Source: Company reports/Coresight Research

Fiscal 4Q18 Results

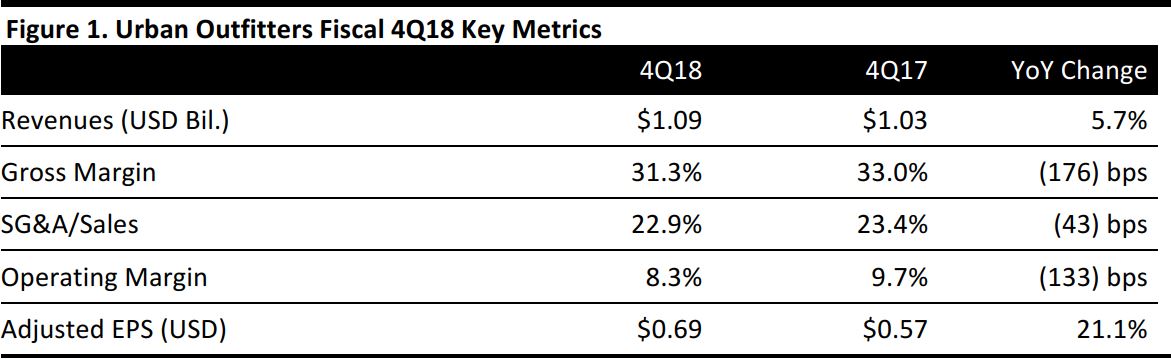

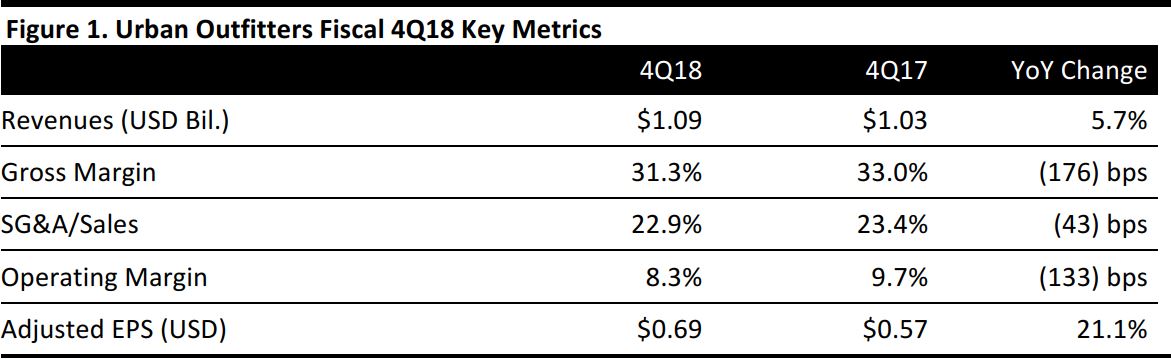

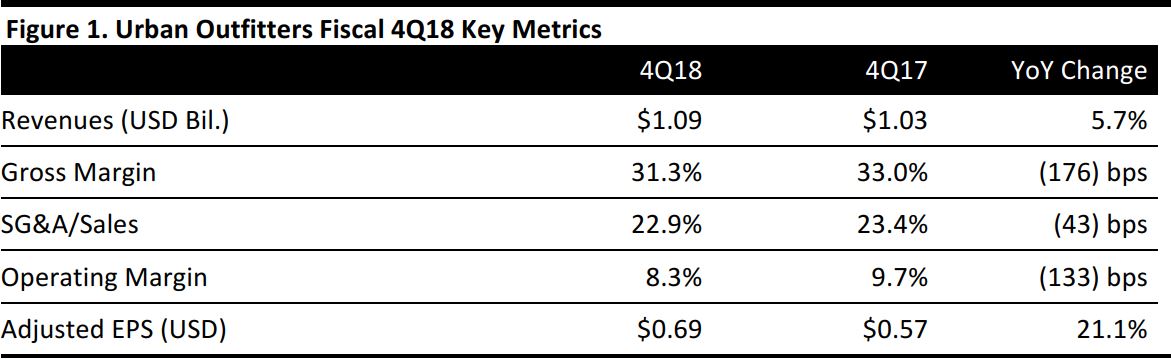

Urban Outfitters reported fiscal 4Q18 revenues of $1.09 billion, up 5.7% year over year and beating the $1.08 billion consensus estimate. Adjusted EPS was $0.69, beating the $0.63 consensus estimate and up from $0.57 in the year-ago quarter.

Comparable sales were up 4.0% year over year, beating the consensus estimate of 2.9%. Comp growth was driven by double-digit growth in the digital channel, which was partially offset by negative retail store sales. The company reported that digital growth was driven by increases in fashion and conversion rates, while average order value was flat.

Management commented that store comparable sales remained negative due to declines in transactions and units per transaction that more than offset increases in average unit selling price. Store traffic in the quarter was up in Europe and flat to down slightly in North America. Although store comps were negative for the quarter, the company reported that such comps were positive in January and that Urban Outfitters has seen overall store comps improve over the previous several quarters.

By brand, comparable retail segment net sales increased by 8% at Free People, by 5% at Anthropologie and by 2% at Urban Outfitters. Wholesale segment net sales increased by 6.3%.

Store closures: During FY18, Urban Outfitters opened 18 locations and closed 11 locations. It opened eight Free People stores, five Urban Outfitters stores, four Anthropologie stores, and one restaurant and closed three Free People stores, two Urban Outfitters stores, three Anthropologie stores, and three restaurants.

Outlook

The company did not provide quantitative guidance for FY19. Urban Outfitters plans to open 17 new stores during the year and to close 11 stores. Anthropologie and the Food and Beverage division will each grow their store counts. The company anticipates that the digital channel will remain a strong sales growth driver for the company.