Nitheesh NH

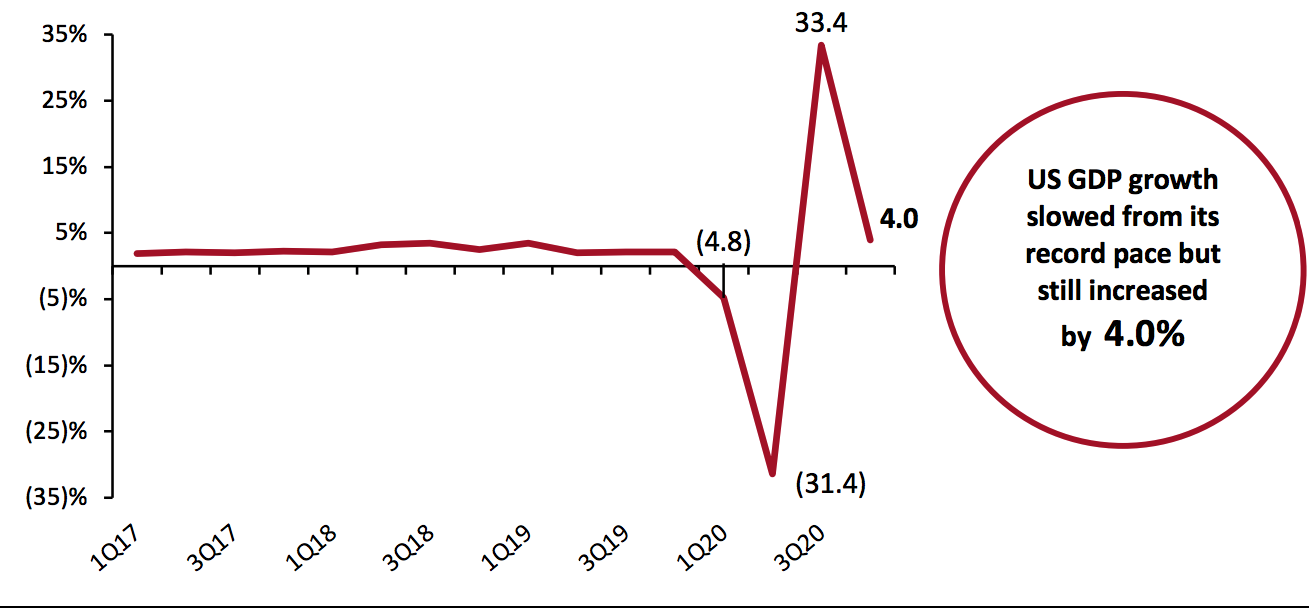

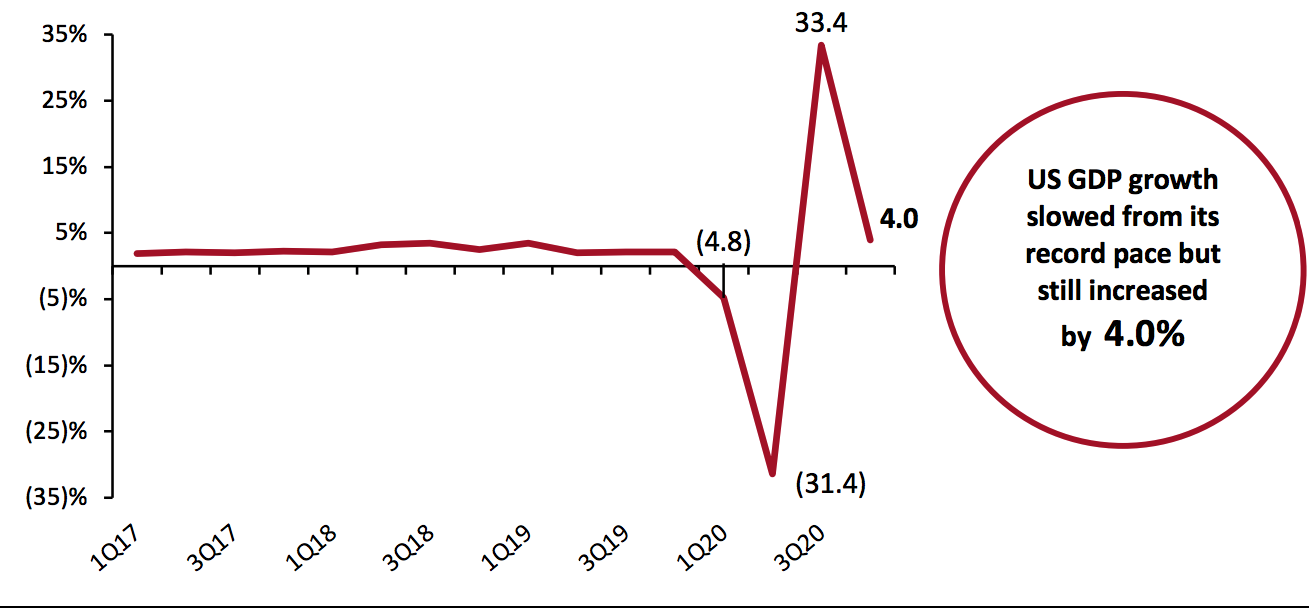

US GDP Growth Misses Estimates

On January 28, 2021, the US Bureau of Economic Analysis (BEA) published its advance estimate of GDP growth, estimating that the US economy accelerated an at annual seasonally adjusted rate of 4.0%. That was a slowdown from 33.4% growth in the third quarter but continues the rebound from a 31.4% plunge in the second quarter. Growth was slightly lower than the 4.2% expected growth. Overall in 2020, GDP decreased 3.5%, following a 2.2% increase in 2019.

GDP growth in the fourth quarter was driven, in part, by a slight increase in personal consumption expenditures, which grew 2.5% on an annualized adjusted basis. Gross private domestic investment climbed 6.0% in current dollars—its second straight quarter of strong growth, while government spending increased very slightly.

Figure 1. US GDP: Change from Preceding Quarter (Annualized; %)

[caption id="attachment_123065" align="aligncenter" width="700"] Source: BEA[/caption]

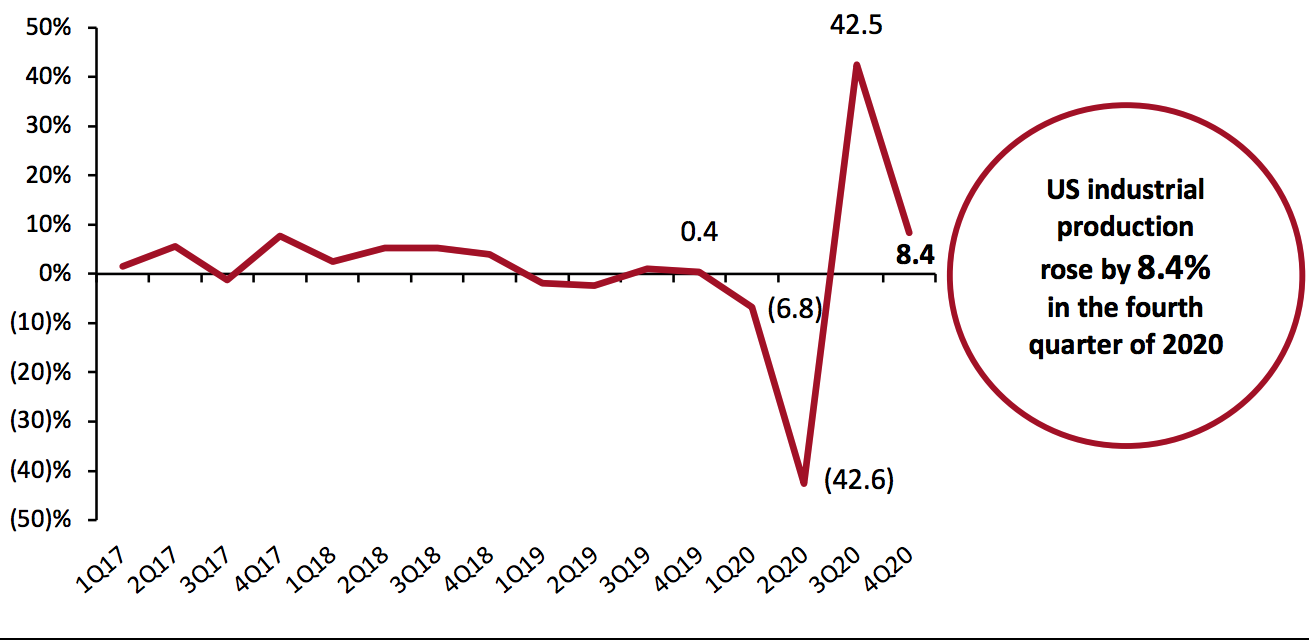

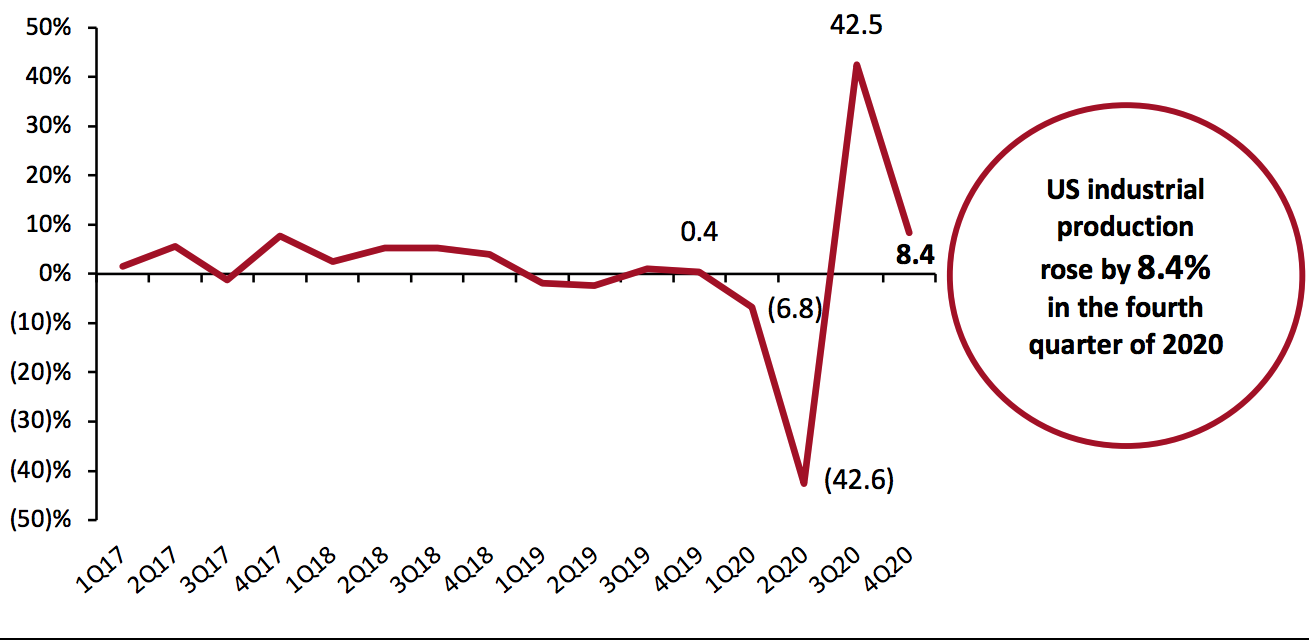

US Industrial Production Bounces Back in the Third Quarter

US industrial production increased at an annual rate of 8.4% in the fourth quarter, a slowdown from the revised 42.5% growth in the third quarter. For the full year, total industrial production declined by 4.7%, following a decline of 0.7% in 2019.

The output of consumer goods improved by 2.5% in the quarter, within which durable goods grew 3.2% and nondurable goods production grew 2.3%. Once again, clothing saw the largest increase within nondurable goods in the quarter, of 33.2%, continuing the strong recovery from its 60.1% dip in the second quarter. After rebounding by more than 2,000% in the third quarter, production of automotive products shrank by 7.7% in the fourth quarter.

Figure 2. US Industrial Production: Change from Preceding Quarter (Annualized; %)

[caption id="attachment_123066" align="aligncenter" width="700"]

Source: BEA[/caption]

US Industrial Production Bounces Back in the Third Quarter

US industrial production increased at an annual rate of 8.4% in the fourth quarter, a slowdown from the revised 42.5% growth in the third quarter. For the full year, total industrial production declined by 4.7%, following a decline of 0.7% in 2019.

The output of consumer goods improved by 2.5% in the quarter, within which durable goods grew 3.2% and nondurable goods production grew 2.3%. Once again, clothing saw the largest increase within nondurable goods in the quarter, of 33.2%, continuing the strong recovery from its 60.1% dip in the second quarter. After rebounding by more than 2,000% in the third quarter, production of automotive products shrank by 7.7% in the fourth quarter.

Figure 2. US Industrial Production: Change from Preceding Quarter (Annualized; %)

[caption id="attachment_123066" align="aligncenter" width="700"] Source: US Federal Reserve[/caption]

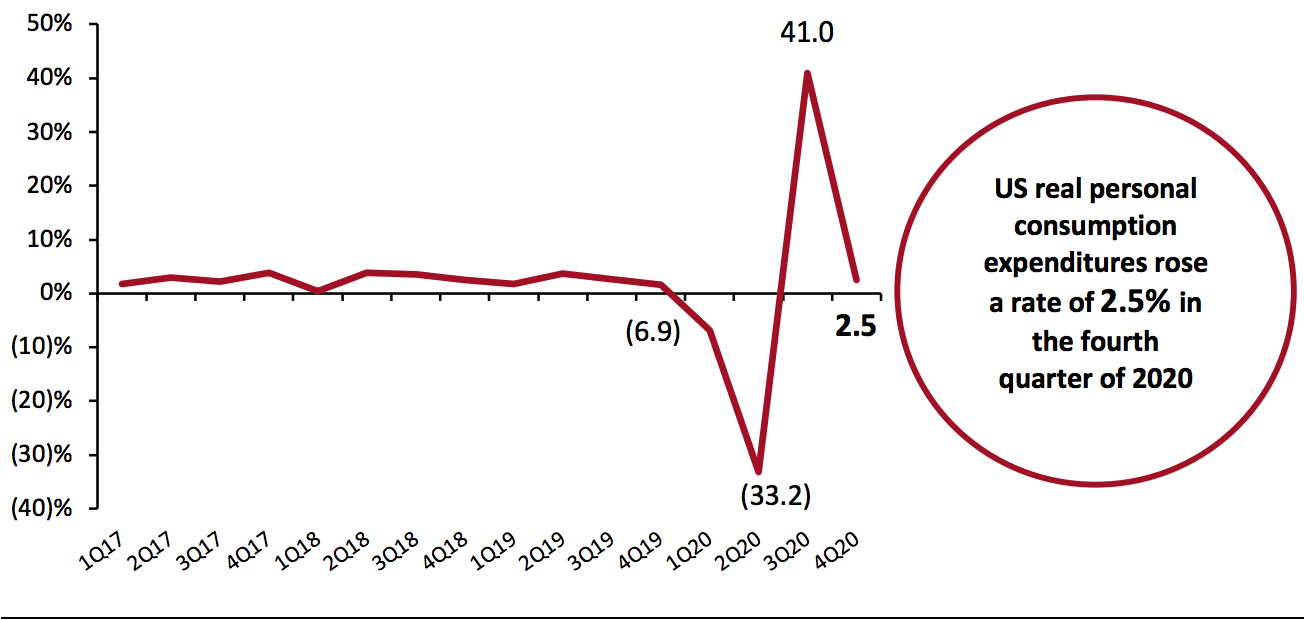

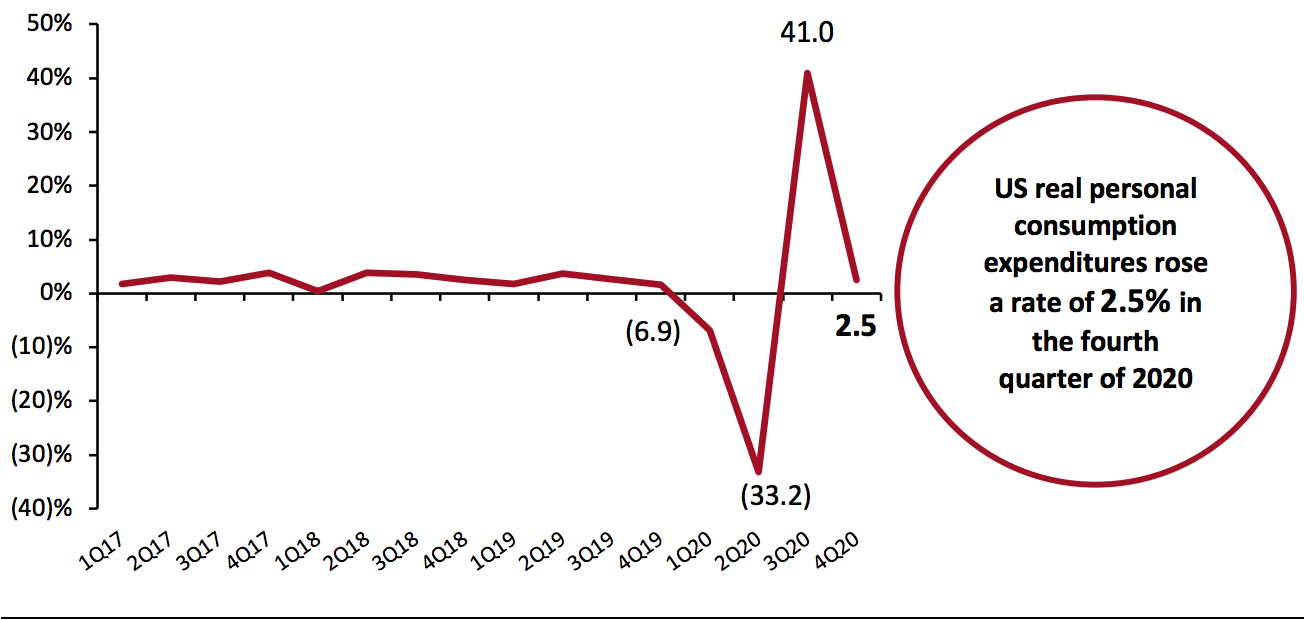

Personal Consumption Expenditure Improves Significantly in the Third Quarter

US real personal consumption expenditures (PCE, or consumer spending) rose at an annual rate of 2.5% in the fourth quarter of 2020, following an unprecedented 41.0% bump in the third quarter.

In December, real PCE decreased by 0.6% month over month, following a month-over-month decrease of 0.7% in November. Meanwhile, disposable personal income rose by 0.2% in December after decreasing for two straight months in October and November. Recreational goods and vehicles spending suffered the most, declining by 5.1% month over month in December. The recovery of food services and accommodations was also stymied in December, with expenditures falling by 4.4% in December as consumers remained wary of pandemic-related risks.

The slight rise in personal income can be largely attributed to slight rises in wages and salaries to employees in private industries. This rise was partially offset by slight decreases in employee compensation in services-producing industries. Government transfers remained largely constant over the quarter, after falling significantly in the third quarter when the first round of stimulus expired. In the first quarter of 2021, personal income should rise again as consumers receive another round of stimulus checks.

Figure 3. US Real-Terms Personal Consumption Expenditure: Change from Preceding Quarter (Annualized; %)

[caption id="attachment_123067" align="aligncenter" width="700"]

Source: US Federal Reserve[/caption]

Personal Consumption Expenditure Improves Significantly in the Third Quarter

US real personal consumption expenditures (PCE, or consumer spending) rose at an annual rate of 2.5% in the fourth quarter of 2020, following an unprecedented 41.0% bump in the third quarter.

In December, real PCE decreased by 0.6% month over month, following a month-over-month decrease of 0.7% in November. Meanwhile, disposable personal income rose by 0.2% in December after decreasing for two straight months in October and November. Recreational goods and vehicles spending suffered the most, declining by 5.1% month over month in December. The recovery of food services and accommodations was also stymied in December, with expenditures falling by 4.4% in December as consumers remained wary of pandemic-related risks.

The slight rise in personal income can be largely attributed to slight rises in wages and salaries to employees in private industries. This rise was partially offset by slight decreases in employee compensation in services-producing industries. Government transfers remained largely constant over the quarter, after falling significantly in the third quarter when the first round of stimulus expired. In the first quarter of 2021, personal income should rise again as consumers receive another round of stimulus checks.

Figure 3. US Real-Terms Personal Consumption Expenditure: Change from Preceding Quarter (Annualized; %)

[caption id="attachment_123067" align="aligncenter" width="700"] Source: Bureau of Economic Analysis[/caption]

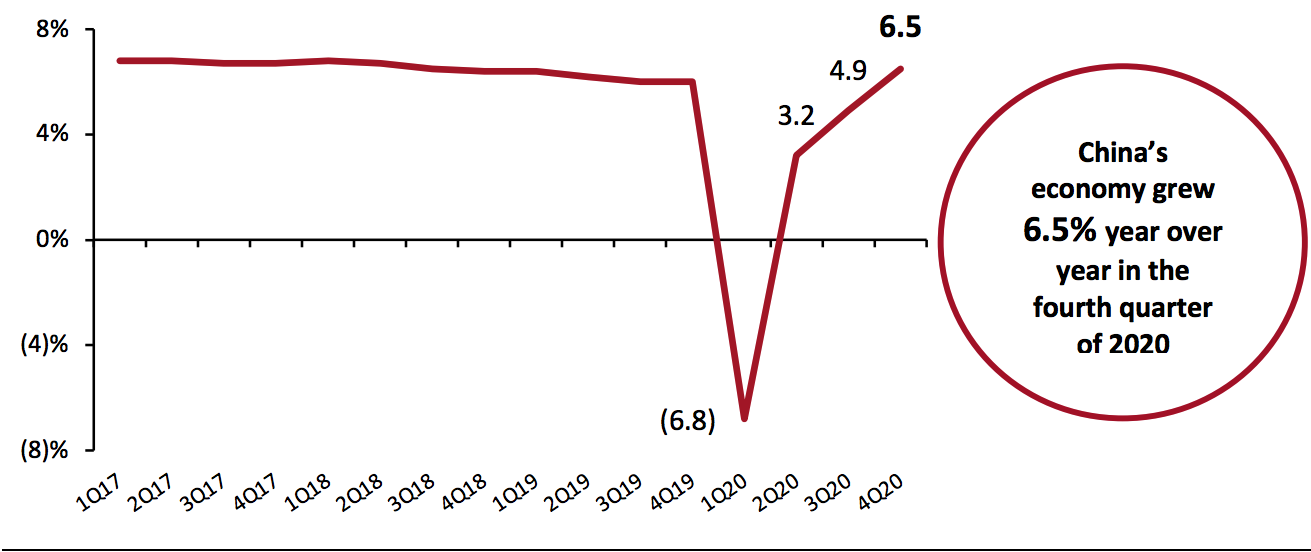

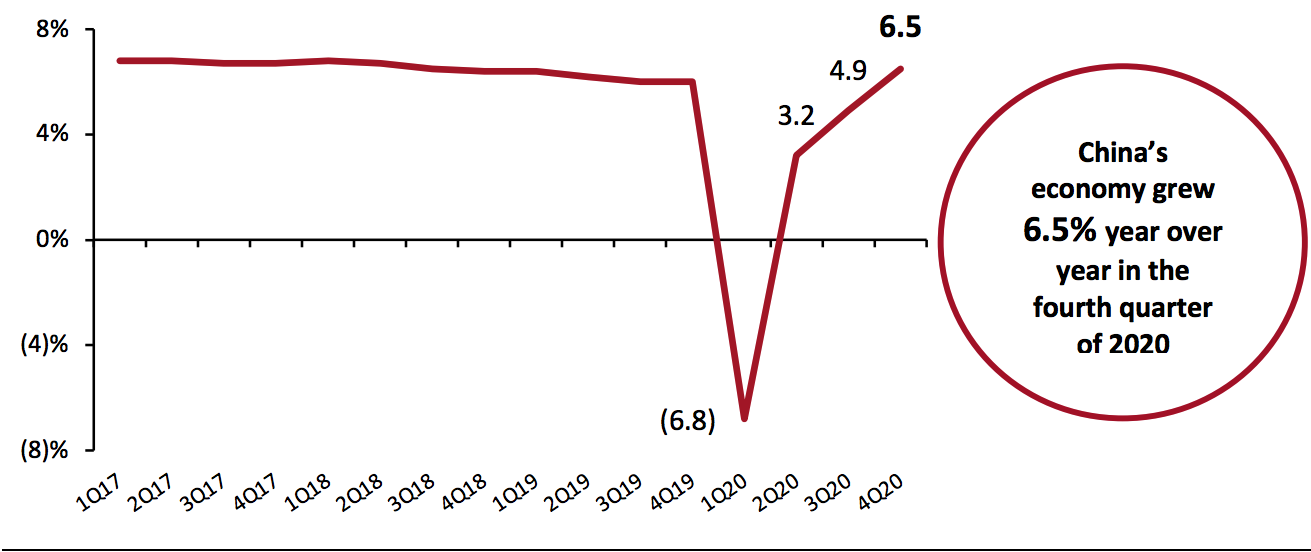

China’s GDP Expands Further

China’s economy grew 6.5% year over year in the fourth quarter of 2020, after two straight quarters of growth that saw the economy expand by 3.2% and 4.9% in the second and third quarters respectively, according to the National Bureau of Statistics of China. The growth beat the 6.1% forecast by economists surveyed in a Reuters poll, and helped the economy to grow by 2.3% in 2020 overall, despite the effects of the pandemic.

China’s strong recovery from the pandemic looks set to continue in 2021—according to a Reuters poll, economists generally expect China’s GDP to grow by 8.4% in 2021.

Figure 4. China GDP: YoY % Change

[caption id="attachment_123068" align="aligncenter" width="700"]

Source: Bureau of Economic Analysis[/caption]

China’s GDP Expands Further

China’s economy grew 6.5% year over year in the fourth quarter of 2020, after two straight quarters of growth that saw the economy expand by 3.2% and 4.9% in the second and third quarters respectively, according to the National Bureau of Statistics of China. The growth beat the 6.1% forecast by economists surveyed in a Reuters poll, and helped the economy to grow by 2.3% in 2020 overall, despite the effects of the pandemic.

China’s strong recovery from the pandemic looks set to continue in 2021—according to a Reuters poll, economists generally expect China’s GDP to grow by 8.4% in 2021.

Figure 4. China GDP: YoY % Change

[caption id="attachment_123068" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

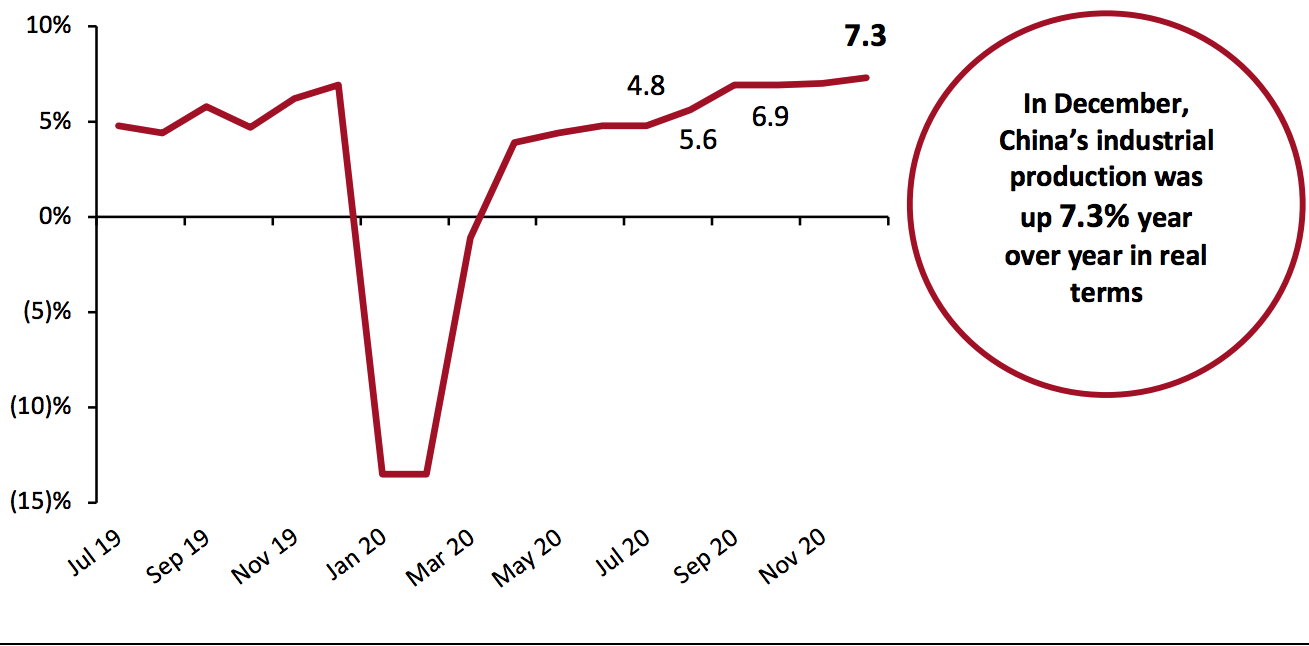

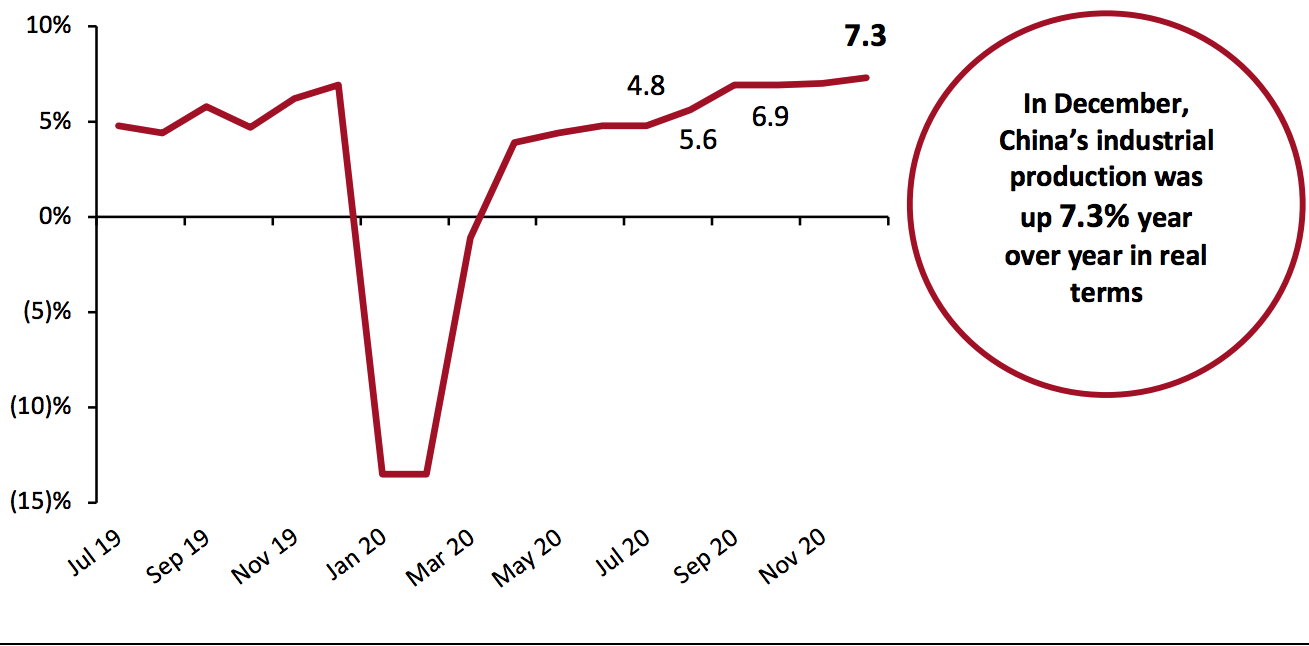

China’s Industrial Production Continues To Accelerate

China’s industrial production increased by 7.3% year over year in December, extending its growth for the ninth consecutive month, following declines in the first three months of the year. This growth was also slightly higher than the analyst consensus of 5.8%. For the full year, industrial production grew 2.8%.

Industrial production of mining and quarrying increased by 4.9% year over year in September; manufacturing improved by 7.7% and manufacturing of high-tech goods grew 13.1%. For the full year, mining and quarrying saw 0.5% growth, while manufacturing grew 3.4% and manufacturing of high-tech goods grew 7.1%.

Figure 5. China Real-Terms Industrial Production: YoY % Change

[caption id="attachment_123069" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China[/caption]

China’s Industrial Production Continues To Accelerate

China’s industrial production increased by 7.3% year over year in December, extending its growth for the ninth consecutive month, following declines in the first three months of the year. This growth was also slightly higher than the analyst consensus of 5.8%. For the full year, industrial production grew 2.8%.

Industrial production of mining and quarrying increased by 4.9% year over year in September; manufacturing improved by 7.7% and manufacturing of high-tech goods grew 13.1%. For the full year, mining and quarrying saw 0.5% growth, while manufacturing grew 3.4% and manufacturing of high-tech goods grew 7.1%.

Figure 5. China Real-Terms Industrial Production: YoY % Change

[caption id="attachment_123069" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

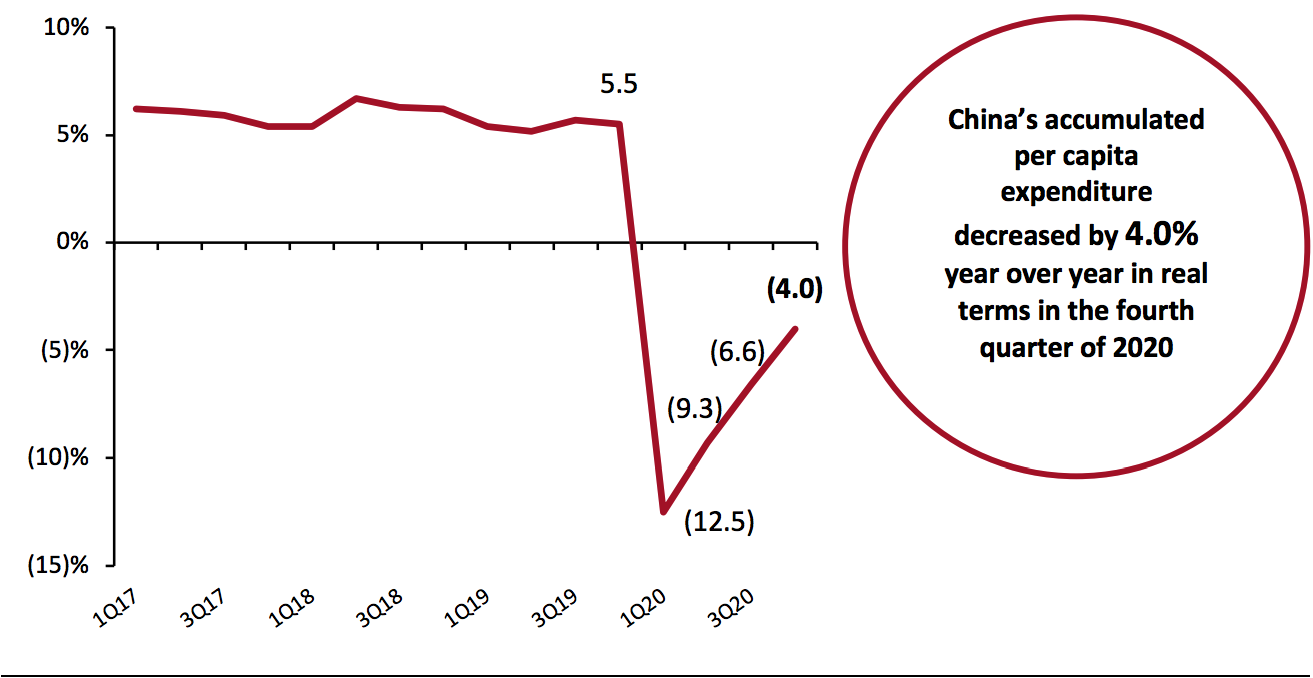

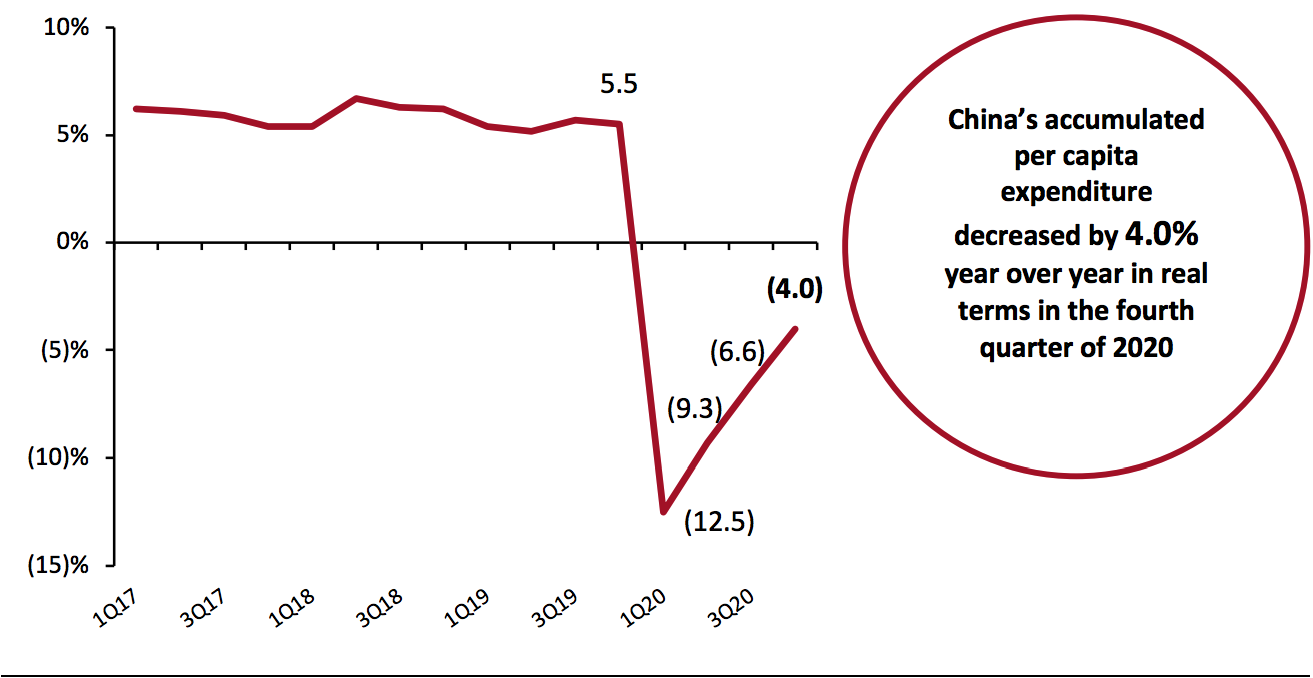

China Real-Terms Per Capita Expenditure Remains Below Pre-Pandemic Levels

Accumulated per capita expenditure in real terms decreased by 4.0% year over year in China overall in 2020. This was, however, less severe than the decline of 6.6% in the first three quarters of the year. Culture, education and recreation spending was unsurprisingly hit hardest in 2020, dropping by 19.1% year over year. Retail sales have continued to recover in China, with 4.3%, 5.0% and 4.6% year over year growth in October, November, and December respectively. In the first quarter of 2021, we expect very strong year over year retail sales growth due to the sharp decrease in spending in the first quarter of 2020, related to the pandemic.

Figure 6. China Real-Terms Per Capita Expenditure: YoY % Change (Accumulated)

[caption id="attachment_123070" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China[/caption]

China Real-Terms Per Capita Expenditure Remains Below Pre-Pandemic Levels

Accumulated per capita expenditure in real terms decreased by 4.0% year over year in China overall in 2020. This was, however, less severe than the decline of 6.6% in the first three quarters of the year. Culture, education and recreation spending was unsurprisingly hit hardest in 2020, dropping by 19.1% year over year. Retail sales have continued to recover in China, with 4.3%, 5.0% and 4.6% year over year growth in October, November, and December respectively. In the first quarter of 2021, we expect very strong year over year retail sales growth due to the sharp decrease in spending in the first quarter of 2020, related to the pandemic.

Figure 6. China Real-Terms Per Capita Expenditure: YoY % Change (Accumulated)

[caption id="attachment_123070" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

Source: National Bureau of Statistics of China[/caption]

Source: BEA[/caption]

US Industrial Production Bounces Back in the Third Quarter

US industrial production increased at an annual rate of 8.4% in the fourth quarter, a slowdown from the revised 42.5% growth in the third quarter. For the full year, total industrial production declined by 4.7%, following a decline of 0.7% in 2019.

The output of consumer goods improved by 2.5% in the quarter, within which durable goods grew 3.2% and nondurable goods production grew 2.3%. Once again, clothing saw the largest increase within nondurable goods in the quarter, of 33.2%, continuing the strong recovery from its 60.1% dip in the second quarter. After rebounding by more than 2,000% in the third quarter, production of automotive products shrank by 7.7% in the fourth quarter.

Figure 2. US Industrial Production: Change from Preceding Quarter (Annualized; %)

[caption id="attachment_123066" align="aligncenter" width="700"]

Source: BEA[/caption]

US Industrial Production Bounces Back in the Third Quarter

US industrial production increased at an annual rate of 8.4% in the fourth quarter, a slowdown from the revised 42.5% growth in the third quarter. For the full year, total industrial production declined by 4.7%, following a decline of 0.7% in 2019.

The output of consumer goods improved by 2.5% in the quarter, within which durable goods grew 3.2% and nondurable goods production grew 2.3%. Once again, clothing saw the largest increase within nondurable goods in the quarter, of 33.2%, continuing the strong recovery from its 60.1% dip in the second quarter. After rebounding by more than 2,000% in the third quarter, production of automotive products shrank by 7.7% in the fourth quarter.

Figure 2. US Industrial Production: Change from Preceding Quarter (Annualized; %)

[caption id="attachment_123066" align="aligncenter" width="700"] Source: US Federal Reserve[/caption]

Personal Consumption Expenditure Improves Significantly in the Third Quarter

US real personal consumption expenditures (PCE, or consumer spending) rose at an annual rate of 2.5% in the fourth quarter of 2020, following an unprecedented 41.0% bump in the third quarter.

In December, real PCE decreased by 0.6% month over month, following a month-over-month decrease of 0.7% in November. Meanwhile, disposable personal income rose by 0.2% in December after decreasing for two straight months in October and November. Recreational goods and vehicles spending suffered the most, declining by 5.1% month over month in December. The recovery of food services and accommodations was also stymied in December, with expenditures falling by 4.4% in December as consumers remained wary of pandemic-related risks.

The slight rise in personal income can be largely attributed to slight rises in wages and salaries to employees in private industries. This rise was partially offset by slight decreases in employee compensation in services-producing industries. Government transfers remained largely constant over the quarter, after falling significantly in the third quarter when the first round of stimulus expired. In the first quarter of 2021, personal income should rise again as consumers receive another round of stimulus checks.

Figure 3. US Real-Terms Personal Consumption Expenditure: Change from Preceding Quarter (Annualized; %)

[caption id="attachment_123067" align="aligncenter" width="700"]

Source: US Federal Reserve[/caption]

Personal Consumption Expenditure Improves Significantly in the Third Quarter

US real personal consumption expenditures (PCE, or consumer spending) rose at an annual rate of 2.5% in the fourth quarter of 2020, following an unprecedented 41.0% bump in the third quarter.

In December, real PCE decreased by 0.6% month over month, following a month-over-month decrease of 0.7% in November. Meanwhile, disposable personal income rose by 0.2% in December after decreasing for two straight months in October and November. Recreational goods and vehicles spending suffered the most, declining by 5.1% month over month in December. The recovery of food services and accommodations was also stymied in December, with expenditures falling by 4.4% in December as consumers remained wary of pandemic-related risks.

The slight rise in personal income can be largely attributed to slight rises in wages and salaries to employees in private industries. This rise was partially offset by slight decreases in employee compensation in services-producing industries. Government transfers remained largely constant over the quarter, after falling significantly in the third quarter when the first round of stimulus expired. In the first quarter of 2021, personal income should rise again as consumers receive another round of stimulus checks.

Figure 3. US Real-Terms Personal Consumption Expenditure: Change from Preceding Quarter (Annualized; %)

[caption id="attachment_123067" align="aligncenter" width="700"] Source: Bureau of Economic Analysis[/caption]

China’s GDP Expands Further

China’s economy grew 6.5% year over year in the fourth quarter of 2020, after two straight quarters of growth that saw the economy expand by 3.2% and 4.9% in the second and third quarters respectively, according to the National Bureau of Statistics of China. The growth beat the 6.1% forecast by economists surveyed in a Reuters poll, and helped the economy to grow by 2.3% in 2020 overall, despite the effects of the pandemic.

China’s strong recovery from the pandemic looks set to continue in 2021—according to a Reuters poll, economists generally expect China’s GDP to grow by 8.4% in 2021.

Figure 4. China GDP: YoY % Change

[caption id="attachment_123068" align="aligncenter" width="700"]

Source: Bureau of Economic Analysis[/caption]

China’s GDP Expands Further

China’s economy grew 6.5% year over year in the fourth quarter of 2020, after two straight quarters of growth that saw the economy expand by 3.2% and 4.9% in the second and third quarters respectively, according to the National Bureau of Statistics of China. The growth beat the 6.1% forecast by economists surveyed in a Reuters poll, and helped the economy to grow by 2.3% in 2020 overall, despite the effects of the pandemic.

China’s strong recovery from the pandemic looks set to continue in 2021—according to a Reuters poll, economists generally expect China’s GDP to grow by 8.4% in 2021.

Figure 4. China GDP: YoY % Change

[caption id="attachment_123068" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

China’s Industrial Production Continues To Accelerate

China’s industrial production increased by 7.3% year over year in December, extending its growth for the ninth consecutive month, following declines in the first three months of the year. This growth was also slightly higher than the analyst consensus of 5.8%. For the full year, industrial production grew 2.8%.

Industrial production of mining and quarrying increased by 4.9% year over year in September; manufacturing improved by 7.7% and manufacturing of high-tech goods grew 13.1%. For the full year, mining and quarrying saw 0.5% growth, while manufacturing grew 3.4% and manufacturing of high-tech goods grew 7.1%.

Figure 5. China Real-Terms Industrial Production: YoY % Change

[caption id="attachment_123069" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China[/caption]

China’s Industrial Production Continues To Accelerate

China’s industrial production increased by 7.3% year over year in December, extending its growth for the ninth consecutive month, following declines in the first three months of the year. This growth was also slightly higher than the analyst consensus of 5.8%. For the full year, industrial production grew 2.8%.

Industrial production of mining and quarrying increased by 4.9% year over year in September; manufacturing improved by 7.7% and manufacturing of high-tech goods grew 13.1%. For the full year, mining and quarrying saw 0.5% growth, while manufacturing grew 3.4% and manufacturing of high-tech goods grew 7.1%.

Figure 5. China Real-Terms Industrial Production: YoY % Change

[caption id="attachment_123069" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

China Real-Terms Per Capita Expenditure Remains Below Pre-Pandemic Levels

Accumulated per capita expenditure in real terms decreased by 4.0% year over year in China overall in 2020. This was, however, less severe than the decline of 6.6% in the first three quarters of the year. Culture, education and recreation spending was unsurprisingly hit hardest in 2020, dropping by 19.1% year over year. Retail sales have continued to recover in China, with 4.3%, 5.0% and 4.6% year over year growth in October, November, and December respectively. In the first quarter of 2021, we expect very strong year over year retail sales growth due to the sharp decrease in spending in the first quarter of 2020, related to the pandemic.

Figure 6. China Real-Terms Per Capita Expenditure: YoY % Change (Accumulated)

[caption id="attachment_123070" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China[/caption]

China Real-Terms Per Capita Expenditure Remains Below Pre-Pandemic Levels

Accumulated per capita expenditure in real terms decreased by 4.0% year over year in China overall in 2020. This was, however, less severe than the decline of 6.6% in the first three quarters of the year. Culture, education and recreation spending was unsurprisingly hit hardest in 2020, dropping by 19.1% year over year. Retail sales have continued to recover in China, with 4.3%, 5.0% and 4.6% year over year growth in October, November, and December respectively. In the first quarter of 2021, we expect very strong year over year retail sales growth due to the sharp decrease in spending in the first quarter of 2020, related to the pandemic.

Figure 6. China Real-Terms Per Capita Expenditure: YoY % Change (Accumulated)

[caption id="attachment_123070" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

Source: National Bureau of Statistics of China[/caption]