DIpil Das

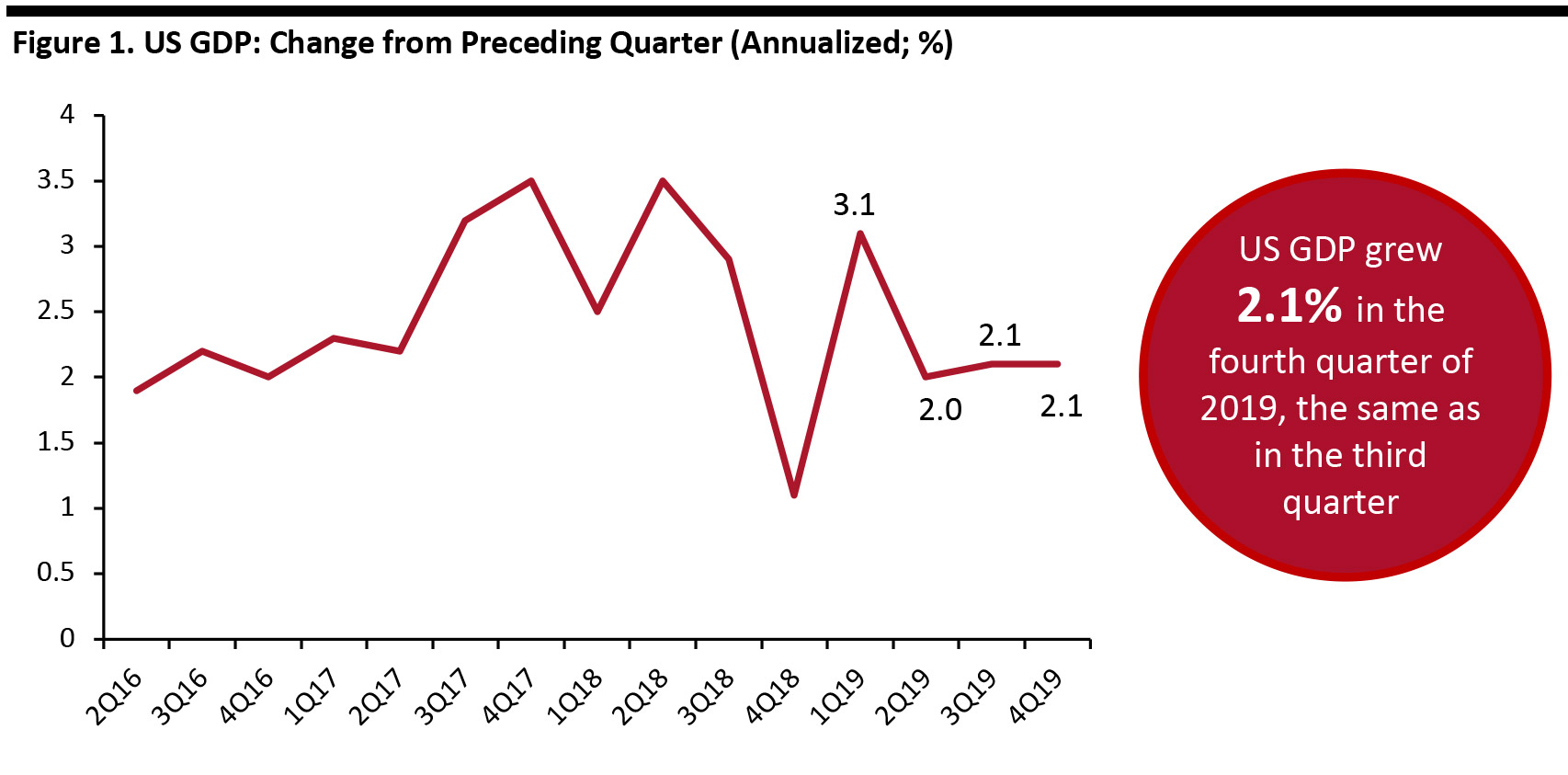

US GDP Growth Decelerates in the Second Quarter

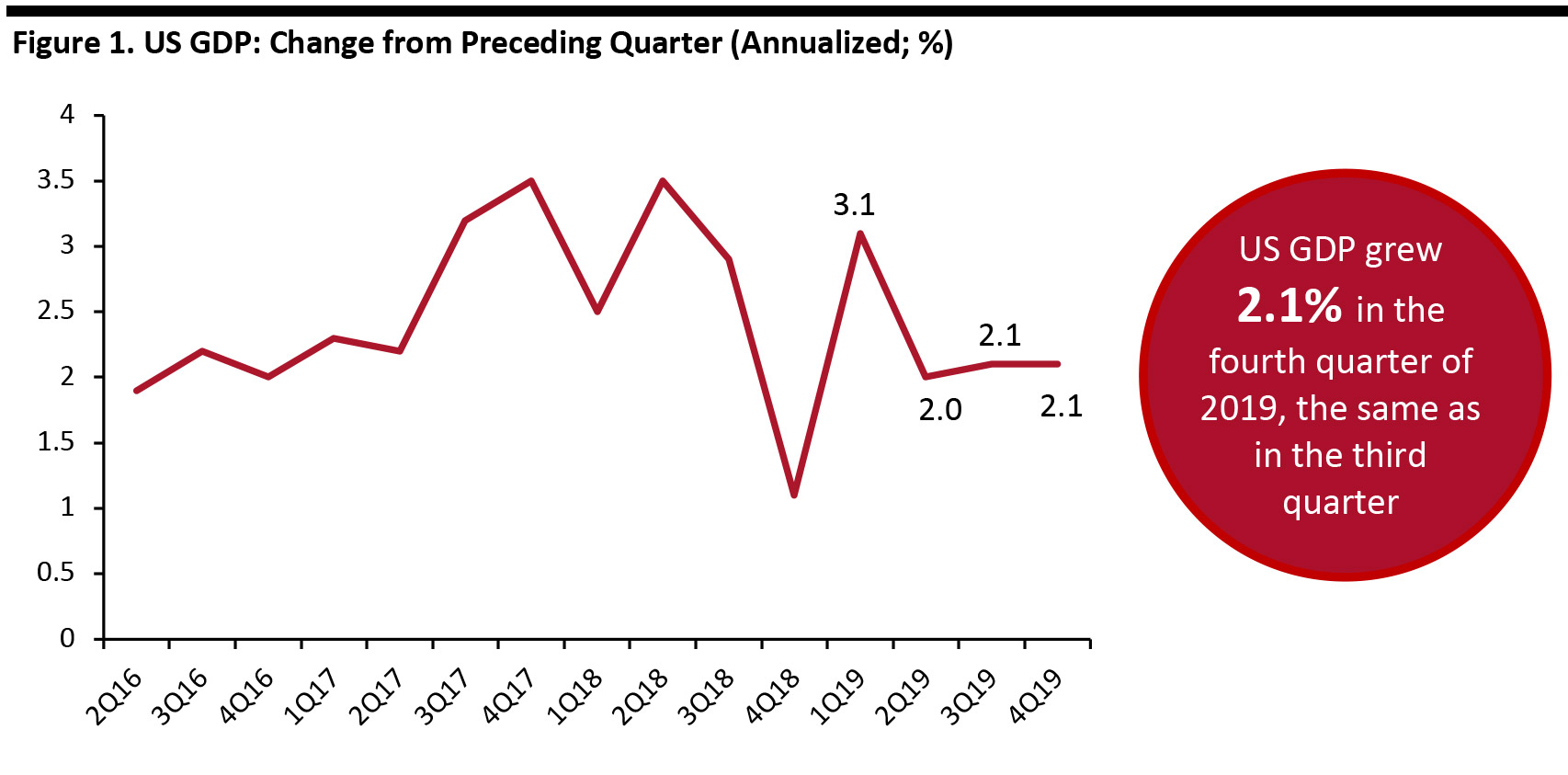

On January 30, the US Bureau of Economic Analysis (BEA) published its advance estimate of GDP growth, estimating the US economy expanded at an annual seasonally adjusted rate of 2.1% in the fourth quarter of 2019, matching third-quarter growth.

For the full year, the BEA estimates the US economy grew 2.3%, slowing from 2018’s 2.9% increase.

GDP growth in the fourth quarter was driven by positive contributions from personal consumption expenditures, federal government spending, state and local government spending, residential fixed investment and exports. However, these were partly offset by negative contributions from private inventory investment and nonresidential fixed investment.

Economic expansion in the full year was driven by positive contributions from personal consumption expenditures, federal government spending, state and local government spending, nonresidential fixed investment and private inventory investment. These were partly offset by negative contributions from residential fixed investment.

[caption id="attachment_103442" align="aligncenter" width="700"] Source: Bureau of Economic Analysis[/caption]

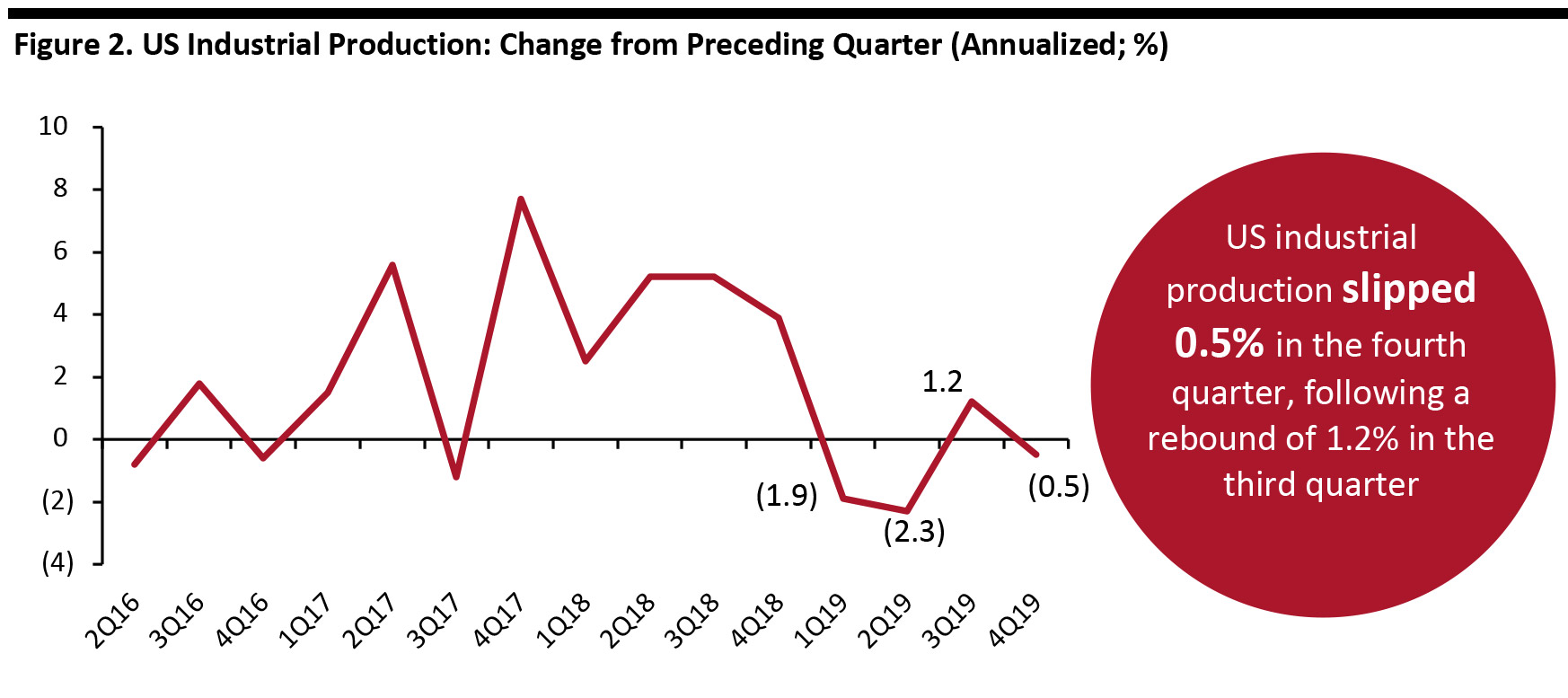

US Industrial Production Declines During the Fourth Quarter

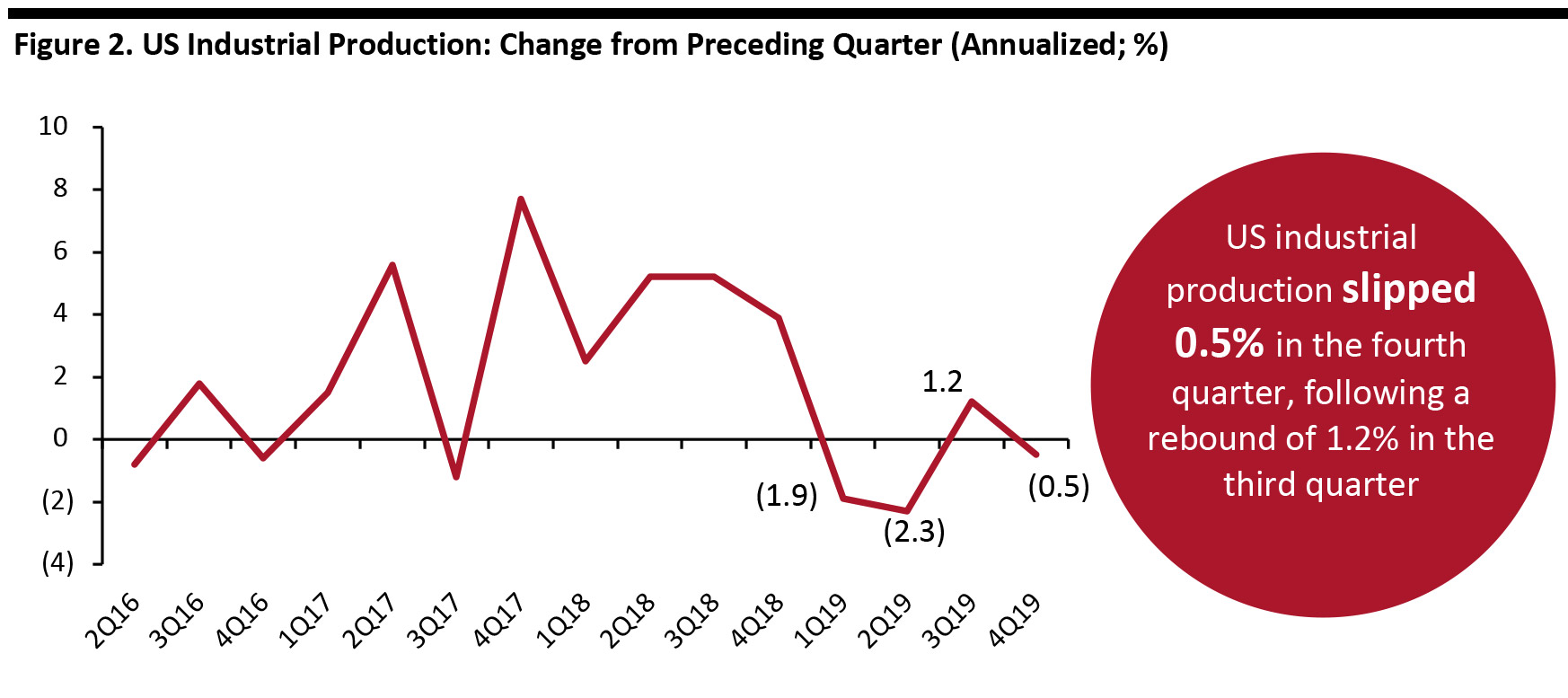

US industrial production slipped 0.5% in the fourth quarter, following a rebound of 1.2% in the third quarter of 2019. Consumer goods output rose 0.4% in the quarter, within which nondurable goods increased 2.2%, while durable goods fell 5.5%. Foods and tobacco was up 8.1% in the quarter, while clothing was down 11.4%.

[caption id="attachment_103443" align="aligncenter" width="700"]

Source: Bureau of Economic Analysis[/caption]

US Industrial Production Declines During the Fourth Quarter

US industrial production slipped 0.5% in the fourth quarter, following a rebound of 1.2% in the third quarter of 2019. Consumer goods output rose 0.4% in the quarter, within which nondurable goods increased 2.2%, while durable goods fell 5.5%. Foods and tobacco was up 8.1% in the quarter, while clothing was down 11.4%.

[caption id="attachment_103443" align="aligncenter" width="700"] Source: US Federal Reserve[/caption]

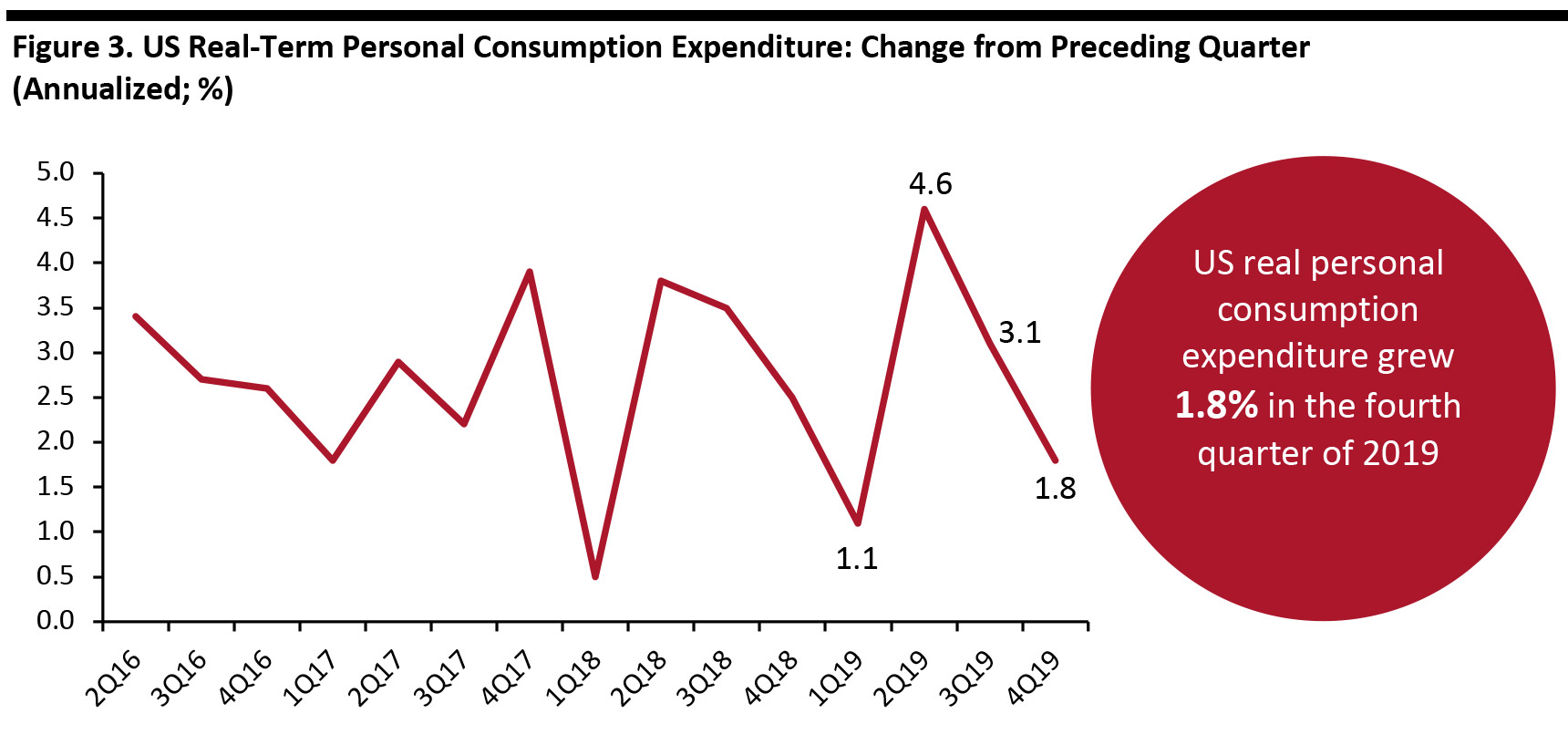

Personal Consumption Expenditure Decelerates During the Fourth Quarter

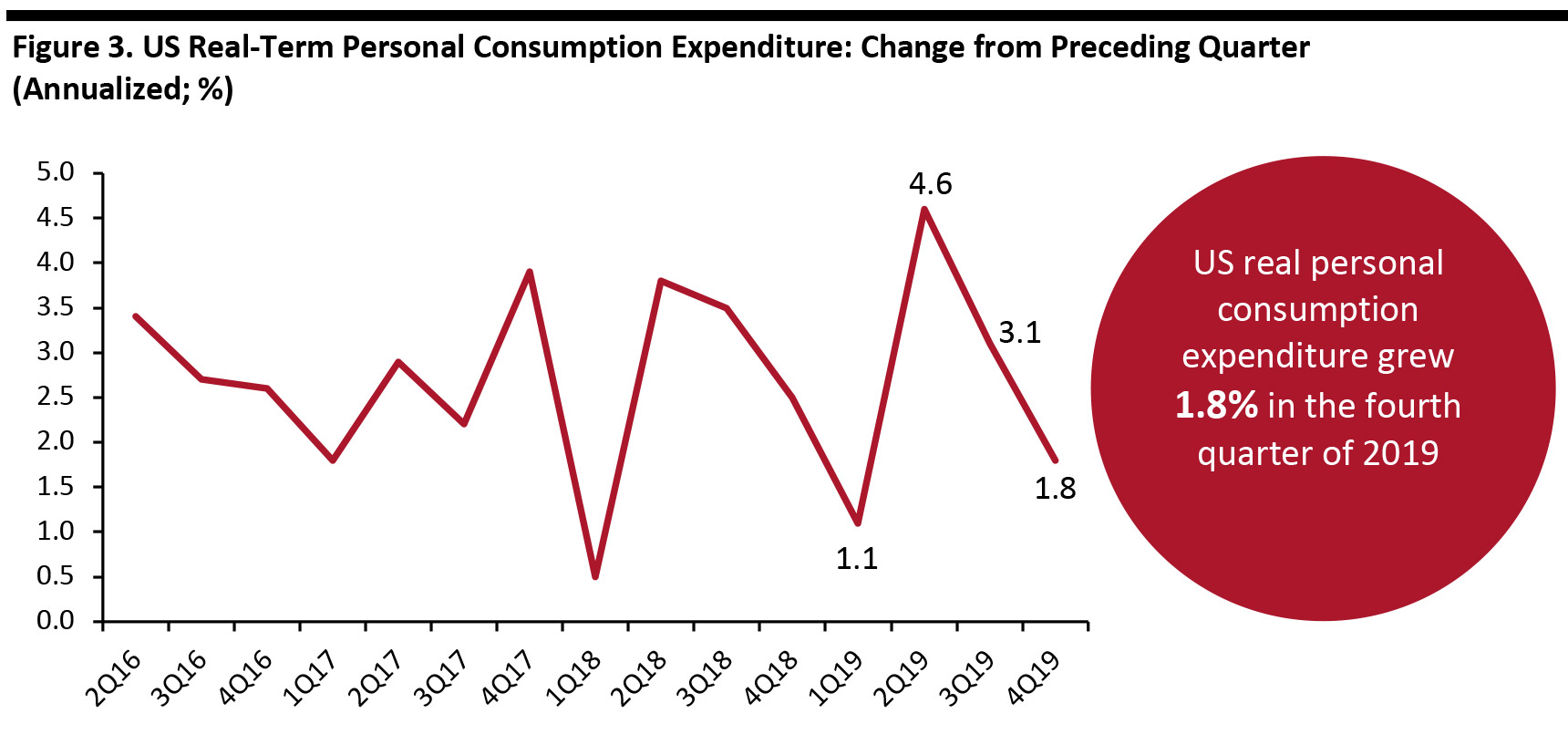

US real personal consumption expenditures (PCE, or consumer spending) increased at an annual rate of 1.8% during the fourth quarter of 2019, slowing from 3.1% in the third quarter.

In December, real personal disposable income (PDI, income after paying tax and other deductions) increased 0.2% while real PCE increased 0.3%. The December increase in real PDI can be attributed to higher wages and personal interest income, partially offset by a decrease in farm income. PCE rose in December on the back of a $2.5 billion increase in spending on goods and a $4.4 billion increase in spending on services.

[caption id="attachment_103444" align="aligncenter" width="700"]

Source: US Federal Reserve[/caption]

Personal Consumption Expenditure Decelerates During the Fourth Quarter

US real personal consumption expenditures (PCE, or consumer spending) increased at an annual rate of 1.8% during the fourth quarter of 2019, slowing from 3.1% in the third quarter.

In December, real personal disposable income (PDI, income after paying tax and other deductions) increased 0.2% while real PCE increased 0.3%. The December increase in real PDI can be attributed to higher wages and personal interest income, partially offset by a decrease in farm income. PCE rose in December on the back of a $2.5 billion increase in spending on goods and a $4.4 billion increase in spending on services.

[caption id="attachment_103444" align="aligncenter" width="700"] Source: Bureau of Economic Analysis[/caption]

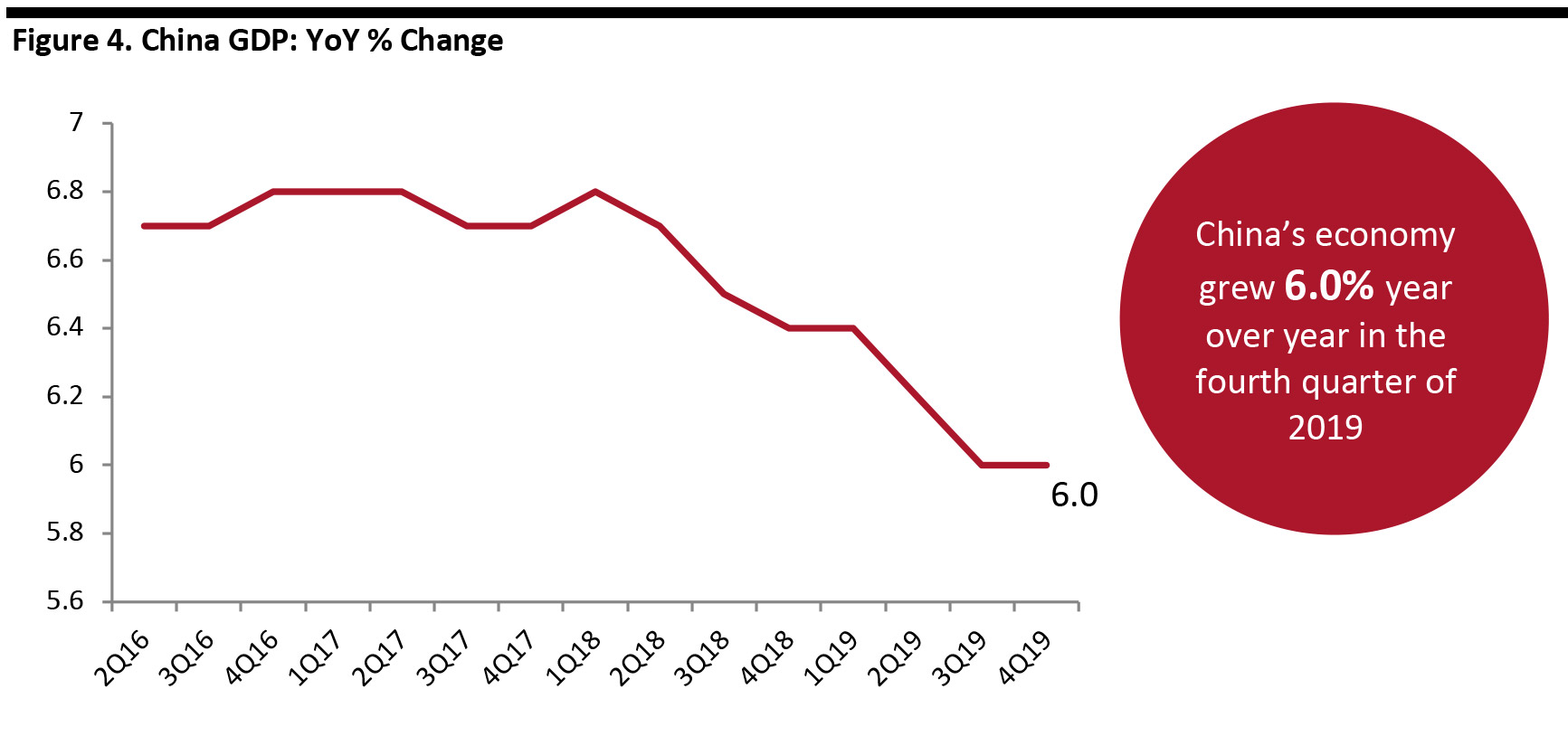

China’s GDP Growth Slows

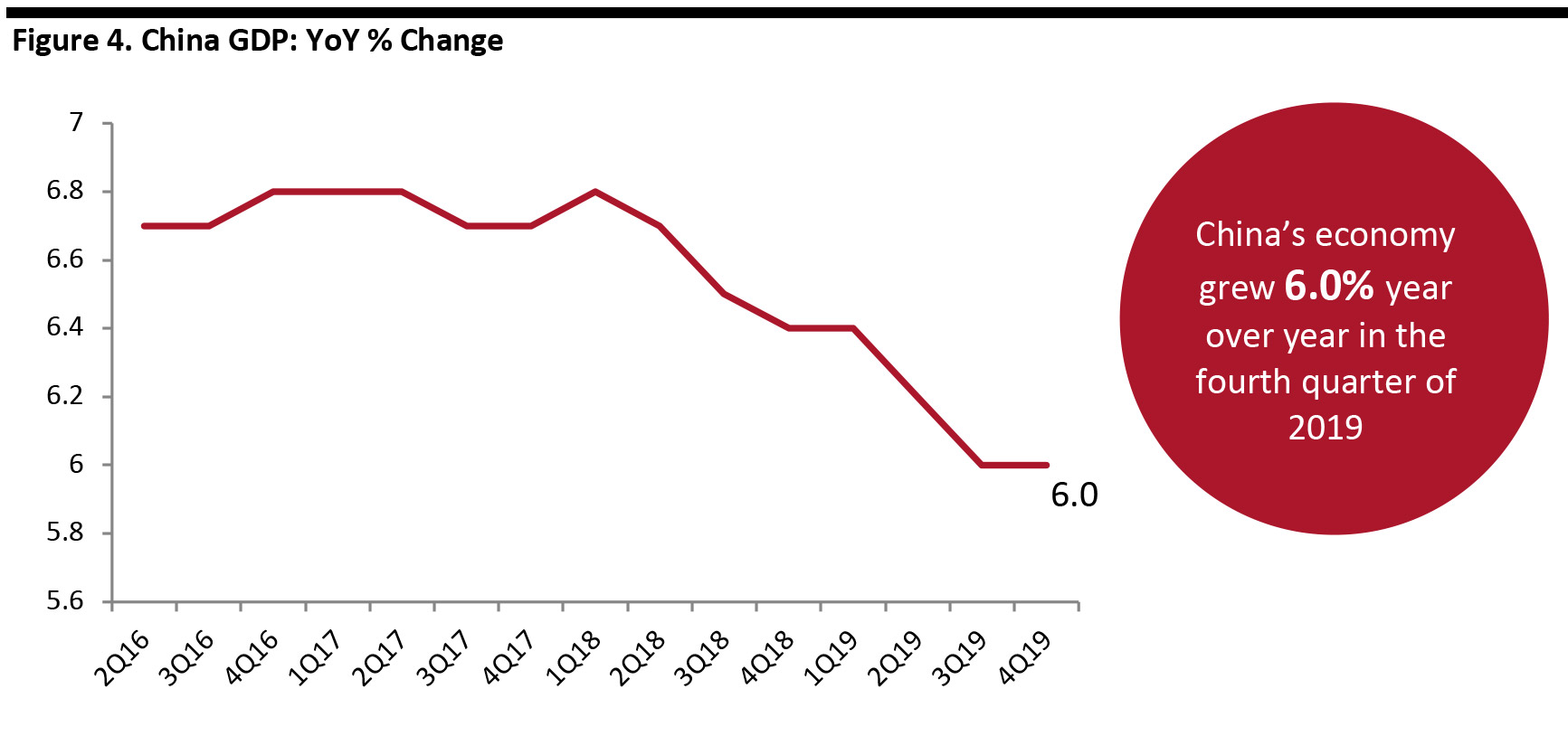

China’s economy grew 6.0% year over year in the fourth quarter of 2019, unchanged from the previous quarter. For the full year, China’s economy grew 6.1%, down from 6.6% in 2018 and the slowest in the past 29 years, but matching estimates by analysts surveyed in a Reuters poll and within the Chinese government’s target range of 6.0–6.5% for the year.

The data reflects weakening demand at home due to the ongoing coronavirus outbreak and the effects of trade tensions with the US.

The coronavirus will slow economic growth in the first quarter. Assuming the outbreak peaks by the end of February, we estimate first-quarter GDP growth could be more than 2 percentage points lower than it would otherwise have been. We assume China’s economy would have grown around 6% year over year in the first quarter without the outbreak, implying first-quarter growth could now come in at around 4% or lower.

[caption id="attachment_103445" align="aligncenter" width="700"]

Source: Bureau of Economic Analysis[/caption]

China’s GDP Growth Slows

China’s economy grew 6.0% year over year in the fourth quarter of 2019, unchanged from the previous quarter. For the full year, China’s economy grew 6.1%, down from 6.6% in 2018 and the slowest in the past 29 years, but matching estimates by analysts surveyed in a Reuters poll and within the Chinese government’s target range of 6.0–6.5% for the year.

The data reflects weakening demand at home due to the ongoing coronavirus outbreak and the effects of trade tensions with the US.

The coronavirus will slow economic growth in the first quarter. Assuming the outbreak peaks by the end of February, we estimate first-quarter GDP growth could be more than 2 percentage points lower than it would otherwise have been. We assume China’s economy would have grown around 6% year over year in the first quarter without the outbreak, implying first-quarter growth could now come in at around 4% or lower.

[caption id="attachment_103445" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

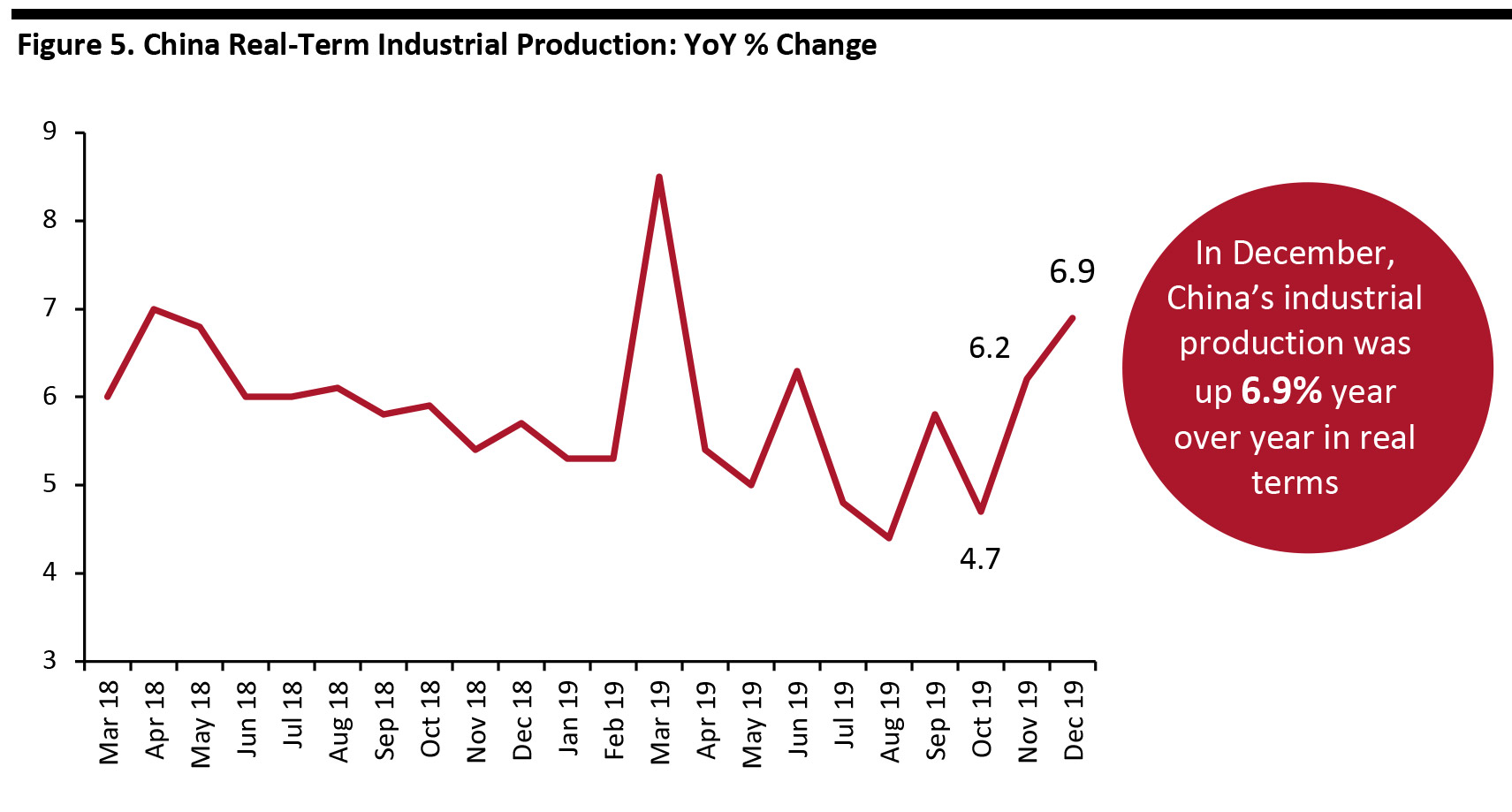

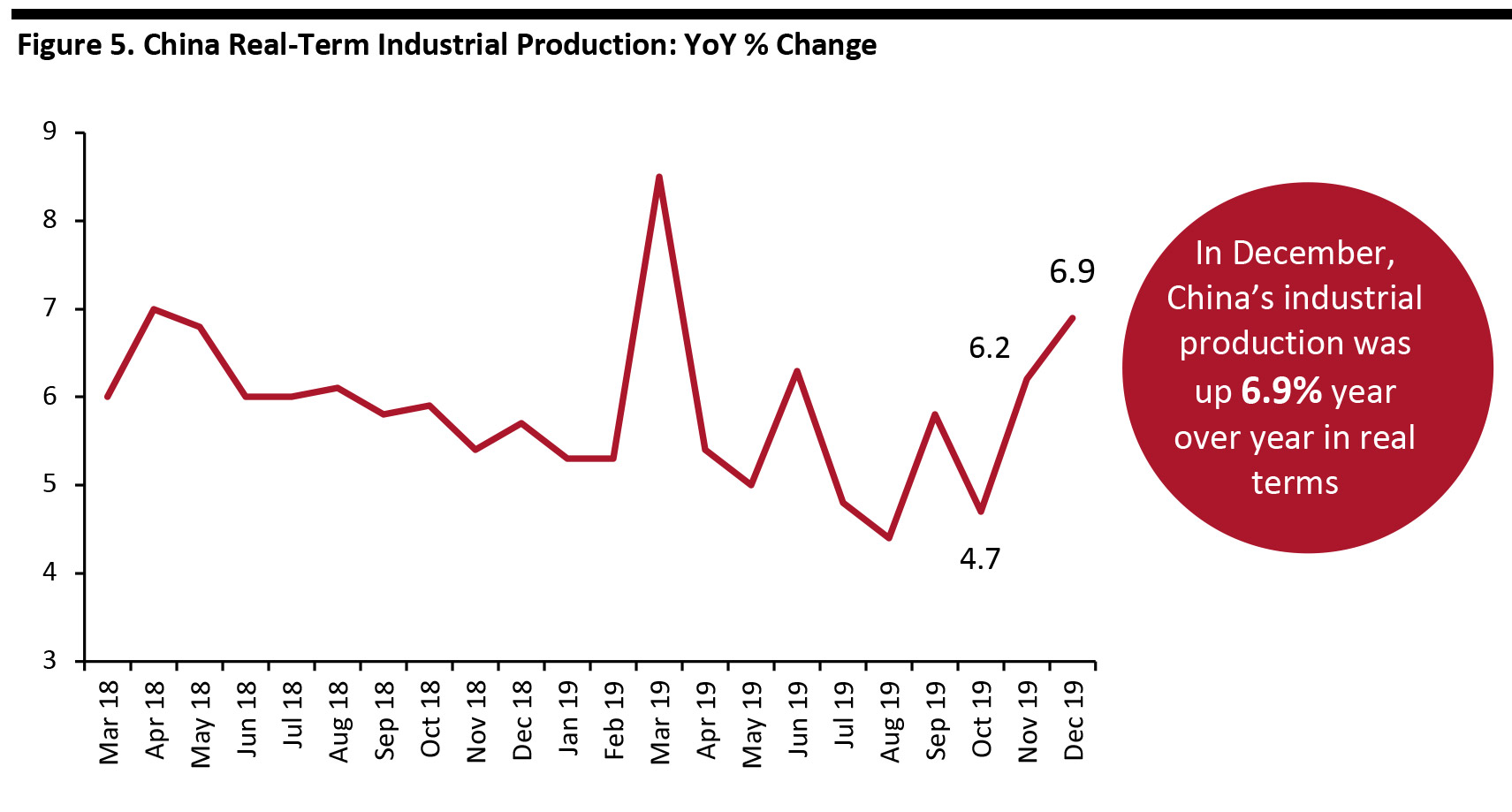

China’s Industrial Production Continues to Show Rising Momentum

In December, China’s industrial production was up 6.9% year over year in real terms, faster than November’s 6.2% growth rate and October’s 4.7%. For the full year, China’s industrial output expanded 5.7%, slightly ahead of the estimate of 5.6% by the Ministry of Industry and Information Technology.

Industrial production in mining and quarrying grew 5.6% year over year in December, manufacturing increased 7.0%, and production and distribution of electricity, heating power, gas and water were up 6.8%.

[caption id="attachment_103446" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China[/caption]

China’s Industrial Production Continues to Show Rising Momentum

In December, China’s industrial production was up 6.9% year over year in real terms, faster than November’s 6.2% growth rate and October’s 4.7%. For the full year, China’s industrial output expanded 5.7%, slightly ahead of the estimate of 5.6% by the Ministry of Industry and Information Technology.

Industrial production in mining and quarrying grew 5.6% year over year in December, manufacturing increased 7.0%, and production and distribution of electricity, heating power, gas and water were up 6.8%.

[caption id="attachment_103446" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

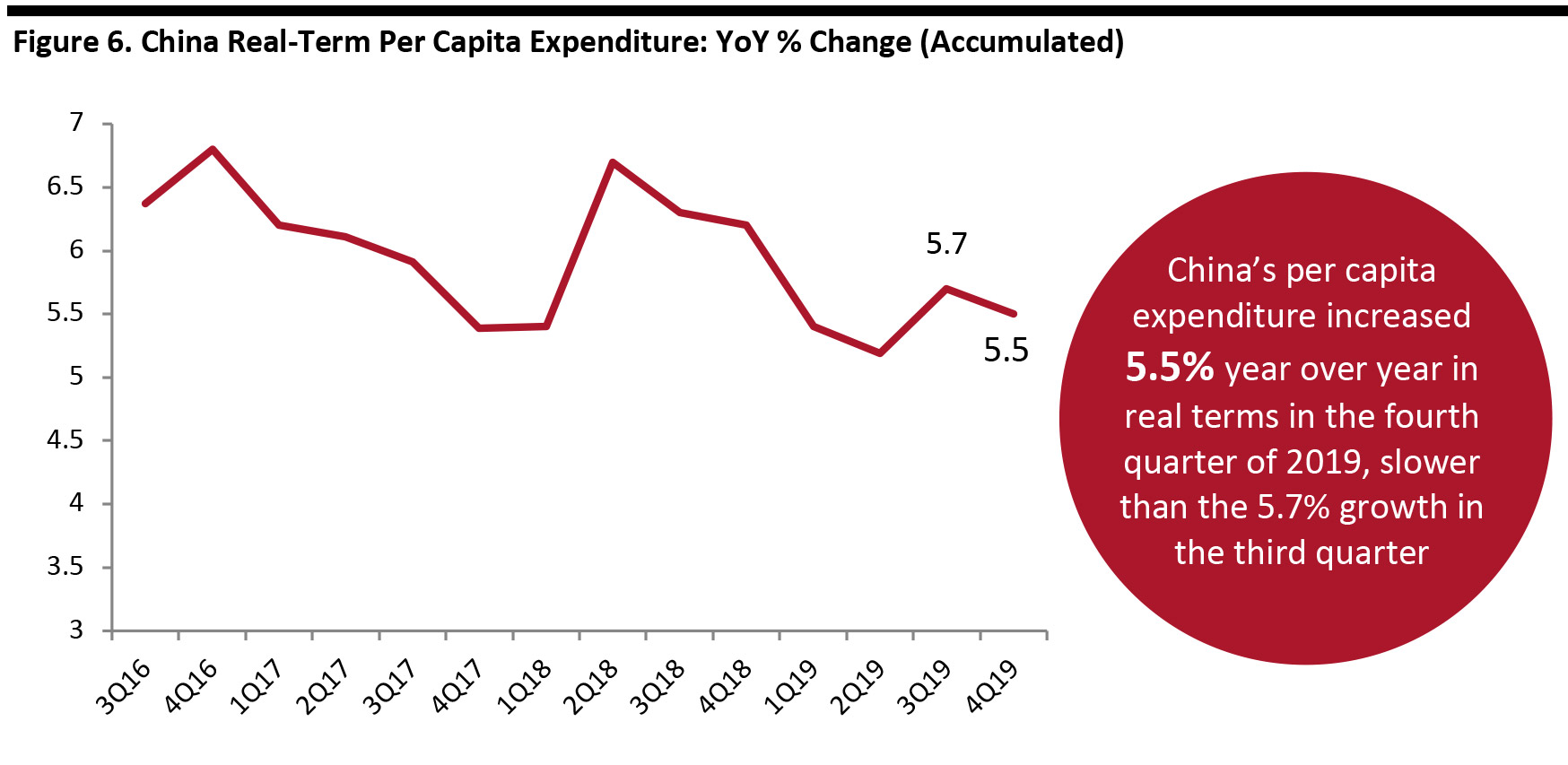

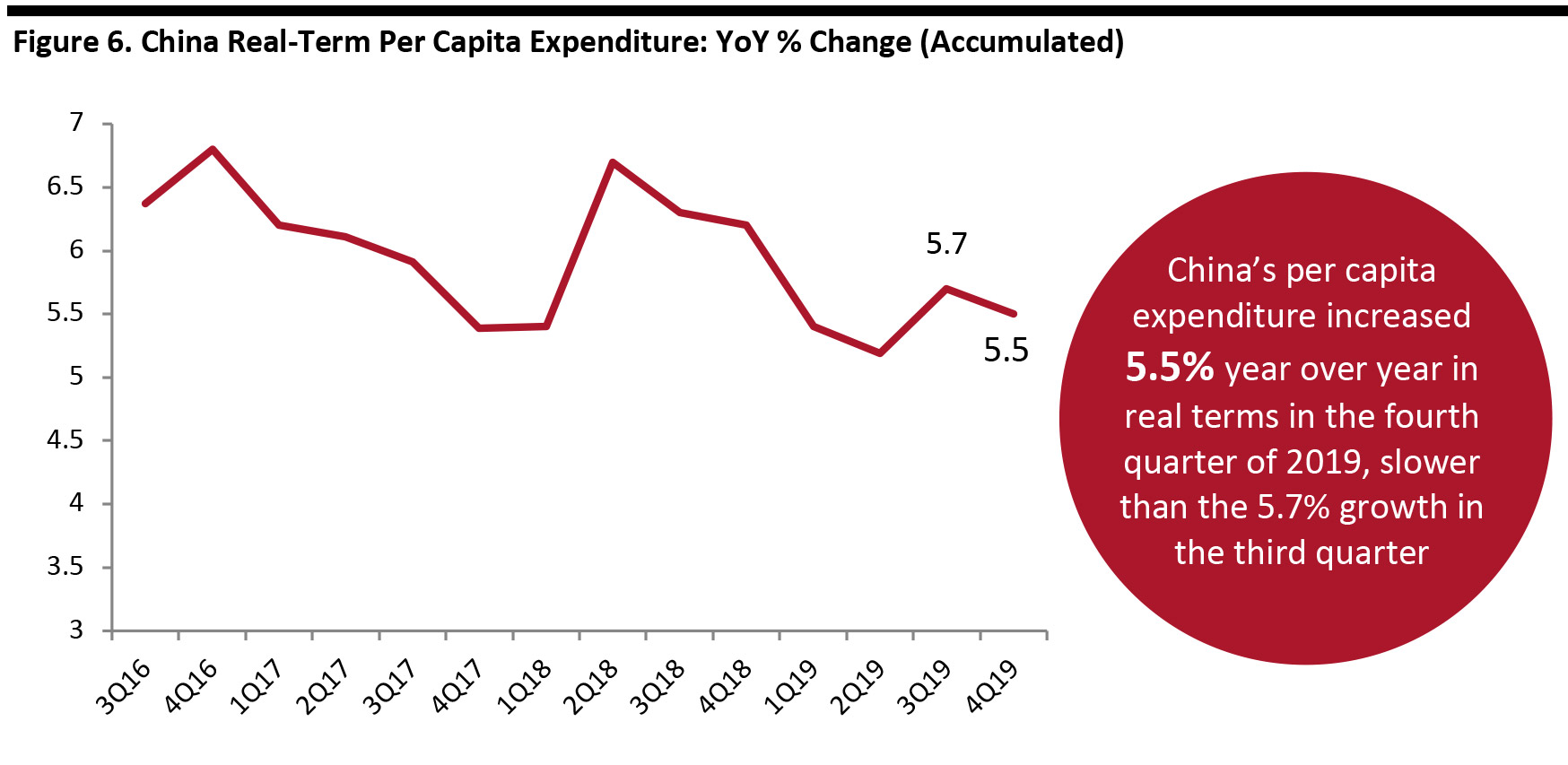

China’s Real-Term Per Capita Expenditure Growth Slows

Accumulated per capita expenditure in real terms increased 5.5% year over year in China in the fourth quarter of 2019, slower than the 5.7% growth registered in the third quarter of 2019. Retail sales grew 8.0% year over year in both November and December, following 7.2% in October. The faster growth in last two months of 2019 was largely driven by the Double 11 and Double 12 shopping festivals. Retail sales in 2019 were up 8% year over year.

[caption id="attachment_103447" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China[/caption]

China’s Real-Term Per Capita Expenditure Growth Slows

Accumulated per capita expenditure in real terms increased 5.5% year over year in China in the fourth quarter of 2019, slower than the 5.7% growth registered in the third quarter of 2019. Retail sales grew 8.0% year over year in both November and December, following 7.2% in October. The faster growth in last two months of 2019 was largely driven by the Double 11 and Double 12 shopping festivals. Retail sales in 2019 were up 8% year over year.

[caption id="attachment_103447" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

Source: National Bureau of Statistics of China[/caption]

Source: Bureau of Economic Analysis[/caption]

US Industrial Production Declines During the Fourth Quarter

US industrial production slipped 0.5% in the fourth quarter, following a rebound of 1.2% in the third quarter of 2019. Consumer goods output rose 0.4% in the quarter, within which nondurable goods increased 2.2%, while durable goods fell 5.5%. Foods and tobacco was up 8.1% in the quarter, while clothing was down 11.4%.

[caption id="attachment_103443" align="aligncenter" width="700"]

Source: Bureau of Economic Analysis[/caption]

US Industrial Production Declines During the Fourth Quarter

US industrial production slipped 0.5% in the fourth quarter, following a rebound of 1.2% in the third quarter of 2019. Consumer goods output rose 0.4% in the quarter, within which nondurable goods increased 2.2%, while durable goods fell 5.5%. Foods and tobacco was up 8.1% in the quarter, while clothing was down 11.4%.

[caption id="attachment_103443" align="aligncenter" width="700"] Source: US Federal Reserve[/caption]

Personal Consumption Expenditure Decelerates During the Fourth Quarter

US real personal consumption expenditures (PCE, or consumer spending) increased at an annual rate of 1.8% during the fourth quarter of 2019, slowing from 3.1% in the third quarter.

In December, real personal disposable income (PDI, income after paying tax and other deductions) increased 0.2% while real PCE increased 0.3%. The December increase in real PDI can be attributed to higher wages and personal interest income, partially offset by a decrease in farm income. PCE rose in December on the back of a $2.5 billion increase in spending on goods and a $4.4 billion increase in spending on services.

[caption id="attachment_103444" align="aligncenter" width="700"]

Source: US Federal Reserve[/caption]

Personal Consumption Expenditure Decelerates During the Fourth Quarter

US real personal consumption expenditures (PCE, or consumer spending) increased at an annual rate of 1.8% during the fourth quarter of 2019, slowing from 3.1% in the third quarter.

In December, real personal disposable income (PDI, income after paying tax and other deductions) increased 0.2% while real PCE increased 0.3%. The December increase in real PDI can be attributed to higher wages and personal interest income, partially offset by a decrease in farm income. PCE rose in December on the back of a $2.5 billion increase in spending on goods and a $4.4 billion increase in spending on services.

[caption id="attachment_103444" align="aligncenter" width="700"] Source: Bureau of Economic Analysis[/caption]

China’s GDP Growth Slows

China’s economy grew 6.0% year over year in the fourth quarter of 2019, unchanged from the previous quarter. For the full year, China’s economy grew 6.1%, down from 6.6% in 2018 and the slowest in the past 29 years, but matching estimates by analysts surveyed in a Reuters poll and within the Chinese government’s target range of 6.0–6.5% for the year.

The data reflects weakening demand at home due to the ongoing coronavirus outbreak and the effects of trade tensions with the US.

The coronavirus will slow economic growth in the first quarter. Assuming the outbreak peaks by the end of February, we estimate first-quarter GDP growth could be more than 2 percentage points lower than it would otherwise have been. We assume China’s economy would have grown around 6% year over year in the first quarter without the outbreak, implying first-quarter growth could now come in at around 4% or lower.

[caption id="attachment_103445" align="aligncenter" width="700"]

Source: Bureau of Economic Analysis[/caption]

China’s GDP Growth Slows

China’s economy grew 6.0% year over year in the fourth quarter of 2019, unchanged from the previous quarter. For the full year, China’s economy grew 6.1%, down from 6.6% in 2018 and the slowest in the past 29 years, but matching estimates by analysts surveyed in a Reuters poll and within the Chinese government’s target range of 6.0–6.5% for the year.

The data reflects weakening demand at home due to the ongoing coronavirus outbreak and the effects of trade tensions with the US.

The coronavirus will slow economic growth in the first quarter. Assuming the outbreak peaks by the end of February, we estimate first-quarter GDP growth could be more than 2 percentage points lower than it would otherwise have been. We assume China’s economy would have grown around 6% year over year in the first quarter without the outbreak, implying first-quarter growth could now come in at around 4% or lower.

[caption id="attachment_103445" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

China’s Industrial Production Continues to Show Rising Momentum

In December, China’s industrial production was up 6.9% year over year in real terms, faster than November’s 6.2% growth rate and October’s 4.7%. For the full year, China’s industrial output expanded 5.7%, slightly ahead of the estimate of 5.6% by the Ministry of Industry and Information Technology.

Industrial production in mining and quarrying grew 5.6% year over year in December, manufacturing increased 7.0%, and production and distribution of electricity, heating power, gas and water were up 6.8%.

[caption id="attachment_103446" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China[/caption]

China’s Industrial Production Continues to Show Rising Momentum

In December, China’s industrial production was up 6.9% year over year in real terms, faster than November’s 6.2% growth rate and October’s 4.7%. For the full year, China’s industrial output expanded 5.7%, slightly ahead of the estimate of 5.6% by the Ministry of Industry and Information Technology.

Industrial production in mining and quarrying grew 5.6% year over year in December, manufacturing increased 7.0%, and production and distribution of electricity, heating power, gas and water were up 6.8%.

[caption id="attachment_103446" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

China’s Real-Term Per Capita Expenditure Growth Slows

Accumulated per capita expenditure in real terms increased 5.5% year over year in China in the fourth quarter of 2019, slower than the 5.7% growth registered in the third quarter of 2019. Retail sales grew 8.0% year over year in both November and December, following 7.2% in October. The faster growth in last two months of 2019 was largely driven by the Double 11 and Double 12 shopping festivals. Retail sales in 2019 were up 8% year over year.

[caption id="attachment_103447" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China[/caption]

China’s Real-Term Per Capita Expenditure Growth Slows

Accumulated per capita expenditure in real terms increased 5.5% year over year in China in the fourth quarter of 2019, slower than the 5.7% growth registered in the third quarter of 2019. Retail sales grew 8.0% year over year in both November and December, following 7.2% in October. The faster growth in last two months of 2019 was largely driven by the Double 11 and Double 12 shopping festivals. Retail sales in 2019 were up 8% year over year.

[caption id="attachment_103447" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

Source: National Bureau of Statistics of China[/caption]