albert Chan

[caption id="attachment_76567" align="aligncenter" width="674"] Source: Company reports/Coresight Research[/caption]

FY18 Results

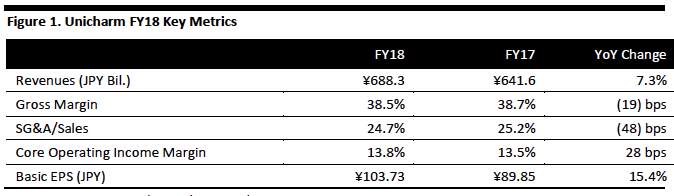

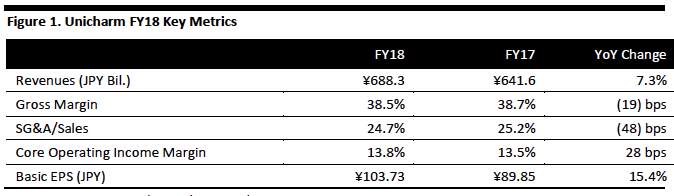

Unicharm reported FY18 revenue of ¥688.3 billion, up 7.3% year over year but slightly below the consensus estimate of ¥689.2 billion. The company commented that growth was driven by economic recovery and rising personal consumption in Japan, increasing demand for high value-added personal care products and company efforts to develop products to better match consumer demand. The company reported basic EPS of ¥103.73, up 15.4% year over year but slightly below the consensus estimate of ¥104.49. Unicharm also noted the gross margin declined 19 bps to 38.5%, and core operating income margin increased 28 bps to 13.8%.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

FY18 Results

Unicharm reported FY18 revenue of ¥688.3 billion, up 7.3% year over year but slightly below the consensus estimate of ¥689.2 billion. The company commented that growth was driven by economic recovery and rising personal consumption in Japan, increasing demand for high value-added personal care products and company efforts to develop products to better match consumer demand. The company reported basic EPS of ¥103.73, up 15.4% year over year but slightly below the consensus estimate of ¥104.49. Unicharm also noted the gross margin declined 19 bps to 38.5%, and core operating income margin increased 28 bps to 13.8%.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

FY18 Results

Unicharm reported FY18 revenue of ¥688.3 billion, up 7.3% year over year but slightly below the consensus estimate of ¥689.2 billion. The company commented that growth was driven by economic recovery and rising personal consumption in Japan, increasing demand for high value-added personal care products and company efforts to develop products to better match consumer demand. The company reported basic EPS of ¥103.73, up 15.4% year over year but slightly below the consensus estimate of ¥104.49. Unicharm also noted the gross margin declined 19 bps to 38.5%, and core operating income margin increased 28 bps to 13.8%.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

FY18 Results

Unicharm reported FY18 revenue of ¥688.3 billion, up 7.3% year over year but slightly below the consensus estimate of ¥689.2 billion. The company commented that growth was driven by economic recovery and rising personal consumption in Japan, increasing demand for high value-added personal care products and company efforts to develop products to better match consumer demand. The company reported basic EPS of ¥103.73, up 15.4% year over year but slightly below the consensus estimate of ¥104.49. Unicharm also noted the gross margin declined 19 bps to 38.5%, and core operating income margin increased 28 bps to 13.8%.

Performance by Segment

- Personal Care: FY18 revenue was up 7.9% year over year to ¥599.3 billion, and core operating income was up 9.9% year over year to ¥84.8 billion. Growth was supported by high demand from China and Southeast Asia for imported baby care products, family care products of high quality and with cute designs, for adult health care products such as adult diapers, and for household products that can help customers clean quickly and easily. In 4Q18, revenue increased 8.6% year over year to ¥164.5 billion.

- Pet Care: FY18 revenue was up 2.8% year over year to ¥82.1 billion, and core operating income was up 4.5 year over year to ¥10.1 billion. Growth can be attributed to Japanese customers owning more cats than previously, customers demanding pet foods that are colourful with good nutritional balance and texture, and steady sales of cleanup sheets for dogs in North America. In 4Q18, revenue increased 4.5% year over year to ¥23.8 billion.

- Others: FY18 revenue was up 8.0% year over year to ¥6.9 billion, and core operating income was up ¥174 million to ¥151 million from a loss of ¥23 million in the previous year. Growth was helped by demand for industrial products for commercial use. In 4Q18, revenue increased 4.5% year over year to ¥1.8 billion.

- Japan: FY18 revenue was ¥279.6 billion, up 5.1% year over year. Core operating income was down 2.4% year over year to ¥56.3 billion. Growth in revenue was helped by consumers’ demand for low- to moderate-value products in Japan, and to a good consumer response to innovative baby care products.

- Asia (Except Japan): FY18 revenue was ¥302.9 billion, up 10.0% year over year. Core operating income was up 37.4% year over year to ¥32.8 billion. Growth can be attributed to demand in China for value-added family care products and baby care products imported from Japan, plus high sales growth of baby care and family care products in India.

- Others: FY18 revenue was ¥105.8 billion, up 5.5% year over year. Core operating income was up 18.6% year over year to ¥5.8 billion. Growth can be attributed to pet care product success in North America.

- There will be global uncertainty due to rising prices of raw materials, friction due to the Sino-U.S. trade war and the impact of disasters in Japan.

- Takahisa Takahara, Unicharm CEO, commented that China will remain a promising market for the diaper business as it has about 15 times more babies than Japan.

- Unicharm will spend ¥4 billion in the current fiscal year to set up a digital innovation centre in China.

- The company will open a smart factory in Japan in spring of 2019 to make products for export to China.