Source: Company reports

1H16 RESULTS

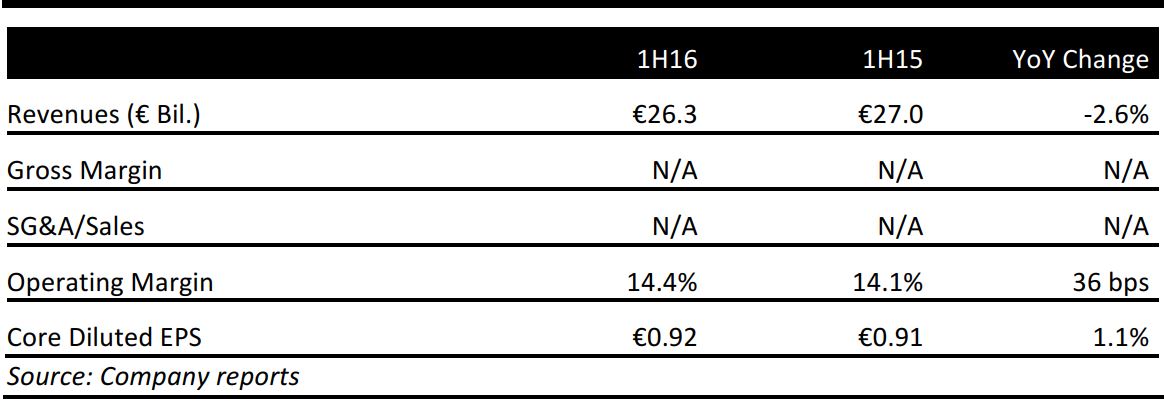

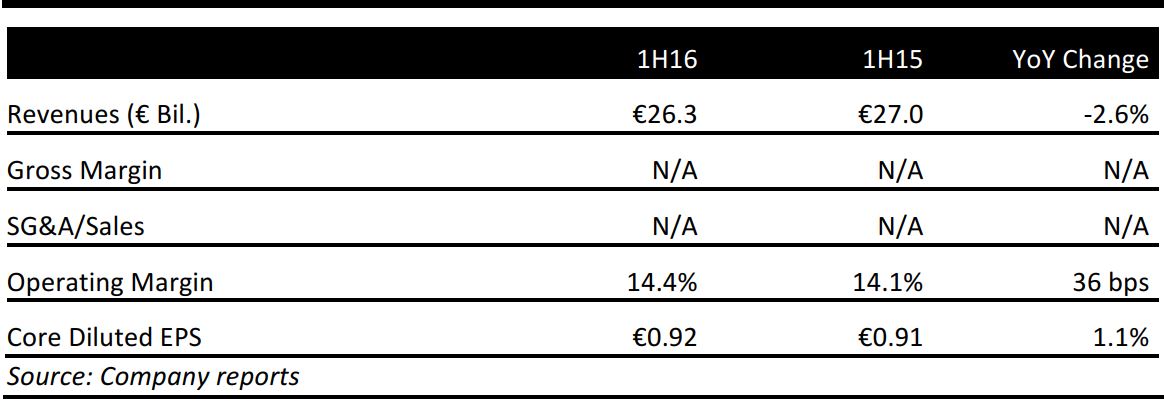

Unilever reported 1H16 revenues of €26.3 billion, down 2.6% year over year and slightly above the consensus estimate of €25.9 billion. The decline was primarily driven by a negative currency impact of 7.6%, which offset sales growth of 4.7% in the first half of the year. In 2Q16, revenues declined by 3.2% to €13.7 billion, year over year. The decline was driven by a negative currency impact of 8.1%, which offset 4.7% sales growth during the period.

“Despite a challenging environment with slower global economic growth and intensifying geopolitical instability, we have again grown profitably in our markets, competitively and driven by strong innovations,” Chief Executive Officer Paul Polman said.

PERFORMANCE BY SEGMENT

- Growth in the Personal Care segment improved and the category maintained strong profitability. Volumes improved across all sub-categories. Deodorants continued to perform strongly, and the new Axe Rise range is targeted at the higher-growth male grooming segment.

- The Food segment also continued to grow and accelerated with a good performance in savory and dressings products. Sales in spreads continued to decline due to market contraction in developed countries.

- The Home Care segment delivered strong broad-based growth and grew faster than its markets. Fabric conditioner products grew at double-digit rates, driven by new product launches for its existing Comfort brand fabric softener.

- Ice cream delivered good growth in the Refreshment segment driven by innovations in premium brands Magnum and Ben & Jerry’s. The company continued to extend its Lipton and PG tips green and specialty teas.

PERFORMANCE BY GEOGRAPHY

- Solid volume gains in Asia and price-led growth elsewhere drove strong performances for Refreshments and Foods. Double-digit growth continued in the Philippines, and Russia and Australia returned to positive volume growth. Despite rapid e-commerce growth in China, declines in other channels offset the growth in the country.

- In the Americas, Latin America delivered double-digit growth, underpinned by pricing to recover higher input costs. Improved growth in North America was driven by innovations in deodorants, dressings and ice cream.

- In Europe, volume growth was offset by price deflation. Personal Care, Home Care and ice cream experienced good volume growth, but the contraction of the margarine market hurt Food segment performance in the UK and France. Strong momentum continued in Central and Eastern Europe, and growth was restored in the Nordic countries.

On July 20, Unilever announced it had signed an agreement to acquire men’s grooming startup Dollar Shave Club in a $1 billion, all-cash transaction. For more information, please take a look at our report

Unilever to Acquire Dollar Shave Club.

OUTLOOK

Chief Executive Officer Polman said, with no signs of improvements in the global economy, Unilever has been preparing for tougher market conditions in 2016. Despite the volatile markets, Unilever remains focused on net revenue management, zero-based budgeting and continued organizational transformation. These key initiatives are expected to drive volume growth, improvements in core operating margins and cash flow.

For FY16, the consensus estimate is for normalized EPS to increase to €1.84. Analysts expect revenues for the current year to decline by 2.2% to €52.1 billion.