Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Fiscal 1Q19 Results

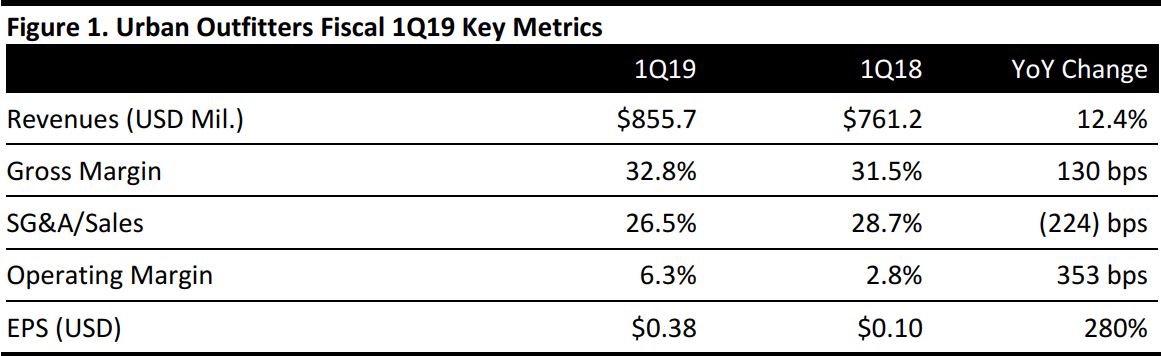

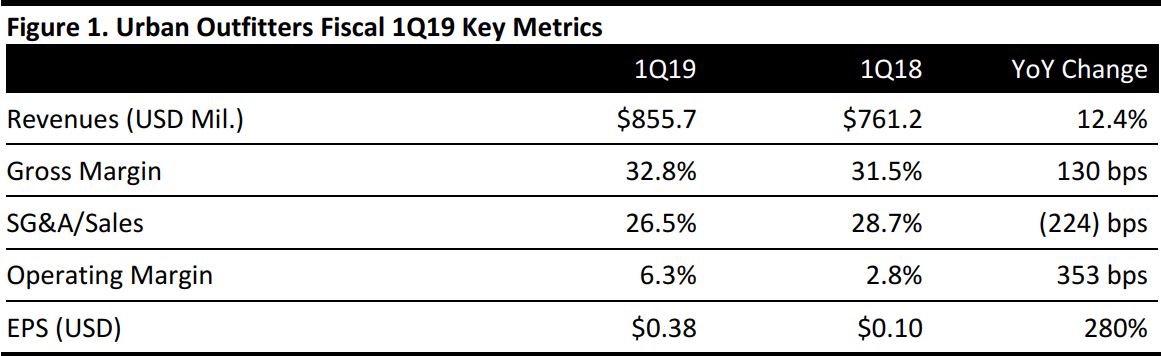

Urban Outfitters reported fiscal 1Q19 EPS of $0.38, up from $0.10 in the year-ago quarter and above the $0.31 consensus estimate. Total revenues were $855.7 million, up 12.4% year over year and above the $838.4 million consensus estimate.

By brand, Anthropologie Group net sales were $347.1 million, up 11.6% year over year. Urban Outfitters brand sales were $322.7 million, up 29.7% from the year-ago quarter. Free People sales increased by 14%, to $181.3 million. Wholesale segment net sales increased by 13% year over year.

Total comps were up 10% during the quarter, beating the 8.9% consensus estimate and driven by double-digit growth in digital sales and positive retail store sales. Comps across brands were driven by increases in traffic, average order value and units per transaction.

By brand, Free People comps were up 15%, beating the 9.8% consensus estimate. Anthropologie Group comps were up 10%, beating the 8.9% consensus estimate, and Urban Outfitters brand comps were up 8%, versus the 8.4% consensus estimate.

SG&A expense as a percentage of sales fell by 224 basis points compared with the year-ago period. The growth in SG&A was primarily due to increased marketing expenses.

The company’s gross margin increased by 130 basis points, to 32.8%, primarily driven by lower markdowns at all three brands. These markdowns were partially offset by lower margins that were attributable in part to a lower mix of private-label merchandise and deleverage in delivery expense due to increased online penetration.

Inventories increased by $45.1 million, or 12.6%, to $404.6 million on a year-over-year basis. Comparable retail segment inventory increased by 8% at cost.

Management noted that the 280% increase in first-quarter EPS was a result of strong sales, healthy margin improvement, SG&A leverage and a lower tax rate.

During the quarter, the company opened a total of four new locations—two Free People stores and two Urban Outfitters stores—and closed one Urban Outfitters store.

Outlook

The company did not provide quantitative guidance for FY19.

- The consensus estimate calls for 2Q19 total comp growth of 6.8% and revenues of $940 million, implying revenue growth of 7.7%.

- Urban Outfitters plans to open 17 new stores during the year and to close 11 stores. Anthropologie and the Food and Beverage division will each grow their store counts.

- The company anticipates that the digital channel will remain a strong sales growth driver.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research