DIpil Das

What’s the Story?

Covid-19 has had a well-documented adverse impact on store-based retail globally in 2020, resulting in widespread store closures and retail bankruptcies. We expect to see more of the same in 2021, despite some renewed optimism arising from the rollout of vaccination programs. Coresight Research’s Weekly US and UK Store Openings and Closures Tracker reports on store closures, openings and bankruptcies. Complementing our weekly report, the Coresight Research Retail Store Databank offers our premium subscribers access to openings and closures data from 2012 to 2021 year to date, filterable by sector and year. In this report, we review store closures for 2020 in the US and the UK and present our projections of US store closures and openings in 2021.US Store Closures: Apparel Stores Saw the Most Closures

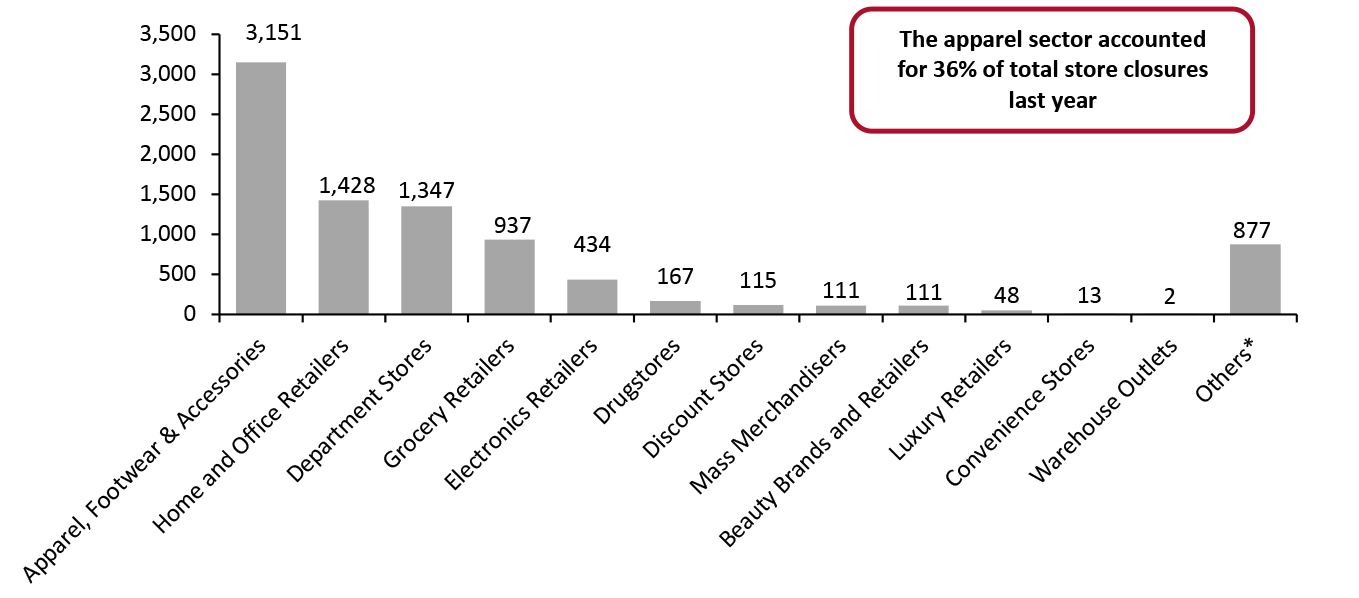

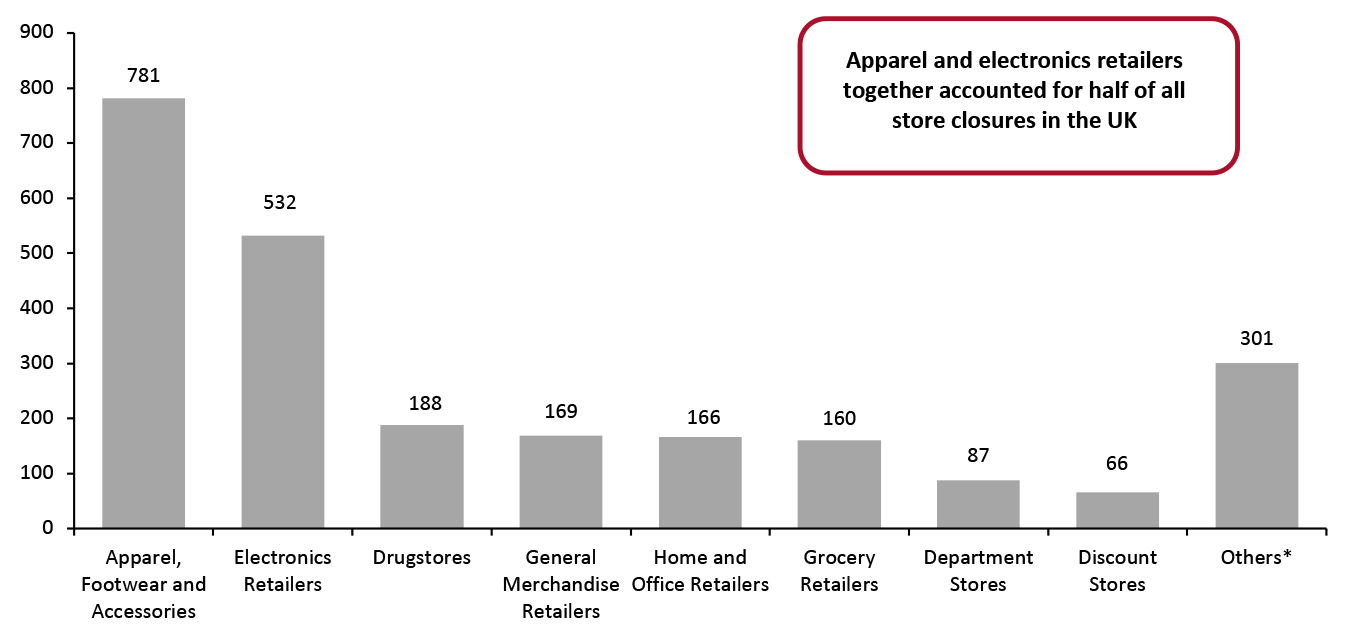

In a challenging year for retail in the US, we saw 8,741 store closures by major retailers in 2020, equivalent to more than 139 million square feet (gross), according to Coresight Research estimates. This was down from the 9,832 closures in 2019 spanning more than 119 million square feet (gross). The uptick in total gross square footage closed despite the higher number of closures in 2019 is explained by the fact that there were significantly more closures of department stores and other large-format stores in 2020. Analyzing the closures by sector, we can see that apparel (including clothing, footwear and accessories retailers) far outpaced other retail sectors over the course of 2020, with 3,151 closures in total (see Figure 1).Figure 1. US Store Closures by Sector, 2020 [caption id="attachment_122375" align="aligncenter" width="725"]

*Includes retailers such as stationery and gifts retailer Papyrus, party-supplies retailer Party City and jewelry retailer Signet Jewelers

*Includes retailers such as stationery and gifts retailer Papyrus, party-supplies retailer Party City and jewelry retailer Signet Jewelers Source: Company reports/Coresight Research [/caption]

Apparel, Footwear and Accessories: Sector Breakdown

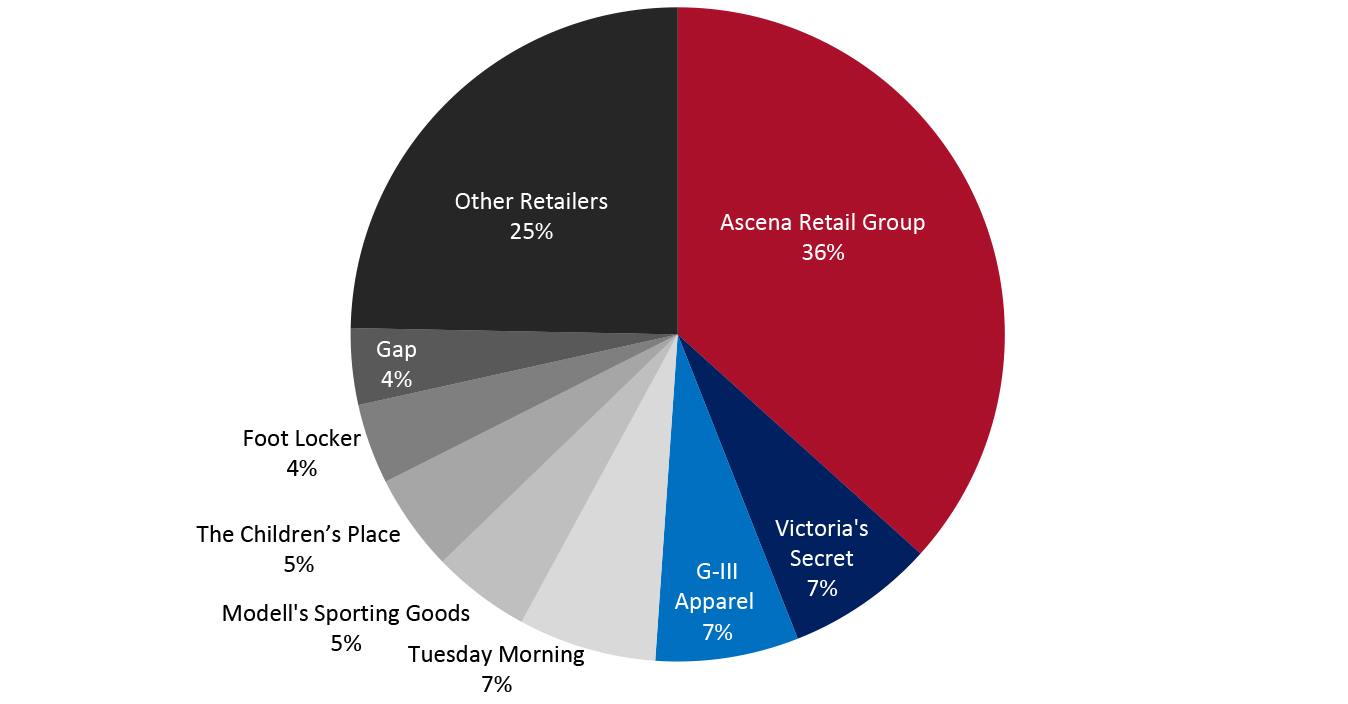

Bankruptcies were a driving force behind the significant number of store closures in the apparel sector:- Ascena Retail Group, which shut 1,156 stores in 2020, accounted for the highest number of store closures in the year across all sectors. The company—which includes Ann Taylor, Catherines, Justice, Lane Bryant, LOFT and Lou & Grey banners—filed for bankruptcy in July 2020.

- Modell’s Sporting Goods filed for bankruptcy in March 2020 and shuttered 153 stores during the year.

- Off-price retailer Tuesday Morning filed for Chapter 11 bankruptcy protection in May and announced plans to reorganize its business in order to realign its store footprint. The company ended up shutting an estimated 215 stores in 2020.

- Foot Locker closed 125 stores.

- Gap shuttered 119 stores.

- G-III Apparel closed 223 stores.

- The Children’s Place closed down an estimated 151 stores.

- Victoria’s Secret shut 231 stores.

Figure 2. Percentage Distribution of US Store Closures in the Apparel Sector, 2020 [caption id="attachment_122376" align="aligncenter" width="725"]

Source: Company reports/Coresight Research[/caption]

Store Closures Across Other Sectors

Among department stores, three major chains closed over 100 stores each:

Source: Company reports/Coresight Research[/caption]

Store Closures Across Other Sectors

Among department stores, three major chains closed over 100 stores each:

- JCPenney shuttered around 169 stores.

- Stage Stores filed for bankruptcy in May and shut all its 738 stores.

- Stein Mart filed for bankruptcy in August and closed 279 stores.

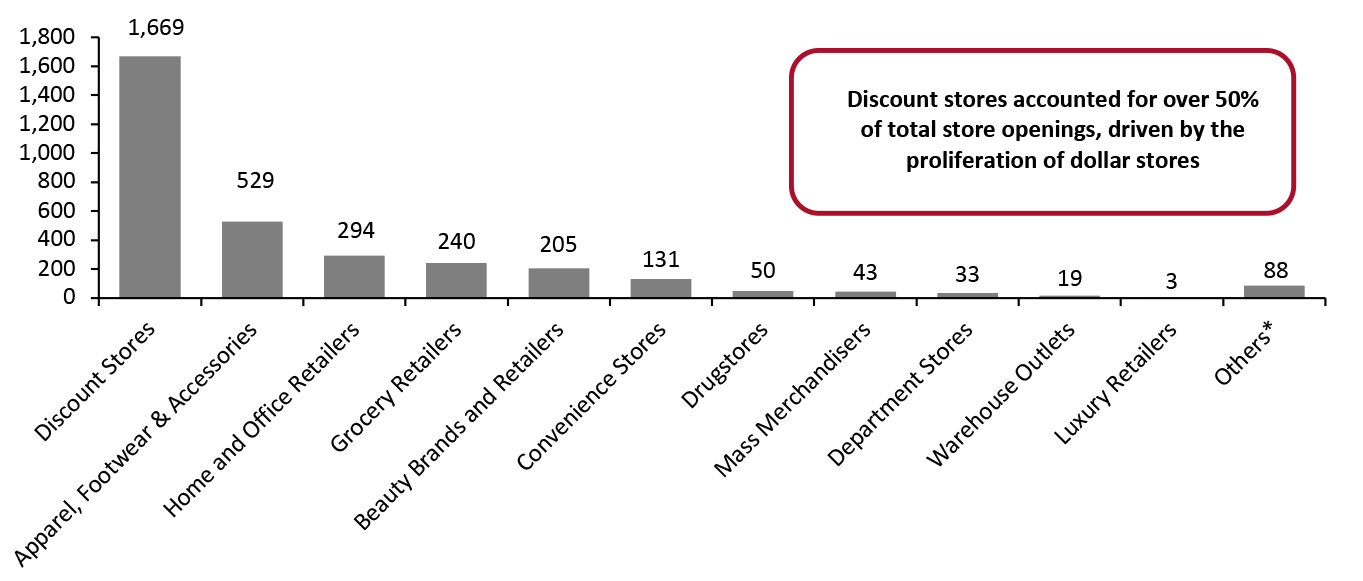

Figure 3. US Store Openings by Sector, 2020 [caption id="attachment_122377" align="aligncenter" width="725"]

*Includes retailers such as stationery and gift retailer Paper Source and offline retail stores of e-commerce giant Amazon

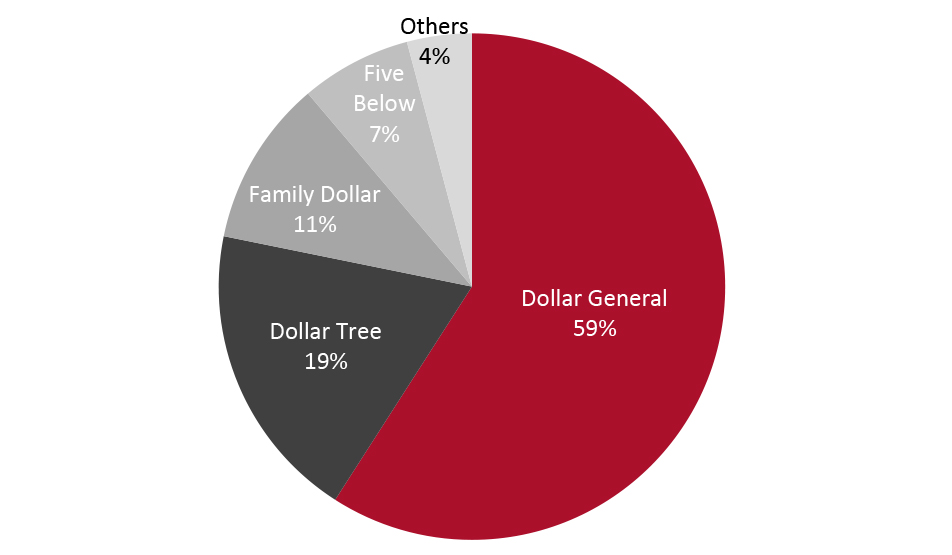

*Includes retailers such as stationery and gift retailer Paper Source and offline retail stores of e-commerce giant Amazon Source: Company reports/Coresight Research [/caption] Discount Stores: Sector Breakdown Dollar stores had a significant impact on the total number of openings in the discount-store sector last year, with Dollar General opening 986 stores, Dollar Tree opening 319 and Family Dollar opening 177. Together, these three retailers accounted for 89% of openings in the sector in 2020, signifying the prolific expansion of dollar stores in the US retail landscape. Among other discount retailers, Five Below opened an estimated 118 stores in 2020. As mentioned previously, we categorize grocery discounters separately under grocery retailers.

Figure 4. Percentage Distribution of US Store Openings in the Discount-Store Sector, 2020 [caption id="attachment_122378" align="aligncenter" width="725"]

Source: Company reports/Coresight Research[/caption]

Store Openings Across Other Sectors

Among apparel stores, Ross Stores and Burlington Stores were the frontrunners in store openings, having opened 66 and 62 stores, respectively.

In the home and office retail sector, Ace Hardware Corporation opened the most stores (90), while Tractor Supply Company opened 80 stores.

In the grocery retail sector, German discount grocery chain Aldi opened an estimated 99 stores, while Lidl opened an estimated 40 stores in 2020.

Convenience store chain Casey’s opened an estimated 57 stores in 2020.

Source: Company reports/Coresight Research[/caption]

Store Openings Across Other Sectors

Among apparel stores, Ross Stores and Burlington Stores were the frontrunners in store openings, having opened 66 and 62 stores, respectively.

In the home and office retail sector, Ace Hardware Corporation opened the most stores (90), while Tractor Supply Company opened 80 stores.

In the grocery retail sector, German discount grocery chain Aldi opened an estimated 99 stores, while Lidl opened an estimated 40 stores in 2020.

Convenience store chain Casey’s opened an estimated 57 stores in 2020.

UK Store Closures: Apparel Stores and Electronics Retailers Drove Store Closures

In the UK, we saw major retailers close 2,450 stores in 2020 compared to the 771 store closures we recorded for 2019. Apparel and electronics retailers together accounted for more than half of all store closures in the UK. Multinational electrical and telecommunications retailer Dixons Carphone led the closures list among UK retailers, having closed an estimated 531 standalone Carphone Warehouse stores. General-merchandise retailer Argos closed an estimated 169 stores over the course of the year as parent company Sainsbury’s focused on relocating Argos outlets to shop-in-shop locations within its supermarkets. Other notable retailers that contributed to high-street closures in 2020 include the following:- Boots—The health and beauty retailer closed an estimated 168 stores.

- McColl’s—The convenience store chain saw an estimated 114 closures.

- Oasis and Warehouse Group—The fashion retail chain closed an estimated 92 stores.

- Signet Jewelers—The jewelry retailer shuttered an estimated 80 stores.

Figure 5. UK Store Closures by Sector, 2020 [caption id="attachment_122379" align="aligncenter" width="725"]

*Includes jewelry retailer Signet Jewelers, sports goods retailer DW Sports and car parts, camping and touring equipment retailer Halfords

*Includes jewelry retailer Signet Jewelers, sports goods retailer DW Sports and car parts, camping and touring equipment retailer Halfords Source: Company reports/Coresight Research[/caption]

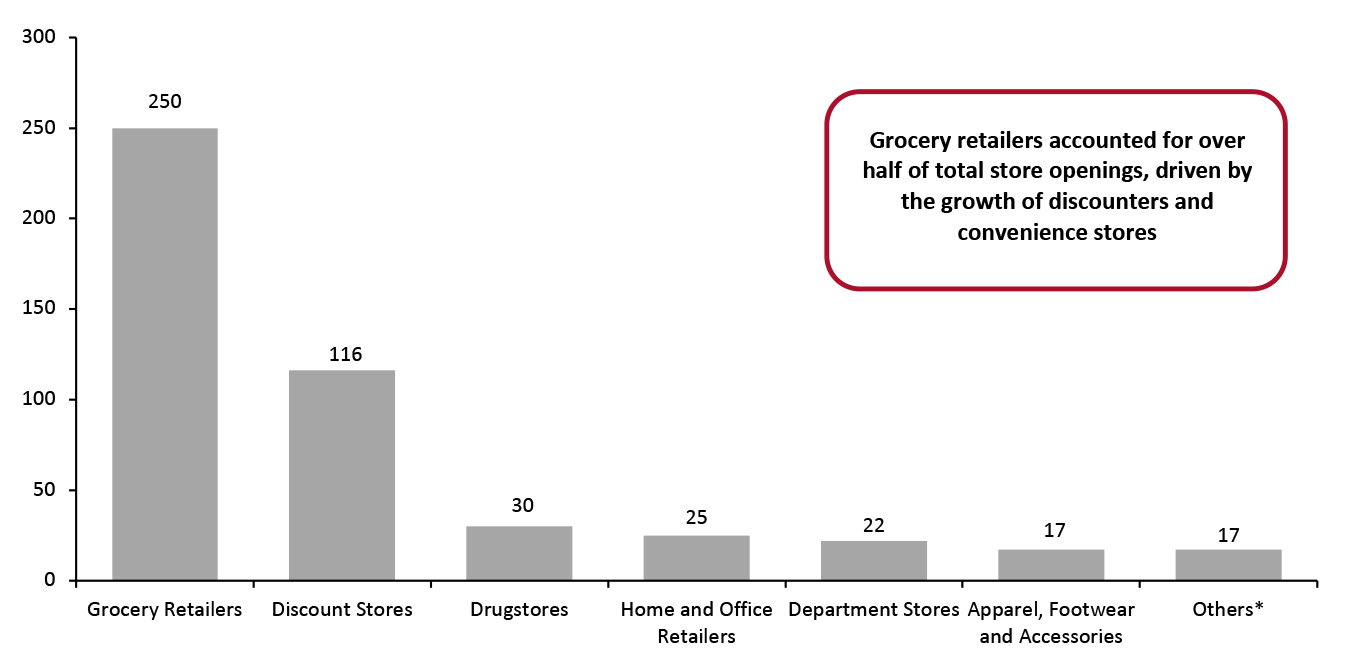

UK Store Openings: Grocery Retailers Recorded the Most Openings

Major retailers in the UK opened a total of 477 stores in 2020, fewer than the 771 store openings we recorded for 2019. The grocery retail sector was the leading contributor of openings, with 250 new stores last year (versus 349 in 2019), driven by the steady growth of discounter formats and convenience stores. German grocery retailers Aldi and Lidl contributed significantly to the UK grocery sector’s total openings count, having opened an estimated 77 and 65 stores, respectively. The Co-operative Group opened an estimated 50 stores during 2020. Other notable contributors include discount retailers Savers and B&M, which opened 70 and 32 stores, respectively, and drugstore retailer Superdrug (sister chain of Savers), which opened 30 stores.Figure 6. UK Store Openings by Sector, 2020 [caption id="attachment_122380" align="aligncenter" width="725"]

*Includes retailers such as gift-card chain Card Factory and stationery retailer The Works

*Includes retailers such as gift-card chain Card Factory and stationery retailer The Works Source: Company reports/Coresight Research [/caption]

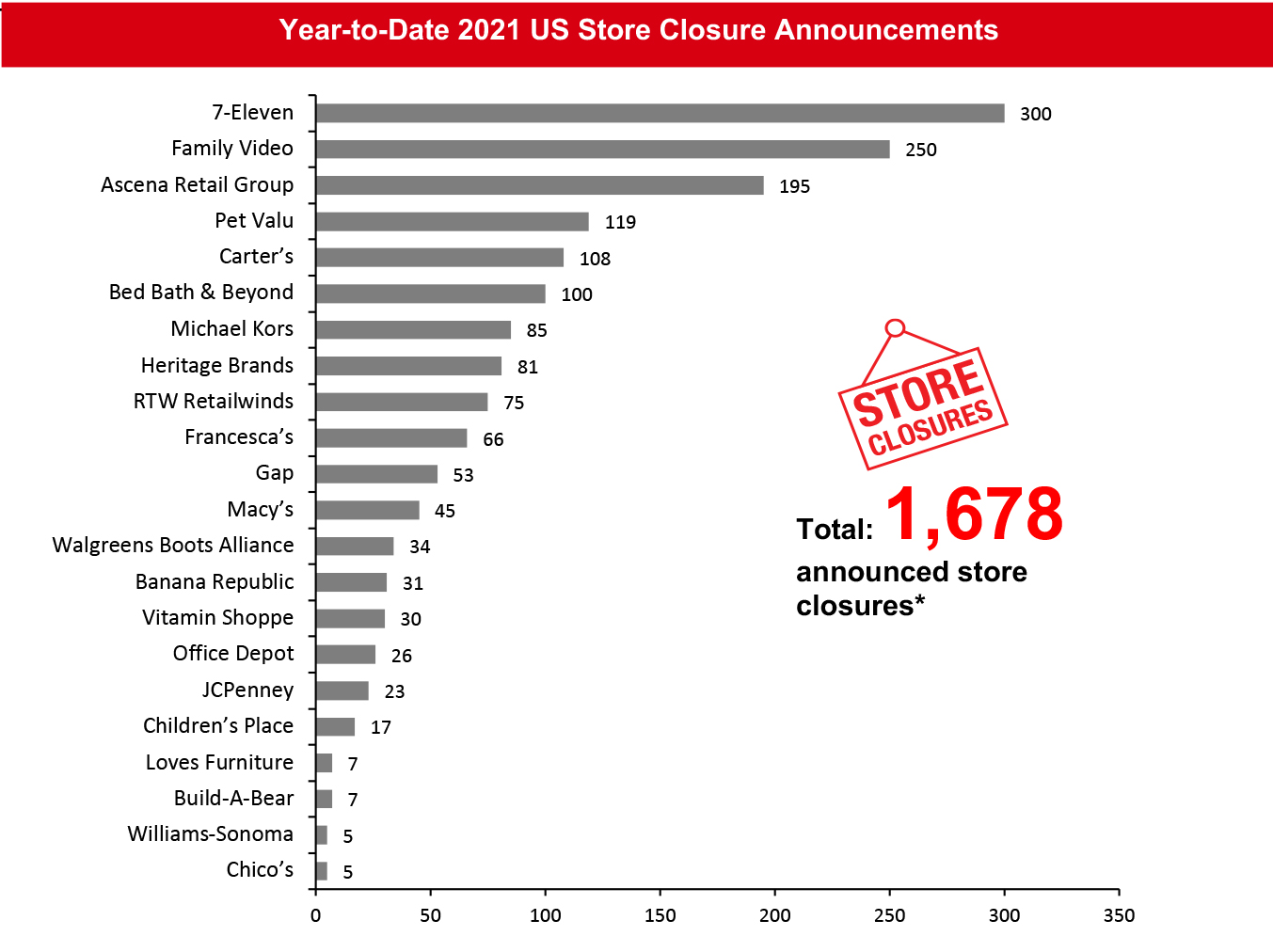

US Outlook for 2021

Estimating 10,000 Closures in 2021 For 2021, we estimate that retail store closures will total around 10,000 (up 14% versus 2020). As of January 22, 2021, the total for announced store closures this year is 1,678 (see Figure 8). Our estimate represents a moderate acceleration in closures from the level seen in 2020, on the assumption that the impacts of the Covid-19 crisis will roll over into 2021. We see potential for 2021 closures to exceed 10,000 should we see an unexpectedly strong wave of closures deferred from 2020. Our estimate for 2021 reflects the triangulation of a number of inputs, including from regression analysis, the outlook for consumer behavior and historical data. Our multi-variate regression analysis considered variables such as store closures and openings in previous years, the impact of the Covid-19 pandemic on offline retail, retail space per capita and e-commerce penetration. Our analysts considered the resulting quantitative predictions alongside multiple industry trends and themes to create a blended estimate for store closures. Below, we outline some of the factors included in our consideration. Some Retailers Will Not Hold Out Until Vaccination Programs Impact Store Sales The unexpectedly low number of store closures in 2020 may reflect some retailers holding out for an upturn in store-based sales, supported in the meantime by reductions in fixed costs such as rent. In 2021, the rollout of vaccination programs should result in a partial recovery in store-based sales. However, these programs may take many months to reach a wide base of consumers and thus support a recovery in discretionary brick-and-mortar retail. Many retailers may not be able or willing to sustain operations at all of their stores until then. In addition, we expect a number of retailers will have kept stores open during the holiday season to maximize sales but may review those stores amid a difficult start to 2021. Crisis-Driven Online Shopping Habits Will Stick Compounding any recovery in store-based sales is likely to be a retention of crisis-driven shopping habits—namely, the shift to e-commerce. Even with a positive vaccination effect, we assume only a partial recovery in brick-and-mortar sales in 2021 in discretionary categories such as apparel, reflecting a high degree of online sales retention. Any sustained shift of sales online will impact store-level profitability, prompting some retailers to close underperforming stores. Trends from 2008 Recession Looking back at the great recession of 2008, which ended around June 2009, retail bankruptcies reached record highs in 2010, with 48 major filings. We noted that although retail was significantly impacted in 2008 and 2009, the repercussions in terms of retail bankruptcies peaked in 2010. Three major retailers—Christopher & Banks, L’Occitane and Loves Furniture—have already filed for bankruptcy this year, while department store chain Belk is set to file for bankruptcy imminently. We could see history repeat itself in 2021, resulting in greater numbers of store closures this year than we saw in 2020. Seesawing Trend in Store Closures Since 2015, Coresight Research’s US store closure data sets have shown a seesawing trend, wherein closure totals have always increased when there has been a dip in the previous year (see Figure 7). As 2020 was a dip year, it implies that 2021 may see an uptick in closures. US Retail Remains Overstored Despite substantial store closures in recent years, the US retail landscape continues to look overstored—relative both to other countries and to the proportion of sales that have migrated online.Figure 7. US Store Closure Totals of Major Retailers in Aggregate [wpdatatable id=715]

Source: Company reports/Coresight Research

Figure 8. 2021 Major US Store Closures as of January 22, 2021 [caption id="attachment_122381" align="aligncenter" width="725"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Children’s Place, Express, Gap, GNC, Heritage Brands, JCPenney, H&M, Michael Kors, Office Depot, RTW Retailwinds and Vitamin Shoppe, among others. Estimates for Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap and Michael Kors closures pertain to North America closures. Macy’s includes Macy’s and Bloomingdale’s banners. Ascena Retail Group includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Family Video, which operates primarily under a rental business model, is included in the chart since it also retails certain products and for comprehensiveness, given its outlets would commonly be perceived as retail stores.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Children’s Place, Express, Gap, GNC, Heritage Brands, JCPenney, H&M, Michael Kors, Office Depot, RTW Retailwinds and Vitamin Shoppe, among others. Estimates for Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap and Michael Kors closures pertain to North America closures. Macy’s includes Macy’s and Bloomingdale’s banners. Ascena Retail Group includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Family Video, which operates primarily under a rental business model, is included in the chart since it also retails certain products and for comprehensiveness, given its outlets would commonly be perceived as retail stores. *Total includes a small number of retailers that each announced fewer than five store closures which are not included in the chart.

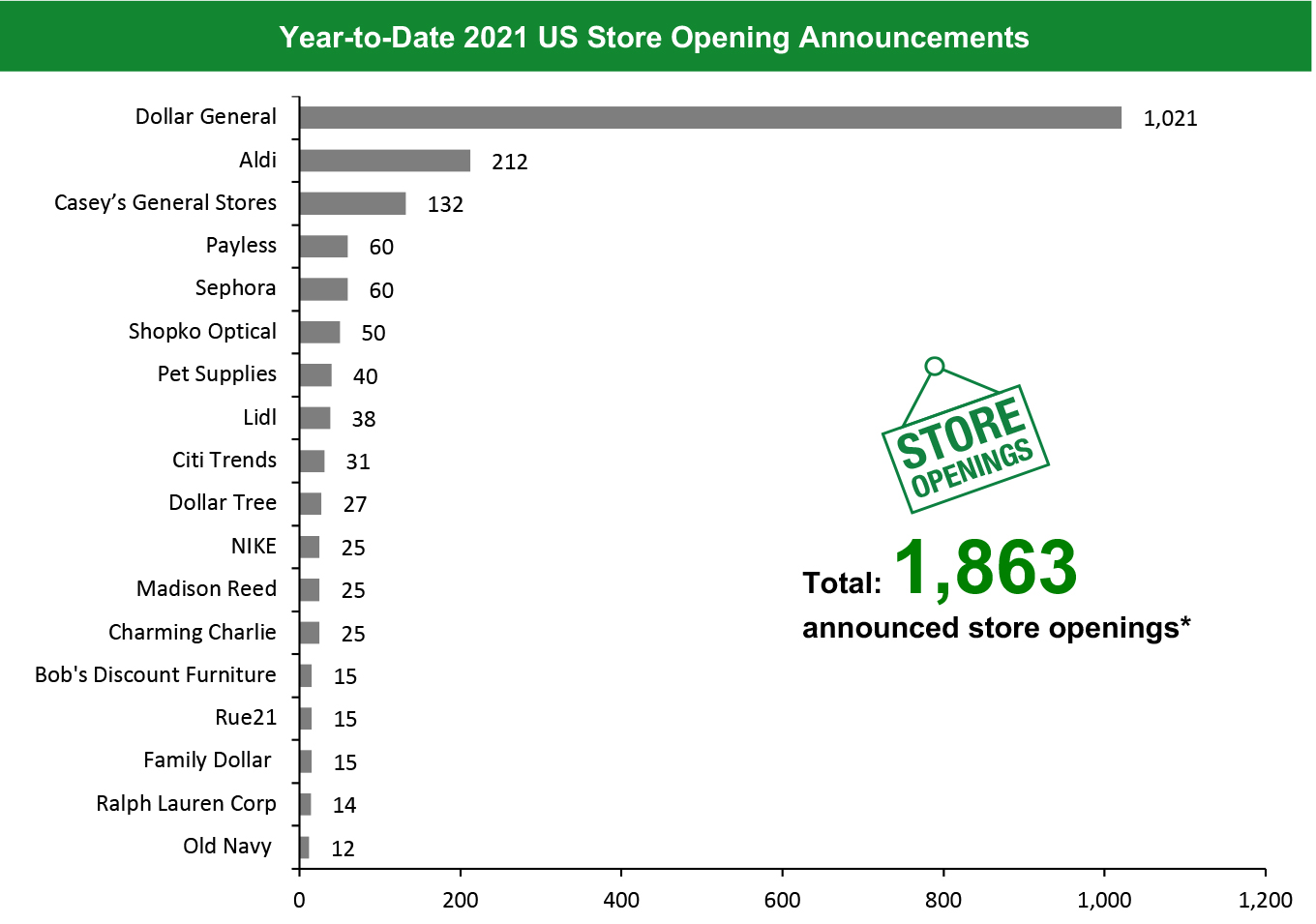

Source: Company reports/Coresight Research [/caption] US Store Openings Could Reach 4,000 in 2021 We estimate that in 2021, there will be between 3,500 and 4,000 US store openings. Despite 2020 being a difficult year for US retail, Coresight Research tracked 3,304 openings. Analyzing the store-openings trend since 2018, we note a dip followed by an increase each year. We expect that this pattern will continue into 2021, implying an increase in openings given the dip in 2020. In 2020, many retailers shelved their store expansion plans due to the uncertainty surrounding the pandemic and the return of consumers to stores, as well as the lack of clarity regarding whether and when vaccinations would begin to be administered. Furthermore, this was against the backdrop of a weak economy, with high unemployment levels and low consumer confidence. In 2021, some retailers are likely to be more confident (relative to 2020), given improvement in the economy and consumer confidence and the rollout of vaccines. As such, we estimate a slight increase in openings this year, albeit weighted toward the second half. We expect that some retailers will take a “wait-and-see” approach to opening substantial numbers of stores: Especially in discretionary sectors, retailers are likely to seek to gauge the timing and scale of any return to stores by shoppers, and this may inhibit the total number of openings.

Figure 9. US Store Opening Totals of Major Retailers in Aggregate [wpdatatable id=716]

Source: Company reports/Coresight Research By sector, we expect that discount retailers will once again lead store openings, as they did in 2020. Discount retailers tend to do well in the aftermath of a recessionary environment. Dollar General has already announced its store expansion plans for fiscal 2021, and as per our calendarized estimate, will open more than 1,000 stores this year. Dollar Tree and Five Below, however, are yet to announce their 2021 expansion plans. Discretionary retailers, such as those in the apparel sector, will be relatively more circumspect with their expansion plans overall during the year. That said, value fashion retailer Citi Trends announced earlier this month that it will open 100 new stores and remodel at least 150 stores by the end of its fiscal-year 2023, ending January 31, 2024. As per our calendarized estimate, the retailer will open 31 stores in 2021. As of January 22, 2021, the year-to-date store openings total is 1,863.

Figure 10. 2021 Major US Store Openings as of January 22, 2021 [caption id="attachment_122382" align="aligncenter" width="725"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aldi, Casey’s, Dollar General, Dollar Tree, Lidl, Madison Reed, and Payless among others.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aldi, Casey’s, Dollar General, Dollar Tree, Lidl, Madison Reed, and Payless among others. *Total includes a small number of retailers that each announced fewer than 12 store openings which are not included in the chart.

Source: Company reports/Coresight Research[/caption]

What We Think

Store-based retail was heavily impacted by the Covid-19 pandemic in 2020, particularly in discretionary categories, resulting in widespread closures. However, we expect that the fallout will be even greater in 2021 and that total store closures will exceed 2020 levels. While we saw 33 major retailers file for bankruptcy in 2020, three major retailers have already filed in January 2021. We expect to see many more follow suit in the coming months, which would inevitably include several more store-closure announcements. As vaccination programs are rolled out, we expect some improvement in store-based sales, but probably backweighted to the second half of 2021 and into 2022. We expect to see substantial e-commerce sales retention in 2021 as consumers’ pandemic-driven online shopping habits stick. This is likely to challenge store-level profitability for some retailers and, so, drive further closures. While we expect to see more store openings this year than in 2020, they will largely be led by discount and off-price retailers. We expect retailers in discretionary categories such as apparel to be relatively conservative with their expansion plans and focus more on optimizing their existing operations and rationalizing their current store fleet. Implications for Brands/Retailers- As retailers rationalize their store fleets, we expect them to enhance their e-commerce and omnichannel operations. Even if some stores are not shuttered, brick-and-mortar outlets will play a greater role in fulfilling e-commerce orders for some retailers.

- While store-level profitability may be challenged by the shift of sales online, retailers may need to consider how they assess the value of their stores. Where stores play a significant role in e-commerce fulfillment or drive online sales in a catchment area, companies will need to review whether traditional four-wall profitability is a true measure of a store’s value.

- We expect apparel to once again be the weakest major retail category this year and register the highest number of store closures.

- A rise in the number of mall-based apparel and department store closures and bankruptcies will significantly impact the revenues of malls.

- Mall owners will look to continue diversifying their tenant mix with more non-apparel tenants given that apparel retailers will likely continue to be stressed and could default or struggle with rent payments.