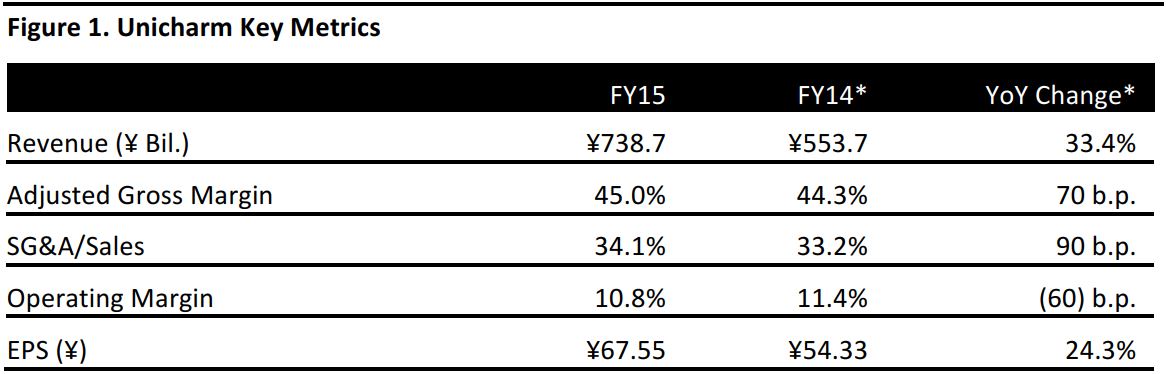

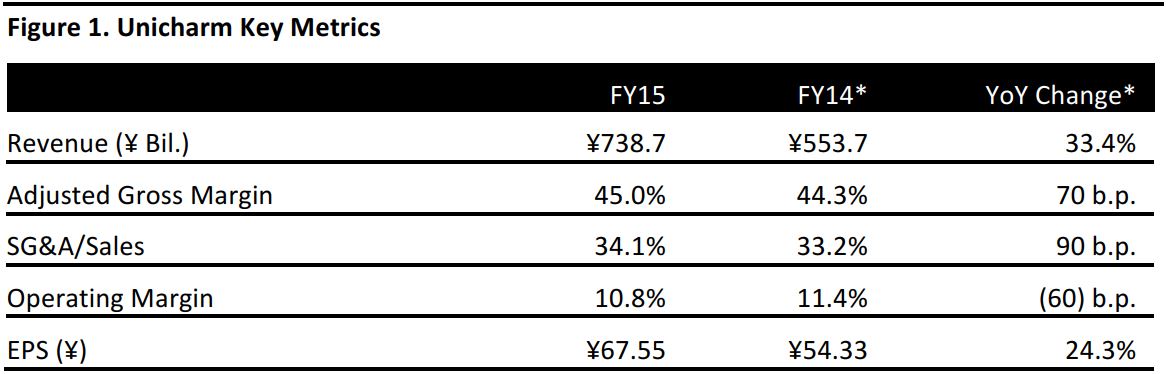

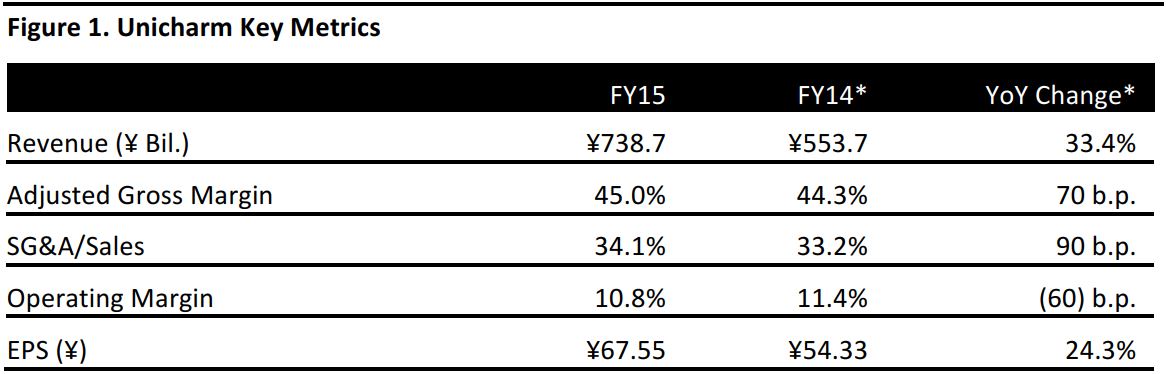

*In 2014, the company changed the end of its fiscal year from March 31 to December 31. FY14 covers only nine months, from April 1 through December 31.

Source: Company reports

Unicharm changed the end of its fiscal year from March 31 to December 31 in 2014; we obtained 12-month metrics for comparison purposes.

As emerging markets faced a deteriorating economic environment, Unicharm’s sales revenue, operating income and net profit all fell behind beginning-of-the-year projections. Revenues in Asia (excluding Japan) increased by 11.7%, reaching ¥341.2 billion, with operating income decreased by ¥7 billion, or 17.8% year over year.

Total sales increased by 10.9% year over year on an adjusted basis, to a record ¥738.7 billion, making 2015 the fourteenth consecutive year that Unicharm has reported a sales increase. Operating income increased by 4.9% year over year on an adjusted basis, to a record ¥79.9 billion, marking the ninth consecutive year it has increased. EPS was ¥67.55, 7.8% lower than the ¥73.24 that was projected at the beginning of the year.

By September 2015, Unicharm reached a 10.2% market share of the global personal care sector, and a 24.8% market share in Asia, ranking it number three in the world and number one in Asia.

Guidance

Unicharm will continue to emphasize its core business, personal care, in Japan. It sees the demand from inbound tourists staying flat.

In emerging markets, the company expects to see an increase in sales in India, and to further expand online and increase its market share in China. The company expects stable growth in the Middle East and North Africa segments.

Unicharm expects to increase dividends further, from ¥14.80 to ¥16.00 in FY16, and it expects total sales to increase to ¥777 billion, which would mark the company’s fifteenth consecutive year of sales growth. The company also projects EPS of ¥78.90, a 16.8% increase over the ¥67.55 reported for FY15.