albert Chan

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

1H19 Results

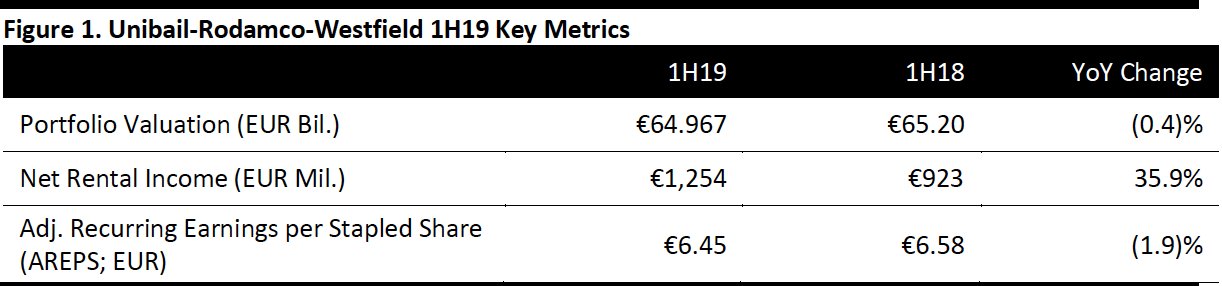

Unibail-Rodamco-Westfield (URW) 1H19 net rental income (NRI) was €1.25 billion, up 35.9% year over year, driven by the acquisition of Westfield Corporation.

Adjusted recurring earnings per stapled share (AREPS) were €6.45, down 1.9% due to the disposals completed in 2018 and 2019 (€2.3 billion), which was partially offset by strong operating performance and an additional €0.09 due to the employment of IFRS 16.

EPRA net asset value (NAV) per stapled share was €216.10, down 2.6%.

Tenant sales grew 5.75% in continental Europe, 7.1% in the UK and 4.9% in the US.

URW signed an agreement with The Void, a virtual reality experience operator, to incorporate The Void’s concept in over 25 URW flagship destinations in Europe and US.

Details for 1H19

Shopping Centers in Continental Europe

Tenant sales through June 30 increased 5.3% for the group and 5.7% for flagship centers. Tenant sales through May 31 increased 4.9%. France grew 4.6% and central Europe grew 4.6%, outperforming their respective indices.

Shopping Centers in the US and the UK

In the US, tenant sales increased 3.0% (4.9% for flagship stores) through June 30, 2019. Specialty sales productivity per square foot (psf) increased 11.3% (12.8% for flagship stores) through June 30, 2019. Occupancy was 93.4% at June 30, 2019 (94.6% in flagships), 90 bps below June 30, 2018.

Traffic in the UK increased 6.4% in 1H19, driven by the opening of Westfield London Phase 2 in March 2018 and continued growth of Westfield Stratford City, outperforming the UK shopping center index by 770 bps. Total tenant sales in UK centers through June 30 increased 7.1%. EPRA vacancy was 8.7% driven by non-renewals, retailer bankruptcies and delays in Westfield London Phase 1 leasing.

Offices

Like-for-like NRI was up 9.4%, of which France was up 13.8% due to an indemnity received. URW sold Tour Majunga for €850 million, the sales transaction was completed on July 3, 2019.

Convention and Exhibition

Recurring NOI in 1H19 benefited from the tri-annual INTERMAT show (for the construction industry) held in 1H18. Excluding these events, recurring NOI increased 20.3% versus 1H18.

Development Pipeline

The expected cost of the development pipeline amounted to €10.3 billion, down from €11.9 billion at the end of 2018. Committed projects total €2.9 billion, of which €1.6 billion has already been invested.

The gross leasable area pipeline is split between retail at 50%, dining & leisure at 16%, offices at 14%, residential and third party residential at 15% and hotels at 5%.

Management characterized progress on the construction of two project (the Trinity and Shift) as significant and on schedule to be delivered in 2H19 and 1H20, respectively, followed by the extension of Westfield Valley Fair in 1H20 and Westfield Mall in the Netherlands in 2H20. Ten floors of residential space at the Palisade at Westfield UTC was delivered in July, the remaining floors scheduled to be delivered in August.

Outlook:

- For 2019, URW expects continental European like-for-like NRI to increase around 3%.

- URW raised its 2019 AREPS guidance by €0.30 to €12.10-12.30.