Nitheesh NH

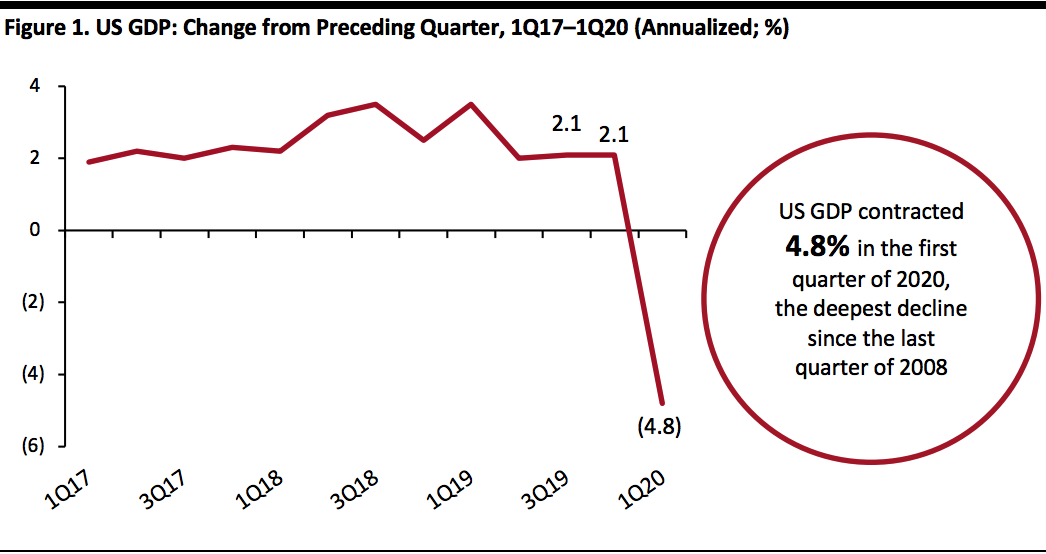

US GDP Shrinks at Fastest Pace since the Great Recession

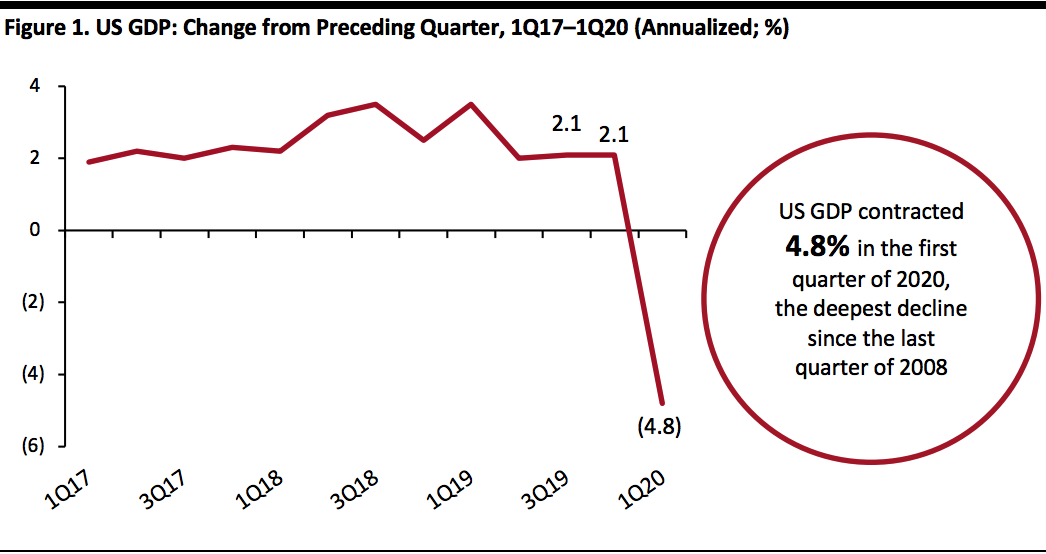

On April 29, 2020, the US Bureau of Economic Analysis (BEA) published its advance estimate of GDP growth, estimating that the US economy shrank at an annual seasonally adjusted rate of 4.8% in the first quarter of 2020, impacted by the spread of coronavirus. This is worse than the market consensus of a 4.0% reduction and is the lowest level since the 8.4% drop in the fourth quarter of 2008, during the Great Recession. The US lockdown began in late March, meaning that only a small proportion of the first quarter of 2020 was directly impacted by stay-at-home orders and the closure of nonessential businesses.

GDP in the first quarter was dragged down by personal consumption expenditures, nonresidential fixed investment, exports and private inventory investment. These were partially offset by positive contributions from federal government spending, state and local government spending and residential fixed investment.

The BEA noted that the advance estimate is probably inaccurate, because the full economic effects of the coronavirus cannot be quantified in the first-quarter GDP estimate, which is based on source data that are incomplete and subject to updates.

The GDP decline in the second quarter is set to far worse, as it will capture the impact of business shutdown and stay-at-home orders more fully. The US unemployment rate rose to 14.7% in April, according to the US Bureau of Labor Statistics. Jerome Powell, US Federal Reserve Chair, warned that the US economy could collapse 20–30% in the second quarter of 2020.

[caption id="attachment_109979" align="aligncenter" width="700"] Source: Bureau of Economic Analysis[/caption]

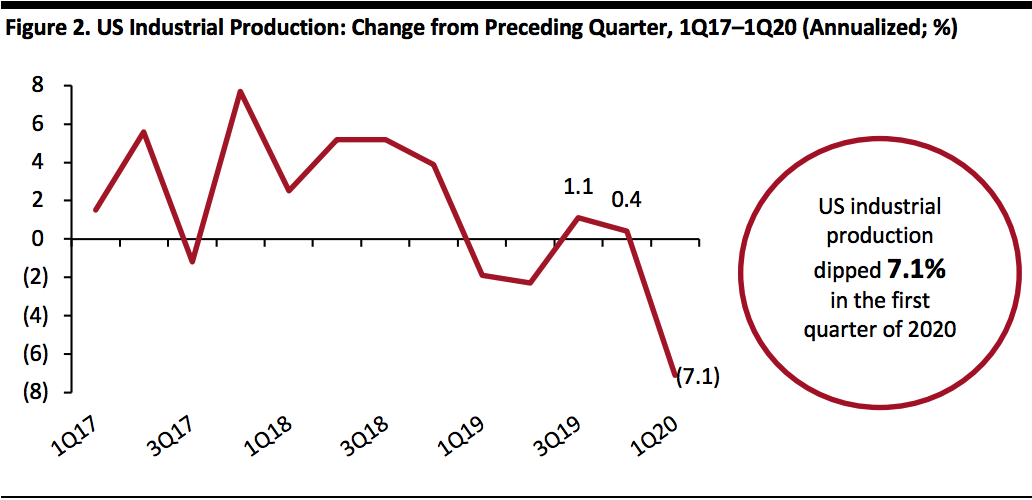

US Industrial Production Declines in the First Quarter

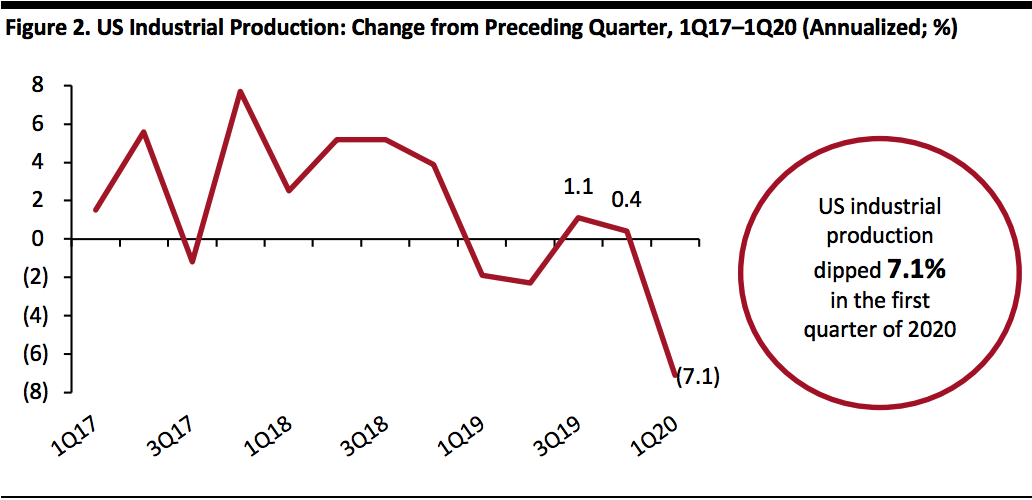

US industrial production slipped 7.1% in the first quarter, as the coronavirus pandemic led to factories suspending their operations from late March. Output of consumer goods plummeted 8.7% in the quarter, within which durable goods slid 11.9%, while durable goods fell 7.7%. Food and tobacco had the smallest decline, down 0.4% in the quarter, while clothing was down 16.2%.

Industrial production could fall further in the second quarter of the year. In April 2020, industrial production nosedived 11.2%, the deepest monthly drop on record, dating back 101 years. Several major factories in the US have gradually started to reopen, as of late May.

[caption id="attachment_109993" align="aligncenter" width="700"]

Source: Bureau of Economic Analysis[/caption]

US Industrial Production Declines in the First Quarter

US industrial production slipped 7.1% in the first quarter, as the coronavirus pandemic led to factories suspending their operations from late March. Output of consumer goods plummeted 8.7% in the quarter, within which durable goods slid 11.9%, while durable goods fell 7.7%. Food and tobacco had the smallest decline, down 0.4% in the quarter, while clothing was down 16.2%.

Industrial production could fall further in the second quarter of the year. In April 2020, industrial production nosedived 11.2%, the deepest monthly drop on record, dating back 101 years. Several major factories in the US have gradually started to reopen, as of late May.

[caption id="attachment_109993" align="aligncenter" width="700"] Source: US Federal Reserve[/caption]

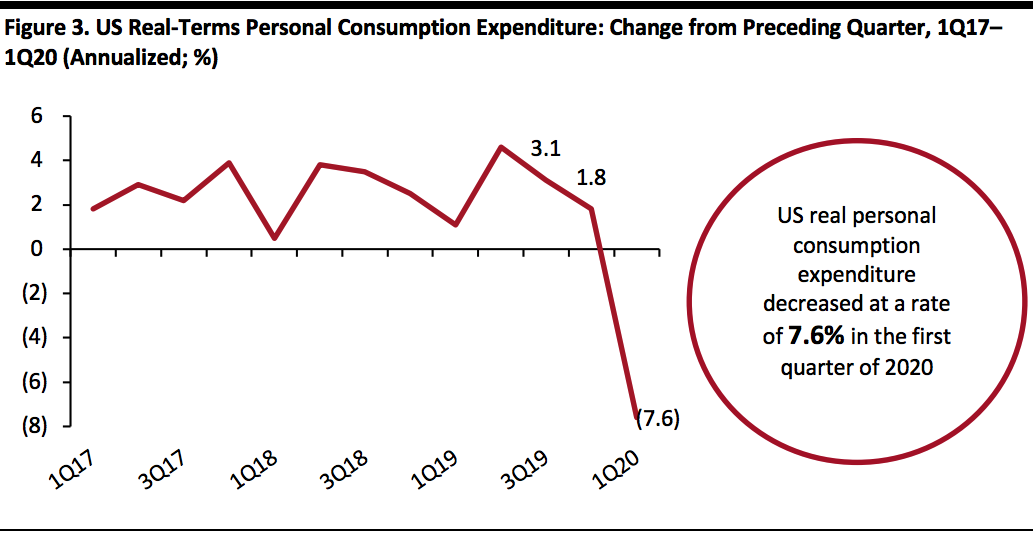

Personal Consumption Expenditure Plunges during the First Quarter

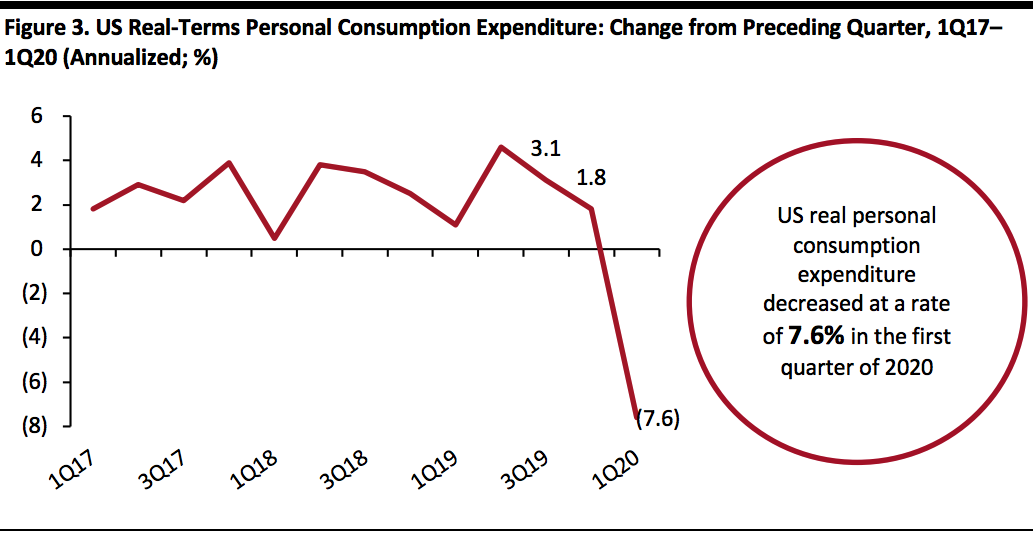

US real personal consumption expenditures (PCE, or consumer spending) tumbled sharply at an annual rate of 7.6% during the first quarter of 2020, following the 1.8% growth in the previous quarter.

In March, real PCE fell 7.3%, while disposable personal income (DPI, income after paying tax and other deductions) decreased 1.7%. The decrease in real DPI in March can be attributed to a decrease in employee compensation. The decline in real PCE in December was a result of a drop of $829.9 billion (10.2%) in spending on services and a fall of $104.9 billion (1.3%) in spending on goods. Within goods, spending on nondurable goods rose a strong 6.9%, reflecting that shoppers were buying groceries and household essentials, while PCE on durable goods fell 16.1%.

Within services, the leading contributors of the contraction was spending on healthcare, as well as spending on food services, accommodation and recreation services. The spending on goods was dragged down by motor vehicles and parts, although this was partly offset by purchases of food and beverages for off-premises consumption.

[caption id="attachment_109994" align="aligncenter" width="700"]

Source: US Federal Reserve[/caption]

Personal Consumption Expenditure Plunges during the First Quarter

US real personal consumption expenditures (PCE, or consumer spending) tumbled sharply at an annual rate of 7.6% during the first quarter of 2020, following the 1.8% growth in the previous quarter.

In March, real PCE fell 7.3%, while disposable personal income (DPI, income after paying tax and other deductions) decreased 1.7%. The decrease in real DPI in March can be attributed to a decrease in employee compensation. The decline in real PCE in December was a result of a drop of $829.9 billion (10.2%) in spending on services and a fall of $104.9 billion (1.3%) in spending on goods. Within goods, spending on nondurable goods rose a strong 6.9%, reflecting that shoppers were buying groceries and household essentials, while PCE on durable goods fell 16.1%.

Within services, the leading contributors of the contraction was spending on healthcare, as well as spending on food services, accommodation and recreation services. The spending on goods was dragged down by motor vehicles and parts, although this was partly offset by purchases of food and beverages for off-premises consumption.

[caption id="attachment_109994" align="aligncenter" width="700"] Source: Bureau of Economic Analysis[/caption]

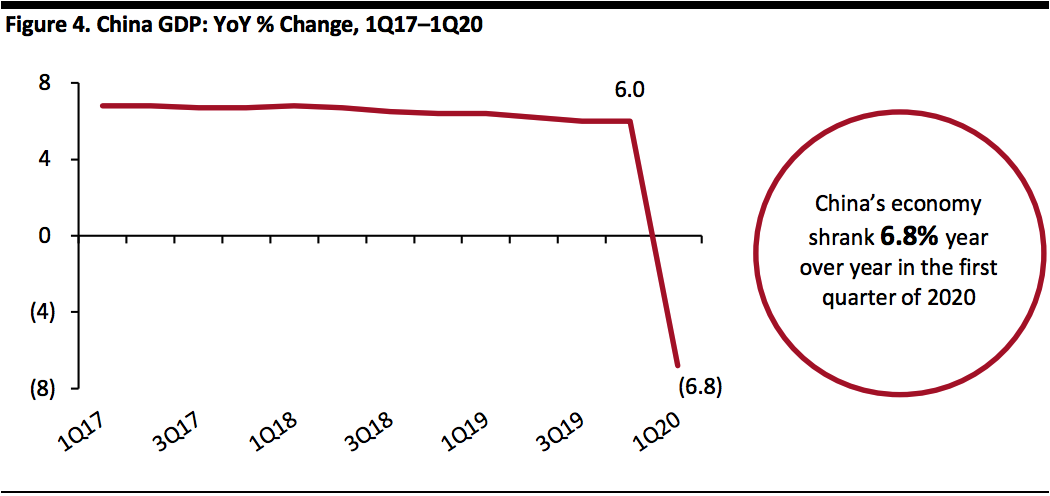

China’s GDP Slumps for the First time in Decades due to the Coronavirus

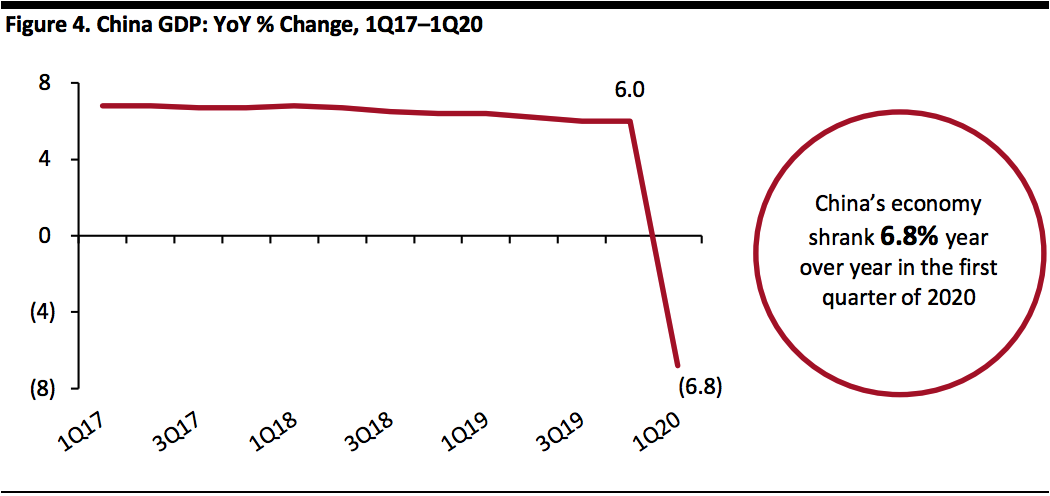

China’s economy shrank 6.8% year over year in the first quarter of 2020, after 6% growth the previous quarter, according to the National Bureau of Statistics of China. This was below the 6.5% reduction that analysts surveyed in a Reuters poll had predicted and was the country’s first GDP contraction since 1992. The unprecedented plunge was caused by a roughly two-month long shutdown and a halt on almost all business activities. China’s exports dropped 11.4% in the first quarter of 2020.

The government has unleashed a range of stimulus measures and is considering greater policy support to fuel domestic demand. The economy may remain weak in the second quarter as the coronavirus crisis continues to hit global demand.

[caption id="attachment_109995" align="aligncenter" width="700"]

Source: Bureau of Economic Analysis[/caption]

China’s GDP Slumps for the First time in Decades due to the Coronavirus

China’s economy shrank 6.8% year over year in the first quarter of 2020, after 6% growth the previous quarter, according to the National Bureau of Statistics of China. This was below the 6.5% reduction that analysts surveyed in a Reuters poll had predicted and was the country’s first GDP contraction since 1992. The unprecedented plunge was caused by a roughly two-month long shutdown and a halt on almost all business activities. China’s exports dropped 11.4% in the first quarter of 2020.

The government has unleashed a range of stimulus measures and is considering greater policy support to fuel domestic demand. The economy may remain weak in the second quarter as the coronavirus crisis continues to hit global demand.

[caption id="attachment_109995" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

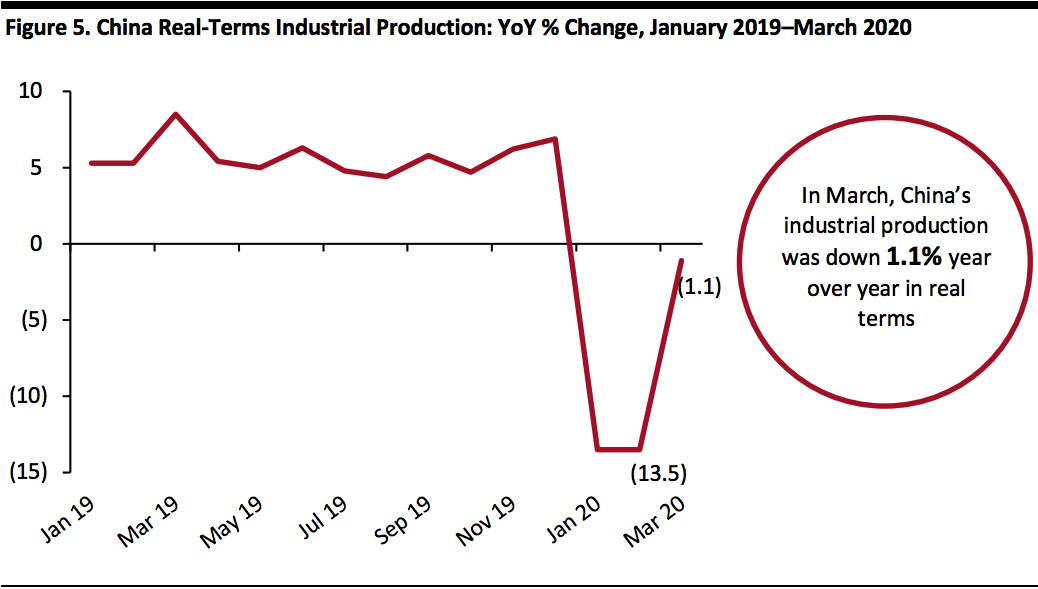

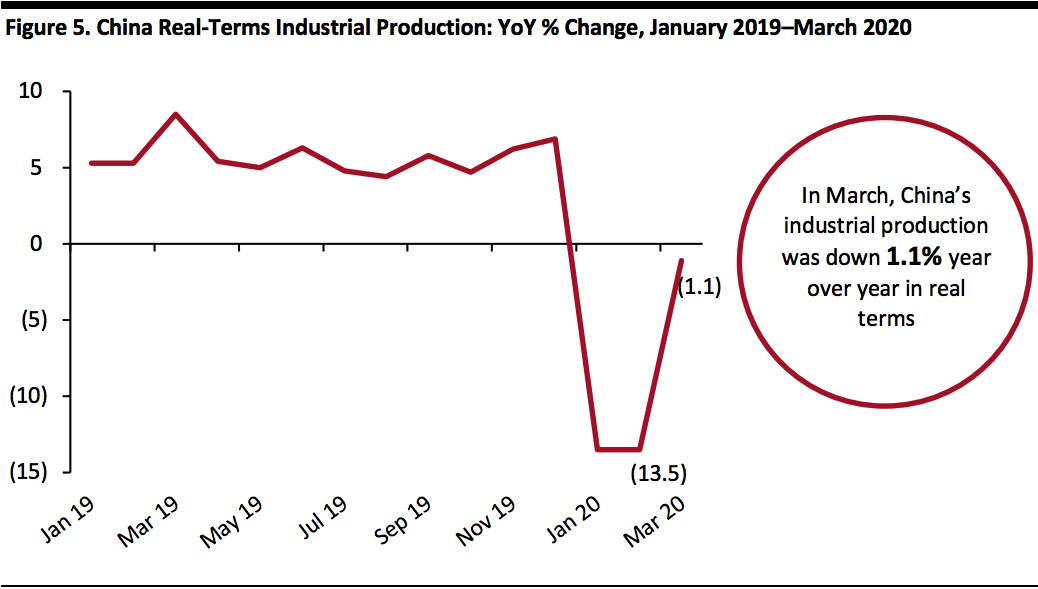

China’s Industrial Production Dips Slightly in March

China’s industrial production slipped 1.1% in March, which represented a 12.4-percentage-point easing in the rate of decline versus the first two months of the year. This was also better than the analyst consensus of a 7.3% dip. The less-than-expected drop suggests a faster pace of factory recovery as lockdowns were eased and travel restrictions were lifted. For the first quarter, industrial output fell 8.4% year over year.

Industrial production of mining and quarrying increased 4.2% year over year in March, manufacturing decreased 1.8%, and production and distribution of electricity, heating power, gas and water were down 1.6%.

[caption id="attachment_109996" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China[/caption]

China’s Industrial Production Dips Slightly in March

China’s industrial production slipped 1.1% in March, which represented a 12.4-percentage-point easing in the rate of decline versus the first two months of the year. This was also better than the analyst consensus of a 7.3% dip. The less-than-expected drop suggests a faster pace of factory recovery as lockdowns were eased and travel restrictions were lifted. For the first quarter, industrial output fell 8.4% year over year.

Industrial production of mining and quarrying increased 4.2% year over year in March, manufacturing decreased 1.8%, and production and distribution of electricity, heating power, gas and water were down 1.6%.

[caption id="attachment_109996" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

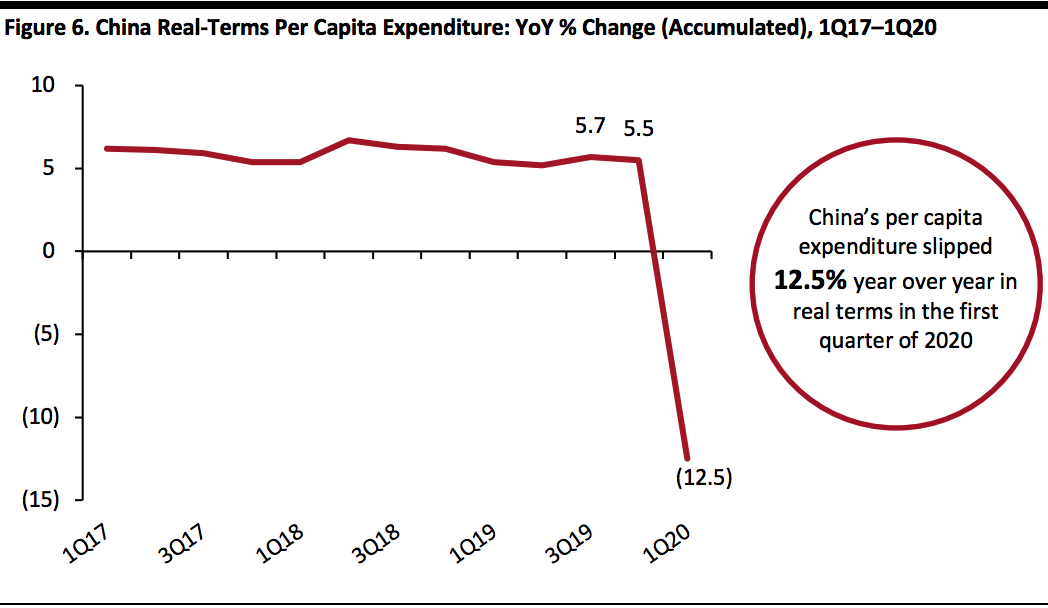

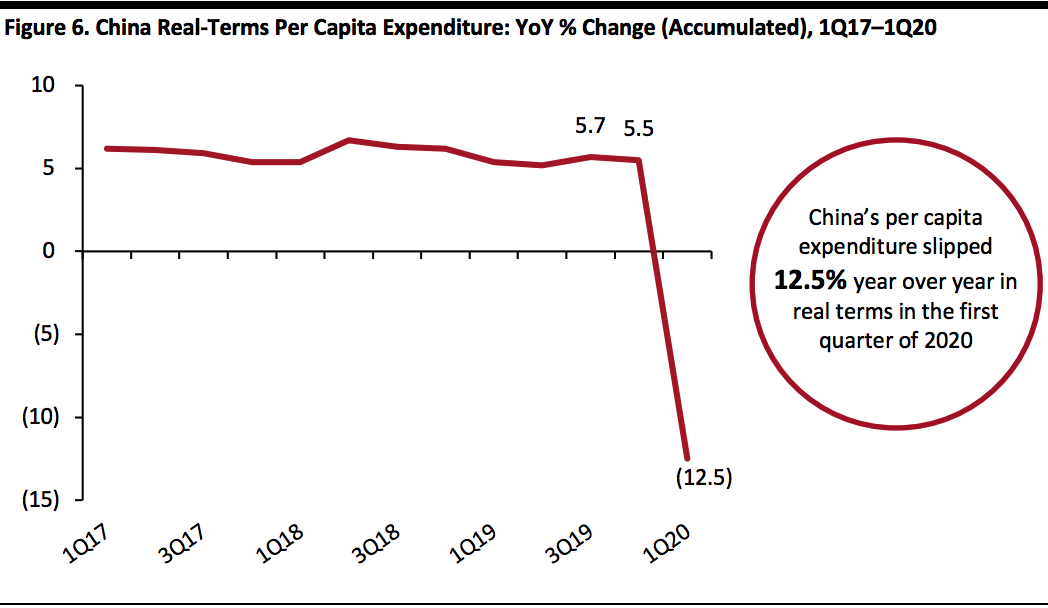

China Real-Terms Per Capita Expenditure Drops

Accumulated per capita expenditure in real terms decreased steeply 12.5% year over year in China in the first quarter of 2020, as per capita disposable income in real terms contracted 3.9% year over year. Retail sales fell 19.0% in the first quarter, with the January/February period seeing a decline of 20.5%, followed by an improvement of 4.7 percentage points to an 15.8% drop in March.

[caption id="attachment_109997" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China[/caption]

China Real-Terms Per Capita Expenditure Drops

Accumulated per capita expenditure in real terms decreased steeply 12.5% year over year in China in the first quarter of 2020, as per capita disposable income in real terms contracted 3.9% year over year. Retail sales fell 19.0% in the first quarter, with the January/February period seeing a decline of 20.5%, followed by an improvement of 4.7 percentage points to an 15.8% drop in March.

[caption id="attachment_109997" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

Source: National Bureau of Statistics of China[/caption]

Source: Bureau of Economic Analysis[/caption]

US Industrial Production Declines in the First Quarter

US industrial production slipped 7.1% in the first quarter, as the coronavirus pandemic led to factories suspending their operations from late March. Output of consumer goods plummeted 8.7% in the quarter, within which durable goods slid 11.9%, while durable goods fell 7.7%. Food and tobacco had the smallest decline, down 0.4% in the quarter, while clothing was down 16.2%.

Industrial production could fall further in the second quarter of the year. In April 2020, industrial production nosedived 11.2%, the deepest monthly drop on record, dating back 101 years. Several major factories in the US have gradually started to reopen, as of late May.

[caption id="attachment_109993" align="aligncenter" width="700"]

Source: Bureau of Economic Analysis[/caption]

US Industrial Production Declines in the First Quarter

US industrial production slipped 7.1% in the first quarter, as the coronavirus pandemic led to factories suspending their operations from late March. Output of consumer goods plummeted 8.7% in the quarter, within which durable goods slid 11.9%, while durable goods fell 7.7%. Food and tobacco had the smallest decline, down 0.4% in the quarter, while clothing was down 16.2%.

Industrial production could fall further in the second quarter of the year. In April 2020, industrial production nosedived 11.2%, the deepest monthly drop on record, dating back 101 years. Several major factories in the US have gradually started to reopen, as of late May.

[caption id="attachment_109993" align="aligncenter" width="700"] Source: US Federal Reserve[/caption]

Personal Consumption Expenditure Plunges during the First Quarter

US real personal consumption expenditures (PCE, or consumer spending) tumbled sharply at an annual rate of 7.6% during the first quarter of 2020, following the 1.8% growth in the previous quarter.

In March, real PCE fell 7.3%, while disposable personal income (DPI, income after paying tax and other deductions) decreased 1.7%. The decrease in real DPI in March can be attributed to a decrease in employee compensation. The decline in real PCE in December was a result of a drop of $829.9 billion (10.2%) in spending on services and a fall of $104.9 billion (1.3%) in spending on goods. Within goods, spending on nondurable goods rose a strong 6.9%, reflecting that shoppers were buying groceries and household essentials, while PCE on durable goods fell 16.1%.

Within services, the leading contributors of the contraction was spending on healthcare, as well as spending on food services, accommodation and recreation services. The spending on goods was dragged down by motor vehicles and parts, although this was partly offset by purchases of food and beverages for off-premises consumption.

[caption id="attachment_109994" align="aligncenter" width="700"]

Source: US Federal Reserve[/caption]

Personal Consumption Expenditure Plunges during the First Quarter

US real personal consumption expenditures (PCE, or consumer spending) tumbled sharply at an annual rate of 7.6% during the first quarter of 2020, following the 1.8% growth in the previous quarter.

In March, real PCE fell 7.3%, while disposable personal income (DPI, income after paying tax and other deductions) decreased 1.7%. The decrease in real DPI in March can be attributed to a decrease in employee compensation. The decline in real PCE in December was a result of a drop of $829.9 billion (10.2%) in spending on services and a fall of $104.9 billion (1.3%) in spending on goods. Within goods, spending on nondurable goods rose a strong 6.9%, reflecting that shoppers were buying groceries and household essentials, while PCE on durable goods fell 16.1%.

Within services, the leading contributors of the contraction was spending on healthcare, as well as spending on food services, accommodation and recreation services. The spending on goods was dragged down by motor vehicles and parts, although this was partly offset by purchases of food and beverages for off-premises consumption.

[caption id="attachment_109994" align="aligncenter" width="700"] Source: Bureau of Economic Analysis[/caption]

China’s GDP Slumps for the First time in Decades due to the Coronavirus

China’s economy shrank 6.8% year over year in the first quarter of 2020, after 6% growth the previous quarter, according to the National Bureau of Statistics of China. This was below the 6.5% reduction that analysts surveyed in a Reuters poll had predicted and was the country’s first GDP contraction since 1992. The unprecedented plunge was caused by a roughly two-month long shutdown and a halt on almost all business activities. China’s exports dropped 11.4% in the first quarter of 2020.

The government has unleashed a range of stimulus measures and is considering greater policy support to fuel domestic demand. The economy may remain weak in the second quarter as the coronavirus crisis continues to hit global demand.

[caption id="attachment_109995" align="aligncenter" width="700"]

Source: Bureau of Economic Analysis[/caption]

China’s GDP Slumps for the First time in Decades due to the Coronavirus

China’s economy shrank 6.8% year over year in the first quarter of 2020, after 6% growth the previous quarter, according to the National Bureau of Statistics of China. This was below the 6.5% reduction that analysts surveyed in a Reuters poll had predicted and was the country’s first GDP contraction since 1992. The unprecedented plunge was caused by a roughly two-month long shutdown and a halt on almost all business activities. China’s exports dropped 11.4% in the first quarter of 2020.

The government has unleashed a range of stimulus measures and is considering greater policy support to fuel domestic demand. The economy may remain weak in the second quarter as the coronavirus crisis continues to hit global demand.

[caption id="attachment_109995" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

China’s Industrial Production Dips Slightly in March

China’s industrial production slipped 1.1% in March, which represented a 12.4-percentage-point easing in the rate of decline versus the first two months of the year. This was also better than the analyst consensus of a 7.3% dip. The less-than-expected drop suggests a faster pace of factory recovery as lockdowns were eased and travel restrictions were lifted. For the first quarter, industrial output fell 8.4% year over year.

Industrial production of mining and quarrying increased 4.2% year over year in March, manufacturing decreased 1.8%, and production and distribution of electricity, heating power, gas and water were down 1.6%.

[caption id="attachment_109996" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China[/caption]

China’s Industrial Production Dips Slightly in March

China’s industrial production slipped 1.1% in March, which represented a 12.4-percentage-point easing in the rate of decline versus the first two months of the year. This was also better than the analyst consensus of a 7.3% dip. The less-than-expected drop suggests a faster pace of factory recovery as lockdowns were eased and travel restrictions were lifted. For the first quarter, industrial output fell 8.4% year over year.

Industrial production of mining and quarrying increased 4.2% year over year in March, manufacturing decreased 1.8%, and production and distribution of electricity, heating power, gas and water were down 1.6%.

[caption id="attachment_109996" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

China Real-Terms Per Capita Expenditure Drops

Accumulated per capita expenditure in real terms decreased steeply 12.5% year over year in China in the first quarter of 2020, as per capita disposable income in real terms contracted 3.9% year over year. Retail sales fell 19.0% in the first quarter, with the January/February period seeing a decline of 20.5%, followed by an improvement of 4.7 percentage points to an 15.8% drop in March.

[caption id="attachment_109997" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China[/caption]

China Real-Terms Per Capita Expenditure Drops

Accumulated per capita expenditure in real terms decreased steeply 12.5% year over year in China in the first quarter of 2020, as per capita disposable income in real terms contracted 3.9% year over year. Retail sales fell 19.0% in the first quarter, with the January/February period seeing a decline of 20.5%, followed by an improvement of 4.7 percentage points to an 15.8% drop in March.

[caption id="attachment_109997" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

Source: National Bureau of Statistics of China[/caption]