DIpil Das

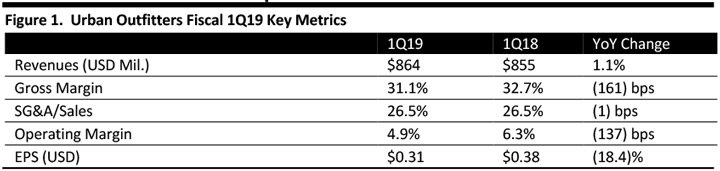

[caption id="attachment_88887" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Urban Outfitters reported 1Q19 revenues of $864.4 million, above the consensus estimate of $854.7 million and up 1.1% year over year. The company reported 1Q19 EPS of $0.31, above the consensus estimate of $0.25 and down 18.4% from the year ago period.

Comparable sales increased 1%, compared to the consensus estimate of (1.1)%, driven by double-digit growth in digital and partially offset by negative retail store sales. By brand, Anthropologie delivered a positive 1% comp compared to the consensus estimate of 1.9%, Free People a plus 2% comp compared to the consensus estimate of 1.2%, and Urban Outfitters was flat compared to the consensus estimate of 1.0%.

Management reported that by channels, comps diverged, with the digital channel recording double digit comps and stores recording mid-single digit negative comps.

The company reported it is seeing demand for the “right product.” Apparel merchants at the company’s two larger brands have been less than accurate interpreting trends this year versus the same period last year. Free People began Q1 with a few product misses, but the brand was able to recover and is now delivering positive comps. The company said it expects sales to improve in the second quarter. The team is using more data to place the orders, and management said the current fashion trends suit back-to-school aesthetics.

The company announced the launch of Nuuly, a monthly subscription rental service from the Anthropologie, Free People and Urban Outfitters brands, other national brands, and vintage brands. Consumers will select the styles that they like each month, wear as often as they choose, and swap new styles the following month. Subscriptions cost $88 per month for a box with six-items. According to the company, each box offers subscribers an average $800 retail value. The company will offer sizes double zero to size 26. Management predicts it will have approximately 50,000 subscribers within 12 months of operation, which would exceed a revenue run-rate of $50 million at the period close. The company reported that customers can join a waitlist on its website for the brand’s summer launch.

Outlook

The company did not provide a financial outlook. The consensus estimate for second quarter earnings per share is $0.60 and $2.41 for the full fiscal year. The revenue consensus estimate for the second quarter is $981.1 million and the full year consensus estimate is $996.6 million.

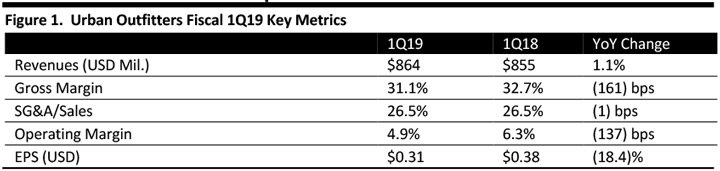

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Urban Outfitters reported 1Q19 revenues of $864.4 million, above the consensus estimate of $854.7 million and up 1.1% year over year. The company reported 1Q19 EPS of $0.31, above the consensus estimate of $0.25 and down 18.4% from the year ago period.

Comparable sales increased 1%, compared to the consensus estimate of (1.1)%, driven by double-digit growth in digital and partially offset by negative retail store sales. By brand, Anthropologie delivered a positive 1% comp compared to the consensus estimate of 1.9%, Free People a plus 2% comp compared to the consensus estimate of 1.2%, and Urban Outfitters was flat compared to the consensus estimate of 1.0%.

Management reported that by channels, comps diverged, with the digital channel recording double digit comps and stores recording mid-single digit negative comps.

The company reported it is seeing demand for the “right product.” Apparel merchants at the company’s two larger brands have been less than accurate interpreting trends this year versus the same period last year. Free People began Q1 with a few product misses, but the brand was able to recover and is now delivering positive comps. The company said it expects sales to improve in the second quarter. The team is using more data to place the orders, and management said the current fashion trends suit back-to-school aesthetics.

The company announced the launch of Nuuly, a monthly subscription rental service from the Anthropologie, Free People and Urban Outfitters brands, other national brands, and vintage brands. Consumers will select the styles that they like each month, wear as often as they choose, and swap new styles the following month. Subscriptions cost $88 per month for a box with six-items. According to the company, each box offers subscribers an average $800 retail value. The company will offer sizes double zero to size 26. Management predicts it will have approximately 50,000 subscribers within 12 months of operation, which would exceed a revenue run-rate of $50 million at the period close. The company reported that customers can join a waitlist on its website for the brand’s summer launch.

Outlook

The company did not provide a financial outlook. The consensus estimate for second quarter earnings per share is $0.60 and $2.41 for the full fiscal year. The revenue consensus estimate for the second quarter is $981.1 million and the full year consensus estimate is $996.6 million.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Urban Outfitters reported 1Q19 revenues of $864.4 million, above the consensus estimate of $854.7 million and up 1.1% year over year. The company reported 1Q19 EPS of $0.31, above the consensus estimate of $0.25 and down 18.4% from the year ago period.

Comparable sales increased 1%, compared to the consensus estimate of (1.1)%, driven by double-digit growth in digital and partially offset by negative retail store sales. By brand, Anthropologie delivered a positive 1% comp compared to the consensus estimate of 1.9%, Free People a plus 2% comp compared to the consensus estimate of 1.2%, and Urban Outfitters was flat compared to the consensus estimate of 1.0%.

Management reported that by channels, comps diverged, with the digital channel recording double digit comps and stores recording mid-single digit negative comps.

The company reported it is seeing demand for the “right product.” Apparel merchants at the company’s two larger brands have been less than accurate interpreting trends this year versus the same period last year. Free People began Q1 with a few product misses, but the brand was able to recover and is now delivering positive comps. The company said it expects sales to improve in the second quarter. The team is using more data to place the orders, and management said the current fashion trends suit back-to-school aesthetics.

The company announced the launch of Nuuly, a monthly subscription rental service from the Anthropologie, Free People and Urban Outfitters brands, other national brands, and vintage brands. Consumers will select the styles that they like each month, wear as often as they choose, and swap new styles the following month. Subscriptions cost $88 per month for a box with six-items. According to the company, each box offers subscribers an average $800 retail value. The company will offer sizes double zero to size 26. Management predicts it will have approximately 50,000 subscribers within 12 months of operation, which would exceed a revenue run-rate of $50 million at the period close. The company reported that customers can join a waitlist on its website for the brand’s summer launch.

Outlook

The company did not provide a financial outlook. The consensus estimate for second quarter earnings per share is $0.60 and $2.41 for the full fiscal year. The revenue consensus estimate for the second quarter is $981.1 million and the full year consensus estimate is $996.6 million.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Urban Outfitters reported 1Q19 revenues of $864.4 million, above the consensus estimate of $854.7 million and up 1.1% year over year. The company reported 1Q19 EPS of $0.31, above the consensus estimate of $0.25 and down 18.4% from the year ago period.

Comparable sales increased 1%, compared to the consensus estimate of (1.1)%, driven by double-digit growth in digital and partially offset by negative retail store sales. By brand, Anthropologie delivered a positive 1% comp compared to the consensus estimate of 1.9%, Free People a plus 2% comp compared to the consensus estimate of 1.2%, and Urban Outfitters was flat compared to the consensus estimate of 1.0%.

Management reported that by channels, comps diverged, with the digital channel recording double digit comps and stores recording mid-single digit negative comps.

The company reported it is seeing demand for the “right product.” Apparel merchants at the company’s two larger brands have been less than accurate interpreting trends this year versus the same period last year. Free People began Q1 with a few product misses, but the brand was able to recover and is now delivering positive comps. The company said it expects sales to improve in the second quarter. The team is using more data to place the orders, and management said the current fashion trends suit back-to-school aesthetics.

The company announced the launch of Nuuly, a monthly subscription rental service from the Anthropologie, Free People and Urban Outfitters brands, other national brands, and vintage brands. Consumers will select the styles that they like each month, wear as often as they choose, and swap new styles the following month. Subscriptions cost $88 per month for a box with six-items. According to the company, each box offers subscribers an average $800 retail value. The company will offer sizes double zero to size 26. Management predicts it will have approximately 50,000 subscribers within 12 months of operation, which would exceed a revenue run-rate of $50 million at the period close. The company reported that customers can join a waitlist on its website for the brand’s summer launch.

Outlook

The company did not provide a financial outlook. The consensus estimate for second quarter earnings per share is $0.60 and $2.41 for the full fiscal year. The revenue consensus estimate for the second quarter is $981.1 million and the full year consensus estimate is $996.6 million.