DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

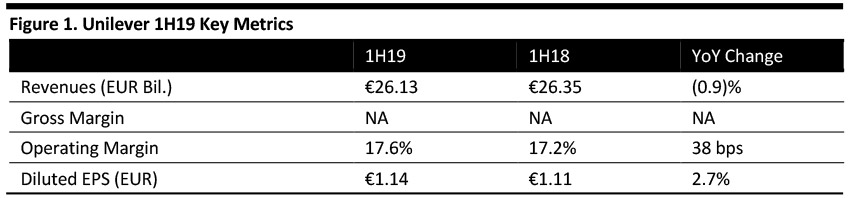

1H19 Results

Unilever reported revenue of €26.13 billion, slightly above the consensus of €26.06 billion and down 0.9% year over year as reported. Organic sales (excluding any change in turnover resulting from acquisitions, disposals and changes in currency) were up 3.3% year over year, with 1.2% growth coming from volume and 2.1% from price. Gross margin expanded 30 basis points (bps) while operating margin improved 38 bps year over year to 17.6%, led by efficiencies from the company’s 5-S program. The company’s 5-S program focuses on cost cutting and enhancing the pricing and product mix; Unilever looks to achieve cost cutting through smart product platform, smart sourcing, smart buying and partnerships.

Unilever grew diluted EPS 2.7% year over year to €1.14. Underlying EPS grew 5% year over year to €1.27, missing the consensus estimate of €1.29.

Performance by Segment

- Beauty and personal care: 1H19 revenue in the beauty and personal care segment was up 6.3% to €10.72 billion as reported. Organic sales rose 3.3% year over with 1.7% from volume and 1.6% from price. Deodorants performed well, led by the Rexona Clinical and Dove Zero Aluminum ranges. New formats continued to drive sales in skin cleansing. Good performance in skin care was driven by innovations including Pond’s Instabright glow cream. Hair care saw only modest growth for the first half, with a challenging second quarter particularly in the US. Oral care returned to growth in the second quarter, helped by innovations such as Closeup natural whitening toothpaste and Signal White Now. The underlying operating margin in the beauty & personal care segment increased 100 bps, driven by efficiency programs in brand and marketing investment.

- Foods and refreshment: 1H19 revenue in the foods and refreshment segment was down 10.9% to €10.0 billion as reported. Organic sales rose 1.3% year over year. In tea, sales declined as volumes were impacted by weak consumer demand in developed markets, partially offset by black tea in emerging markets and fruit, herbal and green tea ranges, including Pukka’s premium herbal offering. Sales in dressings were flat with volumes slightly down. Savory performance was helped by the launch of new snack pot variants. Underlying operating margin in foods & refreshment decreased 40 bps, due to adverse impact on overheads related to the disposal of the company’s spreads business, which it sold to KKR in late 2017.

- Home Care: 1H19 revenue in the home care segment was up 7.2% to €5.41 billion as reported. Organic sales rose 7.4% year over year. Fabric solutions performed strongly, led by premiumization and the execution of the strategy of promoting consumer benefits. China saw good performance from the relaunch of Omo Perfect Wash while in India sales of Surf Excel continued to grow double digits. Home and hygiene grew well, driven by double digit growth from Sunlight. Good growth in fabric sensations was aided by the launch of a redesigned Comfort core range, focusing on clothing care, as well as a natural variants range. Underlying operating margin in home care expanded 120 bps, led by improvements in gross margin and efficiencies in brand, marketing investment and overhead.

Performance by Geography

- Asia/AMET/RUB: 1H19 revenue in the Asia/Africa, Middle East, Turkey (AMET)/ Russia, Ukraine, Belarus (RUB) segment grew 3.9% to €12.2 billion. Organic sales rose 6.2% year over year with 2.9% coming from volume and 3.2% from price. Southeast Asia grew well, with accelerating growth in Indonesia, the Philippines and Vietnam. Turkey continued to see good volume growth despite double digit price growth in response to the devaluation of the lira. Sales in China were up high-single digits led by premium innovation and strong growth in e-commerce. Underlying operating margin expanded 70 bps driven by brand and marketing investment efficiencies and improvements in gross margin.

- The Americas: 1H19 revenue in the Americas was up 0.7% to €8.14 billion. Organic sales grew 2.1% year over year. Latin America sales grew 4.9% year over year while in Argentina, which continues to be a hyperinflationary market, volumes declined 9.1%. Underlying sales growth in North America was flat with price growth of 0.7% but volume declined 0.5%.

- Europe: 1H19 revenue in the Europe segment was down 11.4% to €5.8 billion. Organic sales declined 0.6% year over year, with volumes down 0.2% and price down 0.4%. European business faced challenges due to price deflation and adverse weather in the second quarter. The company said the broader retail environment remains difficult, particularly in Germany, which witnessed a significant decline. Underlying operating margin was down 40 bps, impacted by the sale of the company’s spreads business and a decline in gross margin due to negative pricing.

2Q19

Unilever’s 2Q19 sales were €13.7 billion, down 0.1% compared to last year. Organic sales grew 3.5% year over year, below the consensus estimate of 3.7%

Alan Jope, Chief Executive Officer, said:

We have delivered consistent growth within our guided range for 2019, led by our emerging markets. Accelerating growth remains our top priority and we continue to evolve our portfolio and seek out fast growth channel and geographical opportunities, as well as address those performance hotspots where growth is falling short of our aspirations. For the full year, we continue to expect underlying sales growth to be in the lower half of our multi-year 3-5% range, an improvement in underlying operating margin that keeps us on track for the 2020 target and another year of strong free cash flow. Our sustainable business model and portfolio of purpose-led brands are key to delivering superior long-term financial performance.

Outlook

The company expects FY19 organic sales to be in the lower half of the 3-5% growth range.

In FY19, consensus estimates recorded by StreetAccount predict Unilever will report revenues of €51.95 billion and EPS of €2.54.