Nitheesh NH

What’s the Story?

The Covid-19 pandemic altered shoppers’ behavior, preferences and propensity to spend. In addition, external factors such as supply chain bottlenecks and rising inflation have contributed to the ever-increasing complexity of the retail landscape. Against this backdrop, we explore shopper expectations for the 2021 holiday season—which should be somewhat less uncertain than the holidays last year. Analyzing the findings of an October 2021 Coresight Research survey of US consumers who plan to shop for gifts across both online and physical channels this holiday season, we discuss holiday shoppers’ plans for buying gifts and their expectations around holiday spending. This report uncovers the increasingly important role of e-commerce in gift shopping, as well as shoppers’ pain points in digital gift purchasing. We also offer a glimpse into how consumers expect to shop for the 2022 holiday season. This report is sponsored by GiftNow, an integrated digital gifting solution.Why It Matters

Gifting is intrinsic to human nature; however, innovation in gifting has not necessarily kept pace with the overall retail sector. We believe gifting provides often-untapped opportunities for retailers and brands given the market’s association with the holidays, its total size and growth trajectory, and its potential to support new innovations, which we outline below.- The holiday season boosts overall sales: US holiday sales (retail sales in October, November and December) amounted to $1.1 trillion last year, according to our analysis of US Census Bureau data. Sales were up 9.2% year over year—the highest annual growth since 2010—and comprised 28% of total US retail sales in 2020. We expect robust demand this holiday season and estimate year-over-year sales growth of 9%–10% (up 19% from pre-pandemic 2019). Although gifting is a year-round process, it is skewed toward the last quarter of the year due to major shopping events such as Black Friday and Cyber Monday and important holidays such as Christmas, Hanukkah and Kwanzaa.

- The gifting market is large and fast-growing: We estimate that the US gifting market will reach $816 billion by 2024, growing at a CAGR of 6% from $621 billion in 2019. Gift cards continue to be a big opportunity, accounting for around 20% of the overall holiday gifting market, we estimate. We expect this trend to continue in the 2021 holiday season and in future years.

- E-commerce has gained prominence, but advancements lag: The online channel accounted for 20% of holiday sales in 2020, with e-commerce sales surging 32.5% year over year, according to the US Census Bureau. We expect online sales to comprise around 21% of total sales in the fourth quarter of 2021—however, innovation in digital gift cards, and personalization and customization options for the recipient are yet to pick up pace and have the potential to substantially enhance the online gift-buying experience.

Unpacking Holiday Gifting: Coresight Research Survey Analysis

This study sheds light on the intrinsic opportunities in the US gifting market, using survey analysis of expected shopper behavior this holiday season to identify ways to elevate the overall gifting experience by making it more connected and seamless. Summing Up the Opportunity in Holiday Gifting Demand for gifts is high this holiday season: Our recent survey found that half of all survey respondents plan to purchase at least nine gifts this holiday season, and more than seven in 10 plan to spend at least $300 on holiday gifts. Shoppers’ propensity to spend online also presents a huge opportunity for online marketplaces such as Amazon as well as retailers with an e-commerce presence. In our survey, the online channel emerged as the most popular choice among holiday shoppers for both purchasing and searching for gifts. That said, the brick-and-mortar retail experience is not being abandoned by shoppers: 50% of respondents reported that they are either “likely” or highly likely” to purchase gifts from malls, while four in 10 cited plans to purchase from open-air shopping centers. With the holiday shopping window pulled forward this year, retailers have the opportunity to lure shoppers with early promotions and boost customer loyalty through the holiday season and beyond. For example, Walmart recently announced that it would offer early online access for Walmart+ loyalty program members during the retailer’s Black Friday Deals for Days event from early November: Walmart + members can shop all deals four hours earlier than the general public. Our survey findings also signal a market gap in innovation in online gifting and consumers’ perceptions. No more than 21% of respondents said that they had tried selected innovative services when gifting digitally, but around 60%–70% of respondents believe that each service has the potential to improve the overall online gifting experience. We summarize these key insights in Figure 1 and explore our findings in detail in the following sections of this report.Figure 1. Holiday Gifting in 2021 and Beyond: Summing Up the Opportunity [caption id="attachment_136137" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Shopper Sentiment for Buying Gifts Is Positive

Shoppers have high expectations for shopping and spending on gifts this holiday season, according to our survey findings, which we believe stems from desires to shop and return to social behaviors following the pandemic-impacted holiday season last year. In addition, US consumers have accumulated $2.5 trillion in excess savings due to an improved savings rate, according to the Bureau of Economic Analysis, and their spending power has been boosted by continued government support—$1.66 trillion in total direct payments to consumers in 2020 and 2021, we calculate. The strong wealth effect is supported by healthy returns on assets; the S&P 500 index is up by around 25% since January, and housing prices have also increased at almost the same rate, according to Case-Shiller US National Home Price Index.

Reflecting this, our survey findings reveal the following:

Source: Coresight Research[/caption]

Shopper Sentiment for Buying Gifts Is Positive

Shoppers have high expectations for shopping and spending on gifts this holiday season, according to our survey findings, which we believe stems from desires to shop and return to social behaviors following the pandemic-impacted holiday season last year. In addition, US consumers have accumulated $2.5 trillion in excess savings due to an improved savings rate, according to the Bureau of Economic Analysis, and their spending power has been boosted by continued government support—$1.66 trillion in total direct payments to consumers in 2020 and 2021, we calculate. The strong wealth effect is supported by healthy returns on assets; the S&P 500 index is up by around 25% since January, and housing prices have also increased at almost the same rate, according to Case-Shiller US National Home Price Index.

Reflecting this, our survey findings reveal the following:

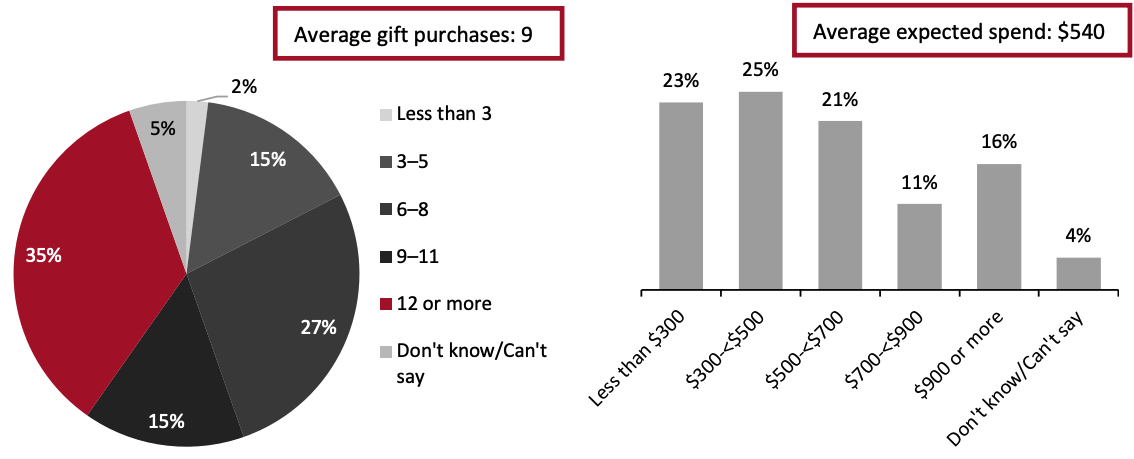

- Half of all respondents expect to purchase at least nine gifts this holiday season, with 35% expecting to purchase 12 gifts or more—a very high proportion for a very large number of gifts.

- More than 70% of respondents expect to spend at least $300 on gifts in total.

Figure 2. Number of Gifts That Shoppers Expect To Purchase (Left) and Total Amount They Expect To Spend on Gifts (Right) During Holiday 2021 (% of Respondents) [caption id="attachment_136138" align="aligncenter" width="700"]

Base: 298 US holiday shoppers aged 18+, who expect to shop gifts online and in-store for holiday 2021, surveyed in October 2021

Base: 298 US holiday shoppers aged 18+, who expect to shop gifts online and in-store for holiday 2021, surveyed in October 2021Source: Coresight Research[/caption] Online Will Be a Major Destination for Gift Buying This Holiday Although we have seen avoidance trends improve in recent weeks, around six in 10 US consumers continue to avoid any public place, according to our weekly US Consumer Tracker survey, and the number of people visiting stores remains substantially lower than pre-pandemic levels. Furthermore, the duration of the pandemic has changed online shopping from an option to the preferred choice for many shoppers. Reflecting this, the gift shoppers we surveyed—who expect to shop both online and in-store this holiday season—reported that they expect to use the online channel for purchasing and searching for gifts:

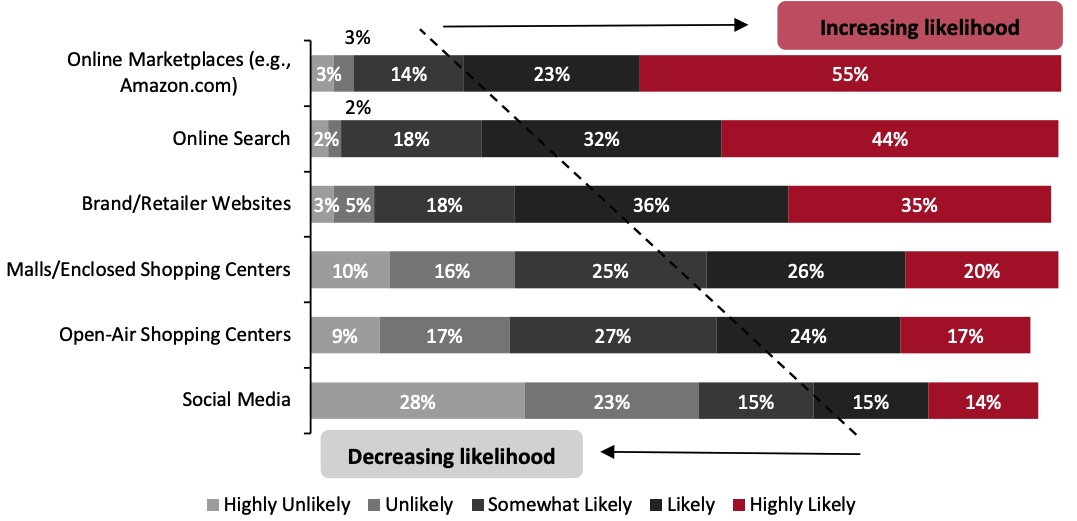

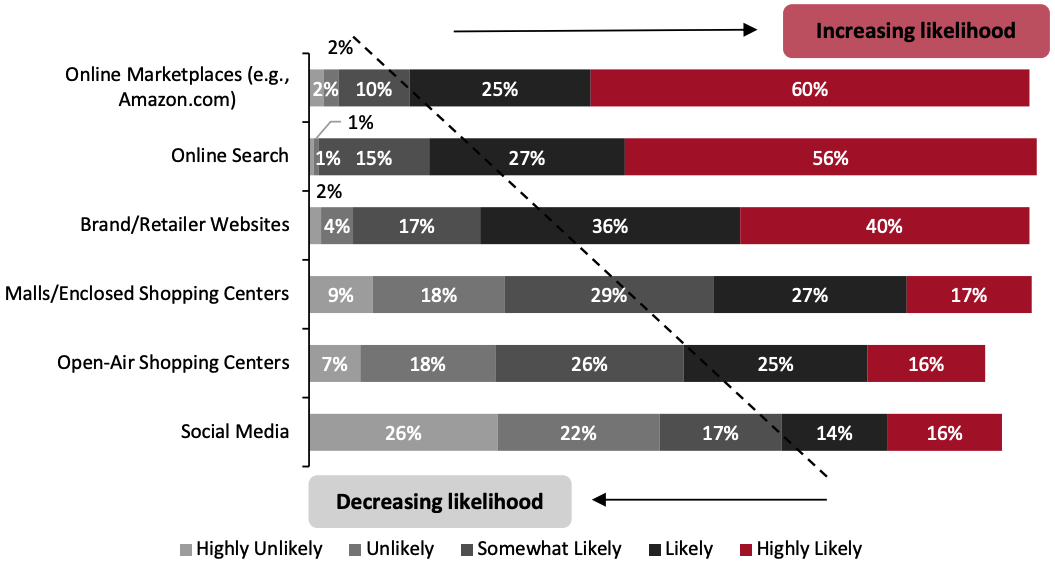

- Almost eight in 10 respondents reported that they are “likely” or “highly likely” to use online marketplaces such as Amazon to make holiday purchases, and 85% will use this channel to search for gifts—making it the most popular choice among all channels for gift searching and purchasing.

- Online search is the second-most popular channel among holiday shoppers for making gift purchases and seeking inspiration (searching for gifts), with 76% and 83% of respondents, respectively, reporting that they are at least “likely” to use this channel.

Figure 3. Holiday Shoppers’ Likelihood To Use Selected Channels To Purchase Gifts (% of Respondents) [caption id="attachment_136139" align="aligncenter" width="700"]

Note: The totals do not sum to 100% as we have not included respondents citing “don’t know.”

Note: The totals do not sum to 100% as we have not included respondents citing “don’t know.” Base: 298 US holiday shoppers aged 18+, who expect to shop gifts online and in-store for holiday 2021, surveyed in October 2021

Source: Coresight Research[/caption]

Figure 4. Holiday Shoppers’ Likelihood To Use Selected Channels To Seek Inspiration and Search for Gifts (% of Respondents) [caption id="attachment_136140" align="aligncenter" width="700"]

Note: The totals do not sum to 100% as we have not included respondents citing “don’t know.”

Note: The totals do not sum to 100% as we have not included respondents citing “don’t know.” Base: 298 US holiday shoppers aged 18+, who expect to shop gifts online and in-store for holiday 2021, surveyed in October 2021

Source: Coresight Research[/caption] We also asked respondents about their gift purchasing and spending plans online relative to overall purchasing and spending expectations. We found that:

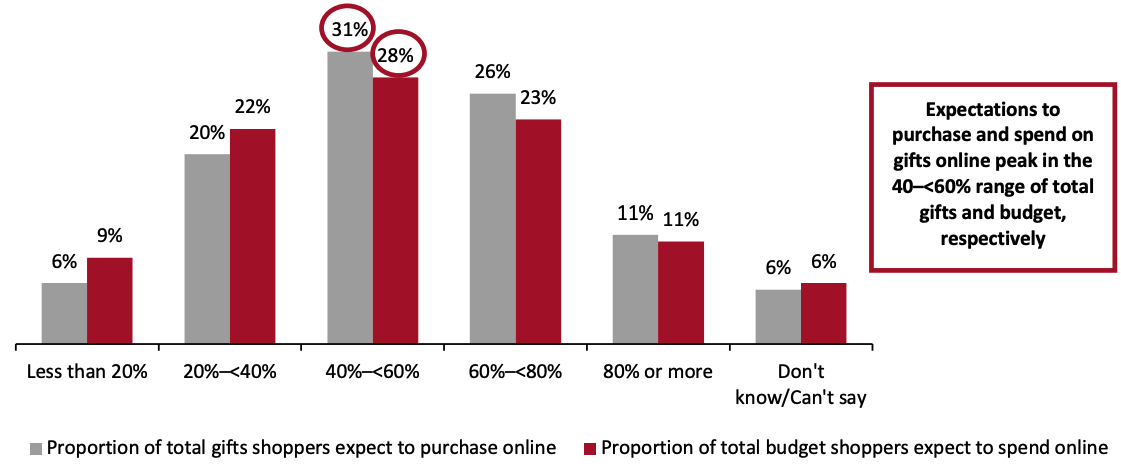

- Seven in 10 respondents expect to purchase at least 40% of holiday gifts online. On average, holiday shoppers expect to purchase four gifts online.

- More than six in 10 respondents expect to spend at least 40% of their overall holiday gifting budget online. On average, holiday shoppers expect to spend $215 online on average.

Figure 5. Proportions of Total Holiday Gifts and Total Budget Shoppers Expect To Purchase/Spend Online (% of Respondents) [caption id="attachment_136141" align="aligncenter" width="700"]

Base: 298 US holiday shoppers aged 18+, who expect to shop gifts online and in-store for holiday 2021, surveyed in October 2021

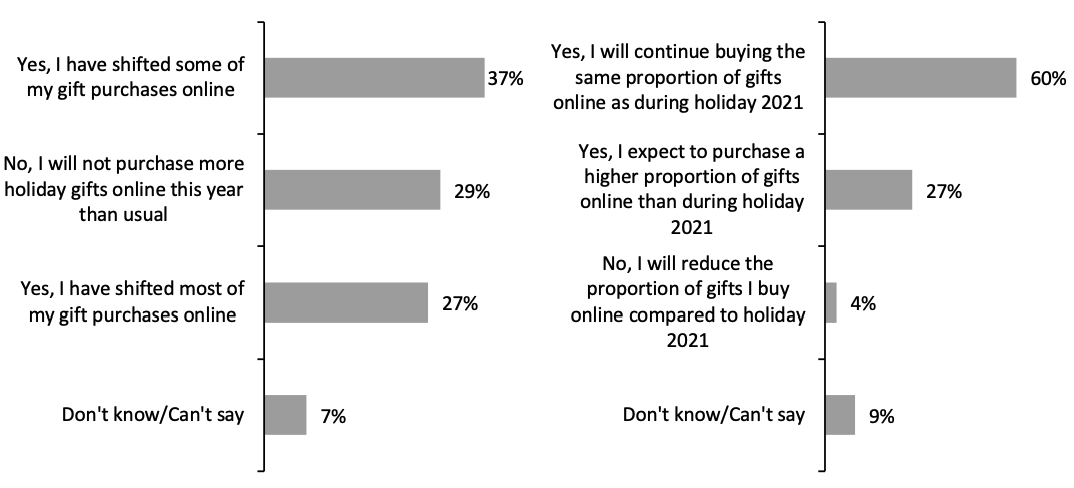

Base: 298 US holiday shoppers aged 18+, who expect to shop gifts online and in-store for holiday 2021, surveyed in October 2021Source: Coresight Research[/caption] The Shift to Online Gift Purchasing Will Be More Than Just a Temporary Trend Reinforcing the popularity of e-commerce, our survey data reveal that Covid-19 has led most gift shoppers to purchase more of their overall holiday gifts online: 64% of respondents reported that they shifted some or most of their holiday gift shopping online this year owing to the pandemic. The newly developed habit of shopping more online has turned into a prominent behavior across all retail categories, and gifting is no exception. Only three in 10 respondents cited not purchasing more gifts online this holiday season than usual (meaning in 2019 and previous holiday seasons). We also asked respondents whether they expect to continue buying gifts online in the 2022 holiday season:

- Almost 90% of shoppers expect to purchase the same or a higher proportion of gifts online for holiday 2022 compared to this year’s holiday season.

- A marginal 4% of shoppers expect to reduce the proportion of gifts they purchase online heading into the holiday season next year versus this year.

Figure 6. Impact of Covid-19 on Shifting Holiday Spending Online (Left) and Shopper Expectations To Continue Shopping Online in 2022 (Right) (% of Respondents) [caption id="attachment_136142" align="aligncenter" width="700"]

Base: 298 US holiday shoppers aged 18+, who expect to shop gifts online and in-store for holiday 2021, surveyed in October 2021

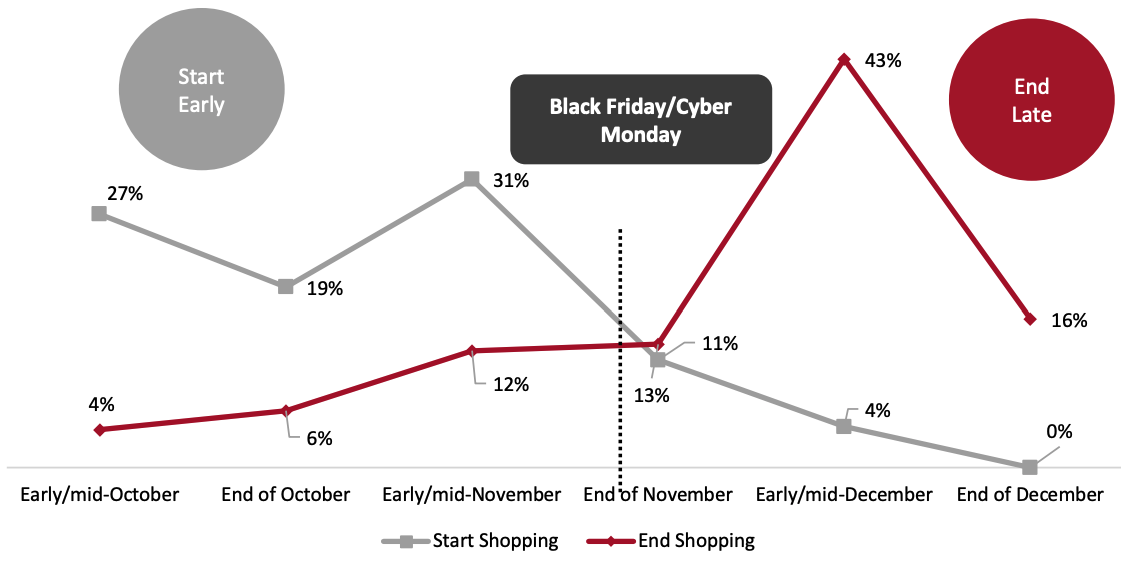

Base: 298 US holiday shoppers aged 18+, who expect to shop gifts online and in-store for holiday 2021, surveyed in October 2021Source: Coresight Research[/caption] The Shopping Window Is Long This Holiday Season—First-Mover Advantage Is Up for Grabs Consumers are beginning shopping for gifts early this holiday season compared to previous years—and plan to finish shopping later too. Our survey data reveal that almost half of all respondents planned to start their holiday shopping in October, and almost six in 10 respondents expect to continue shopping in December. The longer shopper window partly signals shopper understanding of supply chain bottlenecks causing shipping delays and stock availability issues; they would rather purchase at a smaller or no discount while products are still in stock, rather than wait for steeper discounts due to the added risk of out-of-stocks. However, we think that appetite for discounts is still strong, which is why consumers expect to be shopping until later in the season. A longer and more spread-out holiday shopping window offers a huge opportunity to retailers for three reasons:

- More shopping days imply that online orders are more spread out, which translates to improved order management and a better footing to forecast product demand.

- The longer window allows retailers to be more responsive to market trends and ensure an improved customer experience.

- Retailers can benefit from early shoppers continuing to make impulse purchases or be attracted by deals through the holiday season even after they have bought their planned gifts.

Figure 7. When Shoppers Expect To Start and Finish Holiday Shopping (% of Respondents) [caption id="attachment_136143" align="aligncenter" width="700"]

Base: 298 US holiday shoppers aged 18+, who expect to shop gifts online and in-store for holiday 2021, surveyed in October 2021

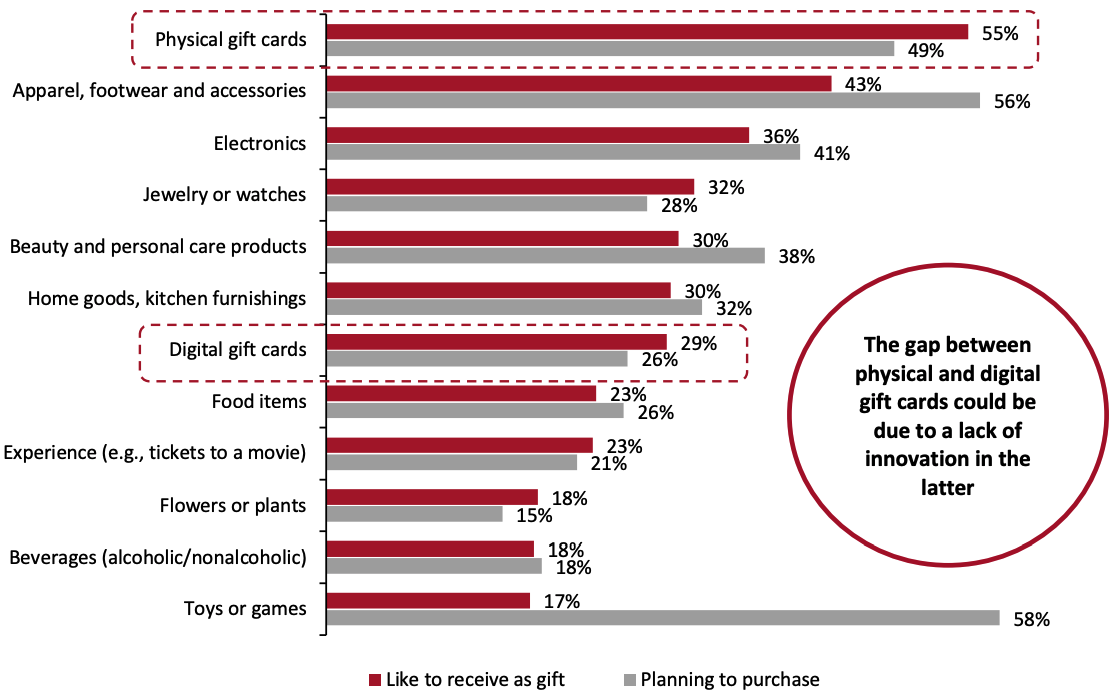

Base: 298 US holiday shoppers aged 18+, who expect to shop gifts online and in-store for holiday 2021, surveyed in October 2021Source: Coresight Research[/caption] Physical Gift Cards To Dominate This Holiday Season Gift cards are one of the easiest picks for gift-givers, as shopping for gift cards takes away the hassle of selecting the right gift. However, gift cards can appear less appealing when picking a gift to make someone feel special or in providing the recipient with a personalized experience. Based on our survey findings, physical gift cards top the list of preferred gifts that shoppers would like to receive this holiday season, cited by 55% of respondents. Physical gift cards also took third place in the list of gifts that shoppers expect to purchase this holiday season, cited by 49% of respondents—behind only toys or games, and apparel, footwear and accessories (see Figure 8). There is a gap between physical and digital gift cards, which we believe represents an opportunity for retailers. Digital gift cards are a much less popular pick among holiday shoppers, with 29% of our survey respondents reporting that they would like to receive them as a gift. This may be due to the lack of innovation in digital gift cards, which offer limited personalization options and are very similar to a monetary transaction.

Figure 8. Gifts Shoppers Would Like To Receive and Gifts They Expect To Purchase This Holiday Season (% of Respondents) [caption id="attachment_136144" align="aligncenter" width="700"]

Base: 298 US holiday shoppers aged 18+, who expect to shop gifts online and in-store for holiday 2021, surveyed in October 2021

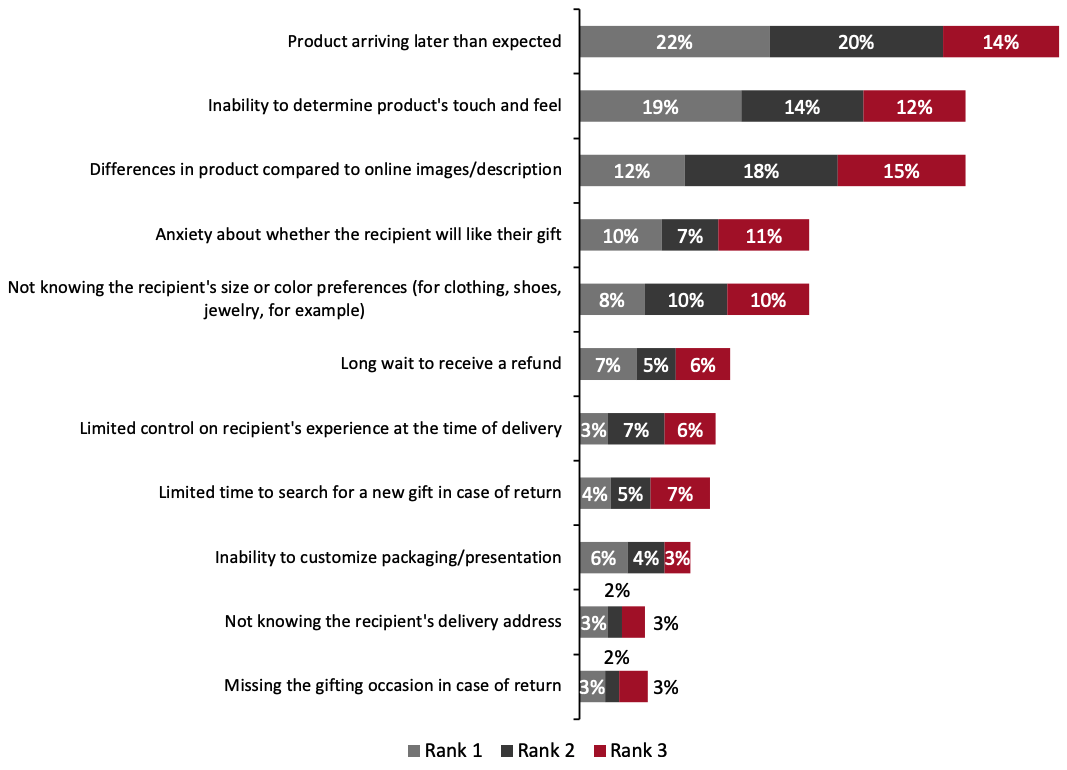

Base: 298 US holiday shoppers aged 18+, who expect to shop gifts online and in-store for holiday 2021, surveyed in October 2021Source: Coresight Research[/caption] Challenges Remain in Gift Shopping Online Our survey findings have so far favored online gifting—understandably so, given the convenience of shopping from the comfort of home and endless digital aisles, topped with lucrative deals and discounts. However, online gift giving is not as simple as it may seem, as shopping for others involves thinking about a recipient’s preferences, and it does not necessarily end at checkout. Shoppers expect a seamless experience even after placing the order, such as readily available and updated delivery-tracking details. We asked our survey respondents about the top three challenges they face when shopping for gifts online.

- Product arriving later than expected emerged as the topmost challenge. Some 56% of respondents cited it among the top three challenges.

- The inability to determine a product’s touch and feel ranked second, with 45% of respondents citing it among the top three challenges.

- Differences in product compared to online images/description was third, with 46% of respondents citing it among the top three challenges.

Figure 9. Key Challenges in Shopping for Holiday Gifts Online (% of Respondents) [caption id="attachment_136145" align="aligncenter" width="700"]

Respondents were asked to select and rank their top three challenges (with “Rank 1” being the most challenging)

Respondents were asked to select and rank their top three challenges (with “Rank 1” being the most challenging)Base: 298 US holiday shoppers aged 18+, who expect to shop gifts online and in-store for holiday 2021, surveyed in October 2021

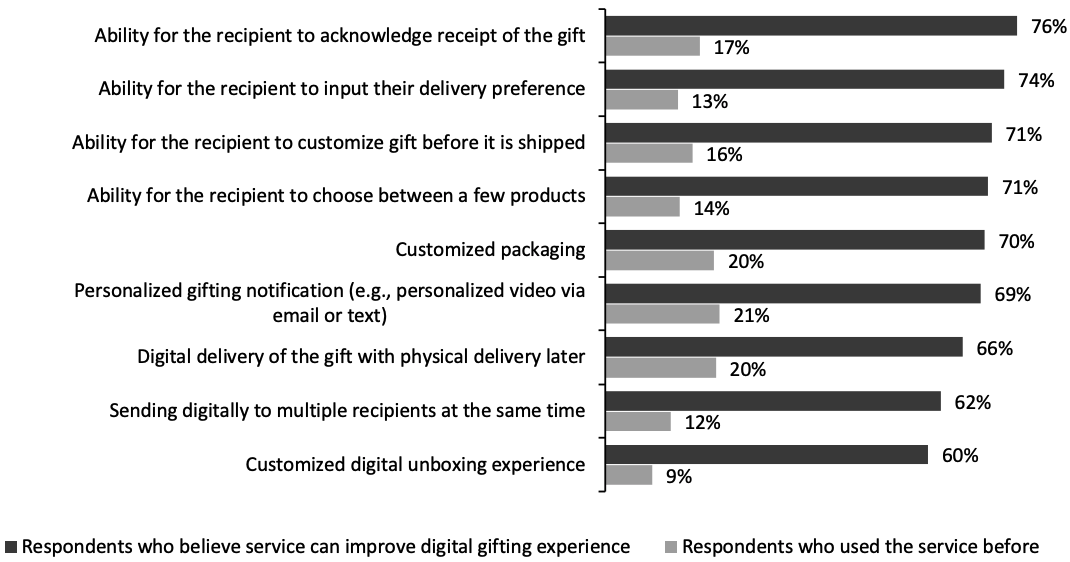

Source: Coresight Research[/caption] Shoppers Are Receptive to Innovative Digital Gift-Giving Services Despite Low Penetration The challenges associated with online gifting (as highlighted above) are not very different from traditional e-commerce challenges. However, this does not necessarily imply that similar solutions can simplify online gift giving. For example, a shopper may have anxiety when shipping directly to the recipient, but not when shipping the same product for themselves. Our survey data reveal that a very small proportion of respondents have tried innovative services when shopping for gifts online. Only 9% of respondents reported that they have used a customized digital unboxing experience—an innovative service that allows step-by-step unboxing through a video and experiential aspects such as confetti and a personalized video greeting for the recipient. The trend is somewhat similar across all innovative digital gift-giving services, with no more than 21% of respondents reporting that they have tried any (see Figure 10). Although penetration is low, holiday shoppers recognize the benefits that innovation could bring to gift giving. Around three-quarters of respondents believe that the overall gifting experience can be improved by having the ability for the recipient to acknowledge the gift or input their delivery preferences—making these the topmost services that can drive improvement. Also, just over seven in 10 respondents believe that the overall gifting experience would be improved if recipients can customize their gifts, such as adjusting the size and color of an apparel item, before it is shipped. Based on our findings, we believe that the gifting market does not support innovative services as much as consumers would prefer, representing an opportunity for retailers: Digital gift giving holds huge upward potential given technology-enabled transformation.

Figure 10. Innovative Digital Gifting Services That Holiday Shoppers Believe Can Improve the Overall Experience; and Services They Have Tried Before When Gifting Online (% of Respondents) [caption id="attachment_136146" align="aligncenter" width="700"]

Base: 298 US holiday shoppers aged 18+, who expect to shop gifts online and in-store for holiday 2021, surveyed in October 2021

Base: 298 US holiday shoppers aged 18+, who expect to shop gifts online and in-store for holiday 2021, surveyed in October 2021Source: Coresight Research[/caption]

Holiday Gifting in 2021 and Beyond: Key Recommendations

GiftNow, an integrated digital gifting solution, is well positioned to help retailers capitalize on opportunities in the gifting market. GiftNow’s Gift Experience Management (GXM) platform offers visual greeting capabilities and easy exchange and modification of gifts before they are shipped, as well as providing gift givers end-to-end visibility of the overall gifting process. GiftNow can solve challenges that are not only limited to the gift giver but also encompass the recipient. For example, empowering the recipient to decide the color, size and variant of the product takes away from the online shopping challenge when shopping for others. GiftNow says that it turns gift shopping into a seamless experience and improves the overall gifting experience. Based on our analysis of survey findings, we underline four key recommendations for retailers.- Early discounts and promotions can help retailers capitalize on the trend of shopping early; providing older inventory at a markdown before others can help retailers increase their share of the overall gifting market. In fact, we are observing this trend in the US retail sector—Amazon’s first holiday sales event, Holiday Beauty Haul, and Target’s Deals Days both took place in October.

- Improving the online experience can help retailers bridge the gap to much-needed innovation in the gifting market. A holistic gift-giving experience for both shoppers and recipients can go a long way in building loyalty. Additionally, this can ensure not only attracting but also retaining first-time online gift shoppers.

- Demand-directed innovations for gifting in 2022 can prepare retailers to better capture the growing market of gifting—especially online. Our survey data reveal a large proportion of shoppers agreeing that innovation is the answer to the experiential gap in gifting. In doing so, retailers must take gift shoppers’ and recipients’ interests into consideration. Retailers that succeed in elevating the overall experience for all stakeholders will be better positioned than others to grab a larger share of the gifting market in coming years.

- A seamless omnichannel experience will be the key to success this holiday season. Holiday shoppers are planning to shop more online more often than in previous years, but no retailer can undermine the importance of their physical storefronts, where a lot of shoppers will be searching for and buying holiday gifts. Ensuring consistency in the online and in-store shopping experiences will be the key to succeeding during this holiday season and beyond.

Methodology

This study is based on the analysis of data from an online survey of 298 US consumers (aged 18+) who typically purchase gifts for the holiday season and who plan to do so this year. We surveyed only omnichannel shoppers—respondents who plan to purchase holiday gifts both in-store and online.GiftNow shares this information solely for your convenience. All statements are the sole opinions of Coresight Research. Synchrony and its affiliates, including GiftNow, makes no representations or warranties regarding the content.