Uppercase has launched a retail technology solution that help brands launch physical retail stores from the ground up. The company received seed funding led by LererHippeau, the investor behind Allbirds, Casper, Everlane, Glossier, Dia& Co, and Warby Parker. Other investors of the company include CRV, One of the World’s Largest VC Firms that has invested in Investing in Classpass, Doordash, Dropbox, and Twitter. These are both companies that are embracing the market shift that retail is presently witnessing.

Tech-enabled Flexible Retail Solution for Brick-and-Mortar Retail

Uppercase has developed an in store technology solution for brands to launch and operate brick-and-mortar retail stores. After helping in the launch of over 5,000 stores operating as a flexible retail marketplace for two years, the company has access to a large volume of data on emerging and sought-after retail locations, and the retail solution that DTC brands need to succeed. Uppercase combines real estate and retail data to provide access to up-and-coming and desirable retail neighborhoods. The company provides insights into where a brand’s retail stores should be located, at what times the stores should open, and how data-informed merchandising plans can be created. Uppercase gives brands everything they need to succeed with a presence in retail.

Approximately 90% of Brands Quickly Move into Permanent Stores after Launching a Pop-up

Yashar Nejati, Uppercase founder, said that approximately 90% of brands quickly seek to move into permanent stores after launching pop-up locations. He further said that anyone can launch an online business today, but brands truly stand out once they upgrade from dotcom to physical ZIP-codes. Examples of such brands include Warby Parker, Casper, and Indochino that will have a total of 350 stores between them by end of 2018.

Uppercase’s research shows that customer acquisition costs rise along with brands’ growth. When a brand reaches $10 million in sales, it becomes more cost effective for it to acquire customers through real-world stores rather than through online channels. Further, customers acquired in the real-world have stronger brand affinities and higher lifetime spends. Although not much data has been collected till date on costs of going online to offline, Uppercase has discovered that these costs can quickly spiral out of control and what begins as a great idea can soon become a resource drain and distraction for a brand’s management. Launching retail stores is therefore both risky and complex.

This is the business case on which Uppercase was founded and Nejati said the company serves the business needs he sees every day and provides modern retail services for brands ready to graduate to the next stage. He further said that he wanted to help brands build game-changing retail experiences from the ground up and provide new business owners with all of the tools that they need to grow in retail. Uppercase’s is to provide retail solutions aimed at helping DTC brands and retailers with a complete tool set that sets them up for success when moving into physical retail.

The market for physical retail solutions is undergoing many paradigm shifts, a renaissance of sorts. First, Lease times are shrinking and the average length of retail leases is now five years, from 20 years in 1991. And, second, the market size for DTC brands has exploded and encompasses nearly every category. Uppercase estimates the present global market size of such brands at $9 trillion.

The top 250 global DTC brands have raised a combined investment of $10 billion and are moving their presence beyond digital in order to grow. Very few companies have remained pure digital, and many including—including Casper, Peloton, and Warby Parker—have grown into physical retail.

Last, although stores are closing (according to our Weekly Store Opening and Closing Tracker, there have been 4,579 store closures as of August 31, 2018) physical retail still comprises over 90% of sales according to US Census Bureau data. Uppercase predicts that in store sales will account for 75-85% of retail sales by 2025.

Lerer Hippeau has recognized this generational shift and has invested in retail solutions that bridge the gap between online and offline. Lerer Hippeau, the NYC-based seed stage venture capital fund, which has invested in many innovative brands, including Allbirds, Casper, Everlane, Glossier, Dia& Co, and Warby Parker, and CRV the investor behind Dropbox, Classpass, and Doordash invested $4.8M in Uppercase.

Uppercase Home Page

Source: Uppercasehq.com

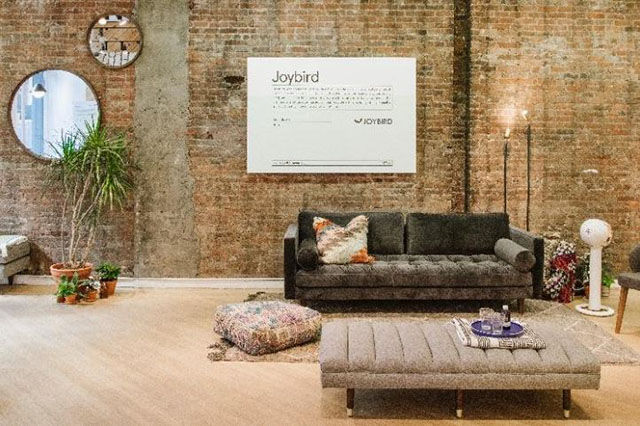

Uppercase Home Page

Source: Uppercasehq.com

Uppercase Home Page

Source: Uppercasehq.com

Uppercase Home Page

Source: Uppercasehq.com