Source: Company reports

2Q 2016 RESULTS

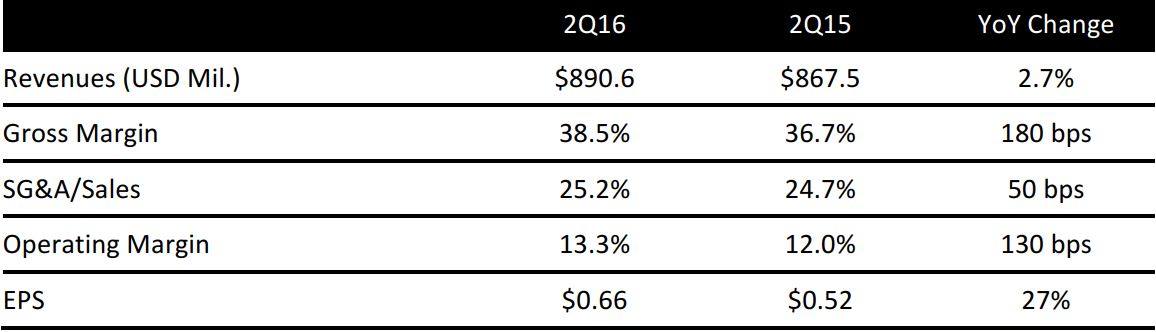

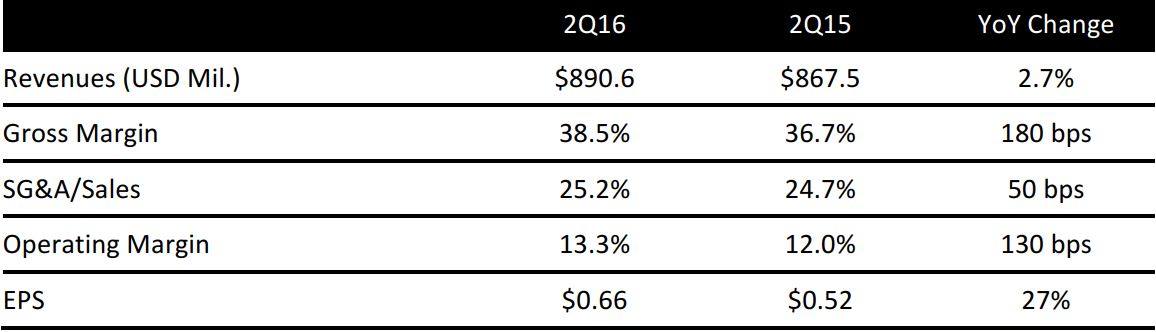

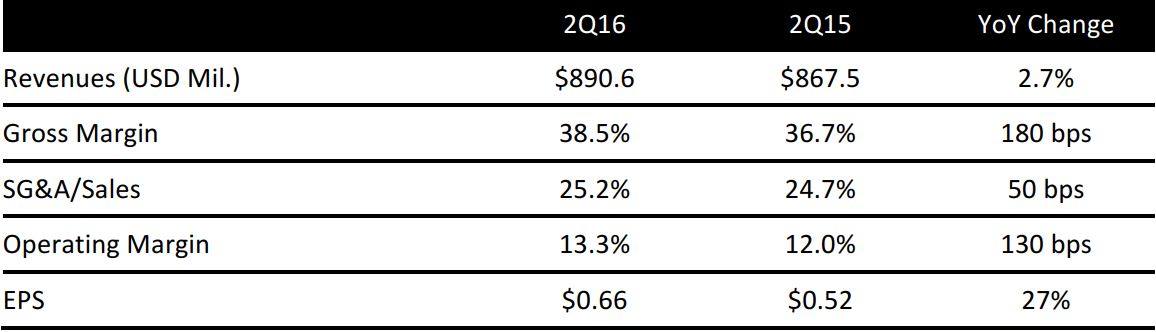

Urban Outfitters reported 2Q 2016 EPS of $0.66 and beat the consensus estimate of $0.55. Reported revenues were $890.6 million, up 2.7% year over year and exceeding expectations of $885.9 million.

By distribution channel, the company’s retail segment grew sales by 1% and wholesale net sales increased 4%. There was an additional $12 million increase in non-comp sales from the opening of new stores and the Vetri Family restaurants in the quarter. Within its retail segment, the direct-to-consumer channel continued to outperform sales from stores and posted another double-digital year-over-year gain, driven by an improvement in conversion rates.

Total retail comps were 1%, and beat expectation. Both the North American and European businesses contributed to the success. By business division; comps at Urban Outfitters reported a strong 5% versus the consensus estimate of 0.5%. Free People comps were flat, but beat an expected 3.1% decline. Anthropologie comps were (3%), generally in line with expectations.

In terms of wholesale, the Free People segment delivered another solid quarter and posted 4% growth in sales to $75 million. The performance was driven by expanded space at select department stores and growth in its European account.

Notably, the company improved its gross margin by 180 basis points to 38.5%, which was primarily driven by higher initial margins and less markdowns at Urban Outfitters and Anthropologie. This was partially offset by lower initial margins and more markdowns at Free People. Management attributed the margin improvement to tight inventory management, on-trend products and successful store visual displays. Inventory was down 4%, versus 3% top-line sales growth.

Ninety percent of its women’s apparel categories are available exclusively at Urban Outfitter stores. Other brand partners like Adidas, Wrangler, and Fila also contributed to in-store traffic.

The company also saw significant growth in its emerging categories such as home, beauty, intimates and music. The beauty category continued to see compounded comp growth and higher penetration in the total business. The success was mainly due to its exclusive brand assortment and curation. Its music category has been key to offering the Urban Outfitter store experience. The company built a digital music video series, “UO Live,” that has tens of thousands of subscribers.

The company operated 574 stores globally at the end of Q2 2016 compared to 581 a year ago.

2016 OUTLOOK

Although they did not provide specific guidance for the overall business, management said its Free People business could deliver lower markdowns in the second half of the year. They also said they are confident in their ability to provide on-trend merchandise. More than 130 Anthropologie stores will have a beauty store inside a store by the upcoming holiday shopping season, up from 70 in the prior year.