Executive Summary

Urban farming refers to the growing, processing and distributing of food through intensive plant cultivation and animal husbandry in and around cities, according to two American academics—Martin Bailkey and Joe Nasr—who have published many papers on the topic.

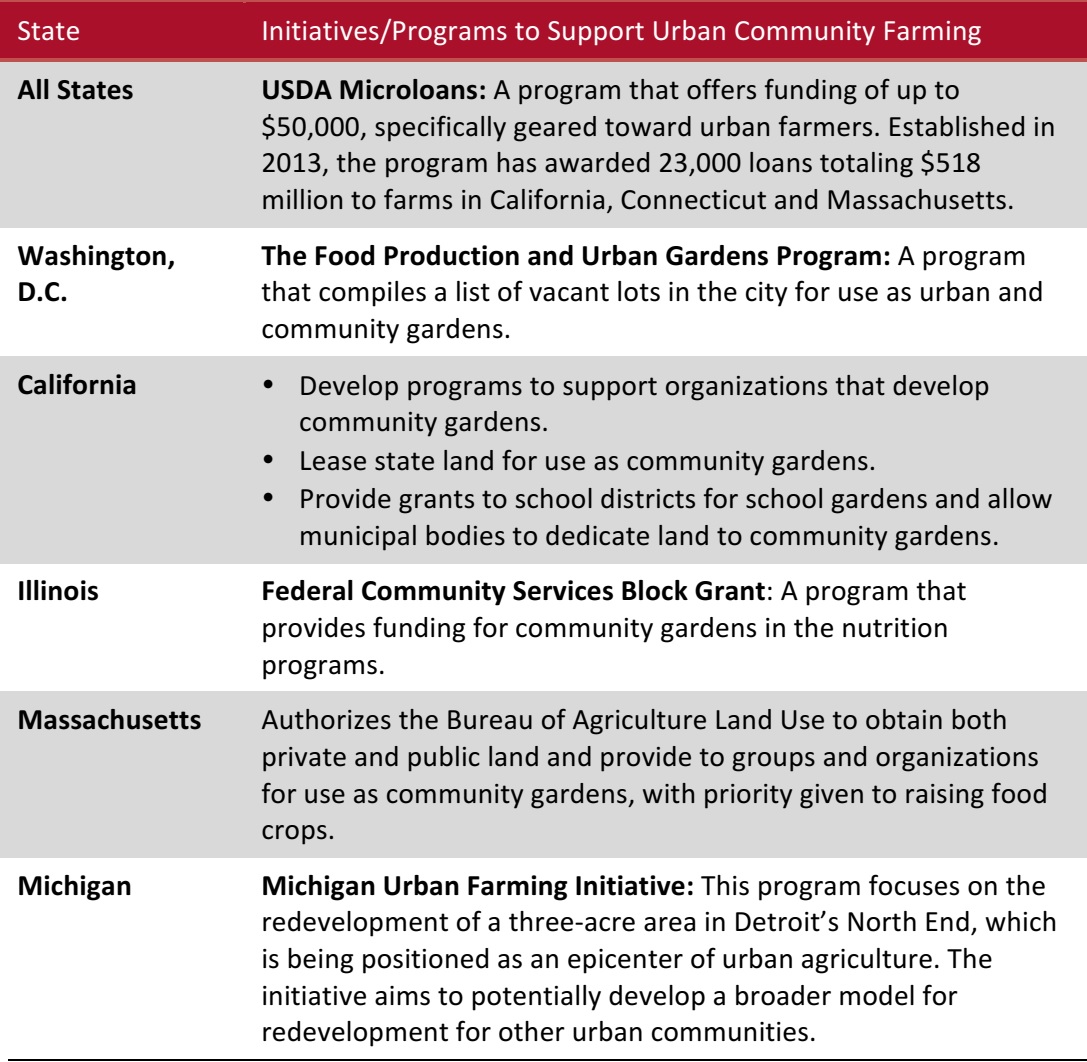

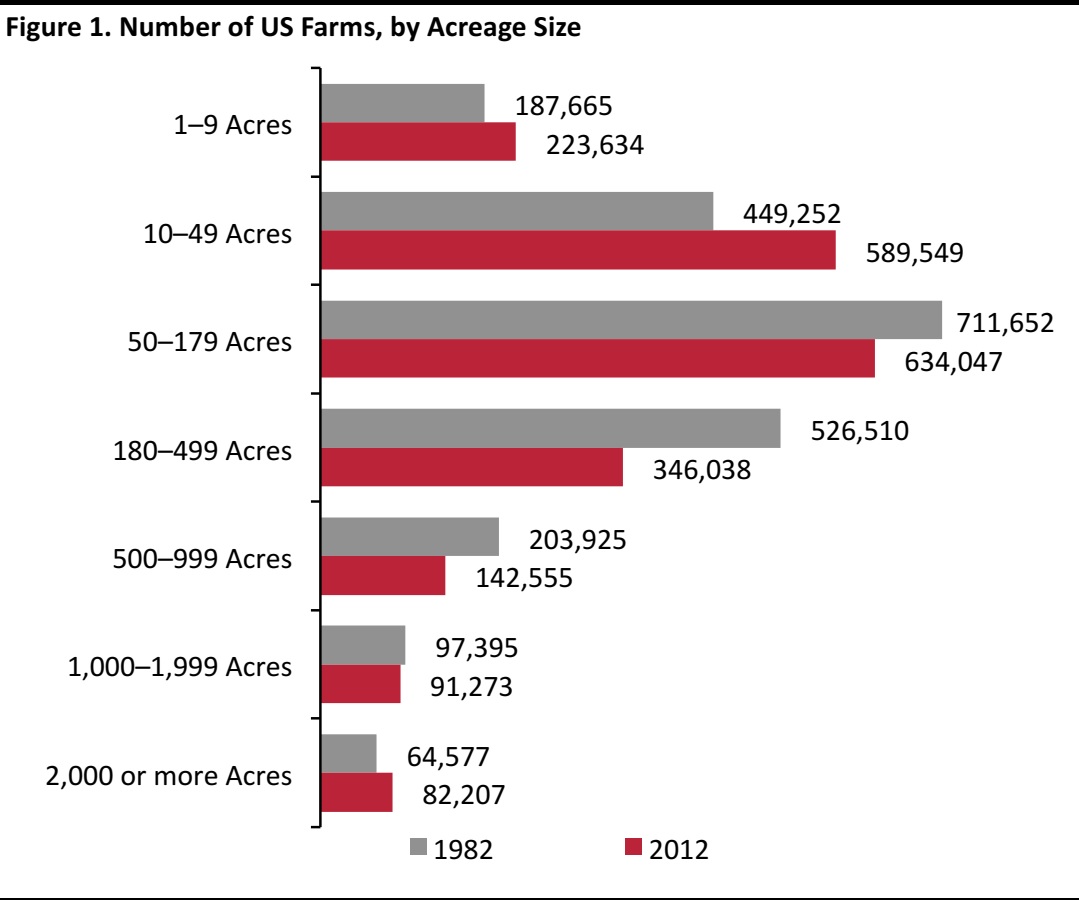

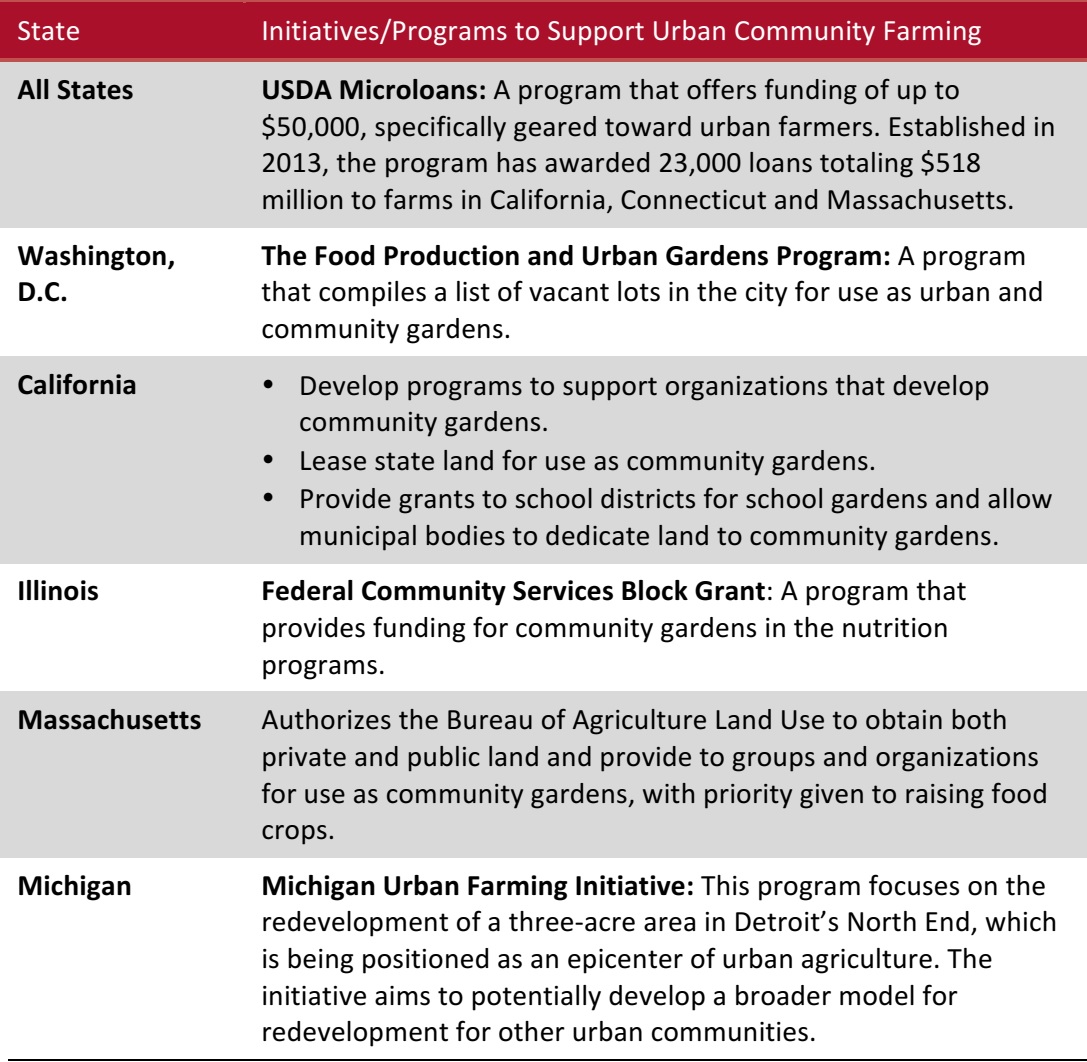

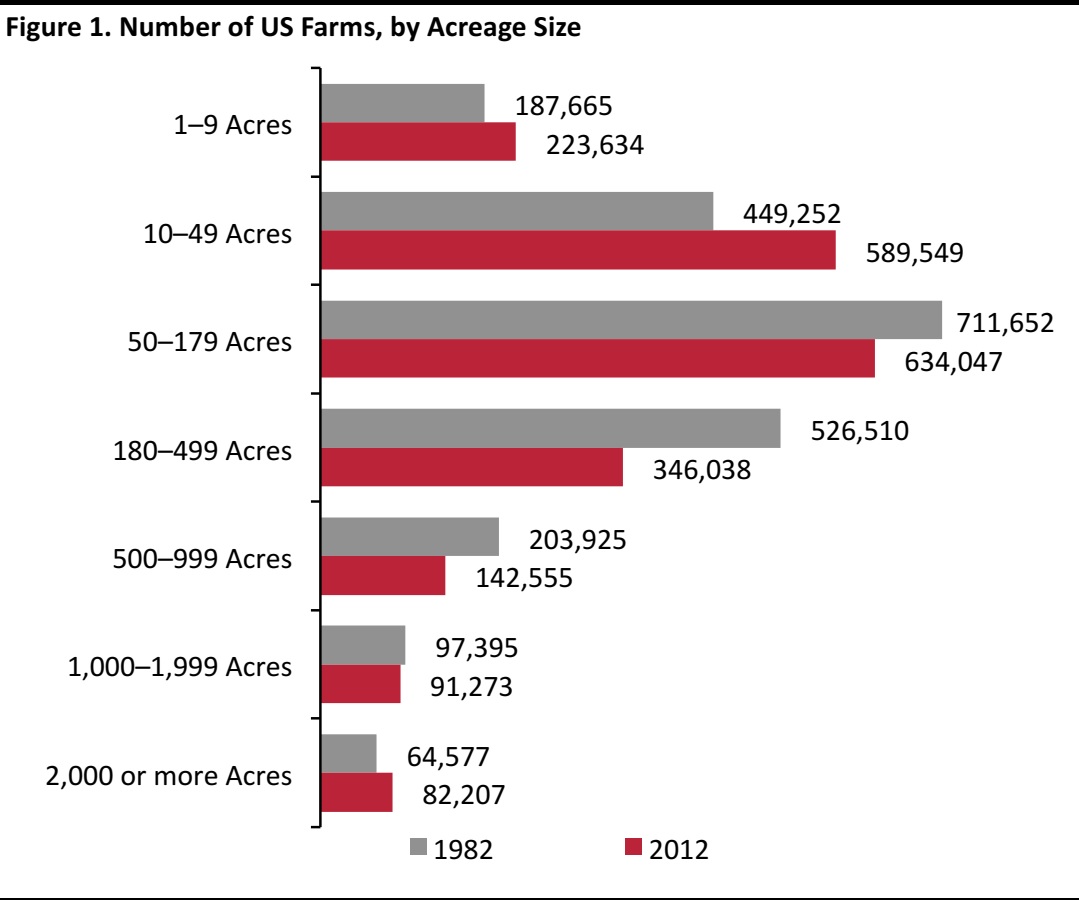

Warehouses and lots of land become vacant when businesses wind down, in particular during an economic downturn. We are seeing a number of government initiatives to turn these vacant lots and unused facilities into community gardens or urban farmlands, bringing many benefits to the community.This trend is growing, as is evident by the increase in the number of farms of less than 50 acres.

Turning empty lots or warehouses into urban community farms brings a multitude of benefits to the community: reducing unemployment, improving community social well being and supporting the local food system.

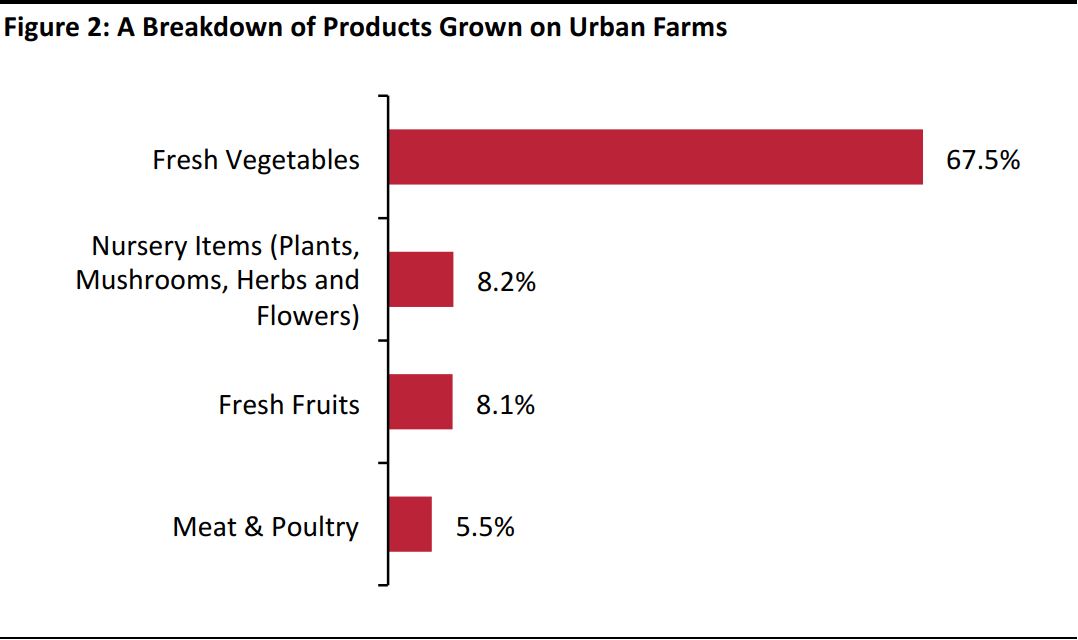

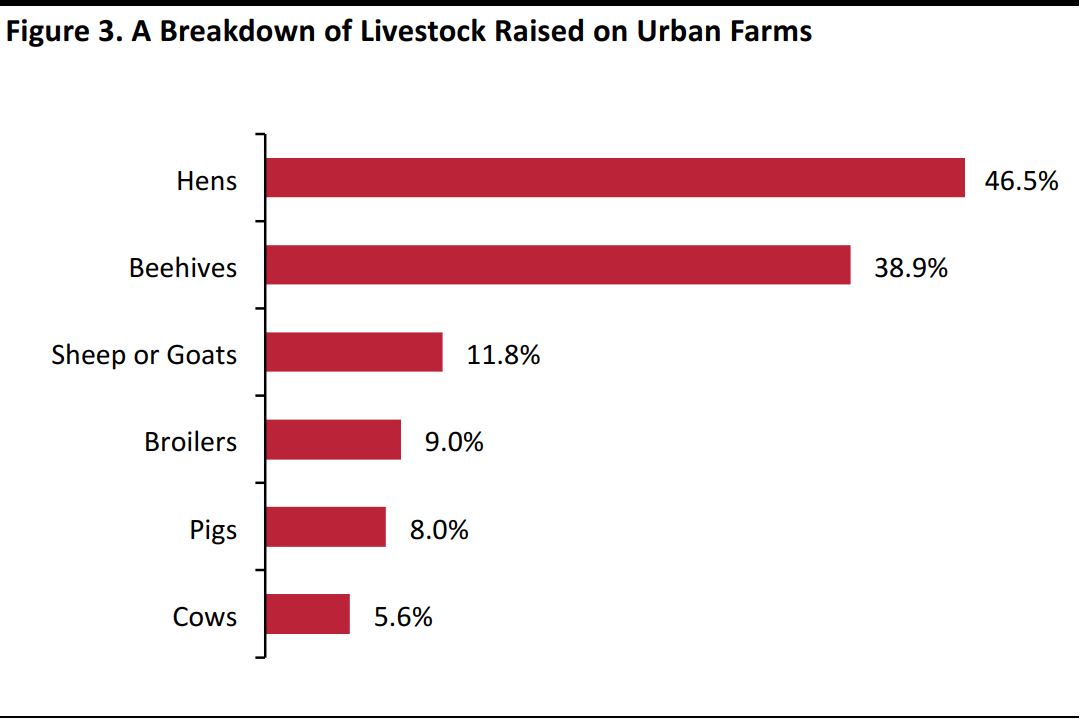

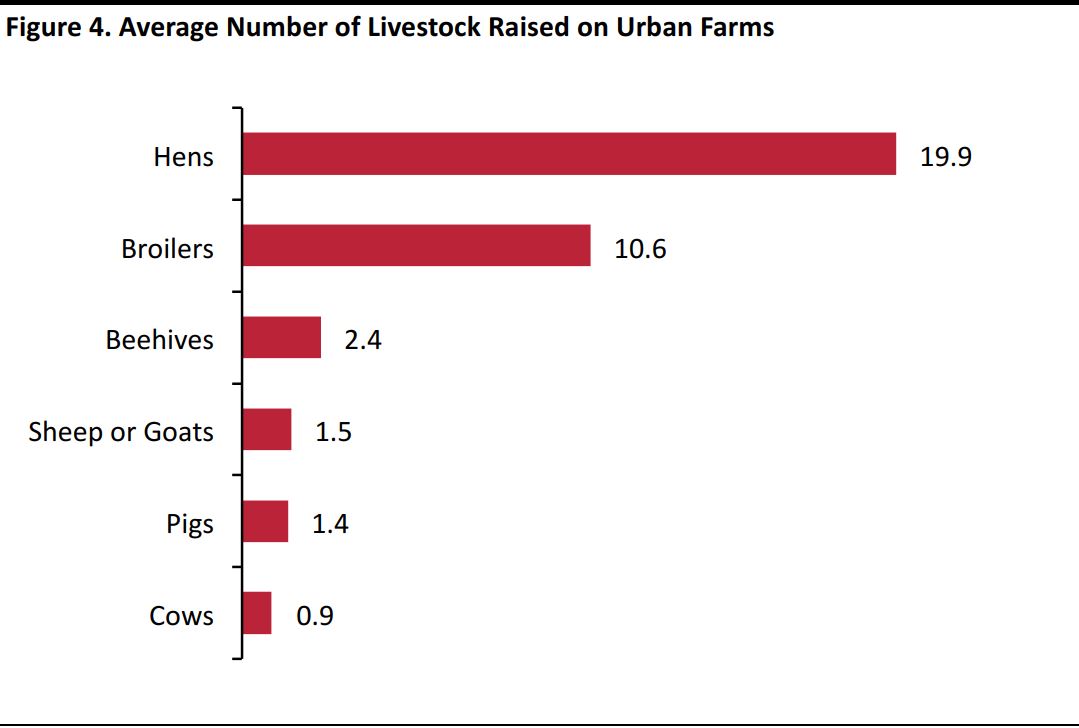

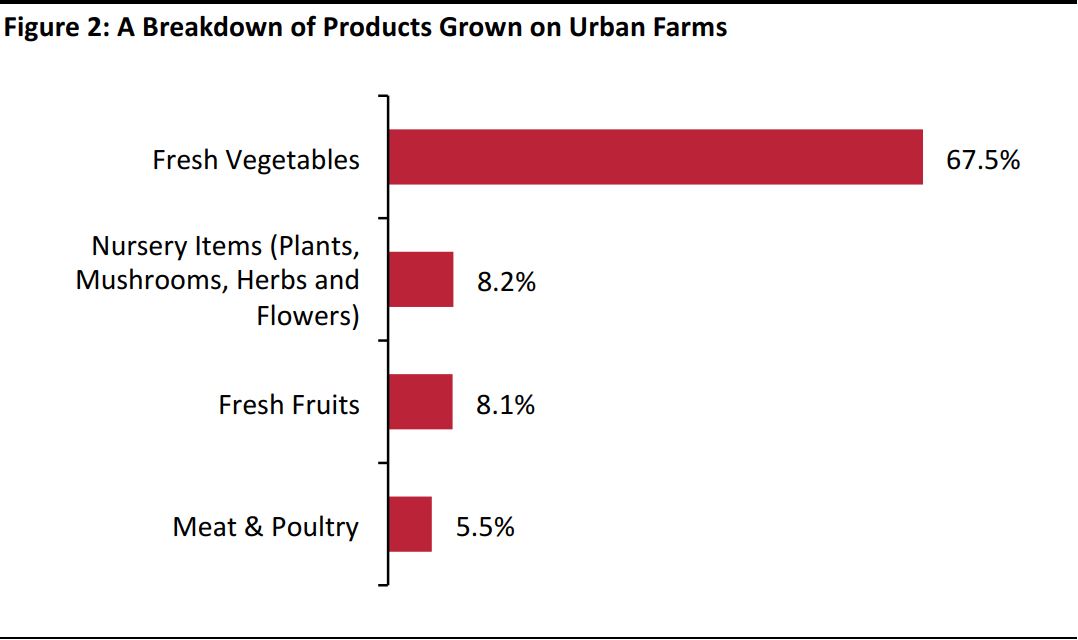

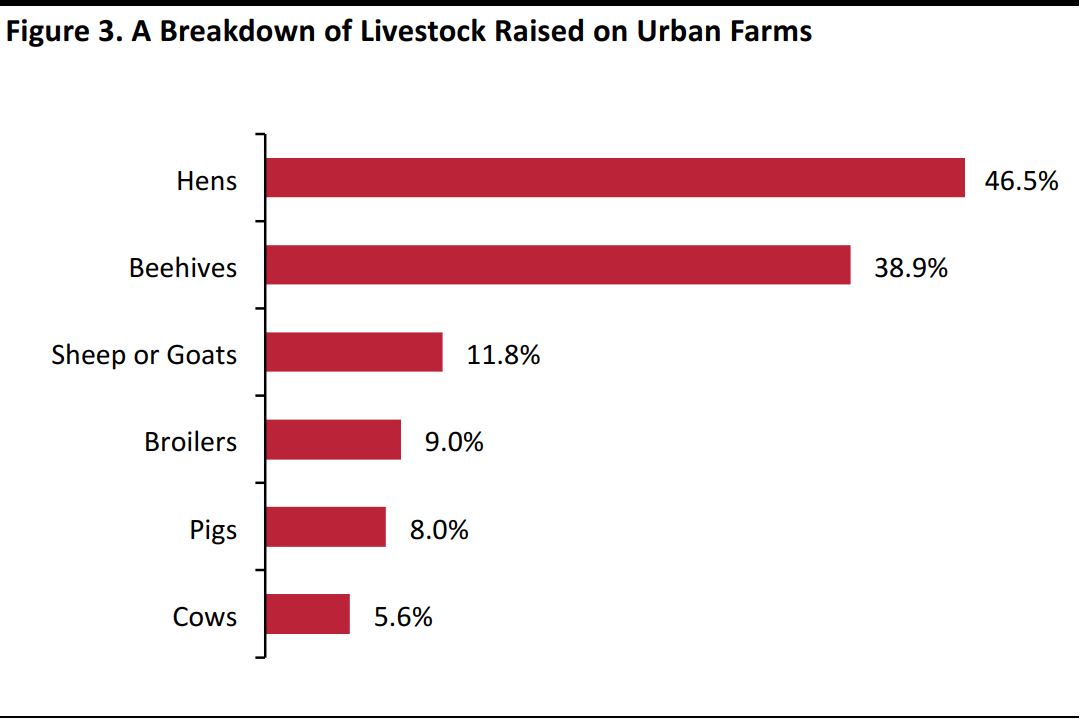

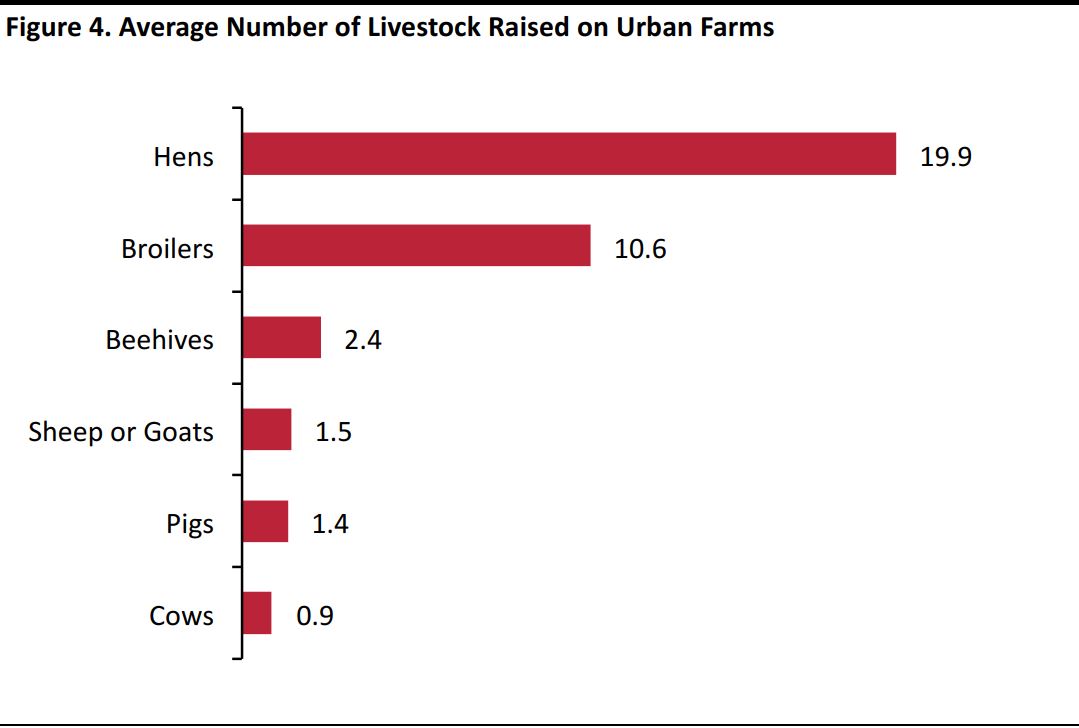

According to a survey of 315 urban farmers by the United States Department of Agriculture (USDA) in 2013, fresh vegetables was the top product grown on urban farms, with over two-thirds of survey respondents saying they grew fresh vegetables.In terms of livestock, hens and broilers (young male chickens) were farmed in the largest numbers. On average, there are 19.9 hens and 10.6 broilers on an urban farm with livestock.

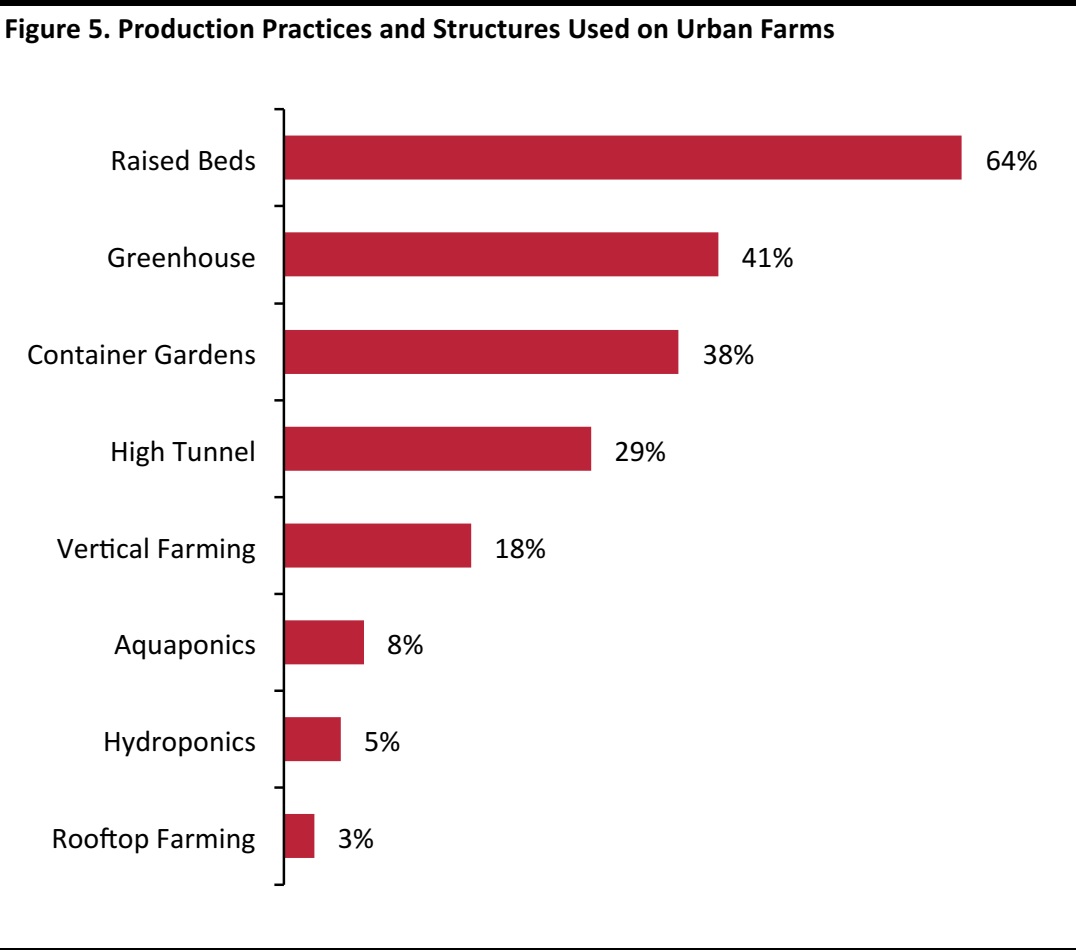

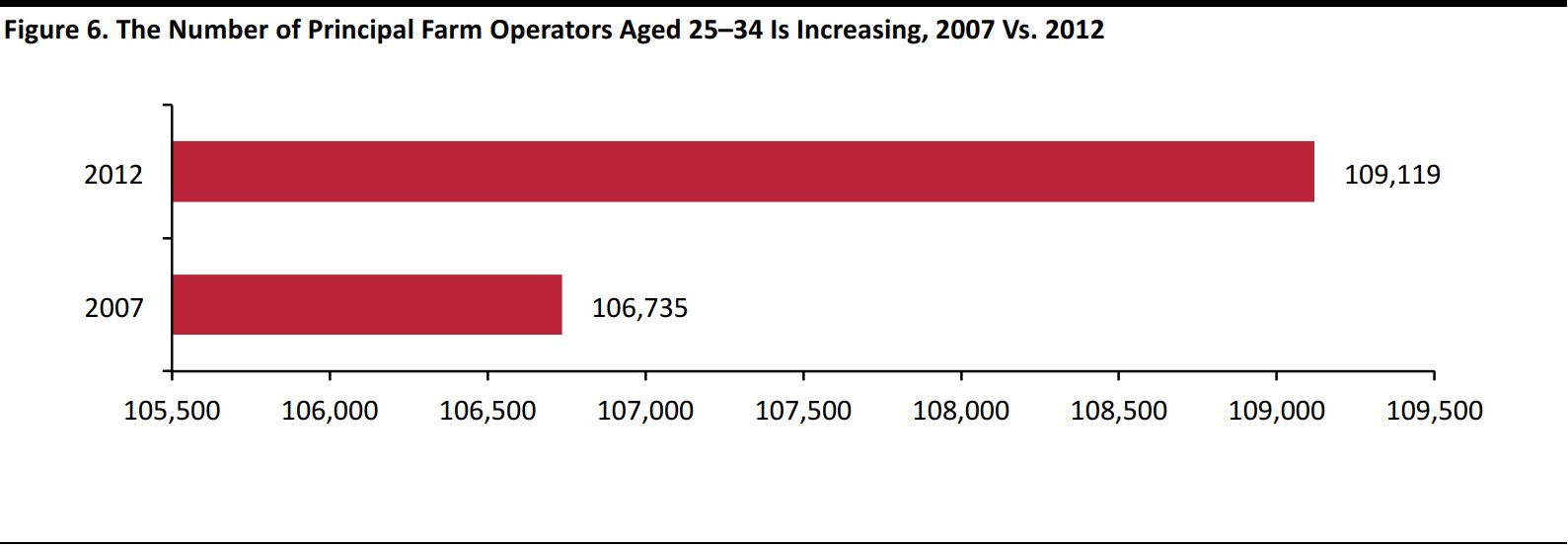

The rise of urban farming has attracted millennials to the industry, resulting in a change in farmer demographics. According to the USDA, a breakdown of the number of principal farm operators in 2007 and 2012 shows that the number of farmers under the age of 35 is growing—this is only the second time this has occurred in the past 100 years. Not only are these farmers younger, they are also more educated. According to a survey conducted by the National Young Farmers Coalition, 69% of those surveyed had college degrees, significantly higher than that of the farmer population in general.

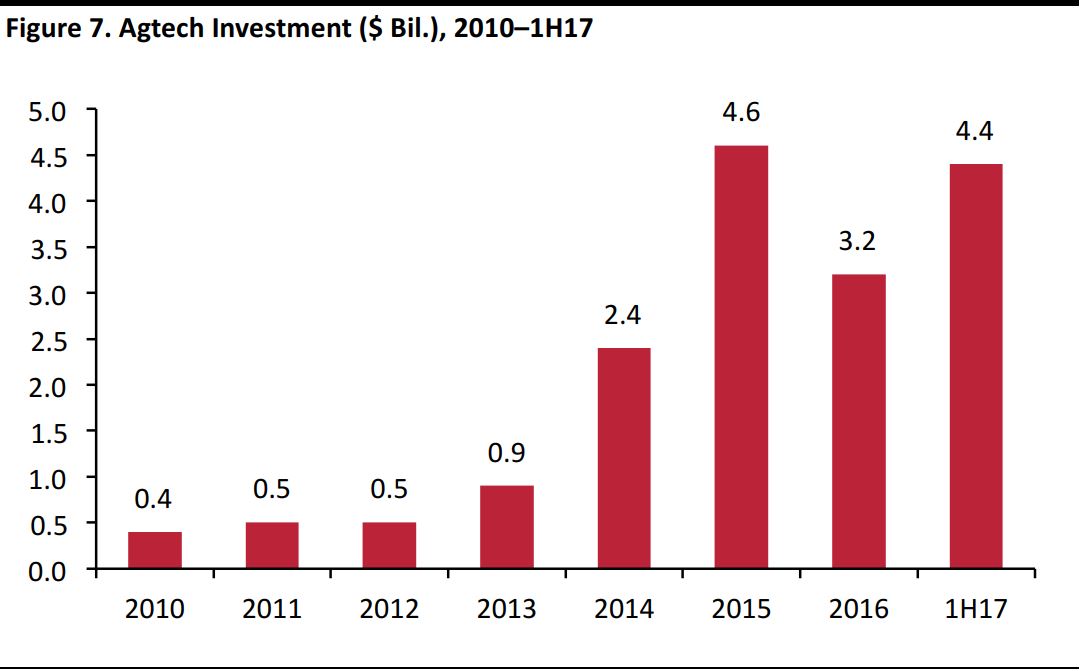

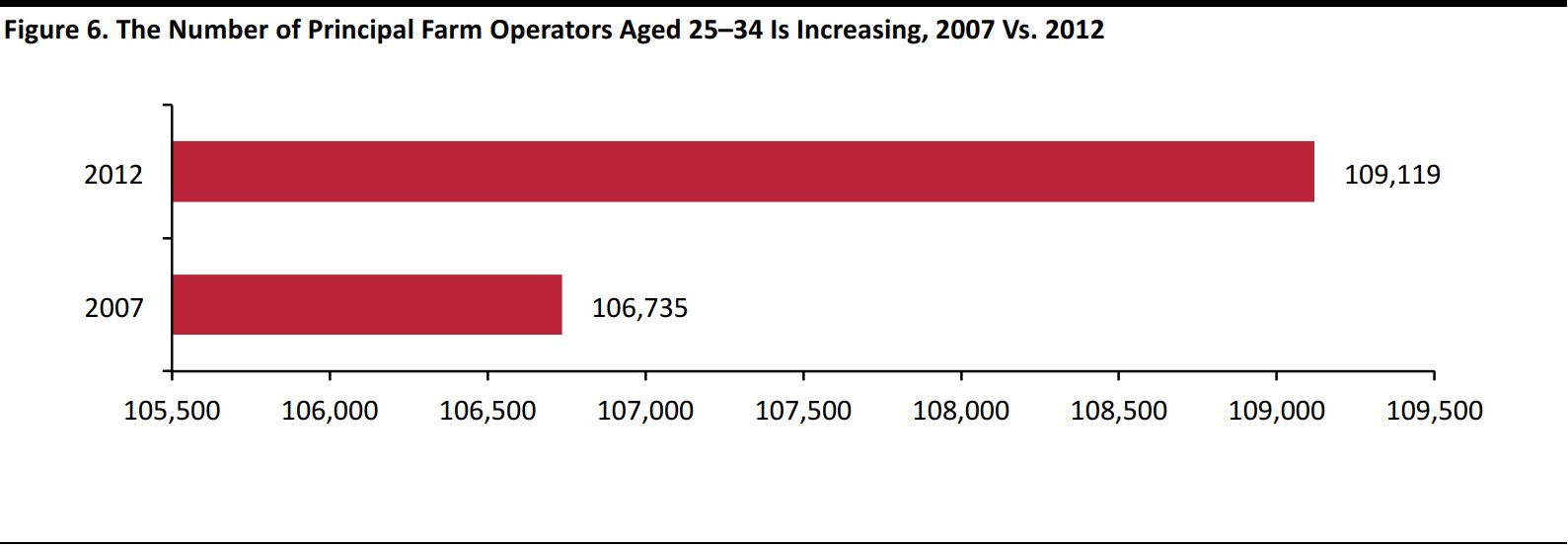

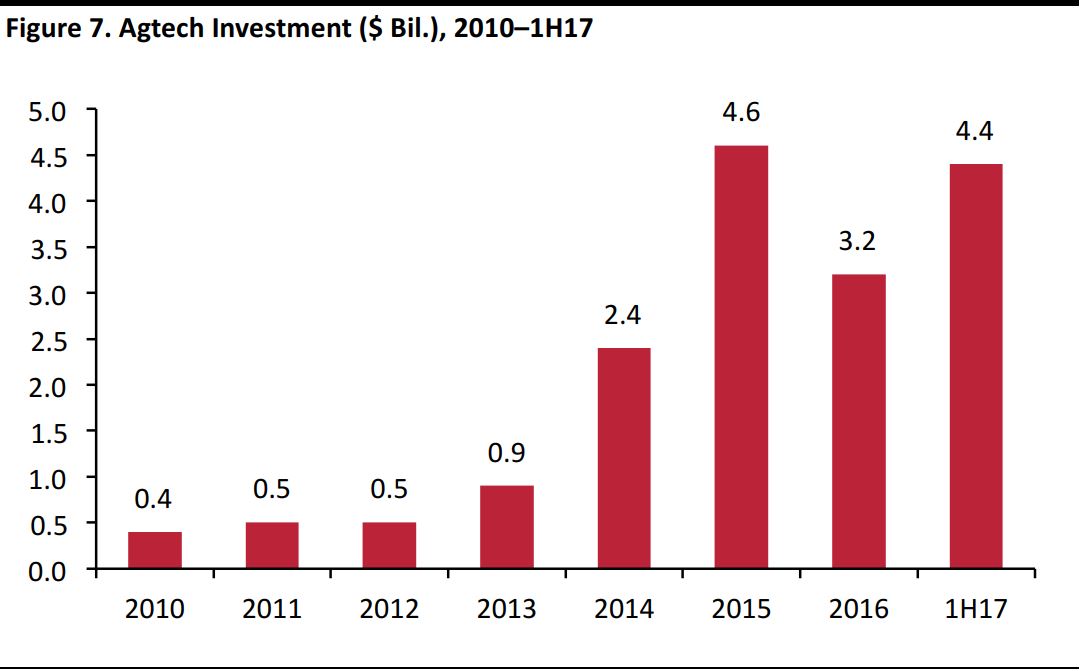

As the demographics of farmers evolve and they become more educated, what is considered the least-disrupted industry looks set to undergo changes with an increase in investment in agtech. According to data from Agfunder, a venture capital platform for the food and agriculture industry, investment in agtech has risen significantly in the past few years, growing almost tenfold to reach $4.6 billion in 2015 from $0.5 billion in 2012. In the first half of 2017 alone, agtech investment had already reached $4.4 billion, and was almost certain to surpass the peak in 2015.

We are seeing agtech investment in a number of areas, and expect urban farming to become more sophisticated with the application of better farming techniques, big data analytics and farming automation through AI and machine learning.

What is Urban Farming?

Urban farming,or urban agriculture,refers to the growing, processing and distributing of food through intensive plant cultivation and animal husbandry in and around cities, according to two American academics, Martin Bailkey and Joe Nasr. Urban farmlands are generally smaller in size compared to the average rural farm, at around 9 acres, according to the USDA.

Urban farming falls into two categories, namely market gardening and community gardening.

- Market gardening refers to an individual farmer or a small group of farmers who grow fresh produce for self-consumption or supply to local markets or restaurants.

- Community gardening, or community farming,refers to a group of people in the neighbourhood utilizing shared plots of public land to produce fresh food.

Government-Supported Urban Farming and Community Gardening—A Growing Trend

As the economy develops, it is not unusual for warehouses and lots of land to become vacant when businesses wind down, particularly during an economic downturn. These vacant lots and warehouses can turn into scrapheaps or even places rampant with crime,and, fuelled by unemployment, can lead to undesirable social problems. To combat this,local governments are introducing initiatives to turn these areas into community gardens or urban farmlands.

Source: United States Department of Agriculture (USDA)/Coresight Research

Growth in the Number of Smaller Farms Points to the Rise of Urban Farming

Thanks to the backing of government programs, we are seeing signs of a growing trend of urban farming. This is evident by the significant increase in the number of farms smaller than 50 acres; most urban farms fall into this category. The number of farms below 50 acres increased by 27.7% to 813,183 in 2012 from 636,917 in 1982, and the number of farms below 9 acres increased by 19.2% during the same period, according to data from the US Census of Agriculture.

Source: US Census of Agriculture, 1982 and 2012, USDA/Coresight Research

Benefits of Urban Community Farming

Turning empty lots or warehouses into urban community farms brings a multitude of benefits to the community, such as reducing unemployment, improving community social wellbeing and supporting the local food system.

1) Brings Jobs to the Community

Urban agriculture improves employment. In Milwaukee, where unemployment among black men was 53% in 2009, the non-profit urban farm Growing Power created 150 jobs for low-income residents, including prisoners, to improve both the social and economic wellbeing of inner-city, low-income residents. Residents are better-off and less prone to commit crime when they have jobs, which reduces crime rates in the neighborhood.

2) Improves Community Social Wellbeing

Urban community farming also improves the social wellbeing of a community. “In community gardening, community comes first,” says the American Community Gardening Association. Urban gardens, not only bring in food and employment, but

, more importantly

,also act as community centers that promote community ties and cohesion. “Gardens cut across age and race and financial barriers by bringing people together to share stewardship of open space,” says urban planner Bill LoSasso, Director of Green Thumb, the largest community gardening program in the US. “They are a unique space in bringing people together, even with the tensions that can come with gentrification. Gardens are a neutral space where everyone can participate, and they are having a positive impact in keeping neighborhoods strong.”

3) Supports the Local Food System

Urban farming supports the local food system.

According to the USDA, local food sales reached $12 billion in 2014 and is expected to grow to $20 billion by 2019, as consumers become increasingly cautious about what they eat and tend to prefer healthy food.

There are no supermarkets in some low-income areas of cities across the US. Fresh produce offerings available at small corner stores are often expensive and of poor quality. For instance, a hamburger at a fast-food restaurant in these areas could cost $1, while a bag of carrots costs three times that at$3. Urban farming can help support the local food system to bring more fresh offerings to consumers in the community.

According to the USDA, despite rapid economic development, there are 48.1 million people in the US struggling to afford a proper diet. Urban farming in these areas can help residents in low-income areas can grow fresh produce themselves and secure their own food.

Urban Farms Producing?

According to a survey of 315 urban farmers by the USDA in 2013, the top products grown were fresh vegetables, followed by nursery items (such as seedlings and herbs), fresh fruits and meat and poultry.Over two-thirds of the survey respondents said they grow fresh vegetables on their urban farms.

Source: 2013 National Survey of Urban Farms,USDA

Chickens Are the Most Popular Livestock Raised on Urban Farms

In terms of livestock, hens and broilers are the most-popular livestock raised on urban farms. A breakdown of urban farms shows that almost half, or 46.5%, raise hens. On average, there are 19.9 hens and 10.6 broilers on an urban farm, the highest number among livestock reported in the survey.

Source: 2013 National Survey of Urban Farms, USDA

Hens and broilers are a popular livestock on urban farms because they are easy to raise and the hens lay fresh eggs.In addition, hens and broilers are much smaller in size compared to pigs or cows, so an urban farmer can easily keep their chickens in a chicken coop on the farm, or even in the backyard.

Growing health concerns: Consumers are increasingly becoming concerned about the quality of food they are eating. In April this year, the Rose Acre Farms company voluntarily recalled over 200 million eggs in nine states, because of the possibility that the eggs were contaminated with salmonella braenderup, which can sicken healthy adults and have serious and possibly fatal effects if eaten by young children and the elderly. A hen laying fresh eggs on an urban farm or even in a backyard could eliminate the processing and distributing processes that could lead to contamination of eggs.

N = 255

Source: 2013 National Survey of Urban Farms, USDA

N = 255

Source: 2013 National Survey of Urban Farms, USDA

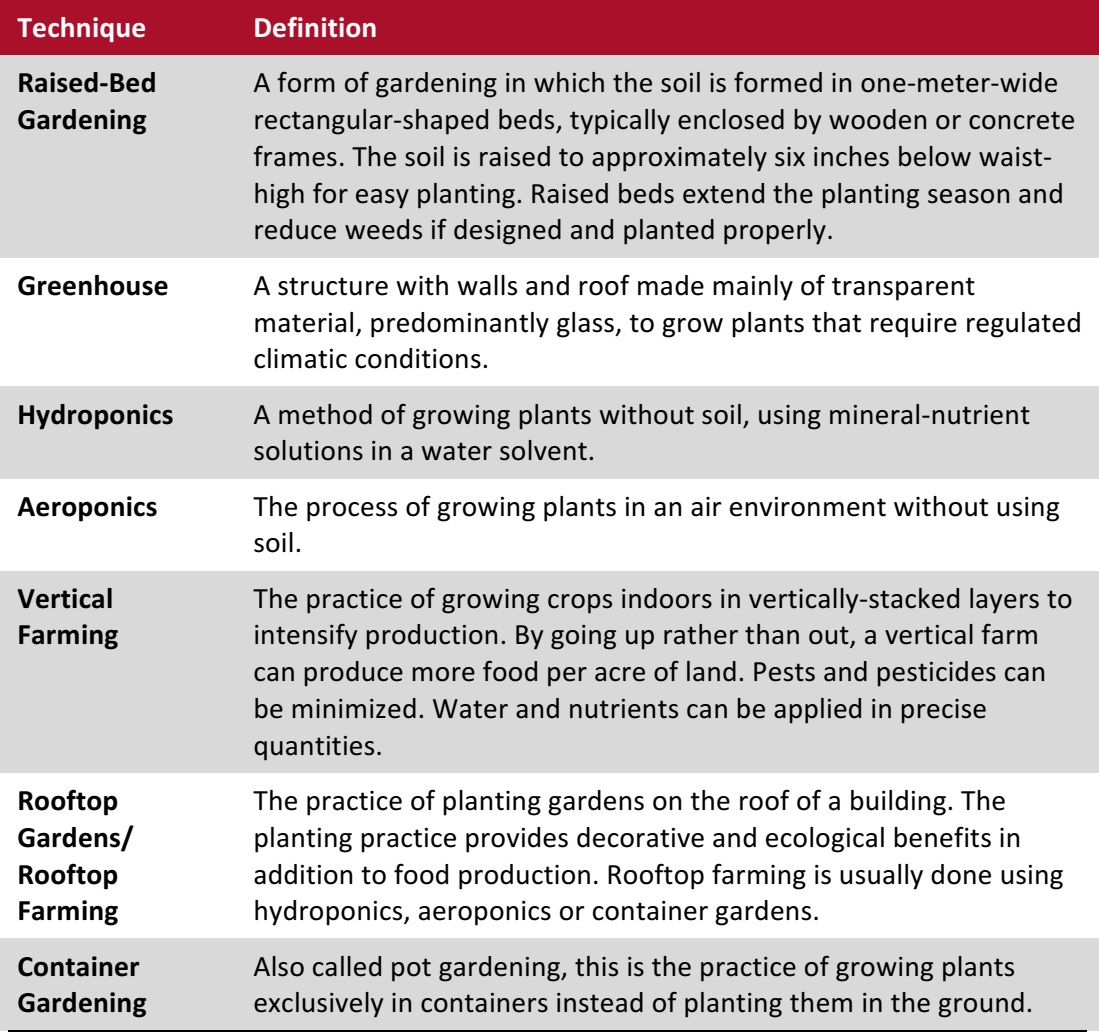

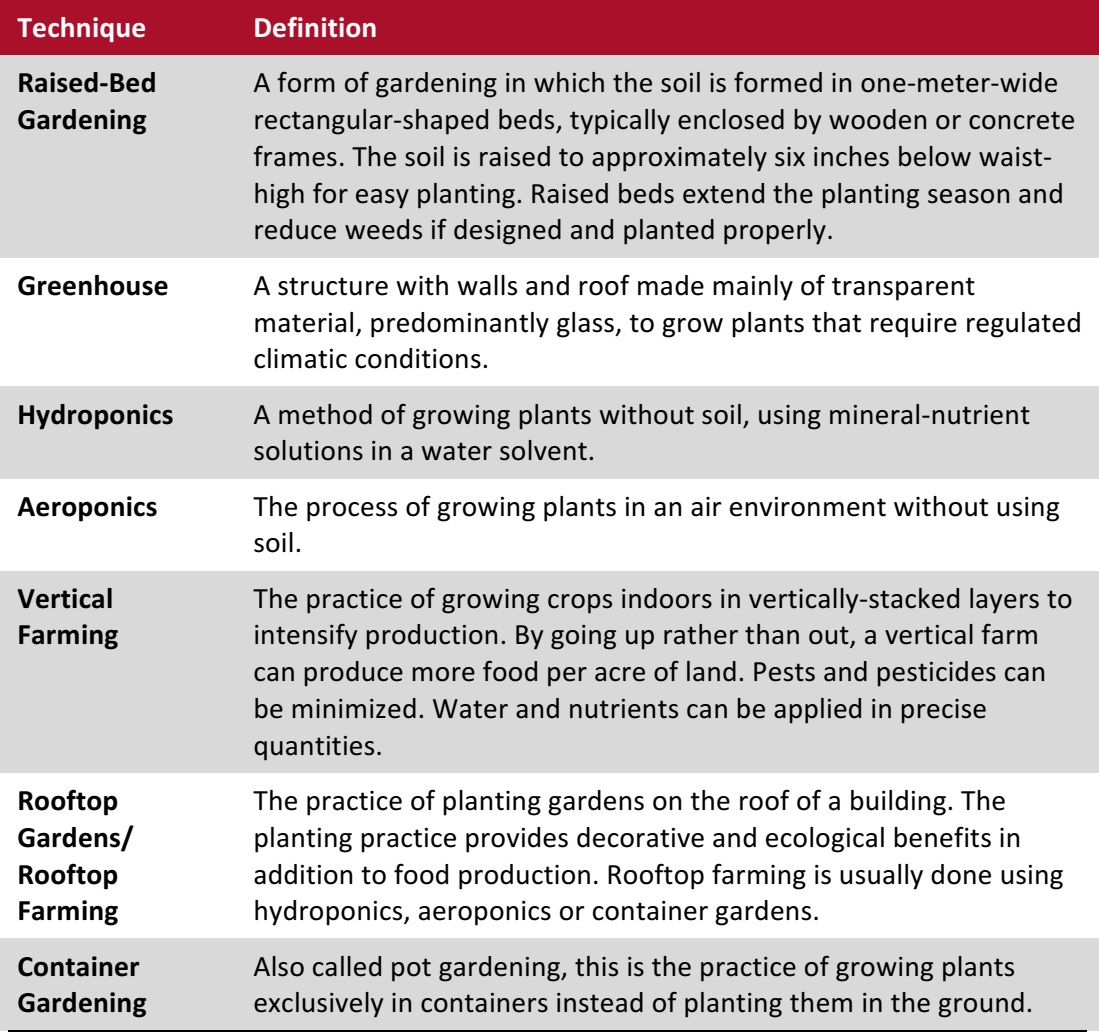

Innovative Production Practices in Urban Farming

Urban farms are usually smaller than rural farms. According to a survey by the USDA in 2013, the average size of an urban farm is 9 acres. Given the smaller scale of urban farms, innovative production practices are used to increase production on smaller land bases.

Source: Scandinavian Green Roof Institute/Journal of Environmental Management/Wiley/Coresight Research

According to a national survey of urban farms in 2013, raised beds, greenhouse and container gardens were the most popular practices among urban farmers. Around two-thirds of urban farms adopted raised beds and more than one-third deployed greenhouse and container gardening.

Source: NCAT

More Millennials, Most with Degrees, Are Turning to Urban Farming

The rise of urban farming as a result of government-supported initiatives is attracting more millennials to the industry. According to the USDA, urban farmers are younger than the overall farming population, with an average age of 44, and ranging in age from 21 to 78, compared to the average age of 58.3 for the overall farming population.

The number of millennials turning to farming, even those with no farming background, is growing, and this is changing the demographics of the farming population. Looking at a breakdown of the number of principal farm operators in 2007 and 2012, those under the age of 35 is increasing, this is only the second time this has happened in the past 100 years. The number of farmers ages 25–34 grew by 2.2% to 109,119 in 2012 from 106,735 in 2007, according to the USDA’s Census of Agriculture. In some states, including Nebraska, California and South Dakota, the number of “new” farmers has grown by 20%.

A survey conducted by the National Young Farmers Coalition reveals that the majority of young farmers did not grow up in an agricultural family, where 75% of the surveyed farmers were first-generation farmers.

Source: USDA NASS, 2012 Census of Agriculture

Not only are these new farmers younger, they are also more educated. According to a survey conducted by the National Young Farmers Coalition, 69% of the surveyed young farmers had university degrees, significantly higher than that of the farming population in general.

Burgeoning Investment in Agtech

As the demographics of farmers evolve and they become more educated, what has been viewed as the least-disrupted industry looks set to undergo changes thanks to agtech.

According to data from Agfunder, a venture capital platform for the food and agriculture industry, investment in agtech has increased significantly in the past few years, growing almost tenfold to reach $4.6 billion in 2015 from$0.5 billion in 2012. In the first half of 2017 alone, agtech investment had already reached $4.4 billion, and was almost certain to surpass the peak in 2015.

Source: Agfunder

We are seeing agtech investment in a number of areas, including more sophisticated farming techniques such as vertical farming and aeroponics, big data analytics of farming supplies and yields, and farming automation through AI and machine learning.

Below, we highlight a few notable startups involved in agtech.

Aerofarms

Aerofarms

Founded in 2004, Aerofarms is an urban agricultural and cleantech company that builds vertical farms with its aeroponic growing systems to produce plants without sun or soil. The company claims to own the largest indoor farm in the world, based on growing capacity. Its global headquarters in Newark, New Jersey produces up to 2 million pounds of produce annually which is supplied to the New York area.

Aerofarms now owns nine farms and has farms under development in several US states and on four continents. The company raised a total of $138 million in eight rounds of funding.

BrightFarms

BrightFarms

Founded in 2011, BrightFarms builds and operates greenhouses in urban and suburban areas to grow fresh produce and deliver fresh food to supermarkets within 24 hours of harvest. The company partners with supermarkets which include Giant, ACME and Pick ’n Save. The company has raised $57.9 million in five rounds of funding to date.

Farmer’s Business Network

Founded in 2014, Farmer’s Business Network connects over 3,400 small farms with data on seeds, yields, soils and supply prices that leverage technology and big data analytics to improve farming yields. The big data company also connects farmers, allowing them to share knowledge and gain insights about their farms, inputs and practices. The company raised $193.9 million in six rounds of funding.

Plenty

Founded in 2014, Plenty is an agriculture technology company that leverages vertical-farming techniques, AI and machine learning to grow plants indoors. The company is building a 100,000-square foot vertical-farming warehouse in Kent, Washington. That farm is expected to open and start delivering produce locally by mid-2018, and is designed to produce 4.5 million pounds of greens annually. Plenty claims that it can get as much as 350 times the produce out of a given acre of land, using 1%of the water.

The company also utilizes machine learning and AI to automate the farming process. Plenty uses cameras and sensors to optimize light, temperature and humidity levels. It even has little robots that transplant seedlings, as the towers and plants are getting so dense that it is difficult for a human to operate among them. The company raised $226 million in four rounds of funding.

Key Takeaways

Backed by government initiatives, urban farming is a growing trend in the US, as is evident by the increase in the number of farms smaller than 50 acres. Turning unused land or vacant lots into community gardens or urban farmlands brings multiple benefits to the communities, including reducing unemployment, improving the social wellbeing in the community and supporting the local food system.

The rise of urban farming has attracted millennials to the industry, resulting in a change in farmer demographics. The number of farmers under the age of 35 grew between 2007 and 2012, according to the USDA, only the second time this has happened in the past 100 years.

These young farmers are not only more educated, but are bringing change to what has been viewed as the least-disrupted industry by introducing the latest technology to the farming fields.

According to data from Agfunder, a venture capital platform for the food and agriculture industry, investment in agtech has grown almost tenfold in the past few years to reach $4.6 billion in 2015 from $0.5 billion in 2012. In the first half of 2017 alone, agtech investment had already reached $4.4 billion, and was almost certain to surpass the peak in 2015.

The agriculture industry is undergoing significant changes with the increase in investment in agtech. We expect urban farming to become more sophisticated with the application of better farming techniques. In addition,we expect farming to become more efficient with the applications of big data analytics and farming automation through AI and machine learning, as well as the help of first movers such as Plenty and Farmer’s Business Network.

N = 255

Source: 2013 National Survey of Urban Farms, USDA

N = 255

Source: 2013 National Survey of Urban Farms, USDA