DIpil Das

Introduction

Chinese consumers are enthusiastic online shoppers, and fresh food has become a category they increasingly buy online. Although the demand for everyday foods offers promise, handling and delivering perishable food items also presents challenges. Fresh food e-commerce is no piece of cake. In this report, we look at developments in fresh food e-commerce in China to understand the consumers who buy fresh food online and how New Retail plays a role in this emerging space.Fresh Food E-Commerce Gains Momentum in China

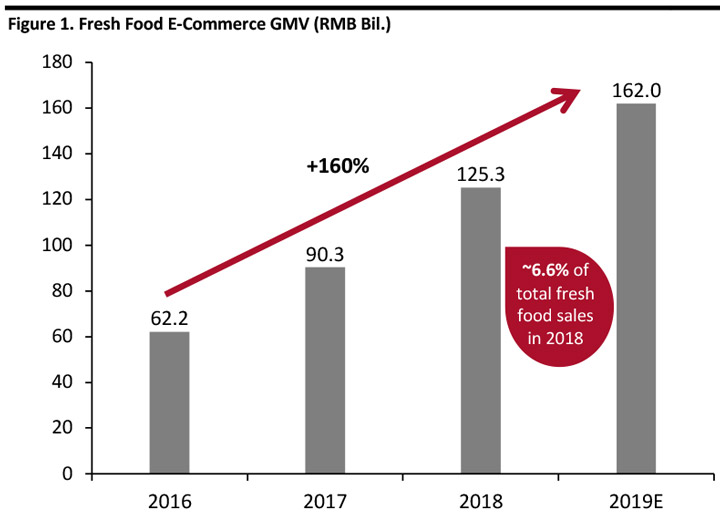

It has become popular for Chinese consumers to go to e-commerce platforms to buy fresh food. The gross merchandise volume (GMV) of China’s fresh food e-commerce market is expected to increase 160% to ¥162.0 billion ($24.1 billion) in 2019 from ¥62.2 billion ($9.2 billion) in 2016, according to China-based data analytics firm iiMedia. Over the same period (2016 to 2019), China-based consultancy iResearch estimates the GMV of overall e-commerce in China will increase 62% to ¥32.7 trillion ($4.9 trillion). According to China-based research institute Qianzhan, total fresh food sales in China were ¥1.9 trillion ($283.6 billion) in 2018, which implies fresh food e-commerce accounted for around 6.6% of the total. [caption id="attachment_88746" align="aligncenter" width="720"] Source: iiMedia/Coresight Research[/caption]

Source: iiMedia/Coresight Research[/caption]

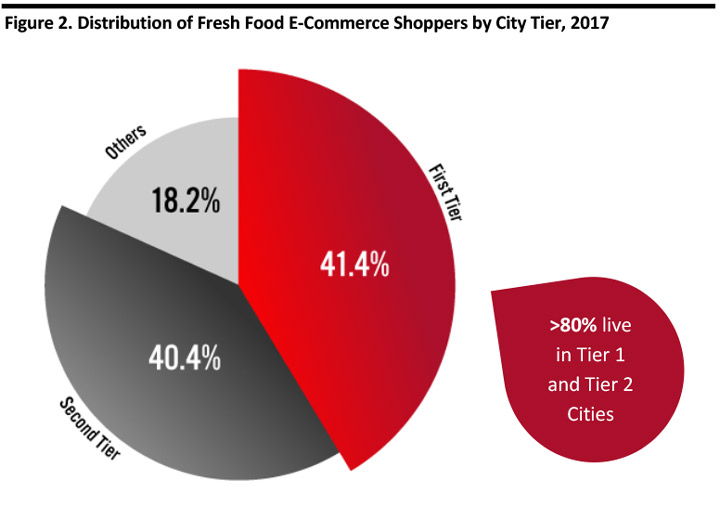

Shoppers: Young, High-Income, from First and Second Tier Cities

Most fresh food e-commerce shoppers are millennials—those born in the 1980s and 1990s. According to iiMedia, over 80% of fresh food e-commerce shoppers were aged 35 or below in 2018, and 55% had a monthly income of ¥5,000 ($740) or above, while only 43% of overall e-commerce shoppers had a monthly income of ¥5,000 ($740) or above. Shoppers are concentrated in first and second tier cities as the typically busier lifestyles there create demand for fresh food delivery, and higher incomes mean consumers are more willing to pay for the convenience of home delivery. According to iResearch, over 80% of fresh food e-commerce shoppers were from first and second tier cities in China in 2017. [caption id="attachment_88724" align="aligncenter" width="720"] Source: iResearch/Coresight Research[/caption]

Source: iResearch/Coresight Research[/caption]

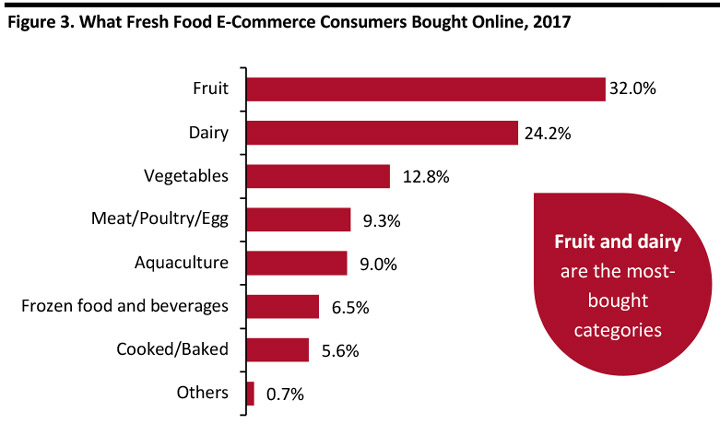

Shoppers Buy Fruit and Dairy Products Most Frequently and Often Buy in Fixed Quantities

Fruits and dairy products were the most frequently purchased categories for fresh food e-commerce shoppers. According to iResearch, fruit was the most commonly bought fresh food online, with 32.0% of shoppers buying fruit while dairy came in second at 24.2% in 2017. [caption id="attachment_88745" align="aligncenter" width="720"] Source: iResearch[/caption]

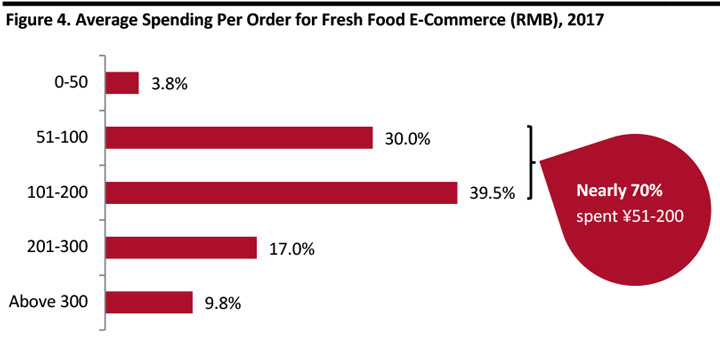

The same study from iResearch revealed that most shoppers spent ¥51-200 ($8-30) on average per order, which is high for the fruit category. This is because shoppers usually have to buy in fixed quantities as e-commerce operators aim to optimize courier costs. For example, when buying New Zealand-imported apples on Yiguo.com, customers have to buy at least six for a price range of ¥36-70, depending on total weight.

[caption id="attachment_88726" align="aligncenter" width="720"]

Source: iResearch[/caption]

The same study from iResearch revealed that most shoppers spent ¥51-200 ($8-30) on average per order, which is high for the fruit category. This is because shoppers usually have to buy in fixed quantities as e-commerce operators aim to optimize courier costs. For example, when buying New Zealand-imported apples on Yiguo.com, customers have to buy at least six for a price range of ¥36-70, depending on total weight.

[caption id="attachment_88726" align="aligncenter" width="720"] Source: iResearch/Coresight Research[/caption]

Source: iResearch/Coresight Research[/caption]

Convenience and Time-Saving Are Key Factors Why Consumers Buy Fresh Food on E-Commerce Platforms

According to BigData-Research, over half of fresh food e-commerce shoppers in China said they bought fresh food online to save time, for the convenience of home delivery and the greater range of products. This aligns with the fact that many fresh food e-commerce consumers live in first- and second-tier cities and tend to have a more hectic lifestyles, so they value convenience. The greater variety also attracts online consumers. Price plays a relatively less important role, although nearly half of shoppers said they found buying fresh food online more economical, according to the same study by BigData-Research. [caption id="attachment_88727" align="aligncenter" width="720"] Source: BigData-Research[/caption]

Source: BigData-Research[/caption]

Types of Fresh Food E-Commerce

There are three types of fresh food e-commerce operations in China: vertical fresh food e-commerce specialists, comprehensive e-commerce platforms that operate a separate fresh food e-commerce channel and online-to-offline (O2O) players. Regardless the type of operation, fresh food e-commerce possesses the following characteristics:- Product sourcing: E-commerce operators source fresh foods either through wholesalers or directly from farms.

- Logistics: Needs cold chain abilities. Delivery time varies from 30 minutes for O2O players to one to two days for online e-commerce platforms.

- SKUs: Can number in the thousands and exceed that of a physical retailer as products are not confined by physical store size.

Yiguo.com website

Yiguo.com website Source: Yiguo.com [/caption] The company has almost 4,000 SKUs and sources fresh products from 23 countries and regions. It initially sold fruit only and gradually expanded its categories to include vegetables, dairy products, meat, seafood and staple foods. It is also common for vertical specialists to build their own logistics infrastructure to have full control over the supply chain. Yiguo.com set up its own cold chain logistics company ExFresh in 2015 as it scaled up. ExFresh can handle over two million orders daily and serve same-day delivery in the first-tier cities of Beijing, Shanghai and Guangzhou. Fresh Food Channels of Comprehensive E-Commerce Platforms Comprehensive e-commerce platforms such as Tmall and JD.com have set up separate fresh food channels. These platforms have strong user traffic, robust payment systems and good customer service. JD.com has a particularly large footprint in China’s fresh food e-commerce market and set up a department dedicated to developing its fresh food business in 2016. JD Fresh is JD.com’s fresh food e-commerce platform. The platform has 160,000 SKUs with a wide range of products sourced both locally and internationally. It has a team of professional buyers and overseas sourcing mechanisms to support quality control from source to customer to deliver imported fresh food as quickly as 48 hours. [caption id="attachment_88729" align="aligncenter" width="720"]

Imported seafood from Greenland sold on JD Fresh

Imported seafood from Greenland sold on JD Fresh Source: JD Fresh [/caption] JD Fresh also applies blockchain technology to track the journey from origin to warehouse in real time. JD.com has built the country’s largest cold chain logistics infrastructure, providing fresh food delivery services to over 300 Chinese cities with over 10 cold chain warehouses. Online-to-Offline Players O2O players focus on digital technology and in-store experience, and have the advantage of serving customers in person through physical stores in residential neighborhoods. Alibaba’s Freshippo (formerly known as Hema) fresh food supermarkets and JD.com’s 7Fresh supermarkets are well-known examples. They share common traits:

- A mobile app is the key to connecting online to offline. When customers shop online or offline and pay, they use the supermarkets’ mobile apps.

- In-store technology helps relieve customers’ pain points during the shopping journey. In Freshippo stores, customers can scan product barcodes to get product information. At 7Fresh, smart shopping carts follow shoppers and will get in line for the shopper at checkout.

- Delivery takes as little as 30 minutes within a three-kilometer (just under two miles) radius of the store, enabled by leading online delivery platform ele.me (which Alibaba acquired last April).

- In-store dining is available for customers to enjoy seafood cooked in the stores.

- Stores serve as fulfillment centers to fulfill online orders.

A shopper scans product barcodes to check product information in a Freshippo store

A shopper scans product barcodes to check product information in a Freshippo store Source: Alizila.com [/caption] [caption id="attachment_88731" align="aligncenter" width="720"]

Smart shopping carts in 7Fresh supermarkets

Smart shopping carts in 7Fresh supermarkets Source: Jdcorporateblog.com [/caption] This format of fresh food e-commerce is part of the New Retail initiative in China, which refers to an increasing integration of online and offline commerce powered by technology and data. Mobile payments and logistics play a key role in linking the online and offline retail as demonstrated by Freshippo and 7Fresh fresh food supermarkets.

Challenges Facing Fresh Food E-Commerce

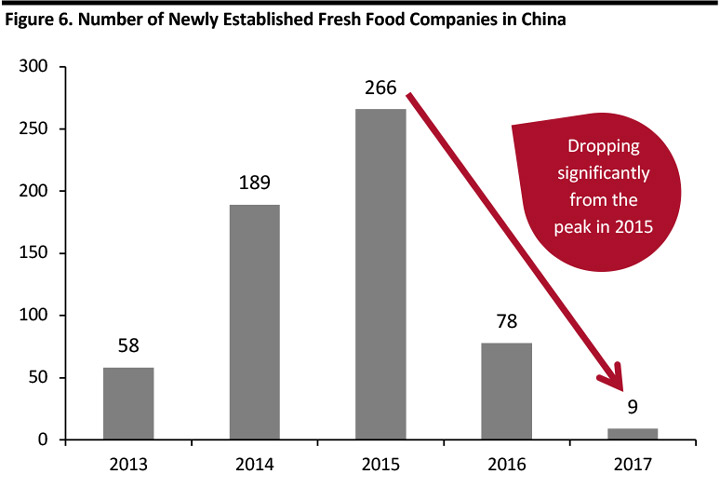

Due to the perishable nature of fresh produce, fresh-food e-commerce requires hefty investments in cold chain logistics to complete last-mile delivery. Consumers also have increasing expectations for delivery time – as fast as one to two hours, particularly in metropolitan areas. According to a 2017 report by China-based technology news media Technode, citing data from the China E-commerce Research Center, the high operation costs and an incomplete cold chain logistics system made 88% of China’s fresh food e-commerce companies lose money, while only 1% were profitable. The lack of capital investment to sustain costly cold chain operations has forced some startups to close and slowed growth of new entrants. According to BigData-Research, the number of newly established fresh food companies in China fell from a peak of 266 in 2015 to only 9 in 2017. [caption id="attachment_88732" align="aligncenter" width="720"] Source: BigData-Research/Coresight Research[/caption]

However, capital funding has flocked to a smaller number of startups which has fostered a few strong players. Take Miss Fresh. Founded in 2014, Miss Fresh already completed its eighth round of fundraising, netting $450 million in September 2018. Internet giant Tencent and investment bank Goldman Sachs were the lead investors in this post-series D funding round.

The capital injection has allowed Miss Fresh to build an extensive cold chain logistics network, including distribution centers and local community warehouses in 20 Chinese cities to deliver locally grown or imported fresh food within two hours – and within one hour for loyalty program members.

Although large players such as Freshippo and 7Fresh can serve customers more efficiently in the neighborhoods, it takes a substantial capital commitment to set up and run the stores. Freshippo stores range from 3,000 to 10,000 square meters as each serves both as a shop and fulfillment warehouse. In an interview with media site Techsina in 2016, Wang Xiaosong, President of JD Fresh, commented that the average net loss in the fresh food e-commerce industry was 35-40%.

Source: BigData-Research/Coresight Research[/caption]

However, capital funding has flocked to a smaller number of startups which has fostered a few strong players. Take Miss Fresh. Founded in 2014, Miss Fresh already completed its eighth round of fundraising, netting $450 million in September 2018. Internet giant Tencent and investment bank Goldman Sachs were the lead investors in this post-series D funding round.

The capital injection has allowed Miss Fresh to build an extensive cold chain logistics network, including distribution centers and local community warehouses in 20 Chinese cities to deliver locally grown or imported fresh food within two hours – and within one hour for loyalty program members.

Although large players such as Freshippo and 7Fresh can serve customers more efficiently in the neighborhoods, it takes a substantial capital commitment to set up and run the stores. Freshippo stores range from 3,000 to 10,000 square meters as each serves both as a shop and fulfillment warehouse. In an interview with media site Techsina in 2016, Wang Xiaosong, President of JD Fresh, commented that the average net loss in the fresh food e-commerce industry was 35-40%.

Innovative Ways to Relieve the Pain for the Industry

Partnering with offline convenience stores and supermarkets has been a cost-efficient way to solve the last-mile delivery problem. This can save online e-commerce players from having to build their own physical stores to expedite delivery. Yiguo.com has partnered with Suning convenience stores to supply the latter fresh food while Suning convenience stores serve as local warehouses to deliver Yiguo products to nearby residents. Some fresh food companies chose to invest in less heavy assets: self-service shelves that provide instant services to customers. Miss Fresh started this trend when it introduced self-service shelves to workplaces: Office workers can buy fresh fruits and some ready-to-eat breakfasts and beverages. Miss Fresh’s local warehouses replenish shelf inventory. [caption id="attachment_88733" align="aligncenter" width="720"] Miss Fresh self-service shelves

Miss Fresh self-service shelves Source: Miss Fresh [/caption] In the coming years, we may see more pure plays become multichannel retailers as fresh food e-commerce operators look to expand into the offline settings. An efficient way will be for consumers to view a large number of SKUs online and pick up products at an offline store or get their order delivered to a nearby store.