Source: Company reports/Fung Global Retail & Technology

FY16 Results

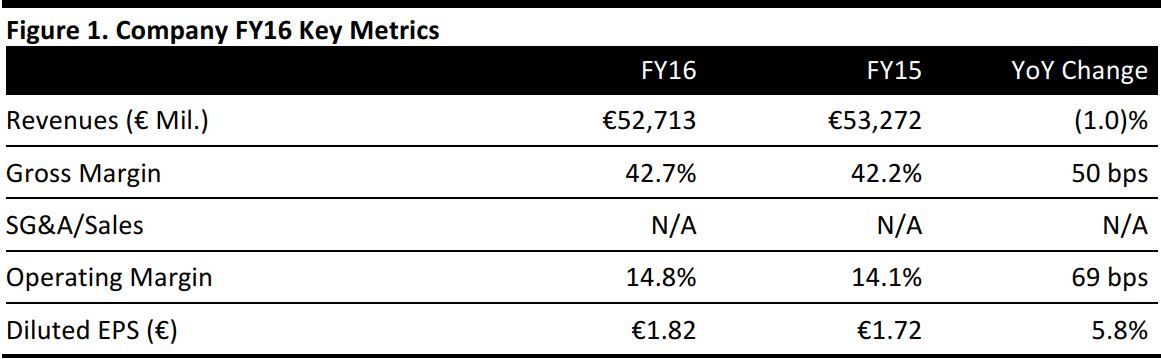

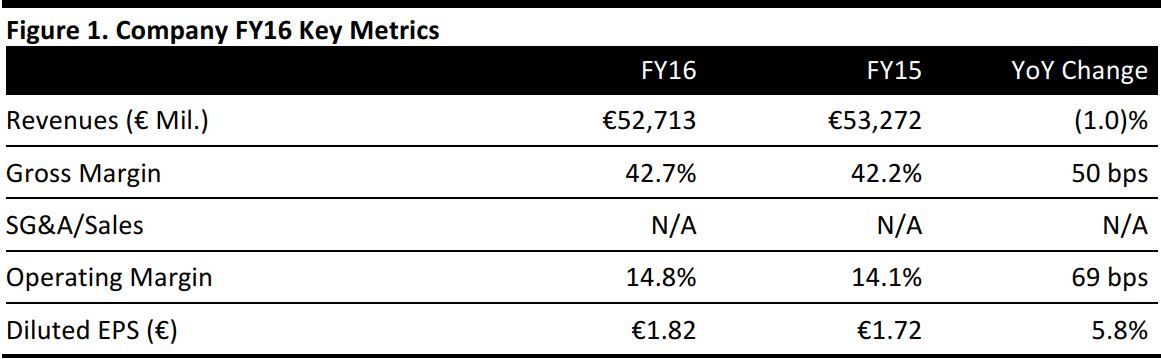

Global FMCG leader Unilever beat estimates on the top and bottom lines in FY16, but sales, hurt by the weakened pound, declined by 1.0%; sales were up 4.3% at constant rates.

Country-specific volatility and downgraded GDP growth, particularly in the last quarter, weighed heavily on the firm’s performance, as noted by CEO Paul Polman. He flagged the economic crisis in Brazil and the removal of Rs500 and Rs1,000 (the largest denominations) notes from circulation in India as the two main country-specific volatilities that caused substantial disruption.

Unilever noted that gross margin improved by 50 bps to 42.7%, without revealing gross profit numbers. It attributed the growth to savings programs and acquisitions. Polman stated that a major contributor to gross margin improvement were margin-accretive innovations undertaken by Unilever across the core ranges of the four product segments. He added that Unilever’s ability to develop innovations that can scale faster, such as the Trésseme Reverse Conditioning products, Magnum Double and Surf

Sensations, have helped it to outperform the market.

The operating profit grew by 3.8% (+5.8% at constant rates) to €7,801 million, and the operating margin improved by 69 bps to 14.8%. Diluted EPS increased by 5.8% to €1.82, which was slightly ahead of the consensus estimate of €1.81.

Performance by Segment

- Personal Care: Unilever’s largest segment contributed nearly 38% of FY16 sales at €20,172 million, up 0.5%. Polman mentioned that Unilever delivered on its goal to grow the core ranges through innovation and build the premium range. Deodorants, mainly the successful dry range in North America, and Rexona Antibacterial product in over 50 countries, drove growth in this segment. In 4Q16, sales grew by 2.3% to €5,240 million.

- Food: The food segment saw sales decline by 3.1% to €12,524 million. Dressings and savory performed well in this segment, but sales in spreads decreased. Sales declined by 1.1% to €3,376 million in 4Q16.

- Home Care: Sales in the home care segment fell by 1.5% to €10,009 million. Unilever highlighted the double-digit growth of Surf, helped the success of the new variant Surf Sensations and its rollout into Central and Eastern Europe. It also drew attention to its value brand Brilhante in Latin America, fabric conditioners, Cif sprays and Domestos toilet blocks, as key performers this year. Sales increased by 3.4% to €2,573 million in 4Q16.

- Refreshments: Sales in this segment fell by 1.1% to €10,008 million. Unilever pointed out that innovations in premium brands such as its Magnum Double, Ben & Jerry’s and Talenti contributed to margin improvements. Growth in leaf tea sales improved in emerging markets, but was arrested by the black tea business in developed markets. Unilever will continue to build its presence in it premium segments by developing T2 and specialty teas further, it said. Sales slid by 0.1% to €1,861 million in 4Q16.

Performance by Geography

- Asia/AMET/RUB (Asia, Africa, Middle East, Turkey, Russia, Ukraine and Belarus): Sales increased by 0.1% to €22,445 million in these countries, which account for the majority of Unilever’s sales. Volume gains in Asia, price-led growth in Turkey, Russia and Africa and double-digit growth in the Philippines drove performance higher in this segment. However, this was offset by disappointing growth in India, especially in the last quarter, due to the removal of high-denomination banknotes, and slowing growth in China, due to price competition from local laundry product brands and an increased shift to e-commerce. In 4Q16, sales grew by 2.4% to €5,547 million.

- The Americas: This region saw sales decline by 1.1% to €17,105 million. While growth improved in North America, due to innovations in deodorants, dressings and premium ice cream, sales declines in hair products and spreads weighed on the overall performance. Latin America was affected by currency devaluation, high inflation and low consumer confidence, but volumes managed to hold up, Unilever said. Sales increased by 5.2% to €4,481 million in 4Q16.

- Europe: Sales slowed by 2.9% to €13,163 million in Europe, due to slow volume growth and continued price deflation across several countries in the region. Ice cream performed well against an already strong season in the previous year. Personal care grew marginally, but home care was affected by intense competition, particularly in 4Q16 in the UK and France. Unilever highlighted that Central and Easter Europe, Spain and the Netherlands delivered another year of growth. Sales dropped by 5.9% to €3,022 million in 4Q16.

4Q16 Results

Unilever’s sales increased by 1.3% in 4Q17 to €13,050 million, marginally below the consensus estimate of €13,131.50 million. The company stated that particularly challenging economic conditions and disruptions specific to countries where it has a large market share affected performance significantly during the quarter.

Outlook

Polman stated that Unilever’s priorities for 2017 continue to be volume growth, increasing the core operating margin and generating strong cash flow. He warned of a difficult start to 2017, and said that the tough market conditions that made the last quarter of FY16 challenging will continue through to 1H17.

As of January 26, 2017, analysts expect the following for FY17:

- Revenue to increase by 5.7% to €55,710.28 million.

- Diluted EPS to increase by 6.6% to €1.94.