Nitheesh NH

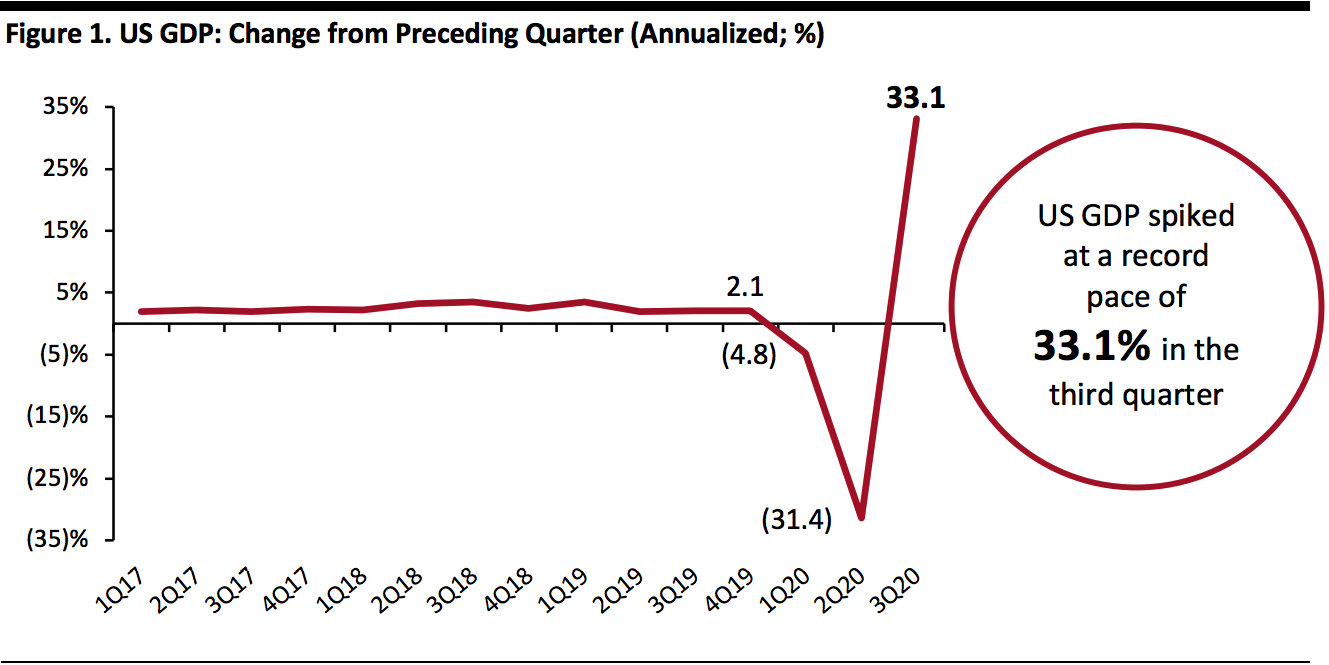

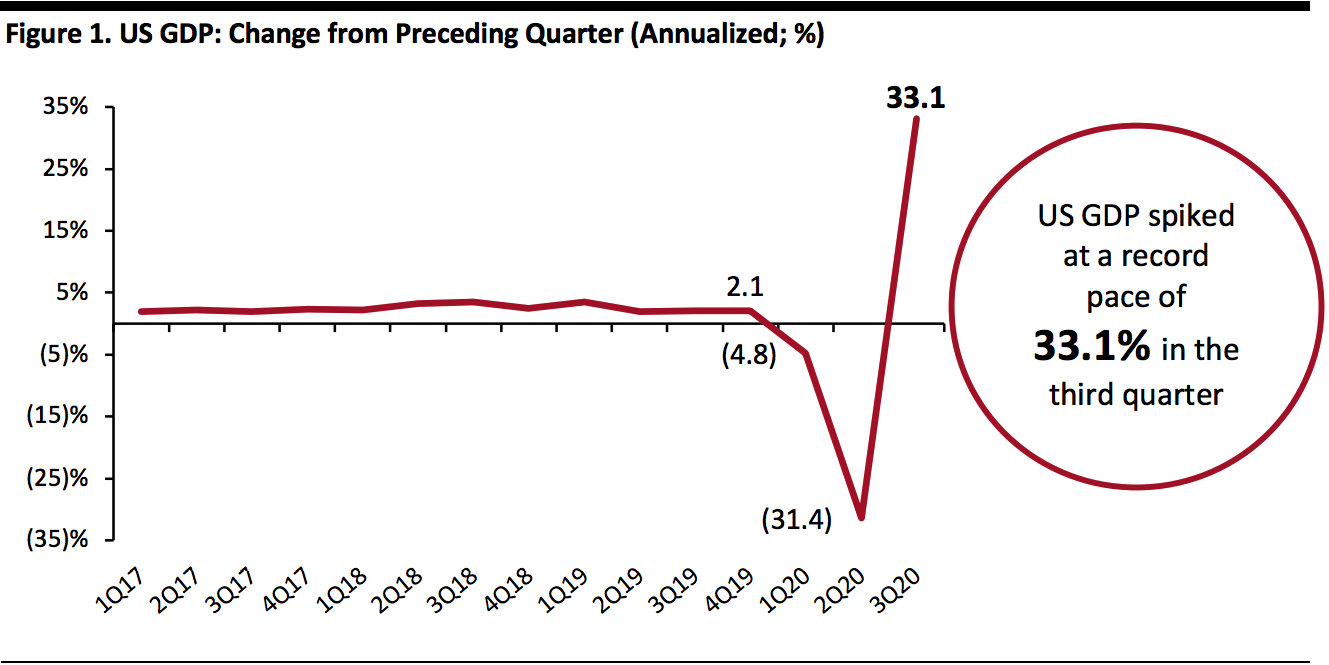

US GDP Booms at Record Pace

On October 29, 2020, the US Bureau of Economic Analysis (BEA) published its advance estimate of GDP growth, estimating that the US economy accelerated at an annual seasonally adjusted rate of 33.1% in the third quarter of 2020, following a steep plunge of 31.4% in the previous quarter—the deepest decline ever recorded. The expansion is slightly better than the market consensus of 31%. On a non-annualized basis, the economy grew 7.4% quarter over quarter.

GDP growth in the third quarter was driven by personal consumption expenditures, residential fixed investment, nonresidential fixed investment, exports and private inventory investment. These were partially offset by decreases in state and local government spending and federal government spending. The BEA noted that the full economic effects of the coronavirus cannot be quantified in the third-quarter GDP estimate, which is based on source data that are incomplete and subject to updates.

The recovery in GDP reverses around two-thirds of the GDP decline in the first half of the year amid the coronavirus pandemic, helped by government funding relief. However, the pace of economic rebound remains uncertain due to the resurgence in coronavirus cases nationwide. Slow employment growth and the absence of planned fiscal stimulus packages could restrain consumer spending over the next few months.

According to The Wall Street Journal’s October poll of economists, more than half do not expect GDP to return to pre-crisis levels until 2021. On average, those polled expect full-year GDP to contract by 3.6%.

[caption id="attachment_118890" align="aligncenter" width="700"] Source: BEA[/caption]

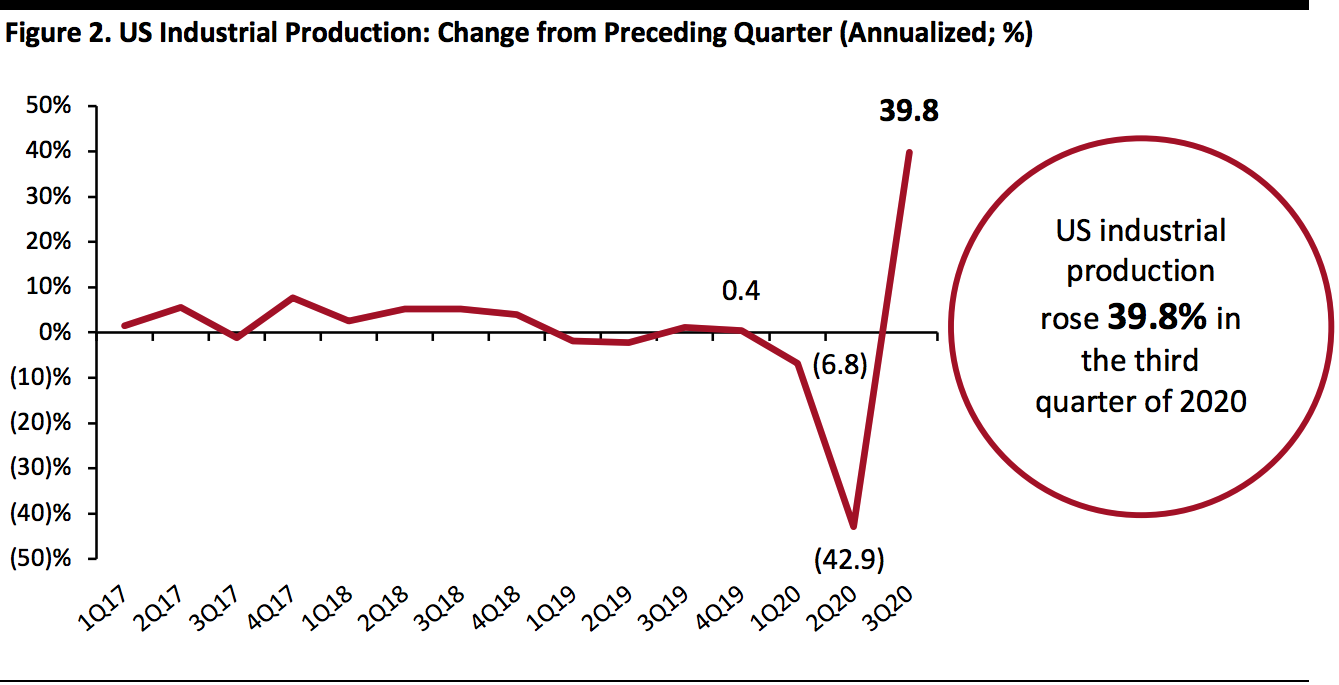

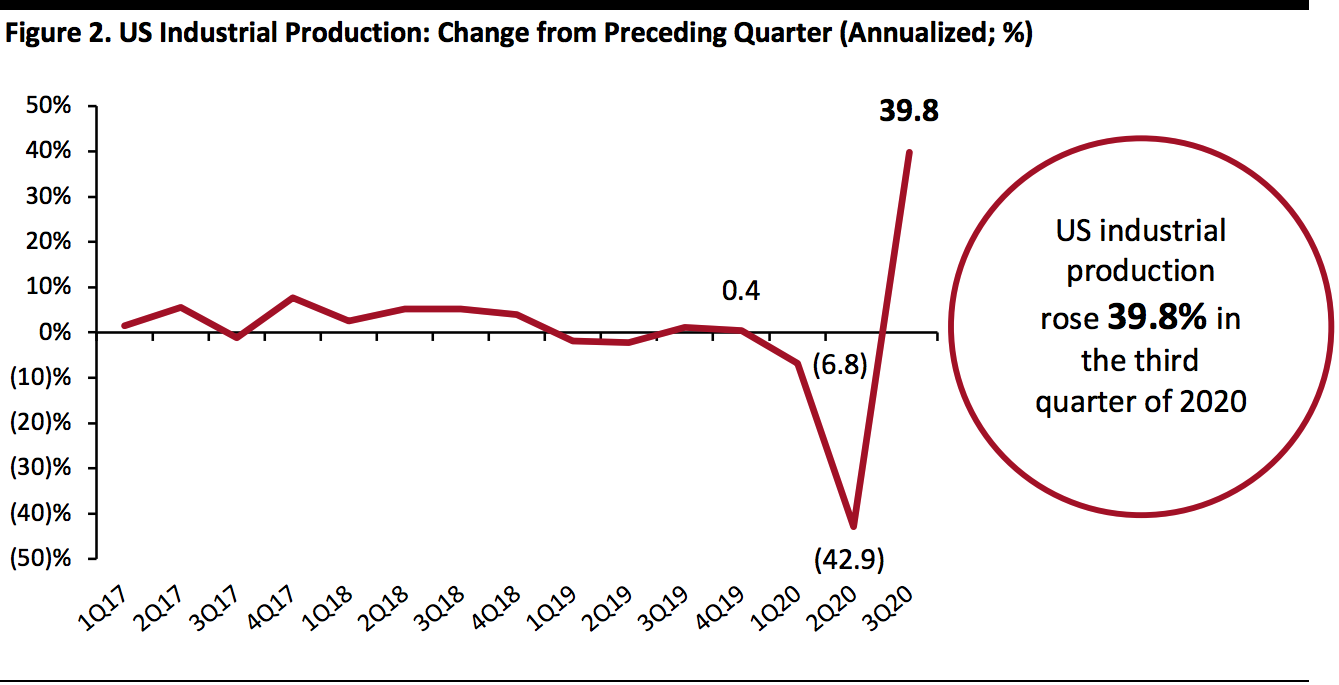

US Industrial Production Bounces Back in the Third Quarter

US industrial production increased at an annual rate of 39.8% in the third quarter, a significant quarterly uplift. US factories saw a rebound in July and August, but unexpectedly fell by 0.6% in September, indicating a slowdown in their recovery.

The output of consumer goods improved by 56.7% in the quarter, within which durable goods grew by 425.7% and nondurable goods jumped by 15.8%. Clothing saw the largest increase of 66.9% within nondurable goods in the quarter, followed by 15.2% growth in the food and tobacco category.

[caption id="attachment_118891" align="aligncenter" width="700"]

Source: BEA[/caption]

US Industrial Production Bounces Back in the Third Quarter

US industrial production increased at an annual rate of 39.8% in the third quarter, a significant quarterly uplift. US factories saw a rebound in July and August, but unexpectedly fell by 0.6% in September, indicating a slowdown in their recovery.

The output of consumer goods improved by 56.7% in the quarter, within which durable goods grew by 425.7% and nondurable goods jumped by 15.8%. Clothing saw the largest increase of 66.9% within nondurable goods in the quarter, followed by 15.2% growth in the food and tobacco category.

[caption id="attachment_118891" align="aligncenter" width="700"] Source: US Federal Reserve[/caption]

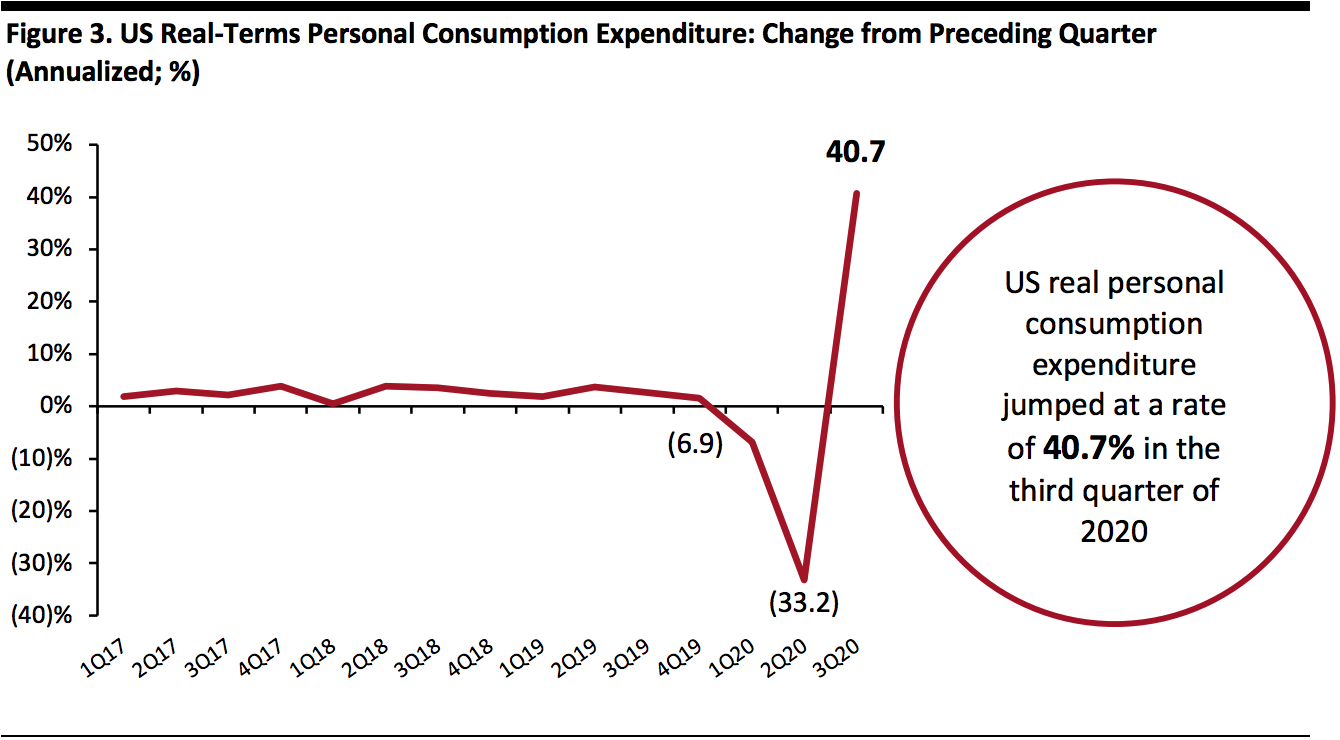

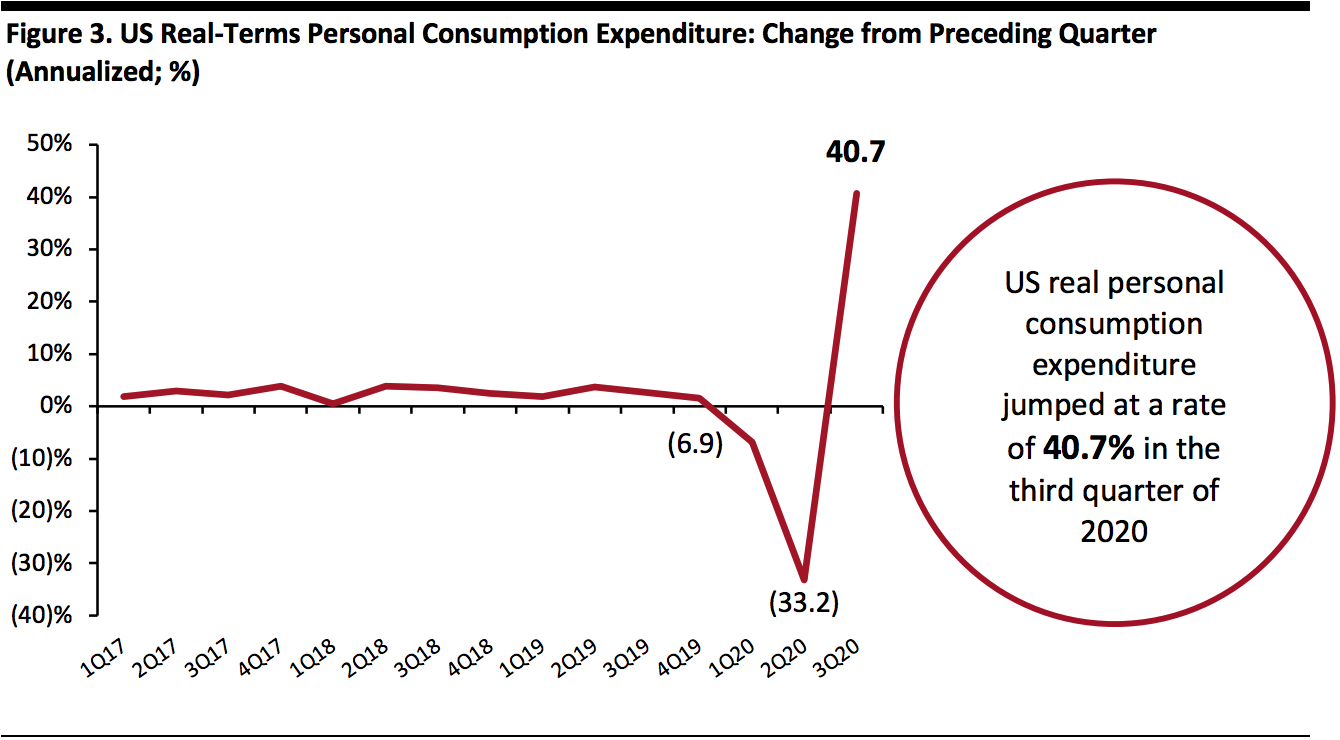

Personal Consumption Expenditure Improves Significantly in the Third Quarter

US real personal consumption expenditures (PCE, or consumer spending) soared at an annual rate of 40.7% during the third quarter of 2020, following the sharp drop of 33.2% in the previous quarter.

In September, real PCE increased by 1.2% month over month, while disposable personal income (DPI, income after paying tax and other deductions) grew by 1.8%. The improvement in real DPI in September can be attributed to increases in proprietors’ income, employee compensation and rental income, partially offset by a decrease in government social benefits as payments made to individuals in response to Covid-19.

The growth in real PCE in September relates to a month-over-month increase of $61.0 billion (a 0.8% increase) in spending on services and an increase of $109.9 billion (a 2.2% increase) in spending on goods. Within services, the top growth contributors were spending on health care, as well as on recreation services. Spending on goods was driven by a month-over-month recovery in clothing and footwear, and motor vehicles and parts.

[caption id="attachment_118893" align="aligncenter" width="700"]

Source: US Federal Reserve[/caption]

Personal Consumption Expenditure Improves Significantly in the Third Quarter

US real personal consumption expenditures (PCE, or consumer spending) soared at an annual rate of 40.7% during the third quarter of 2020, following the sharp drop of 33.2% in the previous quarter.

In September, real PCE increased by 1.2% month over month, while disposable personal income (DPI, income after paying tax and other deductions) grew by 1.8%. The improvement in real DPI in September can be attributed to increases in proprietors’ income, employee compensation and rental income, partially offset by a decrease in government social benefits as payments made to individuals in response to Covid-19.

The growth in real PCE in September relates to a month-over-month increase of $61.0 billion (a 0.8% increase) in spending on services and an increase of $109.9 billion (a 2.2% increase) in spending on goods. Within services, the top growth contributors were spending on health care, as well as on recreation services. Spending on goods was driven by a month-over-month recovery in clothing and footwear, and motor vehicles and parts.

[caption id="attachment_118893" align="aligncenter" width="700"] Source: Bureau of Economic Analysis[/caption]

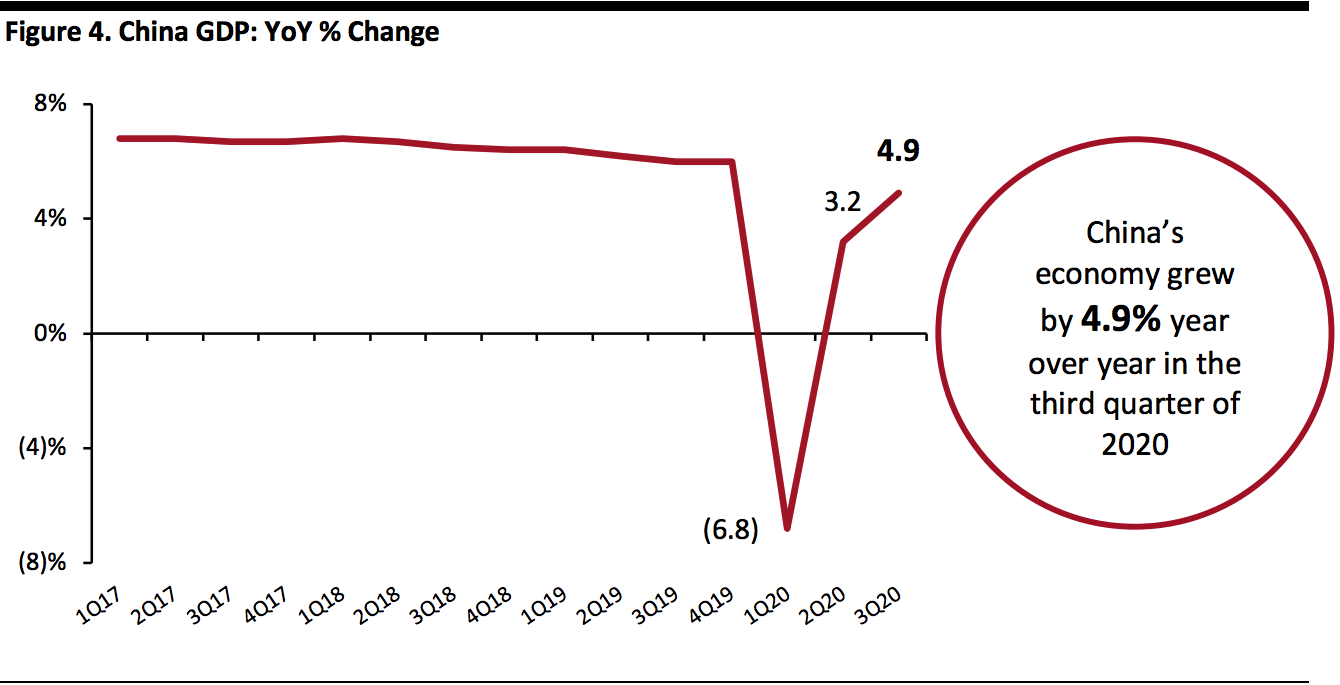

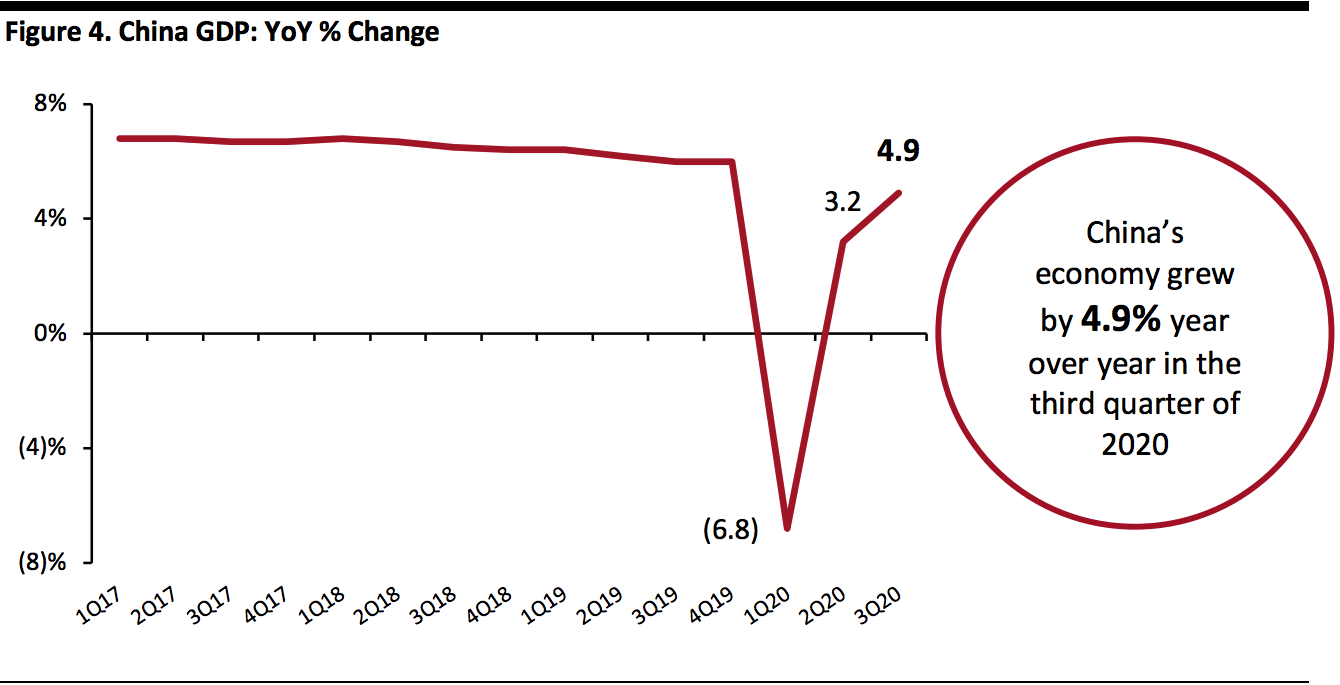

China’s GDP Expands Further

China’s economy grew by 4.9% year over year in the third quarter of 2020, after a return to growth of 3.2% in the previous quarter and a decline of 6.8% in the first quarter, according to the National Bureau of Statistics of China. Although the recovery accelerated, this was below the 5.2% growth that had been predicted by analysts surveyed in a Reuters poll. Accumulative GDP for the first three quarters of 2020 increased by 0.7%.

China is on the path for steady recovery, led by strength in investment and exports, as well as a rebound in consumption. According to the latest projection by the International Monetary Fund (IMF) on October 13, China’s economy is expected to grow by 1.9% this year, revised from June’s forecast of 0.9%.

[caption id="attachment_118894" align="aligncenter" width="700"]

Source: Bureau of Economic Analysis[/caption]

China’s GDP Expands Further

China’s economy grew by 4.9% year over year in the third quarter of 2020, after a return to growth of 3.2% in the previous quarter and a decline of 6.8% in the first quarter, according to the National Bureau of Statistics of China. Although the recovery accelerated, this was below the 5.2% growth that had been predicted by analysts surveyed in a Reuters poll. Accumulative GDP for the first three quarters of 2020 increased by 0.7%.

China is on the path for steady recovery, led by strength in investment and exports, as well as a rebound in consumption. According to the latest projection by the International Monetary Fund (IMF) on October 13, China’s economy is expected to grow by 1.9% this year, revised from June’s forecast of 0.9%.

[caption id="attachment_118894" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

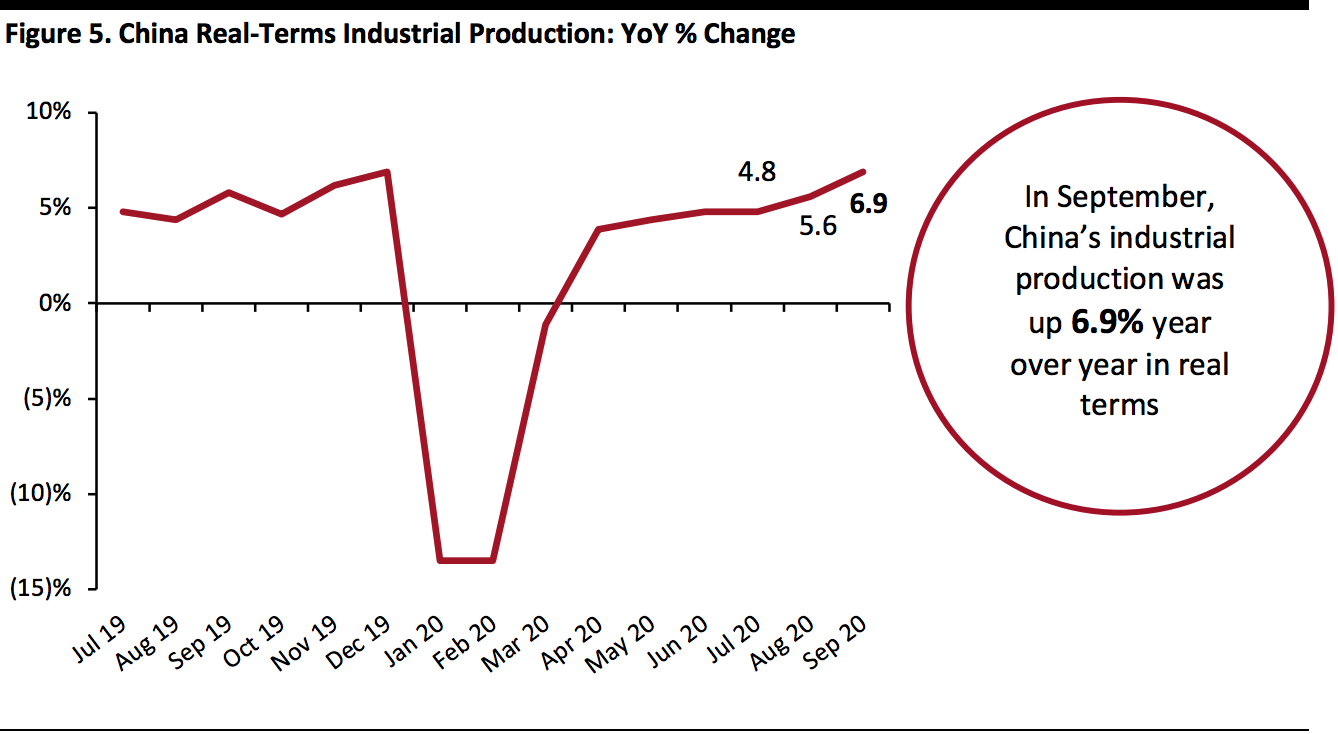

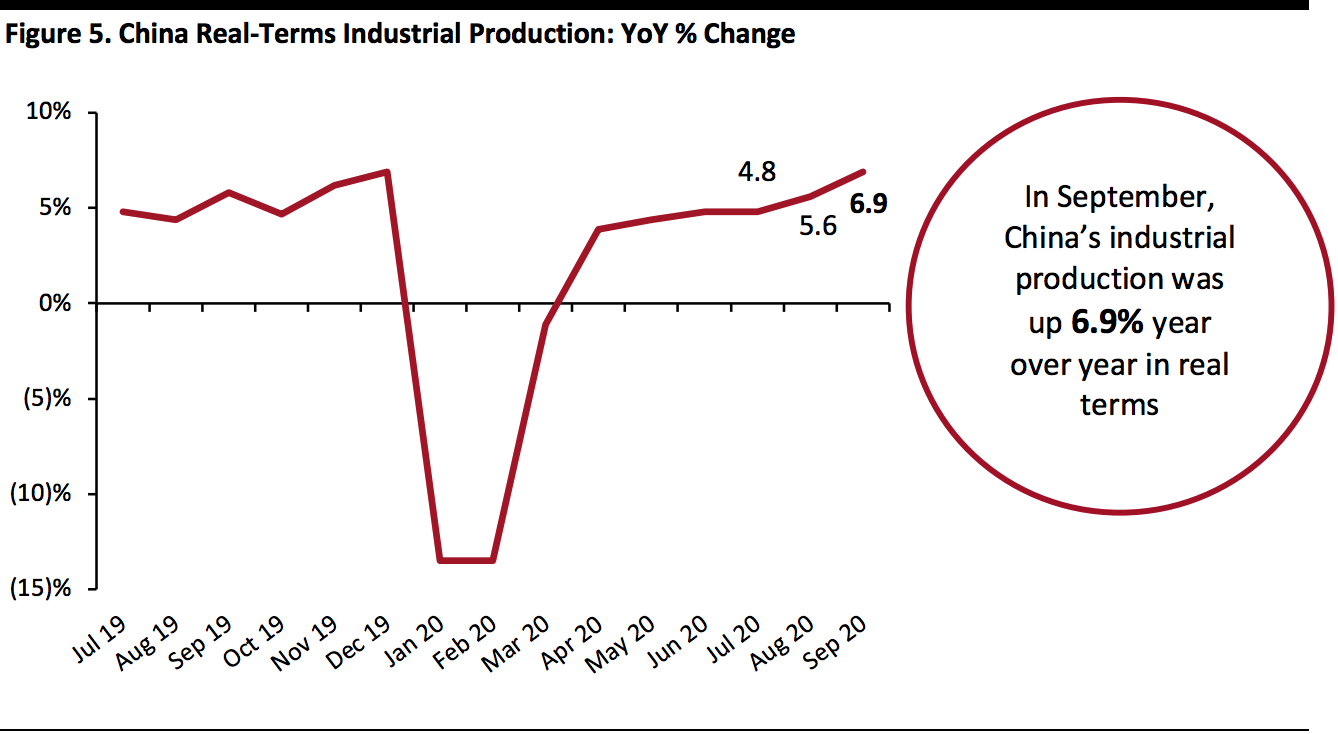

China’s Industrial Production Continues To Accelerate

China’s industrial production increased by 6.9% year over year in September, extending its growth for the sixth consecutive month and following declines in the first three months of the year. This growth was also slightly higher than the analyst consensus of 5.8%. For the third quarter, China’s industrial output rose by 5.8% year over year. That brings growth for the first three quarters of the year to 1.2%.

Industrial production of mining and quarrying increased by 2.2% year over year in September; manufacturing improved by 7.6%; and production and distribution of electricity, heating power, gas and water also went up by 4.5%.

[caption id="attachment_118895" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China[/caption]

China’s Industrial Production Continues To Accelerate

China’s industrial production increased by 6.9% year over year in September, extending its growth for the sixth consecutive month and following declines in the first three months of the year. This growth was also slightly higher than the analyst consensus of 5.8%. For the third quarter, China’s industrial output rose by 5.8% year over year. That brings growth for the first three quarters of the year to 1.2%.

Industrial production of mining and quarrying increased by 2.2% year over year in September; manufacturing improved by 7.6%; and production and distribution of electricity, heating power, gas and water also went up by 4.5%.

[caption id="attachment_118895" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

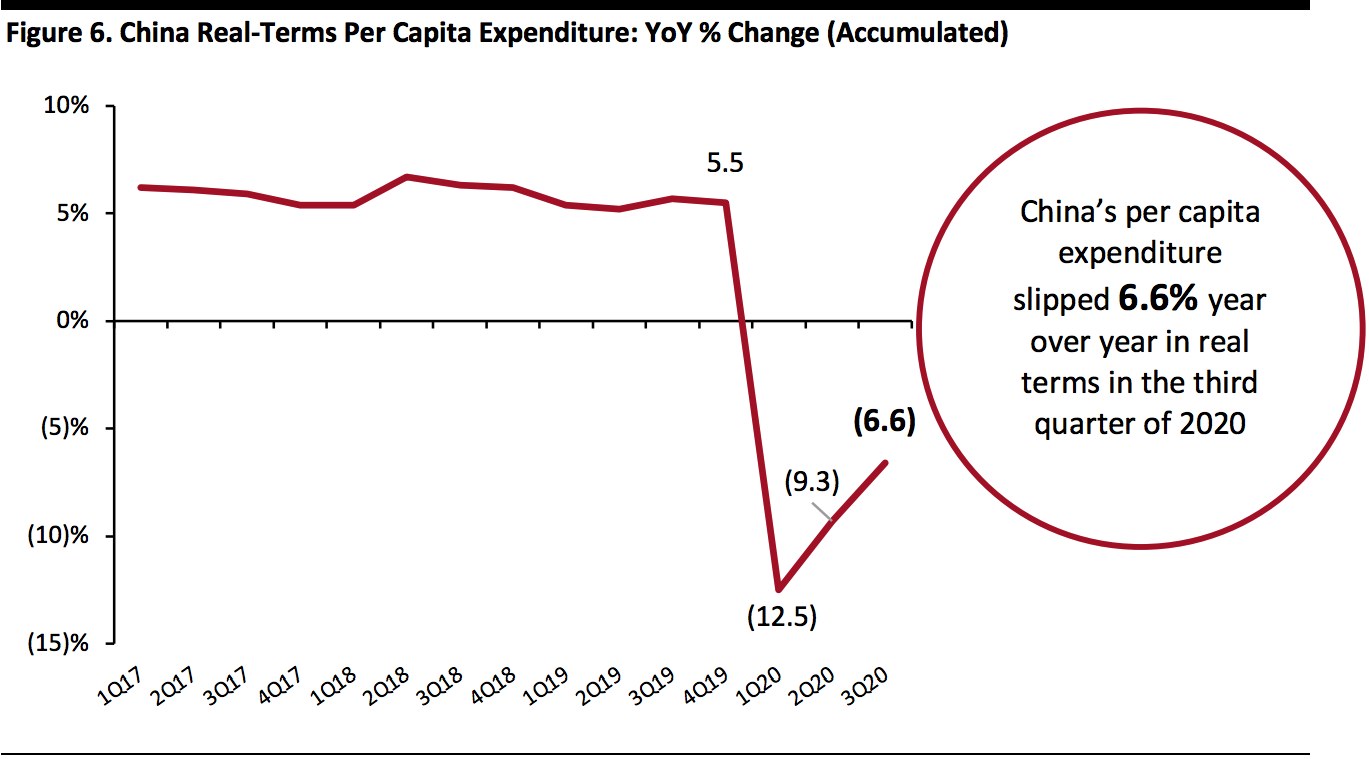

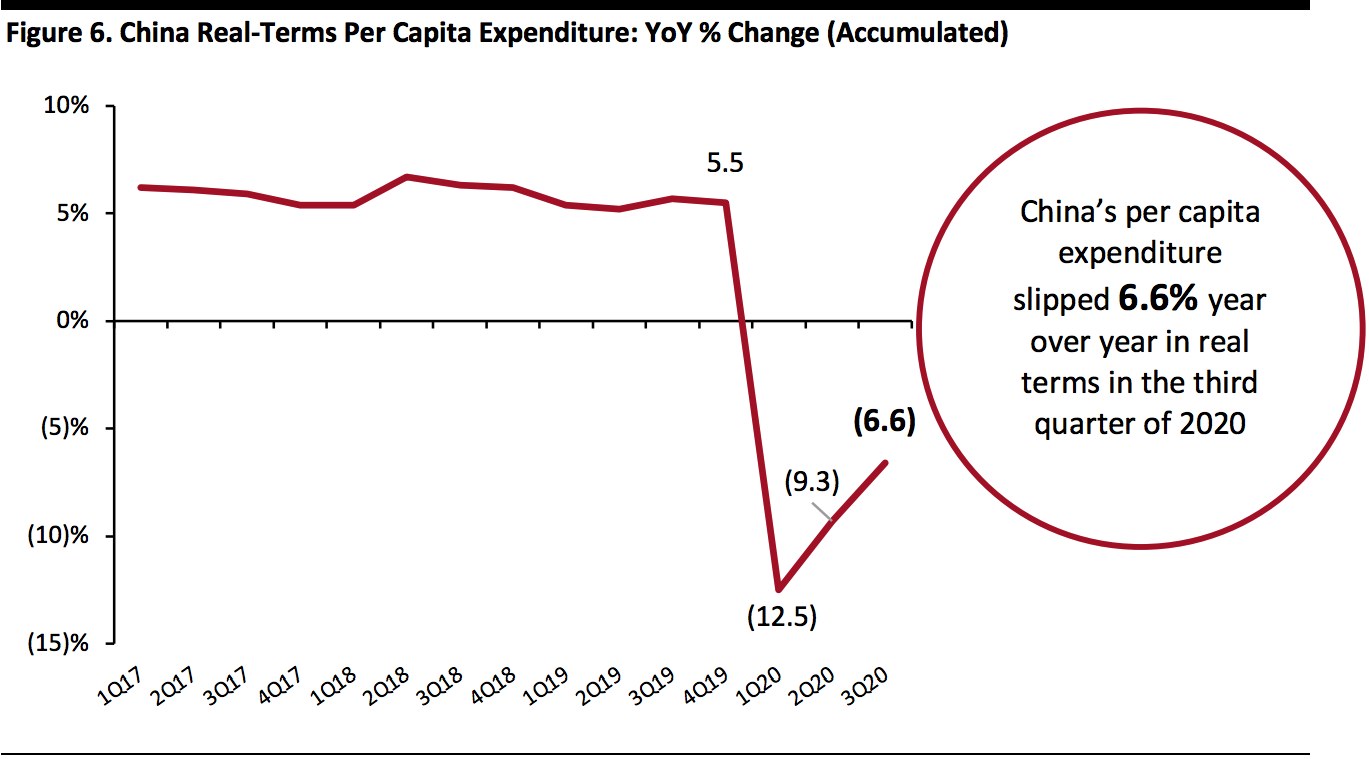

China Real-Terms Per Capita Expenditure Slides

Accumulated per capita expenditure in real terms decreased by 6.6% year over year in China in the first three quarters of 2020 but was less severe than the decline of 9.3% in the first half of the year. Retail sales turned to positive in the third quarter to 0.9%. In particular, retail sales in April fell by 1.1%, followed by the return of positive monthly growth—of 0.5% in August—and a further expansion of 3.3% in September. We expect to see retail sales continue to pick up in the fourth quarter, boosted by Golden Week and the Singles’ Day shopping festival.

[caption id="attachment_118896" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China[/caption]

China Real-Terms Per Capita Expenditure Slides

Accumulated per capita expenditure in real terms decreased by 6.6% year over year in China in the first three quarters of 2020 but was less severe than the decline of 9.3% in the first half of the year. Retail sales turned to positive in the third quarter to 0.9%. In particular, retail sales in April fell by 1.1%, followed by the return of positive monthly growth—of 0.5% in August—and a further expansion of 3.3% in September. We expect to see retail sales continue to pick up in the fourth quarter, boosted by Golden Week and the Singles’ Day shopping festival.

[caption id="attachment_118896" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

Source: National Bureau of Statistics of China[/caption]

Source: BEA[/caption]

US Industrial Production Bounces Back in the Third Quarter

US industrial production increased at an annual rate of 39.8% in the third quarter, a significant quarterly uplift. US factories saw a rebound in July and August, but unexpectedly fell by 0.6% in September, indicating a slowdown in their recovery.

The output of consumer goods improved by 56.7% in the quarter, within which durable goods grew by 425.7% and nondurable goods jumped by 15.8%. Clothing saw the largest increase of 66.9% within nondurable goods in the quarter, followed by 15.2% growth in the food and tobacco category.

[caption id="attachment_118891" align="aligncenter" width="700"]

Source: BEA[/caption]

US Industrial Production Bounces Back in the Third Quarter

US industrial production increased at an annual rate of 39.8% in the third quarter, a significant quarterly uplift. US factories saw a rebound in July and August, but unexpectedly fell by 0.6% in September, indicating a slowdown in their recovery.

The output of consumer goods improved by 56.7% in the quarter, within which durable goods grew by 425.7% and nondurable goods jumped by 15.8%. Clothing saw the largest increase of 66.9% within nondurable goods in the quarter, followed by 15.2% growth in the food and tobacco category.

[caption id="attachment_118891" align="aligncenter" width="700"] Source: US Federal Reserve[/caption]

Personal Consumption Expenditure Improves Significantly in the Third Quarter

US real personal consumption expenditures (PCE, or consumer spending) soared at an annual rate of 40.7% during the third quarter of 2020, following the sharp drop of 33.2% in the previous quarter.

In September, real PCE increased by 1.2% month over month, while disposable personal income (DPI, income after paying tax and other deductions) grew by 1.8%. The improvement in real DPI in September can be attributed to increases in proprietors’ income, employee compensation and rental income, partially offset by a decrease in government social benefits as payments made to individuals in response to Covid-19.

The growth in real PCE in September relates to a month-over-month increase of $61.0 billion (a 0.8% increase) in spending on services and an increase of $109.9 billion (a 2.2% increase) in spending on goods. Within services, the top growth contributors were spending on health care, as well as on recreation services. Spending on goods was driven by a month-over-month recovery in clothing and footwear, and motor vehicles and parts.

[caption id="attachment_118893" align="aligncenter" width="700"]

Source: US Federal Reserve[/caption]

Personal Consumption Expenditure Improves Significantly in the Third Quarter

US real personal consumption expenditures (PCE, or consumer spending) soared at an annual rate of 40.7% during the third quarter of 2020, following the sharp drop of 33.2% in the previous quarter.

In September, real PCE increased by 1.2% month over month, while disposable personal income (DPI, income after paying tax and other deductions) grew by 1.8%. The improvement in real DPI in September can be attributed to increases in proprietors’ income, employee compensation and rental income, partially offset by a decrease in government social benefits as payments made to individuals in response to Covid-19.

The growth in real PCE in September relates to a month-over-month increase of $61.0 billion (a 0.8% increase) in spending on services and an increase of $109.9 billion (a 2.2% increase) in spending on goods. Within services, the top growth contributors were spending on health care, as well as on recreation services. Spending on goods was driven by a month-over-month recovery in clothing and footwear, and motor vehicles and parts.

[caption id="attachment_118893" align="aligncenter" width="700"] Source: Bureau of Economic Analysis[/caption]

China’s GDP Expands Further

China’s economy grew by 4.9% year over year in the third quarter of 2020, after a return to growth of 3.2% in the previous quarter and a decline of 6.8% in the first quarter, according to the National Bureau of Statistics of China. Although the recovery accelerated, this was below the 5.2% growth that had been predicted by analysts surveyed in a Reuters poll. Accumulative GDP for the first three quarters of 2020 increased by 0.7%.

China is on the path for steady recovery, led by strength in investment and exports, as well as a rebound in consumption. According to the latest projection by the International Monetary Fund (IMF) on October 13, China’s economy is expected to grow by 1.9% this year, revised from June’s forecast of 0.9%.

[caption id="attachment_118894" align="aligncenter" width="700"]

Source: Bureau of Economic Analysis[/caption]

China’s GDP Expands Further

China’s economy grew by 4.9% year over year in the third quarter of 2020, after a return to growth of 3.2% in the previous quarter and a decline of 6.8% in the first quarter, according to the National Bureau of Statistics of China. Although the recovery accelerated, this was below the 5.2% growth that had been predicted by analysts surveyed in a Reuters poll. Accumulative GDP for the first three quarters of 2020 increased by 0.7%.

China is on the path for steady recovery, led by strength in investment and exports, as well as a rebound in consumption. According to the latest projection by the International Monetary Fund (IMF) on October 13, China’s economy is expected to grow by 1.9% this year, revised from June’s forecast of 0.9%.

[caption id="attachment_118894" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

China’s Industrial Production Continues To Accelerate

China’s industrial production increased by 6.9% year over year in September, extending its growth for the sixth consecutive month and following declines in the first three months of the year. This growth was also slightly higher than the analyst consensus of 5.8%. For the third quarter, China’s industrial output rose by 5.8% year over year. That brings growth for the first three quarters of the year to 1.2%.

Industrial production of mining and quarrying increased by 2.2% year over year in September; manufacturing improved by 7.6%; and production and distribution of electricity, heating power, gas and water also went up by 4.5%.

[caption id="attachment_118895" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China[/caption]

China’s Industrial Production Continues To Accelerate

China’s industrial production increased by 6.9% year over year in September, extending its growth for the sixth consecutive month and following declines in the first three months of the year. This growth was also slightly higher than the analyst consensus of 5.8%. For the third quarter, China’s industrial output rose by 5.8% year over year. That brings growth for the first three quarters of the year to 1.2%.

Industrial production of mining and quarrying increased by 2.2% year over year in September; manufacturing improved by 7.6%; and production and distribution of electricity, heating power, gas and water also went up by 4.5%.

[caption id="attachment_118895" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

China Real-Terms Per Capita Expenditure Slides

Accumulated per capita expenditure in real terms decreased by 6.6% year over year in China in the first three quarters of 2020 but was less severe than the decline of 9.3% in the first half of the year. Retail sales turned to positive in the third quarter to 0.9%. In particular, retail sales in April fell by 1.1%, followed by the return of positive monthly growth—of 0.5% in August—and a further expansion of 3.3% in September. We expect to see retail sales continue to pick up in the fourth quarter, boosted by Golden Week and the Singles’ Day shopping festival.

[caption id="attachment_118896" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China[/caption]

China Real-Terms Per Capita Expenditure Slides

Accumulated per capita expenditure in real terms decreased by 6.6% year over year in China in the first three quarters of 2020 but was less severe than the decline of 9.3% in the first half of the year. Retail sales turned to positive in the third quarter to 0.9%. In particular, retail sales in April fell by 1.1%, followed by the return of positive monthly growth—of 0.5% in August—and a further expansion of 3.3% in September. We expect to see retail sales continue to pick up in the fourth quarter, boosted by Golden Week and the Singles’ Day shopping festival.

[caption id="attachment_118896" align="aligncenter" width="700"] Source: National Bureau of Statistics of China[/caption]

Source: National Bureau of Statistics of China[/caption]