Nitheesh NH

[caption id="attachment_70083" align="aligncenter" width="620"] Source: Company reports/Coresight Research[/caption]

FY18 Results

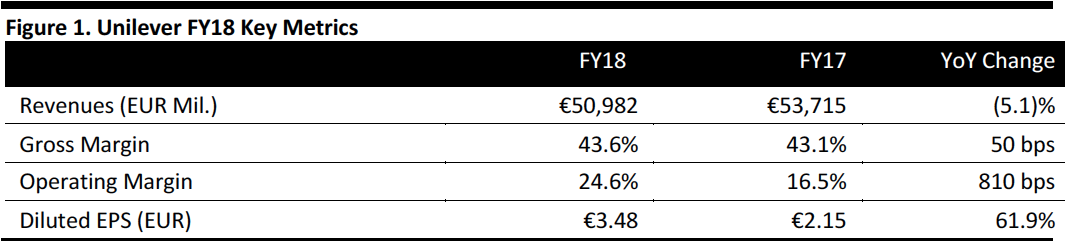

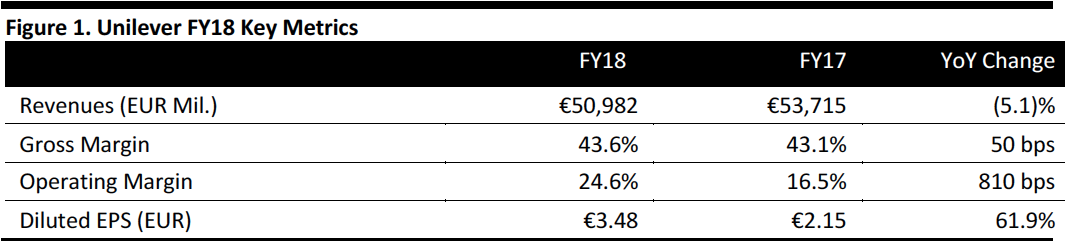

Unilever reported revenue of €50.98 billion, slightly behind consensus of €51.06 billion and down 5.1% from FY17 due to adverse currency impacts. Organic sales were up 2.9% year over year, driven by strong growth in Asia/AMET (Africa, Middle East, Turkey)/RUB (Russia, Ukraine and Belarus) region, yet slightly below consensus of 3.0%. Unilever noted that gross margin improved 50 bps to 43.6%, but did not disclose gross profit numbers.

Operating margin rose to 24.6%, 810 bps above previous year. Unilever grew its underlying operating margin from 17.5% in FY17 to 18.4% in FY18. Diluted EPS increased 61.9% to €3.48.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

FY18 Results

Unilever reported revenue of €50.98 billion, slightly behind consensus of €51.06 billion and down 5.1% from FY17 due to adverse currency impacts. Organic sales were up 2.9% year over year, driven by strong growth in Asia/AMET (Africa, Middle East, Turkey)/RUB (Russia, Ukraine and Belarus) region, yet slightly below consensus of 3.0%. Unilever noted that gross margin improved 50 bps to 43.6%, but did not disclose gross profit numbers.

Operating margin rose to 24.6%, 810 bps above previous year. Unilever grew its underlying operating margin from 17.5% in FY17 to 18.4% in FY18. Diluted EPS increased 61.9% to €3.48.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

FY18 Results

Unilever reported revenue of €50.98 billion, slightly behind consensus of €51.06 billion and down 5.1% from FY17 due to adverse currency impacts. Organic sales were up 2.9% year over year, driven by strong growth in Asia/AMET (Africa, Middle East, Turkey)/RUB (Russia, Ukraine and Belarus) region, yet slightly below consensus of 3.0%. Unilever noted that gross margin improved 50 bps to 43.6%, but did not disclose gross profit numbers.

Operating margin rose to 24.6%, 810 bps above previous year. Unilever grew its underlying operating margin from 17.5% in FY17 to 18.4% in FY18. Diluted EPS increased 61.9% to €3.48.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

FY18 Results

Unilever reported revenue of €50.98 billion, slightly behind consensus of €51.06 billion and down 5.1% from FY17 due to adverse currency impacts. Organic sales were up 2.9% year over year, driven by strong growth in Asia/AMET (Africa, Middle East, Turkey)/RUB (Russia, Ukraine and Belarus) region, yet slightly below consensus of 3.0%. Unilever noted that gross margin improved 50 bps to 43.6%, but did not disclose gross profit numbers.

Operating margin rose to 24.6%, 810 bps above previous year. Unilever grew its underlying operating margin from 17.5% in FY17 to 18.4% in FY18. Diluted EPS increased 61.9% to €3.48.

Performance by Segment

- Beauty and Personal Care: FY18 revenue in the beauty and personal care segment was down 0.4% to €20.62 billion. FY18 organic sales rose 3.1% year over year due to the acquisition of Schmidt’s and growth in skincare brands such as Dove, innovations in the Vaseline range and also launch of new skincare brands that address the fast-growing naturals trend. FY18 adjusted operating margin increased 80 bps to 21.9%, driven by efficiencies in brand and marketing. In 4Q18, revenue increased 2.6% year over year to €5.33 billion.

- Foods and Refreshment: FY18 revenue in the foods and refreshment segment was down 9.9% to €22 billion. FY18 organic sales rose 2.0% year over year due to innovations in ice cream brands such as Magnum and a non-dairy range of Ben & Jerrys. In beverages, Pukka and Unilever’s new organic Lipton range also helped drive growth. In savory, Knorr had good performance with cooking products in emerging markets. Adjusted operating margin increased 80 bps to 17.5% as a result of improvements in gross margin and lower overhead costs. In 4Q18, revenue decreased 16.8% year over year to €4.19 billion.

- Home Care: FY18 revenue in the home care segment was down 4.2% to €13 billion. Organic sales rose 4.2% year over year due to growth in home and hygiene and fabric sensations products. In home and hygiene ranges, re-launch of Sunlight across Southeast Asia and the success of Domestos toilet blocks helped drive growth. In fabrics, market development in India, China and Germany helped drive growth for the Comfort brand. The introduction of premium formulations such as Surf Excel Matics also helped drive growth. Adjusted operating margin increased 80 bps to 13.0% as a result of lower overhead costs and marketing efficiencies. In 4Q18, revenue decreased 0.6% year over to €2.57 billion.

- Asia/AMET/RUB: FY18 revenue in the Asia/AMET/RUB segment was down 1.7% to €22.86 billion. FY18 organic sales rose 6.2% year over year, driven by growth momentum in India, Pakistan and Bangladesh. Premium innovations and strong e-commerce growth in China also helped to drive growth. FY18 adjusted operating margin increased 130 bps to 19.0%, driven by improvement in gross margin and lower investment in brand and marketing. In 4Q18, revenue decreased 0.3% year over year to €54 billion.

- The Americas: FY18 revenue in the Americas was down 8.6% to €16.02 billion. FY18 organic sales remained unchanged year over year, with volume declines in Argentina offset by strong growth in Mexico across categories. FY18 adjusted operating margin decreased 70 bps to 16.8%, driven by currency driven commodity inflation and hyperinflationary accounting in Latin America. In 4Q18, revenue decreased 6.3% year over year to €97 billion.

- Europe: FY18 revenue in the Europe segment was down 6.4% to €12.09 billion. FY18 organic sales increased 0.7% year over year, mainly due to innovation and good weather benefiting the growth of ice cream brands. FY18 adjusted operating margin increased 200 bps to 19.2%, driven by improvements in gross margin and lower overhead costs. In 4Q18, revenue decreased 14.5% year over year to €59 billion.

- CEO Alan Jope commented that accelerating growth will be Unilever’s number one priority, and the company will continue to expand in markets through global reach and purpose-led brands.

- Unilever will be more agile through a strengthened organization and portfolio, its own digital transformation and savings programs.

- Market conditions are expected to remain challenging in 2019, with commodity costs remaining high and consumers purchasing power remaining low in high-inflation countries such as Argentina and Turkey.