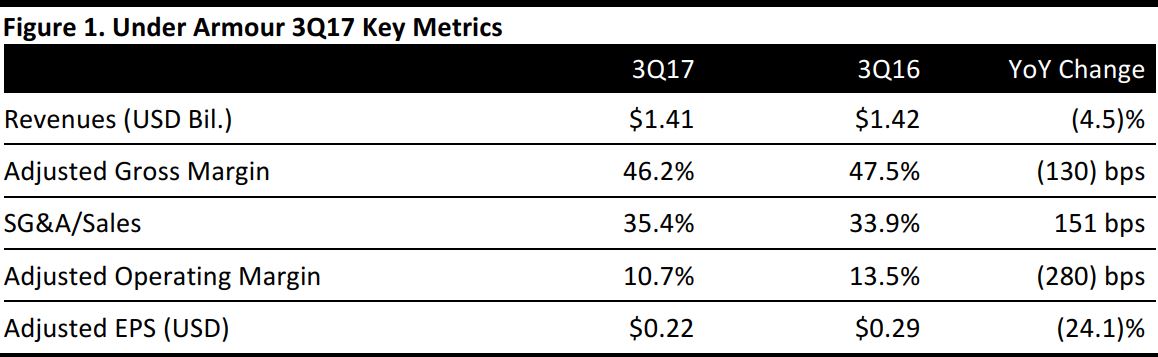

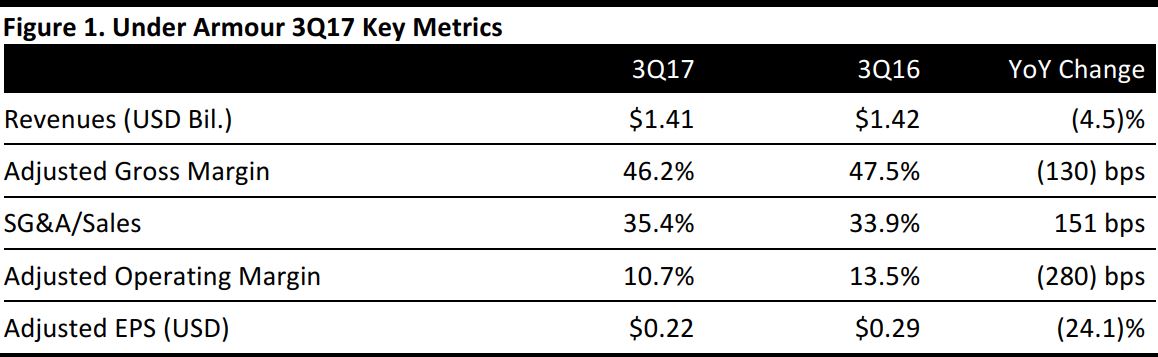

Source: Company reports/FGRT

3Q17 Results

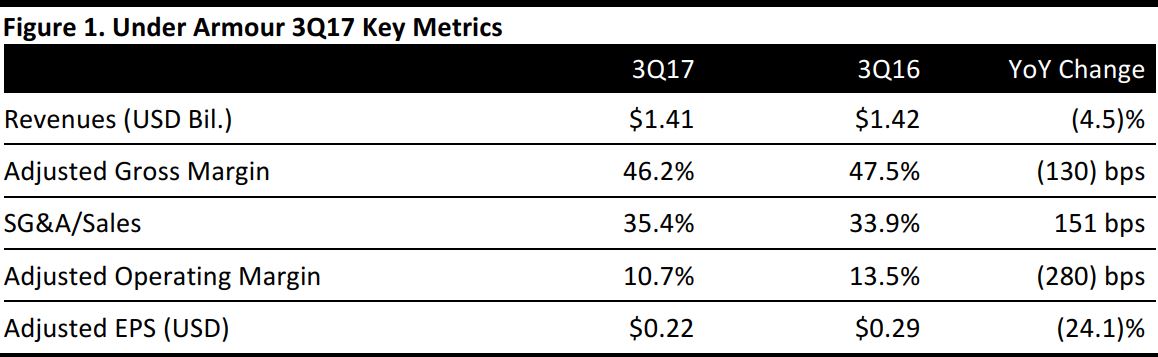

Under Armour reported 3Q17 adjusted EPS of $0.22, versus consensus expectations of $0.19. Total revenues were $1.41 billion, below the $1.49 billion consensus estimate and down 4.5% year over year. The revenue decline was driven by a 13% decrease in wholesale revenues (to $880 million) that was partially offset by a 15% increase in direct-to-consumer revenues (to $468 million).

North American revenues, which make up more than three-quarters of overall revenues, were down 12% in the quarter, as a promotional retail environment and tough competition continued to temper results. International revenues reflected continued strong momentum and were up 35%, representing 22% of total revenues in the quarter.

Within the International business, revenues were up 22% in the Europe, Middle East and Africa region; up 59% in the Asia-Pacific region; and up 33% in Latin America.

By product type, apparel revenues decreased by 8%, to $939 million, driven by weakness in the outdoor, women’s training and youth subcategories. Footwear revenues were up 2%, to $285 million, driven by strength in the running and outdoor subcategories that was partially offset by declines in basketball shoe sales. Accessories revenues were up 1%, to $123 million, with strength seen in the men’s training and golf subcategories.

The company’s adjusted gross margin fell by 130 basis points, while inventory increased by 22%, to $1.2 billion. Earlier this month, the company launched ArmourBox, a new subscription service that sends customers Under Armour items every month, every two months or every three months, according to the subscriber’s preference.

FY17 Outlook

The company lowered its FY17 revenue guidance to a low-single-digit percentage increase from a 9%–11% increase previously, reflecting lower North American demand and operational challenges. Under Armour now expects full-year revenues of $4.85–$5.04 billion, versus consensus of $5.19 billion. The company expects FY17 adjusted EPS of $0.18–$0.20, down from $0.37–$0.40 previously and below the $0.37 consensus estimate.

Management said it now expects charges of $140–$150 million related to its ongoing restructuring, up from $110–$130 million previously. Under Armour is exploring the exit of the tennis category and other outdoor categories to focus on its core performance businesses, such as basketball and golf.

The company declined to offer guidance for FY18 at this time.