albert Chan

On January 9, 2019, Deborah Weinswig, CEO and Founder of Coresight Research, held a talk with Cecilia Tian, Vice General Manager of the Smart Retail Strategic Partnership Department at Tencent, and Chen Zhang, Chief Technology Officer at JD.com, at the CES convention in Las Vegas. Weinswig also presented on “Understanding the Asian Retail Market,” including eight insights from China; we summarize that presentation in this report.

[caption id="attachment_74721" align="aligncenter" width="664"] Cecilia Tian, Vice General Manager of the Smart Retail Strategic Partnership Department at Tencent, speaks with Deborah Weinswig, CEO and Founder, Coresight Research

Cecilia Tian, Vice General Manager of the Smart Retail Strategic Partnership Department at Tencent, speaks with Deborah Weinswig, CEO and Founder, Coresight Research

Source: Coresight Research[/caption] [caption id="attachment_74722" align="aligncenter" width="654"] Chen Zhang, Chief Technology Officer at JD.com, with Deborah Weinswig, CEO and Founder, Coresight Research

Chen Zhang, Chief Technology Officer at JD.com, with Deborah Weinswig, CEO and Founder, Coresight Research

Source: High-Tech Retailing[/caption] Coresight Research’s Core Framework for AI in Retail

Weinswig presented Coresight Research’s proprietary CORE framework for AI in retail.

Coresight Research’s Core Framework for AI in Retail

Weinswig presented Coresight Research’s proprietary CORE framework for AI in retail.

Communication is a key component in Coresight Research’s proprietary CORE framework. AI is helping retailers improve the customer experience without adding staff:

Communication is a key component in Coresight Research’s proprietary CORE framework. AI is helping retailers improve the customer experience without adding staff:

Coresight Research believes AI can help retailers create better consumer experiences:

Coresight Research believes AI can help retailers create better consumer experiences:

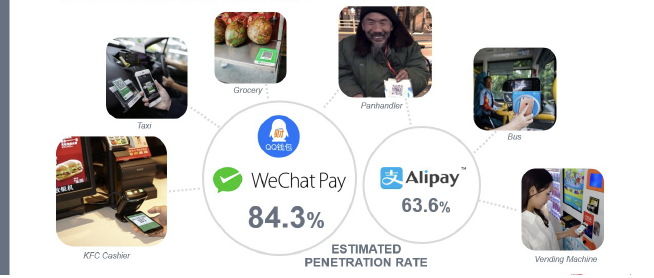

In China, you need only your smartphone. Almost everything can be ordered and paid for via WeChat Pay. In the U.S., consumers have not (yet) adapted to mobile payments on this scale.

In China, you need only your smartphone. Almost everything can be ordered and paid for via WeChat Pay. In the U.S., consumers have not (yet) adapted to mobile payments on this scale.

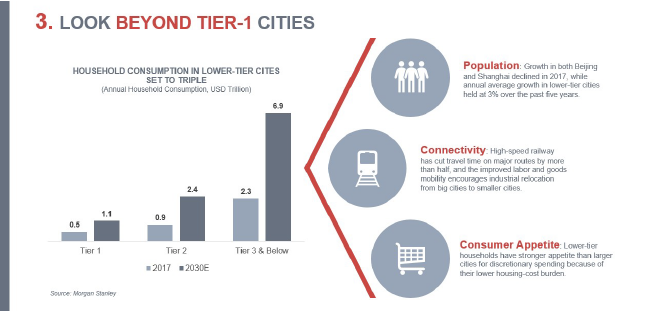

China is not only about tier-1 cities such as Shanghai and Beijing: Household consumption in lower-tier cities is expected to triple by 2030:

China is not only about tier-1 cities such as Shanghai and Beijing: Household consumption in lower-tier cities is expected to triple by 2030:

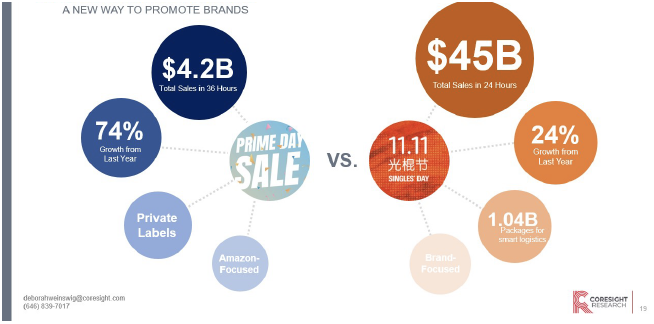

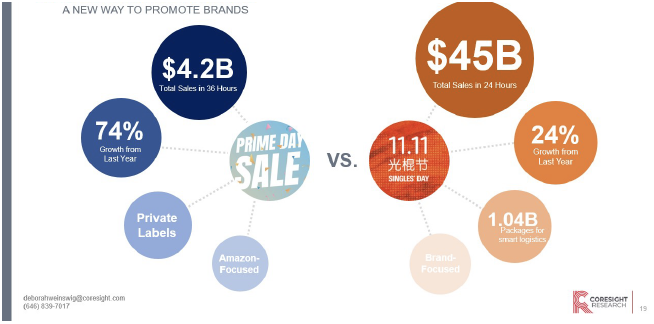

Shopping festivals are a new way to promote brands in China:

Shopping festivals are a new way to promote brands in China:

Companies are developing robotics for package distribution and organization:

Companies are developing robotics for package distribution and organization:

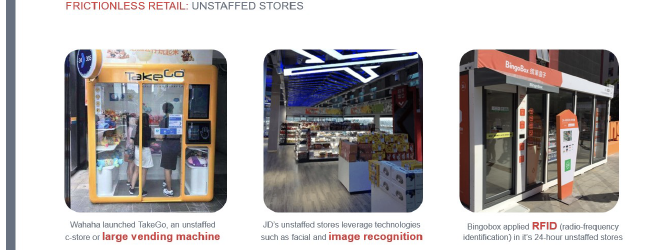

China is creating a series of unstaffed stores, similar to Amazon Go, as a form of frictionless retail, featuring:

China is creating a series of unstaffed stores, similar to Amazon Go, as a form of frictionless retail, featuring:

Cecilia Tian, Vice General Manager of the Smart Retail Strategic Partnership Department at Tencent, speaks with Deborah Weinswig, CEO and Founder, Coresight Research

Cecilia Tian, Vice General Manager of the Smart Retail Strategic Partnership Department at Tencent, speaks with Deborah Weinswig, CEO and Founder, Coresight ResearchSource: Coresight Research[/caption] [caption id="attachment_74722" align="aligncenter" width="654"]

Chen Zhang, Chief Technology Officer at JD.com, with Deborah Weinswig, CEO and Founder, Coresight Research

Chen Zhang, Chief Technology Officer at JD.com, with Deborah Weinswig, CEO and Founder, Coresight ResearchSource: High-Tech Retailing[/caption]

Coresight Research’s Core Framework for AI in Retail

Weinswig presented Coresight Research’s proprietary CORE framework for AI in retail.

Coresight Research’s Core Framework for AI in Retail

Weinswig presented Coresight Research’s proprietary CORE framework for AI in retail.

Communication is a key component in Coresight Research’s proprietary CORE framework. AI is helping retailers improve the customer experience without adding staff:

Communication is a key component in Coresight Research’s proprietary CORE framework. AI is helping retailers improve the customer experience without adding staff:

- Retailers such as Target and DSW are using chatbots to engage with customers.

- Sephora partnered with Google to bring beauty tutorials to Google Home Hub.

- AI-powered chat centers can provide 24-hour customer services at a reasonable cost.

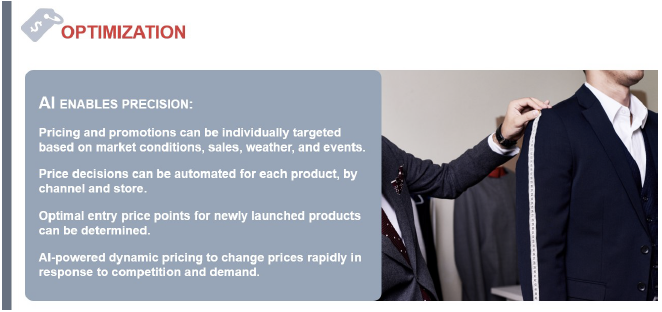

- Coresight Research believes pricing optimization is one of the top priorities for retailers in 2019.

- Retailers can now track consumers’ footprints across multiple browsers, differentiate customers by geography, market environment and other factors and adjust in real-time personalized products, pricing and promotion.

- Dynamic pricing reflecting supply and demand has been used for many years by hotels, airlines and others. Now, it’s coming to retail.

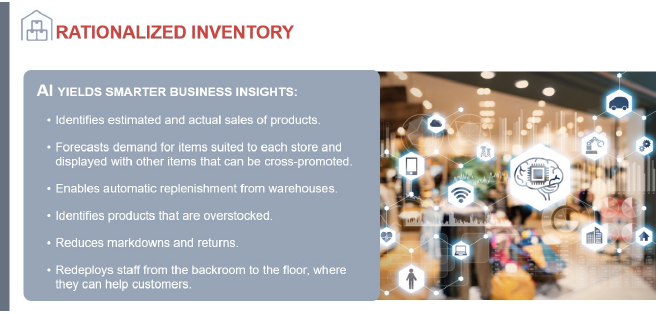

- Rationalization of inventory can be achieved through AI applications.

- Companies are using AI-driven robots for real-time inventory monitoring.

Coresight Research believes AI can help retailers create better consumer experiences:

Coresight Research believes AI can help retailers create better consumer experiences:

- Amazon Go is an example of frictionless shopping.

- Lowe’s uses in-store autonomous robots to help customers navigate the stores.

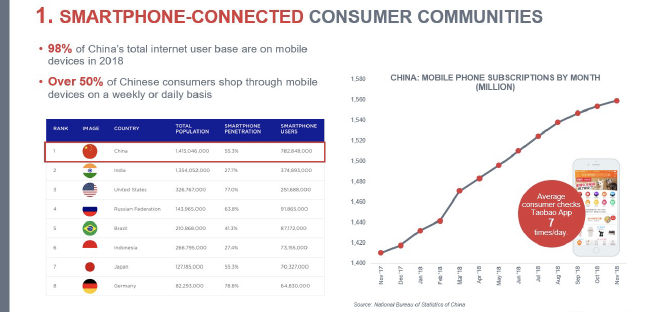

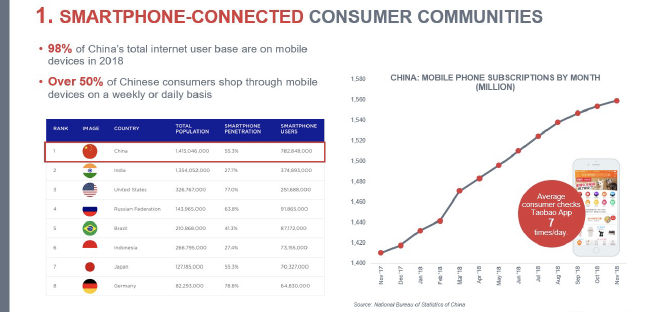

- China’s consumers are tech-savvy and browse mainly on mobile devices.

- There are over 1.5 billion mobile phone subscriptions in China – more than one phone for every man, woman and child.

- There are more than 780 million smartphone users in China, more than three times the 251 million in the U.S.

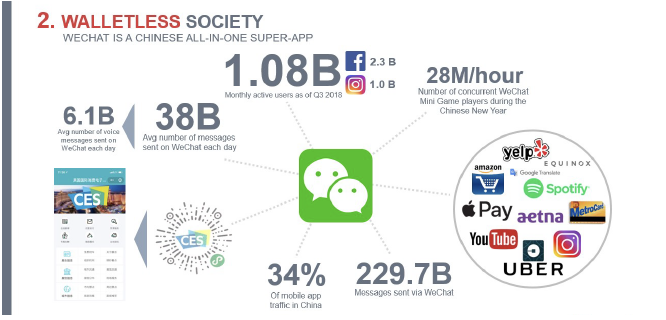

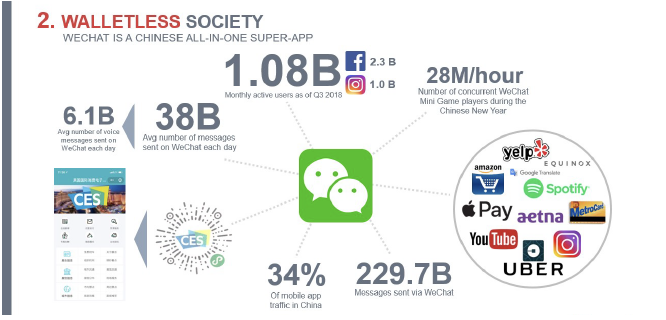

- WeChat is a Chinese all-in-one super-app that started as an instant messaging service with social network functions.

- The company has developed mini apps that run within WeChat so users can access third-party apps, such as the Chinese equivalent of Yelp, Apple Pay, Spotify, Uber, etc. - without exiting WeChat. Starbucks even has a WeChat mini app in addition to its own stand-alone app.

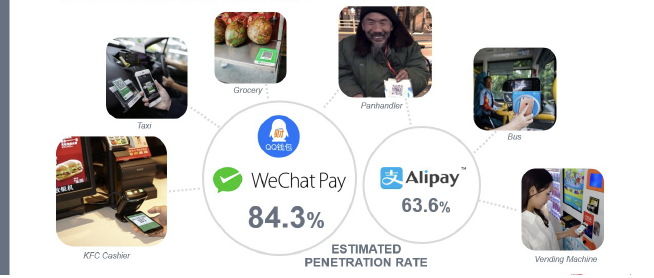

In China, you need only your smartphone. Almost everything can be ordered and paid for via WeChat Pay. In the U.S., consumers have not (yet) adapted to mobile payments on this scale.

In China, you need only your smartphone. Almost everything can be ordered and paid for via WeChat Pay. In the U.S., consumers have not (yet) adapted to mobile payments on this scale.

- Estimated penetration rate for WeChat Pay is 84.3% and 63.6% for Alipay.

- Mobile payments can be used at KFC restaurants, taxis, at grocery stores, busses, vending machines – and many more!

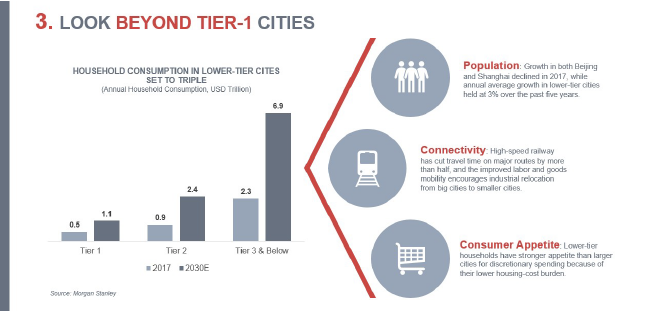

China is not only about tier-1 cities such as Shanghai and Beijing: Household consumption in lower-tier cities is expected to triple by 2030:

China is not only about tier-1 cities such as Shanghai and Beijing: Household consumption in lower-tier cities is expected to triple by 2030:

- Households in tier-3 and below cities are projected to consume $6.9 trillion by 2030.

- Population growth, increased connectivity and a growing consumer appetite will fuel consumption.

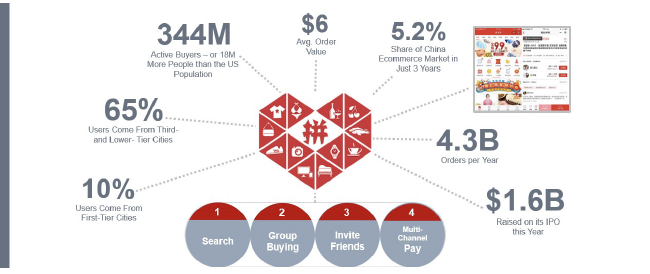

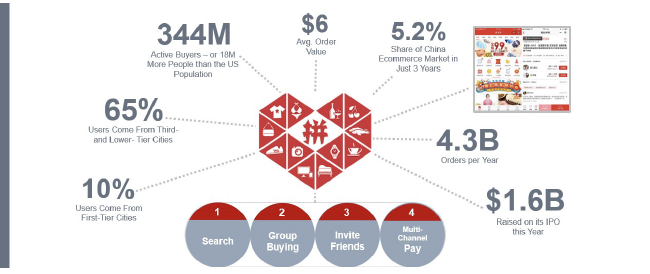

- Pinduoduo is an e-commerce platform that offers group deals for lower-end goods and encourages users to invite friends to participate for a lower price.

- Founded in September 2015, the company is growing rapidly in lower-tier cities. The company raised $1.6 billion in its IPO in July 2018.

- Chinese consumers celebrate more shopping festivals: Nine shopping festivals in China versus three in the U.S last year.

- Coresight expects to see more shopping events that will give retailers and brands opportunities to create special products and drive consumer engagement.

Shopping festivals are a new way to promote brands in China:

Shopping festivals are a new way to promote brands in China:

- There were $45 billion total sales in 24 hours on China’s Singles’ Day (created by Alibaba), while Amazon Prime Day generated $4.2 billion total sales in 36 hours.

- China’s Singles’ Day grew 24%, almost $8.8 billion, in 2018 over 2017, while Amazon Prime Day grew 74%, approximately $1.8 billion in sales.

- There were over one billion packages delivered using smart logistics on Singles’ Day.

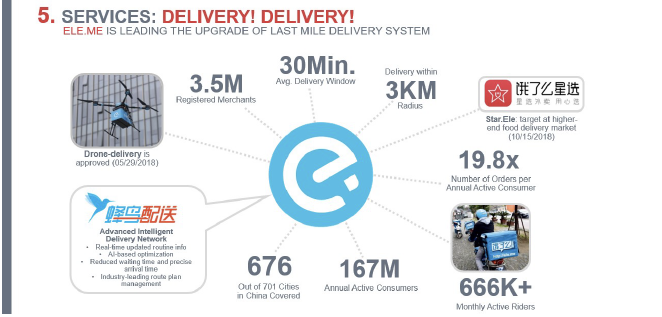

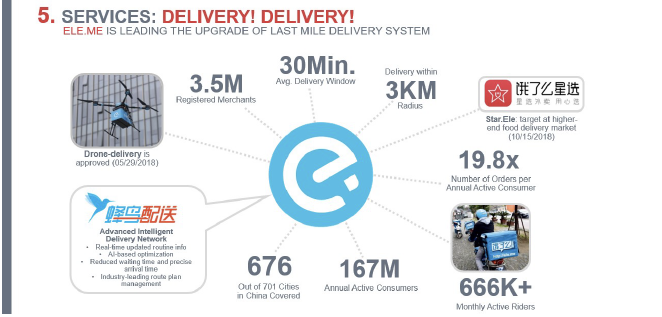

- Chinese companies focus on delivery services. Ele.me, a food ordering and delivery platform, is leading the upgrade of last mile delivery in China.

- The company is building an advanced intelligent delivery network to increase efficiency.

- By taking advantage of plentiful and low-cost labor in China, retailers can rely on fast and accurate delivery systems.

- Companies in China are also starting to offer white-glove delivery services and lockers for delivery.

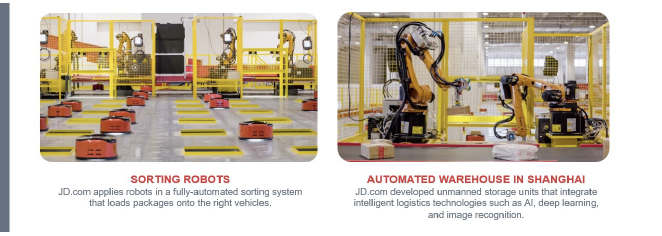

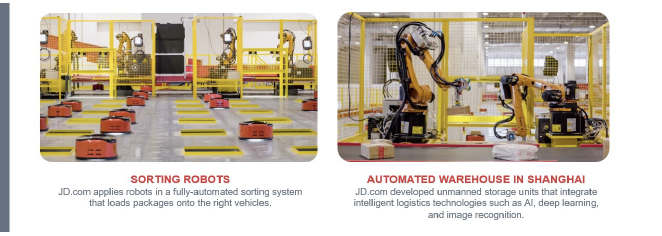

Companies are developing robotics for package distribution and organization:

Companies are developing robotics for package distribution and organization:

- JD.com launched proprietary delivery drones.

- JD.com uses robots with facial recognition technology to deliver packages on university campuses and industrial parks in China.

- JD.com uses robots for a fully-automated sorting system.

- JD.com developed unstaffed storage units.

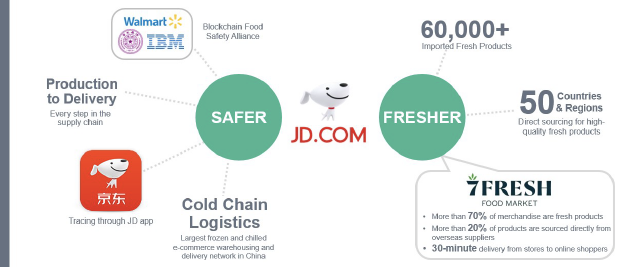

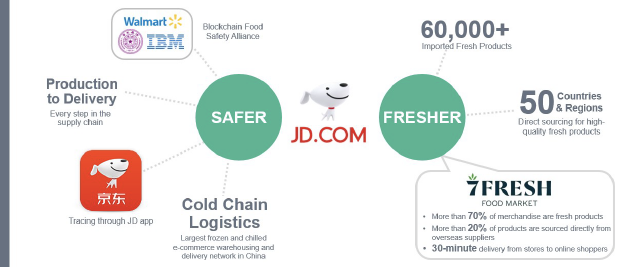

- Quality assurance and fresh, safe food attract loyalty.

- JD.com offers rapid delivery of fresh and safe food, as does Alibaba’s Freshippo.

- The company is expanding its 7Fresh Food Market, which offers 30-minute delivery of online food orders.

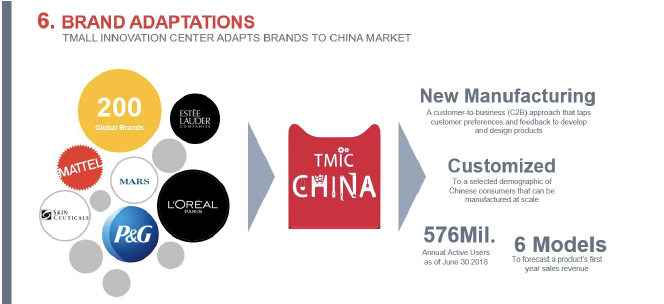

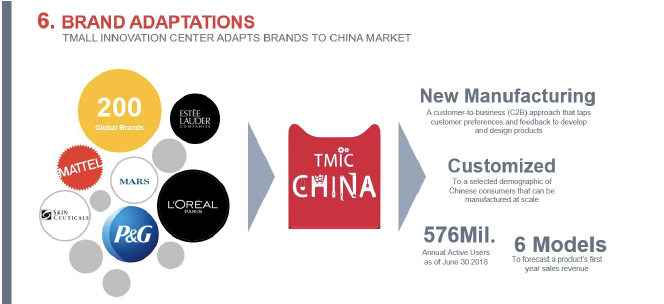

- TMall Innovation Center (TMIC) is helping brands adapt to Chinese consumers.

- TMIC can identify elements such as flavor and smell that is favored by Chinese consumers for product development: advised by TMIC, Mars Wrigley Confectionary developed a spicy Snickers bar – and sales surpassed $1.4 million in the first eight months.

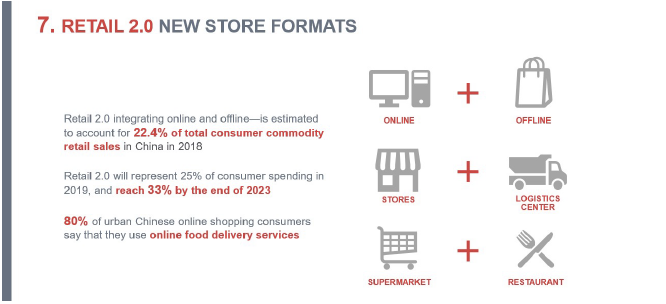

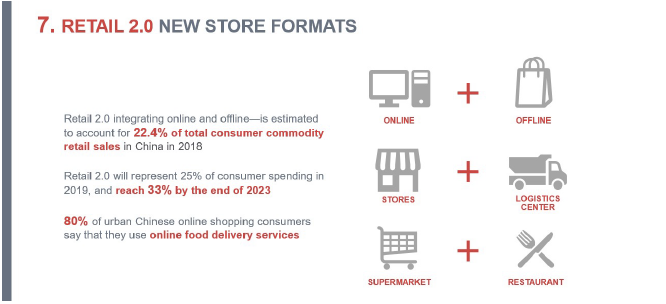

- Retail 2.0 will be a combination of six elements: online and offline, stores and logistics centers, supermarkets and restaurants.

- Companies such as Alibaba and JD.com are acquiring brands, retailers and retail tech to expand their reach.

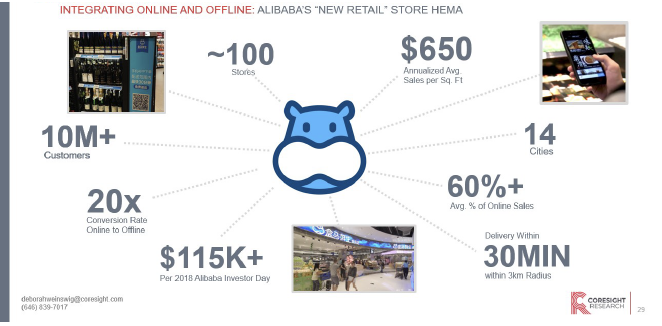

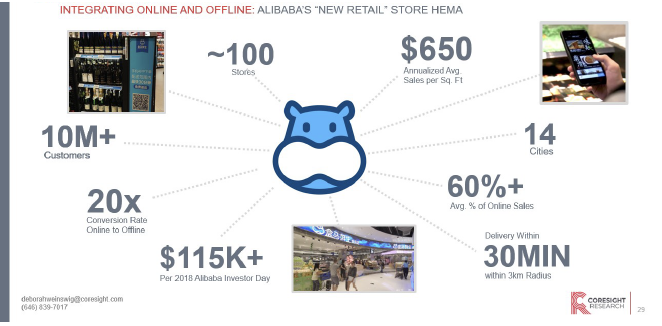

- Alibaba’s “new retail” store Freshippo (formerly called Hema) is a typical example of integrating online and offline.

- Successful integration leads to a 20x conversion rate online to offline.

- Customers can order food in store and online using an app from Freshippo.

- JD.com has been pushing consumer-centered, boundaryless retail with mobile.

- Customers can connect smart home devices, order online and pick up in store through JD.com.

- The company is promoting seamless transition across platforms.

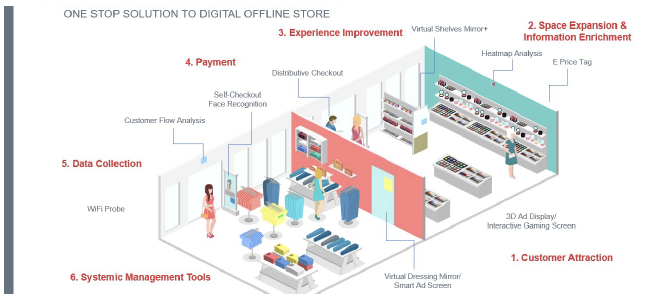

- Retail 2.0 will require new store formats.

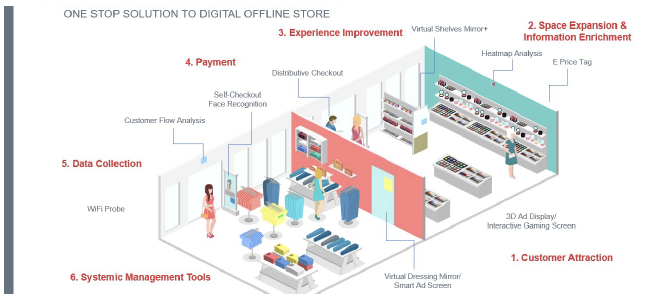

- One-stop solution to digital offline stores includes six different elements.

- Retail 2.0 is also changing the customer expectation.

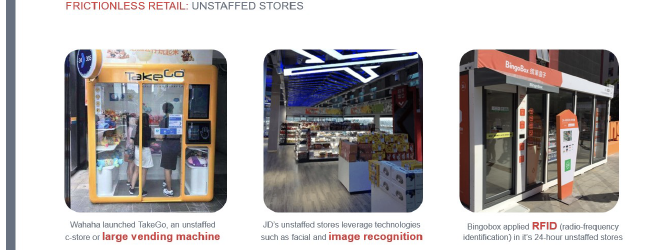

China is creating a series of unstaffed stores, similar to Amazon Go, as a form of frictionless retail, featuring:

China is creating a series of unstaffed stores, similar to Amazon Go, as a form of frictionless retail, featuring:

- Large vending machines that customers can walk into.

- Image recognition and radio-frequency identification applications for unstaffed stores.

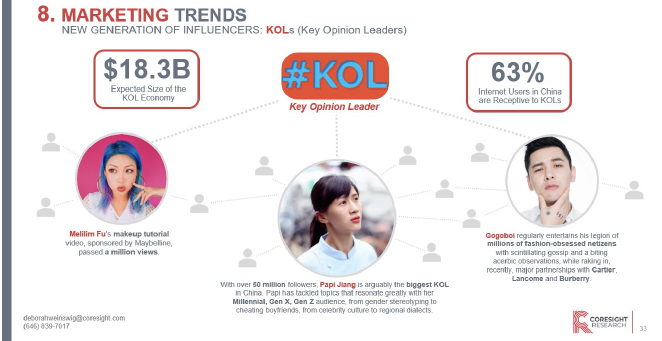

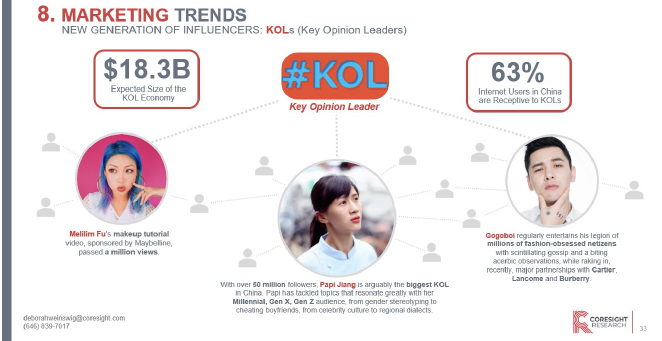

- Key Opinion Leaders (KOLs) are a must for brand marketing strategies.

- Lead by Melilim Fu, Papi Jiang and Gogoboi, the KOL market is estimated to be worth $18.3 billion.

- And, 63% of Chinese Internet users are receptive to KOL influence.

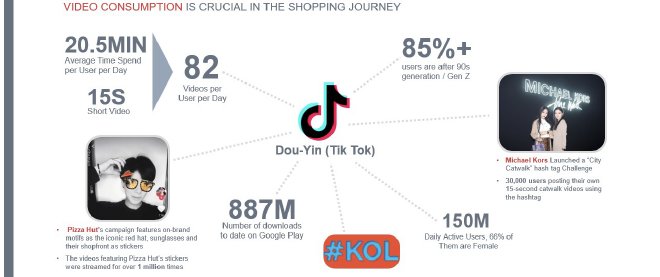

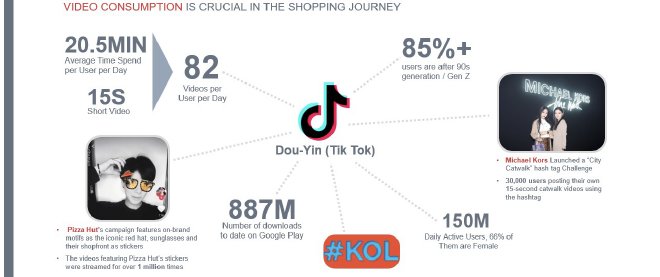

- Video consumption is crucial in the shopping journey and Tik Tok is a leader in short video platforms.

- The average Tik Tok user watches 82 videos per day. The app has 150 million daily active users: 66% female, and there have been 887 million downloads to date on Google Play.

- Coresight Research sees even more rapid adoption of video marketing in the U.S.

- China’s word-of-mouth shopping culture is driving social commerce and creating communities.

- Founded in 2013, Red (Xiaohongshu) is a leader in user-centric social media and e-commerce platforms on which consumers can share and read other people’s shopping notes and tips.

- Luxury brands have been using multiform marketing strategies in China.

- Chinese consumers represent 38% of global luxury spend.

- A number of luxury brands have experienced a decrease in Chinese tourist shoppers offset by a pickup in sales in mainland China.