Nitheesh NH

Introduction

Unstaffed stores are powered by different automation systems that enable them to operate without associates inside; at a minimum, they typically deploy technologies that facilitate checkout-free transactions or self-checkout. Unstaffed stores have emerged in recent years, predominantly in China and the US but with momentum gaining in Europe and other Asian countries. They appear in different formats—kiosks, convenience stores and supermarkets—but mostly they are seen as alternatives to, or an evolution of, convenience stores, given the size of the stores and range of product offerings. In this report, we review the development of unstaffed stores (primarily convenience stores as they are the most mainstream) and the technologies employed to support daily operations. We also explore whether unstaffed stores can become the store of the future by considering examples in China and the US.Emergence of Unstaffed Stores

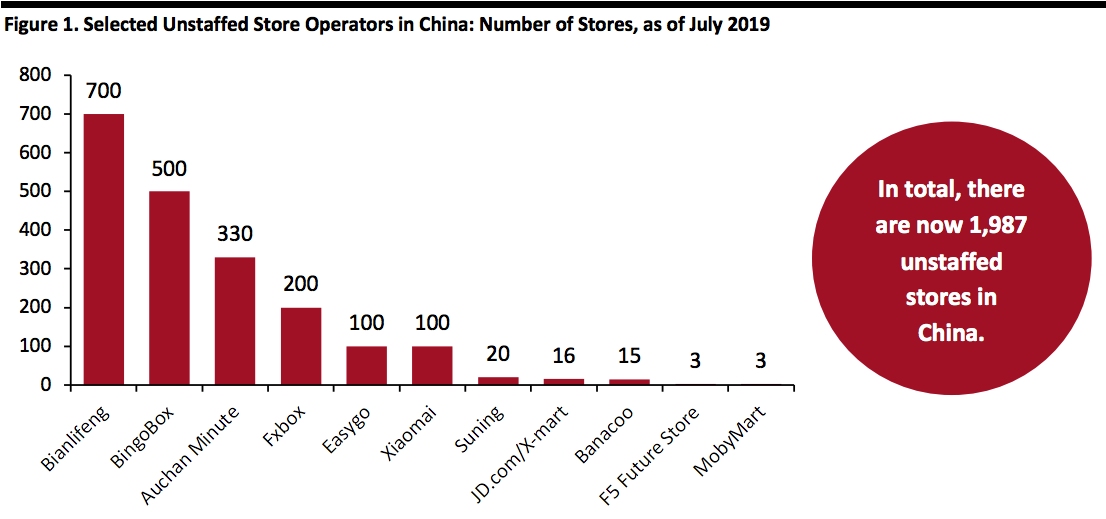

Thanks to a high smartphone penetration rate and the development of advanced technologies, unstaffed stores have emerged across China and the US in the past three years, and they are also now gaining momentum in Europe and Japan. China is a pioneer in the field of unstaffed stores, and in addition to startups such as Bianlifeng and Xiaomai, we have seen many such stores opened by conglomerates in the country. For example, JD.com has opened unstaffed convenience stores and unstaffed supermarkets under the X-mart banner, while Auchan has launched the Auchan Minute format. [caption id="attachment_97824" align="aligncenter" width="700"] Source: Company reports[/caption]

[caption id="attachment_97825" align="aligncenter" width="700"]

Source: Company reports[/caption]

[caption id="attachment_97825" align="aligncenter" width="700"] A BingoBox convenience store

A BingoBox convenience storeSource: BingoBox[/caption] In the US, Amazon announced its Amazon Go concept in 2016 and opened its first Amazon Go unstaffed store to the public in Seattle in January 2018. As of July, 2019, there are 15 Amazon Go stores in the US. [caption id="attachment_97826" align="aligncenter" width="700"]

An Amazon Go store

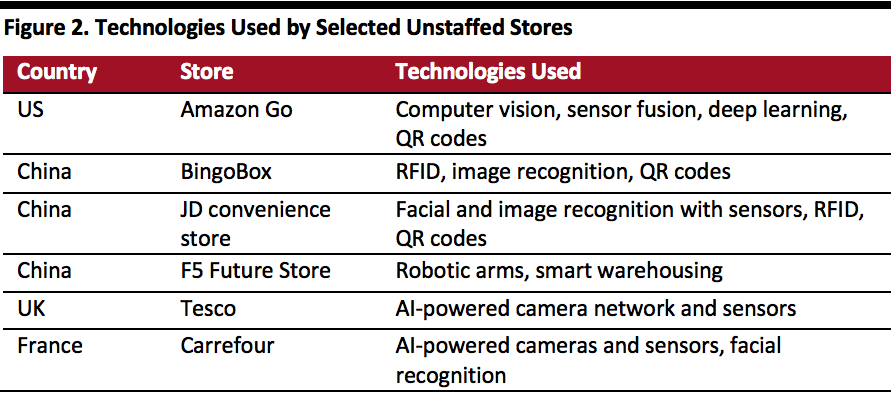

An Amazon Go storeSource: Amazon[/caption] In Japan, unstaffed stores are a potential solution to the labor shortage problem caused by an aging population. In 2017, the Japanese government launched an initiative, inviting five convenience store chains—FamilyMart, Lawson, Ministop, New Days and 7-Eleven Japan—to automate their stores nationwide by 2025 using radio-frequency identification (RFID) technology. Other brands in the country have also started trials of unstaffed outlets. For example, JR East, a railway network operator in Japan, trialed an unstaffed convenience store in a railway station in Tokyo last year. In Europe, British grocery retailer Tesco is testing an automated “cashierless” store in which AI-powered cameras and sensors can detect the products that shoppers are adding to their baskets and automatically charge customers when they leave. French retailer Carrefour launched a cashierless concept store dubbed “Flash” in its head office in Massy, France, in June 2019. Cameras and sensors inside the Flash store can track shoppers’ behavior, and shoppers can make payments through facial recognition technology. The Flash store is currently open only to Carrefour staff, but the company plans to roll out the technology to more locations in the near future.

Technologies Employed by Unstaffed Stores

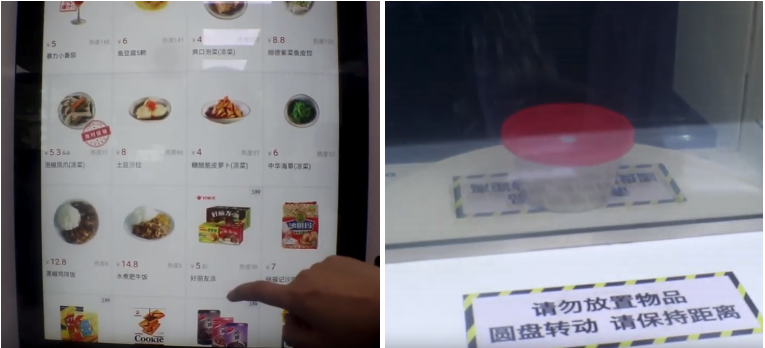

Although the flow of unstaffed operations varies by store, it generally relies on a combination of the following technologies to enable automation of the store. Computer vision/machine learning: Cameras and sensors equipped with image recognition technology can track shoppers’ movement when they pick up an item or put it back on the shelf. It also enables facial recognition payment, which enables faster checkout for customers. RFID technology: RFID identifies and tracks objects that are equipped with RFID tags via electromagnetic fields. This allows the store to instantly identify the products that shoppers place in a designated checkout point and bill the total amount to their mobile accounts to settle payments. QR code: Stores can identify customers when they scan a QR code upon entering. Scanning QR codes also allows shoppers to settle payments and look for more product information. Amazon Go delivers the “just walk out” concept with the most advanced technologies fully in place—computer vision, sensor fusion and deep learning. With an Amazon account created and the Amazon Go app installed, users can walk into the store by scanning a QR code within the app to pass through the turnstile at the entrance. When shoppers are inside, their movement when theypick up items or put them back on the shelf is tracked by cameras and sensors. The technology is therefore able to create a virtual cart of selected items that matches each customer’s physical one. The shopper can then simply walk out of the store, as Amazon Go will automatically send a digital receipt to their account and charge them for the items they chose. Other unstaffed stores use image recognition systems to track shoppers’ movements, but they mostly still require some form of checkout with an RFID counter and rely on RFID technology to confirm if customers have paid. In a BingoBox store, for example, shoppers scan a QR code at the entrance—as with Amazon Go—and all products in the store are attached with an RFID tag to enable tracking. When customers are ready to pay, they place the chosen items on a checkout counter that uses image recognition to identify the products and calculate costs. After paying with either Alipay or WeChat Pay (mainstream mobile wallets in China), customers must scan another QR code in order to leave, during which the security cameras will detect again whether all items have been paid through the RFID tags before opening the doors for exit. F5 Future Store is more unique. It mainly relies on robotic arms to serve customers through separate ordering terminals for three categories of product: freshly made food, freshly brewed beverages and packaged consumer goods and customers need to go to the respective terminals to buy the items they want. There is also a self-cleaning dining table at which customers can eat in store. Shoppers use digital screens toselect and pay for products, which are then prepared by robotic arms at the pick-up counter. [caption id="attachment_97827" align="aligncenter" width="700"] A customer selects items on a shopping screen in the F5 Future Store (left). After settling payments, the customer goes to the pick-up counter where robotic arms deliver the products (right).

A customer selects items on a shopping screen in the F5 Future Store (left). After settling payments, the customer goes to the pick-up counter where robotic arms deliver the products (right).Source: YouTube[/caption] [caption id="attachment_97828" align="aligncenter" width="700"]

Source: Company reports[/caption]

Source: Company reports[/caption]

Unstaffed Store Boom Cools Down in China

Although China’s unstaffed store business started aggressively in 2017 with venture capital flowing in, it soon cooled down as news emerged of store closures and progress delays.- GOGO, an unstaffed store in Chengdu and the first of its kind in southwestern China, was shut down in 2018 after less than five months of operation.

- Guangzhou-based i-Store opened its first store in 2017 and had nine operational at its peak. However, as of March 2019, only three stores remain in the southern Chinese city.

- JD.com planned to open 500 unstaffed stores in 2018 but encountered difficulty, with only around 20 locations operating by September that year, according to the Nikkei Asian Review.

- Startup BingoBox closed its first batch of stores in Shanghai in September 2017 after starting its business in 2016.

Implications from China’s Unstaffed Store Closures

Amazon expanded its Amazon Go stores carefully in the US and launched its first store after a trial of only one year. However, many unstaffed stores in China have not yet figured out a way to turn a profit while relentlessly expanding. Several factors are hindering the development of unstaffed stores in the country, which have implications for the overall unstaffed retail segment. 1. Operating Costs The first challenge for retailers pursuing the unstaffed concept is that such stores are costly to operate. Although labor expenses on store associates and cashiers are no longer necessary, wages in China are low compared to developed countries, so this comprises a relatively small saving. Furthermore, manual labor is still needed for stock replenishment, cleaning and attaching RFID tags to products. The maintence costs of cameras and sensors in the more advanced tech-equipped stores are also not negligible. Xiaoe Weidian (小e微店) operates unstaffed kiosks targeting white-collar workers in office buildings in upper-tier cities in China. The average monthly turnover of the company’s unstaffed kiosks in Beijing is around ¥5,000 (US$699), and personnel are sent there to replenish stock eight times per month on average, stated the company’s CEO Rong Guang in an interview with Chinese media outlet Retail Boss Insider (零售老板内参) in 2018. In the interview, Guang pointed out that the shrinkage rate was low at around 5%. This is because Xiaoe Weidian’s unstaffed kiosks are mostly situated in private locations, such as within office buildings. However, in public areas on the street, there are likely to be higher associated surveillance costs to prevent shrinkage and protect products. [caption id="attachment_97829" align="aligncenter" width="700"] In a Xiaoe Weidian kiosk, shoppers scan the QR code labels via WeChat to buy products.

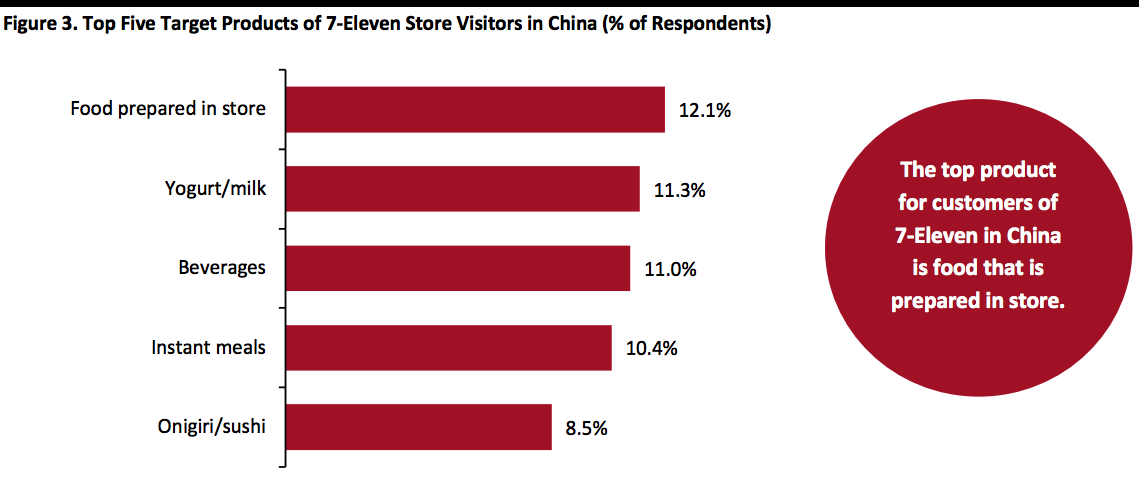

In a Xiaoe Weidian kiosk, shoppers scan the QR code labels via WeChat to buy products.Source: Xiaoe Weidian[/caption] 2. Customer Experience Many shoppers initially visited unstaffed stores out of curioristy, but as this format gets closure to maturity, it is crucial that such stores offergood customer experience—or at least an experience in line with the general convenience sector—in order to secure repeat business. However, with most unstaffed stores in China relying on RFID technology for tracking and idenification rather than the more advanced AI-powered cameras and sensors, the shopping experience is less smooth. For example, a customer must scan the QR code twice—once to enter and once to leave—at a BingoBox store compared to the “just walk out” experience from Amazon Go. Although a smoother shopping journey is the primary goal, it comes with higher set-up costs. The first Amazon Go store in Seattle is said to have cost the company more than $1 million in hardware alone, according to a Bloomberg report. RFID tags are much less costly. Unstaffed convenience stores are generally smaller than typical stores, which limits the number of people that can shop at the same time. In China, there were news reports that some customers stayed in the stores for a long time to enjoy air-conditioning in summer, obstructing others from making purchases. There were also cases of periodic malfunctions that required the stationing of staff to keep the stores running. 3. Products Due to the limited store sizes, there are generally fewer stock keeping units in unstaffed convenience stores than there are in typical convenience stores, but the products are largely similar. This means that shoppers can buy the same products elsewhere, so it is not a must for them to go to an unstaffed convenience store. The freshly prepared/cooked food category tends to possess a higher gross margin than packaged food. In a joint study on China’s convenience store sector by Deloitte and AliResearch published in 2017, the top three target products for shoppers visting 7-Eleven stores in China were food prepared in store, yogurt/milk and beverages—confirming the popularity of freshly prepared food among Chinese consumers. Failure to sell these products will therefore negatively impact store traffic, but it is difficult for unstaffed convenience stores to offer freshly cooked food without having personnel to prepare it. Currently, only F5 Future Store has attempted offering freshly prepared food, but it remains to be seen how this is perceived by the wider consumer market, as the company currently only operates three stores in the southern Guangdong province. [caption id="attachment_97830" align="aligncenter" width="700"]

Source: 7-Eleven/Deloitte[/caption]

Source: 7-Eleven/Deloitte[/caption]