Nitheesh NH

Unilever PLC

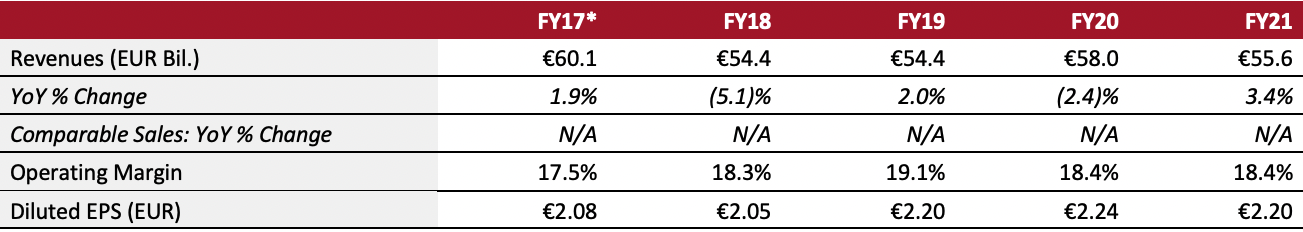

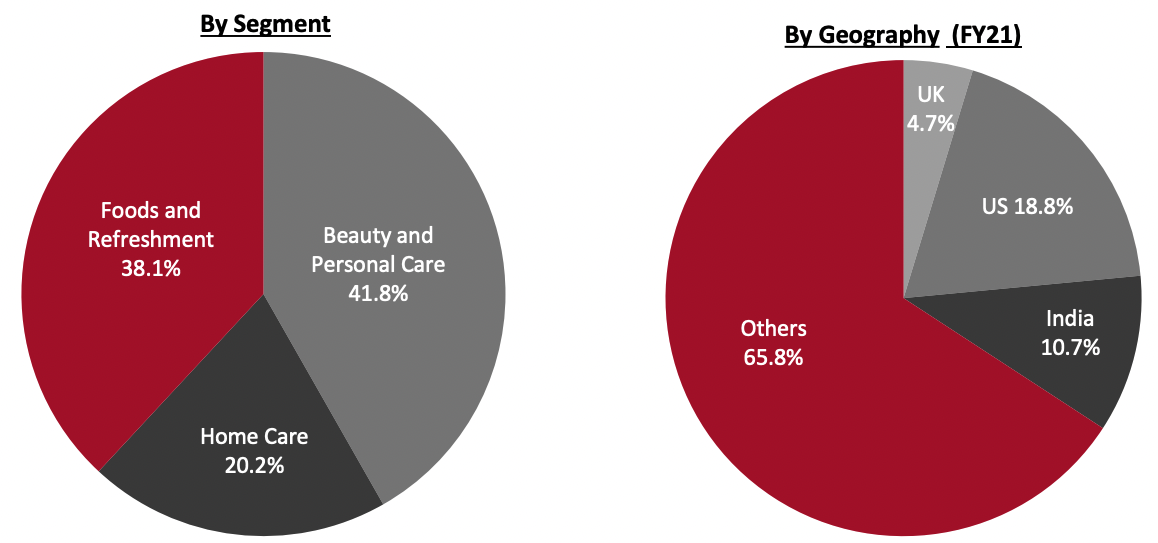

Sector: CPG Countries of operation: Unilever operates in over 190 countries across Africa, the Americas, Asia, Europe and The Middle East Key product categories: Beauty and personal care, foods and refreshment, and home care Annual Metrics [caption id="attachment_151349" align="aligncenter" width="700"] Fiscal year ends on December 31

Fiscal year ends on December 31*For FY17 alone, the year ended on Jan 1, 2018[/caption] Summary Headquartered in London, the UK, Unilever is a CPG company that operates in three segments: beauty and personal care, foods and refreshment, and home care. The company was formed in 1929 after a merger between the Lever Brothers and Margarine Unie. Now, it owns and operates an extensive portfolio of brands, including Axe, Ben and Jerry's, Bryers, Dove, Lifebuoy, Lipton, Lux, Seventh Generation, Sunlight, TRESemmé and Vaseline, among many others. Company Analysis Coresight Research insight: Unilever’s goal for 2022 is to increase the company’s competitiveness according to its 2021 annual report. It will continue to invest in its high-growth categories—particularly beauty and wellbeing—as well as focus on premium product innovation and expanding its markets in China and the US. Additionally, it aims to make the business more agile, efficient and accountable by restructuring its portfolio and reducing costs. Despite the company’s solid performance in 2021 and its market strategy in 2022, the company believes that cost inflation will cause margins to shrink this year.

| Tailwinds | Headwinds |

|

|

- Unilever plans to continue to drive science-based innovation in its hygiene and skincare businesses–such as upgrading its skin brightening, therapeutics and hydration products.

- The company will also evolve its functional nutrition and prestige beauty portfolio to enable high growth and a sizeable business in the segment.

- Unilever will expand its plant-based portfolio in 2022 to meet rising consumer demand.

- Unilever plans to invest in new technologies and leverage insights from testing to improve product performance and innovation.

- Unilever stated it plans to focus its R&D team on fewer projects to bring innovations to the market faster.

- The company will out “Clean Future” technologies across its home care products, making them more sustainable and environmentally friendly.

- Unilever claims that about 36% of its business comes from China, India, and the US. It will focus on building a strong brand and category presence in these markets by transforming its portfolio and improving its digital and e-commerce channel presence.

- Per its 2021 annual report, Unilever’s e-commerce sales in India and China witnessed double-digit growth in the year. As such, it also plans to leverage digital channels to expand its presence to small retail stores in India and expand prestige beauty and VMS offerings in China.

- Unilever hopes to partner with e-commerce giants such as Amazon and Alibaba to expand its footprint across digital channels and better organize its e-commerce business.

- The company will leverage shopper insights and merchandising strategies to adapt to trends faster, meeting consumer needs.

- Unilever plans to increase cost savings by reducing senior management by 15%, junior management by 5% and additional non-people cost savings, which the company estimates will lead to €600 million ($645 million) of savings across 2022 and 2023.

- The company aims to build new, fast-growing businesses in the prestige beauty and functional nutrition categories, while disposing of slower-growth food products such as spreads and tea.

Source: Company annual report[/caption]

Company Developments

Source: Company annual report[/caption]

Company Developments

| Date | Development |

| May 31, 2022 | Unilever announces the appointment of Nelson Peltz as one of its non-executive directors and a member of its compensation committee, effective July 20, 2022. |

| May 30, 2022 | Unilever signs an agreement to acquire a majority stake in Nutrafol, a leading hair wellness products brand. It currently holds a 13.2% stake in Nutrafol through Unilever Ventures. |

| May 5, 2022 | Unilever announced plans to launch two pilot ice cream freezer cabinets for retail sales in Germany. The freezer cabinets will have warmer temperatures around –12 degrees Celsius (compared to the industry standard of –18 degrees Celsius) to improve energy efficiency and lower greenhouse gas emissions. |

| Apr 28, 2022 | Unilever raises its input cost inflation forecast for 2022 from the estimated €3.6 billion ($4.0 billion) in February 2022 to €4.8 billion ($5.1 billion). To offset this, the company plans to drive its savings program and raise prices judiciously. |

| Mar 7, 2022 | Unilever announces it will publicly disclose the performance of its product portfolio against six different government-mandated Nutrient Profile Models (NPM) and its own Highest Nutritional Standards (HNS). Unilever claims it will be the first global food company to report these metrics and will publish its first report in October 2022. |

| Feb 10, 2022 | Unilever accelerates the shift of its portfolio into consumer health and well-being to drive growth. |

| Oct 21, 2021 | Unilever enters into over 500 IP-generating partnerships ranging from plant-based proteins to biotechnology. |

| Sept 15, 2021 | The U.S. Environmental Protection Agency (EPA) collaborates with Unilever to evaluate new methodologies for assessing chemical safety without animal testing. |

| Jun 23, 2021 | Unilever announces it hopes to grow its Prestige Beauty category to at least $3.34 billion (€3 billion) over time through a combination of organic growth and value-creating mergers and acquisitions. |

| Jun 7, 2021 | Unilever generates over $55.56 billion (€50 billion) turnover a year, 60% of which is generated from emerging markets in Brazil, China, India, and Indonesia. |

- Nils Smedegaard Andersen—Chairman of the Board

- Alan W. Jope—CEO and Executive Director

- Graeme David Pitkethly—CFO and Executive Director

- Nitin Paranjpe—Chief People and Transformation Officer and Chief Operating Officer

- Richard Williams—Head of Investor Relations

Source: Company reports/S&P Capital IQ