Source: Company reports/Fung Global Retail & Technology

1Q18 Results

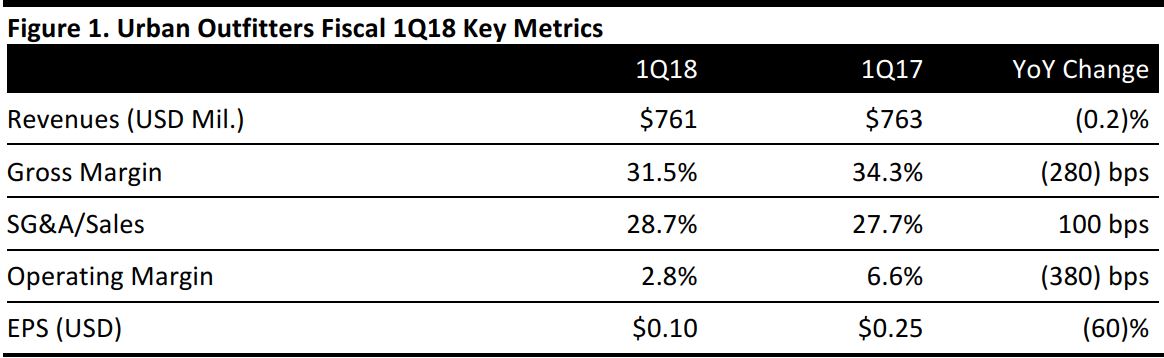

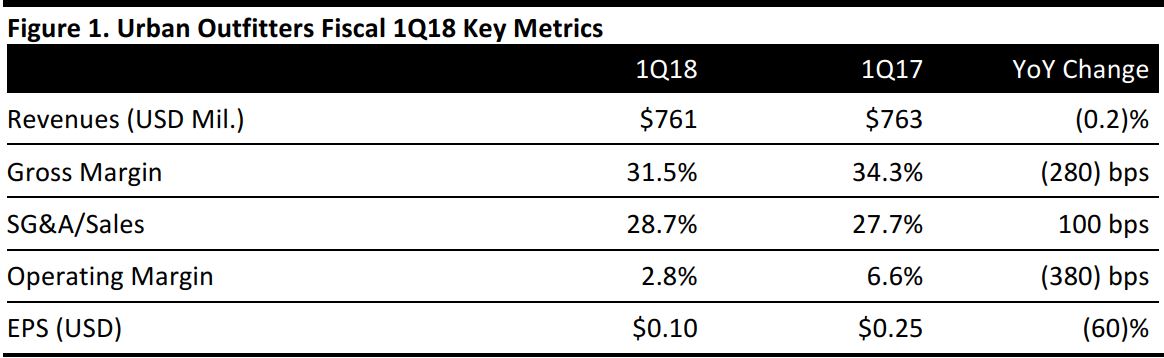

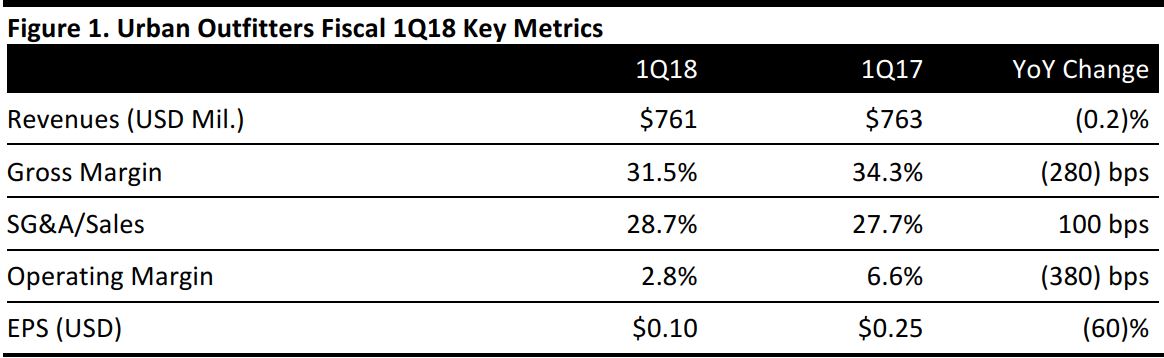

Urban Outfitters reported fiscal 1Q18 EPS of $0.10, below the consensus estimate of $0.16. Nonrecurring costs associated with a store organization project negatively impacted EPS by $0.03. Total revenues were $761.2 million, below the consensus estimate of $769.8 million and down 0.2% from the year-ago quarter.

Total comps for the quarter, including e-commerce, decreased by 3.1% versus the consensus estimate of a 2.5% decline. By brand, comps increased by 1.5% at Free People, decreased by 3.1% at Urban Outfitters and decreased by 4.4% at Anthropologie. Retail comps were driven by double-digit growth in the company’s direct-to-consumer channel, which was offset by negative store comps. Net sales for the wholesale segment increased by 14%.

The company’s gross margin for the quarter decreased by 280 basis points year over year, driven by higher markdowns in women’s apparel and accessories at Anthropologie and Urban Outfitters, higher logistics costs in the e-commerce business and deleverage in store occupancy associated with negative comps.

Total inventory was $359 million, which was flat on a year-over-year basis. Comparable retail segment inventory decreased by 3.3% at cost; the decrease was offset by inventory needed to stock non-comparable stores.

Outlook

The company plans to open 19 new stores during the year and to close eight existing stores. Management noted that the company’s gross margin could see a greater decline in the second quarter than it did in the first quarter, reflecting projected markdowns. The company also believes that SG&A could grow by 2% in the second quarter and by 1% over the full fiscal year.

Management noted that the beauty category is expected to continue to contribute to growth. The company envisions integrating an artfully curated assortment and expanding into color cosmetics and skincare.

Regarding the company’s store base, management commented that while the store count may decrease in North America, overall square footage may grow.