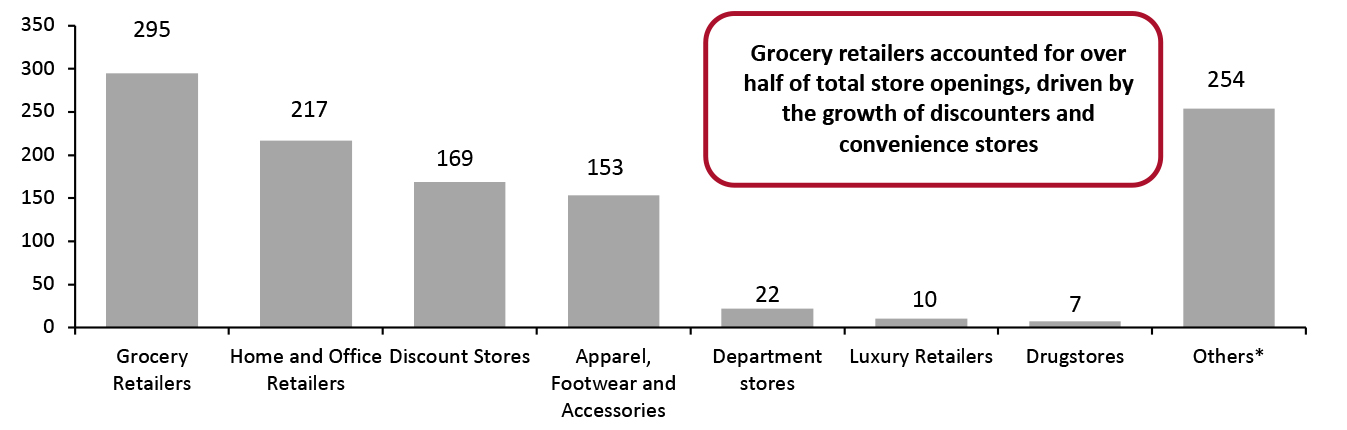

In the UK we saw 1,562 store closures by major retailers in 2021, down from 2,677 closures in 2020. UK retailers opened 1,127 stores in 2021, more than double the 505 store openings seen in 2020 (see Figure 7).

Grocery retailers contributed the most toward openings in 2021, as in 2020—accounting for 26.1% of the total openings, albeit a decrease from 40.4% in 2020. The higher openings percentage in 2020 is primarily due to lockdown restrictions allowing only essential retailers to be open for most of the year. As in the US, apparel retailers led closures in the UK in 2021—with the sector contributing 51.9% of total closures, an increase from 34.5% of total closures in 2020.

Source: Company reports/Coresight Research[/caption]

Store Openings Across Other Sectors

Among convenience stores, Murphy USA, Casey’s and Alimentation Couche-Tard were the frontrunners in store openings, opening an estimated 211, 160 and 155 stores, respectively.

In the apparel sector, Aerie, Windsor Fashion and TJX Companies opened the highest number of stores with 76, 75 and 74 estimated stores openings, respectively.

In the home and office retail sector, Ace Hardware opened the highest number of stores (145 estimated openings), while Tractor Supply Company opened 80.

In the grocery retail sector, German discount grocery chain Aldi opened 78 stores in 2021, while Lidl opened 38. Ahold Delhaize opened 75 stores.

4. 2021 UK Store Closures and Openings Review

In the UK we saw 1,562 store closures by major retailers in 2021, down from 2,677 closures in 2020. UK retailers opened 1,127 stores in 2021, more than double the 505 store openings seen in 2020 (see Figure 7).

Grocery retailers contributed the most toward openings in 2021, as in 2020—accounting for 26.1% of the total openings, albeit a decrease from 40.4% in 2020. The higher openings percentage in 2020 is primarily due to lockdown restrictions allowing only essential retailers to be open for most of the year. As in the US, apparel retailers led closures in the UK in 2021—with the sector contributing 51.9% of total closures, an increase from 34.5% of total closures in 2020.

Figure 7. UK Store Closure and Openings Overview [wpdatatable id=1621]

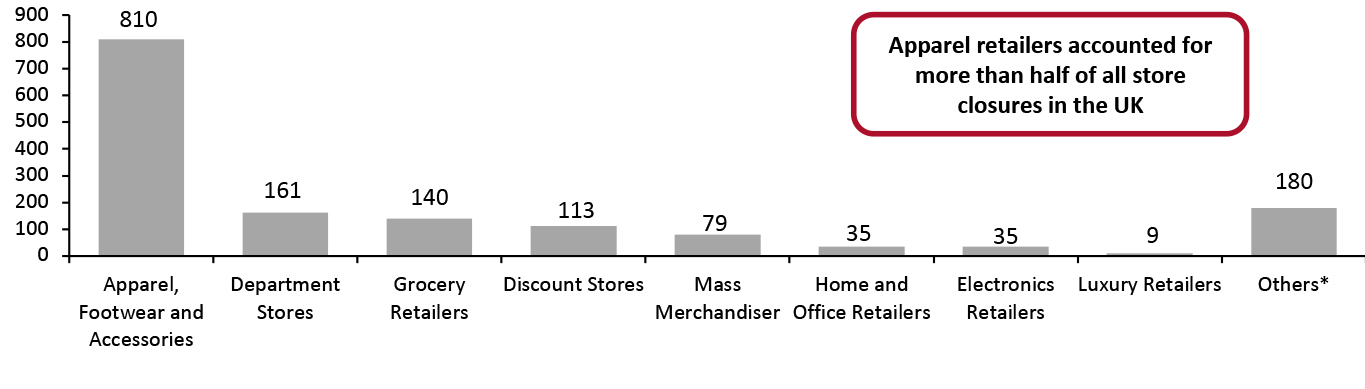

Source: Company reports/Coresight Research 5. UK Store Closures: Apparel Stores Drives Store Closures When broken down by sector, apparel retailers led store closures in 2021—witnessing 810 store closures and accounting for 51.9% of the total. Department stores were the next highest, seeing 161 store closures.

- Apparel retail group Arcadia Group, which collapsed into administration in November 2020, finalized the sale of its brands to various online retailers and closed 444 stores across its brands in 2021.

- Department store chain Debenhams closed all its 124 stores in 2021, after entering administration in November 2020.

- McColl’s—The convenience store chain saw an estimated 114 closures.

- Edinburgh Woolen Mill—The apparel retailer closed 85 stores after it was acquired by private equity firm Purepay Retail.

- Gap—The apparel retailer closed all its 81 stores in the UK.

- Argos—The general merchandiser closed an estimated 79 stores as parent company Sainsbury’s focused on relocating Argos outlets to shop-in-shop locations within its supermarkets.

Figure 8. UK Store Closures by Sector, 2021 [caption id="attachment_139759" align="aligncenter" width="700"]

*Includes retailers such as stationery retailers, jewelry retailers, gift retailers, toys retailer and chocolatier Thorntons

*Includes retailers such as stationery retailers, jewelry retailers, gift retailers, toys retailer and chocolatier Thorntons Source: Company reports/Coresight Research[/caption] 6. UK Store Openings: Grocery Stores Lead Store Openings By sector, grocery retailers saw the highest number of openings in 2021, witnessing 297 new stores, which accounted for 26.1% of the year’s total openings. German grocery retailers Aldi and Lidl contributed significantly to the UK grocery sector’s total openings count, opening an estimated 60 stores each in 2021. The Co-op opened an estimated 85 stores during 2021. Other notable contributors include: bakery chain Greggs, which opened 100 stores; home-improvement retailers Screwfix and Toolstation, which opened 70 and 62 stores, respectively; and toys and hobby retailer Geek Retreat, which opened 60 stores.

Figure 9. UK Store Openings by Sector, 2021 [caption id="attachment_139760" align="aligncenter" width="700"]

*Includes retailers such as gift-card chain Card Factory and stationery retailer The Works

*Includes retailers such as gift-card chain Card Factory and stationery retailer The Works Source: Company reports/Coresight Research [/caption] 7. US Outlook for 2022 Estimating 4,500 Closures in 2022 For 2022, we estimate that retail store closures will total around 4,500 (down 10% versus 2021). As of January 20, 2022, the total for announced store closures this year is 727 (see Figure 11) down 55.2% compared to 1,626 closures as of January 22, 2021. Our estimate for 2022 reflects the triangulation of a number of inputs and data points, including from retail sales, the outlook for consumer behavior, historical data and announced store openings and closure data for 2022. Bankruptcy Trend in Store Closures Store closures peaked in 2019 (see Figure 10) where retailers with large store bases, such as Charlotte Russe, Fred’s, Gymboree and Payless, among others, filed for bankruptcies in the year and contributed to store closures. In 2020, a record number of retailers filed for bankruptcy due to the pandemic, causing a similar level of closures to 2019—however, in 2021 we saw the number of bankruptcies decrease and store closures stabilized to pre-2019 levels.

Figure 10. US Store Closure Totals of Major Retailers in Aggregate [wpdatatable id=1622]

Source: Company reports/Coresight Research Retail Robustness Index Through 2021, Coresight Research’s Retail Robustness Index evaluated the 100 largest US retailers (by revenue) on their ability to weather the current environment. The index is based on financial health, sales capacity, product mix and management tenure. The Retail Robustness Index is at a record high as of October 31, 2021, suggesting a positive trend for store-based retail in 2022.

Figure 11. Major Announced US Store Closures in 2022 [caption id="attachment_139761" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. *Estimated store closures

†Figures pertain to North America closures

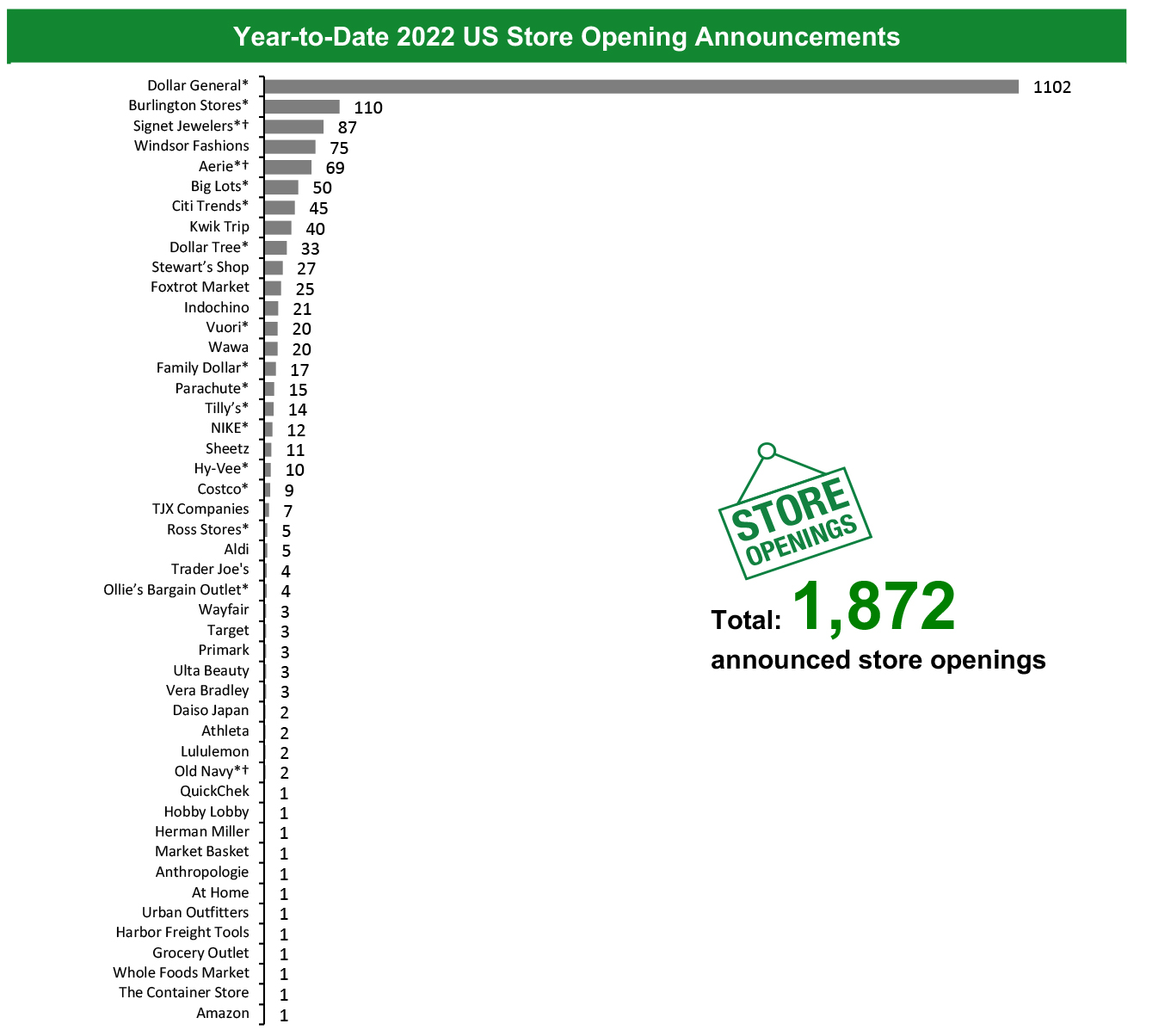

Source: Company reports/Coresight Research [/caption] US Store Openings Could Reach 4,900 in 2022 For 2022, we estimate that retail store openings will total around 4,900 (down 3.0% versus 2021). This would represent a second consecutive year of openings running ahead of closures. As of January 20, 2022, the total for announced store openings this year is 1,872 (see Figure 13), up 5.3% compared to 1,777 openings as of January 22, 2021. 2021 saw retailers opening more than 5,000 stores, bouncing back from 2020, after they were forced to cut back on their initial store expansion plans due to the pandemic. We expect that the store-based retail sector will stabilize in 2022, with openings in line with 2021.

Figure 12. US Store Opening Totals of Major Retailers in Aggregate [wpdatatable id=1623]

Source: Company reports/Coresight Research By sector, we expect that discount retailers will once again lead store openings, as they did in 2021 and 2020. Dollar General has already announced its store expansion plans for fiscal 2021, and as per our calendarized estimate, will open more than 1,100 stores this year. Dollar Tree and Five Below, however, are yet to announce their 2021 expansion plans. Discretionary retailers, such as those in the apparel sector, saw similar numbers of openings in 2021 compared to 2019 and we expect them to maintain their current levels in 2022. Retailers Citi Trends and Burlington Stores have already announced store expansion plans for fiscal 2022 in line with their fiscal 2021 plans.

Figure 13. Major Announced US Store Openings in 2022 [caption id="attachment_139762" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. *Estimated store openings

†Figures pertain to North America closures

TJX Companies includes Marmaxx (T.J. Maxx and Marshalls), HomeGoods, Sierra, and Homesense stores. Amazon includes Amazon Fresh stores.

Source: Company reports/Coresight Research [/caption]

What We Think

In the US and the UK, store-based retail in 2020 was heavily impacted by the Covid-19 pandemic, with a record number of retailers filing for bankruptcy. In 2021 retail sectors recovered, seeing fewer closures and more openings compared to 2020—and we expect that store closures and openings will stabilize in 2022. US retail, in particular, was buoyed by the hundreds of billions of dollars paid to consumers in the form of stimulus checks; the UK, however, saw no similar stimulus scheme and, coupled with lockdowns in early 2021, its retail recovery was more muted as a result. In the US, we expect to see similar store openings this year compared to 2021, with discount and off-price retailers opening the most stores. Openings in discretionary categories such as apparel are likely to be flat compared to 2021 based on already announced expansion plans for 2022. In the UK, store-based retail’s continued recovery will be supported by the country’s apparently early lead out of the pandemic. As we went to press, the WHO’s special envoy for Covid-19, David Nabarro, stated that “it’s possible to start imagining that the end of the pandemic is not far away” in the UK as case numbers have fallen sharply, following a pattern similar to that previously seen in Omicron-hit South Africa. In both the US and the UK, the demand side of retail will be impacted by rising costs for consumers, with inflation likely to remain elevated and interest rates likely to rise. Closures caused by bankruptcies have been a primary reason for high store closures in the last three years. However, with bankruptcies reducing in 2021 and no major bankruptcies announced yet in 2022, we expect closures to be lower than in 2021 this year. Historically, apparel retailers have always led store closures and we expect the trend to continue in 2022. Implications for Brands/Retailers- As retailers optimize their store fleets, we expect them to enhance their e-commerce and omnichannel operations due to the pandemic-driven shift in consumer behavior.

- Retailers with large store square footage, such as department stores, might look to optimize their store base by opening new, smaller format stores and closing larger format stores.

- Once again, we expect apparel to be the weakest major retail category and to register the highest number of store closures this year—and for discount retailers to lead in openings.