DIpil Das

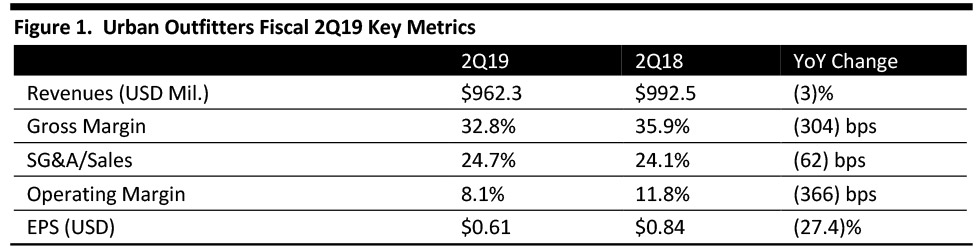

[caption id="attachment_95025" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

Urban Outfitters reported fiscal 2Q19 revenues of $962.3 million, lower than the consensus estimate of $980.6 million and down 3% YoY. The company reported 2Q19 EPS of $0.61, above the consensus estimate of $0.58 and down 27.4% from the year-ago period.

Comparable sales were down 3% compared to the consensus estimate of down 2%, driven by negative retail store sales growth, partially offset by growth in the digital channel. By brand, Free People delivered the strongest comp for the quarter, up 6%, beating the consensus estimate of up 1.4%, while Anthropologie was down 3% compared to the consensus estimate of down 1.9%, and Urban Outfitters dropped 5% compared to the consensus estimate of down 3.3%.

Management said acceptance of the company’s women’s apparel assortments was softer than planned, resulting in higher YoY markdowns and lower merchandise margins. Lower store traffic accentuated the negative comp store performance and weighed on overall results. On the other hand, the company launched local-language and local-currency Urban Outfitters websites in Korea, Singapore and Hong Kong and is seeing improved website sessions and increases in new customer acquisition in these geographies.

In July, the company launched Nuuly, a monthly subscription rental service from Anthropologie, Free People, Urban Outfitters, other national brands and vintage brands. The rental subscription service shipped its first boxes on July 30. Urban Outfitters reported the internally built systems, processes, warehouse and laundry equipment all worked as planned for the launch, and that subscriber feedback has been positive. Management said it is confident Nuuly will become a vital part of the brand portfolio.

The company also recently launched a back-to-school assortment featuring #UOonCampus across its social channels, and has partnered with Afterpay on its loyalty program, called UO Rewards. Membership to its UO Rewards program increased 11% in the quarter and the company now has 11.5 million members globally.

Outlook

Management said 3Q19 should bring improved comps driven by improved assortments in the apparel category. The company believes its gross margin rate for 3Q19 could deleverage by approximately 200 basis points. The decrease in the gross profit rate could be due to higher markdown rates, unfavorable delivery and logistics expenses, the launch of Nuuly and the transition to managing the company’s furniture and non-sortable distribution from a third-party logistics provider to an internal operation.

Urban Outfitters is re-platforming and re-launching its customer loyalty program UO Rewards platform in 3Q19, which will allow it to further personalize offerings with new spending tiers and by better supporting contests and giveaways.

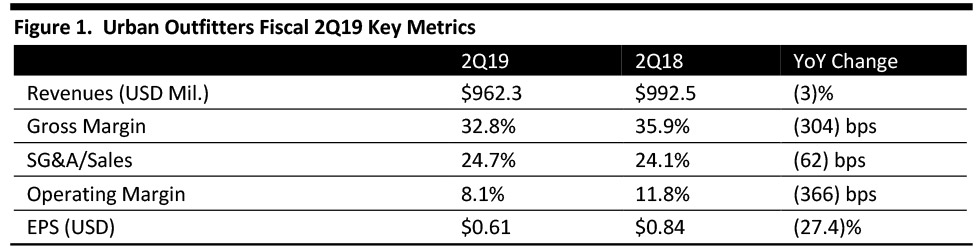

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Urban Outfitters reported fiscal 2Q19 revenues of $962.3 million, lower than the consensus estimate of $980.6 million and down 3% YoY. The company reported 2Q19 EPS of $0.61, above the consensus estimate of $0.58 and down 27.4% from the year-ago period.

Comparable sales were down 3% compared to the consensus estimate of down 2%, driven by negative retail store sales growth, partially offset by growth in the digital channel. By brand, Free People delivered the strongest comp for the quarter, up 6%, beating the consensus estimate of up 1.4%, while Anthropologie was down 3% compared to the consensus estimate of down 1.9%, and Urban Outfitters dropped 5% compared to the consensus estimate of down 3.3%.

Management said acceptance of the company’s women’s apparel assortments was softer than planned, resulting in higher YoY markdowns and lower merchandise margins. Lower store traffic accentuated the negative comp store performance and weighed on overall results. On the other hand, the company launched local-language and local-currency Urban Outfitters websites in Korea, Singapore and Hong Kong and is seeing improved website sessions and increases in new customer acquisition in these geographies.

In July, the company launched Nuuly, a monthly subscription rental service from Anthropologie, Free People, Urban Outfitters, other national brands and vintage brands. The rental subscription service shipped its first boxes on July 30. Urban Outfitters reported the internally built systems, processes, warehouse and laundry equipment all worked as planned for the launch, and that subscriber feedback has been positive. Management said it is confident Nuuly will become a vital part of the brand portfolio.

The company also recently launched a back-to-school assortment featuring #UOonCampus across its social channels, and has partnered with Afterpay on its loyalty program, called UO Rewards. Membership to its UO Rewards program increased 11% in the quarter and the company now has 11.5 million members globally.

Outlook

Management said 3Q19 should bring improved comps driven by improved assortments in the apparel category. The company believes its gross margin rate for 3Q19 could deleverage by approximately 200 basis points. The decrease in the gross profit rate could be due to higher markdown rates, unfavorable delivery and logistics expenses, the launch of Nuuly and the transition to managing the company’s furniture and non-sortable distribution from a third-party logistics provider to an internal operation.

Urban Outfitters is re-platforming and re-launching its customer loyalty program UO Rewards platform in 3Q19, which will allow it to further personalize offerings with new spending tiers and by better supporting contests and giveaways.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Urban Outfitters reported fiscal 2Q19 revenues of $962.3 million, lower than the consensus estimate of $980.6 million and down 3% YoY. The company reported 2Q19 EPS of $0.61, above the consensus estimate of $0.58 and down 27.4% from the year-ago period.

Comparable sales were down 3% compared to the consensus estimate of down 2%, driven by negative retail store sales growth, partially offset by growth in the digital channel. By brand, Free People delivered the strongest comp for the quarter, up 6%, beating the consensus estimate of up 1.4%, while Anthropologie was down 3% compared to the consensus estimate of down 1.9%, and Urban Outfitters dropped 5% compared to the consensus estimate of down 3.3%.

Management said acceptance of the company’s women’s apparel assortments was softer than planned, resulting in higher YoY markdowns and lower merchandise margins. Lower store traffic accentuated the negative comp store performance and weighed on overall results. On the other hand, the company launched local-language and local-currency Urban Outfitters websites in Korea, Singapore and Hong Kong and is seeing improved website sessions and increases in new customer acquisition in these geographies.

In July, the company launched Nuuly, a monthly subscription rental service from Anthropologie, Free People, Urban Outfitters, other national brands and vintage brands. The rental subscription service shipped its first boxes on July 30. Urban Outfitters reported the internally built systems, processes, warehouse and laundry equipment all worked as planned for the launch, and that subscriber feedback has been positive. Management said it is confident Nuuly will become a vital part of the brand portfolio.

The company also recently launched a back-to-school assortment featuring #UOonCampus across its social channels, and has partnered with Afterpay on its loyalty program, called UO Rewards. Membership to its UO Rewards program increased 11% in the quarter and the company now has 11.5 million members globally.

Outlook

Management said 3Q19 should bring improved comps driven by improved assortments in the apparel category. The company believes its gross margin rate for 3Q19 could deleverage by approximately 200 basis points. The decrease in the gross profit rate could be due to higher markdown rates, unfavorable delivery and logistics expenses, the launch of Nuuly and the transition to managing the company’s furniture and non-sortable distribution from a third-party logistics provider to an internal operation.

Urban Outfitters is re-platforming and re-launching its customer loyalty program UO Rewards platform in 3Q19, which will allow it to further personalize offerings with new spending tiers and by better supporting contests and giveaways.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Urban Outfitters reported fiscal 2Q19 revenues of $962.3 million, lower than the consensus estimate of $980.6 million and down 3% YoY. The company reported 2Q19 EPS of $0.61, above the consensus estimate of $0.58 and down 27.4% from the year-ago period.

Comparable sales were down 3% compared to the consensus estimate of down 2%, driven by negative retail store sales growth, partially offset by growth in the digital channel. By brand, Free People delivered the strongest comp for the quarter, up 6%, beating the consensus estimate of up 1.4%, while Anthropologie was down 3% compared to the consensus estimate of down 1.9%, and Urban Outfitters dropped 5% compared to the consensus estimate of down 3.3%.

Management said acceptance of the company’s women’s apparel assortments was softer than planned, resulting in higher YoY markdowns and lower merchandise margins. Lower store traffic accentuated the negative comp store performance and weighed on overall results. On the other hand, the company launched local-language and local-currency Urban Outfitters websites in Korea, Singapore and Hong Kong and is seeing improved website sessions and increases in new customer acquisition in these geographies.

In July, the company launched Nuuly, a monthly subscription rental service from Anthropologie, Free People, Urban Outfitters, other national brands and vintage brands. The rental subscription service shipped its first boxes on July 30. Urban Outfitters reported the internally built systems, processes, warehouse and laundry equipment all worked as planned for the launch, and that subscriber feedback has been positive. Management said it is confident Nuuly will become a vital part of the brand portfolio.

The company also recently launched a back-to-school assortment featuring #UOonCampus across its social channels, and has partnered with Afterpay on its loyalty program, called UO Rewards. Membership to its UO Rewards program increased 11% in the quarter and the company now has 11.5 million members globally.

Outlook

Management said 3Q19 should bring improved comps driven by improved assortments in the apparel category. The company believes its gross margin rate for 3Q19 could deleverage by approximately 200 basis points. The decrease in the gross profit rate could be due to higher markdown rates, unfavorable delivery and logistics expenses, the launch of Nuuly and the transition to managing the company’s furniture and non-sortable distribution from a third-party logistics provider to an internal operation.

Urban Outfitters is re-platforming and re-launching its customer loyalty program UO Rewards platform in 3Q19, which will allow it to further personalize offerings with new spending tiers and by better supporting contests and giveaways.