DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

2Q19 Results

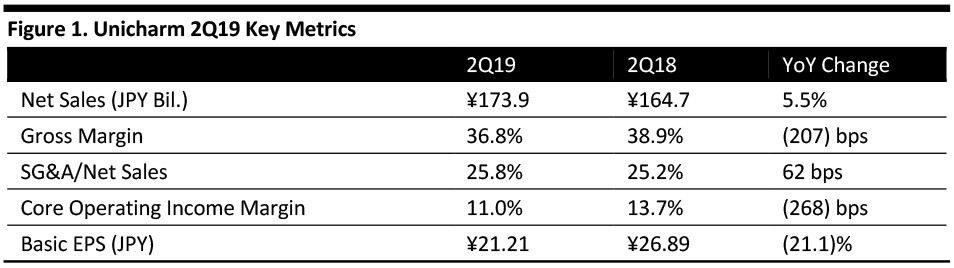

Unicharm reported 2Q19 net sales of ¥173.9 billion, up 5.5% year over year and broadly in line with the consensus estimate of ¥173.5 billion. The company commented that there is growing uncertainty about the future of the Chinese economy amid a slowdown of the global economy due to the trade dispute, and that the company actively promoted personal care-related products to meet consumption needs and achieve growth. Unicharm also noted gross margin declined 207 basis points (bps) to 36.8%, and core operating income margin decreased 268 bps to 11.0%.

Performance by Business Segment

- Personal care: 2Q19 net sales were up 5.3% year over year to ¥150.5 billion, and core operating income was down 17.0% year over year to ¥16.5 billion. Growth was supported by continued demand for family care products of high quality and with cute designs, and growth of adult health care products such as adult diapers.

- Pet care: 2Q19 net sales were up 8.0% year over year to ¥21.7 billion, and core operating income was down 1.4% year over year to ¥2.56 billion. Net sales grew due to the company’s active promotions in its Silver Spoon Premium Three Star Gourmet cat food range, steady sales of dog cleanup sheets and wet-type snacks for cats in North America.

- Others: 2Q19 net sales were down 4.9% year over year to ¥1.76 billion, and core operating income remained unchanged at ¥61 million compared to the same quarter last year.

Performance by Geography

- Japan: 2Q19 net sales were ¥67.7 billion, down 1.4% year over year. Core operating income was down 28.7% year over year to ¥10.1 billion. The decline in net sales was due to a slowdown in cross-border e-commerce and rising material and logistics costs of its manufacturing factory in Kyushu (in far southern Japan).

- Asia (ex Japan): 2Q19 net sales were ¥79.3 billion, up 13.2% year over year. Core operating income was up 9.3% year over year to ¥7.4 billion. Net sales grew due to good sales performance in the family care segment in China and proactive marketing investment in baby care and family care in India.

- Others: 2Q19 revenue was ¥26.9 billion, up 3.4% year over year. Core operating income was up 0.1% year over year to ¥1.56 billion. Growth can be attributed to good sales performance in the Middle East.

Outlook

The company maintained its forecast for FY19 revenue of ¥730 billion, up 6.1% compared to FY18, and core operating income of ¥100 billion, up 5.1% compared to FY18. The company, however, increased its forecast for FY19 basic EPS from ¥106.70 to ¥106.92.

- The company will continue to seek to increase product sales and market share in emerging countries including Indonesia, Thailand and Vietnam.

- The company will continue to extend its adult excrement care model from Japan to other Asian regions.

The company expects net sales will further improve upon introduction of new products and inventory adjustment of cross-border e-commerce.