Unibail-Rodamco-Westfield

Sector: Real estate investments trusts (REITs)

Countries of operation: France, the UK, the US and 10 other countries

Key categories: Convention, centers, exhibition centers, offices and shopping centers

Annual Financial Results

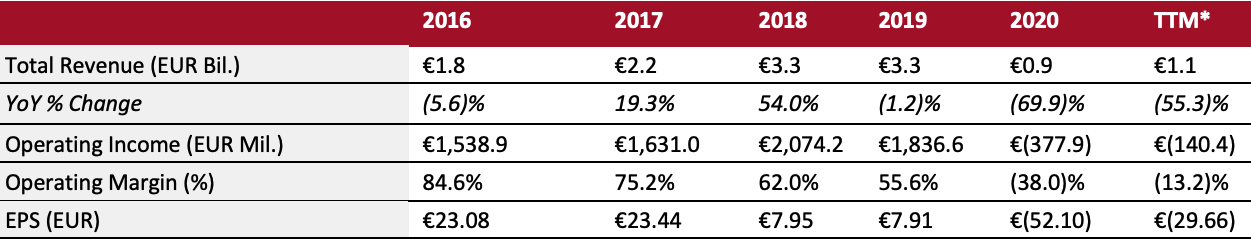

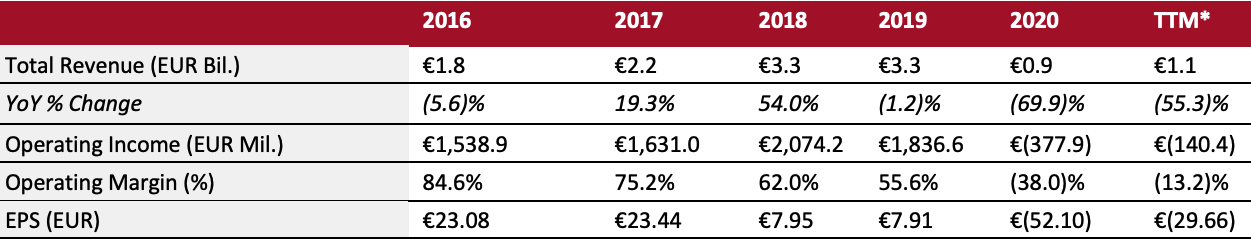

[caption id="attachment_136354" align="aligncenter" width="700"]

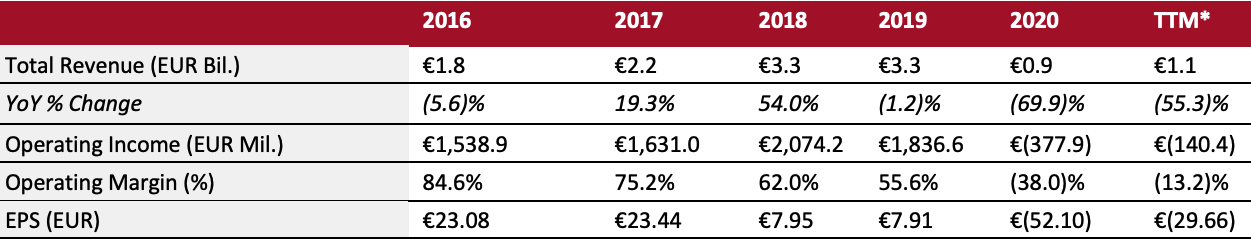

Fiscal year ends December 31

Fiscal year ends December 31

*Trailing 12 months ended June 30, 2021[/caption]

Summary

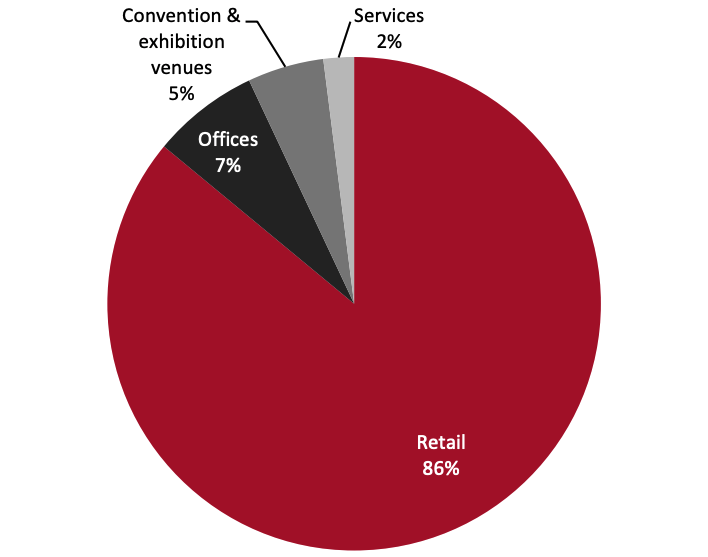

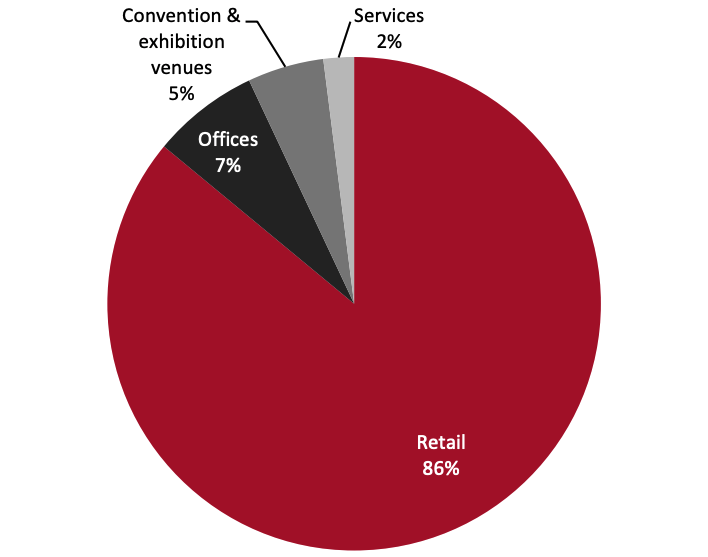

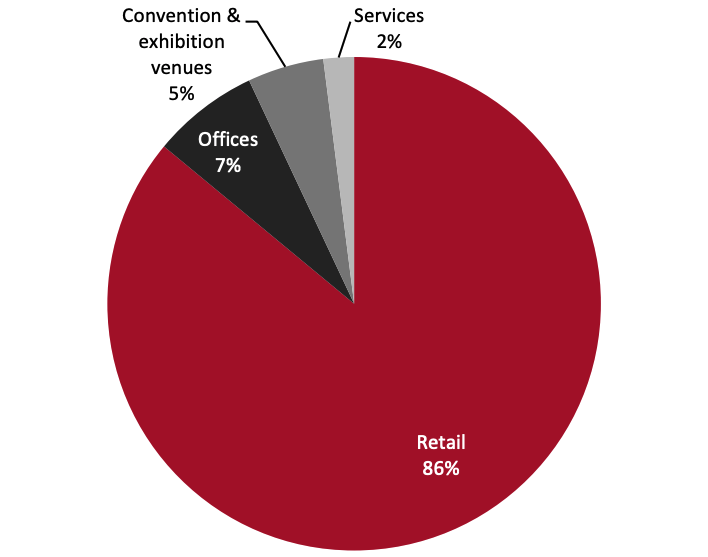

Headquartered in Paris, France, Unibail-Rodamco-Westfield is a global developer and operator of flagship shopping destinations. The company owns and operates 86 shopping centers in Europe and the US, 53 of which are flagships. As of June 30, 2021, the company’s portfolio valuation is €55 billion ($62.3 billion): 86% in retail, 7% in offices, 5% in convention and exhibition venues and 2% in services. Unibail was founded in 1968 and merged with Rodamco Europe in 2007, acquiring Australia-based Westfield Corporation in 2018 to become Unibail-Rodamco-Westfield. Its stapled shares are listed on Euronext Amsterdam and Euronext Paris, with a secondary listing in Australia through Chess Depositary interests. As of June 30, 2021, the company has 2,900 employees and is rated BBB+ by credit rating agency Standard & Poor’s and Baa2 rating by Moody’s.

Company Analysis

Coresight Research insight: Unibail-Rodamco-Westfield’s operations have been significantly impacted by the Covid-19 outbreak and subsequent restrictions, continuing into the first half of fiscal 2021 (ended June 30, 2021). On average, its shopping centers were closed for 68 days during the first half of fiscal 2021 and 67 days in the first half of 2020. It faced significant disruption in its properties in central locations across cities in Europe and the US, as well as in its food and beverage exposure.

Though the company’s key performance indicators for the first half of fiscal 2021 reflect tough business conditions, there are encouraging signs. Many of the company’s assets are well connected and in prime locations, which is proving to be a key factor for recovery. As restrictions are lifted, increasing footfall and growth in sales figures are expected to generate sustained rental income. Its flagship destinations have attracted leading retail brands such as Carrefour, H&M and Inditex, as well as emerging brick-and-mortar players, including digitally native vertical brands (DNVBs) such as Amazon, Bonobos and Peloton, who have all opened stores at Unibail-Rodamco-Westfield Flagship centers as part of their omnichannel approaches.

The company aims to strengthen its balance sheet through disposals to limit capex and retain earnings as deleveraging has been a strategic priority. The company aims to implement a US disposal program over fiscal 2021 and 2022, as it changes focus to Europe. Its favorable access to credit markets will provide enough liquidity to allow the company to cover all its refinancing needs until July 2024, further supporting its deleveraging process.

| Tailwinds |

Headwinds |

- Rising footfall and sales at flagship locations as trading conditions gradually normalize

- High-quality assets in well-connected locations will capture pent-up consumer demand

- Westfield to centers in the second half of fiscal 2021

- Increasing tenant sales when restrictions indicate a positive recovery as things normalize

- Newly reconfigured management team to strategically position for the future

|

- Uncertainty and unpredictability surrounding the pandemic

- Increased competition from online retail

- Changing exhibition, office and retailer preferences may impact its future leasing and rental revenues

|

Strategy

Unibail-Rodamco-Westfield aims to “Reinvent Being Together,” creating destinations that integrate homes, leisure, restaurants and work. Based on the company’s 2020 annual report and its first half of 2021 report, we have identified the following three key strategic goals:

1. Strengthen governance and leadership expertise to address evolving consumer preferences

- Capture new opportunities through changing leadership positions. The company appointed Catherine Puechoultres as Customer Officer in July 2021, aiming to become a more customer-focused organization.

- Address evolving consumer preferences more effectively and drive future growth in advertising, data and omnichannel retail.

2. Concentrate its portfolio, differentiate assets and deleverage the business

- Focus on large, well-connected assets in Europe’s wealthiest cities to build and develop.

- Improve assets and services continually to drive traffic, by attracting new and differentiated retailers.

- Deleverage its portfolio through the control of investments and costs, and via property disposals.

3. Restore attractive fundamentals, capitalize on economic recovery and deliver sustainable growth

- Create a mix of the right team and necessary financial means to achieve its goals stated above and deliver sustainable growth.

Asset Breakdown by Category

[caption id="attachment_136355" align="aligncenter" width="480"]

As of June 30, 2021.

As of June 30, 2021.[/caption]

Recent Developments

| Date |

Development |

| Jul 28, 2021 |

Unibail-Rodamco-Westfield SE sells its 7 Adenauer head-office building in Paris to an unknown buyer for approximately €250 million ($283 million). |

| Jul 07, 2021 |

Unibail-Rodamco-Westfield announces that it will rebrand six European shopping centers as Westfield in September. |

| Jun 15, 2021 |

Unibail-Rodamco-Westfield appoints Caroline Puechoultres as Chief Customer Officer, as part of its wider strategy to capture future growth opportunities in a rapidly changing retail environment and become a more customer-focused organization. |

| May 31, 2021 |

Unibail-Rodamco-Westfield proposes amendments to the company’s articles of association. |

| May 12, 2021 |

Unibail-Rodamco-Westfield announces at its annual general meeting that Aline Sylla-Walbaum has been appointed as a member of the Supervisory Board. |

| Apr 28, 2021 |

Unibail-Rodamco-Westfield enters into an agreement to sell a 45% stake in Shopping City Süd in Vienna to insurance company Crédit Agricole Assurances S.A. |

| Apr 28, 2021 |

Unibail-Rodamco-Westfield enters into an agreement with Wood & Company Investiční Společnost and Tatra Asset Management to sell Aupark Bratislava shopping center in Slovakia for €450 million. |

| Apr 19, 2021 |

Unibail-Rodamco-Westfield sells a 2.1% stake in the company to Rock Investments S.A. for €200 million. Under the terms of the transaction, Rock Investments will acquire 2.9 million shares at a price of €69.4 per share. |

| Mar 22, 2021 |

Unibail-Rodamco-Westfield and American Eagle Outfitters Inc. announce that they have signed leases for seven new Aerie stores and two adjacent standalone OFFLINE by Aerie locations at Unibail-Rodamco-Westfield’s shopping destinations in the U.S., opening in the second half of 2021. |

Management Team

- Jean-Marie Tritant—Chairman of Management Board and Group CEO

- Fabrice Mouchel—Group CFO

- Olivier Bossard—Chief Investment Officer and Group Chief Development Officer

- Michel Dessolain—Special Advisor to the CEO

- Astrid Panosyan—Group Chief Resources Officer

- Catherine Puechoultres—Chief Customer Officer

Source: Company reports/S&P Capital IQ/Coresight Research

Fiscal year ends December 31

Fiscal year ends December 31 As of June 30, 2021.[/caption]

Recent Developments

As of June 30, 2021.[/caption]

Recent Developments

Fiscal year ends December 31

Fiscal year ends December 31 As of June 30, 2021.[/caption]

Recent Developments

As of June 30, 2021.[/caption]

Recent Developments