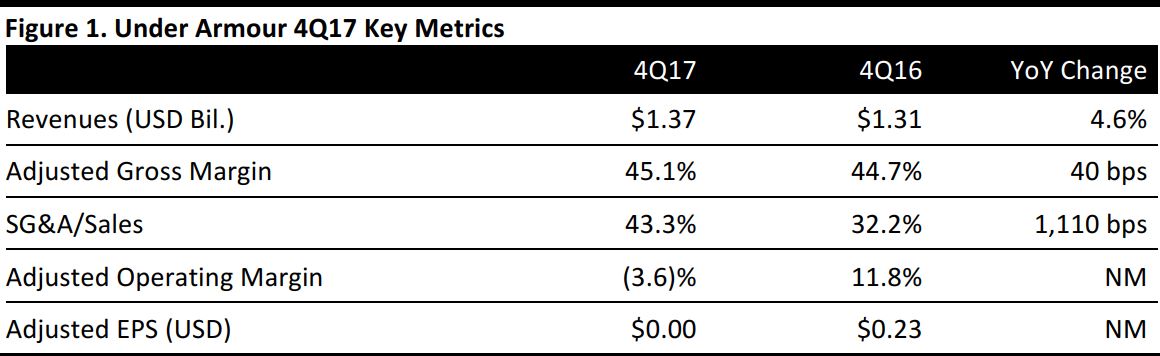

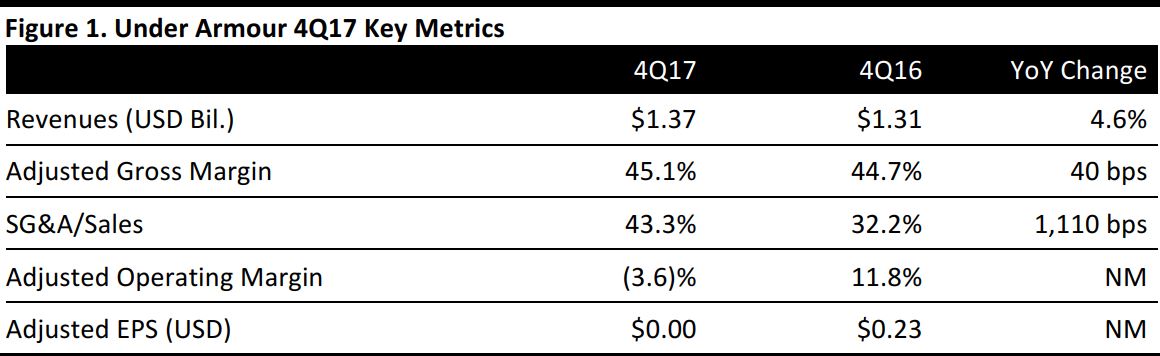

Source: Company reports/FGRT

4Q17 Results

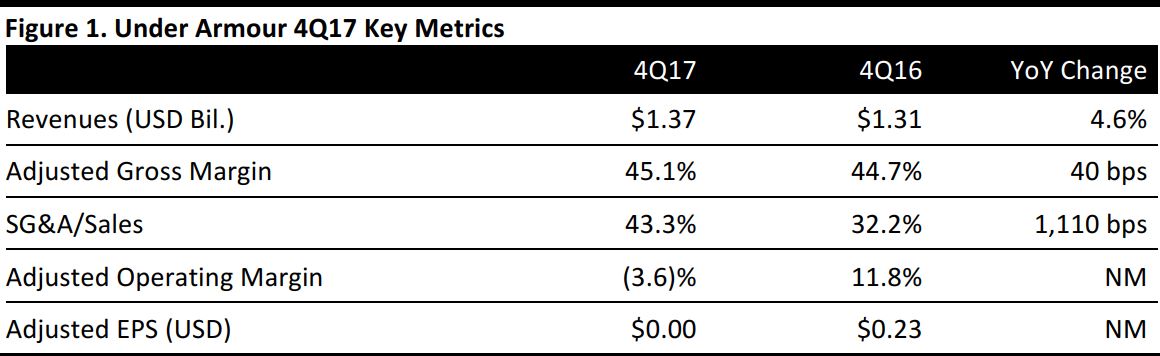

Under Armour reported 4Q17 adjusted EPS of $0.00, in line with the consensus estimate. Total revenues were $1.37 billion, beating the $1.31 billion consensus estimate and up 4.6% year over year.

North American revenues, which make up more than three-quarters of overall revenues, were down 5% in the quarter. International revenues reflected continued strong momentum and represented 46% of the increase in revenue. Within the international business, revenues were up 42% in the Europe, Middle East and Africa region; up 61% in the Asia-Pacific region; and up 28% in Latin America.

By product type, apparel revenues increased by 2%, to $939 million, driven by strength in men’s training and golf that was moderated by declines in outdoors and team sports. Footwear revenues were up 9%, driven by strength in running and men’s training that was mitigated by basketball and youth. Accessories revenues were up 6%, to $446 million, with strength seen in men’s training.

The company’s adjusted gross margin was 45.1%, while inventory increased by 26%, to $1.2 billion, driven by a mid-teen-percentage-rate increase in North America and nearly 50% growth in the international business.

FY18 Outlook

The company announced additional 2018 restructuring plans, following the plan it announced on October 31, 2017. The company now expects to incur $110–$130 million of pretax restructuring and related charges. In addition, it expects up to $25 million in noncash charges, with $10 million in inventory-related charges and up to $15 million of asset-related impairments.

For 2018, Under Armour expects net revenue to be up by low single digits, including a mid-single-digit decline in the North America business and international growth of more than 25%. The company expects full-year EPS of $0.14–$0.19, below the consensus estimate of $0.21. The company expects its gross margin to increase by 50 basis points, to 45.5%, due to lower planned promotions, product costs, channel mix and changes in foreign currency.