Source: Company reports/Fung Global Retail & Technology

4Q16 Results

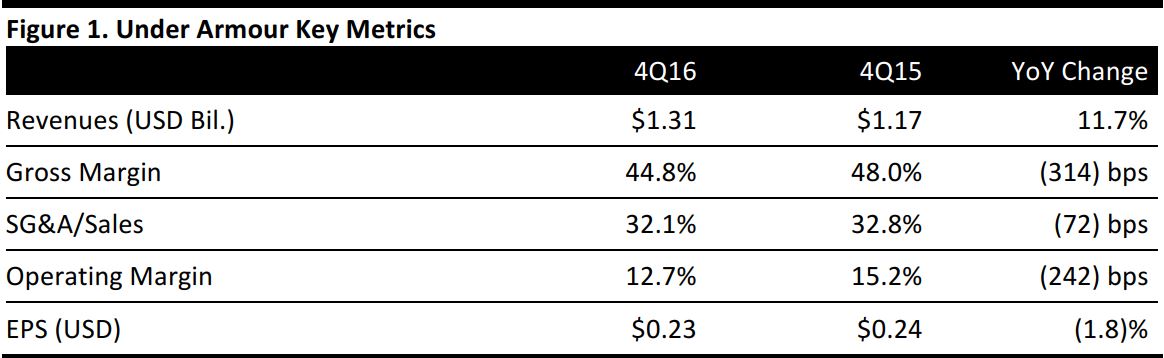

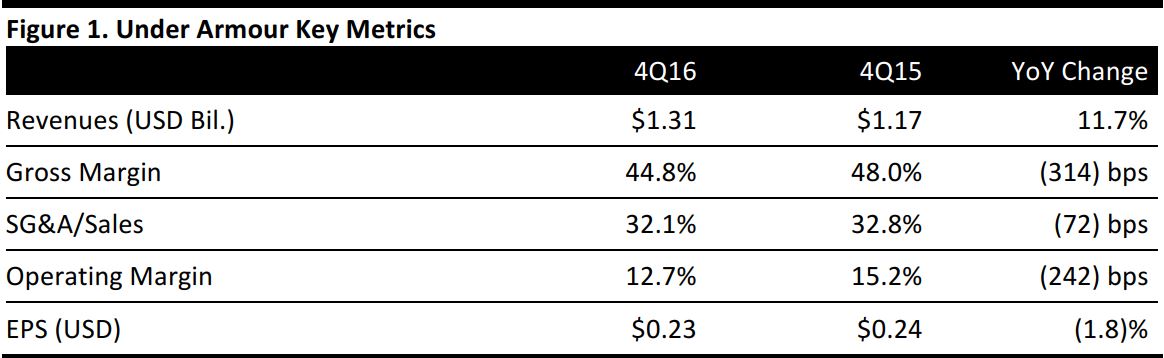

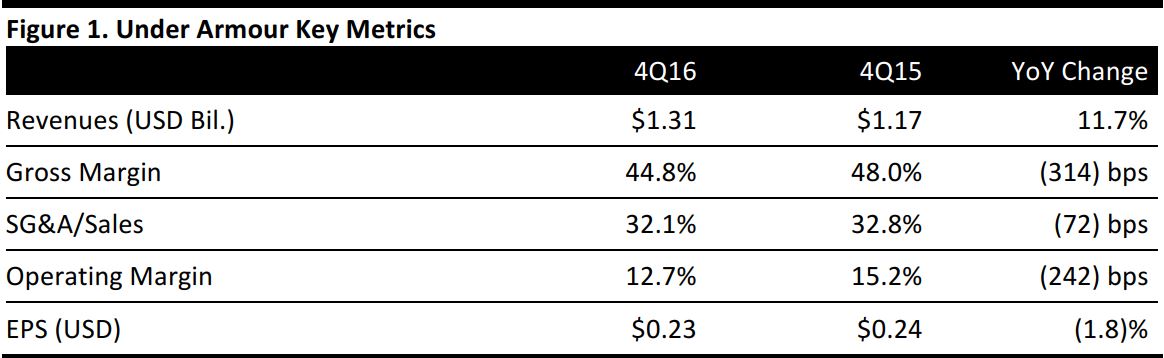

Under Armour reported 4Q16 adjusted EPS of $0.23, down from $0.24 in the year-ago quarter and missing the consensus estimate by $0.02. Revenues were $1.31 billion, up 11.7% year over year but also missing the consensus estimate, which had called for revenues of $1.41 billion. Despite reporting record revenue for the quarter, management commented that numerous challenges and disruptions in North American retail had tempered the company’s results.

The company’s gross margin fell to 44.8% from 48.0% in the year-ago quarter. Benefits from more favorable product costs were offset by aggressive efforts to manage inventory, changes in foreign currency and the effects of product mix.

SG&A expense grew by 9.2% year over year, to $419.8 million, due to continued investments in the growth of businesses such as footwear, international and direct-to-consumer.

Management Change

Separately, the company announced that its CFO, Chip Molloy, has decided to leave the company due to personal reasons. Effective February 3, David Bergman, SVP,

Corporate Finance, will serve as acting CFO. Bergman joined Under Armour in 2005 and is currently responsible for leading all major finance functions, including financial planning and analysis, treasury and tax. He previously served as Corporate Controller and in several senior management roles within the company’s accounting and finance organization.

Performance by Segment

Under Armour’s wholesale revenues increased by 5% in the quarter, to $742 million, and direct-to-consumer revenues increased by 23%, to $518 million.

Apparel revenues increased by 7.4%, to $929 million, driven by strength in the golf and basketball categories. Footwear revenues increased by 36.4%, to $228 million, driven by accelerated growth in running and basketball category sales. Accessories revenues increased by 7.4%, to $104 million, with strength seen in bags and headwear.

North American revenues grew by 5.9%. International revenues increased by 55.2% (up 60% percent on a currency-neutral basis), driven by significant growth in the UK, Germany, China and Australia.

Results for the Year

For the full year, revenues increased by 21.8% (23% on a currency-neutral basis), reaching $4.8 billion.

Wholesale revenues increased by 19%, to $3.1 billion, and direct-to-consumer revenues increased by 27%, to $1.5 billion.

North American revenues grew by 16.0% and international revenues grew by 63.2% (69% on a currency-neutral basis).

Apparel revenues increased by 15.3%, to $3.2 billion, led by growth in the golf, basketball and training categories. Footwear revenues grew by 49.5%, to $1 billion, driven by growth in all categories, particularly running and basketball. Accessories revenues increased by 17.2%, to $407 million, with strength in bags and headwear, and Connected Fitness revenues increased by 50.6%, to $80 million.

EPS for the class C shares, excluding the stock dividend, was $0.58, compared with the $0.60 consensus estimate.

Outlook

For 2017, Under Armour expects revenues to grow by 11%–12%, to nearly $5.4 billion, which is below the consensus estimate of $6.06 billion. This represents a considerable slowdown from 2016’s 21.8% revenue growth.

Based on guidance of $320 million in operating income, $40 million of interest expense, and a tax rate of 32%–34%, EPS should be in the range of $0.42–$0.43, compared with the consensus estimate of $0.69.