Introduction

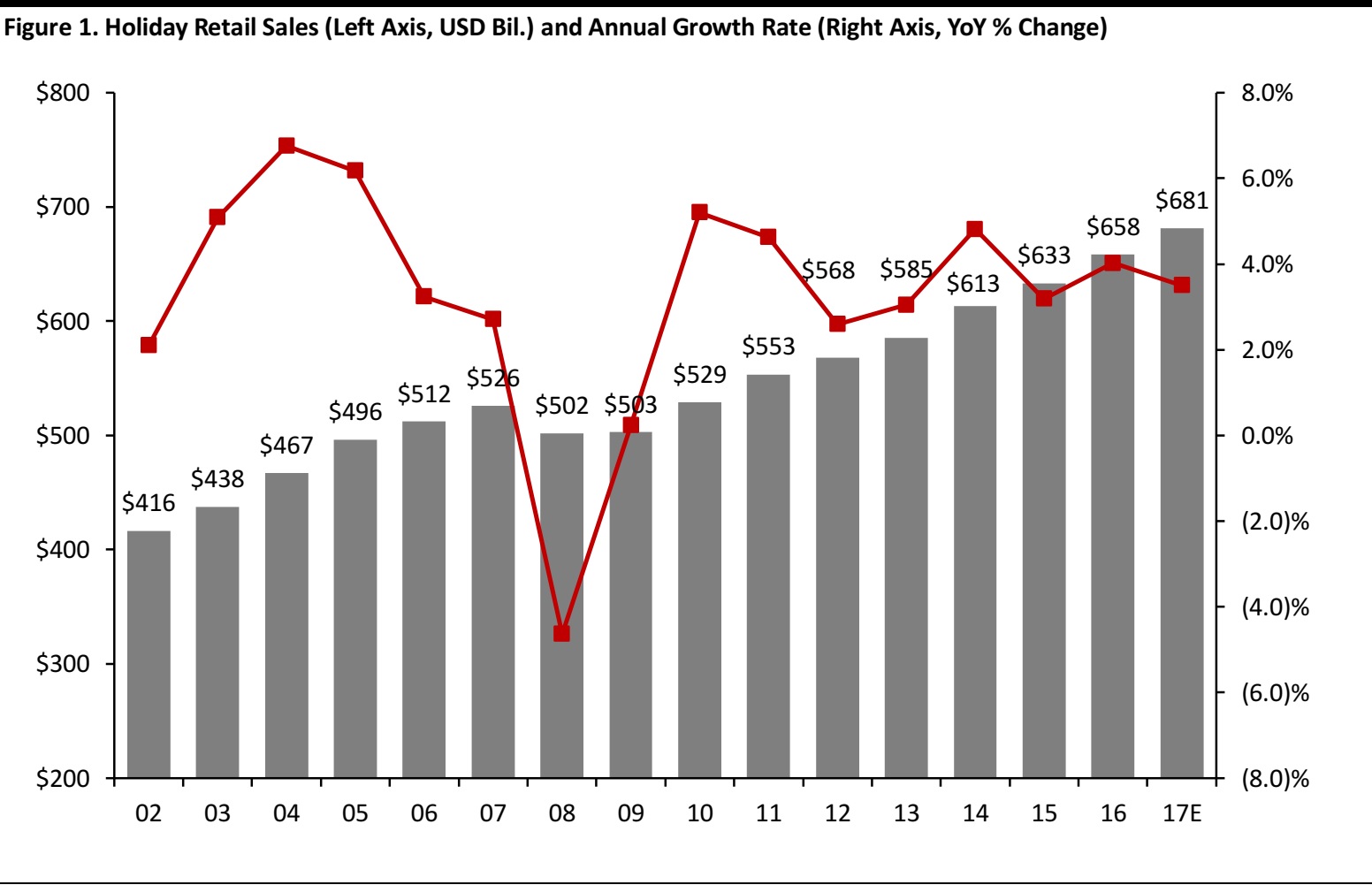

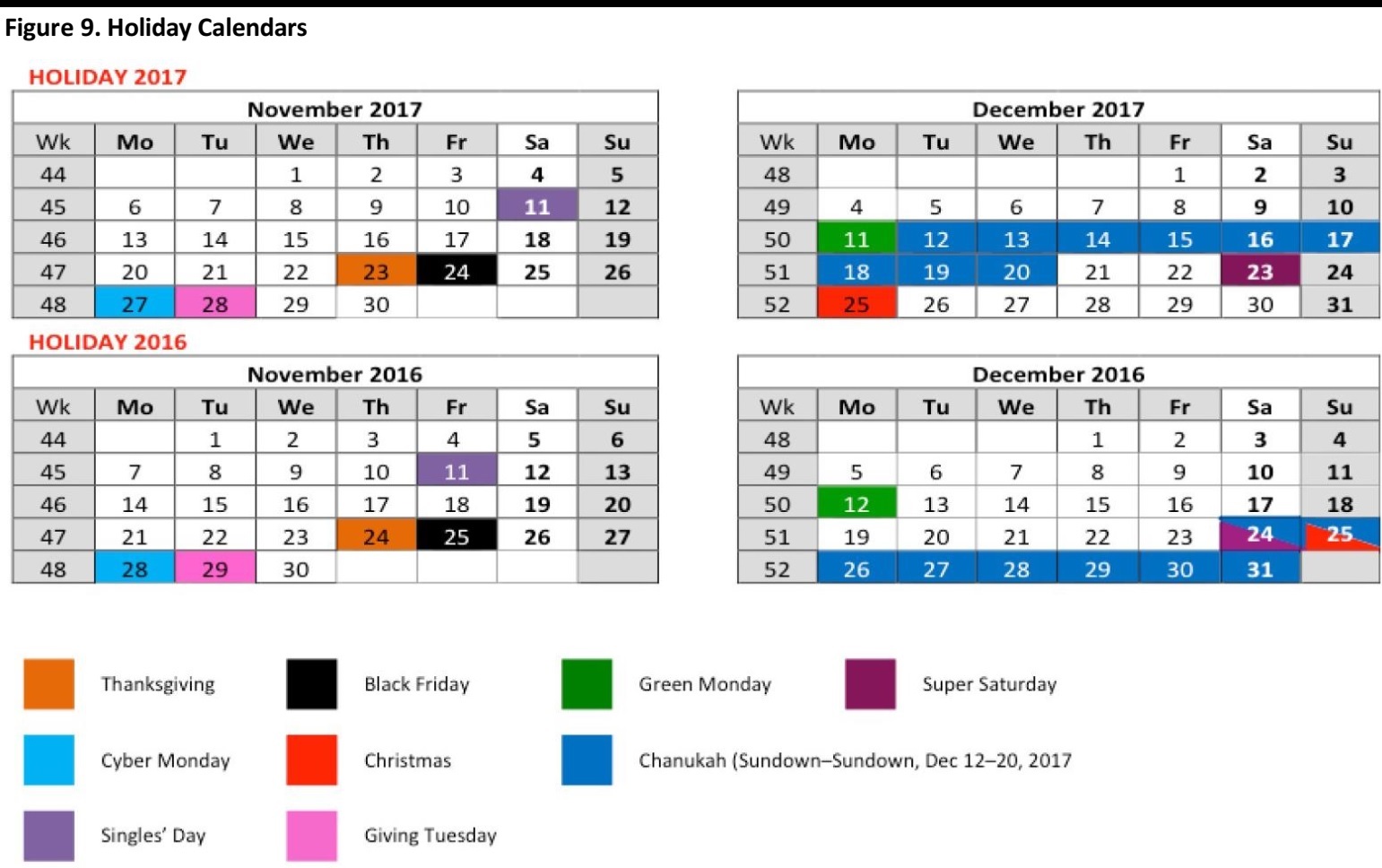

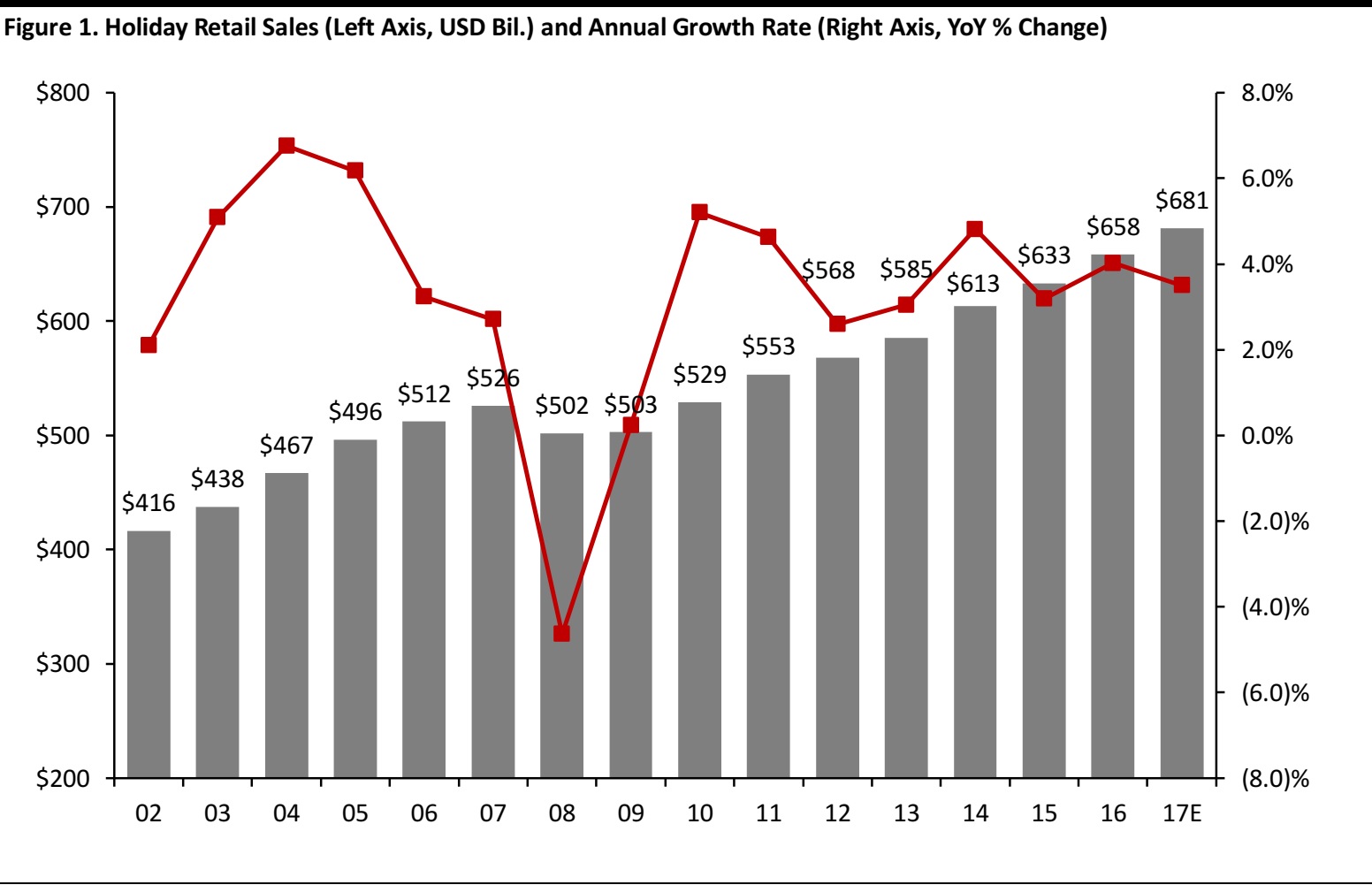

In this report, we take stock of the succesful 2017 holiday retail season in the US. The season saw sales growth of 4.9% year over year, the highest since 2011. E-commerce sales continued to grow by double digits, rising by 18.1% over the holiday season. In addition, Cyber Monday 2017 was the biggest day ever for online sales in the US. Favorable macroeconomic conditions, including low unemployment, positive consumer sentiment and a strong housing market, have helped create a “wealth effect” in the US, encouraging consumer spending. Holiday season sales also benefited from cold, dry weather and a favorable 2017 holiday calendar that included 31 days between Thanksgiving and Christmas, one more day than in 2016.

Overall Holiday Retail Sales Growth Exceeded Expectations

Data released just after Christmas suggest that retail sales growth over the 2017 holiday season exceeded expectations and beat FGRT’s forecast of a 3%–4% year-over-year increase. Mastercard SpendingPulse reported that total US holiday retail sales rose by 4.9% over the period from November 1 through December 24, the biggest year-over-year increase since 2011. In late November, the National Retail Federation (NRF) reiterated its retail sales growth forecast calling for a 3.6%–4.0% increase in holiday sales.

Source: NRF/FGRT

Online Sales Growth Outpaced In-Store Sales Growth

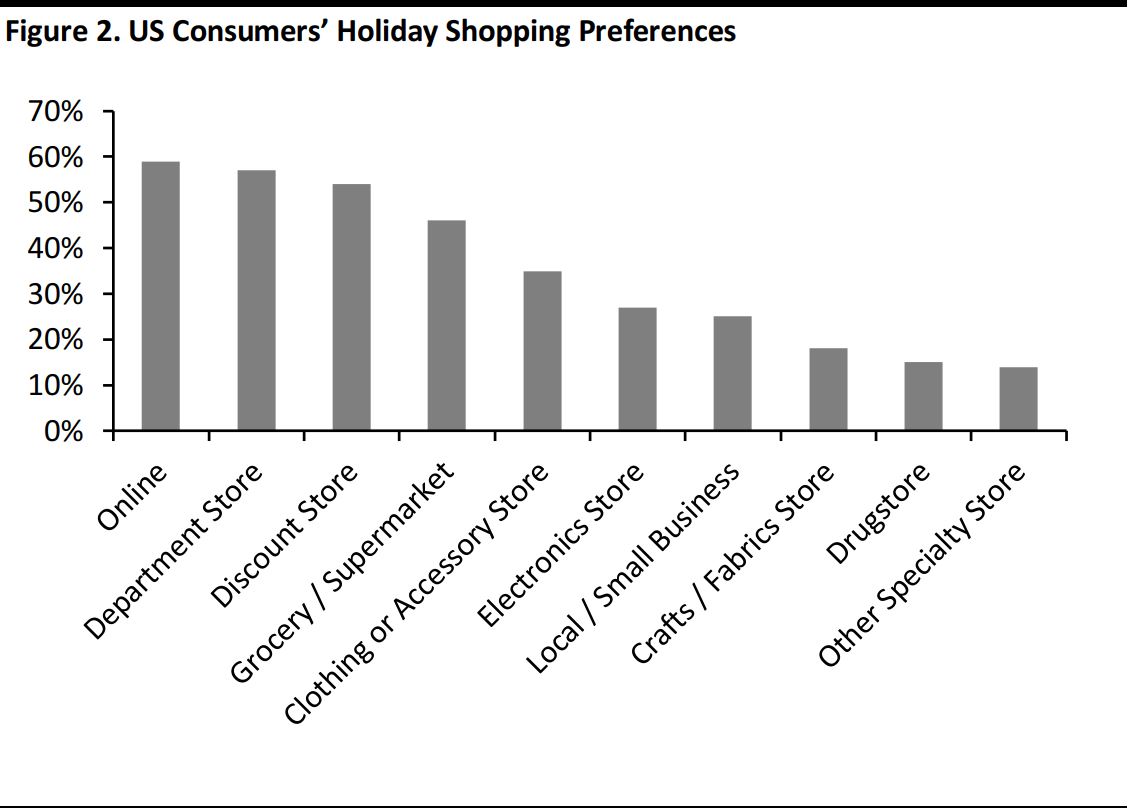

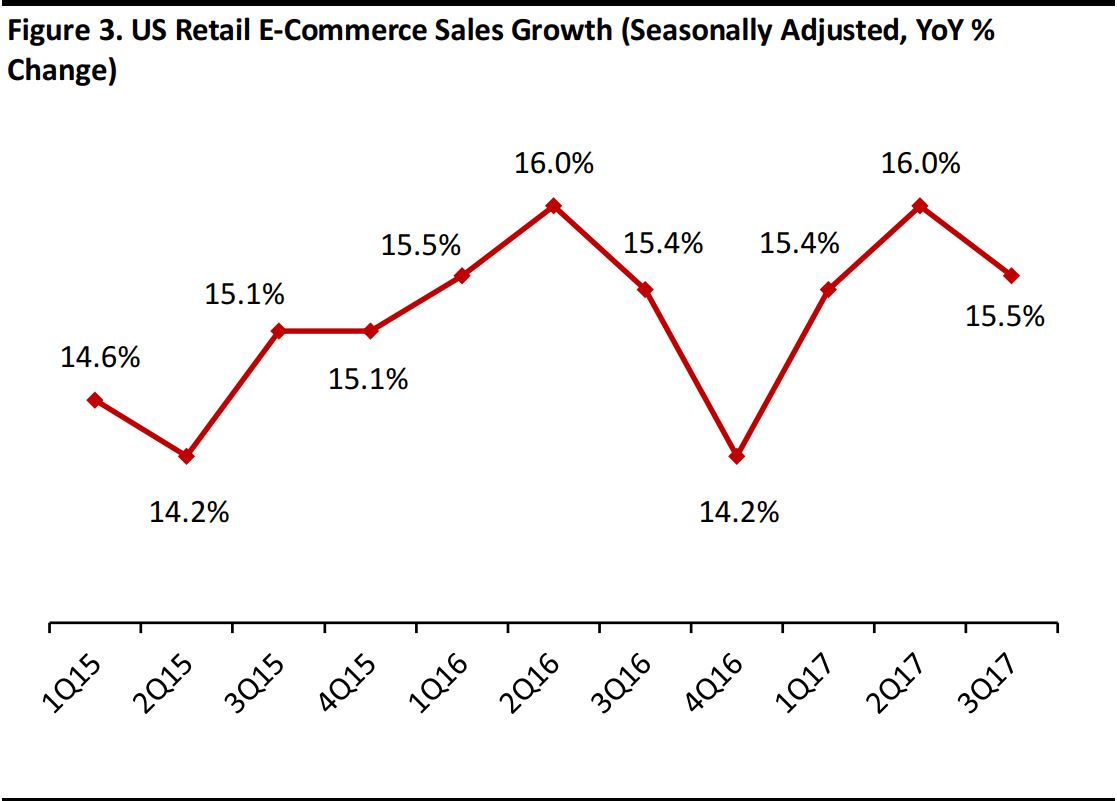

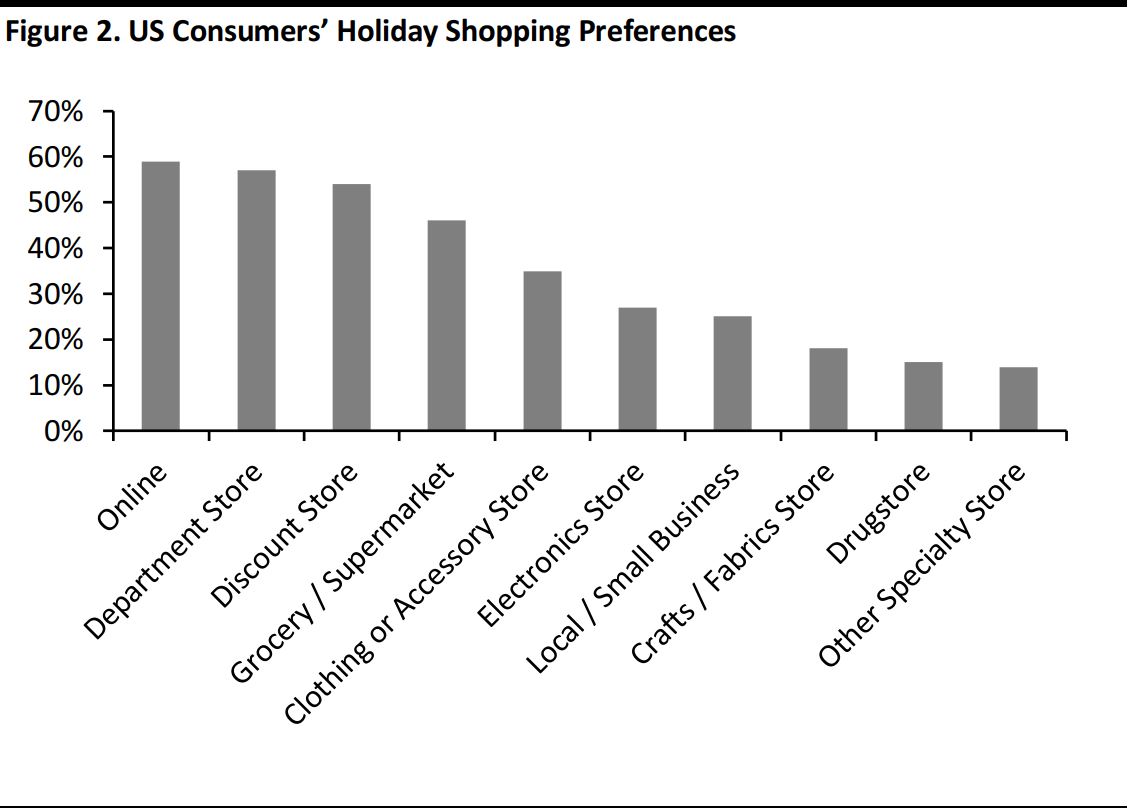

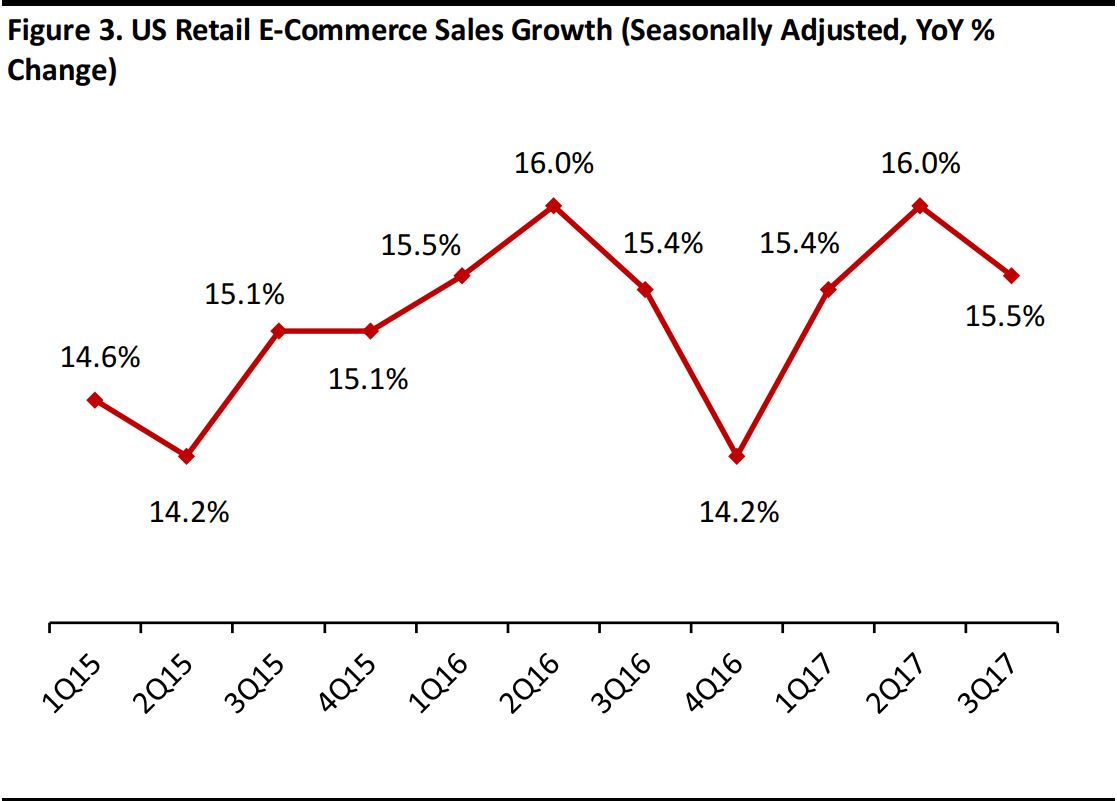

This holiday season, e-commerce sales saw continued strong growth that outpaced overall retail sales growth. According to Mastercard SpendingPulse, online holiday retail sales increased by 18.1% year over year, strongly outperforming total holiday retail sales growth of 4.9%. In the NRF’s annual consumer holiday shopping survey

, which was conducted by Prosper Insights & Analytics in early October 2017, “online” was the most popular holiday shopping destination among respondents, with 59% of those polled saying they planned to shop online.

Source: NRF/Prosper Insights & Analytics

According to Adobe, Cyber Monday 2017 was the biggest e-commerce day in history, registering a record $6.59 billion in online sales. That figure was up by more than $1 billion over Cyber Monday 2016 and exceeded the $5.0 billion in online sales expected on Black Friday 2017. Adobe further estimated that the entire holiday season generated online sales of $107.4 billion, an increase of 13.8% year over year.

Source: US Census Bureau

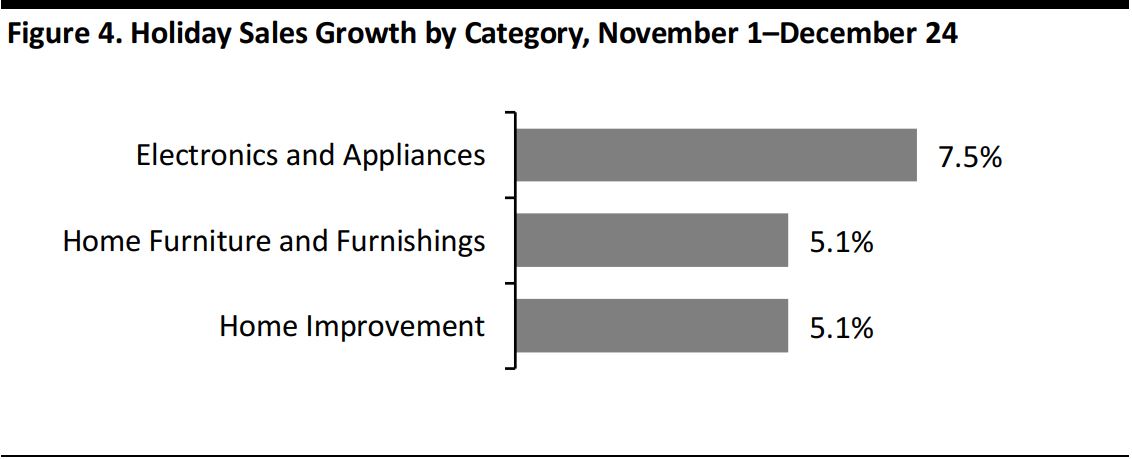

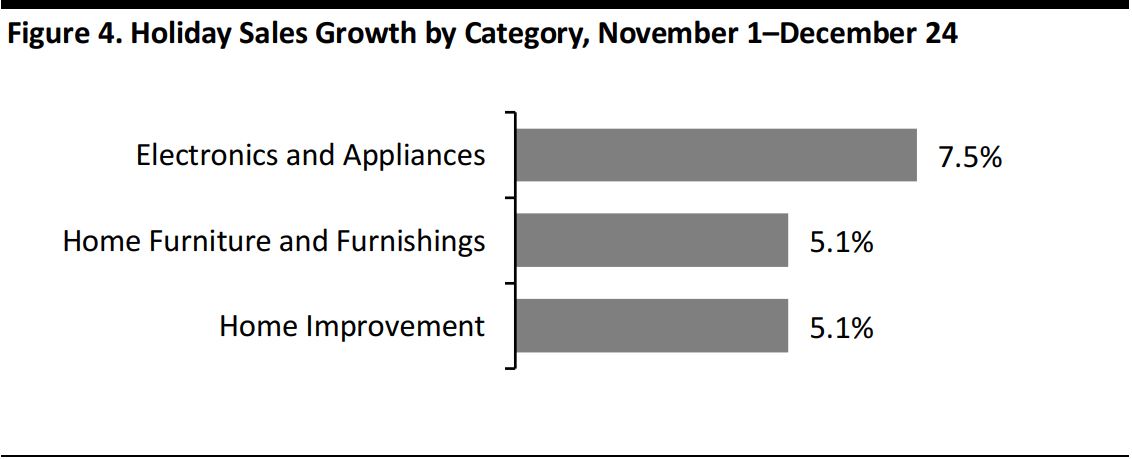

While All Categories Saw Sales Growth over the Holidays, Electronics and Home Products Performed Particularly Well

According to Mastercard SpendingPulse, all retail categories experienced growth over the holiday season. The strongest performers were home products categories, including electronics, appliances, furniture and home furnishings. Sales of electronics and appliances rose by 7.5%, the category’s strongest performance in the last decade. Specialty apparel and department stores saw moderate gains, which is impressive given the category’s recent flat growth and the number of stores that were closed in 2017. Jewelry sales grew by 5.9% over the holiday season, largely driven by last-minute promotions, according to Mastercard SpendingPulse.

Source: Mastercard SpendingPulse

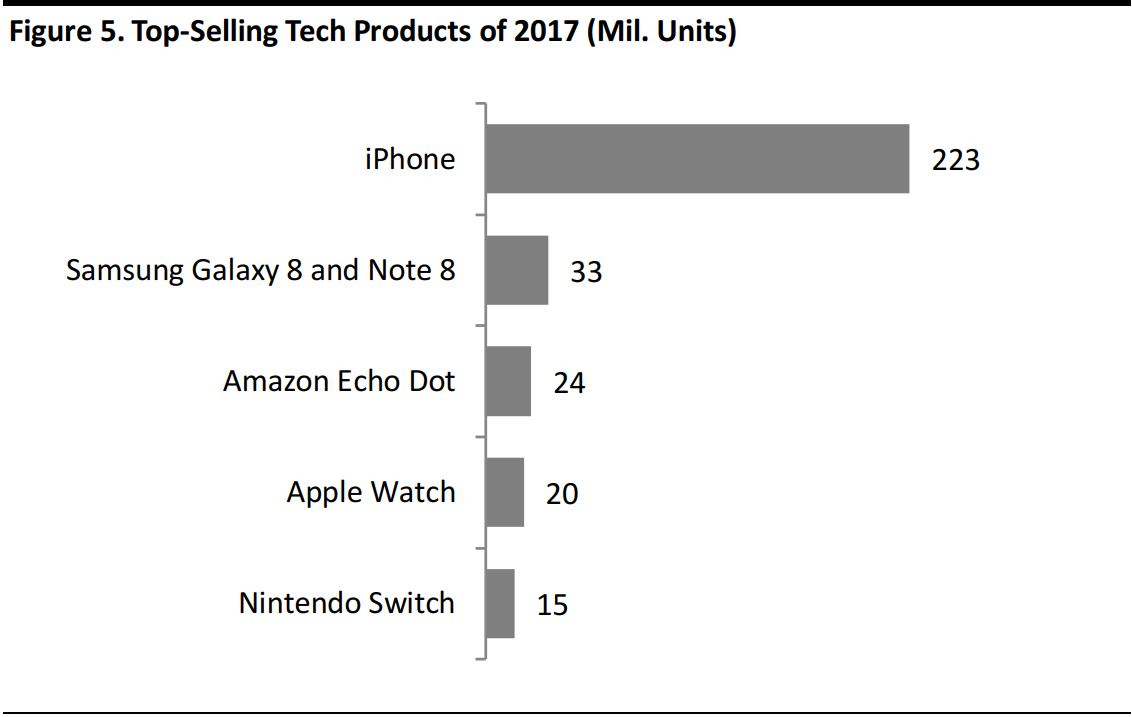

Technology Accounted for 22% of Annual Retail Sales in 2016

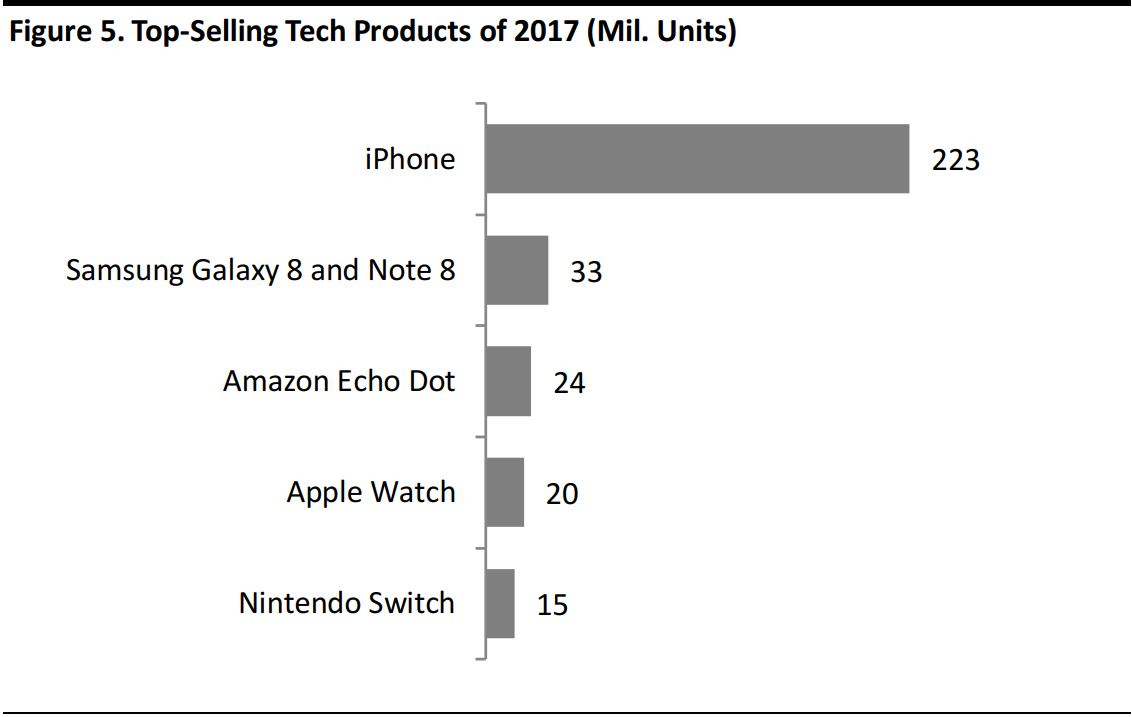

Data from the US Census Bureau indicate that holiday sales at electronics and appliance stores amounted to nearly $22 billion in the 2016 (latest available) and accounted for 22% of annual sales. In 2017, Apple made a risky move by introducing three new iPhones—and the move paid off. According to GBH Insights, the iPhone was the best-selling technology product in 2017, with 223 million units sold.

Source: GBH Insights

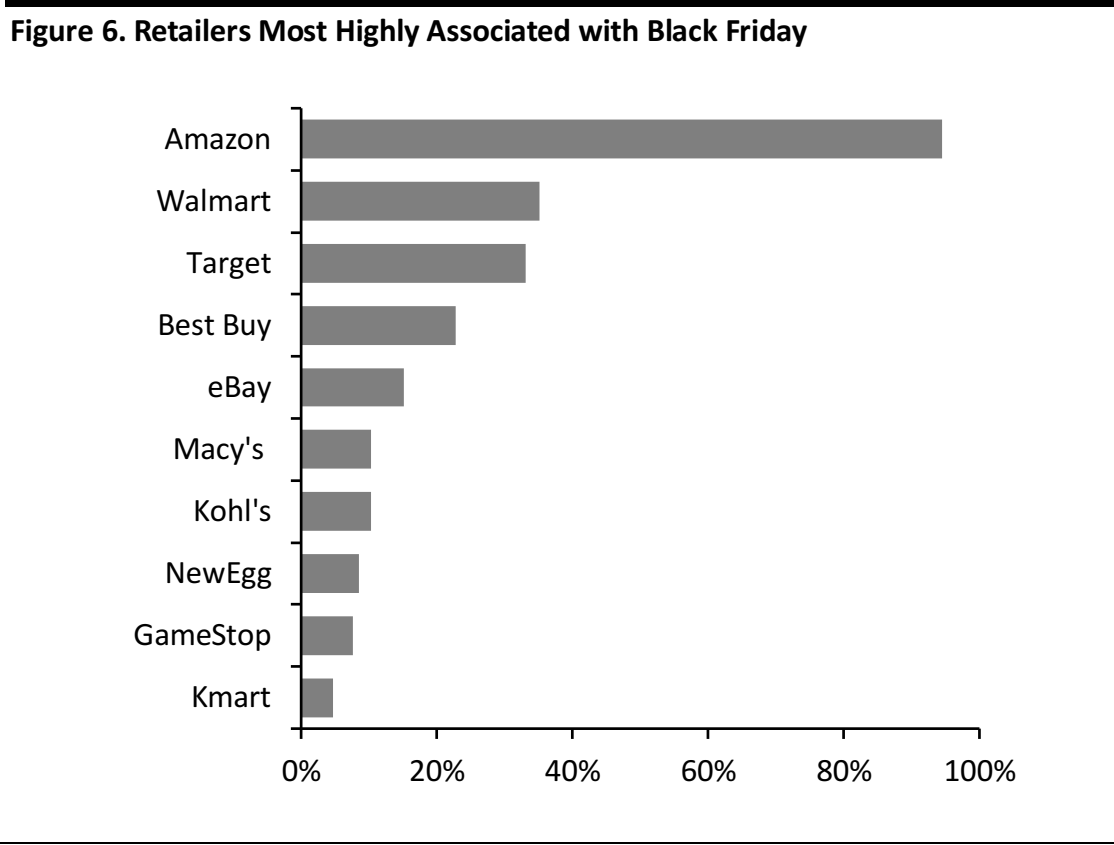

Amazon Won Again, Reporting Its “Biggest Holiday Season”

Amazon reported that it celebrated its “biggest holiday season” ever in 2017, with customers around the world shopping at “record levels.” In addition, the company said that more than 4 million people either trialed or joined Amazon Prime in the course of one week over the holiday season. GBH Insights estimated that there were 88 million Amazon Prime members in December, up 40% year over year.

Consumers purchased hundreds of millions of products on Amazon this past holiday season, including more than a billion items ordered from small businesses. On December 29, Amazon offered discounts on apps, games and movies as part of its second annual “Digital Day” shopping event, which is similar to Prime Day.

Source: Amobee Brand Intelligence

Source: Amobee Brand Intelligence

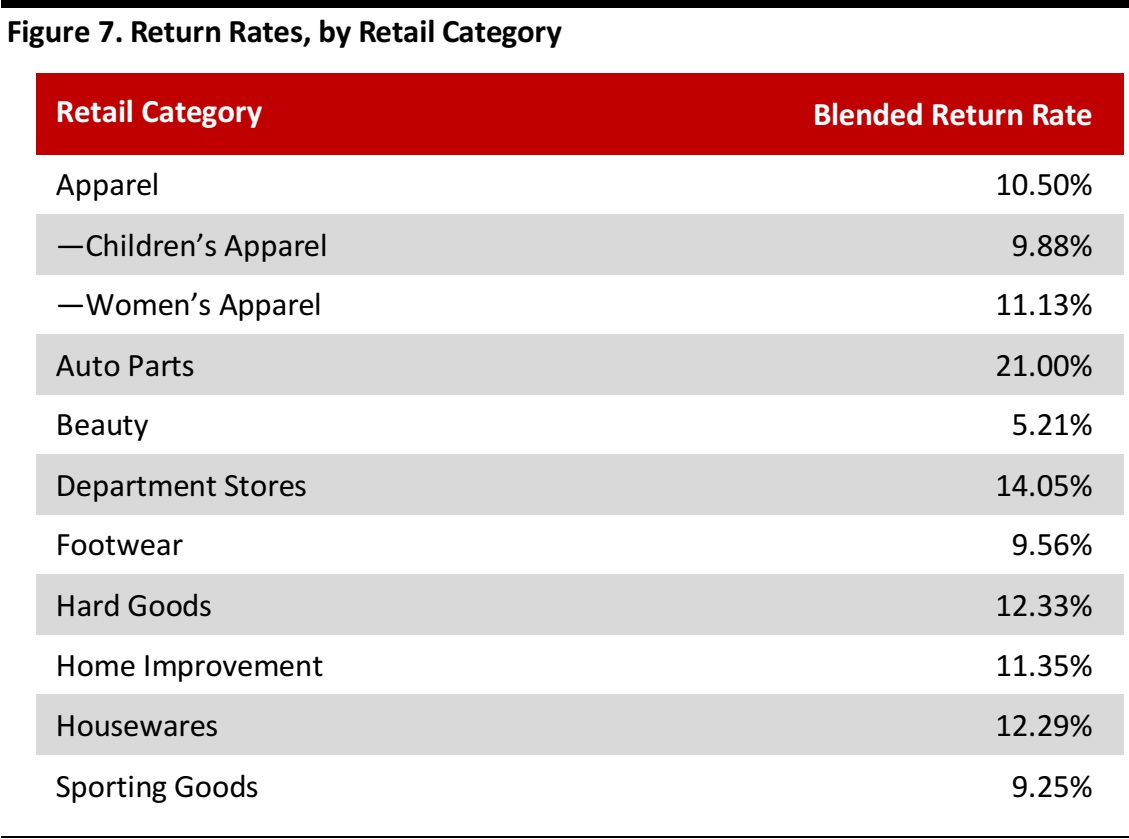

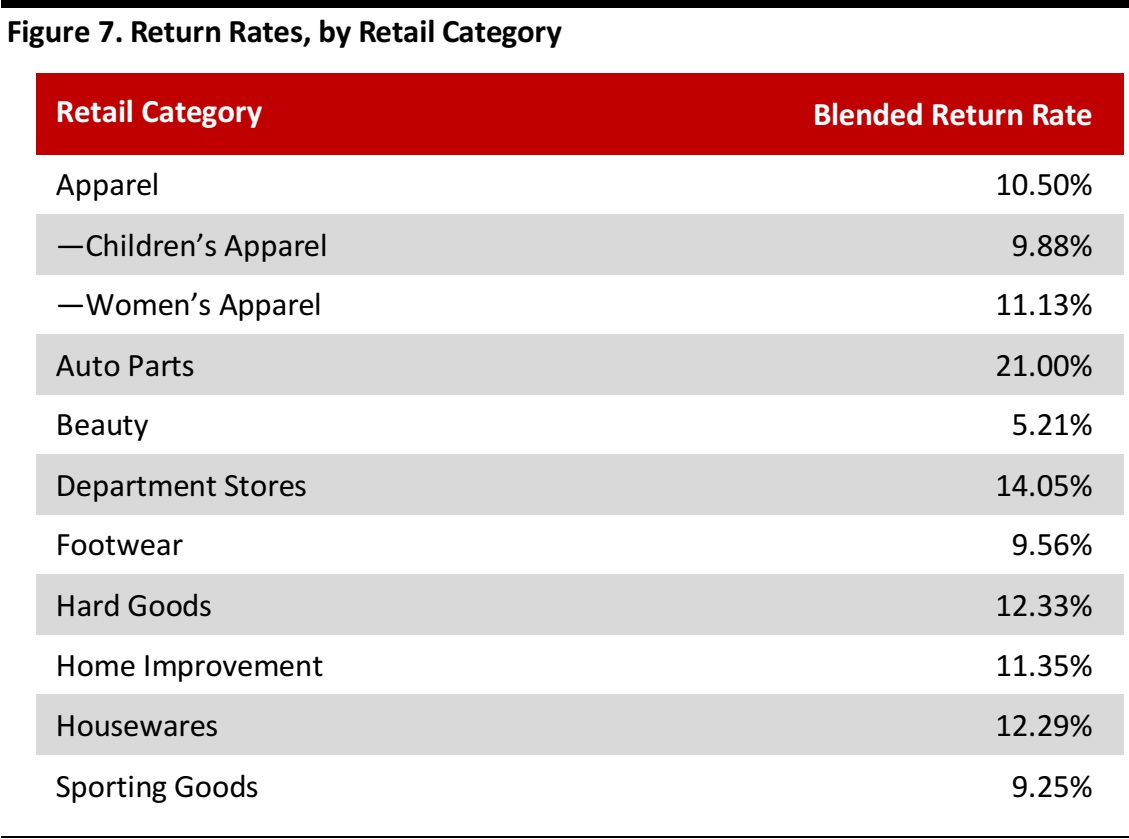

National Returns Day Expected to See 1.4 Million Packages; Returns Present Retailers with an Opportunity to Upsell

Returns are a big part of the holiday season. UPS estimated that 1.4 million packages would be returned to retailers on January 3, which the company termed “National Returns Day.” That is in addition to the 1 million returns that UPS projected it would process each day leading up to Christmas. According to the NRF’s 2015

Return Fraud Survey, in October and November of 2015, one out of every three gift recipients (38%) returned at least one item. Reverse logistics firm Optoro estimated that consumers would return $90 billion worth of goods from the 2017 holiday season.

Source: The Retail Equation

Returns offer opportunities for retailers. When consumers visit brick-and-mortar stores to exchange or return an item, retailers have the chance to upsell them or sell them additional items—and the majority of gifts that are returned are taken back to a physical store, regardless of where they were purchased. According to JCPenney, more than 90% of online returns are brought to a physical store. Experts say that US in-store conversion rates range from 15% to 30%, so retailers could generate additional sales in the billions by catering to shoppers who visit stores to make returns.

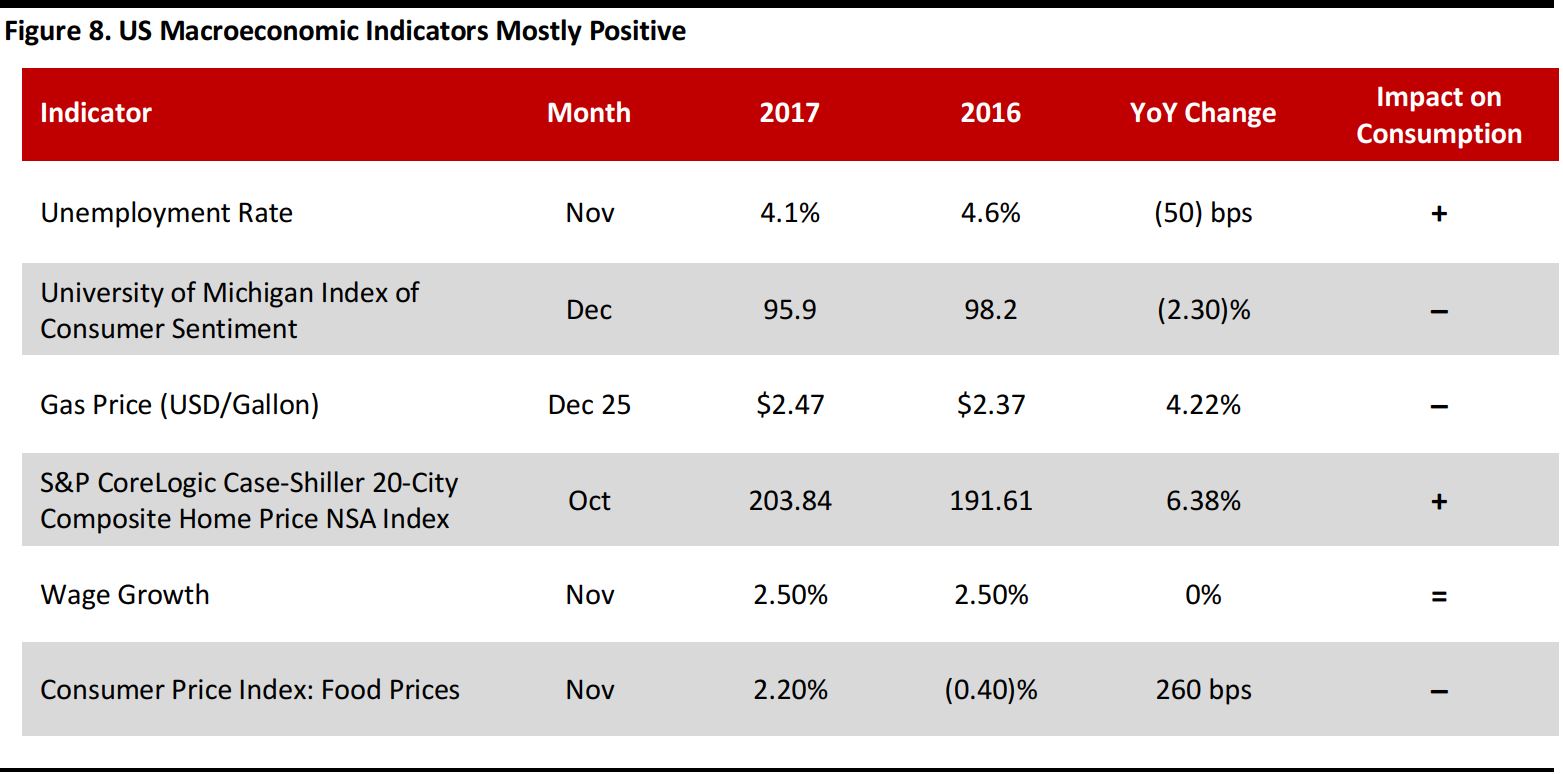

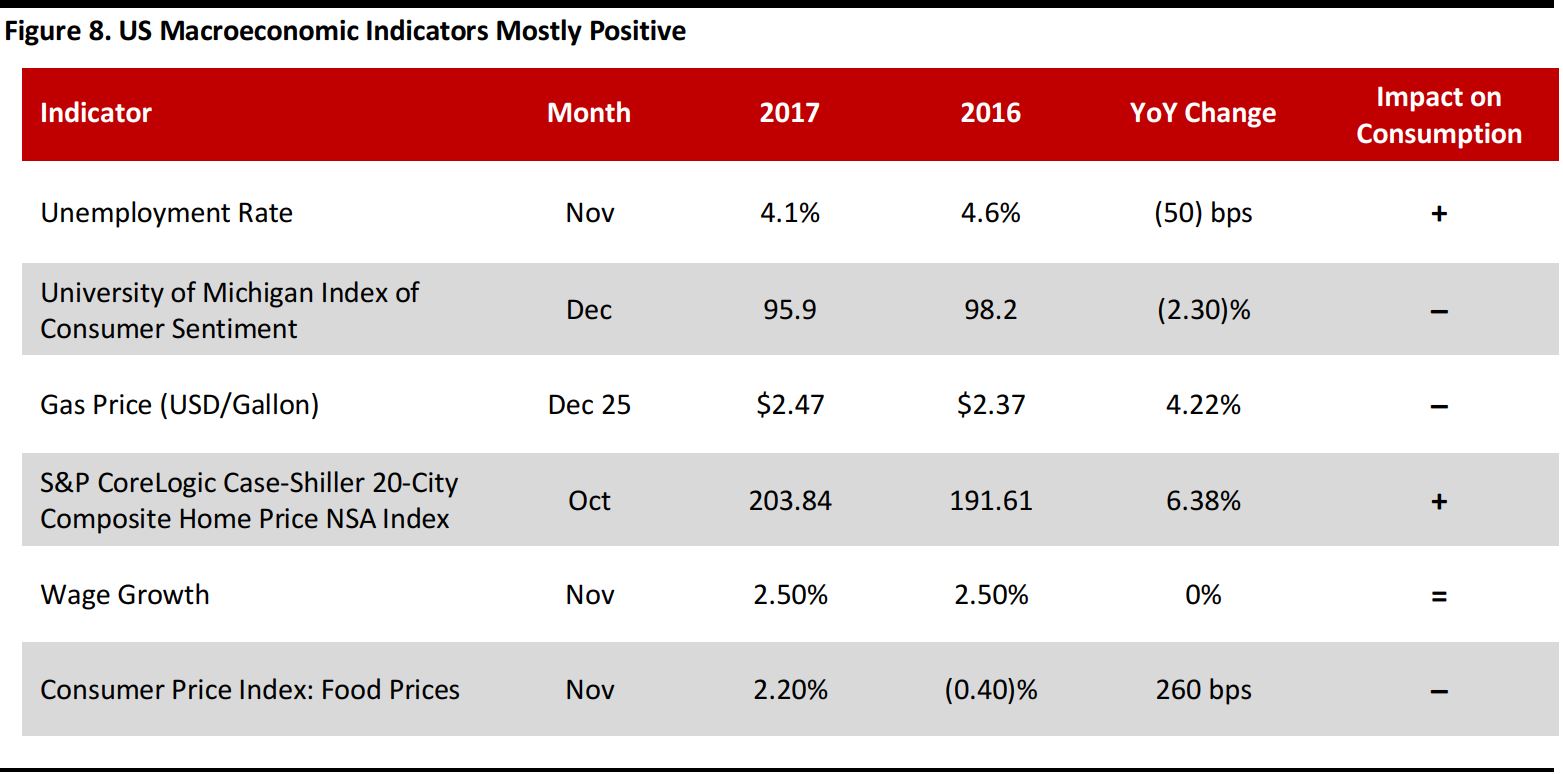

Favorable Macro Backdrop for Spending

The US macroeconomic environment was favorable toward consumer spending throughout the fourth quarter of 2017. The unemployment rate hit 4.1% in October, its lowest level in 17 years, and remained at that level through December. In the fourth quarter, consumer sentiment was positive, wage growth remained healthy and gas prices were moderate, at $2.47 per gallon as of the end of December. In addition, consumers’ homes were more valuable going into the 2017 holiday season, supported by low inventories and increasing sales. This created a “wealth effect” that made consumers more comfortable spending over the holidays. Taken together, US macro indicators were much more positive than negative, supporting holiday retail sales.

Source: US Bureau of Labor Statistics/University of Michigan/US Energy Information Administration/S&P Dow Jones/US Bureau of Economic Analysis

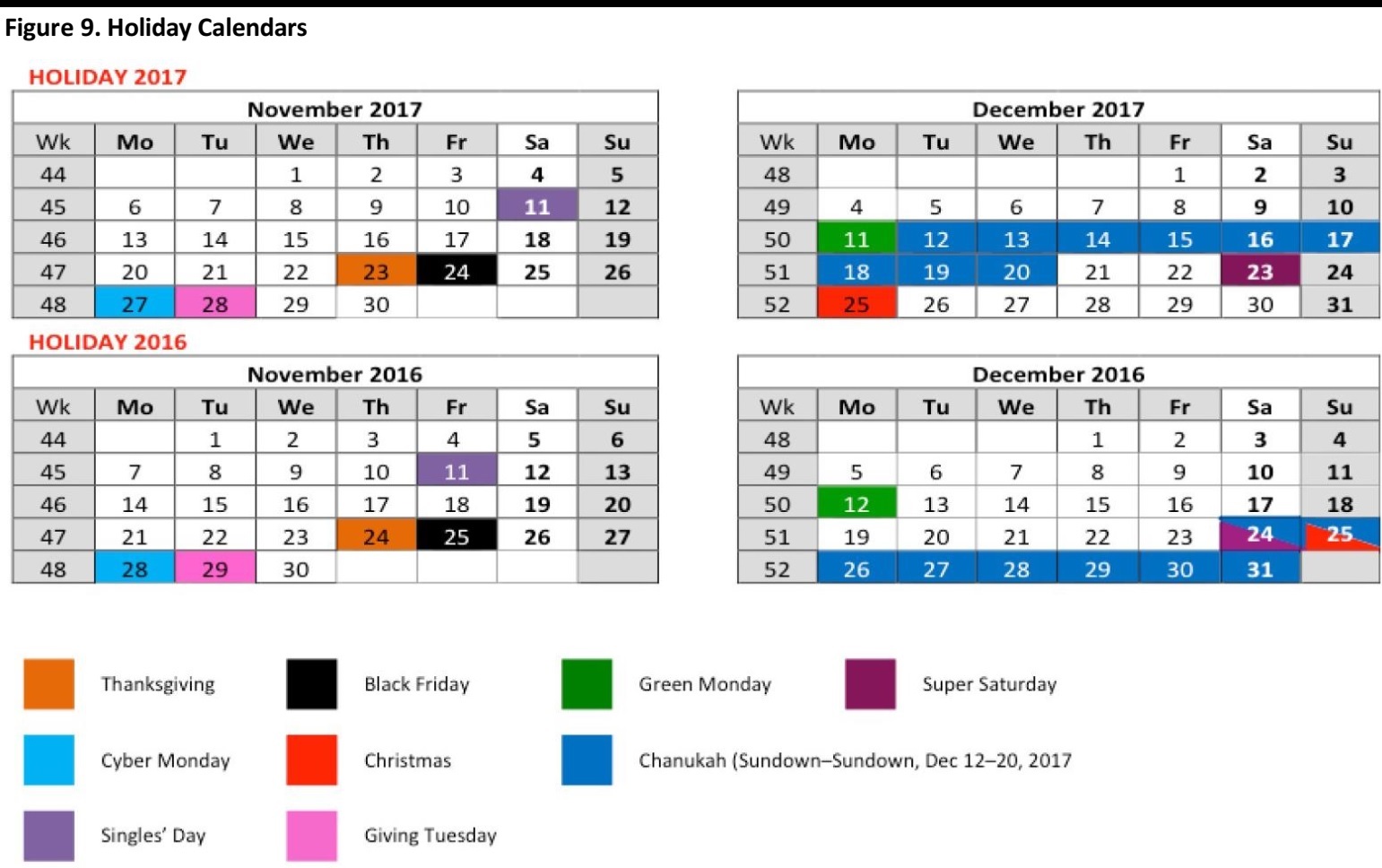

Weather and Holiday Calendar Were Both Favorable

This year, two factors that were out of consumers’ control proved favorable for retail spending: the weather and the holiday calendar. According to Planalytics, a research firm that tracks the weather’s impact on retail, cold and dry weather in many US regions had a positive impact on holiday sales. The weather in November and December was cooler and drier than last year, particularly in the East, which benefited seasonal apparel categories such as coats, boots, scarves, hats and gloves. The weather was also dry in most areas over key shopping days, including Black Friday, Super Saturday and Friday, December 22, which supported in-store traffic and seasonal demand.

With Christmas Day falling on a Monday in 2017, more shoppers than usual visited stores over the final weekend before Christmas. Also, there was one more shopping day between Thanksgiving and Christmas in 2017 than there was in 2016, with 31 days between the two holidays versus 30 days in 2016.

US 2017 Holiday Retail Recap

According to Mastercard SpendingPulse, US holiday retail sales grew by 4.9% year over year, exceeding analysts’ forecasts and reaching the highest rate since 2011. Meanwhile, e-commerce holiday sales grew by 18.1% year over year. In addition, Cyber Monday 2017 was the biggest e-commerce sales day ever, according to Adobe. Favorable macroeconomic conditions, including low unemployment, positive consumer sentiment and a strong housing market, supported US consumer spending over the holiday season. Cold, dry weather and a favorable holiday calendar also boosted sales to record-breaking levels over the 2017 holidays.

Source: Amobee Brand Intelligence

Source: Amobee Brand Intelligence