Source: Company reports/Fung Global Retail & Technology

1H17 Results

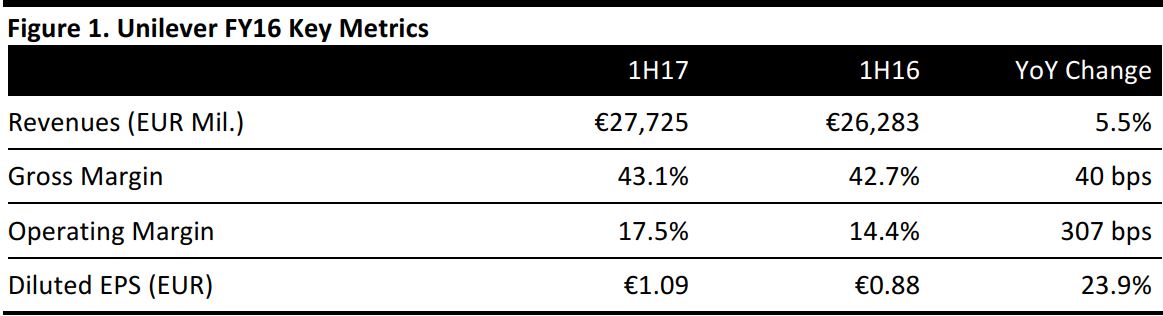

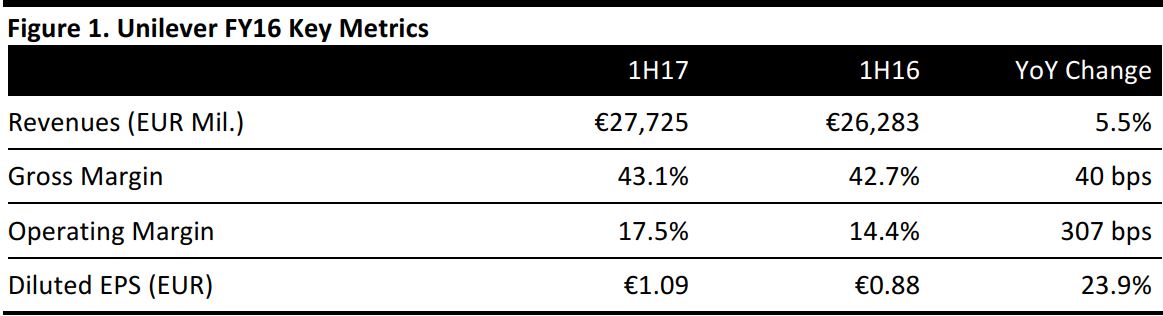

Anglo-Dutch FMCG firm Unilever posted 1H17 sales of €27,725 million, close to the consensus of €27,724 million and up by 5.5% from 1H16. At constant exchange rates, sales grew by 3.8%. Underlying sales growth (which strips out the impact of acquisitions, disposals and currency rate fluctuations) was 3.0% during the half.

Gross margin expanded by 40 basis points and the operating margin jumped by 307 basis points, helped by investments in brand and marketing, and an acceleration in cost savings.

EPS leapt by 23.9% to €1.09, owing to a gain on the disposal of Unilever’s soy beverage business in Latin America.

Performance by Geography

Asia: Sales in Asia strengthened by 7.1% as reported and 5.5% on an underlying basis, helped by price increases prompted by rising commodity costs.

Americas: In the Americas, reported sales bounced by 9.7%, while underlying growth was more subdued at 2.5%. In North America, soft market conditions were offset by strong sales in deodorants, hair care and skin-cleansing products.

Europe: Performance in Europe was weak, as sales dropped by 2.4% and by 0.8% in underlying terms, due to challenging conditions, particularly in home care and the margarine market.

Performance by Segment

Among Unilever’s product segments, home care and personal care performed the strongest, with sales growing by 7.5% (2.8% on an underlying basis).

Foods and refreshment sales increased by 2.9% (3.1% on an underlying basis). Unilever expects to divest its spreads business and said that “preparations for the exit…via a sale or demerger is well under way.”

Outlook

Unilever estimates full-year underlying sales growth to be in the range of 3%–5% and expects the underlying operating margin to grow by at least 100 basis points—up from the 80 basis-points rise that it previously guided for.

For FY17, analysts expect the following:

- Revenue to increase by 4.9% to €55.3 billion.

- EBIT to grow by 12.4% to €9,041 billion.

- Diluted EPS to rise by 16.5% to €2.12.

These estimates were collated before the announcement of the results.