Source: Company reports

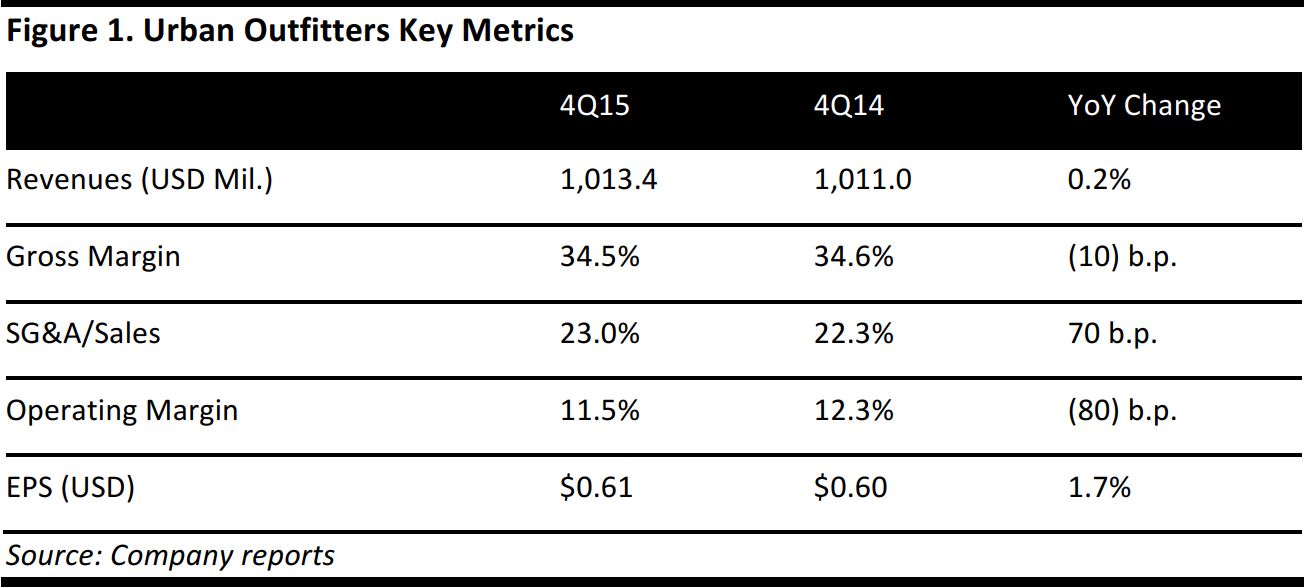

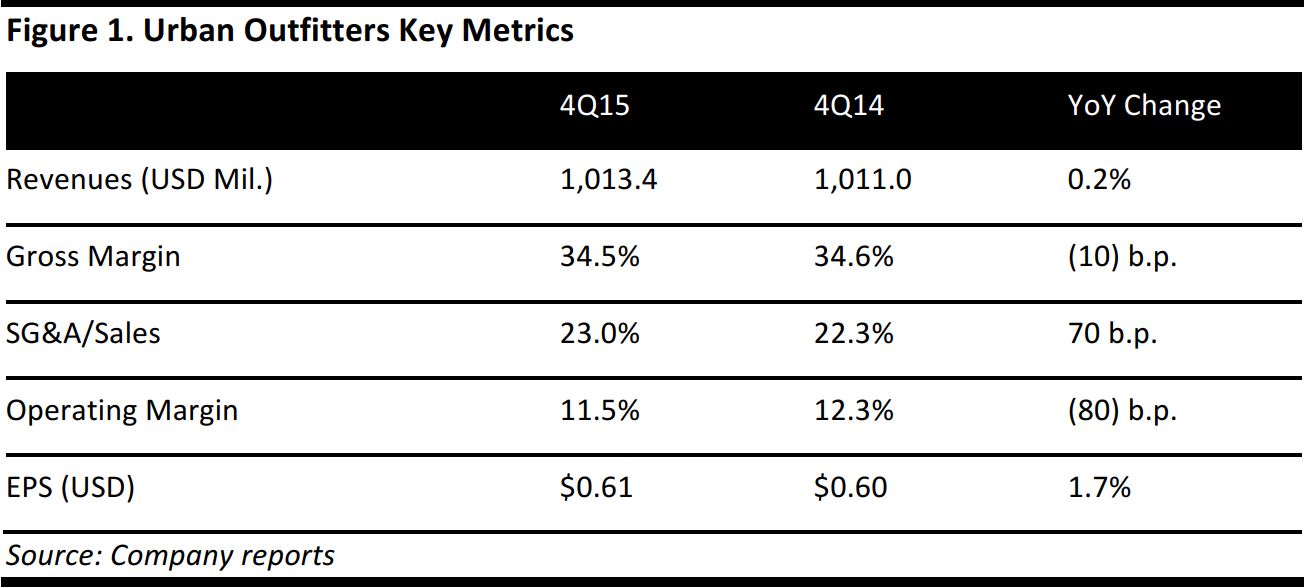

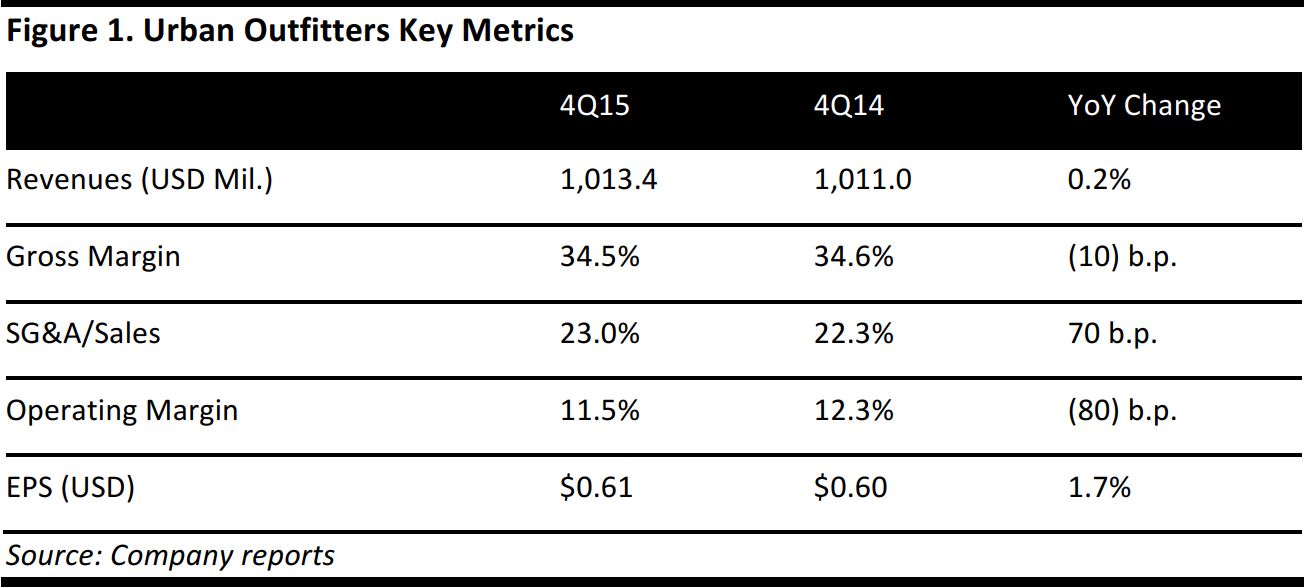

Urban Outfitters reported 4Q15 EPS of $0.61 versus the consensus estimate of $0.56.

As previously reported on February 9, total sales came in at $1.01 billion for the quarter. Comps, which include the direct-to-consumer channel, decreased by 2%. Comps were up 2% at Free People, down 2% at Anthropologie and down 3% at Urban Outfitters. Wholesale sales increased by 29%, partially due to delayed shipments from the third quarter carrying over into the fourth quarter. The apparel category underperformed during the quarter.

Gross margin declined by 10 basis points in 4Q15 versus the prior year period. The decline was driven by approximately 100 basis points of deleverage in delivery and fulfillment center expense. An increase in online sales penetration, the impact of a fulfillment center transition and additional deleverage related to higher store occupancy costs, store impairment charges and the negative impact of foreign currency all contributed to the decline. The decrease was offset by a 200-basis-point increase in margin that was driven by significant improvement in the Urban Outfitters brand markdown rate.

SG&A increased by 70 basis points versus the prior year period. The increase was primarily due to higher marketing expenses in support of customer acquisition efforts and higher technology expenses in support of omni-channel initiatives.

Inventories were $330.2 million at the end of the period, down 7.8% year over year, and sales growth was 22.8% during the quarter. The decrease in total inventories was related to a decline in comparable retail inventories, which decreased by 6% at cost and by 8% in units.

During the year ended January 31, 2016, the company opened 31 new stores, comprising 14 Anthropologie stores, 13 Free People stores and four Urban Outfitters stores. During the year, it closed five stores: two Urban Outfitters stores, two Anthropologie stores and one Free People store.