DIpil Das

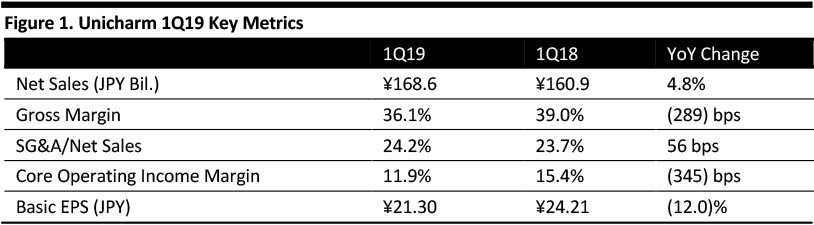

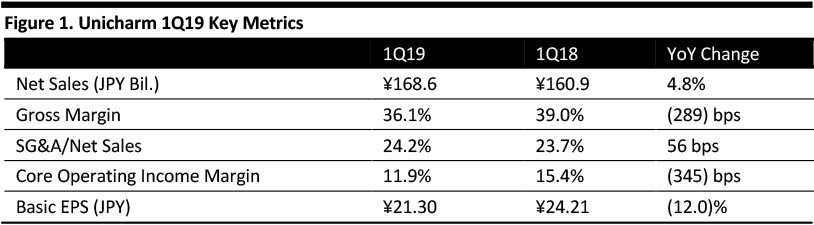

[caption id="attachment_87754" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Unicharm reported 1Q19 revenue of ¥168.6 billion, up 4.8% year over year and broadly in line with the consensus estimate estimate of ¥168.5 billion. The company commented that it achieved sustainable growth in the first quarter of 2019 driven by demand for high value-added personal care products, economic recovery in Japan, and company efforts to develop products that match consumer demand. Unicharm also noted that gross margin declined 289 bps to 36.1%, and core operating income margin decreased 345 bps to 11.9%.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Unicharm reported 1Q19 revenue of ¥168.6 billion, up 4.8% year over year and broadly in line with the consensus estimate estimate of ¥168.5 billion. The company commented that it achieved sustainable growth in the first quarter of 2019 driven by demand for high value-added personal care products, economic recovery in Japan, and company efforts to develop products that match consumer demand. Unicharm also noted that gross margin declined 289 bps to 36.1%, and core operating income margin decreased 345 bps to 11.9%.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Unicharm reported 1Q19 revenue of ¥168.6 billion, up 4.8% year over year and broadly in line with the consensus estimate estimate of ¥168.5 billion. The company commented that it achieved sustainable growth in the first quarter of 2019 driven by demand for high value-added personal care products, economic recovery in Japan, and company efforts to develop products that match consumer demand. Unicharm also noted that gross margin declined 289 bps to 36.1%, and core operating income margin decreased 345 bps to 11.9%.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Unicharm reported 1Q19 revenue of ¥168.6 billion, up 4.8% year over year and broadly in line with the consensus estimate estimate of ¥168.5 billion. The company commented that it achieved sustainable growth in the first quarter of 2019 driven by demand for high value-added personal care products, economic recovery in Japan, and company efforts to develop products that match consumer demand. Unicharm also noted that gross margin declined 289 bps to 36.1%, and core operating income margin decreased 345 bps to 11.9%.

Performance by Segment

- Personal Care: 1Q19 net sales were up 5.1% year over year to ¥148.5 billion, and core operating income was down 20.7% year over year to ¥18.1 billion. Growth was supported by sales of family care products in India and Vietnam, demand for family care products of high quality and with cute designs, and growth of adult health care products such as adult diapers.

- Pet Care: 1Q19 net sales were up 3.5% year over year to ¥18.7 billion, and core operating income was up 4.0% year over year to ¥2.0 billion. The company attributed growth to demand in Japan for pet foods that are colorful with good nutritional balance, and steady sales of dog cleanup sheets and wet-type snacks for cats in North America.

- Others: 1Q19 net sales was down 12.3% year over year to ¥1.5 billion, and core operating income loss decreased to ¥9 million from a loss of ¥32 million in the same quarter last year.

- Japan: 1Q19 net sales were ¥56.4 billion, down 10.3% year over year. Core operating income was down 45.9% year over year to ¥7.0 billion. Growth in net sales was helped by good sales performance in personal care products.

- Asia (ex Japan): 1Q19 net sales were ¥84.2 billion, up 14.7% year over year. Core operating income was up 6.9% year over year to ¥11.4 billion. Growth was attributed to the expansion of market share in personal care in India and steady sales in China, Indonesia, Thailand and Vietnam.

- Others: 1Q19 revenue was ¥28.0 billion, up 13.6% year over year. Core operating income was up 41.8% year over year to ¥1.4 billion. Growth was attributed to good sales performance in Brazil and the Middle East.

- The company will continue to increase consumer awareness of its corporate brand and its diaper brand

- The company will extend its adult incontinence care model from Japan to other Asian regions.

- The company expects net sales to further improve upon introduction of new products and inventory adjustments in cross-border e-commerce.