Nitheesh NH

Introduction

What’s the Story? Livestreaming e-commerce has skyrocketed in popularity over the past two years, providing an opportunity for brands and retailers to elevate the online shopping experience through live video. Coresight Research has identified livestreaming e-commerce as a key trend to watch in retail. While livestream shopping developed as an alternative revenue stream during the pandemic, some companies are still evaluating various platforms, testing technology infrastructure and refining shopping integration to provide a seamless shopping experience. In this report, we analyze the findings of a recent Coresight Research survey of retail executives to examine the opportunities presented by livestreaming e-commerce and how brands, retailers and manufacturers worldwide expect to grow the livestreaming channel as a revenue stream in the next 12 months. This report was produced in partnership with the Retail Innovation Conference and Expo (RICE), an event organizer that provides engaging and educational digital events worldwide. The report is sponsored by Firework, a shoppable-video and livestreaming e-commerce solution provider.- Read more Coresight Research coverage of livestreaming e-commerce.

Understanding the Livestreaming Opportunity: Coresight Research x RICE Analysis

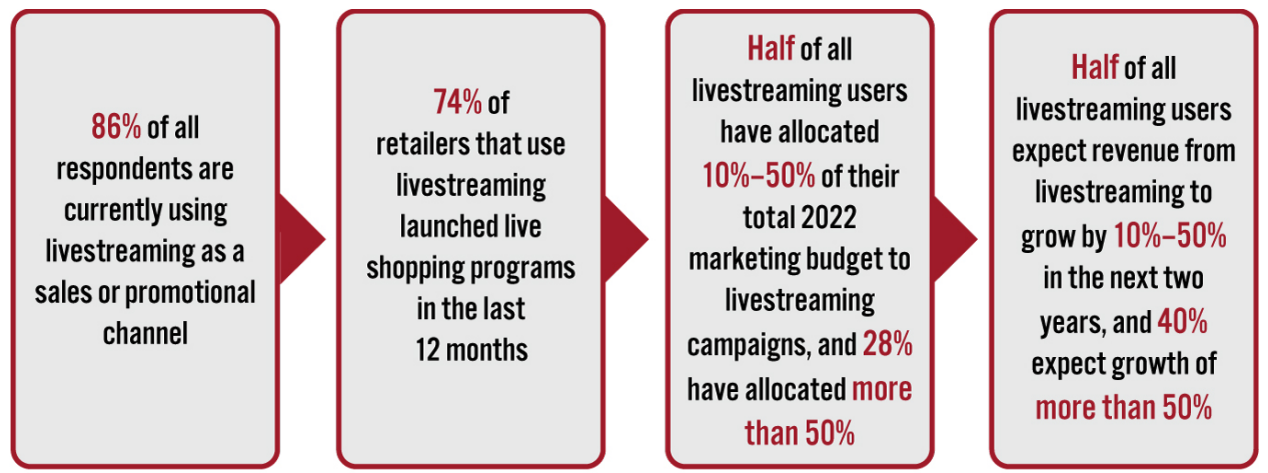

We summarize our key survey findings below, before presenting our analysis and exploring the implications of each in detail.Figure 1. Livestream Shopping Adoption: Key Survey Findings (% of Respondents) [caption id="attachment_147379" align="aligncenter" width="700"]

Base: 278 retail executives, surveyed in April 2022

Base: 278 retail executives, surveyed in April 2022Source: Coresight Research[/caption] Retail Investments in, and Expectations for, Livestreaming E-Commerce Brands, retailers and marketplaces are increasingly establishing shoppable live-video events to promote their products and raise brand awareness. Our survey revealed that 86% of retail companies currently use livestreaming as a sales or promotional channel. Retailers such as Farfetch, Macy’s, Moda Operandi, Neiman Marcus and Nordstrom have recently partnered with live-video-commerce tech providers to accelerate sales conversion and improve brand appeal. Our survey found that 74% of surveyed retailers that use livestreaming launched livestream shopping programs in the last 12 months, with only 26% having started over a year ago. Significant Investments Retail companies are devoting a significant budget to livestream shopping: half of the surveyed companies that are currently using livestreaming reported that they are spending 10%–50% of total annual marketing budget on livestreaming in 2022, and 28% are spending over 50% on the channel.

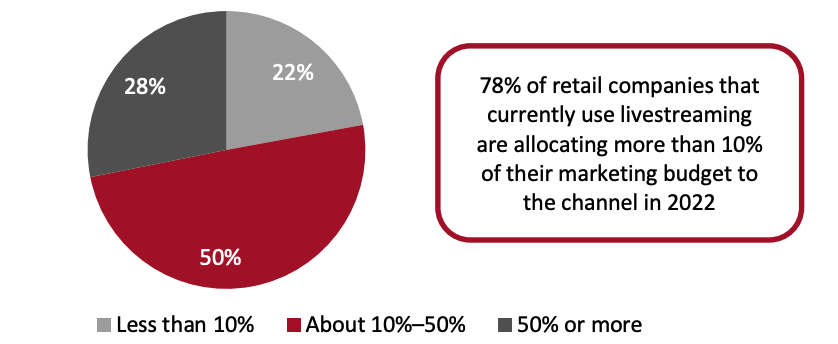

Figure 2. Proportion of Annual Marketing Budget Allocated to Livestreaming in 2022 (% of Respondents) [caption id="attachment_147380" align="aligncenter" width="700"]

Base: 220 respondents who are currently using livestreaming as a sales or promotional channel, surveyed in April 2022

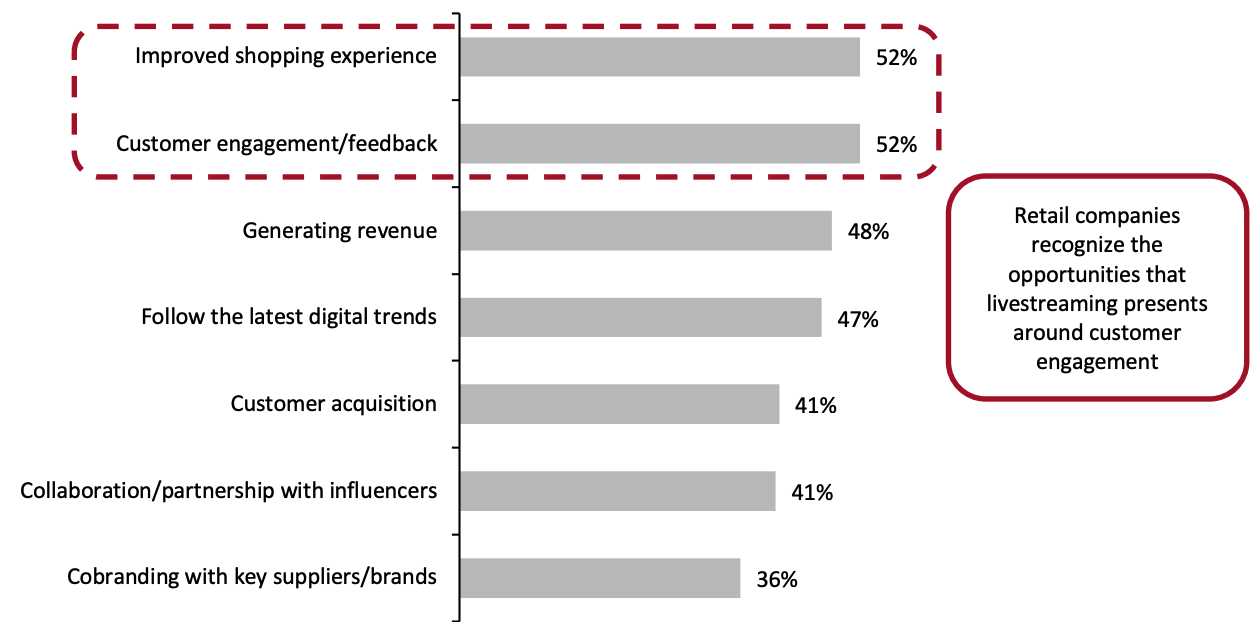

Base: 220 respondents who are currently using livestreaming as a sales or promotional channel, surveyed in April 2022Source: Coresight Research[/caption] Improving the Shopping Experience The interactivity of livestreaming enables shoppers to access product information and communicate with the host to receive recommendations and answers to questions, helping brands and retailers to drive customer loyalty and engagement as well as presenting opportunities for them to gather consumer insights and feedback. In fact, improving the shopping experience and enhancing customer engagement emerged as the topmost primary objectives for livestreaming strategies in our survey, each cited by more than half of retail companies (52%) that currently use livestreaming. Interestingly, these two objectives placed higher than revenue generation in our survey (see Figure 3), showing that retail companies recognize the engagement opportunities as a key benefit of the live shopping channel. Companies can look to analyze consumer behavior, product mix and content curation to create a more engaging and entertaining journey.

Figure 3. Primary Objectives for Livestreaming Strategy (% of Respondents) [caption id="attachment_147382" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple optionsBase: 220 respondents who are currently using livestreaming as a sales or promotional channel, surveyed in April 2022

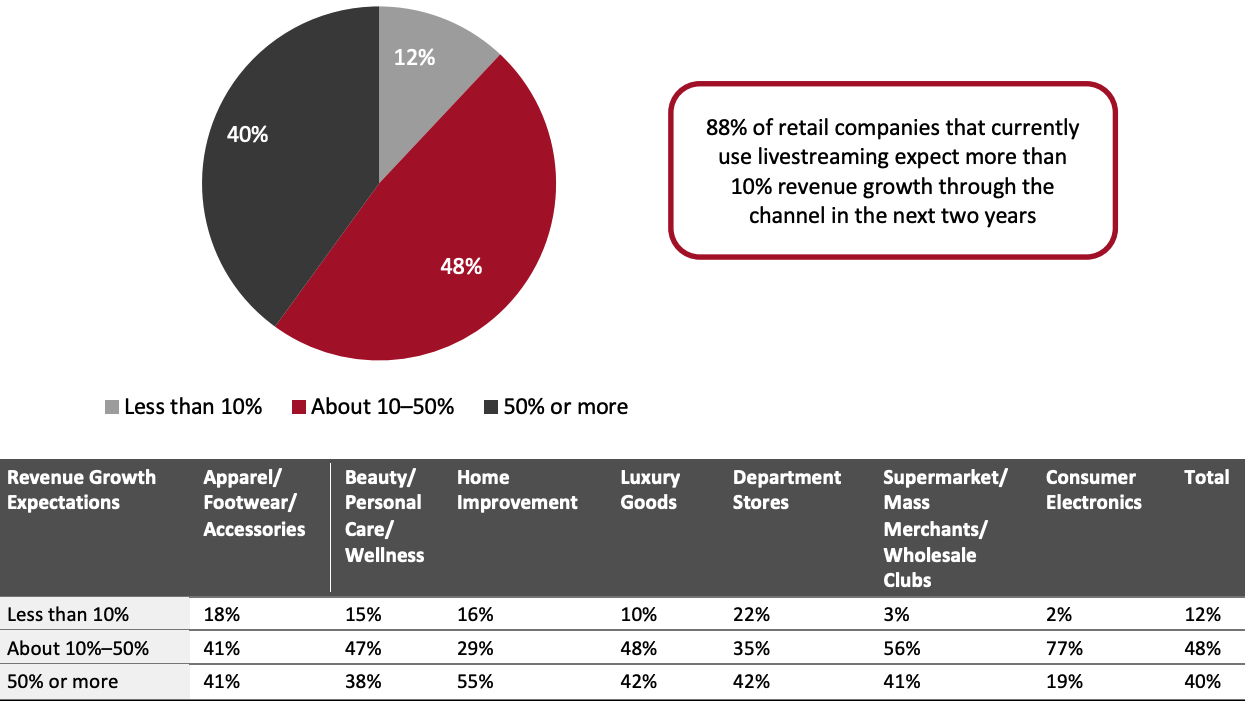

Source: Coresight Research[/caption] Revenue Growth Expectations Building on the acceleration in the adoption of livestreaming e-commerce through the pandemic, nearly half (48%) of the surveyed companies that currently use livestreaming expect revenue from the channel to grow 10%–50% over the next two years, and 40% expect more than 50% revenue growth in the channel. The home-improvement sector is looking forward to the biggest gains in the livestreaming e-commerce, with 55% of respondents in this sector reporting expectations of greater than 50% growth (highlighted in Figure 4).

Figure 4. Expected Growth in Livestream E-Commerce Revenue in the Next Two Years: Overall (Charted) and by Retail Sector (% of Respondents) [caption id="attachment_147383" align="aligncenter" width="700"]

Base: 220 respondents who are currently using livestreaming as a sales or promotional channel, surveyed in April 2022

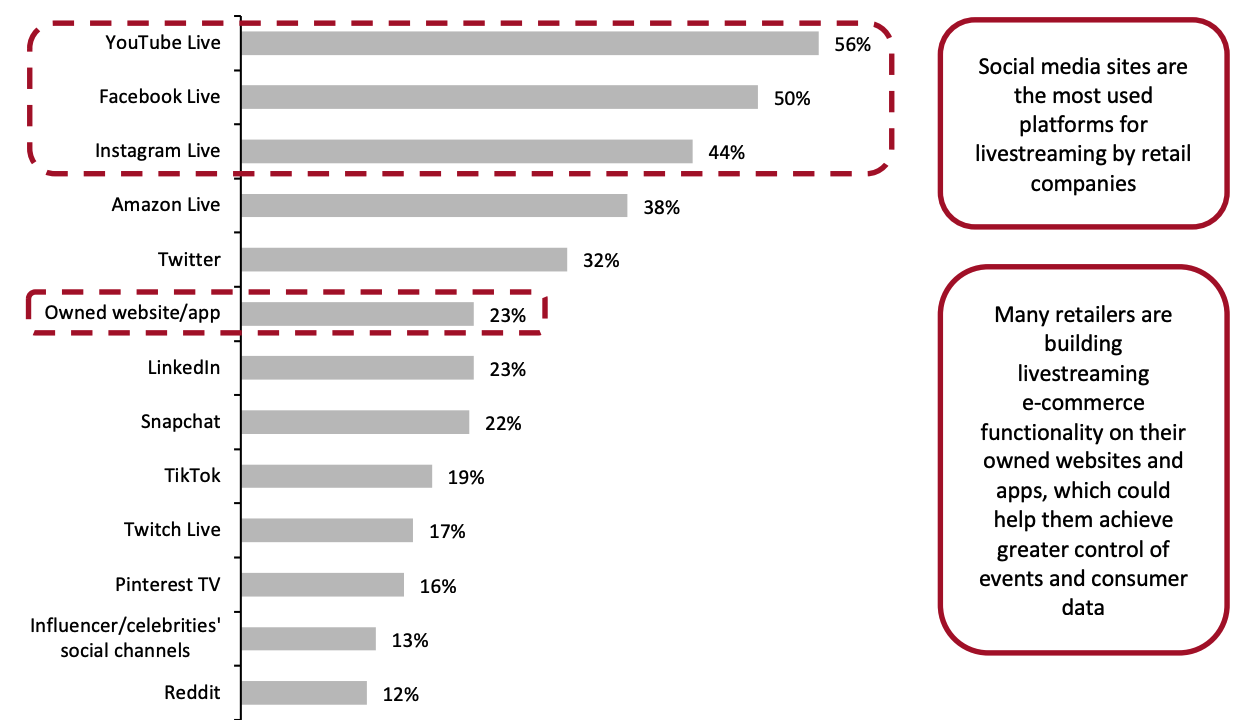

Base: 220 respondents who are currently using livestreaming as a sales or promotional channel, surveyed in April 2022Source: Coresight Research[/caption] Diverse Livestreaming Approaches and Innovations The proliferation of livestream shopping events on e-commerce platforms, apps and social media underlines the channel’s effectiveness as customer engagement tool. Brands and retailers are differentiating themselves with adaptive marketing strategies to win in the live-shopping space—with the foundational pillars covering multichannel platforms, frequent schedules, knowledgeable and engaging hosts, and creative formats. Robust Livestreaming Platforms Our survey indicates that social media platforms play an essential role in livestreaming campaigns, as shown in Figure 5: cited by 56% of companies that currently use livestreaming, YouTube Live is the most-used platform for live video commerce, followed by Facebook Live (50%) and Instagram Live (44%). Social media platforms enable brands and retailers to reach billions of existing users and make use of in-app checkout options and product discovery features, which platforms continue to launch and upgrade. Nearly one-quarter (23%) of surveyed companies that use livestreaming host such events on their own websites and apps. These platforms provide brands and retailers with additional opportunities to control all aspects of an event, including the content, the landing page and consumer data. Companies can also use simulcast technologies to host livestreams through both social media channels and their owned platforms, which would enable them to capture a wider viewer base.

Figure 5. Platforms Used for Livestreaming (% of Respondents) [caption id="attachment_147384" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple optionsOptions that were selected by fewer than 10% of respondents are not included in the chart

Base: 220 respondents who are currently using livestreaming as a sales or promotional channel, surveyed in April 2022

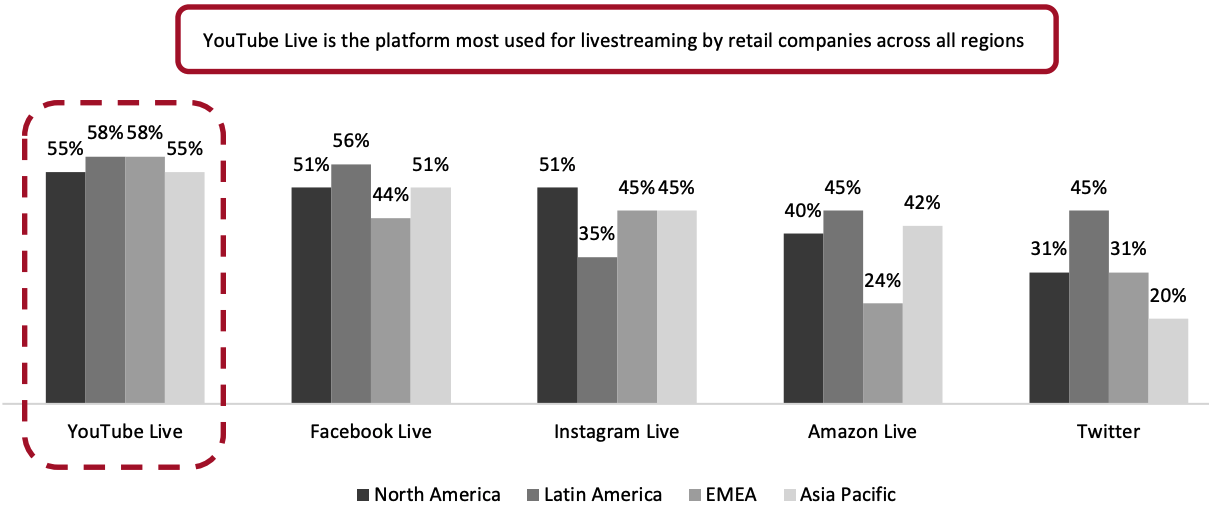

Source: Coresight Research[/caption] Looking at the top five most-used channels for livestreaming (as shown in Figure 5), YouTube Live is the most prevalent globally, which is unsurprising considering its early establishment in video services. Meta-owned Facebook Live and Instagram Live have long offered shopping tools that harness user data to surface recommended items, which have likely contributed to their wide adoption by retail companies in North America, Latin America, EMEA (Europe, the Middle East and Africa) and Asia Pacific. Twitter is used disproportionately more in Latin America (45%) than other regions for livestream shopping.

Figure 6. Platforms Used for Livestreaming, by Companies’ Geographic Region (% of Respondents) [caption id="attachment_147385" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple optionsBase: 220 respondents who are currently using livestreaming as a sales or promotional channel, surveyed in April 2022

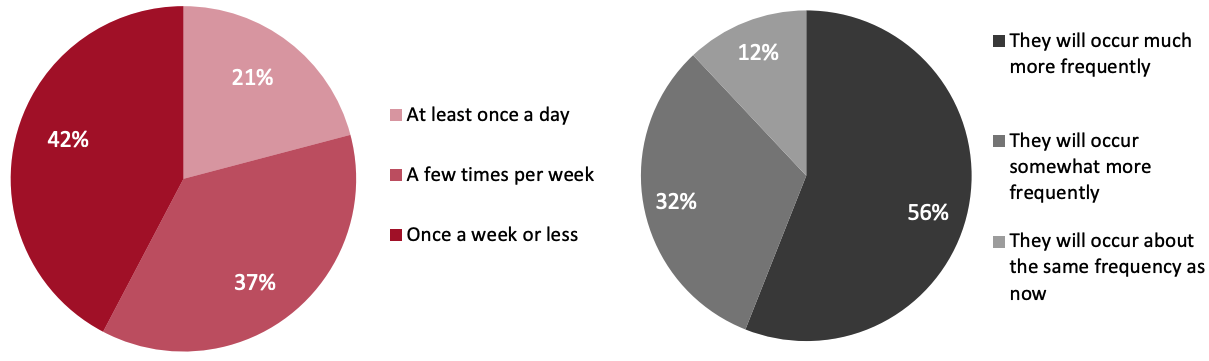

Source: Coresight Research[/caption] Regular Schedules Having a regular cadence of livestreaming sessions is a key strategy for brands and retailers to build a base of repeat viewers, fostering new consumer habits. Regular live-shopping schedules enable brands and retailers to become an ongoing part of their customers’ lives. Our survey found that 58% of retail companies that currently use livestreaming hold live sessions more than once a week. Even more telling about the potential of livestreaming e-commerce and the value that retail companies believe the channel provides is that 88% of livestream users expect to increase the frequency of live shopping events in the next 12–24 months—and no companies plan to decrease the frequency.

Figure 7. Current Frequency of Livestream Shopping Events (Left) and Expectations To Change That Frequency in the Next 12–24 Months (% of Respondents) [caption id="attachment_147386" align="aligncenter" width="700"]

Base: 220 respondents who are currently using livestreaming as a sales or promotional channel, surveyed in April 2022

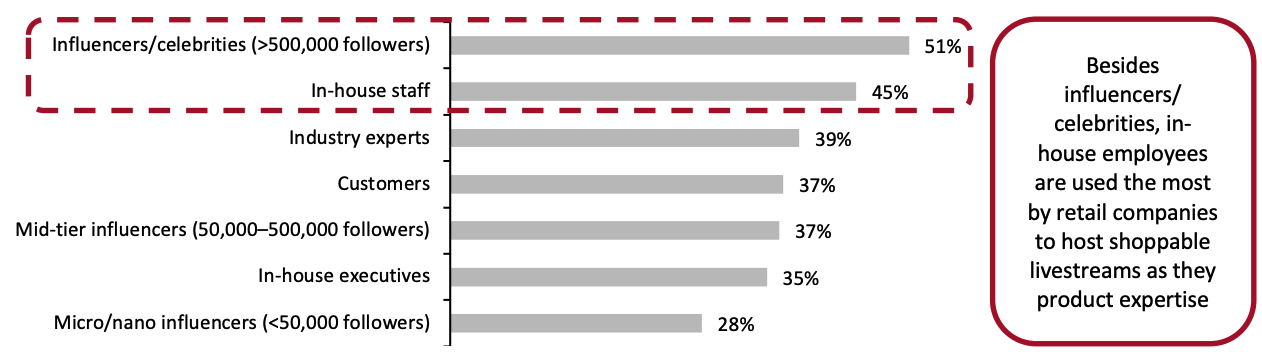

Base: 220 respondents who are currently using livestreaming as a sales or promotional channel, surveyed in April 2022Source: Coresight Research[/caption] Engaging Hosts Livestream hosts are essential in attracting a wide audience and creating an authentic connection with viewers. Influencers/celebrities are the most popular type of host, used by 51% of livestreaming retail companies, according to our survey (see Figure 8). This is likely because they bring in their own established follower and fan bases, which can boost brand exposure. However, in-house staff follow closely behind, with 45% of companies that use livestreaming using employees as livestream hosts. In-house staff can be effective in driving conversion through livestreaming, as they provide product and brand expertise; they are able to effectively demonstrate products and answer viewers’ questions. Knowledgeable industry experts, customers, mid-tier influencers and even charismatic company founders are also used to host live shopping events. Hosts such as these are typically passionate about the featured products and so can come across to viewers as more personable and relatable—and possibly more trustworthy in the case of customers. It is critical for hosts to communicate genuine enthusiasm to the audience to create a strong customer relationship and thus drive sales.

Figure 8. Types of Host Used by Retail Companies in Their Livestream Shopping Events (% of Respondents) [caption id="attachment_147387" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple optionsBase: 220 respondents who are currently using livestreaming as a sales or promotional channel, surveyed in April 2022

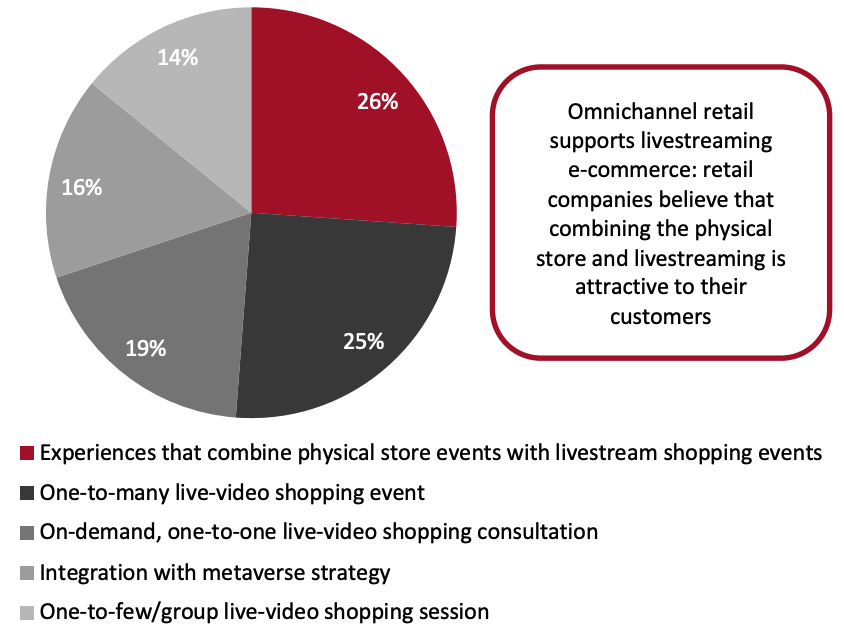

Source: Coresight Research[/caption] Creative Formats To attract both first-time and return viewers to livestream events, brands and retailers must be mindful of the formats that their target audience are looking for when they engage in live-video shopping. We asked the surveyed retail companies that use livestreaming what they believe to be the most appropriate event format to target their customers: Topping the list are livestream shopping events that tie-in with events at physical stores, cited by 26% of respondents, underscoring how livestreaming has become part of the omnichannel retail ecosystem. Also notable is that one-quarter of retail companies that use livestreaming believe that one-to-many live shopping events are most appropriate for their customers (see Figure 9). This format is centered around entertainment and current trends; it often features influencer collaborations and new product launches to attract hundreds of thousands of viewers.

Figure 9. Most Appropriate Livestream Shopping Event Format for Retail Companies’ Customers (% of Respondents) [caption id="attachment_147388" align="aligncenter" width="700"]

Base: 220 respondents who are currently using livestreaming as a sales or promotional channel, surveyed in April 2022

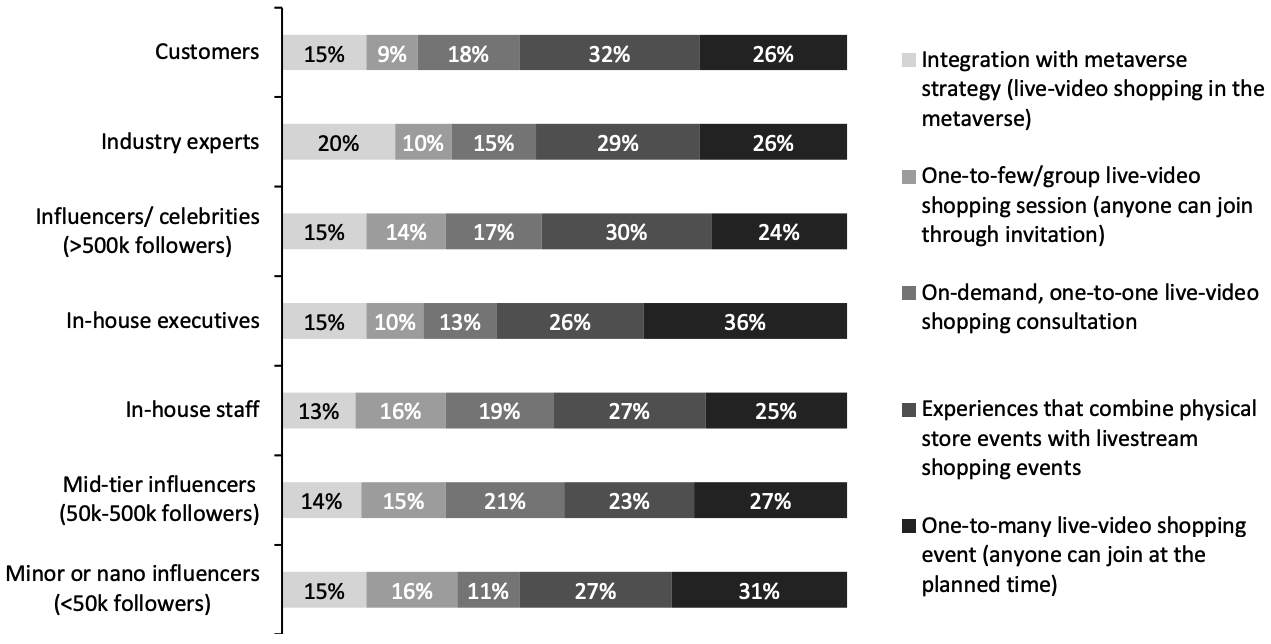

Base: 220 respondents who are currently using livestreaming as a sales or promotional channel, surveyed in April 2022Source: Coresight Research[/caption] The format of a livestream event can influence a retail company’s choice of host as they look to attract customers. In Figure 10, we break down the types of host used by retail companies for different livestreaming formats. Our survey found that for one-to-many events, in-house executives are the most used type of host, likely because their status and reputation attracts viewers and they have the final say on heavy discounts. Notably, for one-to-one virtual consultations, in-house staff and mid-tier influencers are the most popular choice of host among retail companies. This is because they are able to provide in-depth product details and recommendations that are tailored to each shopper’s needs. We can see that industry experts are the most-used type of host for live-video shopping events in the metaverse—an emerging technology that we are seeing gain traction in the retail industry. We discuss technology-enabled live shopping in more detail in the next section.

Figure 10. Types of Host Used by Retail Companies in Their Livestream Shopping Events, by Format (% of Respondents) [caption id="attachment_147389" align="aligncenter" width="700"]

Base: 220 respondents who are currently using livestreaming as a sales or promotional channel, surveyed in April 2022

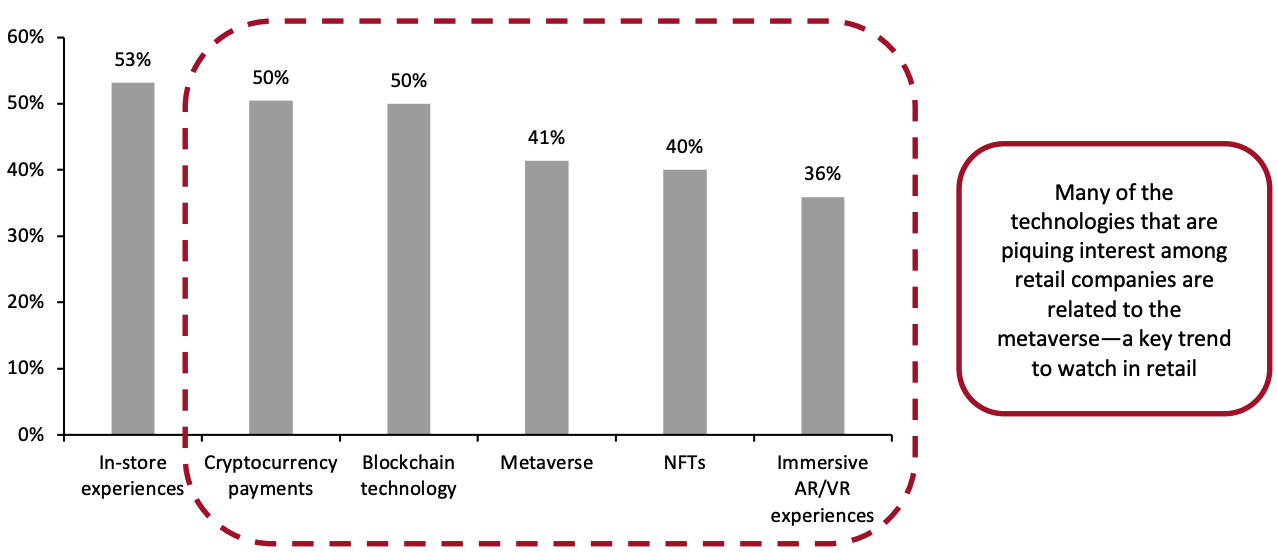

Base: 220 respondents who are currently using livestreaming as a sales or promotional channel, surveyed in April 2022Source: Coresight Research[/caption] Live Shopping in the Metaverse and Other Emerging Technologies Brands and retailers are increasingly experimenting with meeting customers through various technology-powered live shopping experiences. Our survey revealed that, over the next 12 months, more than half (53%) of surveyed companies that use livestreaming are considering investing more heavily in technology that enhances the in-store experience—making it the topmost focus for technology investment (see Figure 11). This highlights the continued importance of physical and omnichannel retail even following the pandemic-led acceleration of e-commerce. Interestingly, the metaverse and NFTs (non-fungible tokens) are set to attract investments from around four in 10 retail companies that currently use livestreaming, according to our survey. Coresight Research has identified the expanding metaverse as a key trend to watch in retail. Virtual- and extended-reality environments provide an opportunity for brands and retailers to offer shoppers immersive and engaging content and exclusive experiences. Other next-generation technologies that are piquing investment interest from retail companies included cryptocurrency payments and blockchain, which support the adoption and development of the metaverse. While the metaverse is at its infancy, brands and retailers are already testing the waters, as Coresight Research explores in our Metaverse Latest series of reports.

Figure 11. Emerging Channels/Technologies That Retail Companies Are Considering Investing in Over the Next 12 Months (% of Respondents) [caption id="attachment_147390" align="aligncenter" width="700"]

Base: 220 respondents who are currently using livestreaming as a sales or promotional channel, surveyed in April 2022

Base: 220 respondents who are currently using livestreaming as a sales or promotional channel, surveyed in April 2022Source: Coresight Research[/caption]

What We Think

As the livestreaming race continues to take shape, brands and retailers are banking on cost-effective and impactful strategies to reach more online shoppers. Retail companies are leveraging social media platforms to reach new customers while also establishing livestreaming via owned websites to gain control over customer data. Successful live shopping events require creativity, an informed choice of livestream host and the courage to make mistakes. Implications for Brands/Retailers- We are seeing the adoption of livestreaming e-commerce expand rapidly across a broad range of retail sectors, and investment in the channel is high: 28% of retail companies that are currently using livestreaming have allocated more than 50% of their total annual marketing budget on livestreaming in 2022, according to our survey.

- We expect brands’ and retailers’ proprietary websites to take an important role in establishing livestreaming programs moving forward, despite the current dominance of social media platforms.

- As the metaverse gains traction in retail, marketers should look to join establish a virtual presence to drive digital footfall and generate revenue through a new stream. Our surveyed showed that many retail companies that are currently using livestreaming are open to the opportunities presented by metaverse-related emerging technologies such as NFTs, blockchain an cryptocurrency. This will be an interesting area to watch in the live shopping space.

Methodology

This study is based on the analysis of data from an online survey of 278 executives across brands, retailers, and manufacturers around the world (220 of which currently use livestreaming). Coresight Research conducted the survey on April 14–21, 2022. Respondents in the survey satisfied the following criteria:- Organizations based in the North America, Latin America, EMEA and Asia Pacific

- Organizations sell products through physical locations or online

- Associated with apparel, beauty, luxury goods, consumer electronics, department store, supermarket or mass merchant/wholesale club verticals

- Holding roles with significant decision-making responsibilities for livestreaming