Understanding WeChat

Considered by many to be China’s “super app,”WeChat—with over 1 billion monthly active users (MAU) and 902 million daily active users—has become a part of daily life for most Chinese consumers. To fully understand consumer behavior in China, it is necessary to understand the roles WeChat plays in the lives of Chinese consumers.

This series,

Understanding WeChat, China’s Super App,will delve into the app’s full-fledged “Swiss army knife” functions in communications (e.g. text or voice messaging), mini programs, social networking, social media and payment functions. In Part 1, we provide an update on the development of WeChat, discuss some of its new functions, look at its dominance and compare it to its US counterpart Facebook and its Messenger app.

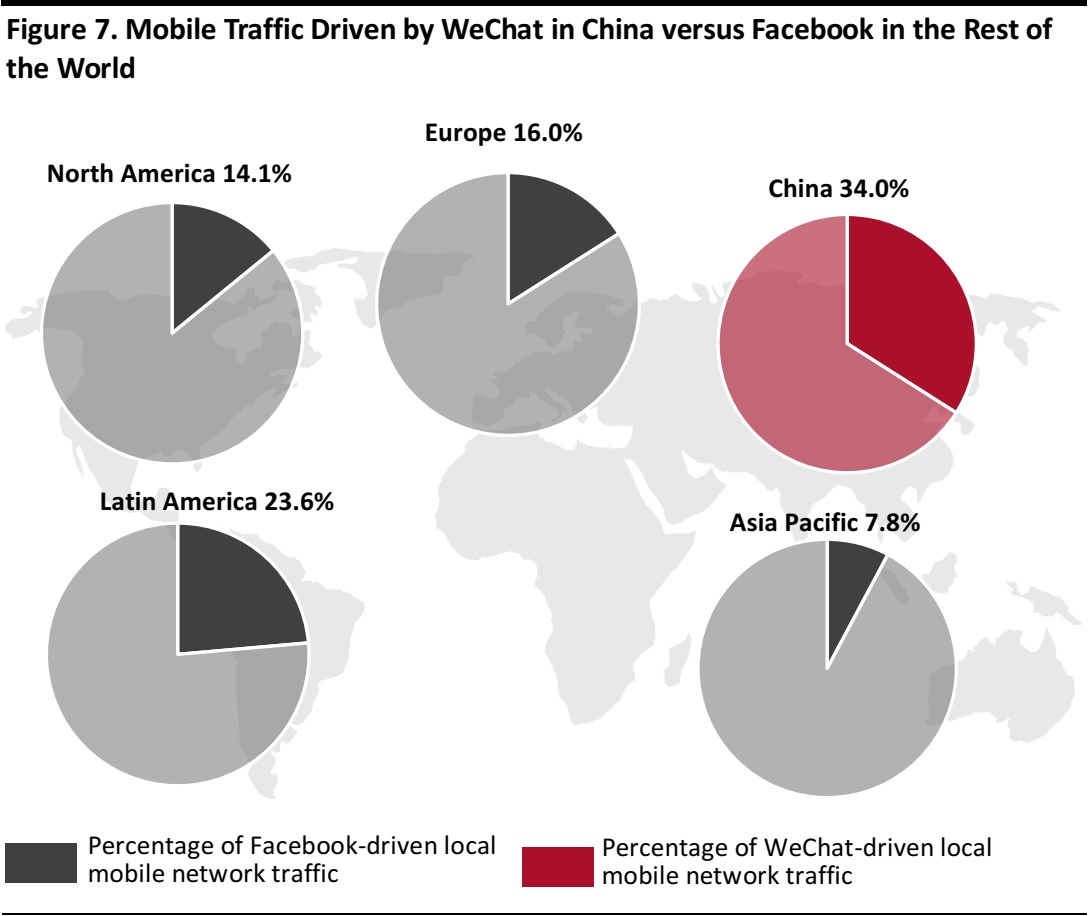

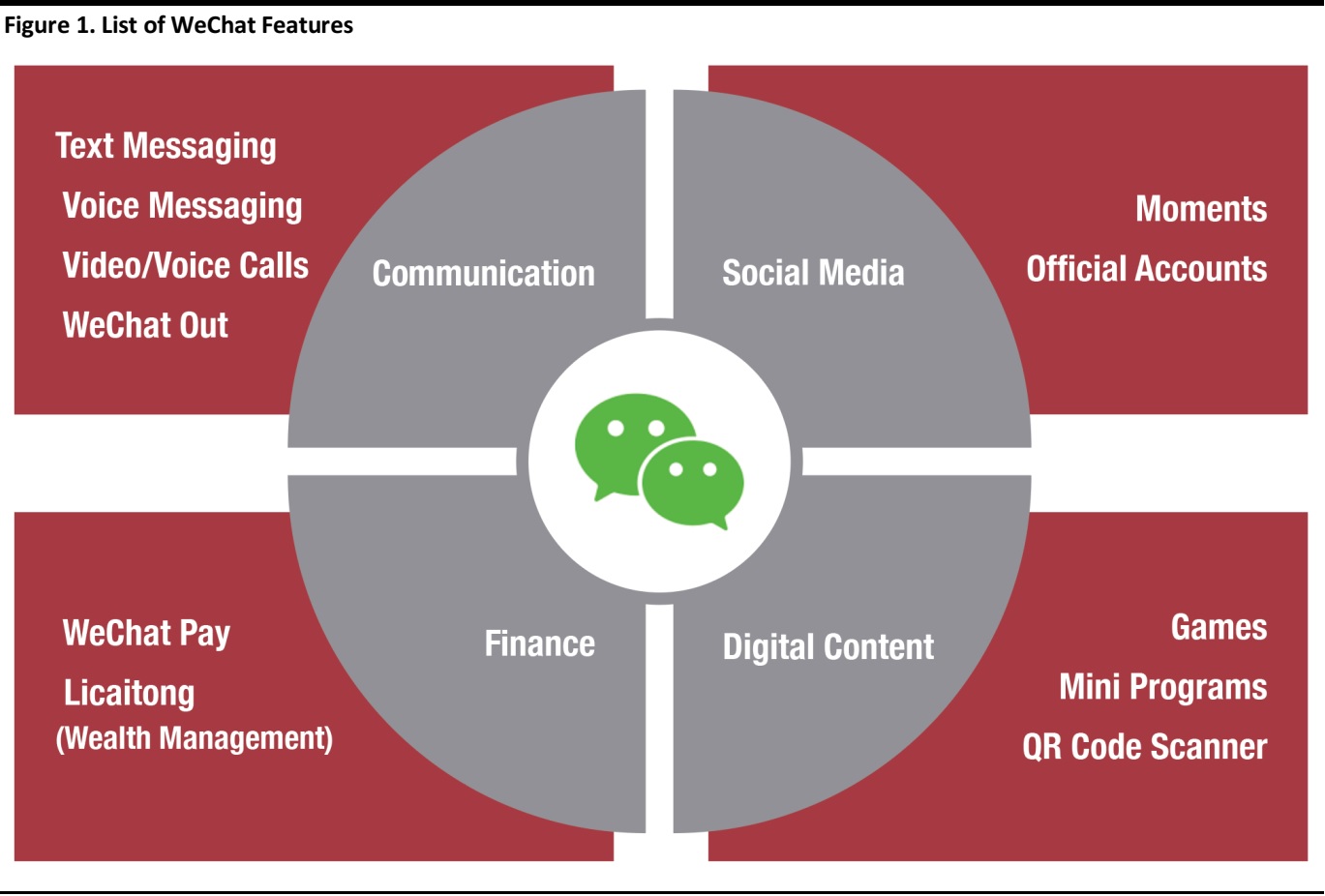

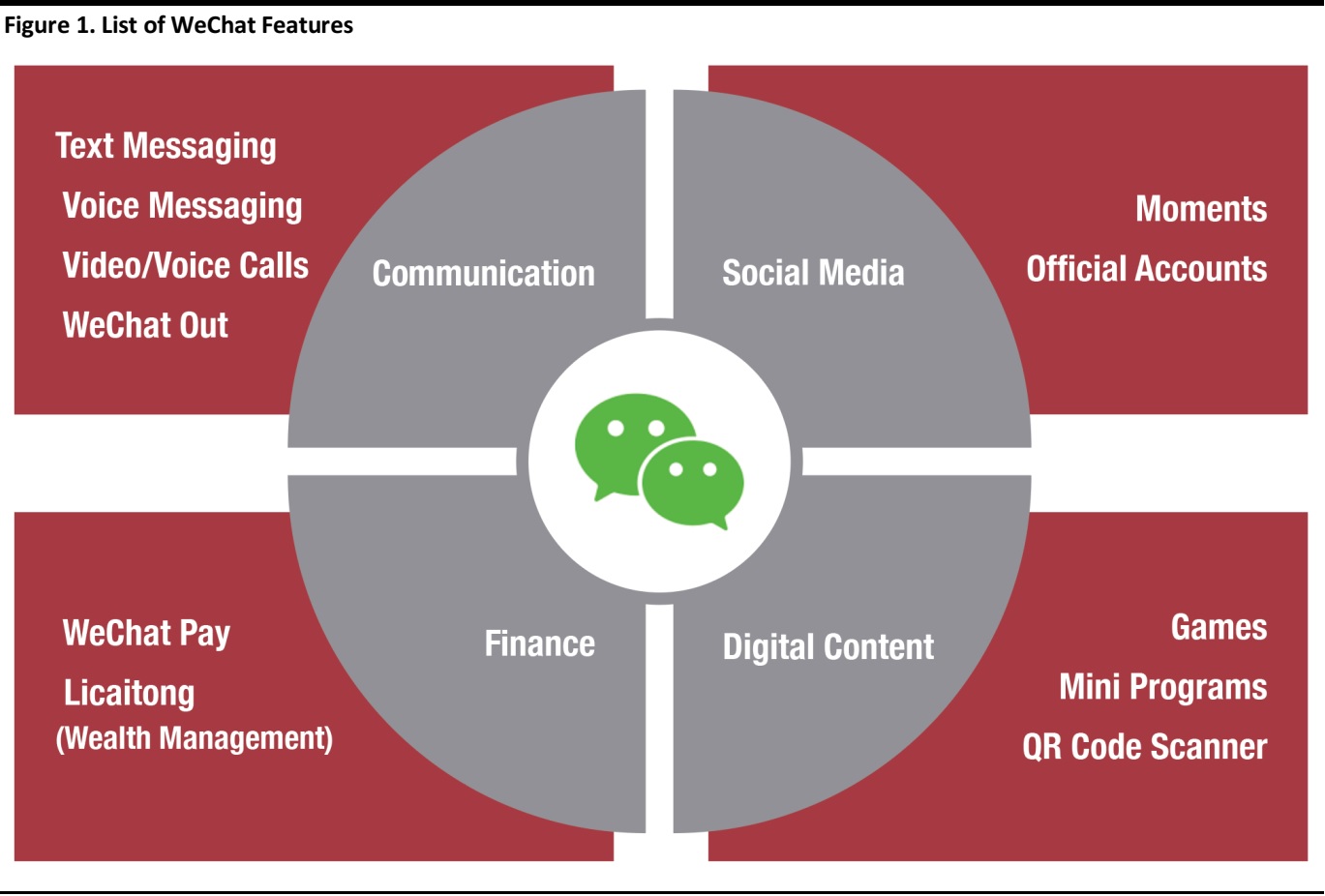

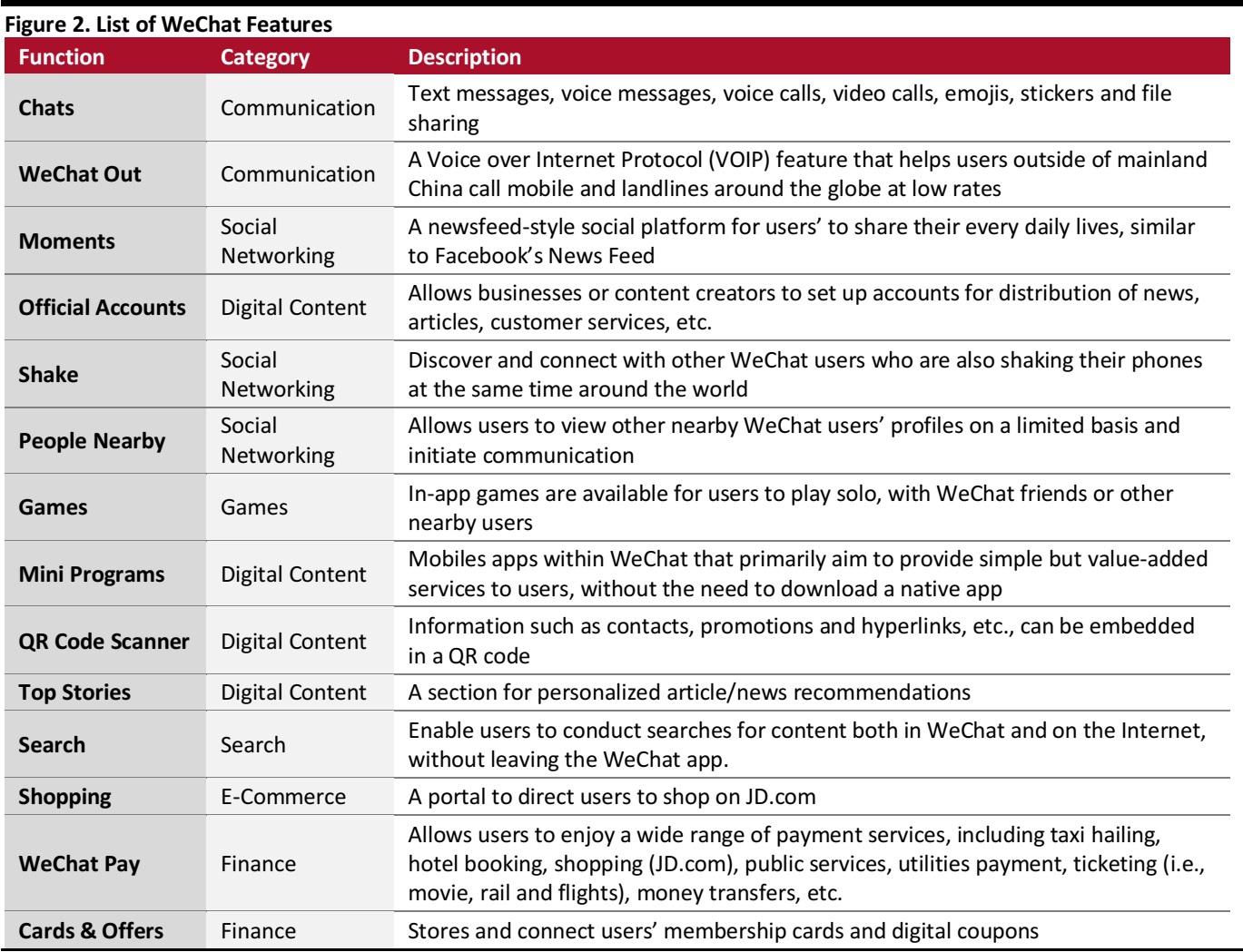

We begin by summarizing the major features of WeChat across four areas: communication, social media, finance and digital content.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

In mid-2017, WeChat added two new functions: “Top Stories” and the Search function;both logical additions to complement its ecosystem as an information portal.

Top Stories

Top Stories is a portal for news and content that is unique to each user, and is customized based on the user’s interests and previous interactions in WeChat, including reading history, comments/repost history, the user’s (and their friends’) interests. It usually includes elements such as followed official accounts, what friends are looking at their posts, what experts are reading, news within the user’s geographical location and content related to the user’s interests.

WeChat aims to filter information to provide quality content to users and enhance the user experience. Users can indicate which content they want and don’t want to improve WeChat’s curation of content that matches their interests.

Search

Users can undertake keyword searches for content both within the app—such as articles published by official accounts, mini programs, content shared by users’ friends in Moments and conversation history—and on the Internet.

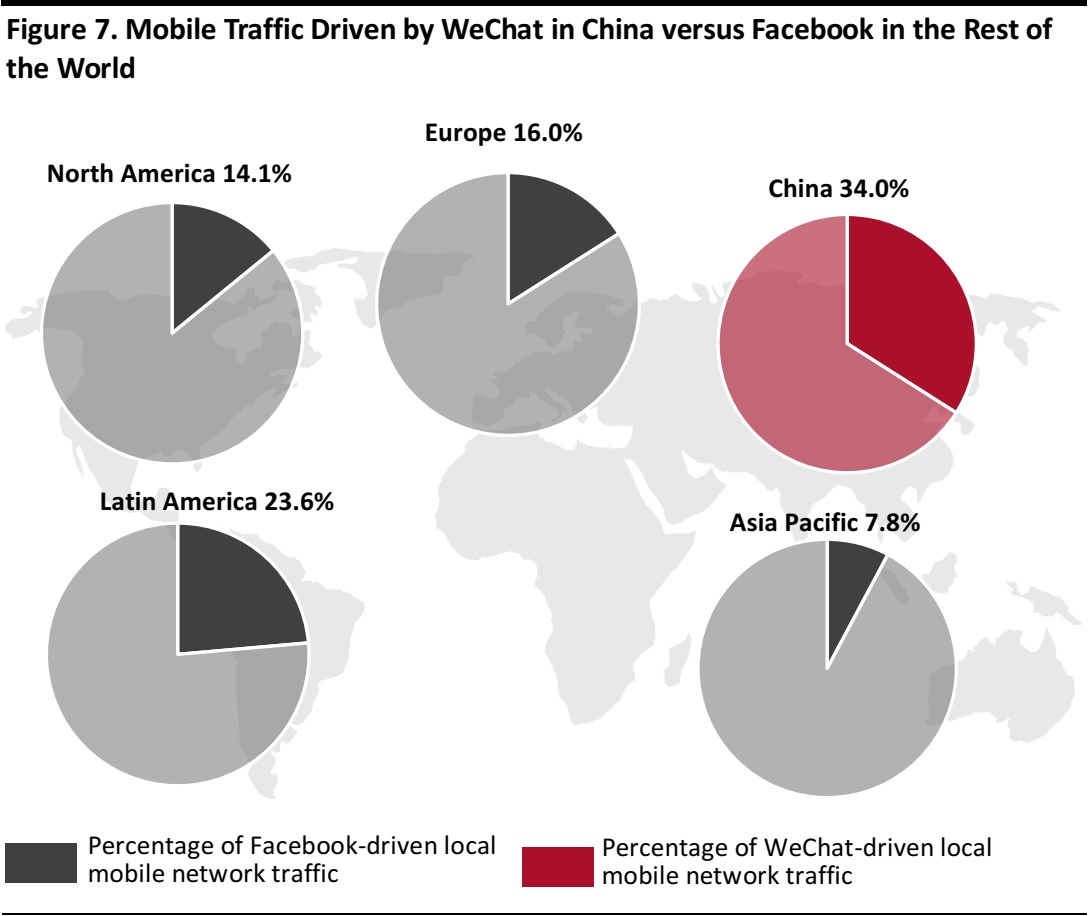

This search function helps users to look for specific content with keyword searches. WeChat has an advantage: it can push its search function to challenge the incumbent market leader Baidu, because WeChat makes up 34.0% of total mobile traffic in China and the content within the WeChat app is not searchable in Baidu.

WeChat, Going from Strength to Strength

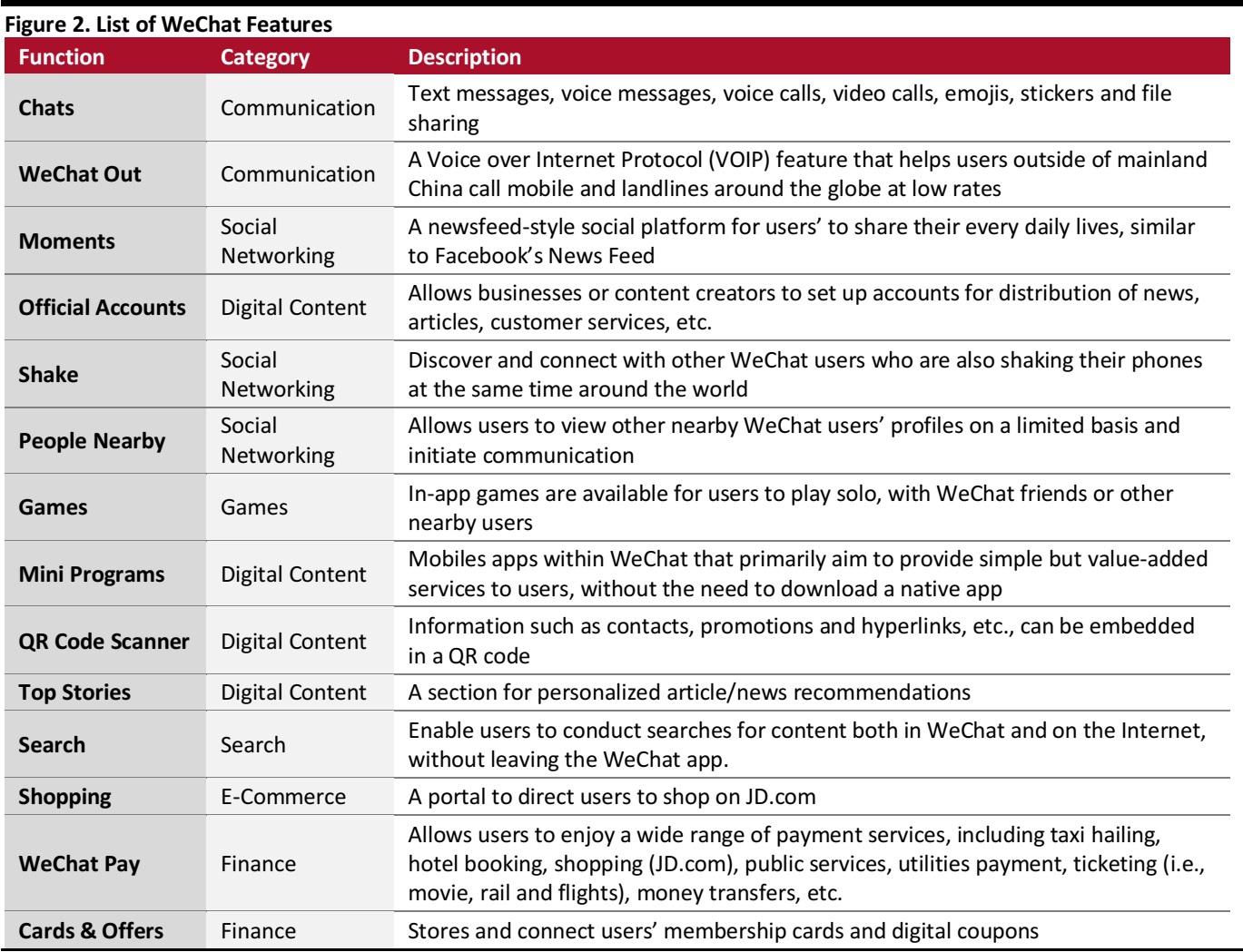

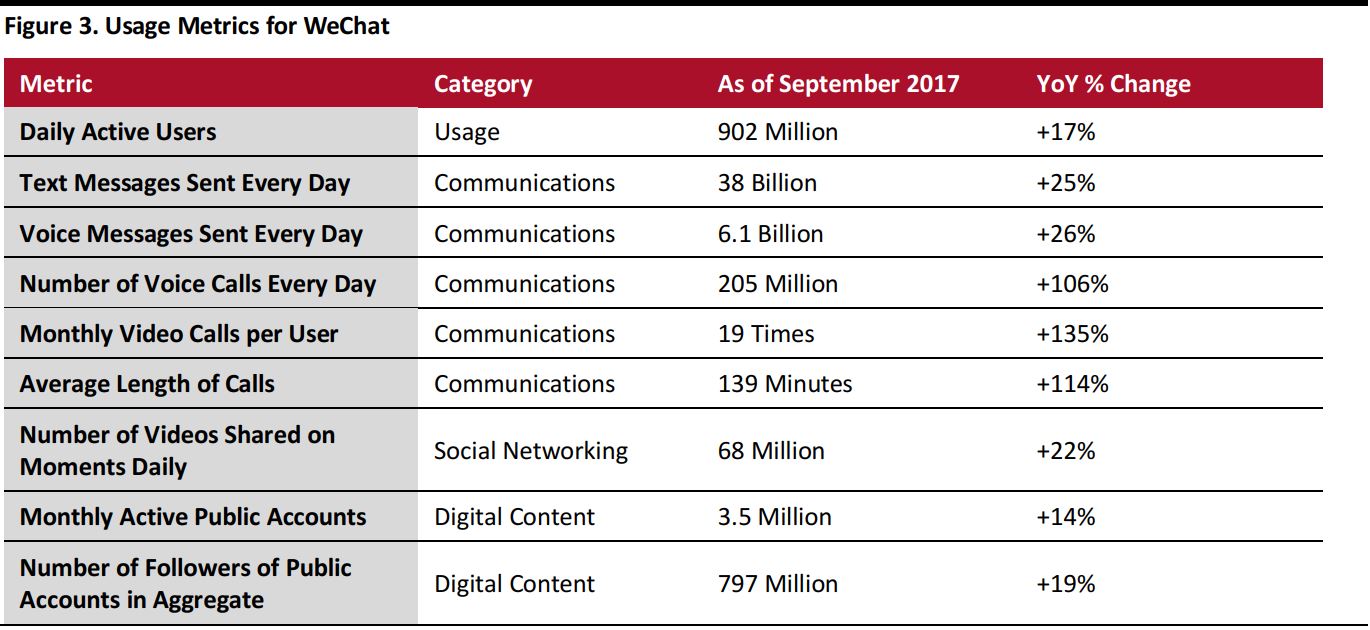

Throughout 2017, across all attributes—communications, social networking and digital content—WeChat continued to strengthen its leading position. According to the

2017 WeChat Data Report released by Tencent on November 9, 2017, the app’s daily active users increased by 17% year over year to 902 million, and as of March 31, 2018, its MAU surpassed 1 billion.

Source: Tencent/Coresight Research

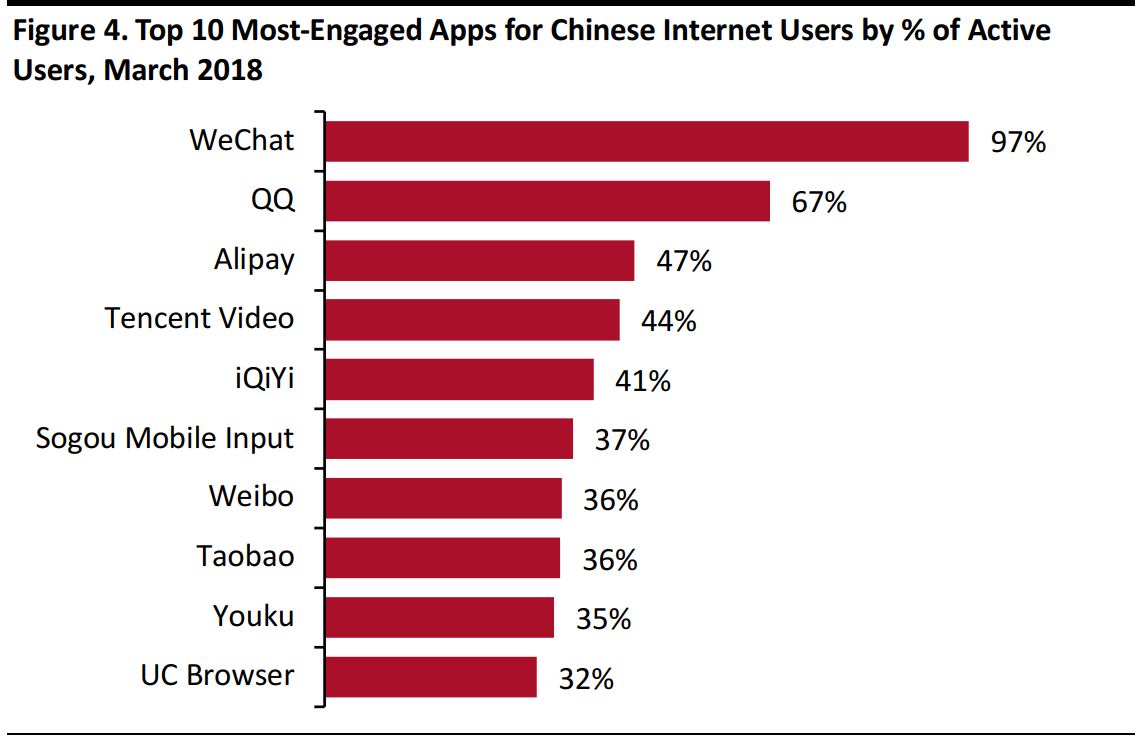

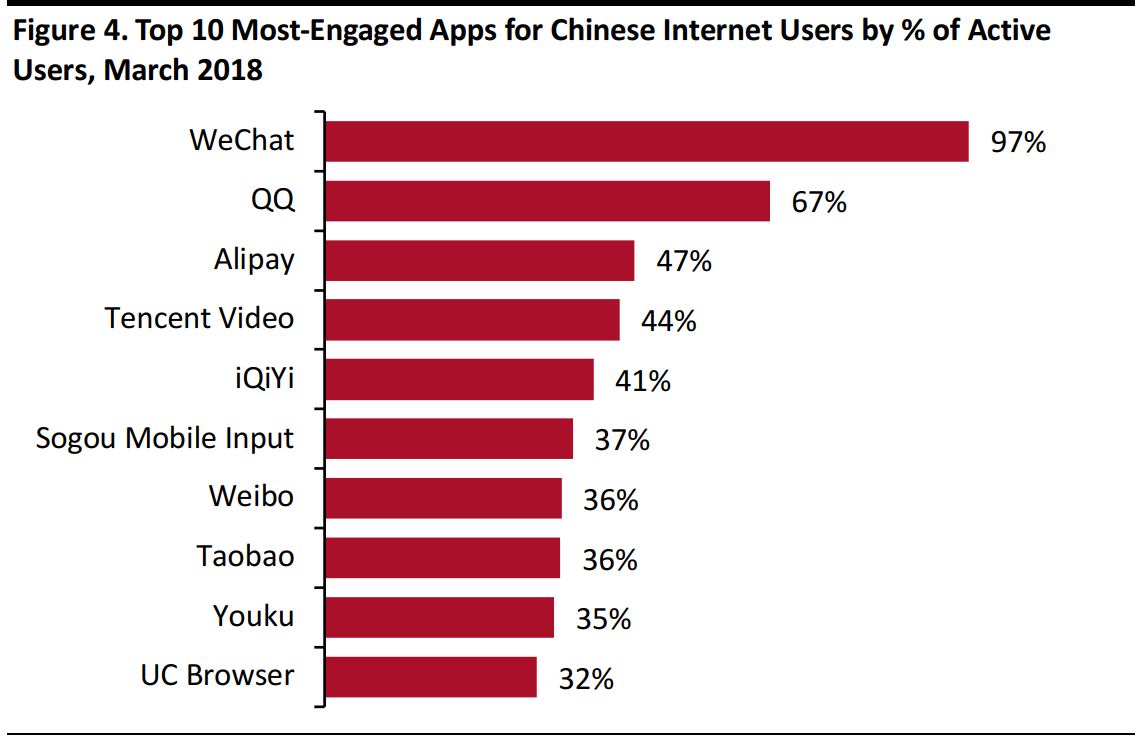

WeChat remains the most-engaged app in China,with the highest proportion of active users, rising from 93% of Internet users one year ago, to 97% as of March 2018, according to data from iiMedia Research.To put this lead into perspective, QQ follows at a distant second at 67% and Alipay at 47%.

Source: CNNIC/Coresight Research

The Go-To Portal for Traffic and Information Consumption

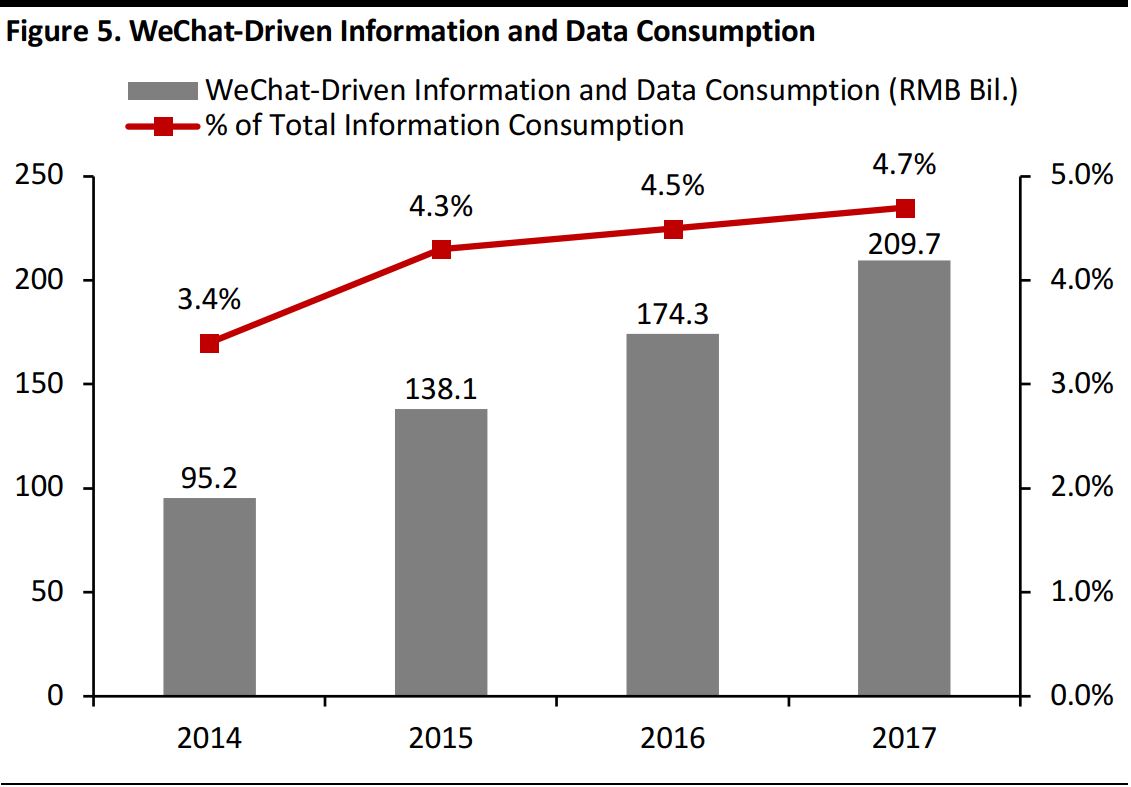

In the new digital economy, information consumption has led to new models and formats of consumption, such as mobile payment and the sharing economy. According to the

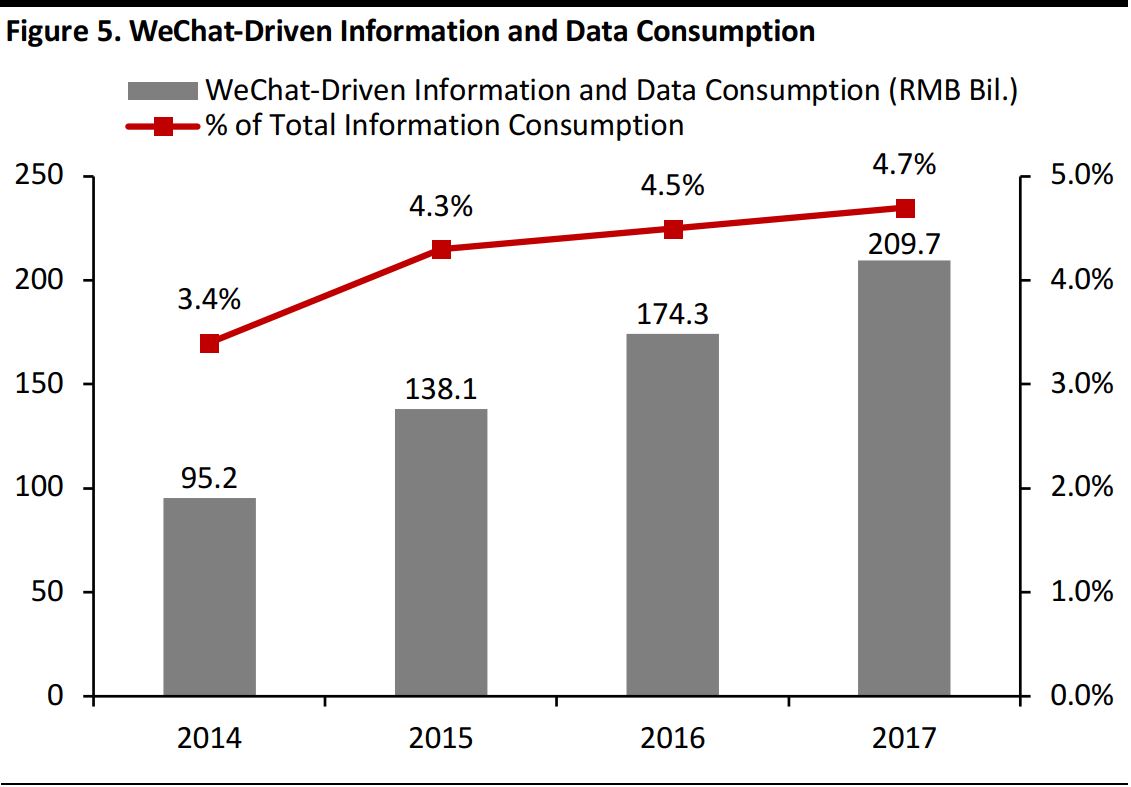

WeChat Economic and Social Impact Report 2017 by research institute China Academy of Information and Communications Technology (CAICT), China’s information consumption totaled ¥4.5 trillion in 2017, accounting for 10% of final consumption expenditure.

WeChat plays a dominant role in the information consumption economy. According to the same report, WeChat-driven information and data consumption reached ¥209.7 billion in 2017, accounting for 4.7% of China’s total information consumption.

Source: China Academy of Information and Communications Technology

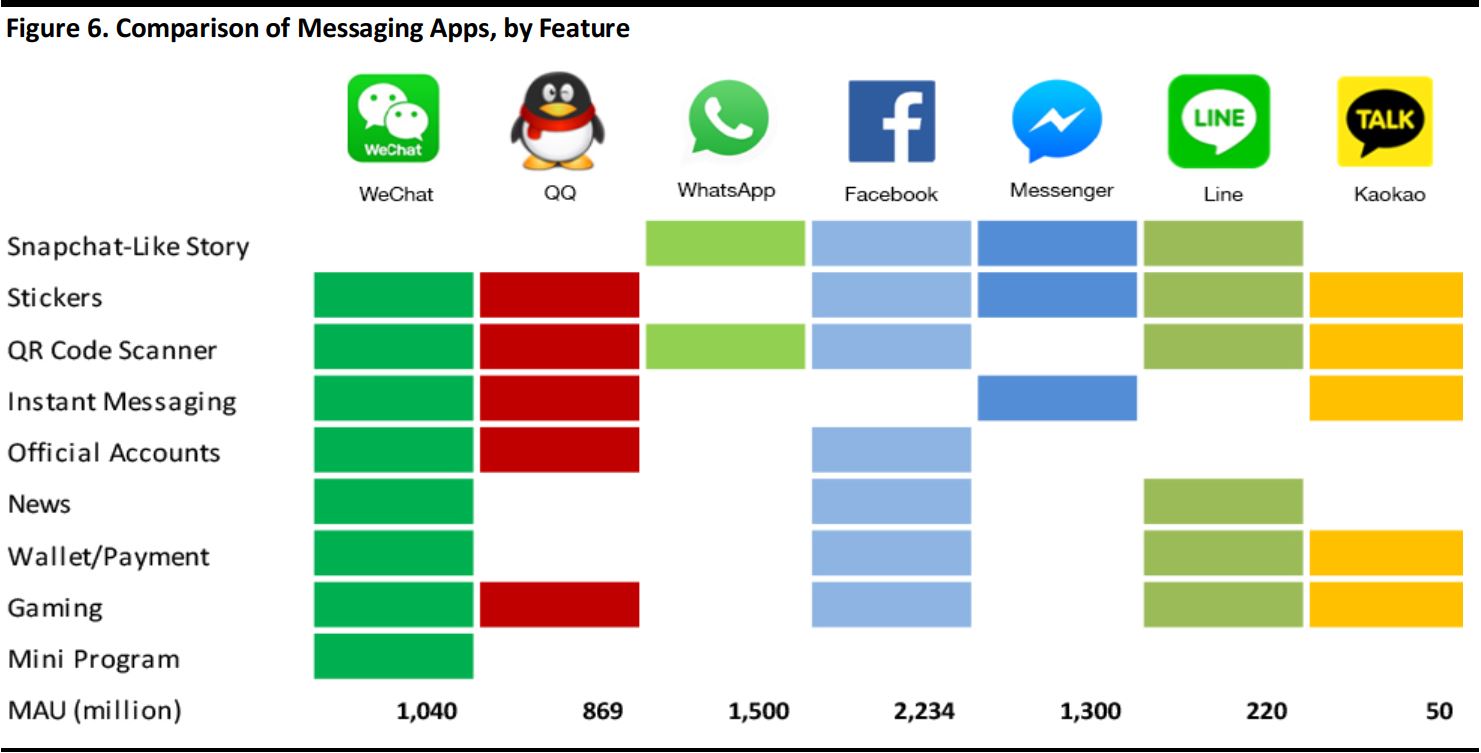

WeChat and Its Global Peers

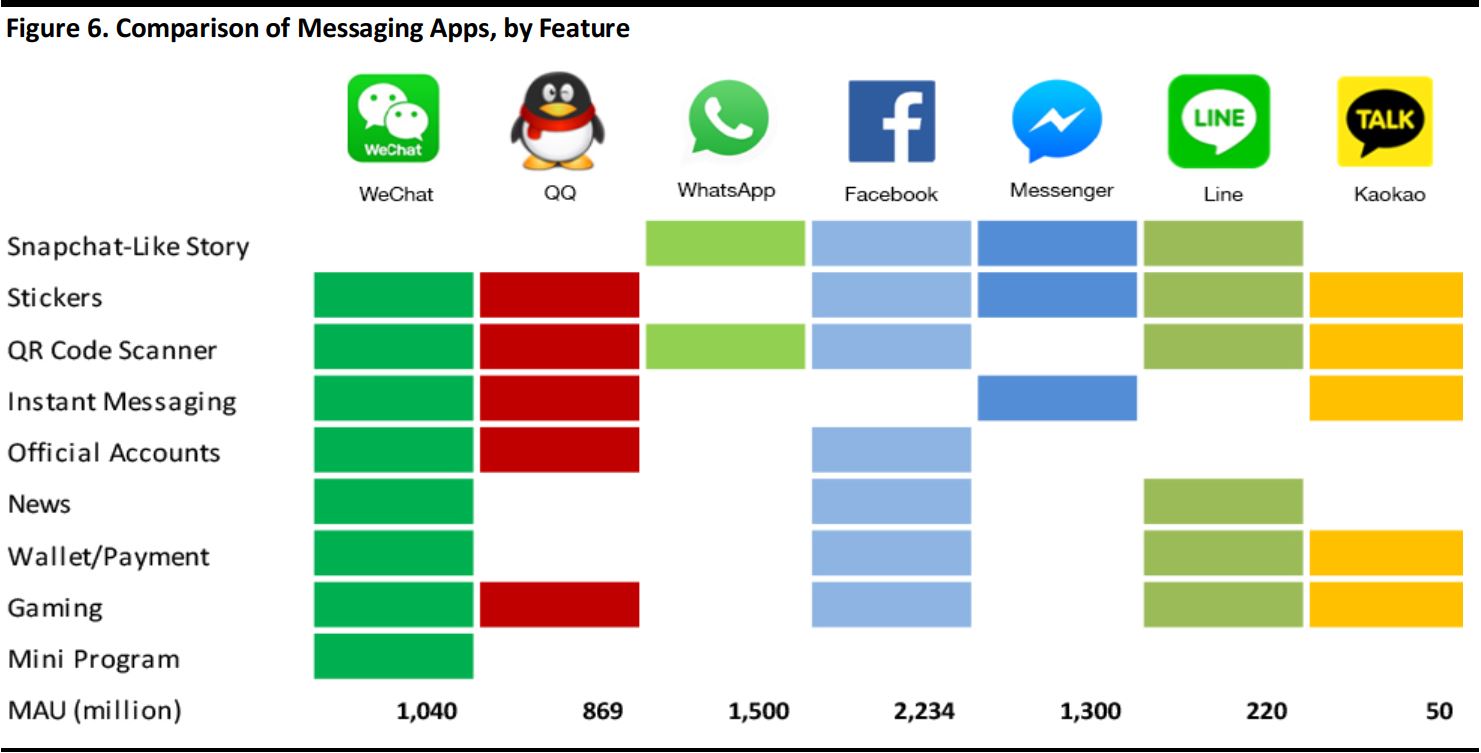

WeChat’s fully fledged “Swiss army knife” functions have further established the app’s leading position in China. Its US counterparts, Facebook and its Messenger app, together seemingly resemble most of the functions in WeChat: for example, Messenger Payment is comparable to WeChat Pay. However, there are significant differences between usage. Messenger Payment is predominantly used for peer-to-peer money transfer. WeChat Pay, on the other hand, is used much more broadly, such as in supermarkets and restaurants and for online shopping. According to data from the

WeChat Economic and Social Impact Report 2017, usage of WeChat Pay in supermarkets and convenience stores reached 76.3% of consumers in 2017, up from 48.9% in 2016.

Thanks to its penetration in mobile payment, WeChat users can book a taxi or a hotel, purchase a high-speed train or air ticket, play games or make an appointment at a hospital or with government services. It is these useful functions that have helped cement WeChat’s strength in Chinese communications.

Data as of June 2018; MAU = monthly average users.

Source: Company reports/Coresight Research

Data as of June 2018; MAU = monthly average users.

Source: Company reports/Coresight Research

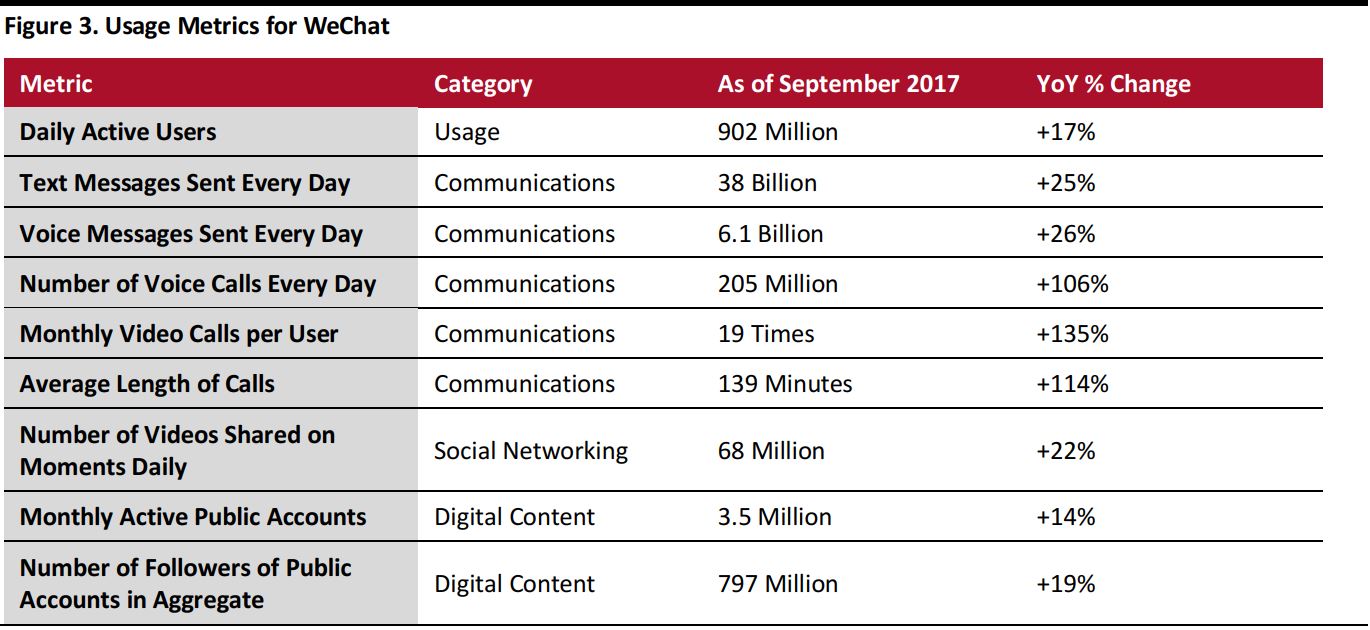

In terms of driving traffic, WeChat has also pulled away from its US counterparts. According to WeChat agency WalktheChat

, WeChat’s traffic accounted for 34% of total mobile traffic in China in 2017. This is more than double the traffic that Facebook accounts for in North America, at only 14.1%. While Facebook seems to be the obvious winner in the rest of the world, it does not come close to WeChat’s dominance in China, where it has become the preeminent information portal, with no competitors in sight.

Source: CAICT WeChat Economic and Social Impact Report 2017/WalktheChat

Slow Monetization Helps Maintain User Experience

Thanks to WeChat prioritizing user experience over monetization, users are staying in the app daily for communication, social interaction and information. According to Kantar, as of January 2016, an average WeChat user checks the app14.6 times per day. In WeChat, information is classified into different categories—namely Moments for friends and families’ activities or sharing where ads are strictly limited to protect the user experience, Top Stories for news, Official Accounts or Mini Programs for business-to-consumer (B2C) interactions and a shopping portal to shop on JD.com.

On Facebook, on the other hand, social and B2C interactions both happen in the News Feed. There are signs that Facebook users are overwhelmed by B2C interactions and advertisements, and this is affecting user experience. In its second fiscal quarter of 2018 (June 30 year-end) earnings release, Facebook’s daily active user growth slowed to 1.44% from 3.42% in the first quarter. In Europe, MAU declined to 376 million from 377 million in the first quarter of 2018.

Our View

WeChat has added “Top Stories” to enable news content to users and the Search functions to search for content, both logical additions to complement its ecosystem as an information portal.

Surpassing 1 billion MAU and 902 million daily active users, WeChat has further strengthened its lead as the dominant portal for traffic and information consumption in China—including communications, social networking and digital content. In 2017, WeChat accounted for 34% of total mobile traffic in China.

The app’s fully-fledged “Swiss army knife” functions have penetrated into all facets of the daily lives of Chinese consumers, and thanks to its strong respect for user experience over monetization, WeChat has become the go-to app in China.

We will continue our coverage of WeChat in the second report in this series, which will look more deeply at its features in B2C interactions.

Data as of June 2018; MAU = monthly average users.

Source: Company reports/Coresight Research

Data as of June 2018; MAU = monthly average users.

Source: Company reports/Coresight Research